Piedmont Lithium (ASX:PLL; NASDAQ:PLL): Developing 100%-Owned Piedmont Lithium Project in North Carolina; Interview with Keith D. Phillips, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/18/2019

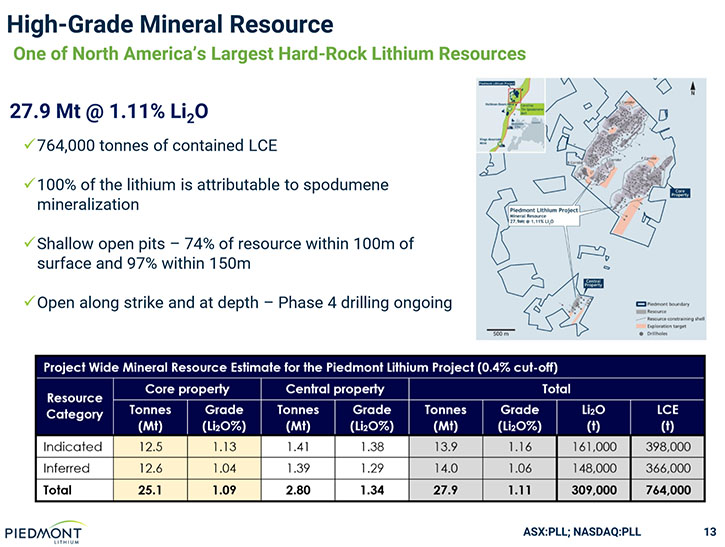

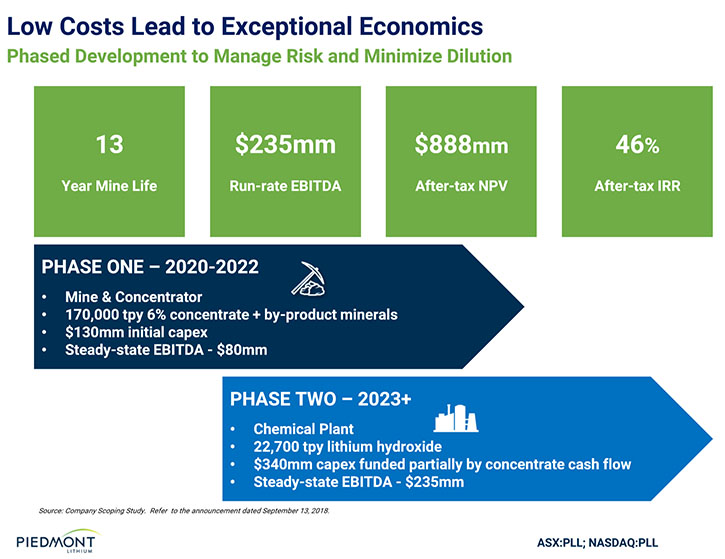

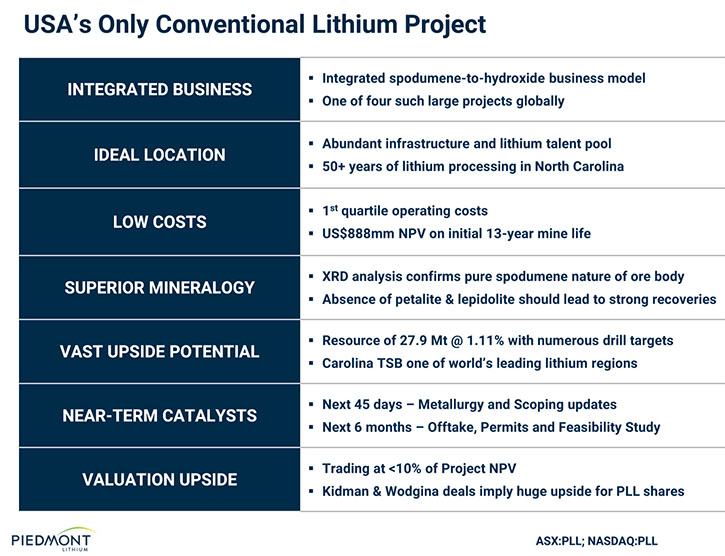

Piedmont Lithium (ASX: PLL; NASDAQ: PLL) is an emerging lithium company focused on the development of its 100%-owned Piedmont Lithium Project in North Carolina. We learned from Keith D. Phillips, Managing Director and CEO of Piedmont Lithium, that the Company is advancing the plans to build a mine, concentrator plant and a lithium hydroxide chemical plant with the goal to develop the only conventional US-based integrated lithium project based on their large, high -grade spodumene deposit. We learned from Mr. Phillips that they have just 47% increased their resource by 47% to 27.9 Mt @ 1.11% Li2O. Near term plans include building and commissioning the mine and concentrator and using the cash-flow from it to build the lithium hydroxide chemical plant. According to Mr. Phillips, the returns are fantastic, with the original scoping study showing the net present value of 888 million dollars before the resource update. Piedmont plans to receive all of the permits in 2019, and begin construction on the project in 2020, and commence the production of lithium in 2021.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Keith D. Phillips, who is managing director and CEO of Piedmont Lithium. I wonder if you could give our readers/investors an overview of your Company.

Keith Philips: Piedmont Lithium is developing an integrated lithium project in North Carolina in the Piedmont region of North Carolina. Piedmont means foothills. We're in the foothills of Appalachia, about 30 miles west of Charlotte, North Carolina.

We have a large spodumene deposit of high grade, and we are advancing our plans to build a mine and concentrator plant and also a lithium hydroxide chemical plant, all in this area where we're operating.

It would be one of the larger such integrated projects in the world. And the only one in the United States.

Dr. Allen Alper: That sounds great! Could you tell our readers/investors more about the resource and your plans to develop the project?

Keith Philips: We put out the updated resource statement two weeks ago. We have a current resource of 27.9 million tons at 1.11% Li2O. It's a measure of lithium content. That's a world-scale resource, by any measure. It's a strong grade. Anything over 1% is typically considered high-grade.

Our plan is to develop the project in two phases, initially build a mine and concentrator with a Capex of around 130 million US dollars in our last study, which was last September. We have an updated scoping study coming out in a few weeks, which will reflect this updated resource.

Once the mine and concentrator plant are up and running and cash-flowing, we would use that cash flow to fund the development of a chemical plant down the road, in Kings Mountain, North Carolina. That would be a capital cost of about 340 million dollars. Those numbers will all be updated in the updated scoping study.

The returns are fantastic. The net present value in our current scoping study is 888 million dollars. We hope that number will rise, with the larger mineral resource we now have. In our prior scoping study, our resource was only 16.2 million tons.

We're now at almost 28 million tonnes and on the Core property, we're up over 50%. So we think the NPV might improve, and we're looking forward to that. That's the base plan. We're working through the permitting process in North Carolina. We're on private land in North Carolina.

The permitting process is rigorous, but we're working with the local agencies and the Army Corps of Engineers and doing a good job. We're optimistic that we'll receive all of our permits in 2019, later this year, and that we'll be in a position to have a development decision early in 2020 and begin construction on the project in 2020, and then production of lithium in 2021.

Dr. Allen Alper: That sounds great! Could you update our readers/investors on why lithium is so important and a little bit about what the market forecast is?

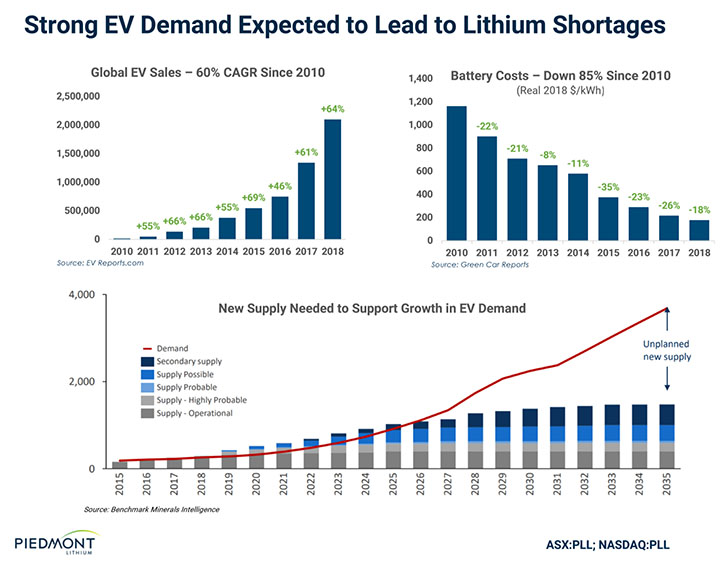

Keith Philips: Yes. Lithium is a rapidly growing business. In terms of market size, to put it in perspective, the market produced about 280 thousand tons of lithium carbonate equivalent last year. That's the standard measure people use. The market's expected to grow around a million tons in 2025. That's only six away.

The growth is really, very substantial, driven mostly by batteries, driven mostly by electric vehicles. So currently, about 60% of the lithium in the world is used for batteries. For your smartphone, for your tablet or laptop, and increasingly for people's cars.

Obviously the bigger the machine the bigger the battery, and Tesla batteries are using dramatically more lithium than, say, an iPhone battery would use.

The real growth driver is electric vehicle demand, and that demand has been up 60% or more each of the last three years globally and the market continues strong this year.

So as electric vehicle demand grows globally, the demand for lithium ion batteries will grow. The one indispensable element in a lithium ion battery is lithium. You can use a lot of other materials, with lithium, to use the cathode in the battery. You can use different amounts of nickel or manganese, or cobalt, or iron, et cetera.

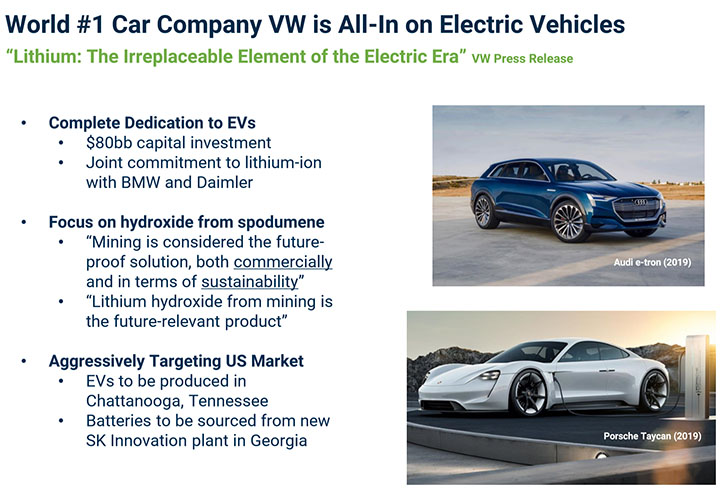

But at the end of the day, lithium is indispensable. Nobody really foresees that changing for some very long time in the future, given how lithium has been adopted by all of the major producers; Tesla, VW, BMW, Mercedes in Germany, et cetera. So the lithium ion battery is the winning technology.

I think that will continue for decades, and lithium demand will grow with battery demand, which will grow with EV penetration, which I think will get stronger and stronger as more people realize not only how good these cars are, but how cost-effective they are.

Electric cars are far less expensive to operate, and to maintain. They're far less expensive to fuel, in most jurisdictions in the United States, than gasoline. And they're far easier to maintain, far simpler engineering. The battery itself is complex. Everything else is pretty straightforward from an engineering perspective.

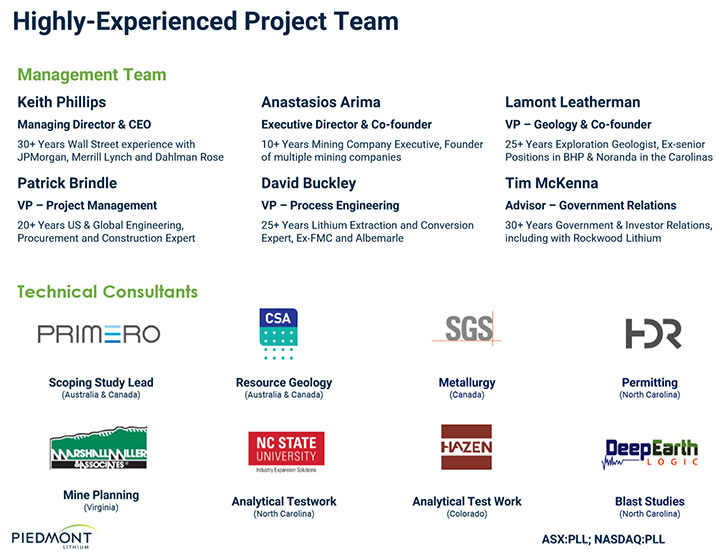

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors about your background, your Management Team, and your Board?

Keith Philips: I joined the Company two years ago, this week, actually, middle of July 2017. I was an investment banker on Wall Street for 30 years. I spent the last 20 of those as a mining investment banker. I ran the mining teams at Merrill Lynch, and then at JP Morgan.

And then I spent a lot of my time the last several years of my career working with smaller cap juniors, mostly in Canada, bringing them into the US capital markets. In that new role I got to know some of the people behind this Company, who were looking for some US-based person to help develop a strategy and market the story.

The Company was actually founded by a group out of Perth, Australia, called Apollo Group. Apollo is a leading mining incubator based in Perth, Australia. Our Chairman, Ian Middlemas was the founder of Apollo. He's been involved with a couple dozen pretty significant mining stories.

They were looking for a lithium opportunity. They discovered the history that most of the lithium in the world came from North Carolina in the 1950s to 1980s. They decided to take a look, and they were able to assemble a nice land package.

The founder of Piedmont was Taso Arima. He's on our board. He had the vision and founded the business jointly with Lamont Leatherman. Lamont is a prominent geologist from Lincolnton, North Carolina, just down the road.

He's been around the world, with BHP and others. He partnered with Taso to put together a land package to do some initial drilling, and they had terrific results. They hired me, and we built a team. Patrick Brindle is our Vice President and project manager. He's coordinating all of the studies, the metallurgy work, et cetera. It's a lean, but strong team. And Dave Buckley is our Chief Process Engineer – he’s a lithium veteran having spent 20+ years with industry leaders Albemarle and Livent.

Dr. Allen Alper: Sounds like you have a very strong, very balanced team, both financially, geologically, and technically. That sounds like a great team! That's what you need. You need the technology and you need the money, so it sounds like your fellows are well-prepared to move forward.

Could you tell our readers/investors about your capital and share structure?

Keith Philips: We actually announced a financing last week. We raised 21 million Australian dollars in a placement led by some first-tier global institutions, principally based in Australia and Asia. The two biggest investors were Fidelity, who hadn't previously been a shareholder, but they've come in and acquired a significant stake in the Company, about a 9% position. The other big investor was Australian Superannuation Fund. Aus Super for short. They've been our biggest shareholder at 13.2%. The rest of the investors were tier-one Australian and Hong Kong based institutions, who just really liked our integrated lithium story, and our location in the United States. We haven't announced our June 30th cash balance yet, but 21 million Australian is around 14, 15 million US, on top of the cash we already had.

We're in a very strong cash position, relative to our requirements in the next year or so.

Dr. Allen Alper: That sounds like an excellent position to be in. That's terrific! Could you tell our readers/investors the primary reasons they should consider investing in Piedmont Lithium?

Keith Philips: I think four reasons. One is, I think fundamentals for lithium demand are well understood and there's a strong consensus that lithium demand will grow dramatically.

Number two, despite that consensus, there has been a fear of oversupply in the lithium market, and there have been some new projects that came on in Australia last year, and from a short-term perspective, I think have driven lithium prices down, and lithium equities have been hit very hard, particularly pre-production lithium equity. The average is down probably 70%.

So I think it's a very opportune buying moment, given strong demand in the sector and really depressed valuations. I think Piedmont stands out for two reasons. One is we're an American project. We're the only conventional American lithium project, and we're listed on NASDAQ. So we're one of only two lithium juniors listed in the United States.

Everyone else is listed in Australia or Canada, or some cases, UK. There are 70 different lithium juniors listed in Australia. There are two in the United States, Piedmont and Lithium Americas. We think that is helpful for American investors, and we're interested in attracting more and more American investors to our stock.

Dr. Allen Alper: Sounds like very good reasons for our readers/investors to consider Piedmont Lithium. Keith is there anything else you'd like to add?

Keith Philips: Thank you for interviewing Piedmont Lithium for Metals News. Additionally, the fact that we're fully funded through a feasibility study, sometime in the next year, puts us in a great position. It’s a US story with a US listing in a hot sector, with an exceptional project, and we hope people will take a hard look at it.

Dr. Allen Alper: That sounds great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.piedmontlithium.com/

Keith D. Phillips | President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

|

|