Altus Strategies PLC (AIM: ALS & TSX-V: ALTS): Project and Royalty Generator, Focused on Africa; Interview with Steve Poulton CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/24/2019

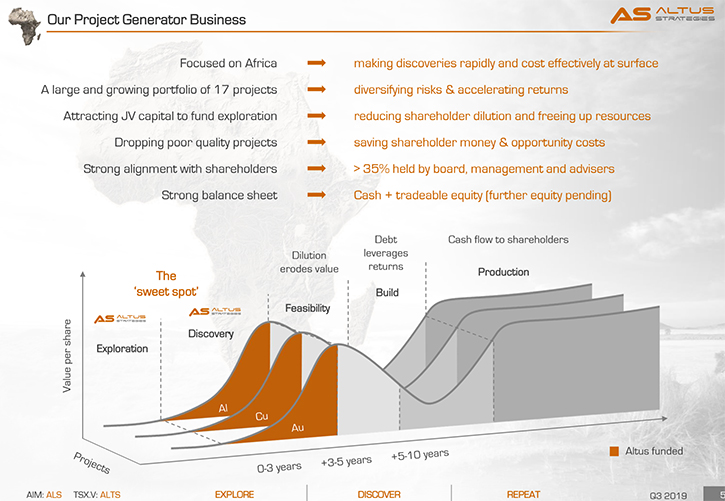

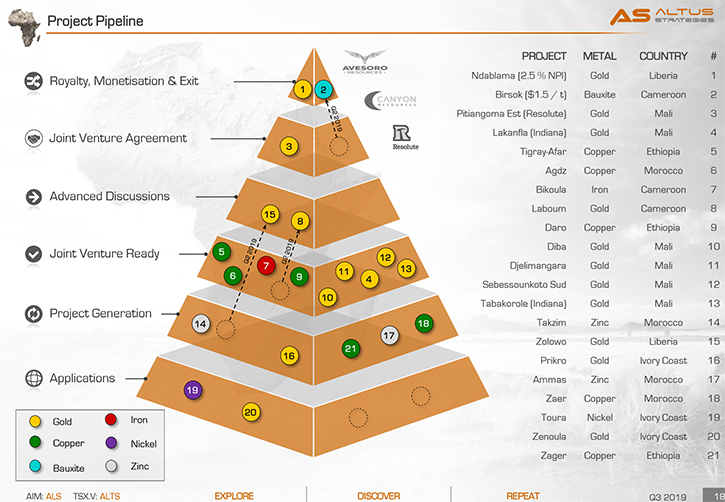

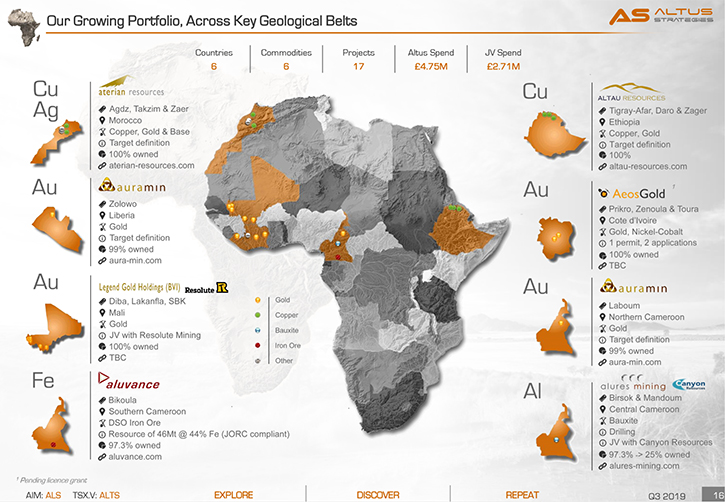

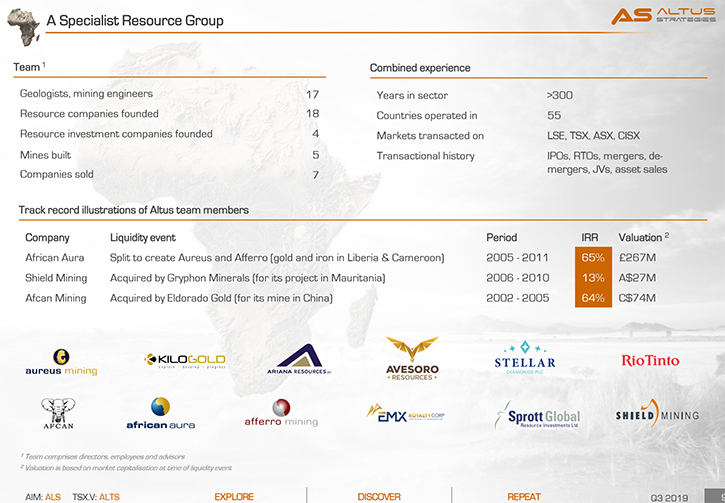

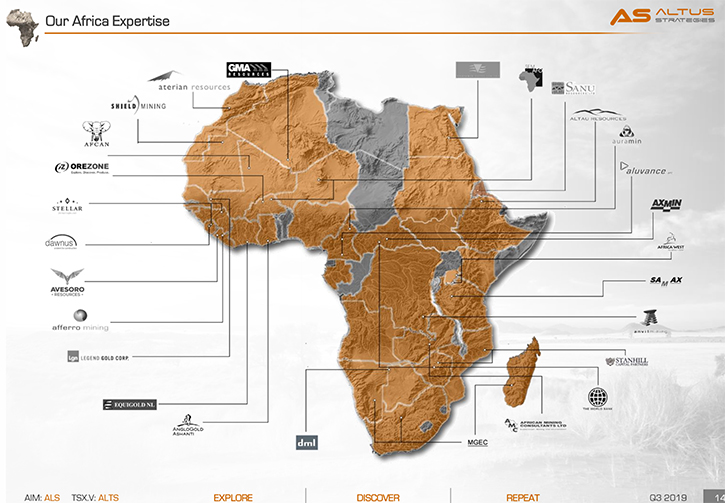

Altus Strategies PLC (AIM: ALS & TSX-V: ALTS) is a project and royalty generator, in the mining sector, with a focus on Africa. The Company makes mineral discoveries across multiple licences simultaneously, then creates joint ventures, where partners earn an interest in these discoveries by advancing them toward production. The royalties, generated from the Company's portfolio of projects, are designed to yield sustainable long-term income. We learned from Steve Poulton, Chief Executive of Altus Strategies, that they are focused on a strong portfolio approach, which is diversified by commodity, geography and jurisdiction, as well as by geology and asset type, thereby minimizing the risks for investors. Altus is constantly expanding their portfolio, accelerating growth. The Company's management team is made up of all major shareholders in the Company and have a track record of undertaking mineral exploration, making discoveries, and monetizing successful projects across Africa.

Altus Strategies Plc

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Poulton, who is Chief Executive and a Co-Founder, of Toronto and London listed, Altus Strategies Plc. Steven, could you tell our readers/investors your business model and strategy?

Steven Poulton: Absolutely and it’s a pleasure to be speak with you, Allen. Altus is a project and royalty generator, in the mining sector which is focused on Africa. We aim to make mineral discoveries across the continent and form joint venture partnerships with third parties who finance the later phases of exploration, with the Company ultimately retaining a royalty interest in each of those underlying assets. By doing so, over time we hope to build a portfolio of perpetual revenue generating income streams. We also gain exposure to the success of the individual projects through our equity ownership in them, and along the way we'll earn income from various milestone payments, which can take the form of cash and equity.

Furthermore, our joint venture partners will typically employ some of our local team and cover other in country expense to complete the initial programs, thereby further reducing our costs. We firmly believe that the project and royalty generator model offers the best risk adjusted return for investors to participate in the mining sector. Another key attribute of the model if that by taking a portfolio approach we are inherently diversified by commodity, jurisdiction, geology and asset type. This means our shareholders enjoy exposure to more potential upside without taking on more downside risk.

Dr. Allen Alper: That sounds like an excellent approach. Could you give our readers/investors an overview of your projects?

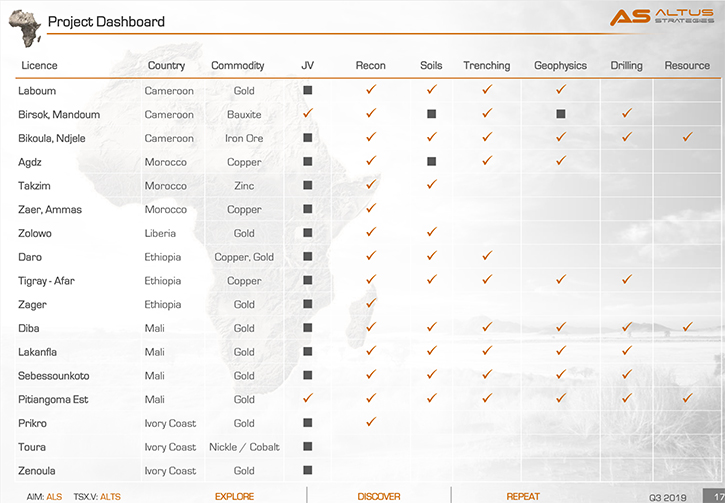

Steven Poulton: Yes, certainly. We have 18 projects across six countries in Africa. Rather than necessarily going into detail on each one right away, I'll perhaps start with what people may consider one of the most advanced assets, and then speak a little about some of the other key assets, to which potential investors should be alert.

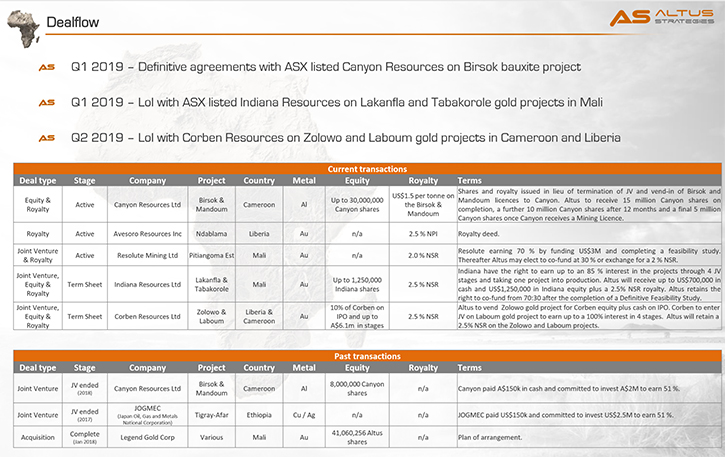

Since we're a project and royalty generator, it's probably appropriate if I start by talking about one of the assets where we have a joint venture, our Birsok & Mandoum bauxite project, located in central Cameroon. We staked these licences back in 2013, when bauxite was a little out of fashion. We then conducted about US$100,000 worth of exploration, before signing a deal with ASX-listed Canyon Resources (ASX: CAY). Canyon took the property on and paid us back A$150,000 in cash and issued Altus eight million shares, in their company, which have a current value of just under $1 million. Following Canyon’s successful acquisition of a very substantial, adjacent bauxite project called Minim Martap, we recently agreed to terminate the joint venture and vend Birsok & Mandoum into Canyon. By any measure, Minim Martap is a tier one asset, perhaps even the world's largest and highest-grade undeveloped bauxite project, which is also strategically located on a railway line. By terminating the JV and vending the projects into Canyon, we expect to receive a further 25 million initially, with potentially another 5 million shares on top. That’s approximately A$6m, at current Canyon prices, and given the quality of the Minim Martap asset, we will be delighted to be Canyon shareholders. In summary we will have made a remarkable return on investment, with very limited capital put at risk.

Dr. Allen Alper: That was an excellent project and negotiation.

Steven Poulton: And perhaps worth adding, during one of the worst bear markets of recent decades!

Dr. Allen Alper: Yes, that's true. Could you give us a few more examples?

Steven Poulton: Absolutely. Altus listed in London in August of 2017, but we actually founded the Company in 2007. Early in 2018, Altus completed a plan of arrangement with TSX-V listed Legend Gold Corp, a company which had assembled an excellent portfolio of strategically well-located advanced gold projects, in western and southern Mali. Legend shareholders became Altus shareholders and in June of last year we dual listed Altus on the TSXV with the ticker ‘ALTS’. Approximately 50% of our shareholders are based in North America. Our deal with Legend also brought with it a distinguished pair of geologists, Demetrius Pohl and Ambogo Guindo, as well as the CEO, Michael Winn, who joined our Board as a non-executive Director. Michael is very well-respected and widely-known in the sector, with a number of very notable successes to his name. He is currently the Chairman of TSXV listed EMX Royalties.

One of the former Legend properties is called Pitiangoma Est, which is located in southern Mali. The project is already under a joint venture, with Resolute Mining, an Australian and now London-listed, African-focused gold mining company. Resolute are currently spending US$3 million and will be undertaking a feasibility study to earn a 70% interest. In the same part of the country, we also have a gold project called Tabakorole, which hosts a potential resource of 600,000 ounces, which is not in accordance with NI 43-101. Whilst I must stress that this currently is a non-compliant number, we will be undertaking an independent study to update and meet NI-43-101 standards. There has also been further positive drilling results completed on that asset since the original estimate. Less than 50% of the prospective ground at Tabakorole has been tested to date.

In the west of the country we have four projects, which are, most notably, adjacent to the world class Sadiola gold mine that has historically produced over 10 million ounces of gold. Interestingly, the mine is operated under a joint venture between IAMGOLD and AngloGold Ashanti, both of whom are presently selling their stakes. Sadiola reportedly still has three million ounces of hard oxide and transitional resource material. Our four projects in western Mali are located within easy trucking distance of Sadiola and could potentially provide significant additional oxide resources to the mine. Whoever acquires Sadiola may see merit in securing the surrounding oxide gold opportunities.

One of our key assets is called Diba, which hosts the non-NI-43-101 resource of approximately 300,000 ounces. The vast majority of these are within the oxide zone. Elsewhere across the license, we have identified numerous other targets, which have yet to be tested and which we believe have the potential to materially increase the scale of the Diba project.

Our second license, close to Sadiola in western Mali, is called Lakanfla. It’s a very interesting project which we believe represents a so-called karst-style orebody where you have the dissolution of limestone by gold-rich sulfidic waters that drain down through the rock and accumulate on a basement layer. This style of deposit is very similar to the FE3 and FE4 pits at Sadiola, which are just six kilometers away. This style of orebody is also identical to the four million-ounce Yatela Mine, located about 30 kilometers to the northwest. Lakanfla has had some historical work undertaken, with very interesting drilling and geophysical results, but key to this asset is the fact that karst-style orebodies occur at depth and the project has never been drilled to test this theory.

The historic drilling identified the limestones that you expect for the karst model, as well as voids and sandy-infill down hole. These are elements which are diagnostic of a potential for a karst orebody. Suffice to say, we are very excited about the potential for this asset! It could be a very large project indeed, if this is what we have. The geophysical gravity anomaly is incredibly compelling, so we shall see. Our expectation is that we will have the opportunity to enter some form of joint venture or other transaction, potentially on all four of our five remaining Malian properties, following numerous expressions of interest.

Moving on from Mali, the Company is also active in Morocco where we have discovered a very interesting copper-silver project at the Agdz license about 15 kilometers from an existing copper-silver mine that has just been opened by the state mining group, MANAGEM. Morocco is incredibly prospective for base metals, most notably for copper as well as cobalt, and we’ve assembled a very interesting package of properties there, over the last five years. Our expectation is, over the course of the next six months, to secure a joint venture agreement on these assets, or to put them into a listed or private shell and have that Company list on an exchange either in Australia or Canada.

Altus is also active in Ethiopia, where we're focusing on the Arabian-Nubian Shield which is prospective for copper and gold, and most notably hosts the Bisha copper-gold mine just across the border in Eritrea. We're having great success in our efforts there, and we now have a land position approaching 1,000 square kilometers. We have three licences, namely Tigray-Afar, Daro, and the recently granted Zager. Each of these contains evidence of artisanal mining activities and host fantastic geology, which appear very encouraging.

We consider Zager and Daro to be prospective for volcanogenic massive sulfide mineralization and exploration is ongoing at both. We're absolutely in the emerging “number one” address for potentially making a large gold and copper discovery and we're very excited by the results that have been coming out. Like all of our assets, our intention is to get our Ethiopian projects into a joint venture over the course of the next 6 to 12 months.

The fourth country we are in is Liberia, specifically the northwest where we're targeting the Archaean greenstone gold. There's one notable company active in western Liberia called Avesoro: it's a London and Canadian listed gold producer currently producing from their flagship asset, the New Liberty gold mine, which is pouring approximately 100,000 ounces each year. Our Chairman David Netherway, is a Director of Avesoro. We are some distance away, but certainly on strike of that project along the key greenstone belts. Our project there, called Zolowo, hosts intensive and currently active artisanal gold mining in many of the rivers. It's actually incredible the amount of gold that's being extracted from the license. We are as convinced as you can be at this early stage that there is a primary and potentially significant hard rock gold project within that property. We announced a transaction with a private company called Corben Resources on that asset, along with our Laboum gold project that we have in the north of Cameroon. Laboum is targeting a 15-20-kilometer-long shear zone which is up to 5 kilometers wide in places. Within this geology we've defined four or five key targets, each about two or three kilometers long, by half a kilometer wide, which are silicified and/or carrying quartz veins directly from which we are getting some high gold grades.

Both Zolowo and Laboum are held in a subsidiary of Altus called Auramin, with which Corben is undertaking a transaction where we'll eventually see Corben list on the ASX with Zolowo as its primary asset. It will then undertake a joint venture with us on Laboum. So that's all incredibly exciting.

Outside of that we're also in Ivory Coast where we have a gold license in the east of the country across one of the highly prospective geological belts there, plus we have a couple of applications. One is for gold in the center of the country and the other, in the west, targets nickel-cobalt, in what is an emerging new cobalt province.

Perhaps finally, we are also in the iron ore market. We have an iron ore project called Bikoula & Ndjele in the south of Cameroon, located just 30 kilometers from a proposed rail line that will run from the Mbalam iron ore deposit that is held by Sundance, to the coast where there's a deep-water port at Kribi. Our iron ore asset is also actually located on the main road that goes to Kribi. We've defined a JORC resource at Bikoula and, given the iron ore prices have been particularly strong in the last 12 months, we wouldn’t be surprised if we were to transact on that asset over the next year or so.

So as you can see, we have a very strong portfolio of projects which is incredibly well diversified. We also have numerous conversations going on, some of which have crystalized into deals and which are in the public domain, and others at an early stage which are not yet at that stage. We are very busy working on potential opportunities for all our assets. I would stress that the Altus management team are all major shareholders in the Company, but also and most importantly, we have a track record of undertaking mineral exploration in Africa and in making and monetizing discoveries. I think that's absolutely key if you're going to undertake this business, particularly in Africa.

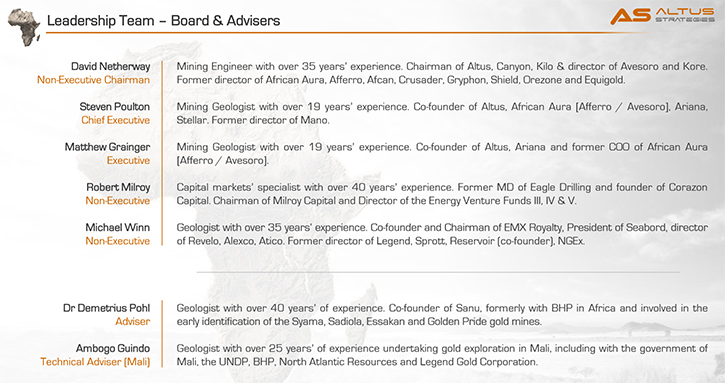

Dr. Allen Alper: That sounds great. It sounds like you have great projects and a great network of people and companies to work with, and joint ventures and relationships. Could you elaborate on your background, your leadership team, your Board, and advisors?

Steven Poulton: Certainly. I went to college and studied geology, after which I went on to the Camborne School of Mines completing a Master's in Mining Geology. I immediately joined a West African focused gold, iron, and diamond exploration business, called Mano River, which was listed on the CDNX (now the TSX-V) and the AIM market London. That business was a pioneer in very favorable geology, but rather unfavorable politics. It was an excellent place to start my career in the late '90s, and I was with that company for the next six or seven years, until finally also joining its board. In 2002, I co-founded a gold exploration company with a couple of former university friends. That company was called Ariana Resources, it acquired a gold project in western Turkey from Newmont Mining and we listed it on AIM in London in 2005.

I was a Co-Founder of that company with Matthew Grainger and Kerim Sener. Kerim has been the CEO since 2007 and the Company is doing very well, and most critically pouring gold. In 2004, I created a company called African Aura which was focused on gold in Liberia and iron ore in Cameroon. We took that Company to the TSXV in 2008, just before the financial crisis; it was a very difficult market. It must be said! We merged that Company with Mano River to create a new Company called African Aura Mining which was dual listed in Toronto and London. We then divested African Aura Mining into two separate business, one focused on gold and the other on iron: the gold business is now Avesoro Resources, which I made mention of earlier, and the iron ore company was called Afferro Mining, which sold for a couple of hundred million dollars in 2013.

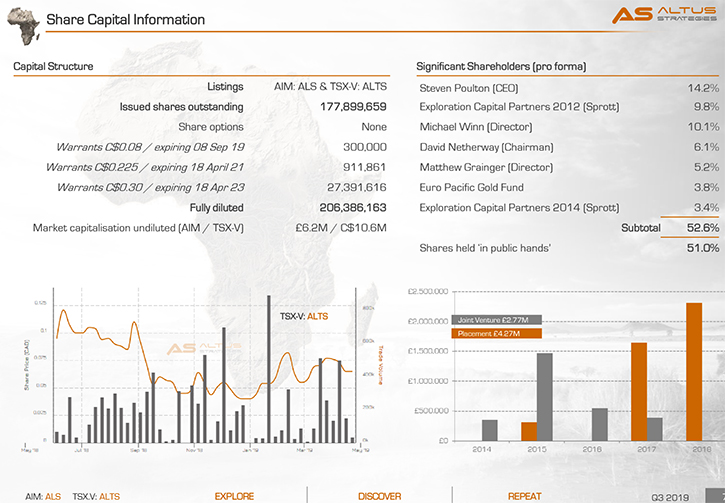

We created Altus as a team in 2007, really to harness the network that we'd created and experiences that we'd gained, to generate as many properties and opportunities as we could in Africa. We called ourselves a ‘Company of Companies’, but actually we were ultimately a project and royalty generating business. We decided to take Altus public in 2017, but before then Sprott became a shareholder in 2012 and 2013. Of course, it was a very challenging market from 2012 all the way to the present day, but between 2012 and 2017 we managed to create considerable value and grow the Company every year, despite the downturn.

That truly speaks to the counter-cyclical nature of our business model, and just how effective it is. Sprott holds approximately a 13% shareholding in Altus, and we're very pleased to have their support. Our Chairman is David Netherway, who is a mining engineer with over 35 years of experience. He's the Chairman of a number of listed resource companies and has a huge amount of experience on the African continent, where he has been involved as a mining engineer, building and then selling gold mines. He also was responsible for building a gold mine in China, which was later sold to Eldorado - David has a phenomenal pedigree in Africa.

My colleague and an Executive Director at Altus, Matthew Grainger, went to the same college as myself, Camborne School of Mines, for his Master's degree and was a Co-Founder of Ariana, was the Chief Operating Officer of African Aura, and a Co-Founder of Altus. His background is very much in the entrepreneurial junior sector, and involved in project and corporate development. We have two further non-executive Directors, Michael Winn, whom I mentioned before, who has a very impressive background and is the current Chairman of EMX Royalties. He's also the President of Seaboard, which is a company that provides mining and exploration companies with various services based out of Vancouver. Previously he was at Sprott in a senior position, and he was a Co-Founder at Reservoir Minerals, which was highly successfully, ultimately being acquired by Nevsun in 2016.

The final Director is Robert ‘Woody’ Milroy. Woody has over 40 years’ experience in capital markets, but also has experience in the mining sector. He was the former Managing Director of Eagle Drilling, and therefore understands the business thoroughly. Woody is based in Guernsey and has a strong reputation for his corporate governance skills, and therefore brings fantastic value to the table as a non-executive.

We have a couple of advisors, namely, Demetrius Pohl who is a very senior geologist, formerly with BHP, who has been involved in the identification of just so many gold mines in Africa, it’s incredibly impressive. We also have Ambogo Guindo, a Malian who is based in Toronto, but is very often in Mali. He was also formerly with BHP and has more than 30 years or experience. Both Demetrius and Ambogo were previously with Legend Gold, with whom we completed the plan of arrangement in early 2018.

So that's our Board and Advisors. We also have a team of 16 geologists. As a team we tend to move our geologists, our ‘project generators’ as we call them, from one asset to another. For example, our Cameroonian geologists may have the opportunity to experience Moroccan geology, and our Moroccan geologists may have the opportunity to experience Ethiopian geology, and so forth.

We think this is good for their skillsets. It's also important for us to get fresh eyes on the ground. So far, we have been incredibly impressed by the caliber and aptitudes of our in-country geology teams. Altus has a very technical team, but having said all that, I would reiterate that as a Board, we have individually had a number of successes in the corporate sense, and ultimately, it's about creating and realizing value for shareholders. You do that through discovery, and you do it through undertaking transactions and monetizing assets.

Dr. Allen Alper: It's a very impressive team and group that you have put together, so that's excellent. Could you tell our readers/investors the primary reasons they should consider investing in Altus?

Steven Poulton: Absolutely. The first thing any CEO should probably talk about is the price of the shares. You only really want to invest, when you hope to make a positive return, and ideally you want to make a very positive return. I believe the current price of our shares doesn't reflect the fair value of our assets.

As the market becomes increasingly aware, and I don't mean just the small market that is the mining sector, I mean when the broader global capital markets realize the underinvestment that has been made in the exploration scene over the last decade, and the lack of projects that are in the pipeline for the mid-caps and majors to get their teeth into. Every day these mining companies consume their balance sheet, by mining and selling their resources. We believe the market will quite rapidly recognize the inherent value of companies, which have high quality projects, who have been diligent and persistent enough to keep hold of and advance them. As the demand for these projects increase so will their value.

I would say there's a realization or realignment event coming. When it comes, we would expect a tremendous uplift in the value of companies that have great projects: I would put Altus firmly into that camp. The second reason I think your readers/investors should buy Altus is because we offer a fantastic balanced portfolio, and diversification is such a critical factor when making any investment decision. In fact, one of our institutional investors relayed to us that the reason they were buying our stock is because we are managing our Company and its projects, from a risk perspective, in a way similar to how they manage their fund and its positions. That's good feedback to hear. The risk diversification is a natural function of the project and royalty generator model, you have this diversification of geology, commodity and jurisdiction, which means at any one time you don’t have all of your assets at risk, perhaps not even 50% or 20% are at risk. Even more importantly, the diversification ensures we maintain management rigor.

We feel it can be quite common in companies with only one or two assets for Management and the Board to feel dependent on the success of those one or two assets, which probably have been quite heavily promoted. It's quite a difficult move, for someone from management or the board to put their hand up and say that those assets don’t work, and that the Company should start afresh with something new. Betting on one project can end very poorly for investors. So, having a diversified portfolio, where you are only going to put at risk a limited amount of capital on each asset, and at the same time have multiple options across numerous assets, in case one or more of those may become world class and highly valuable projects. We think that's a phenomenal risk return proposition.

The team we've assembled here at Altus is also highly entrepreneurial. We have a strong track record of doing exactly this before, and making our investors and shareholders money. To that end, the Board and Management Team have a 35% shareholding in the Company. That means our interests are firmly aligned with all of our investors. The management team hasn't been outsourced as it were: we are very much in this together with our shareholders.

All of the above perhaps underpins why we are fortunate to have such a strong shareholder base. I have mentioned Sprott, but we are also delighted to have high quality investors such as Adrian Day, who has a fantastic track record of being a patient investor, with an ability to pick good opportunities early. We also have a number of individuals on our register, who are in themselves incredibly successful mining sector entrepreneurs. We think that speaks volumes - that they now also want to be shareholders in Altus.

Dr. Allen Alper: Sounds like very excellent reasons for our readers/investors is to consider investing in Altus Strategies! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Steven Poulton: Many thanks Allen, it has been a real pleasure speaking with you.

Dr. Allen Alper: And with you.

https://www.altus-strategies.com/

Steven Poulton, Chief Executive

Tel: +44 (0) 1235 511 767

E: info@altus-strategies.com

|

|