Pan American Silver Corp. (NASDAQ: PAAS, TSX: PAAS): Founded by Ross Beaty, World's Second Largest Primary Silver Producer; Interview with Siren Fisekci, VP Investor Relations and Corporate Communications

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/27/2019

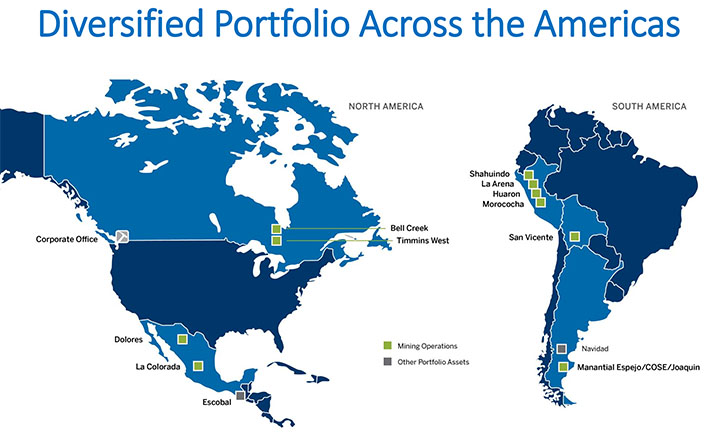

Founded in 1994 by Ross Beaty, Pan American Silver Corp. (NASDAQ:PAAS, TSX:PAAS) is the world's second largest primary silver producer, providing enhanced exposure to silver through a diversified portfolio of assets, large reserves and growing production. The Company owns and operates mines in Mexico, Peru, Canada, Argentina and Bolivia. We learned from Siren Fisekci, VP Investor Relations and Corporate Communications of Pan American Silver, that since the acquisition of Tahoe Resources in February of 2019, the Company is focused on their three high-value catalysts: the potential restart of the world class Escobal silver mine in Guatemala, the significant high-grade La Colorada discovery, with the first resource estimate due by the end of the year, and the potential development of the Navidad project in Argentina, which is the world's largest undeveloped primary silver deposit.

Pan American Silver Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Siren Fisekci, who is VP Investor Relations and Corporate Communications of Pan American Silver. Could you tell our readers/investors about your premium world's silver Company, Pan American Silver and give us an overview and tell us what differentiates it from its peers?

Siren Fisekci: Yes, I'd be happy to. Pan American Silver is currently the second largest primary silver mining company in the world. We have a diversified asset base of 10 operating mines. We also have one mine in Guatemala called Escobal, which is currently not operating. Our mines are located in Canada, Mexico, Peru, Bolivia and Argentina.

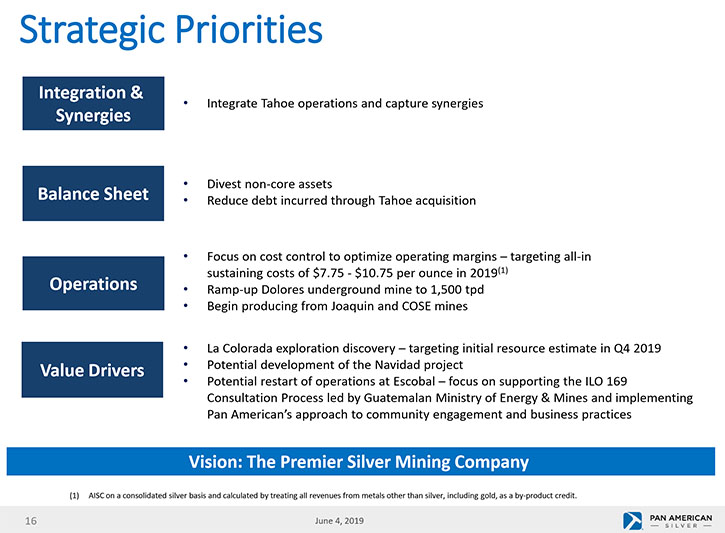

I would say the unique thing about Pan American at this stage, following our acquisition of Tahoe Resources, which closed on February 22, 2019, is that we now have a number of high-value catalysts representing very good optionality in the Pan American investment. Those catalysts would be the Escobal mine in Guatemala, but currently not operating. This is a world class silver mine. It's fully built out. It was producing roughly 20 million ounces of silver annually at all in sustaining costs of under $10 an ounce before operations were suspended in June of 2017. That's one catalyst, the potential restart of that mine, for which we have not provided a timeframe yet. The Guatemalan government must complete an ILO 169 consultation, and we are working to better understand the communities around the mine.

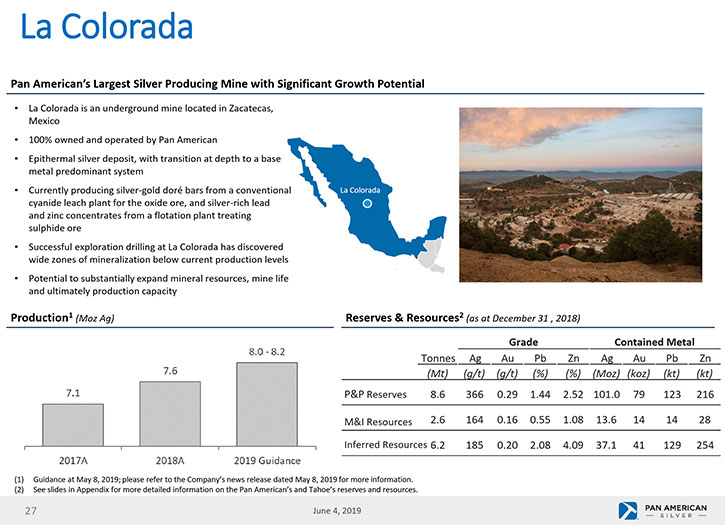

The second catalyst for the Company is the La Colorada discovery. We made a significant exploration discovery that we first announced in October, 2018. We are continuing to drill on that discovery. We've encountered several meters of high grade mineralization. We are planning to provide a first resource estimate for that discovery later this year in 2019.

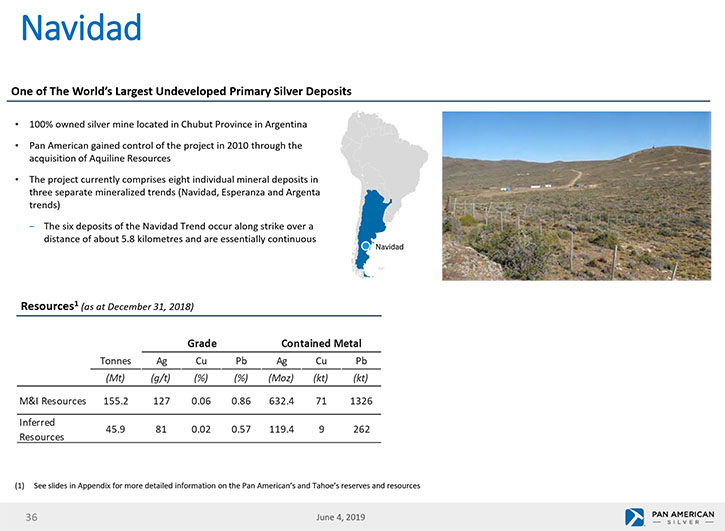

The third catalyst for the Company is potential development of our Navidad project in Argentina. Navidad is the world's largest, undeveloped, primary silver deposit, and there have been a number of developments on the political front. The reelection of Mr. Arcioni, the Governor in the province of Chubut recently and the potential that they will introduce into the legislature a bill that would allow open-pit mining in certain areas of the province. That may open the door for the development of Navidad. So that's a positive development. That represents three key catalysts for the Company going forward.

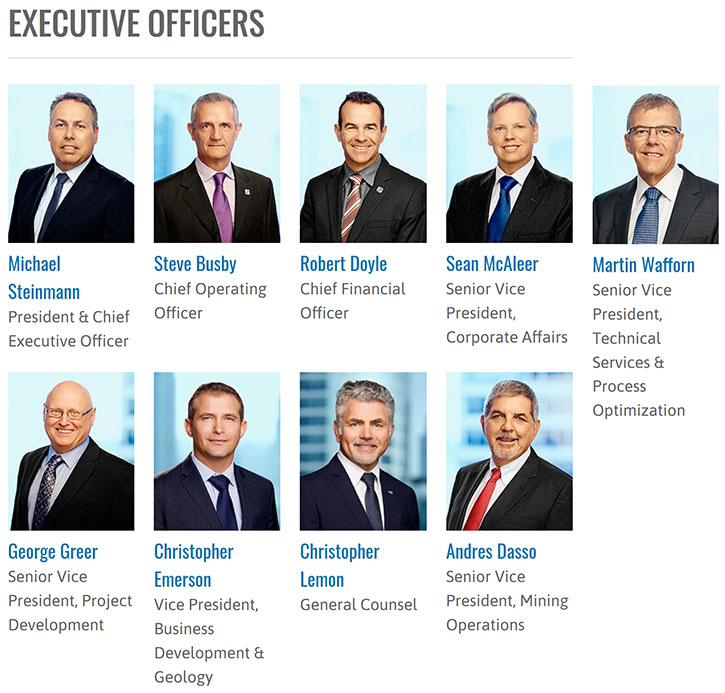

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little about the Management Team and the Board?

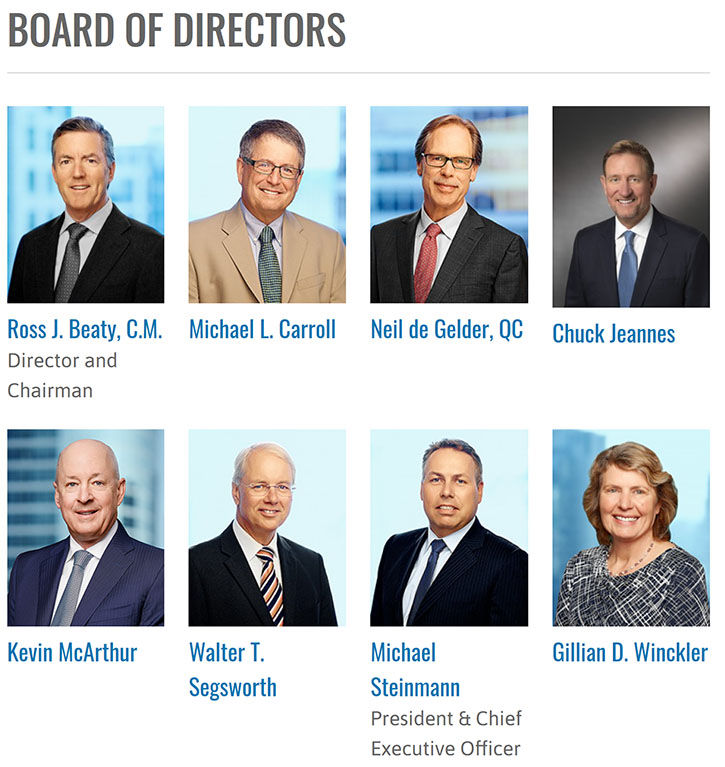

Siren Fisekci: Yes. Our Chairman of the Board is Ross Beaty. He's recognized as being a leading figure in Canadian mining circles. He is an entrepreneur and has started several mining companies. He founded Pan American in 1994, and as Chair is still active in the Company. Most of the Management Team has been together for 10 plus years at the senior level, and they've been responsible for building out many of the mines that we currently operate.

Dr. Allen Alper: That sounds like a very, very well respected, outstanding group. And of course Ross is well known throughout the whole world for his work in mining. Could you tell our readers/investors a bit about yourself, Siren?

Siren Fisekci: I'm the VP of Investor Relations and Corporate Communications at Pan American Silver. I joined in 2016. I'm responsible for developing the strategies for reaching out to both our institutional investors and the analysts, who cover the Company, as well as communicating with our retail investors, so providing full, fair disclosure to our shareholder base. In directing Corporate Communications, I help develop and execute strategies to reach our other key stakeholders.

Dr. Allen Alper: That sounds excellent.

Siren Fisekci: I have roughly 25 years of experience in Investor Relations and Corporate Communications in the resource sector.

Dr. Allen Alper: That's excellent. Excellent background. Could you tell our readers/investors a bit about the capital structure and share structure of Pan American Silver?

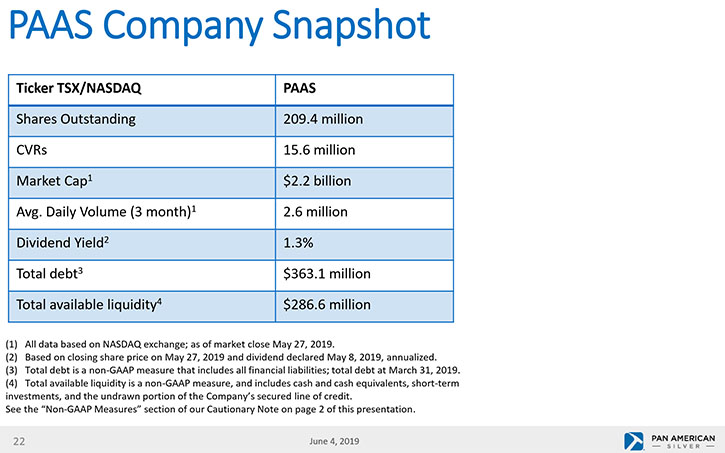

Siren Fisekci: We have 209.4 million shares outstanding. We did issue some shares when we acquired the Tahoe transaction. We issued 56 million shares. We also have these contingent value rights that would be converted into Pan American shares on the event that the Escobal mine is restarted.

At the end of the first quarter we had a cash and short-term investment balance of $121.6 million. We have a strong liquidity position, with $165 million available under our $500 million revolving credit facility. The total debt at the end of the first quarter was $363.1 million, as we drew on our credit facility to partly fund the Tahoe acquisition through cash and drawing on our debt facility, and repaying debt Tahoe had drawn under its credit facility.

Dr. Allen Alper: Sounds like Pan American Silver's in an excellent position. What are the primary plans for 2019?

Siren Fisekci: Well, we're going to continue drilling out the La Colorada discovery, with the aim of providing that first resource estimate towards the end of 2019. Our other operations are largely steady state, but we will be making investments to continue the long life nature of those mines.

We are building out two mines in Argentina called COSE and Joaquin, so another thing to watch for would be bringing the production from those two mines on in the second half of this year.

In terms of the Escobal mine, which many people ask about, we will support the ILO 169 consultation that's being led by the Guatemalan Government, as requested. We will also respond to the community's needs for further information and inquiries. These processes will take time and we are not providing any timeline for the restart of Escobal.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Pan American Silver?

Siren Fisekci: First of all, it's the operational expertise behind the Company. We've made strong progress in terms of bringing down costs and improving our operating margins. We're advancing those key catalysts; the discovery at La Colorada, potential development of Navidad, and the potential restart of the Escobal mine. I don't think those catalysts are currently priced into our stock, so it's really a strong optionality for an investor. Any one of those is a game-changing development for the Company, in terms of valuation.

The other reason is the exposure to precious metal prices. We are highly leveraged to silver and gold, so any improvement in those commodity prices would be very supportive for an improved valuation for the Company.

Dr. Allen Alper: Those sound like very, very strong reasons to consider investing in Pan American Silver. Is there anything else you'd like to add, Siren?

Siren Fisekci: Of course I’d like to thank you for interviewing us at Pan American Silver for Metals News. The only other thing I'll add is that we're quite a unique company in our portfolio diversification and in the length of our experience. This year, we're celebrating 25 years of operation, and we have a reputation, throughout Latin America, for responsibly building and operating mines. We're very proud of that.

Dr. Allen Alper: Well that sounds excellent. Thank you for a very interesting interview. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

|

|