Blackstone Minerals (ASX: BSX): Option to Acquire the Modern Mechanized Nickel Mine in Vietnam’s Premier Nickel Sulfide District, Interview with Scott Williamson, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/24/2019

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Scott Williamson, who's Managing Director of Blackstone Minerals. Could you give our readers/investors an overview of Blackstone Minerals and also tell them what differentiates Blackstone Minerals from others?

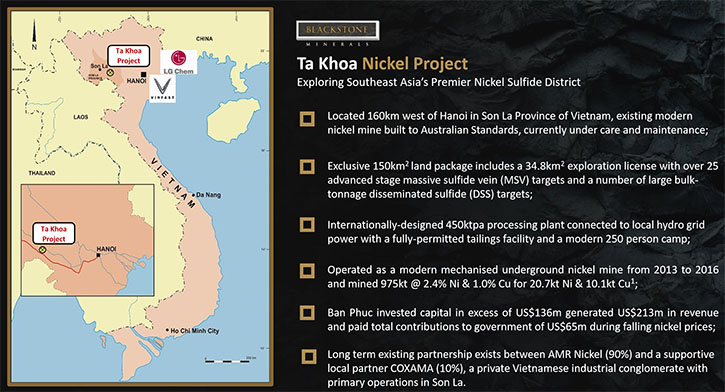

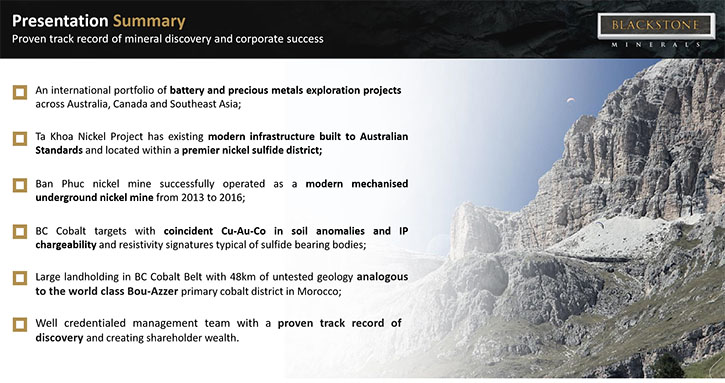

Scott Williamson: Thank you for interviewing Blackstone Minerals for Metals News. Much has happened since we last spoke. Recently, we have been given the option to acquire the Ta Khoa Nickel Project in Vietnam. We did this deal about two months ago that will allow us, over the next two years, to have the option to acquire the mine, which is currently under care and maintenance. To exercise that option, we need to give the vendor a million dollars’ worth of the Company.

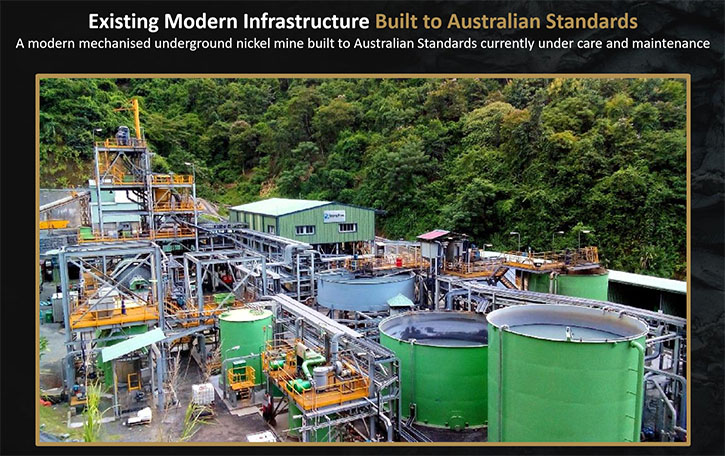

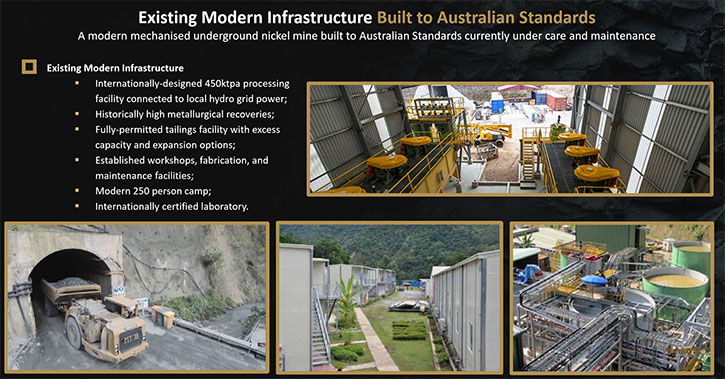

We think this is a very good deal for Blackstone shareholders. The mine was operating between 2013 and 2016 by a company called Asian Mineral Resources, a tier six listed company, and their mines are built very successfully. They've built a modern day underground mechanized mine, and a processing facility. They've spent over $130 million U.S. on capital infrastructure and generated a revenue of greater than $200 million.

That was during a period of difficult nickel prices, when the nickel price fell. Since this project was put into care and maintenance nickel processing has improved, and we now have nickel as a key ingredient in the battery chemistry of a lithium-ion battery.

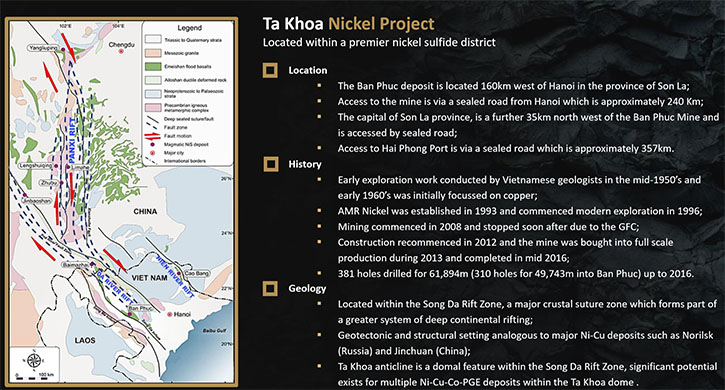

The last time we spoke was in Vancouver, when we were looking at the Canadian Cobalt asset. We're still focused on battery metals, but this time we're focused on the nickel sulfide geology. The magnetic nickel sulfide system comes through Vietnam into China, on the Chinese side of the border there are nickel mines all the way through this belt. The Vietnamese portion of this belt has never been properly explored with modern techniques. It was first explored with modern exploration in 1996. They went in, in 2008, and then they stopped, but started to build the mine again in 2012.

It was a five-year mine, and they operated and mined it for three and a half years. They went to the first massive sulfide vein and drilled and mined it. However, there are 25 massive sulfide vein targets that haven't been tested. There is also a very large disseminated body, right next to the existing mine. They mined out a massive sulfide vein, which is about 500 meters strike and mined down to about 400 meters, but didn't make use of the very large disseminated ore body, which is next to the vein. The disseminate body is one and a half kilometers long by a half kilometer wide.

Our focus initially will be on understanding the disseminated body. The disseminated system has some very good grades, up to 1% nickel in the disseminated body alone. We want to understand that, but then we want to look for more disseminated body, then eventually we'll get onto the massive sulfide as well. Just in the last week or so, we've announced our main induced polarization (IP) survey, the first company to do these geophysical techniques. We are looking for chargeability and resistivity/conductivity anomalies.

That first survey has performed better than we could have ever expected. We've already found two or three new targets from the first test line of IP. The previous owners and explorers only really focused on massive sulfide. We believe that the disseminated sulfides have just as much economic potential and have the potential to offer a 10 to 20 year mine life at this project.

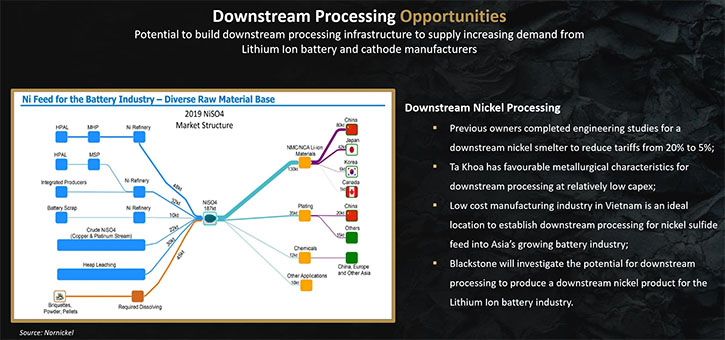

I suppose the key takeaway for this story is the fact that we're right on the doorstep of the lithium-ion battery industry. The lithium-ion battery industry has currently been driven by China, Japan, and Korea. We believe that there's no better place than Vietnam to look at a downstream process for nickel, so we have a 450,000 tonne per annum concentrator ready to go. We now need to look at the downstream process to convert the concentrate to a nickel battery product and deliver that into the lithium-ion battery industry.

LG Chem, one the world's largest battery manufacturers, is looking to build a battery mega factory in Hai Phong. Hai Phong is 350 kilometers along a sealed road from the Ta Khoa Project. VinFast is a local conglomerate, and they're looking to build electric vehicles. LG Chem and VinFast have formed a joint venture whereby LG Chem will build the batteries and VinFast will build the electric vehicles. This Joint Venture has already started and it’s happening in Hai Phong, the port where the mine, when it was operating, was shipping concentrate.

That's one reason why we're looking at downstream processing; the other reason is, that there is a 20% tariff on concentrate. In Asia and Africa, the governments are pushing miners to move into the downstream processing. In Vietnam, they're doing that through a tariff. There is a 20% tariff on concentrate, so we believe that if we can move downstream and produce a nickel battery product, then we could remove that tariff or reduce it significantly.

For the next few months, we'll continue exploring, we have already started drilling. The geophysics is performing better than we'd hoped, and we're finding more targets, so there is plenty to test. Concurrent with doing this exploration, we will also be carrying out studies and looking to scoping and feasibility studies over the next six to twelve months.

It was a very successful mine that generated significant revenue, and the cash costs were well below the nickel price, even though the nickel price was falling. The good thing about nickel sulfides is that nickel sulfide mines work in any commodity price environment because the technical aspects of the mineralogy and metallurgy are much more straightforward.

Scott Williamson: It's changed a lot since we last spoke (chuckles).

Dr. Allen Alper: Yes, it sounds like a great investment that you made, a great location, and the timing has been perfect. So, you and your team are to be congratulated, that's great work.

Scott Williamson: Thank you.

Dr. Allen Alper: And it sounds like 2019 will be an extremely exciting time for Blackstone Minerals.

Scott Williamson: Definitely.

Dr. Allen Alper: So that's fantastic.

Scott Williamson: We can restart the concentrator with minimal effort, but to go down the downstream process, we're looking for partners. Those partners will most likely come from the battery industry and use our product. Our relationships in the battery end user space is what has driven us to acquire this asset. We've seen a significant amount of demand from lithium-ion batteries, but that demand is not nearly as strong as it will be over the next five years. Therefore, this is a three to five-year play.

We believe we can bring in a big funding partner to help us achieve this downstream process, and then we can joint venture on the downstream. There is a local joint venture partner in Son La, and they have been very supportive with getting the mine back up and running.

The key part for us is to attract a battery end-user as a partner, to help us deliver the downstream process, which would be the nickel battery product.

Dr. Allen Alper: That sounds excellent, what an excellent approach! Outstanding! Could you tell our readers/investors about your background and your teams?

Scott Williamson: The first half of my career was as an underground mining engineer. I did underground and a little bit of open pit mining. So, my background was more technical in underground mining. For the second half of my career, I've been involved in the capital markets as a mining analyst, or stockbroker, and in investor relations and capital markets. My skill set is a blend of technical mining engineering and capital markets.

The others on the Board are geologically focused exploration and mine geologists. We have a team of geologists that has taken very small companies and created much larger companies over time. One example is Steve Parsons. He is currently the Managing Director of Bellevue Gold Limited. When Steve arrived at Bellevue, it was a 5 million-dollar shell. It is now worth around 300 million dollars. And that's happened in probably one of the most difficult small resource markets that we've seen in decades. So, not only do we have an ability to make major discoveries, but also to create shareholder wealth through increasing shareholder returns. Hamish Halliday is our Non-executive Chairman and has a similar history. His most successful venture was Adamus Resources, and that was a similar story whereby a three million-dollar firm became a multi-million-ounce discovery and eventually a gold producer, which was eventually taken over by Endeavour Mining.

Therefore, there is a history, over the last 20 years, of our small companies making major discoveries with exploration, and then creating shareholder wealth. Another key addition to the team is the vendor of the Ta Khoa Project, Steve Ennor. Steve has the skillset that’s useful for our team, and we're excited to have him on board. Steve runs the concentrator and the processing plant at Ta Khoa and has been living in Vietnam for ten years. He has a very strong skill set technically in metallurgy, but also experience in operating in Vietnam. He understands the government, the permitting, the processes, and the culture, so even though he's the vendor, assuming we exercise the option, which is most likely, then he is a valuable part of our team. He is also a very important part of what we're trying to achieve in Vietnam.

Dr. Allen Alper: That sounds like an excellent team you have, and with excellent experience. Could you tell us a little bit about your capital structure?

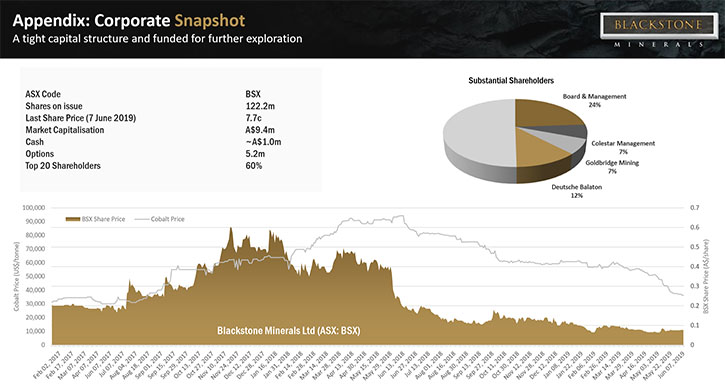

Scott Williamson: We had to issue two million dollars’ worth of shares at the time we acquired this asset or advanced the option. Now we have 152.2 million shares in issue, which is still a very tight capital structure, but it allows us to start the studies and commence the exploration drilling.

The top 20 shareholders, made up of insiders or friends and family, own 60%; Board and Management own 23%; the vendor of the BC Cobalt Project owns approximately 10-15%; and we have a very supportive German shareholder who owns 12%. It can be a volatile environment for the shareholders and can move very quickly on small volumes. But, that's always a good thing when you have a good story. So, that's the capital structure. At the current market, it stands at about 16 or 17 million dollars Australian.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Blackstone Minerals?

Scott Williamson: One of the primary reasons you should invest in Blackstone is that we are one of the only junior exploration and mining companies that have the potential to move downstream to produce a nickel battery product for the lithium-ion industry. We have existing infrastructure - over 130 million dollars has been spent by the previous owners - and we can leverage off that to continue to explore and understand the geology, move through the mining and metallurgical studies, to then restart this mine with minimal dilution for shareholders moving forward.

In addition, we are leveraged to the lithium-ion battery electric vehicle revolution. But, most importantly, we see fairly small hurdles and a fairly quick turnaround into production. Potentially we can deliver this nickel battery product sooner than it would appear.

Dr. Allen Alper: All right. Is there anything else that you'd like to add, Scott?

Scott Williamson: I would like to add that we still have a portfolio outside of Vietnam. We have the BP Cobalt Project which we're continuing to progress and looking for major partners there. We have nickel and gold in Kalgoorlie, so we'll continue to progress that. We have an international portfolio of battery and precious metals, and the focus now is on our flagship mine in Vietnam, which is the most advanced asset and the nearest to production. But we also have a pipeline of projects at different stages of exploration and development behind that.

Dr. Allen Alper: All right! That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://blackstoneminerals.com.au/

Telephone: +61 8 9425 5217

Fax: +61 8 6500 9982

admin@blackstoneminerals.com.au

|

|