SSR Mining Inc. (NASDAQ: SSRM, TSX: SSRM): Growing Low-Cost Intermediate Precious Metals Producer with Very Large Cash Position; Interview with Stacey Pavlova, Manager of Investor Relations

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/21/2019

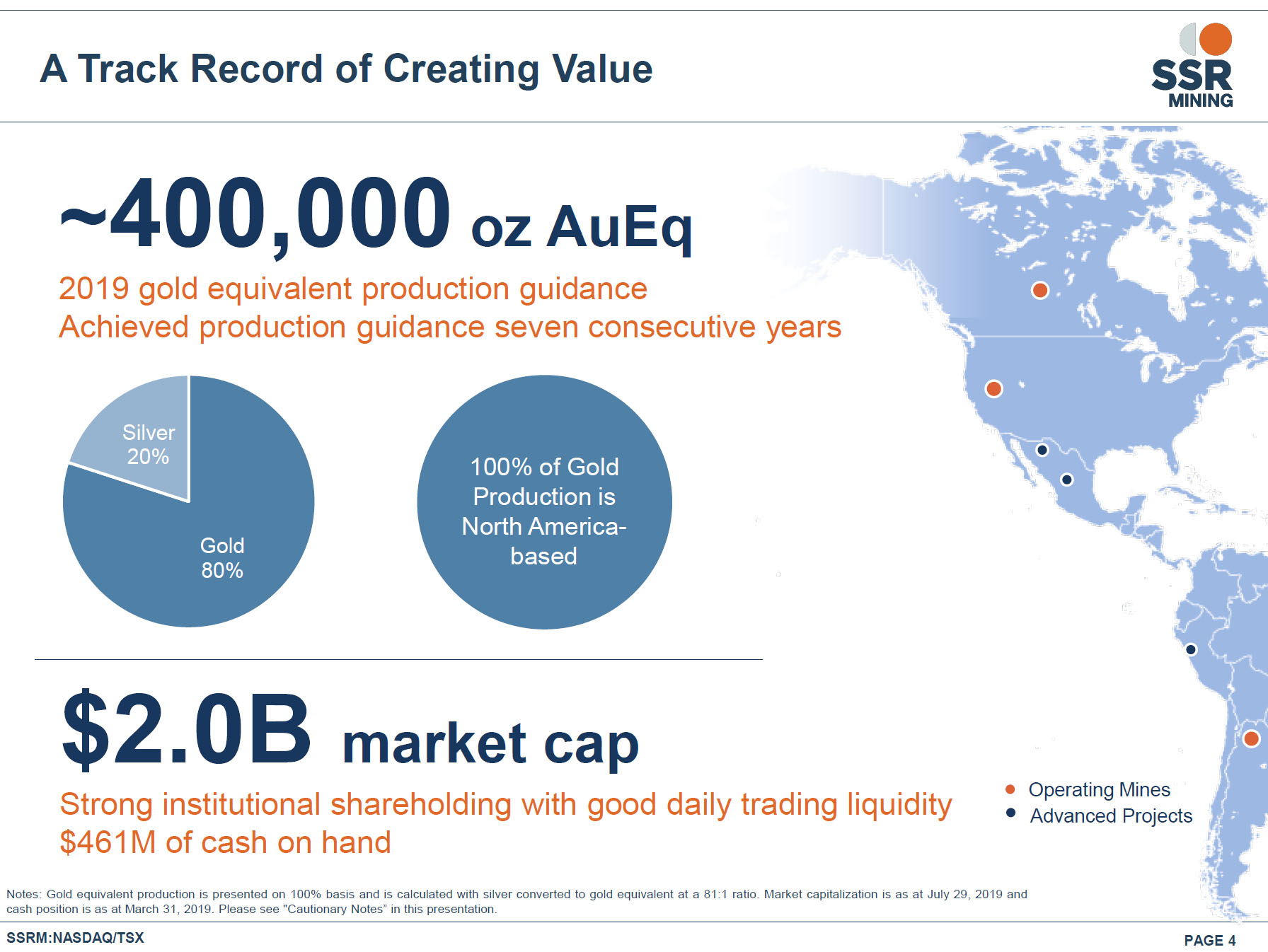

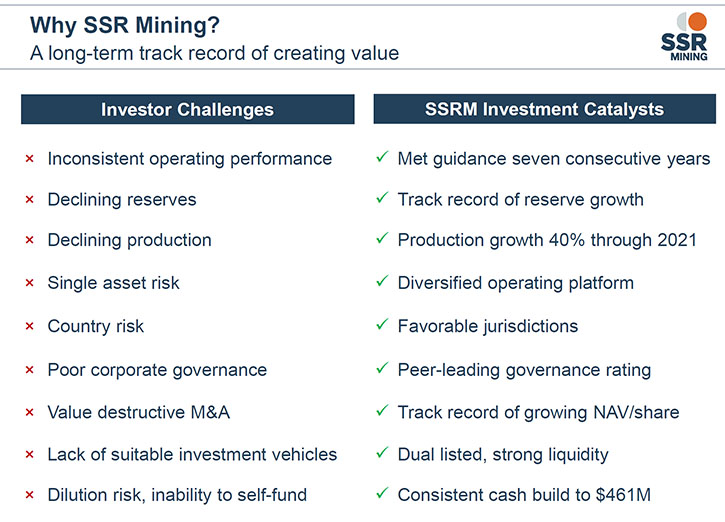

SSR Mining Inc. (NASDAQ: SSRM, TSX: SSRM) is a Canadian-based precious metals producer, with three operations, including the Marigold Mine in Nevada, U.S., the Seabee Gold Operation in Saskatchewan, Canada and the 75%-owned and operated Puna Operations joint-venture in Jujuy, Argentina. We learned from Stacey Pavlova, Manager of Investor Relations for SSR Mining, that the Company has been in existence for over 70 years, it has met or exceeded its production and cost guidance for seven consecutive years and is on track to do it this year. In 2019, SSR is expected to produce over 200,000 ounces of gold at the Marigold mine, over a 100,000 ounces of gold at the Seabee Gold Operation, and approximately 7 million ounces of silver at their Puna Operations. The Company has a strong production growth outlook, with approximately a 40% increase in production from 2018 to 2021. In addition, SSR Mining has two feasibility-stage projects and a portfolio of exploration properties in North and South America.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Stacey Pavlova, who is manager of Investor Relations for SSR Mining. I was wondering, Stacey, if you could give our readers/investors an overview of SSR Mining and also tell us what differentiates SSR Mining from others.

Stacey Pavlova: Absolutely. SSR mining is a plus 70-year-old company. We produce both gold and silver. We have three mines in excellent jurisdictions. One of our mines is called the Marigold Mine located in Nevada, a gold mine expected to produce over 200,000 ounces of gold this year. Our other gold mine is called the Seabee Gold Operation. It's located in Saskatchewan. This year it's expected to produce over 100,000 ounces of gold. Our third mine is called Puna Operations, located in Argentina. It has existed for a number of years, with the original Pirquitas Mine. Most recently production has started at the Chinchillas Mine, which is about 45 kilometers away from the Pirquitas property. Ore is driven from the Chinchillas Mine to the Pirquitas plant for processing. This mine produces silver, lead and zinc in a lead concentrate and a zinc concentrate. This year it's expected to produce approximately 7 million ounces of silver. We recently improved the production guidance at all three operations and expect to produce approximately 400,000 ounces of gold for the year on consolidated basis.

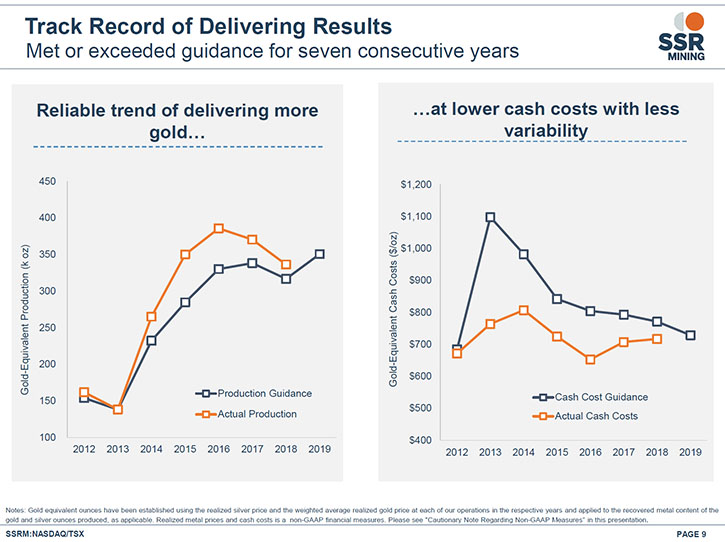

To address the second part of your question – what differentiates SSR Mining: Our management team has a strong track record of doing what they have said they will do. We have met or exceeded our production and cash costs guidance for seven consecutive years and we are on track to do that for an eighth year in 2019.

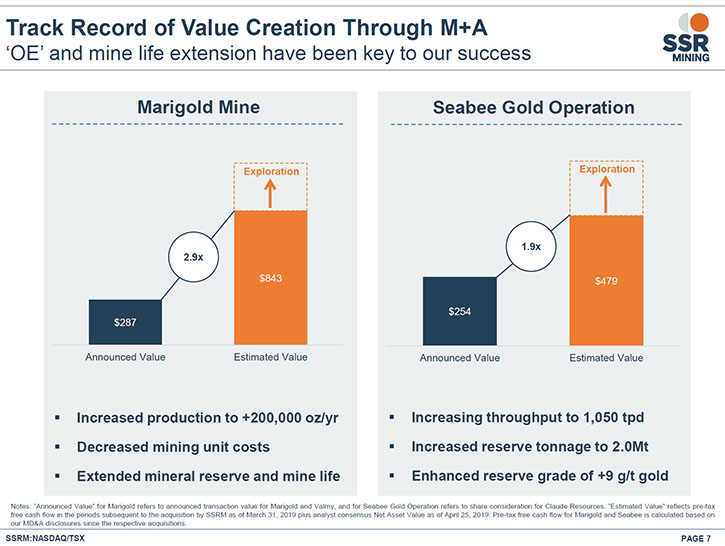

Additionally, over time, we have had a great track record of increasing our mineral reserves and resources at our operations, consistently, through our exploration efforts and strategic acquisitions of land in and around those operations, as well as with acquisitions of our Marigold mine and Seabee mine and the joint venture at Puna Operations.

Additionally, over time, we are seeing production growth, which cannot be said for a lot of our peers over the next couple of years. We do expect our production profile to increase, while cash costs are decreasing. Our investors benefit from our diversified operating platform. Our three operations are producing two different primary metals, gold and silver. They're located in stable, mining-friendly jurisdictions, with Nevada and Saskatchewan being in the top three jurisdictions rated by the Fraser Institute. Additionally, we have a peer-leading governance rating. Our ISS governance rating has a quality score of one. We have held this rating for a number of years now and it is a testament to the quality of our Board and our Management Team and of course their independence.

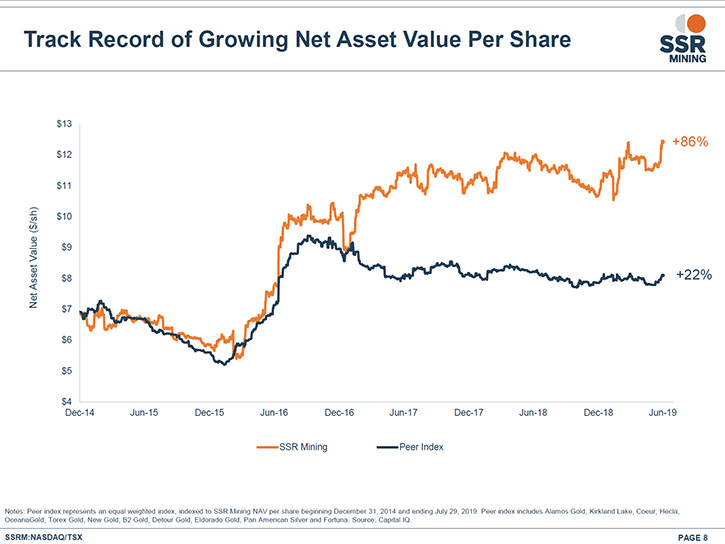

In addition to that, we have had a track record of growing our net asset value per share overall, compared to peers over time. You can see a slide on that in our corporate presentation, in terms of where SSR mining is. As of June, we have had over 86% of increase in net asset value since the benign of 2015, compared to our combined peer group average of over 22% of growth. Finally, we have strong liquidity as at the end of the second quarter, 452 million of cash, which provides a great opportunity for the Company to grow both internally through exploration efforts as well as externally through potential mergers and acquisitions. Our investors can benefit from our dual listing as we're listed on the NASDAQ and the TSX as well as our strong trading liquidity.

Dr. Allen Alper: Oh, that sounds outstanding. That's a Company that could be very proud of its performance, so that's excellent.

Stacey Pavlova: Thank you.

Dr. Allen Alper: Could you tell our readers/investors a little bit about your background and the Management Team and the Board?

Stacey Pavlova: Absolutely. My background is in finance. I have a master's in finance and I am Chartered Financial Analyst Charterholder. I have been with the Company for just under eight years. Prior to that I worked with Newmont mining at the head office in Denver.

We have an independent Board of Directors. Our CEO is the only Company executive on the Board. We have a total of nine members with an independent Chairman.

They all have backgrounds in different areas including finance, mine operations, banking, legal, capital markets, as well as a specific background in Argentina, as one of our operations is located there.

In terms of our executive management team, a lot of the members come from large companies such as BHP Billiton and Placer Dome. Each of them brings a wealth of experience, incorporating a lot of the positive qualities of a bigger organization, while minimizing the level of bureaucracy, so we can advance certain projects much faster, for instance.

Dr. Allen Alper: Well, that sounds excellent. Tell our readers/investors the primary reasons they should consider investing in SSR mining?

Stacey Pavlova: Everything that I described earlier in terms of the advantages of investing in SSR would apply here too. We have a strong production growth outlook at decreasing cash costs. We have a strong track record of delivering what we said we would. Over time we have shown that we are very astute investors in terms of M&A, with our acquisitions of the Marigold mine and the Seabee mine and a number of other investments we have made. Our investors can be assured that we will continue, with our disciplined operating and investment approach, to deliver value for them. Whether that's through exploration internally to increase reserves and resources at our operations or through potential external growth.

Dr. Allen Alper: Well that sounds excellent. Stacey, is there anything else you'd like to add?

Stacey Pavlova: Yes. Over the last couple of months, we have had a number of positive news releases, to which I would like to draw your readers/investors’ attention. For instance, at our Marigold mine, we have just announced that we are acquiring another parcel of land, which nearly doubles our land position there and increases our potential for growth of mineral reserves and resources. This land package is just to the South and contiguous to the Marigold property.

Additionally, we have an interest in a company called SilverCrest. This company owns an interesting project and we have approximately 9.8% interest in the company. It is a high grade gold and silver project, very interesting and similar to our Seabee Gold Operation. Finally, we announced exploration results at Marigold and Seabee, outlining potential for an increase in mineral resources, with our year-end Mineral Reserves and Mineral Resources estimate.

See the relevant news release copied here:

http://ir.ssrmining.com/investors/news/default.aspx

Dr. Allen Alper: All right, sounds excellent. That's great.

https://www.ssrmining.com/

W. John DeCooman, Jr.

Senior Vice President, Business Development and Strategy

SSR Mining Inc.

Vancouver, BC

Toll free: +1 (888) 338-0046

All others: +1 (604) 689-3846

E-Mail: invest@ssrmining.com

|

|