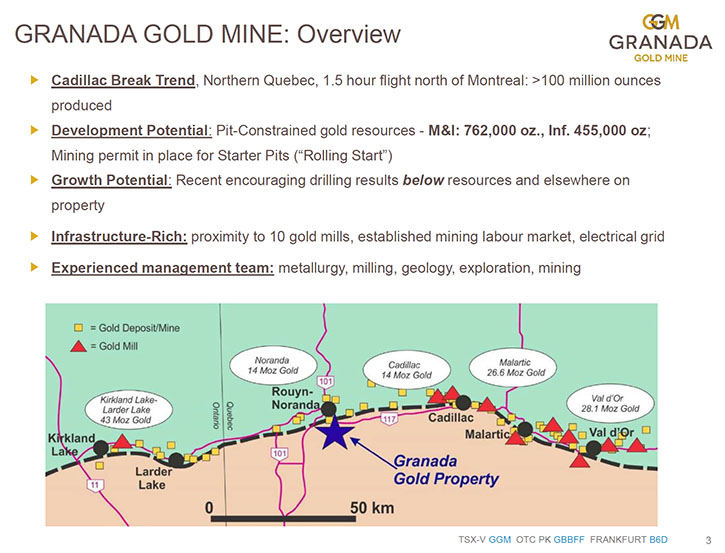

Granada Gold Mine Inc. (TSXV: GGM): Developing Their Gold Project Along the Prolific Cadillac Trend, Near Rouyn-Noranda, Quebec; Interview with Frank Basa, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/28/2019

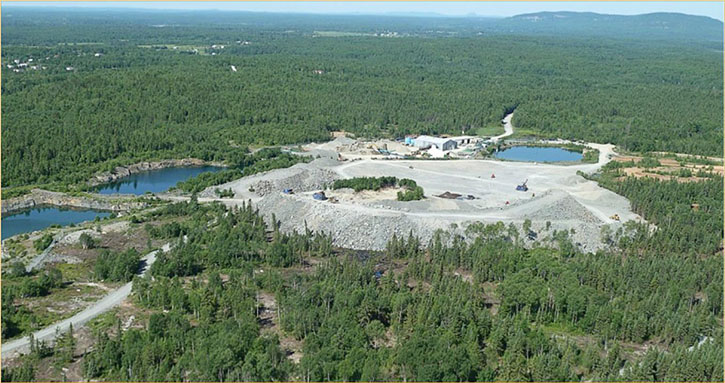

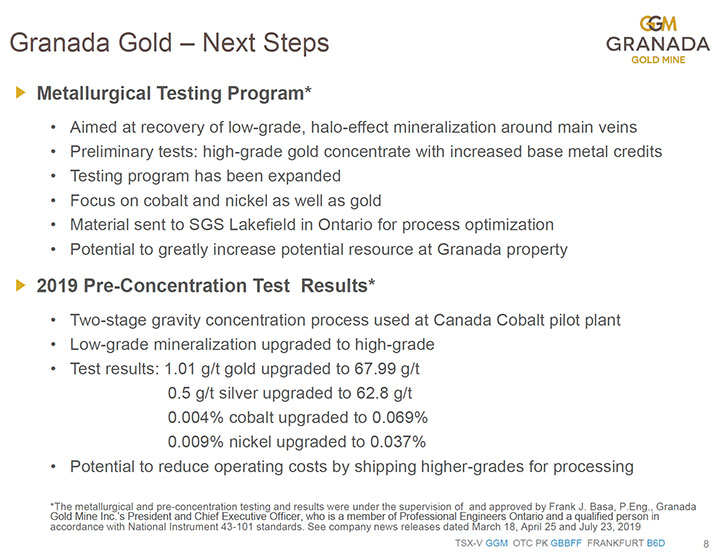

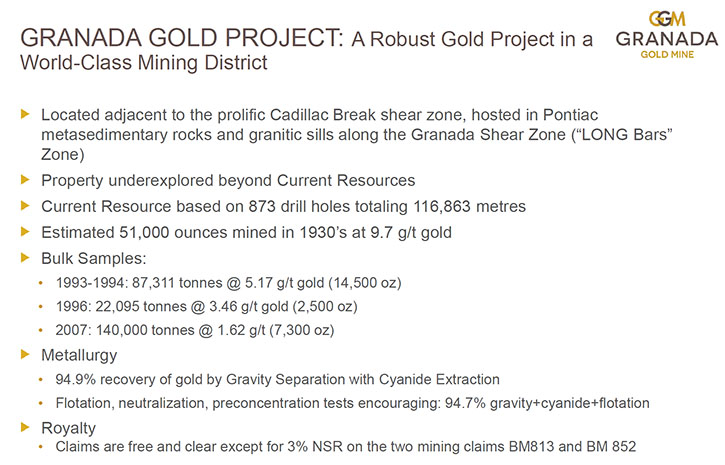

Granada Gold Mine Inc. (TSXV: GGM) continues to develop the Granada Gold Deposit, located along the prolific Cadillac Trend, near Rouyn-Noranda, Quebec. We learned from Frank Basa, President and CEO of Granada Gold Mine, that they can greatly increase the potential resource at the Granada Property by recovering the low-grade, halo-effect gold mineralization, around the main mineralized veins. The low-grade waste pile mineralized material, in addition to gold, contains cobalt, nickel, and copper, and has been sent to SGS Lakefield, Ontario, to begin a metallurgical test program. We learned from Mr. Basa, the Company plans new exploration drilling this fall, after the spectacular results of the last year's drilling.

Granada Gold Mine Inc.

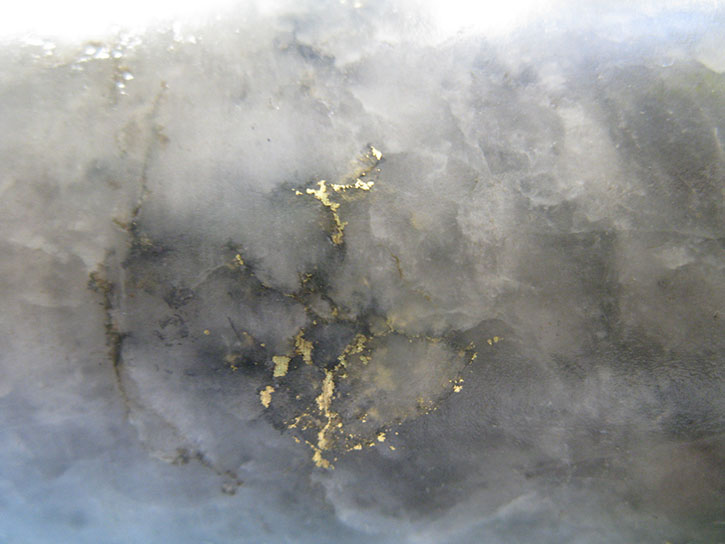

Veinlets of gold at the surface at Granada.

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Frank Basa, who is President and CEO of Granada Gold Mine. Could you give our readers/investors, an overview of Granada Gold, and what differentiates Granada Gold Mine from other mining companies? We have many new readers/investors since our last interview.

Frank Basa: We've sampled the waste pile that's been left there since the 1930s. We found a fair amount of gold in the waste pile and we undertook some tests. We can concentrate the material relatively easily. We're able to take material that usually is half a gram to one gram per tonne and concentrate it to about 62 grams per tonne. We also found cobalt, nickel and copper in the ore. Levels are quite low, but they did concentrate. We sent the larger samples to SGS Lakefield to evaluate the viability of treating what we call the halo effect around our main veins.

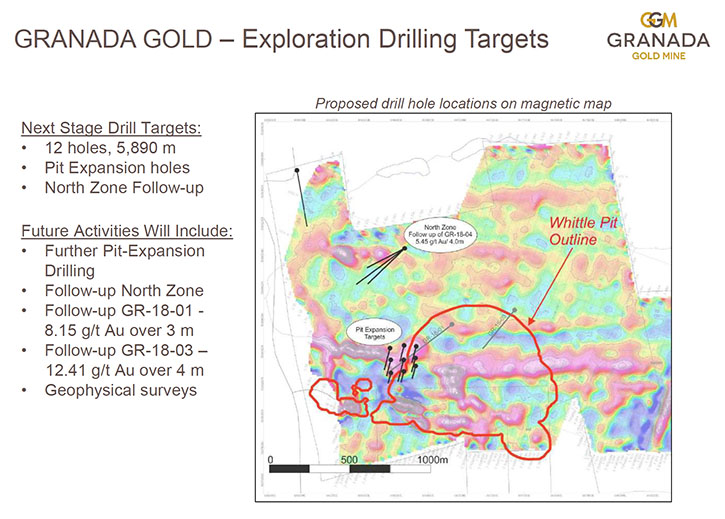

Right now, in all three categories, we have about 1.2 million ounces, open-pittable, at a little over a gram per tonne. We feel that adding the lower grade material, what we call the halo effect, should increase this substantially. We may be able to recover the low grade material, pre-concentrating it, and then feeding it into the plant and get the gold out in that way. We're also looking at carrying on a drill program. We had such spectacular results last year. We have a lot of targets we'd like to start drilling on, more than likely we'll start drilling this fall. The intent is to add, what we call underground ounces. We feel there might be anywhere from one and a half to 2 million ounces of gold in the ground, grading about four to six grams a tonne.

This mine historically did average 9 to 10 grams a ton, when it operated in the 1930s. We're going after the larger vein structures, which are actually a little lower grade. But by doing that, we're increasing the amount of ounces that we might be able to recover from underground. We did a fair amount of drilling, it's actually going towards the Cadillac trend. The assay results showed some pretty large grades, so we look to carry on with this program this fall. The intent is to add a million and a half to 2 million ounces -- 4 to 6 grams a tonne.

Dr Allen Alper: Oh, that sounds excellent! Could you tell us a little bit more about the location of the project and why it's such an outstanding area?

Frank Basa: The project is on the Cadillac trend, a structure that goes through Quebec and Ontario and up into northern Manitoba. There are multiple mines on it and most of the mines are multimillion ounce deposits. Everybody is aware of Osisko’s Malartic mine that came into a 10 million ounce deposit at one gram per tonne. We are all on the Cadillac trend. And at Granada we're looking at about up to 3 million ounces right now. We still have a lot to explore. We're only working on two kilometers of our 5.5 kilometer structure and a large amount of exploration has been carried out on that. We have done about 120,000 meters of drilling already, and we're looking at adding another 100,000 to 200,000 meters in the next three years.

Dr Allen Alper: Oh, that sounds excellent! Could you tell our readers/investors about your background and your team’s?

Frank Basa: Well, most of my people, including myself, have been in the industry at least 30 years and we're hands on. We've worked for companies like Agnico Eagle, Placer Dome, Miranda, you name it. We all worked for them. So we do have experience finding deposits and putting them into production. We're very straight forward in the way we work. We have a very low profile. We run what we call a virtual office. While we’re in the exploration mode and as we go towards production, we do have all of our permits for open-pit mining.

We're looking for somebody to process all our rock. We want to do what we call a rolling start. In essence, it's a very large bulk sample. We’d start with about 25,000 ounces a year, thereafter we'd be looking at 80,000 to a 100,000 ounces a year, open pittable. We're looking at a 10 year mine life on the open pit, and that does not include the underground, which hopefully would be drilled off in the three year timeframe, giving us another million and a half to 2 million ounces.

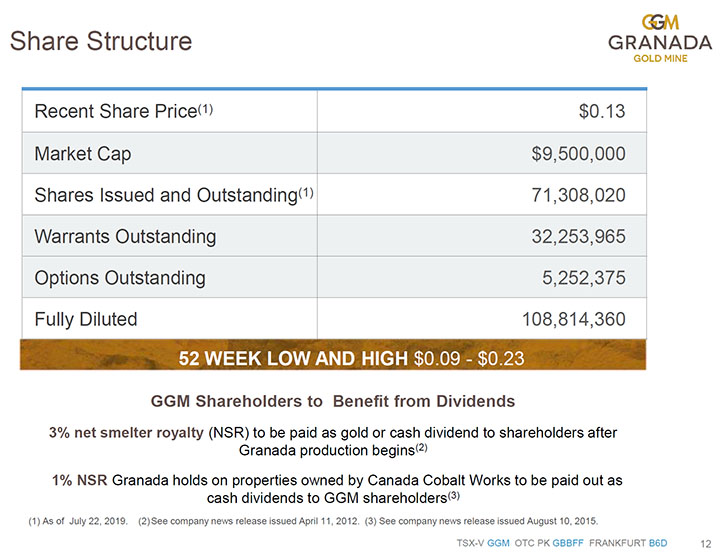

Dr Allen Alper: Excellent. Could you tell our readers/investors a bit more about your capital structure and share structure?

Frank Basa: Well, we went through a fairly hard time. We've had to, like everybody else, consolidate our stock and clean up our share structure. We did an eight-to-one rollback, and kind of cleaned up the accounts. So now we're taking it from here. We do have a history of driving companies, we call it riding the wave. I think this might be the best gold wave that I've ever seen. The intent is to take this stock from where we are now and, as everybody knows, we have a tendency of attempting a 20-fold increase in our stock price.

Dr Allen Alper: Well, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Granada?

Frank Basa: Well, we're what I'd call a mandatory company as an exploration company. We're on the Cadillac trend. We've proven to the industry, to the investors, that we can find the gold. We have a very good deposit. We have the ability to get permits and we have a team, that's what I call old school. We produce results and we survived one of the worst downturns I've ever been through in the resource sector. We survived it!

Dr Allen Alper: With a gold price now heading towards $1,500 an ounce, most experts are predicting that the next few years will be excellent years for gold, and also mining companies. What are your thoughts on that?

Frank Basa: Last time, a lot of people were looking for $5,000/ounce gold. I don't know if it will make it, but I'm definitely very confident it will break $2,000. It's hard to call. I could see it breaking $2,000 and actually carrying on.

Dr Allen Alper: That's very good. Is there anything else you'd like to add, Frank?

Frank Basa: Thank you very much for interviewing Granada Gold Mine for an article in Metals News. Anybody can reach out to me. We do run a private forum on our website and normally if an investor asks me a question they’ll get an answer from me within 24 hours. I think we're the only ones, who do that.

Dr Allen Alper: Sounds excellent! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.granadagoldmine.com/

Frank J. Basa, P. Eng., President and CEO at 1-819-797-4144 or

Wayne Cheveldayoff, Corporate Communications, at 416-710-2410 or

waynecheveldayoff@gmail.com

|

|