New Century Resources (ASX: NCZ): Operating the Century Zinc Mine in Queensland, Australia, Becoming One of the World’s Top 10 Zinc Producers; Interview with Patrick Walta, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/1/2019

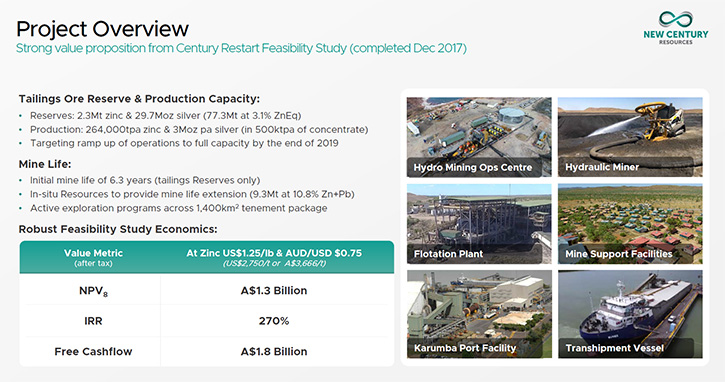

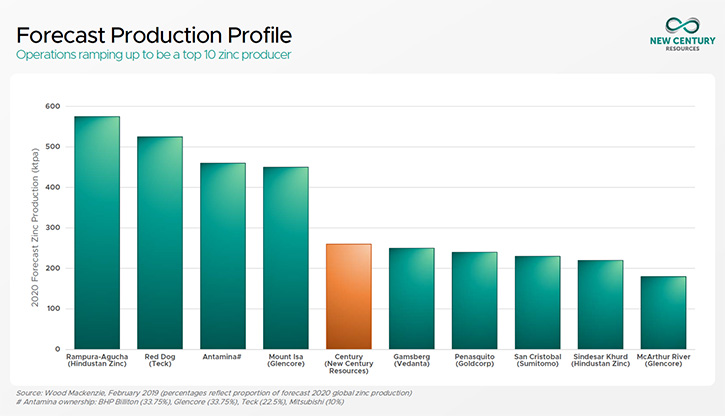

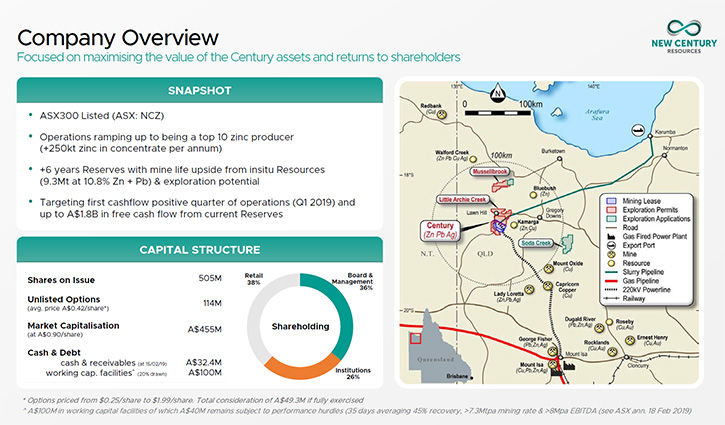

New Century Resources (ASX: NCZ) is operating the Century Zinc Mine in Queensland, Australia, with the aim of becoming one of the world’s top 10 zinc producers. After the rehabilitation process that upgraded the mine’s existing world-class infrastructure, it successfully entered production in August 2018, with the goal of producing zinc in the lowest cost quartile globally, initially with the existing vast tailings resource on the mine site. We learned from Patrick Walta, Managing Director of New Century Resources, that during their third full quarter of operations they produced nearly 21,000 tons of zinc metal, placing them in the top 25 of all operating zinc mines in the world. The Company currently has half of the plant online, with the goal of bringing on the rest of the plant over the next 12 months, doubling its capacity and, ultimately, re-establishing Century as a top 10 zinc producer. According to Mr. Walta, the key differentiator for the Century Zinc Mine is its competitive operation cost of 56 cents a pound, because reclaiming the existing stockpile largely eliminates most mining costs. The Company plans to develop and bring into production the significant amount of undeveloped resources on the mine lease, to increase the life of mine, which is currently 7 years.

The Century Zinc Mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Patrick Walta, who is Managing Director of New Century Resources. Patrick, could you give our readers/investors an overview of your Company and also what differentiates your Company from others?

Patrick Walta: Absolutely, Allen. New Century Resources is a relatively young company, it's been listed for only a couple of years now and its primary asset is the Century Zinc Mine, which is located in Queensland in Australia. Century is quite a famous mine in terms of Australian and worldwide mining history. We actually acquired the mine after it had completed 16 years of operations, producing zinc as the third largest zinc mine in the world, and we're actually restarting those operations by initially reclaiming the vast tailings resource on the mine site, and utilizing all of the infrastructure to continue operations producing a bit more zinc on a smaller scale than the original operations, but certainly producing zinc and ramping up to being a top 10 zinc producer globally. So, we're very much differentiated from a typical mining company, in some respects we're not a mining company, we're as much a rehabilitation company as well.

However, we’re able to reclaim the tailings very cheaply, about a 10th of the cost of a traditional mining operation, and then we have all of the existing infrastructure that was already built for us and we've been able to restart operations very quickly and on a material scale as well. We've just completed our third full quarter of operations of ramp up today. During that quarter, for example, we produced nearly 21,000 tons of zinc metal, which puts us in the top 25 already of operating zinc mines, and there are about 360 operating zinc mines around the world. We are also continuing the ramp up process on the operations. We only have half of our plant online at the moment, so we'll be looking to bring on the rest of that plant, doubling our plant capacity over the next 12 months and that will allow us to continue to grow and ultimately re-establish Century as a top 10 zinc producer.

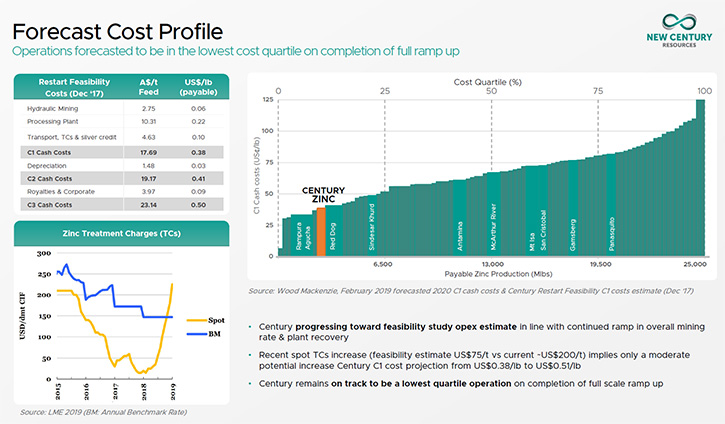

Dr. Allen Alper: Well, that sounds excellent. How will your costs compare to some of the others?

Patrick Walta: That's the key differentiator for our business, because we don't really have mining costs and we're reclaiming a stockpile, so we're able to be a low-cost operator. We're tracking down towards a life of mine C1 cost of 56 cents a pound, which is quite competitive in the market. Some comparisons are around, for example, Glencore's entire production portfolio has a cost of around 66 cents a pound and C1 costs are obviously not the only costs that mining businesses have. Typically, you have C3 cost, which is the cost for operations. Century doesn't really have C3 costs like a traditional operation does. So we don't have big underground developments or big open-pit cutbacks that have large depreciation schedules that are included in a C3 cost.

Our C1s are a much truer representation of what it costs to run our business. So we're in quite a competitive space there in terms of the cost of operations. As we're ramping up our operations, we're continuing to get a significant reduction in our costs down to that 56 cents a pound, so around 70% of our costs on site are fixed costs. We have a lot of infrastructure that was built for us and we're utilizing that. As we increase our production rate ultimately, we're getting better leverage on that fixed cost base and driving down our C1 costs further.

Dr. Allen Alper: Sounds like fun! Could you tell our readers/investors a little bit about say the life of the supply, et cetera?

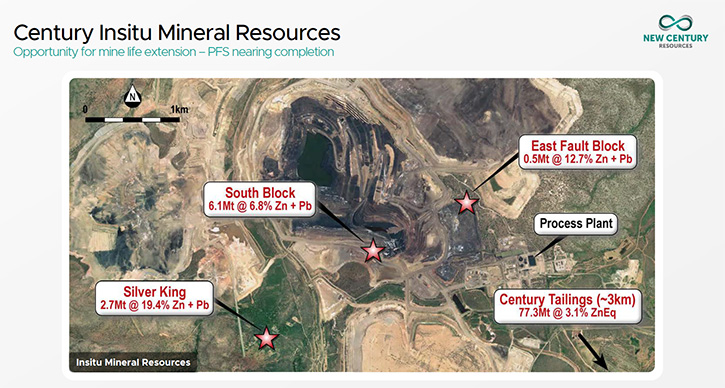

Patrick Walta: Yeah, absolutely. We have a reserve mine life of seven years, so through to mid-2026 at the moment. We also have a significant amount of in situ resources, traditional deposits, which have remained on the mining lease and on the tenements, which we plan to utilize in the future to bring them into the operations. I have around 10 million tons at 10% zinc and lead sitting in three deposits, within about a kilometer of the existing plant. Outside of that, we have around 4,800 square kilometers and lots of opportunities for exploration inside that tenement package. We feel we have a decent mine life established already. We plan to continue, at least maintain, that mine life for an extended period, continuing to use the vast infrastructure we have, which is not only on the mine site itself.

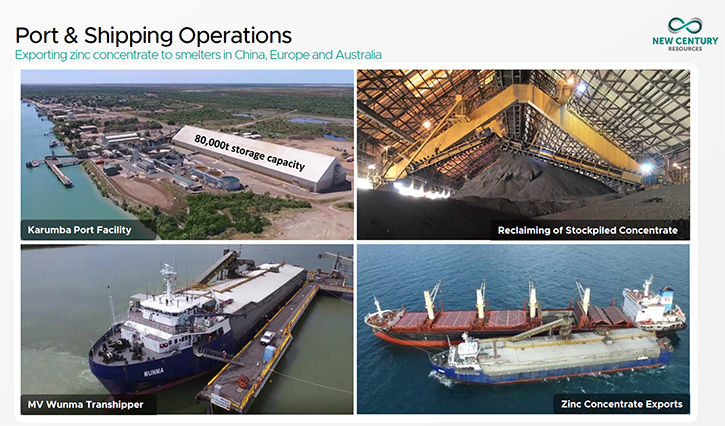

We have a 700-man camp, we have a private airport, we have a fully operational mine, but we also own the 300 kilometer underground slurry pipeline, which feeds product to our port facility in Karumba. And we own the transshipment vessel, which transships the material to the big export vessels waiting in the Gulf of Carpentaria. So for us, we continue to use the existing base metals and we use our infrastructure to recover and generate value from those efficiently. After a decade or so, if we don't discover any new base metal prospects, there are a number of other deposits on our tenements and in the region, which potentially could utilize our infrastructure. There's an iron ore deposit just to the north and a very large phosphate deposit just to the south of us. All of it requires the use of the Century infrastructure, otherwise it would be a stranded asset.

Dr. Allen Alper: Sounds excellent! Could you tell us a about your zinc concentrate.

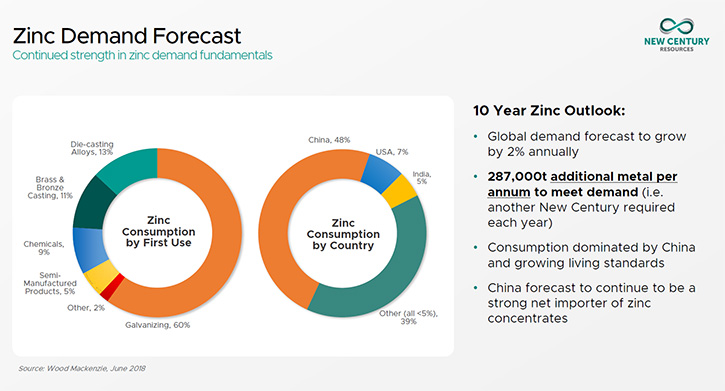

Patrick Walta: We will sell a zinc concentrate, grading about 48 to 50% zinc, and that is sold all over the world. So there're smelters in Europe, America, China and in Australia as well where they will smelt that concentrate into a zinc ingot before it's utilized predominantly in galvanizing. Zinc is a very stable commodity in terms of demand and currently it's about 14 million tons per annum of zinc is consumed. Put it in reference, our production right at full production will be about 230,000 tons of metal, so we're only a drop in the ocean in terms of the overall size of the market. And, as I said, about 50% of all zinc is consumed in galvanizing, so rustproofing, so it's very much linked to steel consumption, global growth, and also about 50% of the world's zinc is consumed in China. So also linked to the growing middle class story in China that's been around for the last decade or so.

Dr. Allen Alper: That sounds excellent. Could you say a few words about supply and demand of zinc?

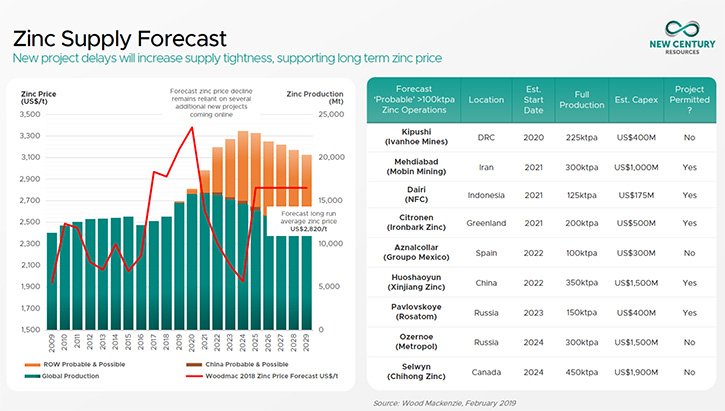

Patrick Walta: Yeah. The zinc industry is reaching a crunch point in terms of supply. At the moment, demand is tepid due to concerns about the trade wars and global growth, themes well-known around the world. However, accompanying that is a complete lack of supply. So at the moment the zinc price is relatively low because of perceived issues around demand, but that will change because global growth will eventually re-establish and demand for zinc will pick up, as these are cyclical industries and base metals are at or near the bottom of their cycle now. As demand picks up, we see some fairly serious structural issues in the zinc supply market that are not going to be able to absorb any future demand increase. Physical zinc ingot or zinc metal stockpiles would have initially absorbed any increase in demand. Now, those stockpiles have whittled down from up to two million tons five years ago, to less than a hundred thousand tons now.

So there really is no metal supply available. There are no new mines to produce the concentrate and provide it to the smelters to produce those ingots that are forecast to come online, any time in the next five to 10 years. There has been a general lack of investment in zinc mines over the last 20 years. As a result of that, we can clearly see that there are realistically no new mines that will come online soon that would be able to increase the supply of the concentrate that may allow flow through to the zinc metal supplier side. So we see a really good opportunity for zinc producers, over the next one, two, three years, as demand picks back up. We think the reaction will be quite severe in terms of that lack of supply.

Dr. Allen Alper: That sounds very good. Patrick, could you tell our readers/investors a little bit about your background and your Board and Team?

Patrick Walta: Absolutely. We're a very young company, young and enthusiastic. I'm a metallurgist by trade. About a decade ago we decided to form a private group that would look at a rehabilitation style place, which is now Century. We worked on the Century transaction with the previous owner for about five years, so there's been a lot of time and planning. As it came into the public space two years ago, it enabled us to get the operation up and running quickly because we'd been planning it for a long time. It has been great to watch the Board of New Century evolve and be part of its evolution. We've grown that from what was initially a fantastic feasibility and promotions Board, with a really good capability getting the story out there and through its feasibility and restart process.

Now we've evolved our Board to have a lot of competency around operations and business and now project management as well. Some really good quality people have joined the Board over the last six to nine months. Rob McDonald, our new Chairman, is ex-Rothschild and former Chief Adviser to Minmetals. Nick Cernotta is the former Operations Director for Fortescue Metals, the very successful iron ore miner, and third iron ore miner in Australia. Even guys like Peter Watson, who's a non-exec Director or the ex-Managing Director of Sedgman, who is our operating partner on the mine side as well. So being able to attract really good quality, capable people, who see the value proposition in our business. That will continue over time as well, we'll continue to evolve our Board.

Dr. Allen Alper: Well, that sounds excellent. Sounds like you and your Board are very strong and very experienced and knowledgeable, so that's great.

Patrick Walta: Thank you.

Dr. Allen Alper: Tell us a bit about your share and capital structure.

Patrick Walta: We recently completed a capital raising to enable us to get through our entire ramp up process, to full production, over this financial year. Subject to full completion of that capital raising, we'll have a bit over 630 million shares on issue and be well-funded in terms of our cash and receivables as well, over $60 million as of the end of July. We have a market capitalization, at the moment, of around 200 million Australian dollars as well. So very much a great opportunity, with our business, as we hit our milestones and as we achieve our ramp up goals in growing shareholder value from the current valuation base.

Dr. Allen Alper: All right. Sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in New Century Resources?

Patrick Walta: Absolutely. Century is one of the only available listed companies, which has very strong exposure to zinc. Look at zinc as a commodity and its potential outlook. If you have a positive outlook on zinc, then Century is a very attractive opportunity to get some strong exposure to it. In terms of our own operations, we have significantly de-risked our operations, so just even 12 months ago, we hadn't even started our operations at all and over the last nine months, we've produced north of 65,000 tons of zinc metal and nearly 150,000 tons of concentrate. We have reestablished the entire logistics chain, demonstrated that it works, and completed over a dozen shipments, to three different continents and seven different smelters. We're re-establishing market share of the Century concentrate or the product that we produce as well.

We've also built our Team, expanded our Board, extended the mine life and reduced the risk exposure of our business in the areas that we can control. The Team has made amazing progress in de-risking the operations. At the moment, the opportunity is that the zinc prices are very low and a lot of that is driven by macroeconomic sentiment. We feel the market is very much in the cyclical bottom and there's a great opportunity for the entire base metal sector, let alone zinc, to have an upswing over the next few years, as we see growth re-establish itself through the next cycle. We plan to take advantage of that fully, by being a ramped up, top 10 zinc producer, supplying into a rising market.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.newcenturyresources.com/

Patrick Walta

Managing Director

+61 3 9070 3300

info@newcenturyresources.com

|

|