Strategic Metals Ltd. (TSX-V: SMD): Award Winning Project Generator, Focused in the Yukon, Portfolio Over 130 Projects; Interview with Richard Drechsler, VP of Communications

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/26/2019

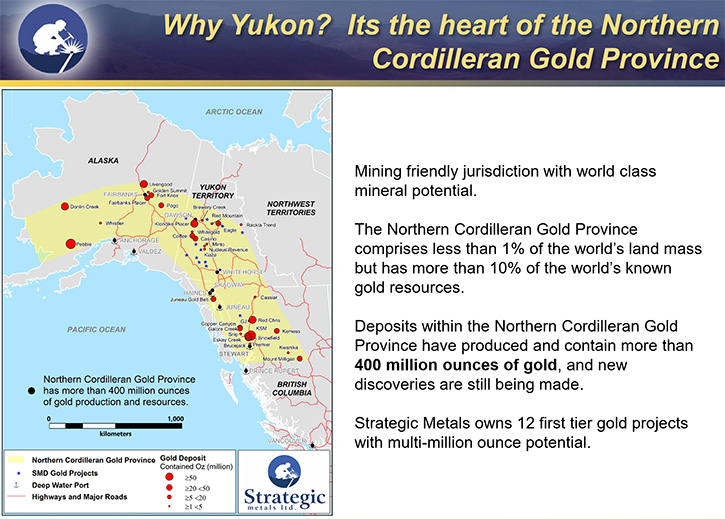

Strategic Metals Ltd. (TSX-V: SMD) is a project generator, focused in the Yukon, with a portfolio of more than 130 projects that are the product of over 50 years of focused exploration and research by a team with a track record of major discoveries. Current projects include 116 wholly owned, 5 joint ventures, 5 under option and 8 royalty interests. We learned from Richard Drechsler, VP Communications for Strategic Metals, that the Company's team is behind the discoveries of many of the mineral deposits in the area, including Yukon’s largest copper gold deposit, and the two highest grade million+ ounce gold deposits. We learned from Mr. Drechsler that this year Strategic Metals have plans to drill on three of their projects, including two high-grade gold targets and one copper gold, porphyry-type target.

Strategic Metals Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Richard Drechsler, who is VP of communications of Strategic Metals, LTD. Richard, could you give our readers/investors an overview of Strategic Metals?

Richard Drechsler: Certainly. Strategic Metals is a mineral exploration company that's listed on the Toronto Venture Exchange under the symbol SMD. We've been an active explorer for going on 20 years now, focused up in the Yukon. We follow the Project Generator business model, so our business plan is basically to leverage the geologic expertise of our team, whose members have spent their entire careers working in Yukon, in order to identify early stage targets. When we're in robust exploration markets, we're able to move a lot of those early stage targets over to partners, where they'll go on to drill define resources.

In markets that are a little slower like the current market, we've had to advance some of the targets a little bit further ourselves. So over the past few years, we've been spending one to two million dollars on exploration each year, making new discoveries and advancing our portfolio projects. We also are continually doing internal evaluations, because as we all know, in exploration not every prospect turns into a mine. In the last five years during this downturn, although the total number of projects held by Strategic has remained constant, we've actually added 34 new projects to the portfolio. Recently we're starting to see a little bit more interest in the sector.

In 2019, we have drill programs planned on three projects. We have twelve projects right now that have permits for large scale drill programs on them. By no means are these our only drill targets. They're just projects that we've selected that have a relatively attractive risk-reward profile. There's only so much information you can get from surface, so at some point, you have to punch a couple holes into the project to see what the mineralization looks like in three dimensions. That's our plan this summer. We'll be drilling two high-grade gold targets and one copper/gold, porphyry-type target.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about some of the projects, just the highlights?

Richard Drechsler: Since our projects are all pre-resource, one of the keys is the experience of our team in the Yukon. We're backed by the Archer Cathro Group, who have been actively exploring in the Yukon for over 50 years. A lot of the known deposits up there were discovered by the geologists that are behind our group. That would include the billion ton copper, gold, porphyry, at the Casino deposit, and the two highest grade gold deposits with over a million ounces, Osiris and Klaza.

Klaza, the second highest grade deposit with over a million ounces ever found in Yukon, is actually held by our subsidiary Company Rockhaven Resources. Klaza is pushing around 1.6 million ounces of gold equivalent at over a five-gram gold equivalent average grade.

It's wide open for expansion. A lot of our best drill holes are right along the bottom of the resource, which is only about 300 meters below surface at this point. It's a system where there are a number of sheeted veins and our current resource is comprised only from work we've done on two of the 11 parallel structures. So basically, when we got in there on our initial work, we made the discovery and kept stepping out along the strike, and ended up finding a real nice sweet spot on that system. Then as we were drilling deeper on that one structure, we started hitting parallel structures. Now that we've continued to do deeper holes, we have more and more and more parallel structures that could be brought into a resource set at future dates.

Strategic's large portfolio of marketable securities provides upside exposure to several large exploration projects. Major shareholdings include:

6.4% interest in ATAC Resources Ltd., which is developing Canada's only Carlin-type gold district at its Rackla Gold Project in east-central Yukon;

41.7% interest in Rockhaven Resources Ltd., which is advancing one of the highest grade gold deposits ever discovered in Yukon towards production;

27.7% interest in Precipitate Gold Corp., which is advancing the Pueblo Grande project located immediately adjacent to Barrick's Pueblo Viejo Mine in the Dominican Republic; and

17.9% interest in Silver Range Resources Ltd., a project generator, focused on high-grade precious metals in Nunavut, N.W.T. and Nevada, that also owns 4 highly prospective zinc-lead ± silver projects in Yukon.

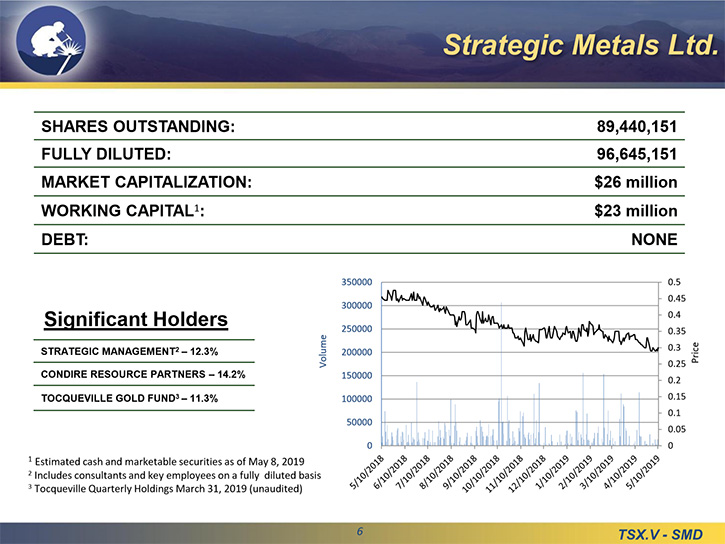

We have lots of exposure to advance projects through shareholdings. The Company itself has a shareholding interest totaling about $17 million. That's at current valuations where a lot of those resources or our stocks are quite beaten up. We also have about $8 million in unallocated cash in the treasury. So at today's prices we have an enterprise value of, roughly $5 million for the largest exploration portfolio in Yukon, which always comes up near the top of the list of places to look for mineral deposits globally. Some of the most prospective geology in the world in terms of the mineral endowment is up there. We're in a fairly strong position at this point, and we're trying to take advantage of some of this market weakness by bringing more targets into the portfolio, some that we've been watching for quite some time.

We did recently announce an option deal, where we will be vending one of our copper gold porphyry targets to a private company, associated with some recent M&A activity in the sector. As the M&A continues, on the more advanced deposits, we expect to see more of that money cycled down into the earlier stage targets, which is typically how the cycles happen. You see the M&A's right at the top. Then they start to work their way down the food chain. When that money needs to be redeployed in that sector, we are the guys with the inventory down at the bottom. Our CEO typically describes us, as the plankton that feeds the industry. We're the guys on the ground doing the early stage prospecting and target generation.

Dr. Allen Alper: Oh that sounds very good. Could you tell our readers/investors a little bit about your Management and Directors?

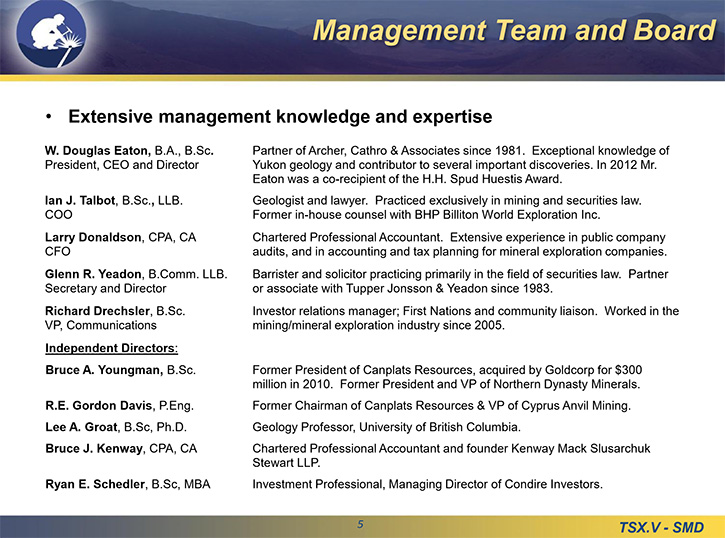

Richard Drechsler: Doug Eaton is the President and CEO of the Company. He's a partner with Archer, Cathro and Associates. He’s been a partner there since '81. Doug spent his entire career working in the Yukon, he has been a part of many of the discoveries of known deposits in the Yukon over the years. He knows what everything looked like at its early stages, which has really helped us in picking our projects, and probably more importantly knowing when to walk away from projects. Our Chief Operating Officer is Ian Talbot, he's a geologist and a lawyer. He was formally with BHP Billiton, so he brings a lot of expertise in terms of doing deals.

We have a strong Board made up of a number of exploration professionals such as Bruce Youngman and Gordon Davis. And then we also have financial capabilities like Ryan E. Schedler, who's an investment professional out of Dallas, Texas, and Managing Director of Condire Resource Partners, LP. They're a large shareholder of the Company. Management and shareholders, such as Condire, hold big chunks of the stock. Management and advisors hold around 12%, Condire holds around 14, and the Tocqueville Gold Fund holds around 11%. So we have strong institutional support that way.

Dr. Allen Alper: That sounds very good, tell us a bit about your share structure.

Richard Drechsler: Right now we have around 89 million shares out. That's the same number of shares we had out six years ago. The fact that Strategic is able to use the cycles to its advantage, really shows up when you watch our Company's share count over the long-term. When the market was robust, we were able to raise capital by issuing stock. But we also rely fairly heavily on moving product to get income. Most recently we announced a deal where we'll be selling our GK projected for a combination of cash, and required work expenditures. So that will be cash payments of upwards of two and a half million dollars coming to Strategic over the next few years as the Company works on the project. That allows us to keep our cash position strong, so that we can go out and acquire more targets and do a little bit of exploration without constantly having to go back to the market. The Company has no debt.

Dr. Allen Alper: Excellent! Could you tell our readers/investors the primary reasons they should consider investing in Strategic Metals?

Richard Drechsler: If you're looking to invest in exploration companies, one of the first things you say is, "What's my downside here?" The cash and shares provide a pretty significant amount of downside protection from our current market value. Currently our stock is trading at around 30 cents on the Toronto Venture Exchange. That gives us a market cap of roughly 31 million, but we have cash and shares of around 25 million currently. You also have downside protection from our property portfolio, as was evidenced by one of our most recent news releases: just one project can be sold for almost the entire enterprise value of a company at these levels. So you have a lot of downside protection.

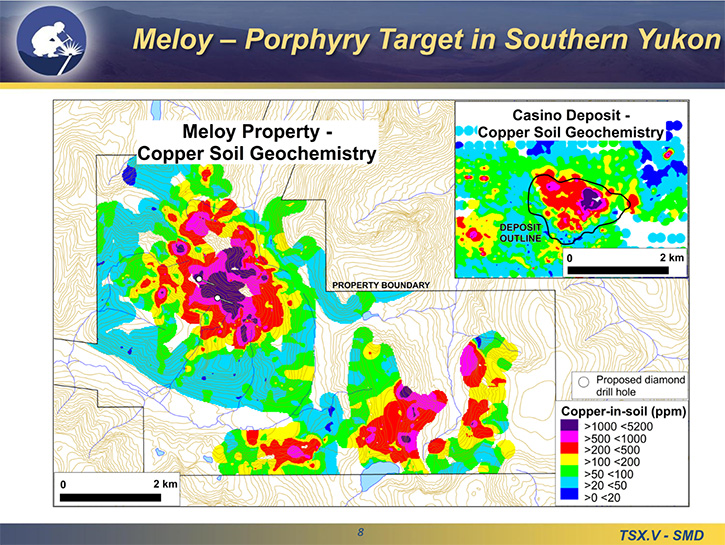

Second is do you have upside? Recently, in British Columbia, a couple companies have drilled good holes into copper gold porphyries and they've actually had some market recognition. So, if you can make a discovery, the market is starting to pay attention. That's one of the reasons we'll be drilling a couple holes at the Meloy project, which is located in the Dawson Range porphyry belt, on the southern end of that belt. It has a multi-square kilometer, multi-element geochem anomaly for copper, moly and silver. Meloy is a giant red mountain that you can pick out from Google earth. It was attempted to be drilled back in, I believe, the 80s. A group tried to get a drill hole into that, but had limited success, drilling down in the valley bottoms, where they brought the drill in with a cat.

In recent years we've expanded the geochem coverage. We've identified three different mineralizing structures on the project and we're looking to see some fresh rock there. We've set up a couple of drill sites so we'll be able to test the various mineralizing fracture sets that we see out at the Meloy and try to get a good handle on where we would sit in the classic type porphyry model.

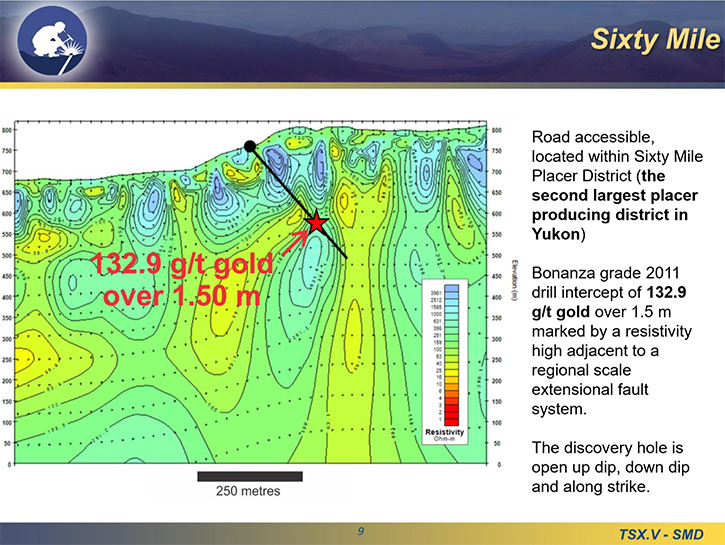

One of our other drill targets this year will follow up on a bonanza grade intersect that was drilled back in 2011 by another company. We were able to purchase the Sixty Mile property from a Yukon prospector, who had optioned it out during the 2011 boom. The company that was working there had a wonderful intersect of about 132 grams gold over a meter and a half. That intercept is about two kilometers away from what seems to be a porphyry center based on the geochemistry. Following that drill hole, the company performed a ground based geophysical survey, and we have a nice resistivity feature that is perfectly coincident with that high grade gold intersect, but it hasn't been followed along strike or down dip. That's going to get a couple of drill holes from us this summer as well as one hole in the afore mentioned porphyry target that's about two kilometers to the north.

The Sixty Mile is along a major fault structure. It’s right in the heart of the 60 mile placer district, which is the second largest placer producing camp in Yukon. So we know there's lots of gold in the area and we have major structures that go right through the project and we have previous drill hits as well as high-grade surface mineralization. So it's another good bet for us there.

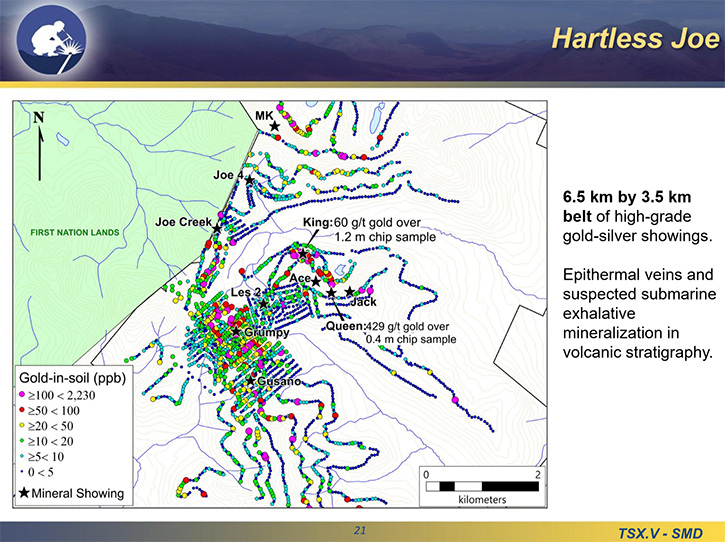

The third project that we are going to be drilling is the Hartless Joe Project. It's located about 20 kilometers outside of the capital of Whitehorse. The Hartless Joe really speaks to the unexplored nature of Yukon. We've had prospectors out there the last few summers and they were finding visible gold showings right on ridge tops. Again only 20 kilometers from the capital city. So the fact that you'd be able to find that sort of thing so close to town, in this day and age, really shows the unexplored nature of Yukon and why we're so excited to be up there doing the early stage work and making new discoveries all the time.

At Hartless Joe we have some chip samples from previous years that were 60 grams gold over 1.2 meters. We also had a 429 gram chip sample over 40 centimeters. Now that we've gone back over the last couple of years and done more detailed mapping to really get a handle on where the structures are and what's controlling some of that mineralization, we have a few drill sites picked out this year that are going to test a couple of the different features, some of the large scale faults that may be controlling a lot of high grade we see at surface as well as a chargeability anomaly that was identified in a previous IP survey.

It's being debated whether we’re in Stikinia or Cache Creek Terrane, but either way, it appears to host an exhalative type of mineralization in the volcanic stratigraphy that we're sitting in, which is similar to what you see a little farther south in that same belt of rocks. The Stikinia Terrane goes down into BC where a lot of the high grade deposits in the Golden Triangle occur. Eskay Creek is the model for a lot of the mineralization that we see here at Hartless Joe. Eskay was one of the highest grade gold deposits in that camp. We see evidence of those exhalative horizons on the Hartless Joe Project. So we're, we're optimistic that we're on to that type of system and there's enough high-grade on surface to support that. We could have some significant features just under the surface.

Dr. Allen Alper: That sounds excellent. Is there anything else you would like to add?

Richard Drechsler: Just to thank you for interviewing Strategic Metals Ltd. for an article in Metals News. We appreciate it.

Dr. Allen Alper: I’ve enjoyed your interview. It was very interesting. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Richard Drechsler

V.P. Communications

Tel: (604) 687-2522

NA Toll-Free: (888) 688-2522

rdrechsler@strategicmetalsltd.com

http://www.strategicmetalsltd.com

|

|