MAS Gold Corp. (TXSV-MAS): Proven Team Exploring Gold Projects in Saskatchewan; Interview with Ron Netolitzky, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/24/2019

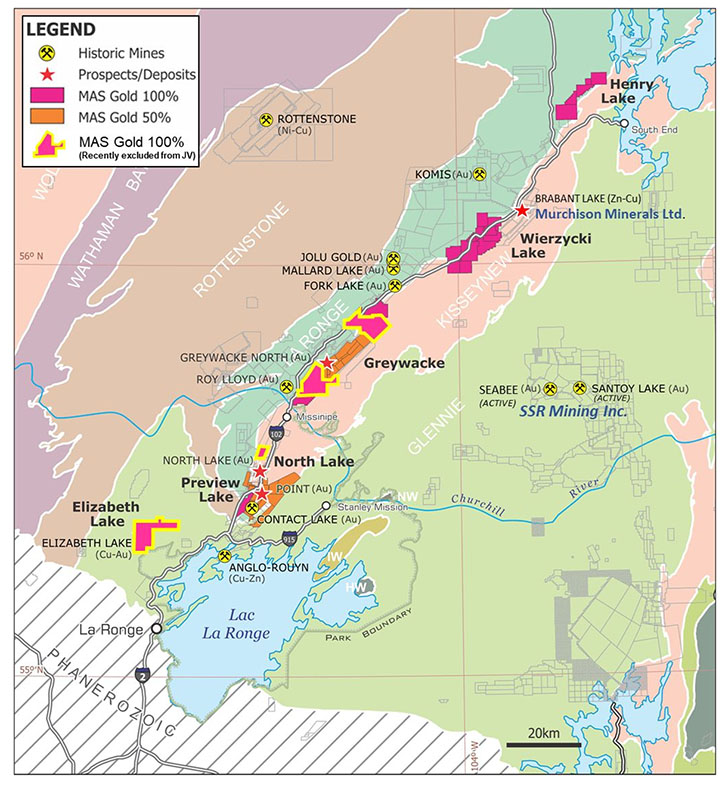

We learned from Ron Netolitzky, President and CEO of MAS Gold Corp. (TXSV-MAS) that they are a Canadian mineral exploration company, focused on exploration projects in Saskatchewan, along the La Ronge Greenstone Belt. MAS Gold’s projects include the advanced-stage, high-grade Greywacke deposit with a NI 43-101 compliant resource. With the addition of the Elizabeth Lake VMS deposit and Henry Lake and Wierzycki Lake properties, MAS Gold now controls six properties, totaling 53,830 hectares (133,017 acres) along geologically prospective sections of La Ronge, Kisseynew and Glennie Domains of the La Ronge Gold Belt. The properties are located very close to and paralleling the main highway that services Northern Saskatchewan. In 2019, the Company is conducting drilling programs at Point Gold and North Lake prospects, with the objective of confirming historic drill results and providing ore for metallurgical testing.

MAS Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ron Netolitzky, who is president/CEO of MAS Gold Corp. Could you give our readers/investors an overview of your Company?

Ron Netolitzky: Certainly. MAS Gold Corp is a Saskatchewan-focused gold exploration company, working along the boundary of the Lower Proterozoic volcanic arc rocks of the La Ronge Domain and the sedimentary basin rocks of the Kisseynew Domain. The area is commonly referred to as the La Ronge Gold Belt, a significant component of the Saskatchewan segment of the Trans-Hudson Orogenic Belt. We think there is world class potential within this belt.

Dr. Allen Alper: What do you think about working in Saskatchewan?

Saskatchewan is an attractive province to work in right now from a political as well as an economic point of view.

In the past, very little activity happened in the precious metals scene, mostly because of the politics. It is very different now. The provincial government views mining activities and exploration very favourably.

SSR's prosperous gold mining operations, located in close proximity to our project are currently leading the change and putting Saskatchewan on the map again.

So far, Saskatchewan has been known for its uranium in the Athabasca Basin, and Flin Flon base metals camp, which sits on the boundary of Saskatchewan and Manitoba.

Dr. Allen Alper: What kind of geology can you expect in the region, on which you are focused?

The deposits we are working on are hosted in Lower Proterozoic rocks, very similar in age to what you find in western Africa. The rocks in western Africa are essentially prolific for gold and that extends into north of Brazil in South America, as a result of pre-continental drift. And the famous Homestake mine in South Dakota is a Lower Proterozoic, iron formation-hosted gold deposit within the southernmost exposure of the Trans-Hudson Orogenic Belt.

The following map gives a reasonable summary of our land holdings.

Dr. Allen Alper: Is this your first experience working in the province, or do you know the area from your previous experiences?

I've worked the La Ronge belt and Saskatchewan off and on for over 50 years now. I started looking for gold, when gold was still cheap, in the 60s in the La Ronge area.

We have focused our recent holdings with MAS Gold on the boundary between the La Ronge Greenstone belt and what is called the Kisseynew gneiss terrain.

There were a number of occurrences that came to my attention that visually and physically didn't look that interesting, until you get the assays back. They're very low sulfide systems, with only one or two percent pyrite, but return very good gold grades. This is what we’ve established at the Greywacke, which I will refer to a little later.

MAS used to be called Masuparia Gold Corp. I decided it was time to get rid of the old Indonesian name of the Company. So we changed it to MAS, which is our stock symbol. It's a nice good old Spanish word meaning 'more'. We think this is a good name for the company.

Dr. Allen Alper: Why exactly do you find La Ronge Belt interesting? Are there any currently active miners nearby to support your case?

La Ronge Belt and the area is known for its high-grade, but small deposits. What has changed however, in the adjacent Glennie Domain, is the great success SSR Mining is having in the SeaBee and Santoy Lake area. It's the same style of gold mineralization as we have in the La Ronge Belt.

Claude Resources began operations at SeaBee back in the 1990’s, but it always struggled a bit. And I was involved in the early days of Santoy, with Claude as partner and we defined all the vein systems, on the surface, but we didn't figure out the structures correctly. We had difficulty drilling off these deposits. SSR took it all over in 2016 and have turned it around into being a fairly significant and profitable operation.

However, I've seen what happened with SSR Mining. They had enough drilled-hole density to find out that there's a very shallow plunge to the gold systems, probably in the order of 20 degrees.

We were drilling too shallow and too deep and didn’t identify the continuation of the high-grade chutes. It has turned out to be very profitable for the SSR group. And good for them. This is one of the things you learn and sometimes it's not bad being the later guy coming into a play because you learn from everybody else's mistakes.

Dr. Allen Alper: The map presented above indicates you are 100% owner of most of the properties, but some are marked as 50% owned. Can you explain?

On this map, we've outlined the properties that we own 100%. We also show the properties, on with which we are still in joint venture with Golden Band Resources. It's a situation that we have seen often, but they're now mainly a mine contracting company and they aren’t operationally very active. They haven't been funding their share of our last drill programs.

We anticipate that we will have them diluted to a royalty position probably in another two to three months.

The royalty position is buyable for $1 million Canadian dollars. We think we're going to get 100% control of the belt soon.

Dr. Allen Alpen: How about the infrastructure and access to your properties?

You'll notice on that map that our deposits are paralleling or are very close to Highway 102 and a high voltage powerline that services northeast Saskatchewan. And we are close to the community of La Ronge. There is a lot of great infrastructure

We do not need helicopter or airplane support for exploration work very much. Virtually none. We have mostly road access and ATV trail access to our properties, which allows us to make the exploration dollars stretch a lot further.

Continuation of the La Ronge gold belt goes into the Lynn Lake area of Manitoba, which has been fairly actively explored by Alamos Gold Inc. and they think they have potentially commercial viable targets in that area too.

We think this is a good place to work. It has opportunities because of its geology and the infrastructure that goes through it.

Dr. Allen Alpen: What work has been done on the property lately and what are you working on at the moment?

We just finished drilling two projects along the southern portion of our properties and released the results in May. First one is Preview Lake, where we have a deposit called Point. And then North Lake, which we think is a very important component of our southern play here.

North Lake is a fairly large, low grade deposit that sits right at surface, with some pretty good widths. We find that we have uniform gold values averaging 0.8 to 1 gram range across 160 meters widths.

The Point area, is located within a provincial park, but the government has allowed both historic and recent mining there. It's a place where you can work. It is still nicer to have processing outside of a park and that's what North Lake supplies. North Lake supports a case of a potential large open pit mine with low production costs, but taking feed from higher grades sources from inside the park.

The metallurgical program on North Lake is commencing now. The samples are in the lab and we're hoping, within a few months, we'll get those results.

We anticipate potentially high recovery rate available on just straight gravity circuit processing, the same as we proved possible at our Greywacke deposit further up along the highway to the northeast. At Greywacke, and in fact most of the deposits in the belt, up to 80% of the gold can be liberated with a simple gravity circuit.

On the Greywacke deposit, historically we have a measured and indicated resource of about 80,000 ounces. These are still subject to joint venture, but as I mentioned earlier, we are working on resolving the situation and claiming 100% ownership of this part of our property.

We did a 17,000 ton bulk sample test on this material and it ran about seven to eight grams and the average width and thickness of this deposit was in the order of five or six meters.

It's all shallow, so it's potentially very accessible. We recovered 83% of the gold using simple Knelson concentrator. It's not worth spending all the money to do the more costly cyanide treatment in this scenario. We've been looking at a very low-cost operation and production here.

Our ultimate goal is looking for bigger regional targets, but we feel that we have the ability to maybe start a small cash flow operation to pay for this sort of activity because it's getting very hard to pay for regional exploration in our industry these days. The costs of everything have gone to the moon.

Dr. Allen Alper: That's true. It's a tough industry for exploration and capital support. What do you have going for you that can get you noticed?

Ron Netolitzky: I would point out that the La Ronge Gold Belt and the world class Homestake are in the same Lower Proterozoic type of rocks. That is potential evidence that large deposits, within this particular belt of rocks, are highly likely.

What we have right now are numerous, small, high-grade occurrences. But the reality is, you consider a lot of these deposits to be small because they haven't been drilled off...maybe only to a maximum depth of 100 meters or less.

Nobody has put serious money into drilling off these deposits except in the SeaBee area. SSR Mining has been very aggressive, with their drill programs there and have indeed started to find significant resources. We feel there is a very strong opportunity in this belt.

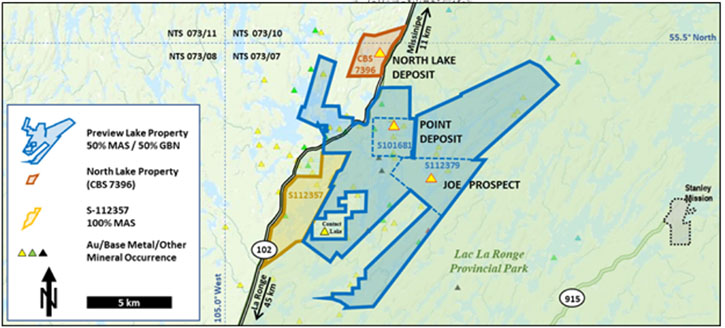

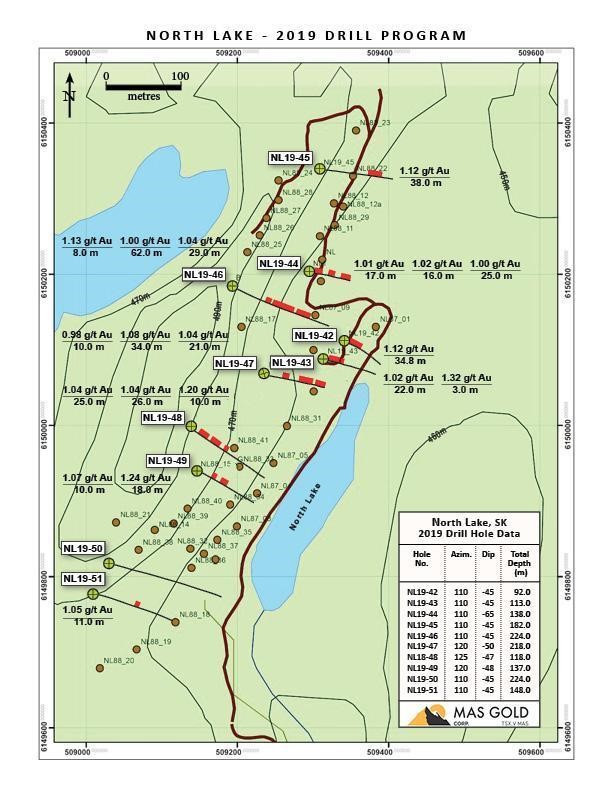

The map below shows the setting of North Lake deposit and the Point deposit. Within the southern end of the Point deposit, there's an area that's a crown reserve. This covers a historical mine area that was put into production by Cameco.

This particular mine extracted less than half of the resource that they've started with. It was shut down because the gold price dropped.

We have neighbors here that have small high-grade deposits that would be available for somebody that puts an operation into the area. Our targets, at the Point deposit and the North Lake deposit, are only about three to four kilometers apart.

It is also very handy to have a central mill located in North Lake area for or processing. We would start processing low grade material and supplement it with high-grade smaller deposits that we would most likely mine from underground.

Dr. Allen Alper: That sounds very good. Can you describe what type of exploration has been done on the property previously? Is there any historic information available to help guide your drill program development?

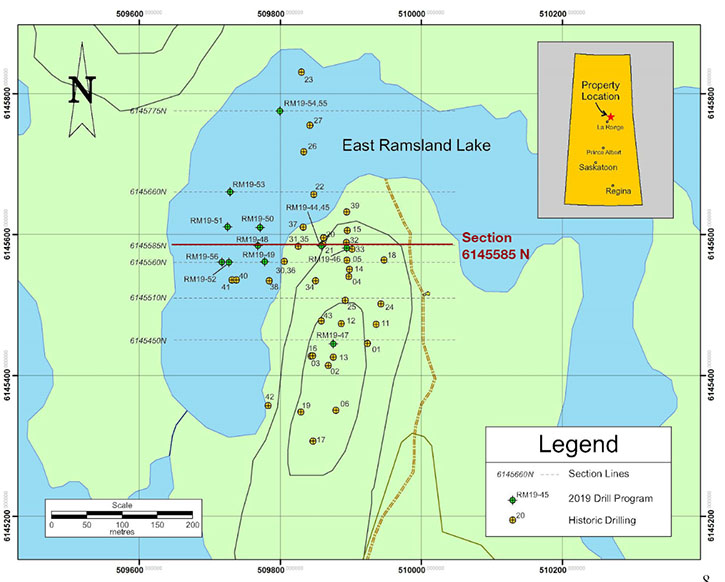

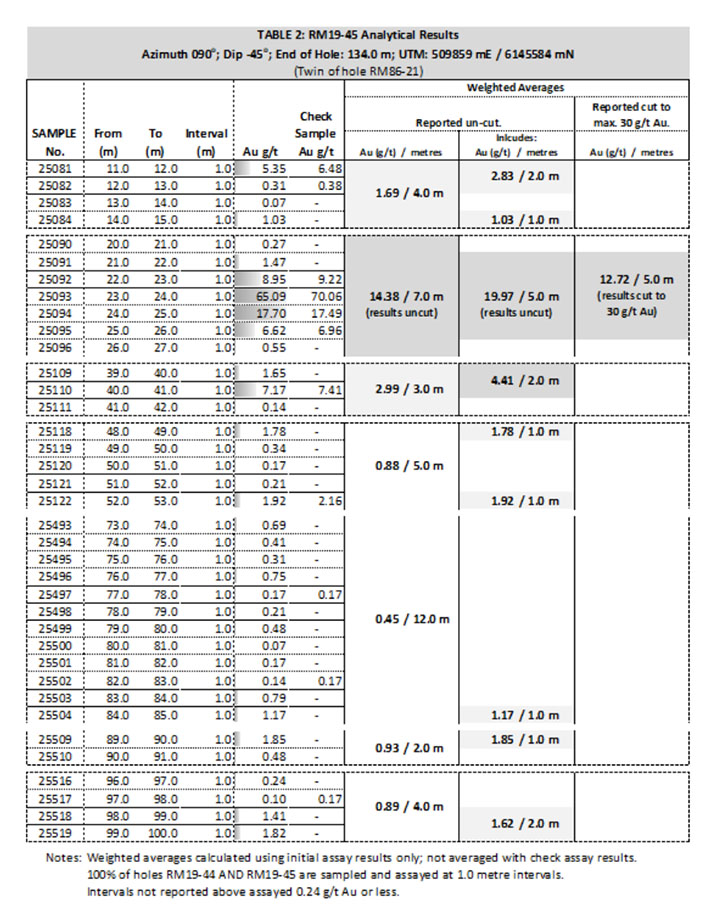

Ron Netolitzky: The details on historic drilling on Ramsland Lake, on the Point deposit and the new holes we put in are indicated in the images below.

The historic core was destroyed in a forest fire, except for two holes, which were stored in the government labs in La Ronge and are available.

There was no old core we could resample. We had to reconfirm some of the geology and results, as the initial step.

On our first pass, we definitely confirmed that the high-grade zones are there. This last winter we didn't confirm everything we wanted to on the extension of that deposit. We might have misinterpreted the plunge of the controlling structures at Point. We look forward to going back, with new drilling, to confirm the structural controls and orientation of the mineralization.

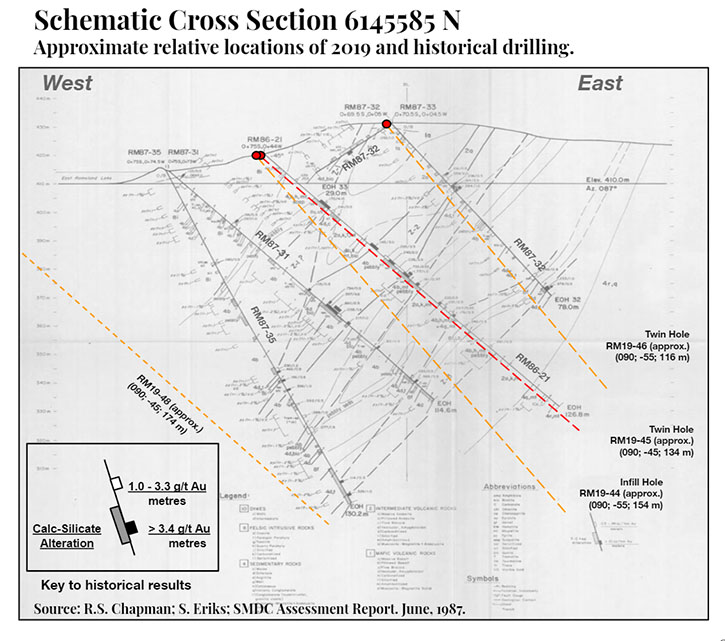

The chart below shows some of the confirming holes we did and the results. They're pretty decent. It gives a summary of all the Point Lake holes we drilled. Even the holes we are not satisfied with, have mineralization, but it's not the core of the deposit.

The next map shows the North Lake type deposit and the type of mineralization that we have there. These rocks can be quite misleading at first. I'll tell you, in my youth I would not bother sampling them. They look so innocuous; they have a small amount of pyrite in them. But, if you look carefully at them, you'll find that there is visible gold there.

We have enough information now to do a proper resource on the North Lake deposit. We've started the serious bench scale metallurgical program on this to see if it behaves properly.

The following map indicates wide-spread, low-grade mineralization that we confirmed.

All the historic core from North Lake property, even though they were drilled in 1987 and 1988, are preserved and we have re-logged and resampled a considerable amount of this core. This core was preserved because it was put in the metal clad building. Forest fires came over the building and didn't burn it.

We have a good record of old core, which is very rare in our industry lately. It's been harder and harder to have the database to confirm what's there and what isn't.

We will have a new resource calculated for North Lake. Looking at the results and the spacing, we will probably drill a few more holes to make sure that that resource is solid.

Dr. Allen Alper: That sounds good. How about other prospects? So far we discussed Preview Lake and the Point Deposit located there, the North lake Deposit and the Greywacke North Deposit, where the resource estimate already exists. Looking at your map, there is also Greywacke South. What is the plan there?

Ron Netolitzky: This is an extension of the Greywacke North, both hosted in the Kisseynew terrain. We flew a high-resolution aeromagnetic survey, back when we became involved with this property. We were astounded when we saw the main structures and the cross structures appearing in the survey.

These structures are not evident in the rocks when you're walking over them; they appear pretty bland to a naked eye. When all the data was compiled together, it was apparent that the historic gold occurrences are coincident with where the cross-structure cuts the main structures.

We feel we have a lot of opportunity to find further Greywacke North type mineralization at the Greywacke South and Lyons Zone. They have trenching and historical drilling that confirms high-grade gold mineralization.

Our first objective is to keep improving our understanding of the belt before we start drilling off these cross structures. We feel that this is an area that could become a center of real juicy mineralization.

Using visual clues alone, I normally wouldn’t bother assaying anything in this type of setting. But those boring looking rocks it runs. It's interesting that the Greywacke deposit and a number of others in this belt have been defined by basic prospecting techniques. Many of the discoveries were made following up anomalous lake sediment samples.

First prospectors that came in instructed this one green kid in the crew to just go out and grab some samples. He came back with a bunch of pretty unimpressive looking samples, but they ran five or six grams. They were some of the best results taken.

Dr. Allen Alper: Anything else that might get our attention?

Ron Netolitzky: In all these Domains - La Ronge, Glennie, Kisseynew, Flin Flon – there are gold occurrences, nickel occurrences and base metal VMS type targets.

We have one VMS-type target, which we acquired from a company that went into high tech. Elizabeth Lake was originally discovered in the 1960s.

It's an interesting VMS system. It's been flown with new high resolution aero magnetic and EM surveys. It indicates some pretty interesting conductive trends that haven't been explored. So we're looking forward to that as a type of a target.

Dr. Allen Alper: How about the financial aspect of your work? How do you find financing your operations in the current market?

Ron Netolitzky: At the moment, we are working towards earning 100% of the projects that are subject to joint venture. We're getting back stopped on this by one of our sister companies, called Eros Resources Corp., which used to be Boss Power.

It has investments in a number of other junior companies and involvements in Nevada and California. Also Eros was the beneficiary of significant working capital because the British Columbia government at the time basically expropriated the uranium deposit we had.

Thank goodness they did, because they had to pay us about $20 million. We had another partner at that time that was a shareholder that had approximately 50% of the stock. We finally settled and our company ended up starting off with about $10 million Canadian. We have a good chunk of that sitting there. Unfortunately, it's partly tied up, waiting for the junior markets to rebound. However, I think we're getting close to having a gold market again.

We decided to become much more active with MAS Gold because we felt that we were probably overdue and we might not be right within a few months. We think the gold business is turning. It should work its way down the food chain to more junior players.

Dr. Allen Alper: Could you tell our readers/investors why they should consider investing in your company?

Ron Netolitzky: We think this potentially will be a very profitable gold operation. And we think there is an opportunity for significant world class deposits on these belts.

We are experienced explorers. I've been through enough of these cycles that we realize that you can make money from mining, but you have to keep your capital costs under control.

You also need good people. There are good experienced people in the operating side available these days. If the business turns, there will not be enough people in our industry again.

But I think right now we are in a good position. I think we do have the opportunity. We think we're undervalued, if you look at the cash flow that we can potentially generate from the high-grade deposits, with which we are already involved.

Dr. Allen Alper: Sounds excellent! Very good reasons for our readers/investors to consider investing in Mas Gold! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.masgoldcorp.com/

Ronald K. Netolitzky

President & CEO

info@masgoldcorp.com

Tel: 604-685-8592

|

|