Osisko Metals Incorporated (TSX-V:OM; OTCQX: OMZNF; FRANKFURT: OB5): Controls Canada’s Two Premier Zinc Mining Camps; Interview with Paul Dumas, Executive VP of Finance

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/23/2019

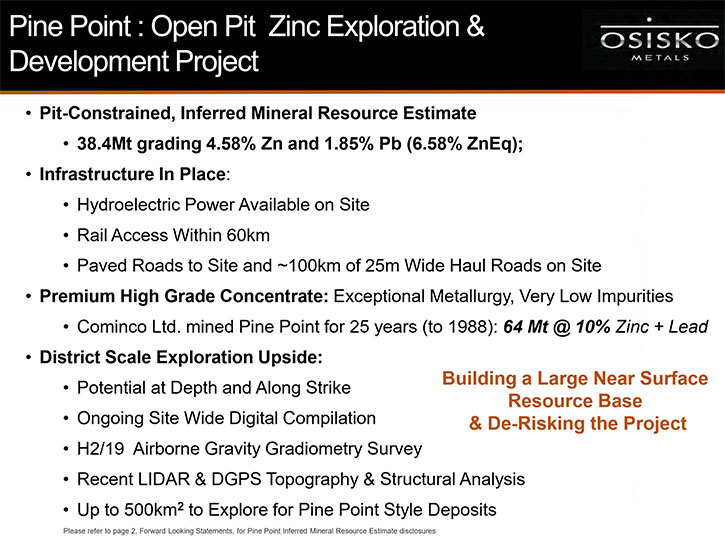

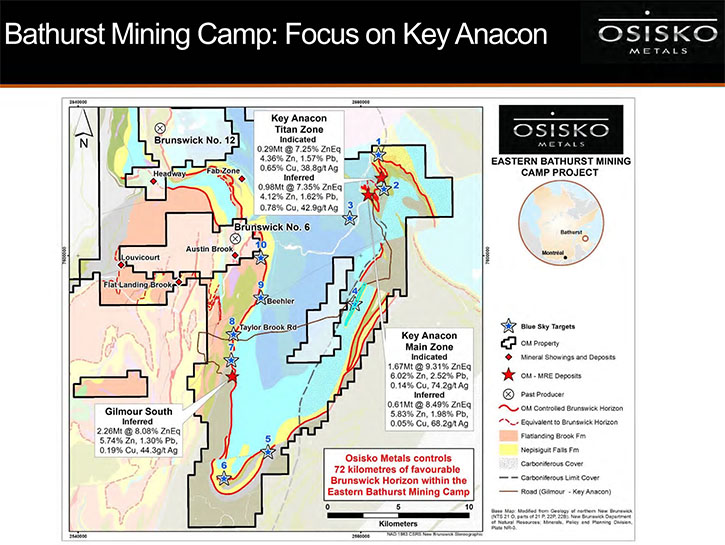

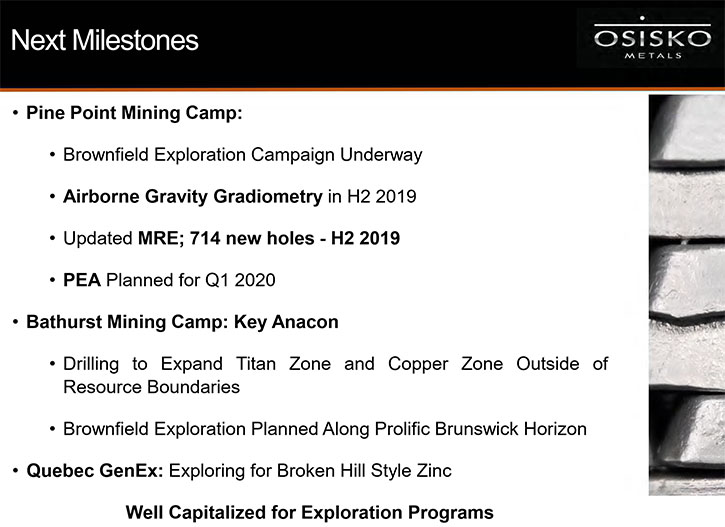

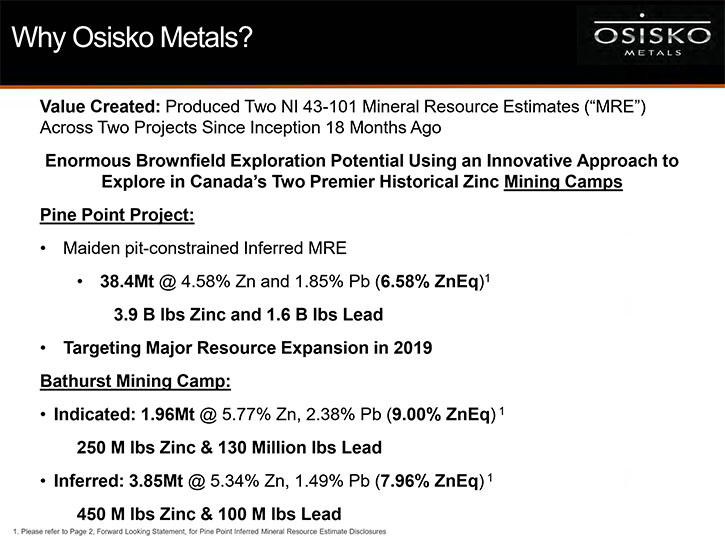

Osisko Metals is a Canadian exploration and development company, creating value in the base metal space, with a focus on zinc mineral assets. The Corporation controls Canada's two premier historical zinc mining camps: The Pine Point Mining Camp and the Bathurst Mining Camp. The Pine Point Mining Camp is located on the south shore of Great Slave Lake in the Northwest Territories, and currently hosts a NI43-101 inferred mineral resource of 38.4 Mt grading 4.58% zinc and 1.85% lead, making it the largest near-surface, pit-constrained zinc deposit in Canada (technical report dated January 25, 2019. The 2018-2019 drill holes, once fully assayed, will be incorporated into the database with the objective of issuing a new resource estimate in the second half of 2019. The Bathurst Mining Camp is located in northern New Brunswick, with a NI43-101 indicated mineral resource of 1.96 Mt grading 5.77% zinc, 2.38% lead, 0.22% copper and 68.9g/t silver (9.00% ZnEq) and a NI43-101 inferred mineral resource of 3.85 Mt grading 5.34% zinc, 1.49% lead, 0.32% copper and 47.7 g/t silver (7.96% ZnEq) in the Key Anacon and Gilmour South deposits. In Québec, Osisko Metals owns 42,000 hectares that cover 12 grass-root zinc targets that will be selectively advanced through exploration in 2019. We learned from Paul Dumas, Executive VP of Finance for Osisko Metals, that all the properties are located in mining-friendly jurisdictions, with great infrastructure and accessibility, and both camps (The Pine Point and Bathurst Camps) have fantastic geological upside for new discoveries. Plans for 2019 include increasing Pine Point’s resource by flying an airborne gravity survey that will identify additional targets, as well as by acquiring more land. According to Mr. Dumas, the updated resource should come out before the end of this year, and a PEA should be published in early 2020.

Osisko Metals Incorporated

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Dumas, who is Senior Executive Vice President of Finance for Osisko Metals. I wonder if you could tell our readers/investors what differentiates Osisko Metals from its peers?

Paul Dumas: Good question, Allen. First of all, Osisko Metals produced a NI 43-101 on Pine Point mining camp, a mineral resource estimate containing 38.4 million tons, grading 6.58% zinc equivalent. So that equates to about 3.9 billion pounds of zinc and 1.6 billion pounds of lead open pitable. The Company controls two of Canada’s top zinc camps. The zinc camps come with lengthy historical production on them, fantastic geological upside for new discoveries, and they’re located in mining-friendly jurisdictions. But I think the key elements that distinguish us from our peers are the infrastructure and location. I think, those two elements in the mining sector are key.

Pine Point itself, is 45 kilometers from a town called Hay River, accessible by paved road. In terms of infrastructure, there's a hydro electrical substation on the site. There's rail access at Hay River. Within the property itself there're over a hundred kilometers of haul roads because it was an existing producing site. In summary, several of our peers are faced with challenges, the majority of which are remoteness and infrastructure. So, I think that's how we distinguish ourselves from some of our peers.

Dr. Allen Alper: Sounds great. Could you tell us a more about your properties and deposits?

Paul Dumas: Pine Point, our flagship project, is all open pit, within tabular and prismatic deposits. The mineralization is contained within five main zones. Two thirds of the mineralization is contained within three zones; the East Mill zone, Central zone, and the North zone. Because it was a past producer, it produced exceptional concentrate, with very low impurities, meaning low deleterious elements such as iron, silica and manganese. When you have these types of impurities within your concentrate, you would get charged penalties at the smelter level. Because Pine Point was a past producer operated by Cominco from mid-1960’s to mid-1980’s we have a lot of data on the concentrate and recoveries. Historically Pine Point produced high quality lead and zinc concentrates with recoveries of 90% plus. We have begun doing our own metallurgy work and results should be available shortly. What's nice about the Pine Point property is that it’s open pitable. All the drilling that we've done so far is above 80 meters. The property has a huge footprint. The property is 60 kilometers long by 30 kilometers wide, so there's lots of room for new discoveries on it.

Dr. Allen Alper: All right. Sounds great. Could you tell our readers/investors, what were the major accomplishments in the last 18 months and your plans for 2019?

Paul Dumas: The last 18 months have been pretty busy for us. Within that time period we managed to consolidate and acquire two major land positions and two top zinc camps, the Bathurst mining camp and the Pine Point mining camp. The Bathurst mining camp is located in New Brunswick on the east coast of Canada. We control over 60,000 hectares there. We acquired a property in early 2018, called the Key Anacon property, it is now our flagship in the Bathurst mining camp. The property has been controlled by a private family, the Irving family, for over 70 years. Back in the '50s, substantial development was done on the property, with very little exploration in the last 30 years.

Acquiring this in early January of 2018 gave us a lot of upside. We converted the historical resources on that asset into NI43-101, but what's exciting about it is that we've managed to extend the mineralization on the property both at depth and on strike through drilling that was executed last year. So for 2019 we're looking to continue on this same path and as a priority, we will be testing 10 new targets that we identified in 2018 in order to do this.

The Pine Point camp was acquired in early 2018. It was a $34 million acquisition that was done by Plan of Arrangement and completed at the end of February 2018. Within nine months from the date of acquisition, we completed over 60,000 meters of drilling on the project, producing a NI43-101, with a mineral resource estimate of 38.4 million tons containing 6.58% zinc equivalent.

Our goal for 2019, on the Pine Point mining camp, is to increase the resource. We're targeting 50 million tons by year end. We're going to be flying an airborne gravity survey that will identify additional targets and we're looking to acquire more land. This camp hasn't been explored, with new techniques, since the '80s. Technology and exploration techniques have advanced substantially since then. We know the mineralization extends to 200, 250 meters at depth. Our drill program last year was focused on historical deposits and the drilling was all above 80 meters. So there's lots of room for new discoveries here. We're looking to update our resource, probably before the end of this year, end of Q3 beginning of Q4. We are also looking to publish a PEA in early 2020.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about the zinc market supply and demand?

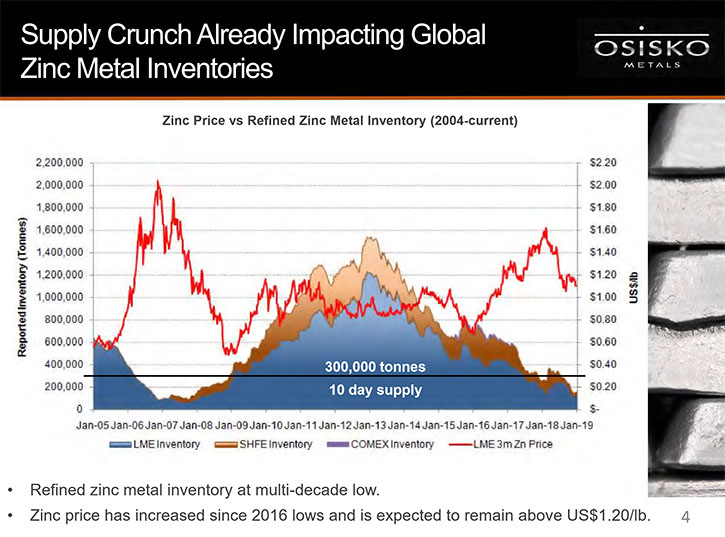

Paul Dumas: The zinc market has been beaten up substantially in the last couple of years. The price is just starting to reflect the significant decrease in world inventories. If you look at the inventories, they have been depleted drastically in the last 10 years. That's basically due to a lot of mine closures over the years; Century Mine, New Brunswick, Lisheen. There hasn't been enough development of zinc projects or simply, new discoveries. There are very few projects in the pipeline that are heading toward production. The critical level for the inventories is usually about 300,000 tons. Now we're way below that. We're staggering around the 175,000 to 190,000 ton level of global supply.

Another element that has affected these inventories is the environmental legislation that has been put in place in China. China used to be a net exporter of zinc and now they are a net importer. With the new environmental legislation, many of the smaller Chinese zinc producers have had to shut down, putting a stranglehold on some of the production there. So we don't see much of a turnaround in these inventories in the near future because there are simply no new mines coming into production. Some of the mines that are coming into production in 2020, 2024 don't have enough supply to offset the demand right now. So we continuously see supply being outstripped. I think it's a great opportunity for Osisko Metals to position itself in this market at this point in time.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors about your background, Management’s and the Board’s?

Paul Dumas: My background is financial. I worked for PricewaterhouseCoopers for several years and after that I worked with RBC Dominion Securities. Then I moved over into the private sector, doing corporate finance for the last 20 years. We have a fantastic team, backing us right now. As you know, we have a strategic alliance with the Osisko Group. We share their offices, we share their technical team, which is great for us. It gives us a great foothold, lots of background, lots of knowledge.

We have a Board of Directors, with a proven track record. Mr. Robert Wares and John Burzynski made the discovery of the Canadian Malartic mine, which is a world class gold deposit, 13 million ounces of gold. They eventually sold that off. Luc Lessard was the engineer behind that project. If you look on the operational side, we have a great Management Team. Jeff Hussey, Robin Adair both come with tremendous geological background and extensive experience at Noranda. We have Anthony Glavac, who's our CFO. Christina Lalli who's our Director of Investor Relations, with extensive experience, about 15 years’ experience in the field. We have a well-rounded Management Team to execute some of these projects that we're moving forward.

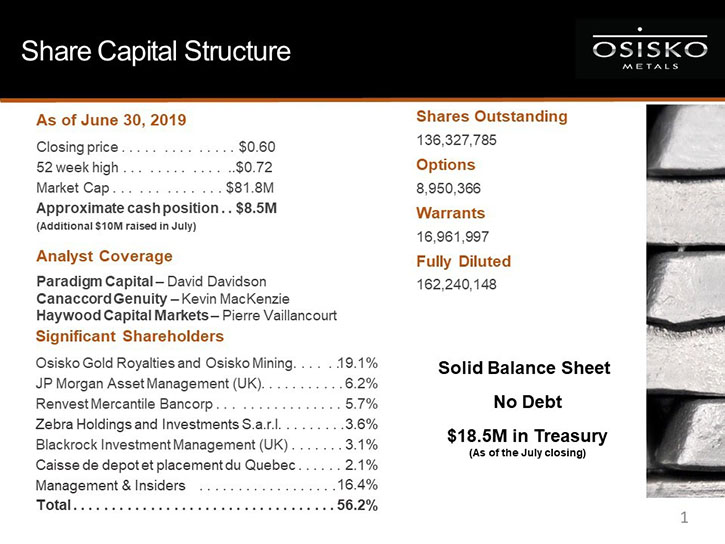

Dr. Allen Alper: That's a very, very strong team and excellent backing by the Osisko group. So that's really excellent. Could you tell our readers/investors about your share and capital structure?

Paul Dumas: Right now we're sitting with a little over 136 million shares outstanding. We have a market cap of about $80 million. We've been beaten up in this market like every other junior. We have some analyst coverage right now. We have Paradigm, Canaccord, and Haywood Capital Markets. Their analysts are all covering us. But one important thing is the insiders and institutional holders of the Company. We have some significant institutions holding our stock. Osisko Gold Royalties and Osisko Mining combined hold about 19%. We have other institutions, such JP Morgan, BlackRock, Caisse Depot. Management and insiders hold a little over 12.5%. Taking into account the institutions and the insiders, we control about 54% of the float right now.

Dr. Allen Alper: Sounds excellent! It's great. Shows that Management and the Team has confidence and skin in the game. That's really great.

Paul Dumas: The Management and the institutions believe in what we're doing. They believe in our track record, the majority of management and institutions have voiced that they will continue to participate on a pro rata basis. As we raise capital, they all participate, pretty much on a pro rata basis, depending on the capital raise that we do. It shows confidence that these institutions have in the company going forward.

Dr. Allen Alper: That's excellent. Could you mention to our readers/investors why they might consider investing in Osisko Metals?

Paul Dumas: We've done a lot of work in the zinc space and the base metal space, prior to acquiring these two assets; Pine Point our flagship and the Bathurst mining camp. Pine Point's really an exceptional asset. There's really nothing out there that is comparable, as an open pitable project, with easy access and existing infrastructure, within a fantastic jurisdiction. In my opinion, Pine Point contains a huge resource that we're looking to move forward. It is an excellent tier two asset that would be viable for any tier one producer. If somebody wants to have exposure to a commodity that's being squeezed right now because of lack of supply and with a lot of potential upside in terms of exploration, good management and the ability to move these assets forward, I think Osisko Metal is a fantastic investment.

Our market capitalization is way below our asset value right now. We just got a listing in the US, which is going to give us some US exposure. We are going to follow up with a lot of marketing in the next 6 to 12 months, just to get some extra exposure and recognition in the markets. So I think it's a great investment and the timing could not be any better. It's an undervalued investment, right now, with a team that's capable of moving an asset forward and bringing additional value to it.

Dr. Allen Alper: That sounds excellent! Those are extremely strong reasons for our readers/investors to consider investing in Osisko Metals. Is there anything else you'd like to add, Paul?

Paul Dumas: I want to thank you for interviewing Osisko Metals. I want your readers/investors to look forward to our next six months. I think there's going to be some fantastic news flow. We're going to fly an airborne survey that's potentially going to identify new targets at Pine Point. Our goal is to move the resource base from 38 million tons to about 50 million tons, which makes it a fantastic asset for a tier one producer. When you have an asset that has 50 million tons +, you're looking at a life of mine of over 15 years. I truly think that Osisko Metals is an undervalued investment and it's a great opportunity right now.

Dr. Allen Alper: That sounds excellent. Thank you for an excellent interview. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.osiskometals.com/en/

Paul Dumas

Executive VP, Finance

Osisko Metals Incorporated

(514) 861-4441

Email: pdumas@osiskometals.com

|

|