Calidus Resources Limited (ASX: CAI): Exploring and Developing 1.25M Oz Gold with Great Upside Potential in Pilbara Goldfield, Western Australia; Interview with Dave Reeves, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/23/2019

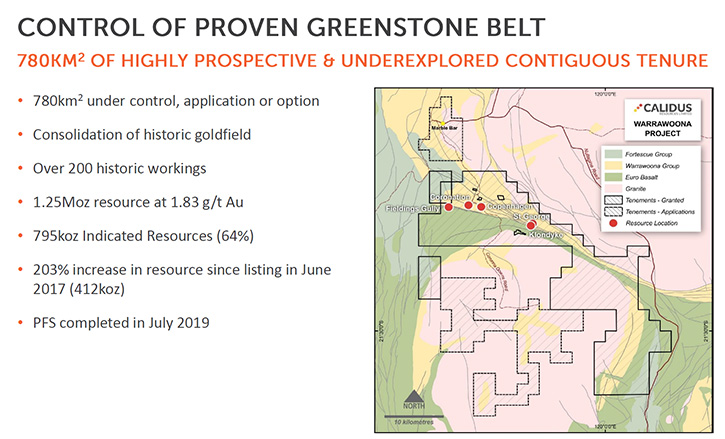

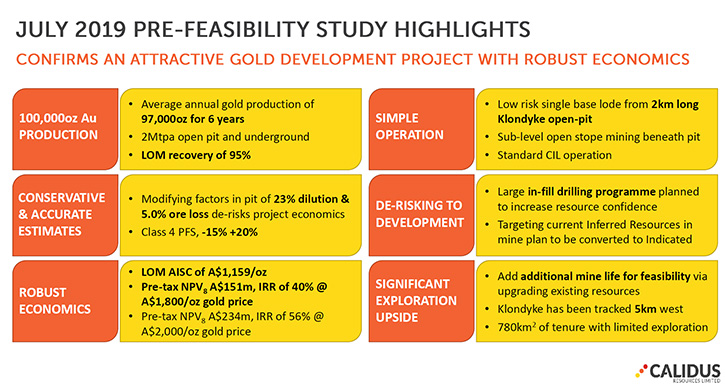

Calidus Resources Limited (ASX:CAI) is a gold exploration company, which controls the 1.25 million ounce Warrawoona Gold Project, in the East Pilbara district of the Pilbara Goldfield, in Western Australia. We learned from Dave Reeves, Managing Director of Calidus Resources, that they have just completed a prefeasibility study, which shows an initial six-year mine life at 100,000 ounces per annum, with an all-in sustaining cost of around 750 US dollars an ounce. Near term plans include more drilling to extend that mine life to at least eight years, more metallurgical work, and a feasibility study that should be completed mid next year. The project holds very large regional exploration potential, as Calidus has only scratched the surface of their 780 square kilometers of exploration licenses.

Calidus Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dave Reeves, who is Managing Director of Calidus Resources Limited. Dave, could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company?

Dave Reeves: Certainly. Calidus controls the Warrawoona Gold Belt in Western Australia. We've defined 1.25 million ounces at 1.83 grams a ton, that's outcropping ore body at surface, which is unusual for Western Australia. Most are fairly deep mines now. We've just completed a prefeasibility study, which shows an initial six-year mine life at 100,000 ounces per annum, an all-in sustaining cost in US dollars of around 750 US dollars an ounce verses today's gold price at over 1500 US an ounce. A very profitable operation! We're currently entering into our feasibility and doing more drilling to extend that mine life. We're aiming for at least an eight-year mine life, when we begin construction at 100,000 ounces per annum. We have very large regional exploration potential as we've only just scratched the surface of our 780 square kilometers of exploration licenses.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit more about the resource and the grade, et cetera?

Dave Reeves: The resource itself is predominantly in one deposit that we call Klondike. Klondike itself has about 1.15 million ounces. It's divided into two types of resource, an open pittable resource and an underground resource. The open pit resource has 930,000 ounces at 1.6 grams, and the underground, which is open down-dip, we've only really drilled down to 250 meters below surface, has 220,000 ounces at 3 grams. We have three satellite deposits nearby on which we've done limited drilling. Some of those deposits have small resources but up to about 5 gram a ton resource grades.

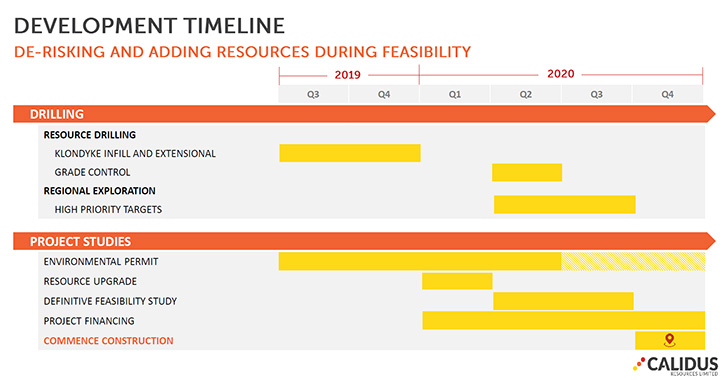

Dr. Allen Alper: That sounds very good, Dave. Could you tell us more about your plans, with the feasibility study and your schedule, when you anticipation getting into development?

Dave Reeves: The prefeasibility study is based on a two-million-ton per annum conventional crush, grind, gravity, CIL plant, so very good metallurgy, being fed by a one-and-a-half-million-ton per annum open pit and a half-million-ton per annum underground to produce that 100,000 ounces. We've done a lot of work on that prefeasibility study. We've used very conservative numbers for our dilution and ore loss, for modeling how the grade will go through the plant.

Now we're doing extensional drilling to add a couple of years mine life to a new resource and put a new mine plan around that. In the meantime, just finalizing some last metallurgical test work for variability and getting the engineering side ready so that we can complete a feasibility mid next year. The timeline for development now is driven more by permitting, but we're budgeting on 12 to 15 months from now to get all our permits in place. That's environmental, clearing, mining, safety, et cetera. So that's really what will drive our construction timeline. Towards the end of next year we should be in a position to begin construction.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background and your Management team?

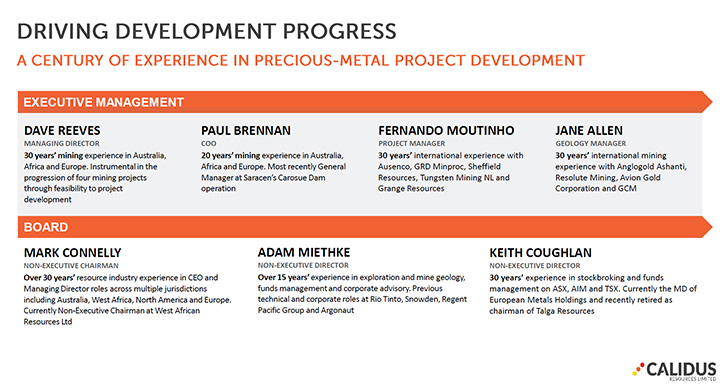

Dave Reeves: I'm a mining engineer by trade. I worked all around Australia and Africa and a little in Europe, mainly involved initially with operating mines, up to mine manager level, but then building mines. I've been involved building three mines, feasibility through to operations. We have a COO, Paul Brennan, who most recently ran a large gold mine, here in Australia, called Carosue Dam for a well-known gold company called Saracen Minerals. He's just joined. Very good operating credentials! Jane Allen, our geology manger, is a very experienced geologist. She worked all around Australia and Africa, most recently with AngloGold Ashanti. A very strong management team, well supported by our Board, where our Chairman, Mark Connelly, is very well known in North American markets, through Papillon, B2Gold and others, where he's been involved in developing gold mines, mainly in Africa.

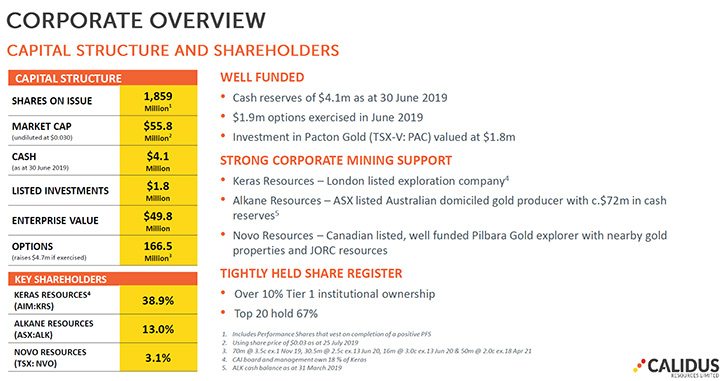

Dr. Allen Alper: That sounds like a very talented Team, experienced and knowledgeable and an accomplished Team and Board, so that's excellent. Could you give our readers/ investors a corporate overview of your capital structure and shareholders?

Dave Reeves: It changed a little bit today. We're just back on trading after announcing a $9 million heavily oversubscribed raising that will see us fully funded through the next 18 months ready for project development. So, our capital structure now is just a little bit over two billion shares on issue. Market cap is around 70 million Australian dollars, or 50 million US. Our largest shareholder is a listed company out of London called Keras Resources, who owns about 34%. There's a gold producer in New South Wales here in Australia called Alkane, our second-largest shareholder. They own about 13%. Our institutional shareholding is now around 20% of the Company. The remainder are retail.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors the primary reasons they should consider investing in Calidus Resources?

Dave Reeves: Yes. I think from a valuation point of view for Australian gold miners, we see that there's a large amount of value still in our share price compared to our peers. The cupboard is pretty bare in Australia for new hundred thousand ounce development opportunities. There are only a couple of other peers and they're trading up over 150 to 200 million Australian dollars. That's where we see a lot of value to be had for potential shareholders. There's a lot of news flow coming, lots of drilling, solid feasibility to be delivered next year. And we're well funded through all of that. So, we see the stars have aligned now, and with this increase in gold price, it's a great place to be.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, Dave?

Dave Reeves: Just to thank you, Allen, for interviewing Calidus Resources for Metals News. It's a pretty simple story. Good study! Lots of news flow with drilling, feasibility, and into development next year!

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.calidus.com.au/

Dave Reeves

Managing Director

dave@calidus.com.au

|

|