IsoEnergy Ltd. (TSXV: ISO; OTCQX: ISENF): Spin-Off from NexGen, Well-Funded Athabasca Basin Uranium Exploration and Development Company: Interview with Craig Parry, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/12/2019

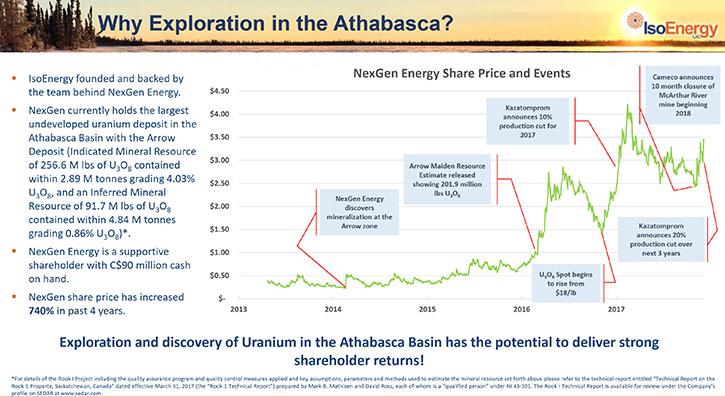

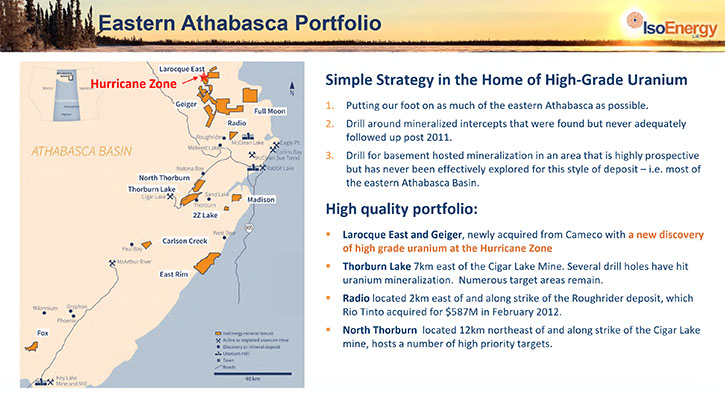

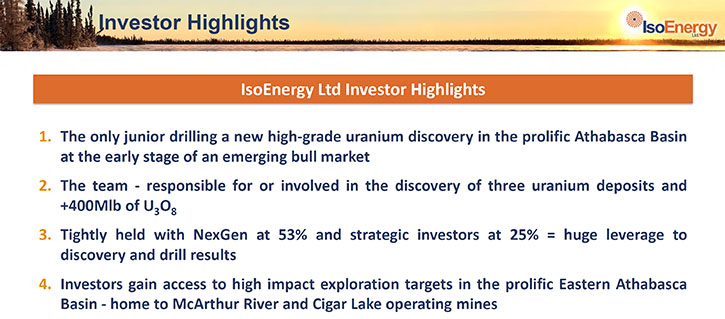

IsoEnergy Ltd. (TSXV: ISO; OTCQX: ISENF) is a well-funded uranium exploration and development company with a portfolio of prospective projects in the Eastern Athabasca Basin in Saskatchewan, Canada and a historic inferred mineral resource estimate at the Mountain Lake uranium deposit in Nunavut. We learned from Craig Parry, CEO of IsoEnergy, that IsoEnergy was a spin-off from NexGen Energy, the company that had discovered and developed the universally recognized Arrow Deposit, and owns about 54% of IsoEnergy. The Company's strategy is to acquire properties with known mineralization, and follow-up on the previously identified targets. We learned from Mr. Parry that last year, they made a significant high-grade Hurricane Zone uranium discovery on their Larocque East property, and now they are in the middle of their second major drill program there.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Craig Parry, who is CEO of IsoEnergy Ltd.

I wonder if you could give our readers/investors an overview of your Company and some of your visions and goals.

Craig Parry: Sure, Allen. We're a uranium exploration company focused on the Eastern Athabasca Basin in Saskatchewan, Canada. We've made a recent discovery there. Midway through last year we discovered, on our Larocque East property, the Hurricane Zone. We've now just commenced our second major drill program on that back property and on that discovery. So we're drilling some high-grade uranium mineralization at the moment.

But just stepping back from that, we started IsoEnergy back in 2016. We were born out of NexGen Energy. We've spun the Eastern Athabasca portfolio of properties that we had at NexGen into IsoEnergy with the objective of expanding our portfolio in the Eastern Athabasca and exploring for uranium out there.

I was one of the co-founders and founding directors of NexGen. Back in 2011 we started NexGen and began exploring, building up a property portfolio again in the Athabasca Basin. We're very fortunate that we discovered the Arrow Deposit; that has become universally recognized as one of the great uranium discoveries of all time. We've now grown that deposit to over 300 million pounds. The team there at NexGen...I was on the Board; I stepped off the board recently to focus on Iso, but we've advanced that Arrow project on towards development, and the Company's now moving through the permitting and feasibility study stages there at Arrow.

NexGen, we've grown up from a $10 million market capitalization to now having a market cap of about $800 million today. So that was a great success, but of course our investors have expected us to focus on that Arrow Deposit, so we decided to move our Eastern Athabasca licenses into Iso and begin exploring and expanding our land position in the Eastern Athabasca.

And that's gone well. We've started off with five licenses that we acquired from NexGen for stock. NexGen remains very supportive, and the major shareholder, of the Company. NexGen owns about 54% of IsoEnergy and participates in every placement we do, so, we have a great, supportive, big shareholder there. That's allowed us to do a lot of deals and a lot of exploration at a time when most others are being very quiet. Three years into the life of the company, we've been very pleased to report that we've made a significant new discovery there at Hurricane.

Dr. Allen Alper: Well, that's great. Could you tell our readers/investors a little bit more about your properties and what's going on?

Craig Parry: Sure. Yeah, we're focused very much on the Eastern Athabasca. What we're doing there, very simple strategy in effect. We're building up our land position at a time when properties are available and it's been relatively cheap to do so. So I think we've grown our land position from five properties, we now have 13 properties. Some of those have been acquired from majors like Orano and Cameco and those companies have become shareholders in IsoEnergy. We've also acquired properties chiefly through staking.

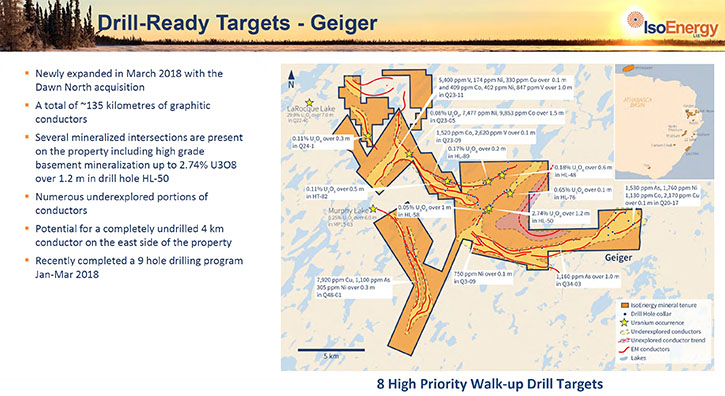

So that's allowed us to build up a very big portfolio of properties. Very importantly, part of those properties is a seat in the northeastern corner of the eastern part of the Athabasca. Those have two flagship properties, Geiger and Larocque East. Those properties have been the focus for the Company in the past couple of years.

The Eastern Athabasca hasn't been thoroughly explored for basement-hosted deposits in the past. Arrow Deposit at NexGen is a basement-hosted deposit. There are two key types of deposits in the Athabasca Basin. There're unconformity related deposits and basement-hosted deposits. The basement-hosted deposits, like we have at Arrow, have now been confirmed to be continue to great depths and have extraordinarily good economics.

So knowing that the Eastern Athabasca hasn't been thoroughly explored for those deposits, we're employing some of the lessons we've learned from that Arrow discovery and deposit drill out and employing those in that under-explored Eastern Athabasca area for that style of mineralization.

Back in 2007, during that last uranium boom, a lot of money was raised and a lot of first and second pass drilling was then done over the next couple of years, up until 2011 when we had that Fukushima disaster off the back of the tsunami in Japan. The Fukushima nuclear plant flooded and funding dried up. And that left a lot of drill holes drilled in the Athabasca Basin, usually just first pass drilling. The companies that did that first pass drilling ran out of funding to complete further exploration work on those drill holes. So that left a lot of mineralized intercepts out in the Eastern Athabasca that had never ever been followed up.

So the key part of our strategy is very, very simple. Acquire as many properties as we can, with those mineralized intercepts and simply get in and drill around them. Any one of those holes could actually be a discovery hole. We simply follow-up around those holes that have been already identified to be mineralized.

You look at our Geiger property; this is a very large property. There are seven individual drill holes on that property, with mineralization in them that have never been followed up. We have a large number of targets there and then, again, at our Larocque East property, which we acquired in early May last year. Having acquired it in May, we immediately sent a rig out there to drill one hole on our very best target. And that's when we announced the Hurricane Zone discovery back in early July last year. Again, another very good example of a mineralized intercept that had never been followed up, and we very simply got in there and started testing around that hole, and made that Hurricane discovery.

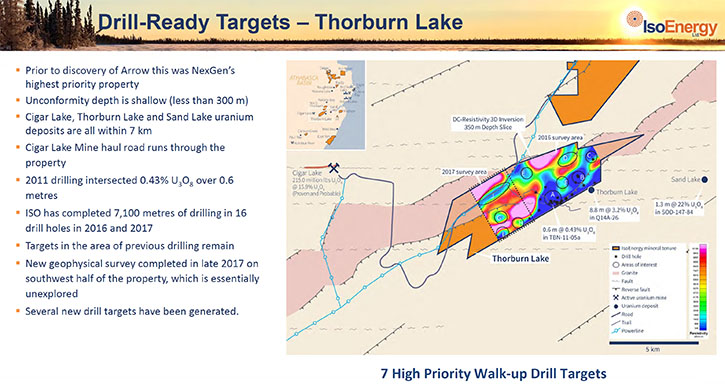

So that's the broader strategy there. We have a number of other properties, prior to the acquisition of Hurricane and Geiger properties. We had the Thorburn Lake property. Thorburn Lake was our primary property at that point in time. Again, characterized by a number of mineralized holes with uranium in them that had never been followed up, so we have started exploring there. There's a lot of unfinished business on that property and very importantly, that Thorburn Lake property is 6 kilometers away from one of the world's great uranium mines, Cigar Lake. It's a long strike from the Cigar Lake deposit on the same structural terrain and the same rock packages and only 6 kilometers away. To have that property in the portfolio is a great thing for our investors as well.

Big package of properties! Very pleased to report that we have a team, with a track record of successfully getting and testing those targets. They do that exploration work very effectively.

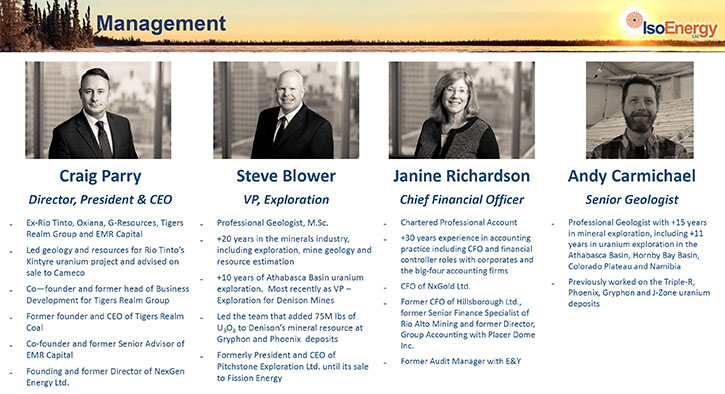

Dr. Allen Alper: Well that sounds excellent. It's great to be in a wonderful location, have excellent properties to explore, many of them, and an excellent team. I wonder if you could tell us more about your background, your management team and your Board of Directors?

Craig Parry: Sure, I spent 9 years with Rio Tinto Exploration. I'm an exploration geologist, before moving into sort of more of the corporate side of things. I joined Oxiana with the original founders of Oxiana, a group of companies called the Tigers Realm Group of companies where we had a number of successes. We helped fund NexGen, which is one of our successful activities there. We also started a company called Tigers Realm Coal where we discovered a coking coal project in far eastern Russia, which we brought into production. I was the CEO of that company, so that's now producing. It's the lowest cost coking coal mine in the world, out there in far eastern Russia. That was another thing we did there. Beyond that I helped form a company called EMR Capital, where I'm still a shareholder and partner. EMR Capital is now one of the leading private equity funds in the resource space. We have about $5 billion dollars’ worth of assets under management and funds under management of the order of $2 billion dollars.

Having left the Tigers Realm Group back in 2016, I moved my family to Canada to help set up IsoEnergy out of NexGen. We have a very supportive Board at Iso.

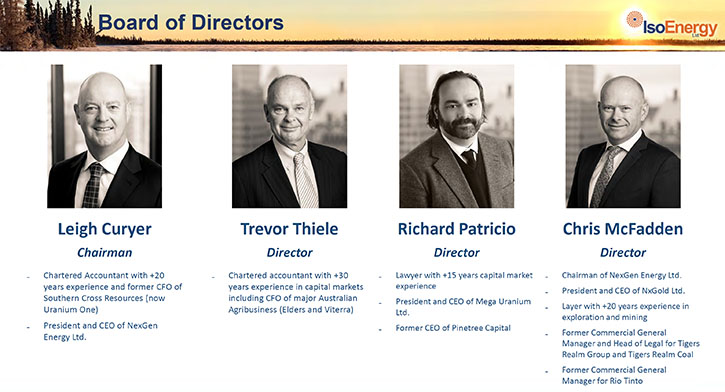

Our Board Chairman, Leigh Curyer, the founder and CEO of NexGen, led all that great work and continues to lead that great work; That Arrow discovery that we have here in NexGen. We have Richard Patricio, Christopher McFadden, Trevor Thiele, all of the original board members of NexGen sitting on the IsoEnergy board, so very strong links to the company there.

Of course Leigh's gone on to expand the NexGen Board very strongly, with the appointment of some very big names. Significant people like Brad Wall, who was the former Premier of Saskatchewan.

We have great support at the Board level and then we were very fortunate to have a gentleman by the name of Steve Blower join us as our Vice President of Exploration. Steve was the head of exploration at Denison and had run a number of companies prior to that. He’s a geologist with a long history of exploration success. Very importantly, when he was at Denison, he looked at a lot of the deposits across the Athabasca basin, but later the team discovered Griffin which is significant part of Denison today. Steve has a great track record of exploration success. Of course he led that team. Now he led our team to discover the Hurricane deposit, so he has two significant uranium deposits and discoveries under his belt. He leads a very good team made up of: Senior Geologist, Andy Carmichael and Justin Rodko, a brilliant young geologist.

We have Janine Richardson as part of the team. She's our CFO. She's a very steady safe pair of hands on the financial front and our Company secretary Wes Short who joined us back in 2016, helped me establish the Company and he's been a real asset to the Company.

Also we have a really good, solid team, who has a very good track record. We just got back from the field today. We took an analysts and investors out on a site visit to Hurricane and the guys presented the work they've been doing on the discovery there. They've just done a fantastic job. You'll see some of that.

So you'll start seeing good coverage from analysts in the near term as well. They saw the team in their natural environment, showing all of our visitors here the high-grade that we just drilled. It was a very exciting trip.

Dr. Allen Alper: Well that's excellent. You have a fantastic management team, background and also Board of Directors. Sounds like you have great financial support, great properties and a great team. Seems like you have everything going for you and your group.

Craig Parry: Yeah I think so, that's right. We're in a very good position now, and it allowed us to do a lot of things at a time when no one else was very active. I think having that sort of team and track record of success behind us, has allowed us to do a number of deals with the majors.

I think the companies that we've done deals with, Cameco, AREVA, etc. have been happy to deal with us, partly because they know that we know what we're doing on the exploration front but also, the fact that they know we can fund, drill projects and test the targets that we have on the properties that they've sold us. They want to see projects move forward and be stewarded correctly. They know that they get that from us.

Very importantly, having that NexGen team and success behind us, we've been able to raise a lot of money and do a lot of work at the time when it was a struggle to raise funds. We started the Company in mid-2016, really only three short years ago.

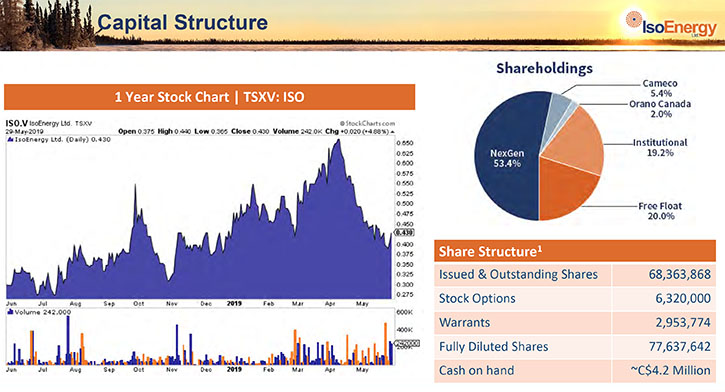

We've raised over $17 million to date and I think that's probably more than the money raised by all of the junior Canadian uranium companies combined in that time frame. That's put us in good shape to make that discovery.

We still have about $4 million in the bank, we raised $5.5 million in a bought deaI. So we have $4 million in the bank and at our current rate, we put the bulk of our invested dollars into drill holes. We have a rig going out there on Hurricane at the moment. We have a 16-hole program. We're one hole into that 16-hole program that should continue to deliver. I think you'll see more good news flow from us over the next two to three months, as we keep that drill program going.

But having that funding support is very good. We have enough funds to get us well into next year. Of course what I'd love to do is come back to the market and say we want to expand our drill program and keep that going for longer this summer, but time will tell. It's an exciting time for the Company, as we speak, we're on hole #2 of the 16 hole-program, so watch for all of that good news flow over the next couple of months.

I'm hopeful that we'll have some very good news for the attendees at the Sprott Natural Resources Symposium.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Craig Parry: Absolutely. Firstly, if you look at the macro picture, the size of the market, the combined market capital today is about $13 billion dollars.

Back in 2010, the combined market capital was over $100 billion dollars. So, of course, a lot of you have lost investing interest because of low uranium prices in recent times. We think that uranium prices can't stay where they are for much longer. We've seen massive mine closure announcements over the past two to three years. It's been a story of supply side, but we are seeing more mine closures and uranium prices have started to rise. As uranium prices continue to rise, the combined valuation of our sector has the potential to rise extraordinarily. That's an opportunity to get outstanding shareholder returns, simply by investing broadly in the sector. But of course what we've shown at NexGen and to some extent at IsoEnergy is that a discovery is still highly valued.

We did our original financing in NexGen at five cents a share. Now it is trading around $2 a share. So in the worst market, a discovery still gets valued. For investors now, the hard work has been done for them and there are probably only 20 to 30 companies left in the uranium space worth looking at. Before there were over 500 listed companies you could invest in uranium. Today there're about 20 to 30 that you would actually consider investment grade. You can build a basket of those stocks if you want to get exposed to that massive potential of the sector, or you can do what we recommend and focus on companies drilling high-grade uranium discoveries now. There're only a few, and we're the only junior at the moment, with a recent high-grade uranium discovery in the Athabasca Basin. That's the key investment piece, if you like this more, we think people should be looking at us. Uranium prices are rising. We're about to enter a uranium bull market and we're the only junior out there with the new high-grade discovery and we are drilling as we speak.

Dr. Allen Alper: That sounds exciting! Sounds like a strong reason for our readers/investors, to consider investing in IsoEnergy. Looks like 2019 will be an extremely exciting time for investors in IsoEnergy.

Craig Parry: Absolutely. I couldn't agree more. I think it's been a long and pretty painful seven years for uranium investors, including ourselves up until this point. We expect a very positive second half to 2019 and beyond that 2020, 2021. I think you've seen something very important emerging in the uranium market, continued strong demands matched with supply side erosion. Should be an exciting couple of years to come. Thank you for giving IsoEnergy the opportunity to share our progress with you and your readers at Metals News.

Dr. Allen Alper: That sounds great. I think we’ve all found it very interesting and exciting. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.isoenergy.ca/

Craig Parry

Chief Executive Officer

IsoEnergy Ltd.

+1 778 379 3211

cparry@isoenergy.ca

|

|