Paramount Gold Nevada Corp. (NYSE American: PZG) to Complete Bankable Feasibility Study for Grassy Mountain Gold Mine in Oregon; Interview with John Seaberg, Executive Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/12/2019

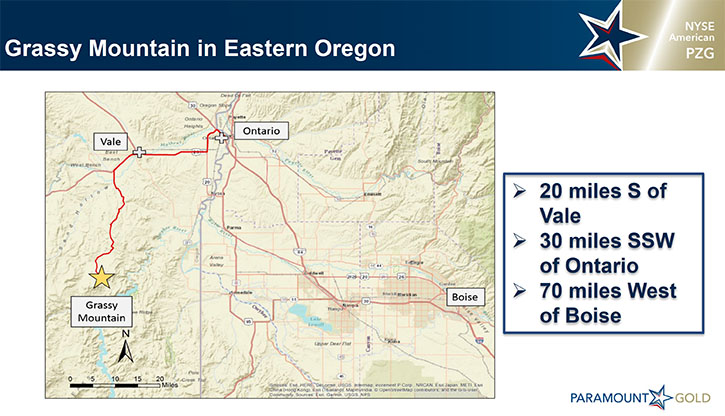

Paramount Gold Nevada Corp. (NYSE American: PZG) is a US focused gold development company that owns 100% of the Grassy Mountain Gold Project, which consists of approximately 11,000 acres located on private and BLM land in Malheur County, Oregon. The Grassy Mountain Gold Project contains a gold-silver deposit, entirely located on private land, for which results of a positive PFS have been released and key permitting milestones accomplished in 2018/19. We learned from John Seaberg, Executive Chairman of Paramount Gold Nevada, that on June 25, 2019, they have entered into an agreement with Ausenco Engineering Canada Inc. to complete a National Instrument 43-101 Feasibility Study for the proposed Grassy Mountain gold mine. In addition, Ausenco is going to become a significant shareholder of Paramount. The Company is very tightly held with only 26 million shares outstanding, and has an exceptional Board of Directors, with significant experience that gives it very good strategic guidance. In addition, Paramount owns a 100% interest in the Sleeper Gold Project, located in Northern Nevada.

Paramount Gold Nevada Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Seaberg who is Executive Chairman of Paramount Gold Nevada Corp. I wonder if you could give our readers/investors an overview of Paramount Gold and also tell them what differentiates Paramount Gold from its peers.

John Seaberg: I would be happy to! As a refresher for your long-term readers/investors, because we've had a couple interviews in the past, and for your many recent readers/investors, Paramount Gold is a US focused exploration and development company in precious metals. We have two advanced stage projects in our pipeline. Our flagship asset is the Grassy Mountain Project in eastern Oregon, where we recently completed a preliminary feasibility study.

We just had an exciting announcement. We entered into an agreement with Ausenco, an engineering, procurement and construction company, to begin developing a feasibility study for our Grassy Mountain Project.

That's an exciting announcement because Ausenco did our pre-feasibility study. They're going to do our feasibility study and they're likely going to build our project and they agreed to take 100% of their fees in Paramount common stock. So not only are they our engineering procurement and construction company, they have enough faith in our project that they'll take their almost a million dollar fee in shares instead of cash. So they've become a significant shareholder in Paramount.

Dr. Allen Alper: That's excellent! Ausenco is clearly in a position to be able to evaluate your Company and your project, so this is a huge endorsement of Paramount Gold Nevada. They're willing to have skin in the game.

John Seaberg: Yes, it's really a good endorsement of the project, the permitting process in Oregon, the Management Team and our Board. So I think it's an excellent step. We also have a new strategic shareholder, Ausenco.

The second project we have is our Sleeper Mine in northern Nevada, host to a four and a half million ounce total resource, that is surrounded by our 40,000 acre land package. It's a massive project, with significant potential. We're not actively developing it now because of resource constraints. All of our attention is focused on Grassy Mountain, but we're excited to have our Sleeper Mine. It's a strategic asset in our portfolio and we will advance it when we have the resources to do so.

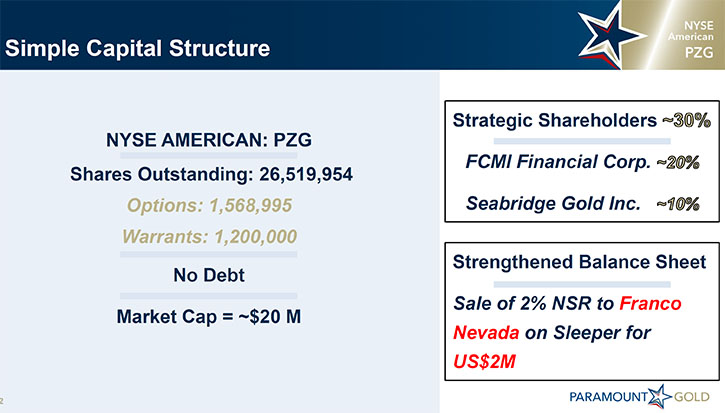

We're a US focused Company with US assets. I think that's unique in this space. A lot of our competitors don't have that and their projects are not as advanced as Sleeper and Grassy Mountain in our pipeline. Another differentiating factor is our low share count. We have 26, almost 27 million shares outstanding, which is very low when you look across the junior mining space. We have an exceptional Board of Directors, with significant experience that gives us very good strategic guidance. I think those are the key differentiators.

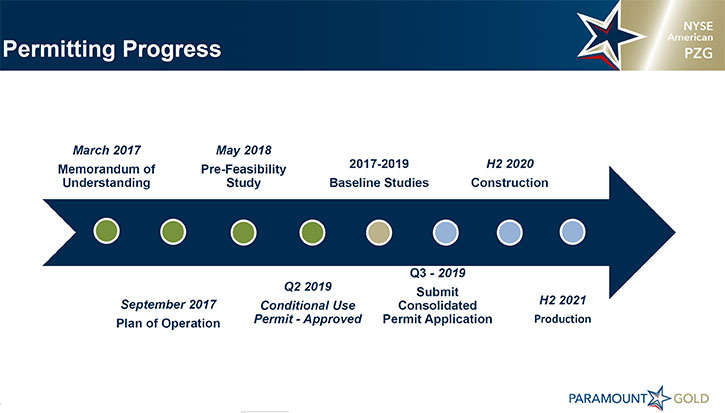

We're also the first mining project to be this advanced in the permitting process in eastern Oregon. We recently received the conditional use permit, which is a county level permit for the Grassy Mountain Project, an excellent endorsement in support of the project. We're currently working on our consolidated permit application, which we expect to submit later this year.

Dr. Allen Alper: Very exciting! Could you highlight the reserves and resources at Grassy Mountain?

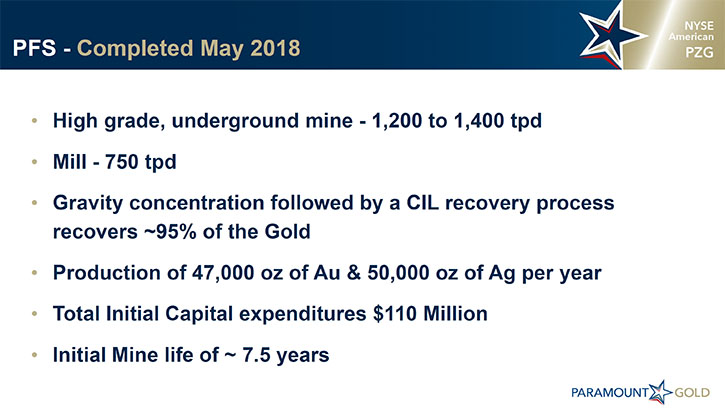

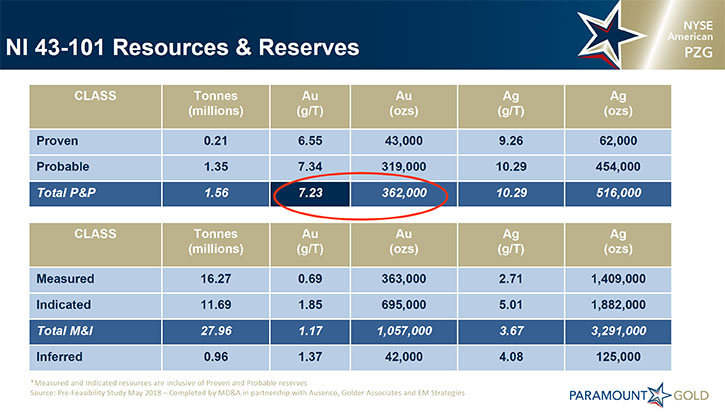

John Seaberg: Absolutely. We have a total resource of over a million ounces at about 1.23 grams per ton. However, we are only focused on the highest grade resource which is 363,000 ounces at 7.23 grams per ton. That is what is included in our preliminary feasibility study and will be included and evaluated in our feasibility study, moving forward. We wanted to have minimal impact on the land, not create a massive open pit, but rather have a small underground operation that's very profitable at a 7.23 grams per ton head grade.

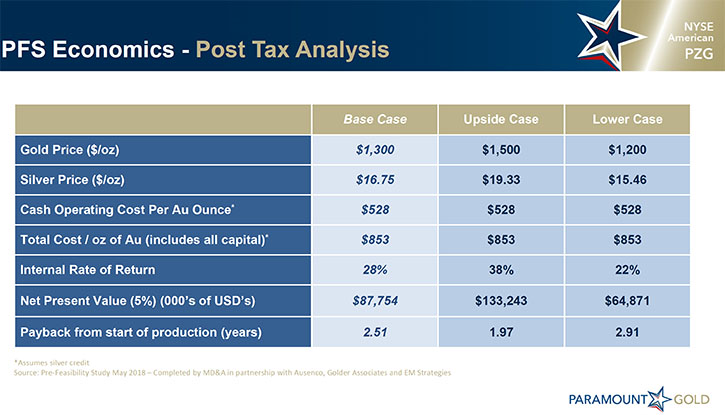

Dr. Allen Alper: That sounds like a very good approach. Could you highlight the economics involved in your preliminary economic assessment?

John Seaberg: Certainly. These numbers will be refined and likely improved in our feasibility study. In our preliminary feasibility study, assuming 363,000 ounces at 7.23 gram per ton, utilizing a 750 ton per day mill, achieving 95% recoveries, at a $1300 gold price, we generate an NPV of close to $80 million dollars after tax and a 28% internal rate of return. It's a very robust project because it has a very low cash cost at $528 an ounce. The high grade and high recoveries generate a significant return of almost $90 million dollars.

Dr. Allen Alper: Very, very good! Could you tell us about your background?

John Seaberg: I'm the newest member of the Paramount team. I've been here for a year now. I have over 25 years in precious metals and mining experience, most of which was gained at Newmont Mining Corporation, where I had over 12 years of experience in corporate development and investor relations. After Newmont I spent about three years at an underground mining company, Klondex Mines, as the Senior VP of Strategic Development. That's where I gained a lot of underground experience, which is serving me well as we evaluate and optimize Grassy Mountain Project.

Dr. Allen Alper: Excellent experience! Could you tell us about the other members of your Team and Board?

John Seaberg: Our CEO is Glen Van Treek. Our CFO is Carlo Buffone and our Director of Corporate Development is Christos Theodossiou. All of those members were with the first Paramount Gold and Silver that was acquired by Coeur Mining in 2015 in a transaction worth approximately $200Million. This version of Paramount was spun out at that time, with the Sleeper asset. These guys have great experience in developing and advancing projects and they have generated a lot of shareholder value, with the sale of that Company to Coeur Mining.

Our Lead Independent Director is Rudi Fronk, who is President and CEO of Seabridge Gold. Rudi has 35 plus years in the metals and mining space and has generated significant value for shareholders. We also have several other members that have various levels of technical expertise that serve us well.

Dr. Allen Alper: That's an excellent Team and an excellent Board. Very strong! Could you tell our readers/investors how your Company is leveraged to the price of gold?

John Seaberg: I think we have significant leverage, given the grade of Grassy Mountain, it can withstand a lot of volatility on the lower metal prices and still make a lot of money. Sleeper actually has more leverage because the margins are thin given the low grade nature, but at higher gold prices the margins and the return increase exponentially. So between the two projects and even on a per share metric because of our low share count I think that we have above average leverage to the price of gold relative to our peer group.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors about your capital structure?

John Seaberg: We have about 26 and a half million shares outstanding. We have zero debt, which is also unique in this space and separates us from our peers. We recently sold a 2% royalty on the Sleeper Project to Franco Nevada for $2 million, an excellent transaction and another significant endorsement for Sleeper and the management team by a very well-known and reputable name in the gold space with Franco Nevada.

It was a small transaction to Franco, but regardless of the size of the transaction, Franco is a professional company and does extensive due diligence, which they did on Sleeper. That's a significant endorsement of that project. We're not advancing it right now, but if we have a vote of confidence for Franco Nevada to invest $2 million dollars in a future royalty then that's exciting to us. That added a significant amount of money to our treasury at zero dilution to our shareholders.

Dr. Allen Alper: That's very impressive that Franco Nevada would have that confidence in Sleeper to invest $2 million dollars. Could you tell our readers/investors the primary reasons they should consider investing in Paramount Gold?

John Seaberg: Absolutely. Paramount is trading at a significant discount to the value of our assets. I think the primary reason for that is because of the permitting process in Oregon. We're further down the permitting road than any other mining company has been in Oregon. We're about to submit our consolidated permit application, which will be a significant milestone. No one's ever done that for a chemical mine in Oregon. I think investors will start to pay more attention to this Company and have more confidence that we're going to be successful in getting our permit.

I think the biggest downward pressure on our share price is that people are not certain we're going to get that permit, but that's why that vote of confidence by Ausenco was so important for us, because they're taking shares. They obviously want to realize a gain on their shares. Those shares were issued at 76 cents which is the 30-day VWAP when we signed the agreement. They're obviously in the game to make money beyond just their fee. I think that is a game changer for our company.

Then we'll turn our attention to advancing the Sleeper Mine and perhaps even entertain a JV option or a strategic investor in that project as well. So it's an exciting time for Paramount. If you add up the value of Sleeper that's supported by a preliminary economic assessment of $125 million dollars after tax, plus the $90 million dollars at Grassy Mountain, our current market cap is just over $20 million. Again, a significant discount on a great opportunity.

The other thing is, we have excellent exploration potential at Sleeper in Nevada and also at Grassy Mountain. In December of last year we acquired the Frost Project, which is 12 miles away from Grassy Mountain and has some historical, very high-grade intercepts of over 20 grams per ton. We recently did some geotech work, identifying some very high priority targets that we intend to design and explore via a drill program. If successful, which we think it will be, that ore can be easily trucked to the Grassy Mountain Complex. There are significant exploration targets, within a mile or two of Grassy Mountain that will provide additional feed to the mill and extend the mine life.

We're well positioned. We have a 7 1/2 year mine life at Grassy Mountain, with excellent exploration potential to at least double that. We're very excited. We have a lot of support and collaboration from the state of Oregon regulators. We are confident we are going to advance this project into production.

Dr. Allen Alper: Oh, that's excellent. It sounds like Paramount Gold is in a great position, with a great location, great property, excellent team and excellent backing. So that sounds fantastic.

John Seaberg: Yeah, we're excited Allen. We're excited. We've made significant process. We're always looking for capital. We have to make sure that we're well-funded to advance projects at Grassy Mountain, through permitting. Then I think the market's going to give us whatever we want for the project financing, which currently today stands at about $110 million. But, permit in hand and the support of Ausenco and the reputation of Ausenco for delivering a feasibility study that they guarantee, schedule, price and performance. That's going to be a significant advantage for us, when we seek further financing next year.

Dr. Allen Alper: That sounds very exciting. Is there anything else you'd like to add, John?

John Seaberg: We have really good advanced stage projects that can make a lot of money. When other companies had Grassy Mountain and Sleeper in the past, Grassy Mountain in particular, didn't get the love and attention that I think it deserved from larger mining companies, because it wasn't a core asset to them.

Grassy Mountain is our flagship asset. It gets all of our attention, our love and our support. We're very fortunate to have the Management team that we have and our Board of Directors to take Grassy Mountain through permitting and into production successfully.

Dr. Allen Alper: Oh, that sounds fantastic. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.paramountnevada.com/

Glen Van Treek, President, CEO and Director

Christos Theodossiou, Director of Corporate Communications

866-481-2233

Twitter: @ParamountNV

|

|