Millrock Resources Inc. (TSX-V: MRO): Premier Project Generator Focused on Gold and Copper, West Pogo in Alaska, USA, and Sonora, Mexico; Interview with Gregory Beischer, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/20/2019

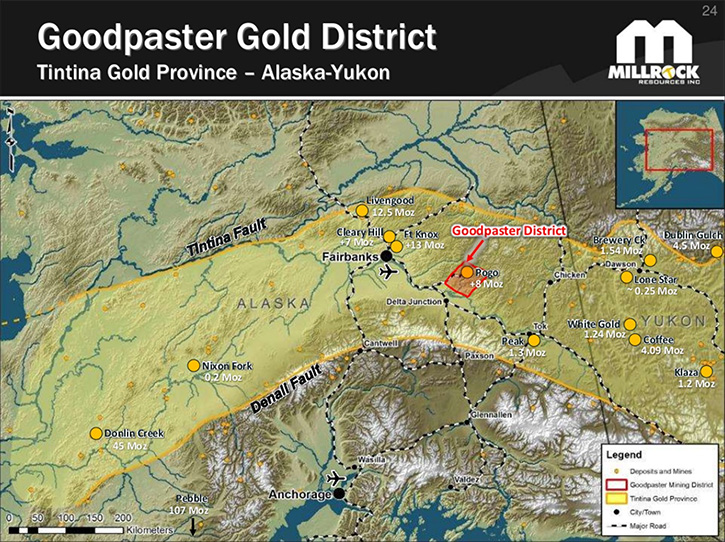

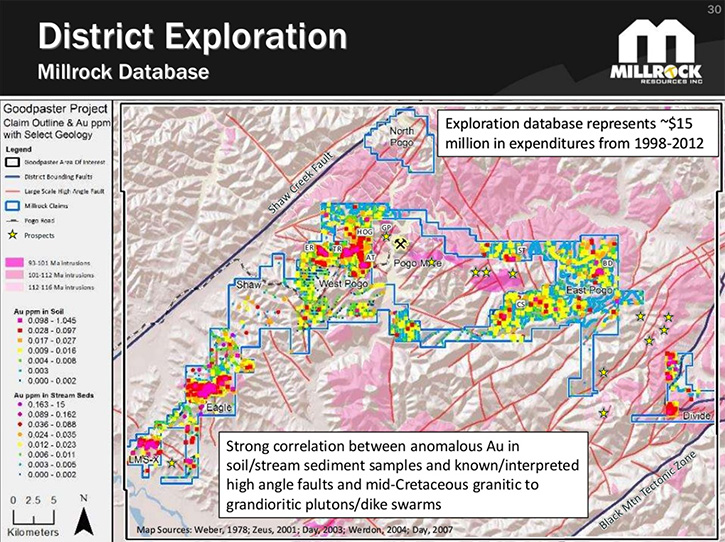

Millrock Resources Inc. (TSX-V: MRO) is a project generator company, focused on gold and copper in Alaska, USA, and Sonora, Mexico. We learned from Gregory Beischer, President and CEO of Millrock Resources, that their key projects currently are the large copper porphyry project, called Batamote, in Sonora, Mexico, and the Chisna project in Alaska. Of particular note is a new strategic acquisition of mineral rights over a gigantic tract of land in Alaska’s Goodpaster Mining District, next to and along trend from the Pogo gold mine, operated by Northern Star Resources. We learned from Mr. Beischer that Millrock has a great head start on making a discovery at Pogo because the Company had purchased about $15 million worth of exploration data on the property at a very low price. According to Mr. Beischer, Millrock plans joint venture partnerships, on its copper properties, and they will bring enough funds for exploration drilling at Pogo as well.

Millrock Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Gregory Beischer, who is President, CEO and Director of Millrock Resources. Could you give our readers/investors an overview of Millrock Resources and tell them about the model of your company?

Gregory Beischer: Sure, Dr. Alper. I'd be happy to. Millrock Resources is a project generator company. We're early stage mineral exploration specialists that concentrate particularly in Alaska, my home base, but also balance our holdings a bit by work in Sonora State, northern Mexico. Primarily, we search for large copper porphyry, gold-type deposits and/or intrusion related deposits or zinc deposits. Those are the primary commodities we seek by exploration, and these styles of mineralization can produce metal deposits of exceptional size. Most of the money for our work comes from mining companies. They invest in our project, in the early stages, to earn their way into an ownership position in our projects. That way we don't have to dilute our existing shareholders so often by selling stock in the Company. We do that from time to time to generate projects, but most of the money for the exploration comes from other mining companies. We've attracted great names over the years, for example, Teck, Kinross, Vale, Inmet, First Quantum, EMX Royalty and others.

These are quality exploration projects. We operate on behalf of the major company, which usually gives us a bit of revenue. So the whole idea of the model is to be able to explore multiple projects at any one time, thereby, increasing our chances of successfully finding an ore body and also limiting dilution to the shareholders.

Dr. Allen Alper: Sounds excellent, excellent model, an excellent approach! Could you tell our readers/investors a bit more about some of your projects and some of your joint venture projects?

Gregory Beischer: It appears likely that we will soon have funding partners earning into our copper projects within a matter of weeks. We'll have a major company earning-in on our large copper porphyry project, called Batamote, in Sonora, Mexico right in the heart of a tremendous belt of giant porphyry deposits. A district scale strategic alliance with another major company in eastern Alaska seems likely. Quite exciting! It is gratifying to see major companies investing in early-stage, grass-roots exploration.

But the biggest move by far, which Millrock has made over the last few months, is to stake mineral rights over a gigantic tract of land in and around and along trend from the Pogo gold mine in eastern Alaska. Now Pogo is operated by Northern Star Resources, an Australian company. They bought it just six months ago, very aggressive miners, obviously very good miners and very good explorers. They've made new gold discoveries west of their mine. When that was announced our ears perked up because we own claims west of the mine as well, in sight actually of the mine portal, the entry way to the mine. So we have a couple of competitors in the area – some of the successful explorers from the Yukon - and it's almost like there's a staking rush going on in an area play. So our claims have become quite attractive targets to gold companies that want to explore in this district.

In my view, it's really an almost virgin district. Pogo was discovered in '95 and there was a big rush of exploration, but then over time no other ore bodies were really found. The claim block cover just dwindled away, until it was almost wide open. I've watched it, for almost five years, being wide open. Finally, we decided now was the time to make a bold, aggressive move and stake the entire district. It's very unusual to be able to do that in gold camps or what will be a gold camp in my view. Usually the competition is intense!

I believe there will be multiple mines like Pogo. Pogo itself produces 300,000 ounces of gold per year. Six million ounces of gold in ore with a grade of almost a third of an ounce per ton of gold. It's really quite an excellent mine. We'd just love to find one or two more of them. We'll have a really good shot. We were able to fine-tune our claim block because we had purchased about $15 million worth of exploration data five years ago for fractions of a penny on the dollar. So we're well armed. We have a $15 million head start on everybody else in the district.

We're quite eager and excited to get into the field. In fact, we’ve just mobilized crews into the field now. We're going to do a geophysical survey near a new discovery made by Northern Star. We understand they're been drilling as close as 90 meters away from our claim boundary. We're going to try to image in the third dimension, using a specialized geophysical survey called CSAMT. If we get the result we hope, it will be a highly compelling drill target. It could be that this new discovery by Northern Star actually trends right onto the Millrock claim. We’ve got some great surface indication on our property. The geophysical survey will help determine to what depth we have to drill.

Dr. Allen Alper: Really exciting! It sounds like 2019 is an interesting and exciting time for Millrock. That's great!

Gregory Beischer: We raised a bit of money. I think we'll see more money coming in by virtue of these partnerships that we're about to form on our copper projects. As soon as we have new partners, all the holding costs of the properties are covered and much of our employees’ salaries are covered by the partner, so our overhead goes way down. That's what it's all about, keeping the burn rate as low as possible, so that we have continuity year to year, and systematic exploration, increasing the chances of ore body discovery and in so doing, creating that big reward for our shareholders.

Dr. Allen Alper: That's excellent! That's a great approach! I noticed you are teaming up with EMX on some projects.

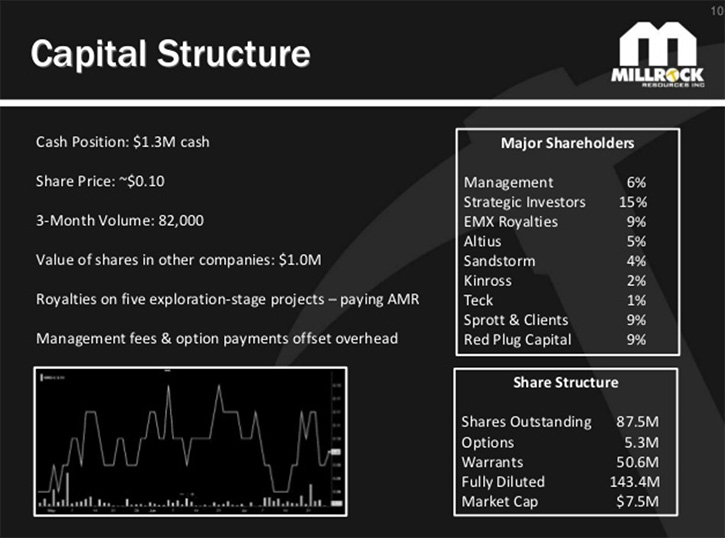

Gregory Beischer: That was a strategic investment by EMX. Our shares were trading at around 10 cents and we were getting quite low on cash. I wanted to stake that entire belt of rocks in the Goodpaster District before anyone else staked it. So we talked to EMX because we know the geologist there well and they became quite interested too. So we made a deal, whereby they would buy Millrock stock at a premium to our share price. They paid 14 cents a share. In return for that premium, we granted them a small royalty on any claim we would stake.

We staked a lot of claims, about half a million Canadian dollars’ worth of claims, covering 660 square kilometers. So they're now a small royalty holder on those claims and we're proud that we're a mineral rights holder on some very prospective grounds. It was a win-win for both parties. We really like the EMX team. We share a similar approach to exploration and we'd like to recreate their success. They made a major discovery that they've monetized and now they have a lot of cash to deploy. We'd like to make it over that first big step too.

Dr. Allen Alper: Yes. They have a great crew. I have known Dave Cole for many, many years. I have great respect for him. It shows he has a lot of confidence in you and your team and what you're doing. He is a very smart guy, so that's excellent.

Gregory Beischer: Yes. We agree.

Dr. Allen Alper: Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company?

Gregory Beischer: I came up through the ranks of Inco, a big Canadian based international nickel mining company. I got a great education there, ending up in Alaska 25 years ago and exploring there ever since. My partner, who founded the Company with me, Phil St. George, is a great geologist. His biggest claim to fame is that, as a young man, 28 years old, he discovered the Pebble, copper, gold, silver, molybdenum deposit in Alaska that's currently in the permitting phase now 30 years later. But it's a huge deposit. Subsequently he led the geological team at NovaGold to build the Donlin Creek gold deposit from 2 million to over 20 million ounces. So he has a lot of ounces of gold and pounds of copper to his credit. We're a good team, very prolific, imaginative fellows that can think about where the next giant ore body could be and put together the picture that convinces mining companies to invest in our ideas.

Dr. Allen Alper: That's great. You both have great experience, great backgrounds and an excellent team. Sounds excellent! Could you tell our readers/investors a little bit about your capital and share structure?

Gregory Beischer: Thanks, Dr. Alper. We have a great team all around. We have some younger geologists coming up that have great drive. They make it all happen in the field. And we have excellent support staff too that help manage all the land and all the exploration data.

After this recent financing and the input of cash through financing from EMX, we have 87 million shares issued and outstanding at this point. We also have quite a few warrants. Those are going to be a good source of cash for us, I think. Our share price is trading at 10 cents now. The warrants are priced at 14 cents and then escalate over a 2.5 period in exercise price up to 17 cents and then 20 cents. But I'm pretty darn sure this is going to be like 2009, where Millrock's shares were around 10 cents. We made some good partnerships, did some good work, made some interesting discoveries and within a year our share price was up to 80 and 90 cents, peaking at over a dollar. So I can see that happening again here. If it does, all those warrants will get exercised and that'll bring in another $4 million Canadian into our treasury and will give us some breathing room, number one. Number two, it'll give us some capital needed to acquire mineral rights on some of the other great prospects that we know exist, but we haven't been able to afford to stake yet.

Dr. Allen Alper: That sounds excellent. That's very good. Could you elaborate on why our readers/investors should consider investing in Millrock Resources?

Gregory Beischer: I would repeat my story of the 2009 situation where the market started to lift up, so there was wind under our wings. We made some good deals, like a strategic alliance with Altius Minerals. Teck Corporation made a deal on one of our projects. Also, just with the uprising market, it helps so much. Investors realized Millrock was way undervalued, with less than a 10 cent share price. So the price went up remarkably. I think the same thing is about to happen now, it's been at a depressed price for so long. It's been six years of a highly depressed cycle in the mining space. They always come to an end. I think this one finally has come to an end and things are about to really take off.

Over the last several weeks I've traveled around, including Vancouver at the Sprott Resource Investment Conference. It's clear that everyone's believing the bull market's on and gold is going to move. Investors are going to surge into the mining and mineral exploration space and the people we've talked to in Australia say, "It's already on." Maybe in North America, we have people not fully engaged, taking summer vacations. But in Australia, apparently, all kinds of deals are being done and money is flowing for our space. That's great to hear.

In fact, there's been a real surge of Australian capital coming to Alaska over the last couple of years. So we're making moves to try and show more Australian companies our prospects and get them spending money up in Alaska on Millrock projects.

Dr. Allen Alper: That's sounds exciting. That sounds like a very exciting time for Millrock and also for Alaska.

Gregory Beischer: It has been a tough six years. You work so hard to get everything together and afloat. When it finally changes, it feels a lot more rewarding and I’m very optimistic for the exploration we will do in the coming years, and with some good science and some good luck, we should make some discoveries that will reward our shareholders.

Dr. Allen Alper: That sounds excellent, Greg. Is there anything else you'd like to add?

Gregory Beischer: Thank you very much for the interview for Metals News. I'm thinking, since we've had such a long down cycle, maybe we're in for an up cycle of similar duration. That would be great. It would be nice to see a good solid gold price, which seems to attract the most investor interest. Also the shortages of copper that we're going to likely see in the next decade, the shortages of zinc that are already in existence. There's going to be huge demand for those metals. I don't think we have enough existing mine and/or brownfield capacity to meet the demand that's going to be there. That's why, as an industry, we need to look for those new deposits. Of course, that's where Millrock comes in. We're the early stage exploration specialists. It is past time really that major mining should be investing in early stage exploration to find the next generation of copper deposits.

Dr. Allen Alper: That sounds excellent! By the way, I recently interviewed Rob McEwen. He feels the gold and precious metals market is about to take off and have a long term increase in value and interest. So it sounds like your timing is right.

https://www.millrockresources.com/

Gregory Beischer, President & CEO

Mel Henderson, Investor Relations

(604) 638-3164

(877) 217-8978 (toll-free)

|

|