Interview with Rob McEwen, Who Discusses Positive Gold Market Outlook and McEwen Mining Inc. (NYSE: MUX, TSX: MUX)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/31/2019

Rob McEwen is a recognized Leader in the mining industry. He has greatly supported investment in mining. He founded Goldcorp Inc., which has merged with Newmont to become the world’s greatest gold mining company. Rob is also a philanthropist, who is funding pioneering stem cell research. Rob is also supporting education. McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a diversified gold and silver producer, with operating mines in Nevada, Canada, Mexico and Argentina. It also owns a large copper deposit in Argentina. Mr. Rob McEwen, Chief Owner and Chairman of McEwen Mining, owns 22% of the Company. He is very excited about the gold and silver outlook, as well as about the mining industry in general. With a diversified production base, in three of some of the best mining districts in the world, a production forecast of about 190,000 ounces of gold this year, and significant resource upside potential, McEwen Mining is well positioned for the next bull market in gold equities.

Rob McEwen holding a gold bar

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rob McEwen, who is Chief Owner and Chairman of McEwen Mining, and also a well-known authority on what's happening in gold and silver and the markets. What are your thoughts on the gold and silver outlook, Rob?

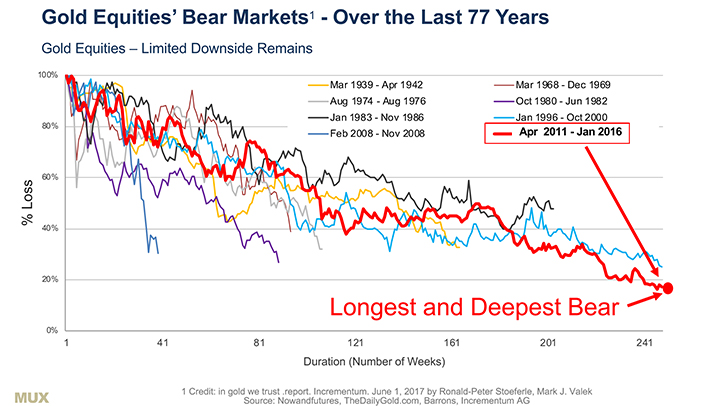

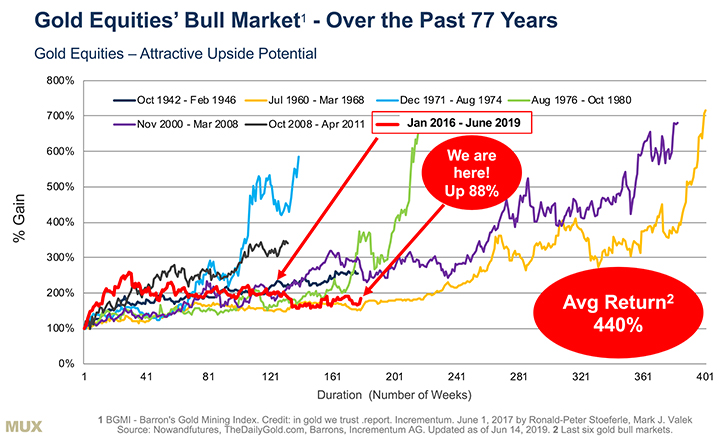

Rob McEwen: I am very positive on the outlook for gold and silver. Up until recently, the price of gold had been increasing faster in many currencies other than the dollar. Now the price of gold is moving up in all currencies. The last time we saw that type of movement in all currencies was back in mid-2005. Gold went from a low $400 per ounce, all the way to over $1900 an ounce, or a four and a half fold increase. The Euro went up four times during that period. I believe we will see those types of returns and more by the end of this bull market in gold, silver and respective equities.

Dr. Allen Alper: That sounds excellent. What do you think about the mining companies? What will happen? What's the outlook for them?

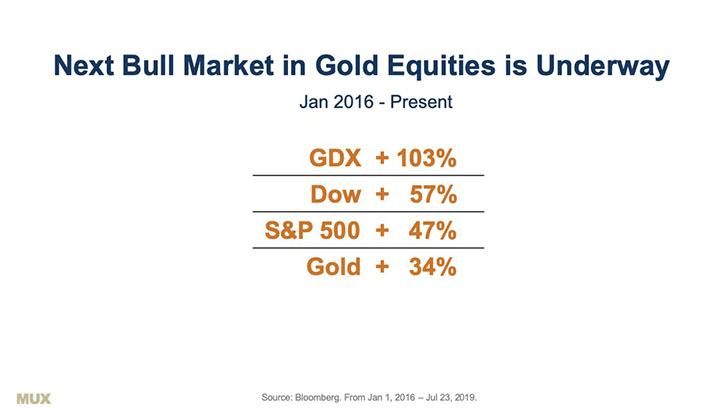

Rob McEwen: I am certain that your readers/investors will be surprised to learn how well this sector has performed. I believe, the bull market in gold shares and gold started at the beginning of 2016. Look at the GDX, which is the ETF comprised of seniors and intermediate gold producers. It has far outperformed the price of gold, the Dow and the S&P. Also, in the past 10 months, there have been a number of interesting exploration stories that have generated 4 – 10 x returns.

Combine this superior performance with the high profile mergers and takeovers in the gold industry that have occurred in the last 12 months and you have a formula for drawing increasing investors’ interest in this sector. You can make money again in this sector. Profits will bring media attention and investors

Dr. Allen Alper: That sounds like a very, very strong outlook for gold, silver, and the mining industry in general. That sounds excellent for an investor in the mining sector. Could you tell our readers/investors what differentiates McEwen Mining from their peers?

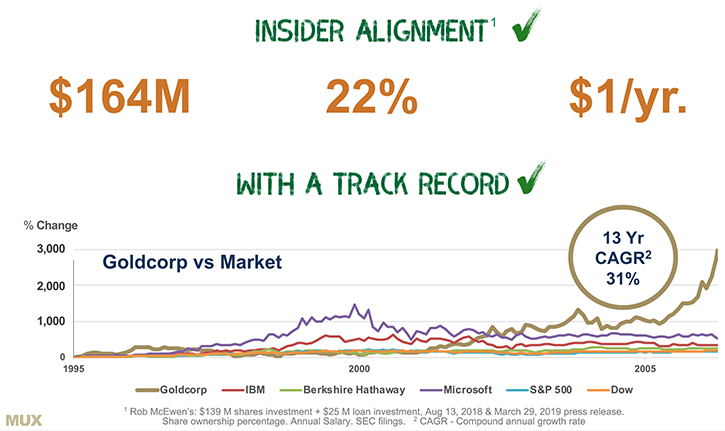

Rob McEwen: I'd be happy to, Al. The most obvious difference is insider ownership. As the Chairman, Chief Owner, and CEO of the Corporation, I own 22% of the Company. The cost base of my investment in the company is $164 million.

Another big difference is compensation. CEO compensation tends to be quite high in the industry. My salary, as CEO, is a dollar a year and I receive no bonus or share options. MUX’s executive compensation is very aligned with our shareholders’ interest.

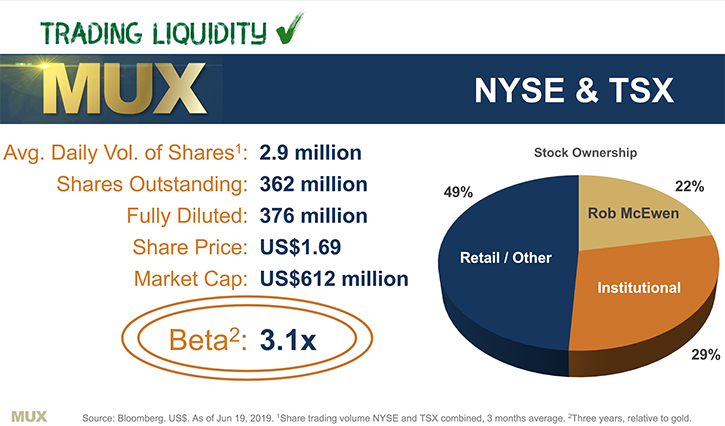

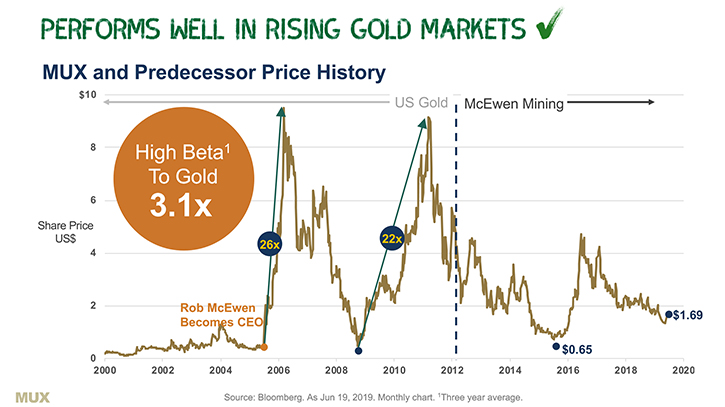

In addition, MUX has good trading liquidity. So for your readers/investors who are looking for a gold investment that has big leverage to the price of gold, they should consider MUX. According to Bloomberg, MUX has a beta of 3% which is one of the highest betas in the industry.

Just like real estate investments, location is a critical value driver for gold mining. MUX has a diversified production base. With mines producing gold and silver in four countries, Canada, United States, Mexico, and Argentina. Two of our mines are located in well-established and prolific gold producing regions. Our newest mine, Gold Bar, just started commercial production at the end of May. It is located in Nevada, some 25 miles south of Barrick Gold’s largest gold mine and their biggest, richest recent discoveries of Four Mile and Goldrush.

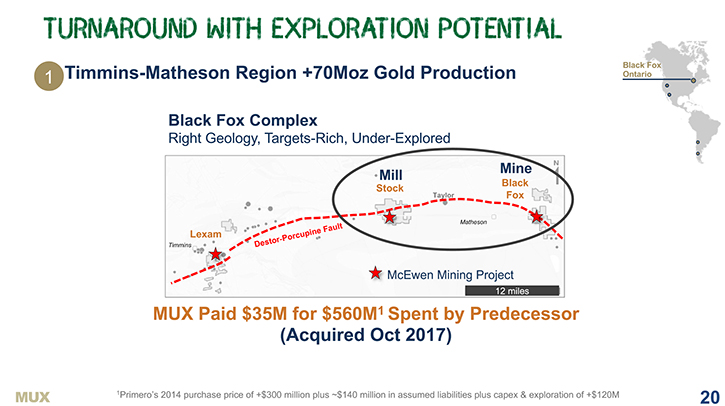

Besides Nevada, the Timmins district in Canada has been producing large amounts of gold for over 100 years. In October 2017, MUX bought the Black Fox complex. This is a turnaround situation. MUX paid a small amount to acquire a large property position in an important gold district. MUX paid $0.06 on the dollar that the previous owner invested. We have committed a large exploration program, which we believe will deliver additional reserves and resources that will allow us to extend the mine life, increase the annual gold production and achieve low cost per ounce.

Dr. Allen Alper: Can you also tell us about what's happening in Argentina and Mexico?

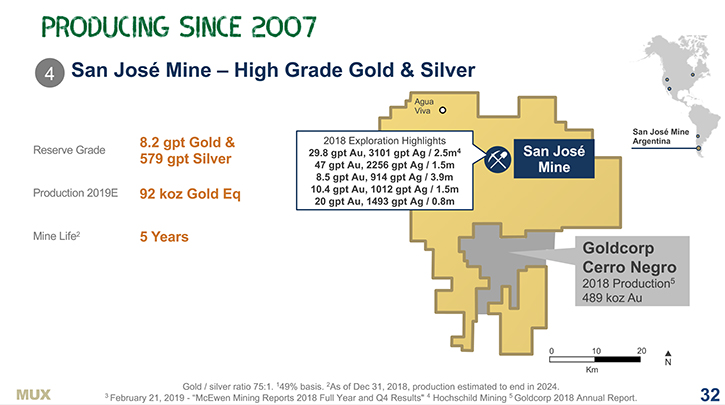

Rob McEwen: We have two properties In Argentina, a gold and silver mine, called the San Jose mine and a large copper deposit called Los Azules. The San Jose mine is located in southern Argentina. It has been producing gold and silver since 2007. Its reserve grade (or concentration of gold and silver per ton) is high at 579 g/t silver and 7 g/t gold. We own 49%. Our 51% joint venture partner, Hochschild Mining operates the mine. MUX’s share of annual production is 46,000 ounces of gold and 3.2 million ounces of silver. The joint venture property holdings are large and surround one of Newmont/Goldcorp’s largest gold mines.

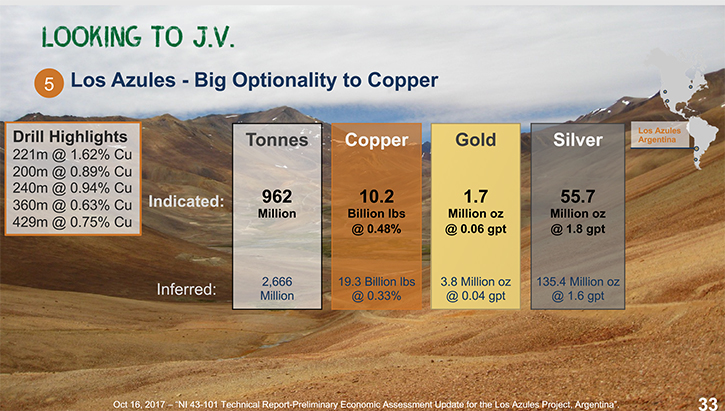

The Los Azules copper deposit is located in San Juan Province in northern Argentina on the border with Chile. It is a very large copper deposit, with indicated and inferred resources totaling 29.5 billion pounds of copper, 5.5 million ounces of gold and 190 million ounces of silver.

We have a very robust preliminary economic assessment on it that models a mine producing 415 million pounds of copper a year and about 100,000 of gold, equivalent ounces. It would run for 36 years. In the first 13 years it would be producing 415 million pounds of copper at a cost of $1.14 a pound. That cost would put it in the lowest quartile of the cost curve for copper producers today. This is a large capex project, $2.4 billion, so we are looking to bring in a joint venture partner, who has the treasury and experience to develop this deposit into a mine.

We're listed on the NYSE and TSX. Our symbol is MUX.

Dr. Allen Alper: Could you update our readers/investors on what's happening with Mexico?

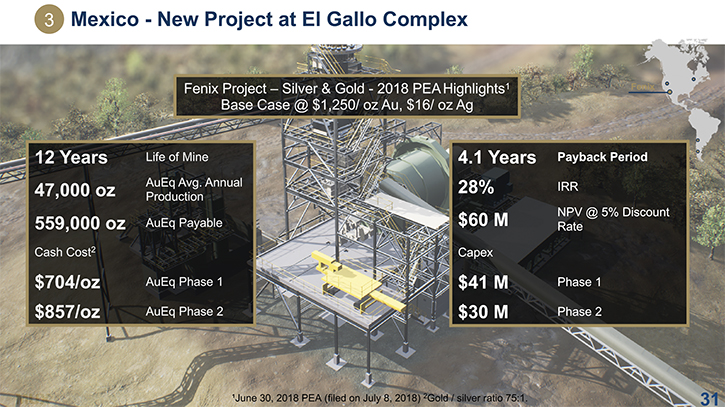

Rob McEwen: In Mexico, we have been producing gold since 2012. It is a heap leach operation with a 2 year life. Annual production has declined to 16,000 ounces of gold per year.

Five miles away, we have a silver deposit that received all the approvals to go into production in 2015. However, we decided not to put it into production at that time because the silver price was low and the economics weren't attractive. Currently, with the improving silver price, we are reassessing the economics of this project and hope to receive an amended permit to build later this year. Our preliminary studies suggest this mine would have a 10 year life and produce approximately 2 million ounces of silver per year.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors, looking ahead, what you see for McEwen Mining?

Rob McEwen: As a result of operating challenges, in the first half of this year, at Black Fox and a slow start up at Gold Bar, we have reduced our 2019 production forecast to 190,000ounces. In 2018, MUX produced 175,000 gold equivalent ounces.

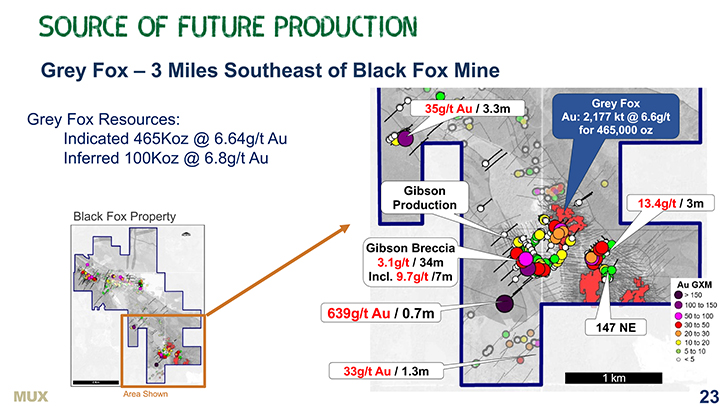

Looking ahead we have several opportunities to increase production on the Black Fox property. One in particular is the Grey Fox project, which has indicated resources of greater than 560,000 ounces and we are evaluating the economics of a central underground ramp system to access Grey Fox’s 3 deposits and two target zones that exist within 1 km2

We have a large exploration program this year. Therefore, we will have a steady stream of press releases, detailing drill results and resource updates throughout the year.

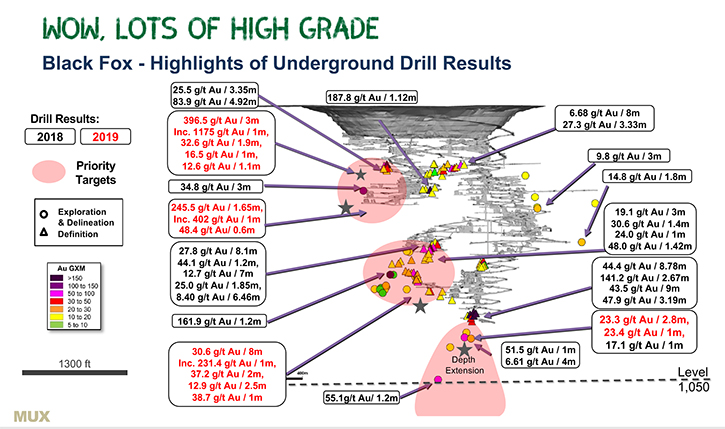

The purpose of our underground exploration program, at the Black Fox mine, is to find new resources and to generate a better mine model, in order to extend the mine life and develop a better mine plan. Exploration this year has generated encouraging high-grade results on the west side of the mine, as well as in the central portion of the mine. Some 800 metres or 2600 feet to the west is a satellite deposit, called Froome, which has good widths and consistent grades. A study that is nearing completion, is evaluating the economics of bringing this deposit into production, within the next 12 months.

Dr. Allen Alper: That sounds very good. What about Gold Bar? What is the outlook concerning production, development and exploration?

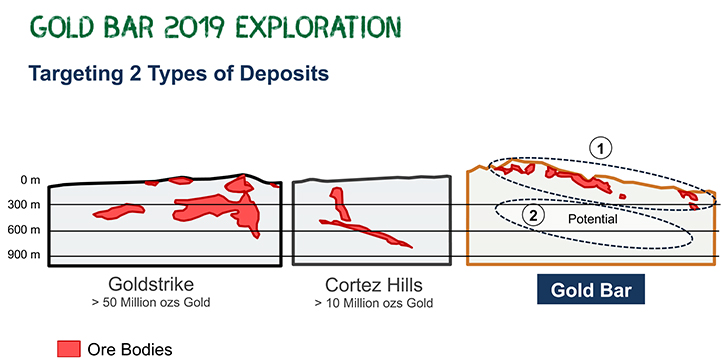

Rob McEwen: The Gold Bar mine is our newest mine. In late May it achieved commercial production. Today there are several exploration drills working at Gold Bar. This drilling is testing three types of targets. One is looking for near surface deposits that we could process through our heap leach facility. Currently Gold Bar has a 7.4 year life.

The second target we are testing is a concept that the rich Carlin style deposit exists at depth on the Gold Bar property. There are two deep drill holes, plus 1,000m depth that will be drilled in Q3. The target is the same rock unit that hosts Barrick Gold’s Cortez Hills, Goldrush and Four Mile discoveries that exist 25 miles north of Gold Bar.

The third target is on Gold Bar South. It is an adjoining property that we bought several years ago. It has a resource of 100,000 ounces, which we bought for less than $4 per ounce contained. We have another 2 drills working at Gold Bar South. We expect to bring Gold Bar South’s ounces into our reserves, within the next 12 months. This would extend the mine life to 9 years.

That's the exciting part of our exploration story.

Dr. Allen Alper: That does sound very exciting, something our readers/investors will want to watch very closely. Could you tell our readers/investors about your capital structure?

Rob McEwen: We have a clean, simple capital structure. MUX has 362 million common shares issued and outstanding, fully diluted the share count is 376 million. We have $50 million in debt. That debt we put in place in the summer of 2018 when we felt our share price was too low to issue equity. I put up $25 million of the $50 million debt. There were no warrants attached to the debt and it is not convertible into shares. It is just straight debt.

MUX’s average daily trading volume over the past 3 months is 3 million shares, which is equal to 1% of our outstanding shares.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors why they should consider investing in McEwen Mining?

Rob McEwen: If your investors have a positive view on gold, want to make an investment in gold and their risk tolerance is high, then they should consider a high beta company such as McEwen Mining.

We have exploration going on in some of the best gold districts in the world. Exploration creates the opportunity to make a discovery. Exploration success was responsible for Goldcorp’s fantastic share performance. But it is important to understand there are no guarantees.

Alignment with shareholders’ interest. As the Chairman, Chief Owner and CEO I have large insider ownership of 22% with a cost base of $164 million, my track record is building Goldcorp Inc. into a large, profitable, NYSE-listed gold producer that delivered excellent share performance.

I am investing my capital, time and experience in order to build another Goldcorp. The profits of this effort will be invested in bettering society by continuing the support my wife and I have given to medical research, particularly focused on regenerative medicine and stem cells, to education, to leadership initiatives and to architecture and the arts.

Dr. Allen Alper: That's excellent. It's excellent to see one of our leaders in the industry invest in medical research and other educational activities. I know you also invest in architectural work. Is that correct?

Rob McEwen: Yes. That's correct.

Dr. Allen Alper: Is there anything else you'd like to add, Rob?

Rob McEwen: Al, it feels like the time to be owning gold and silver stocks is now. All you have to do is look at its relative performance to the broad market and ask yourself the question, "How much higher is the broad market going to go?" Are we going to get a double or a triple from here, or would it be easier to see a gold stock generate that 2x-3x return? After all, gold and gold shares have been out of favor with quite depressed prices and illiquid for a long time. If you're a contrarian, it's time to get on board and buy some gold.

Dr. Allen Alper: That sounds excellent. My family and I continuing to be investors in McEwen Mining. We all wish you well. I appreciate your hard work in growing the Company.

Rob McEwen: Thank you very much for your interest, Al. Have a very golden day.

Dr. Allen Alper: You too. We’ll publish your press releases as they come out so our readers/investors/investors can follow your progress.

Disclosure: The Alper family owns McEwen Mining stock.

https://mcewenmining.com/

Mihaela Iancu

Investor Relations

(647) 258-0395 ext. 320

info@mcewenmining.com

|

|