Pala Investments to Acquire Cobalt 27 for C$5.75 per Share; Creation of Nickel 28; Interview with Anthony Milewski, Chairman and CEO, and Justin Cochrane, President and COO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/8/2019

Cobalt 27 Capital Corp. (TSXV: KBLT) (OTCQX: CBLLF) (FRA: 27O), is a battery metals streaming and royalty company, primarily focused on cobalt and nickel, offering exposure to metals integral to key technologies of the electric vehicle and energy storage markets. We learned from Anthony Milewski, Chairman and CEO, and also from Justin Cochrane, President and COO, of Cobalt 27, about the recent agreement providing for the acquisition of Cobalt 27 by Pala Investments Limited, and a spin-off of a new company called Nickel 28 Capital Corp., subject to vote by shareholders in late August or early September. According to the deal, the Voisey's Bay stream and the physical position will remain with Cobalt 27 and Pala will repay Cobalt 27's nearly US$50 million of debt. Nickel 28 will receive the joint venture interest in the Ramu Nickel-Cobalt Mine, considered one of the most efficient, integrated lateritic nickel-cobalt operations in the world, ranking in the first quartile of the 2019 global nickel asset cost curve, as well as a 1.75% NSR royalty on Dumont, a shovel-ready nickel-cobalt project in Canada, a 2.0% NSR royalty on the Turnagain project and a 7.4% equity stake in Giga Metals, owner of the Turnagain project.

The Ramu Nickel Cobalt joint venture

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing both Anthony Milewski, Chairman and CEO of Cobalt 27, and also Justin Cochrane President and COO of Cobalt 27. Anthony, could you tell us what's happening with Cobalt 27 and also introduce us to Justin.

Anthony Milewski: Yes, sure. First of all, I want to thank you for having me back for Metals News. I always enjoy talking with you about the market for battery metals, and our Company. I appreciate that, and to all the readers/investors out there, thank you for your time.

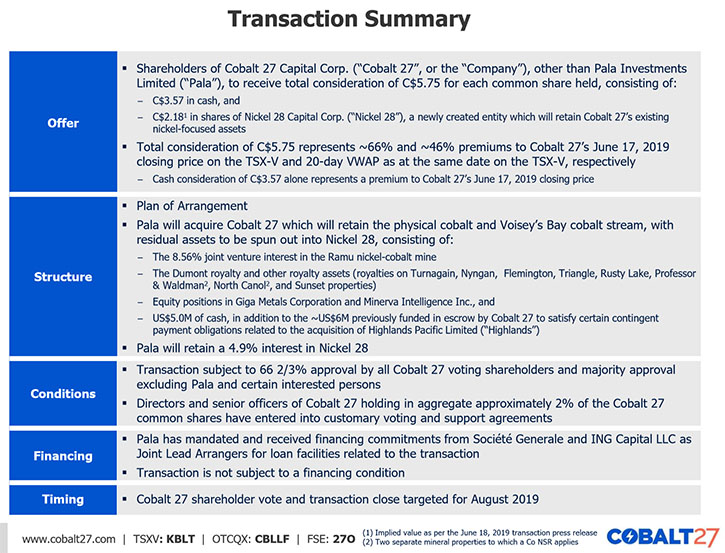

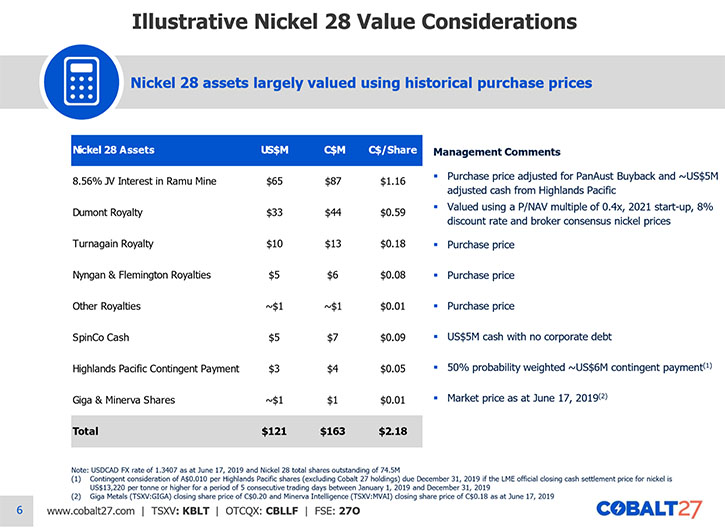

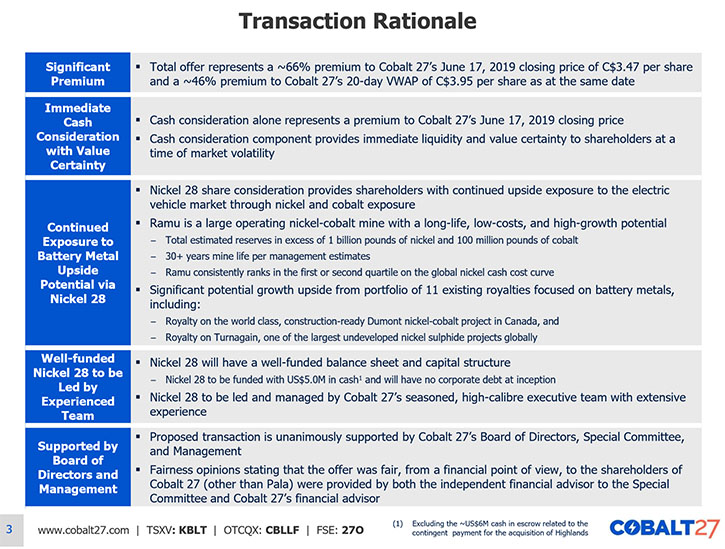

So yes, there have been a number of changes since the last time we spoke. The most important and biggest change of course is that on June 17, 2019, Cobalt 27 entered into an agreement with Pala providing for the acquisition of 100% of Cobalt 27’s issued and outstanding common shares for total consideration of approximately C$501 million. Under the terms of the proposed transaction Cobalt 27 shareholders will receive C$5.75 per common share, comprised of C$3.57 in cash plus one common share of a newly listed company to be named Nickel 28 Capital Corp., valued at C$2.18 per share. The proposed transaction represents a 66% premium to Cobalt 27’s share price at the time of the announcement.

In connection with the special meeting of shareholders to be held in late August or early September 2019, to consider and vote, detailed information on the proposed acquisition will be set out in the Information Circular to be mailed to Cobalt 27’s shareholders within 45 days of the announcement. The Information Circular will include the Fairness Opinions prepared by TD and Scotiabank, both of which use a number of different commodity price scenarios and production scenarios to formulate their views on fairness.

And we anticipate that the Information Circular will be mailed out to shareholders probably in the next few weeks and the vote will occur sometime late August or early September.

Dr. Allen Alper: Very good. We’ve been getting a very large increase in new readers/investors to our audience. Could you tell all of our readers/investors about your vision for Nickel 28?

Anthony Milewski: Cobalt 27 historically has been a streaming and royalty company, primarily focused on cobalt with exposure to nickel. Going forward, the proposed SpinCo, Nickel 28, looks slightly different. The Voisey's Bay stream and the physical position will be retained by Pala. Pala is also repaying the nearly US$50 million of debt that we have. Which is very important to note!

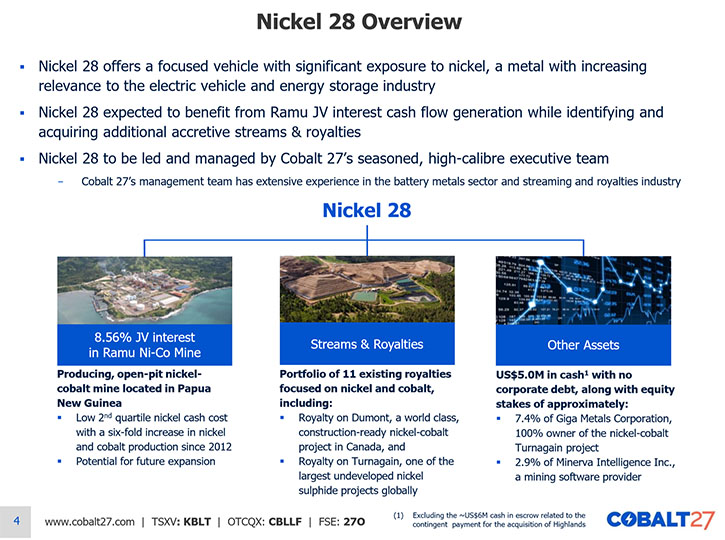

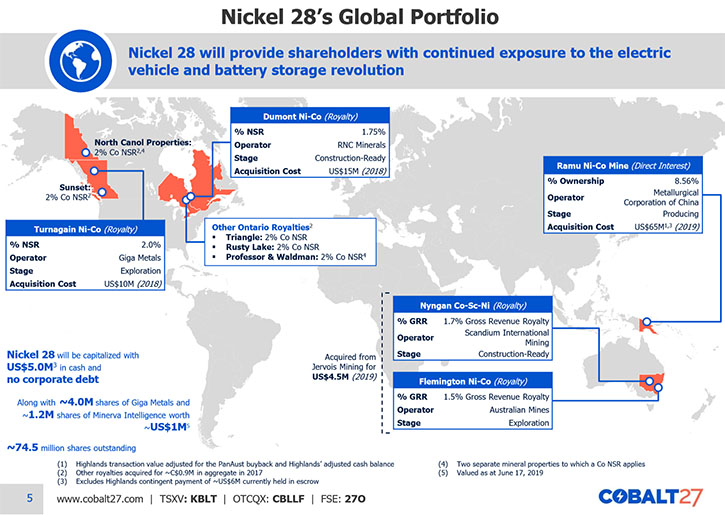

The shareholders are left with what Justin and I consider to be the crown jewels: the Ramu nickel-cobalt joint venture, a 1.75% NSR royalty on Dumont, a 2.0% NSR royalty on Turnagain and a 7.4% equity stake in Giga Metals. The Ramu nickel-cobalt joint venture is one of the best operating nickel cobalt mines in the world, where we own an 8.56% percent joint venture interest, with the option to increase to 11.3% upon repayment of attributable JV partner loans.

In May 2019, Cobalt 27 acquired the 8.56% JV interest in the Ramu Nickel-Cobalt Mine, a large scale, modern nickel-cobalt operation with total estimated reserves of 1 billion pounds of nickel and 100 million pounds of cobalt. The 8.56% JV interest implies attributable production to Nickel 28 of over 600,000 pounds of cobalt and over 2,900 tonnes of nickel per year, based on 2018 Ramu production guidance. However, upon repayment of attributable JV partner loans, Nickel 28’s interest in Ramu could increase to 11.3%, which would imply attributable production of over 800,000 pounds of cobalt and over 3,800 tonnes of nickel, again, based on 2018 production guidance.

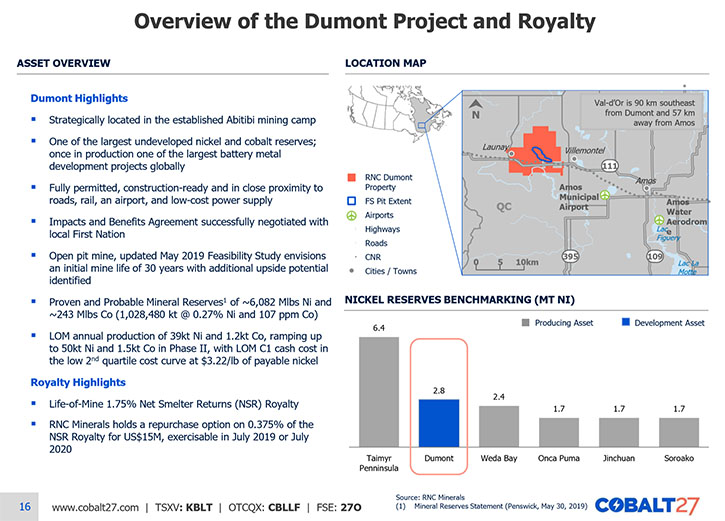

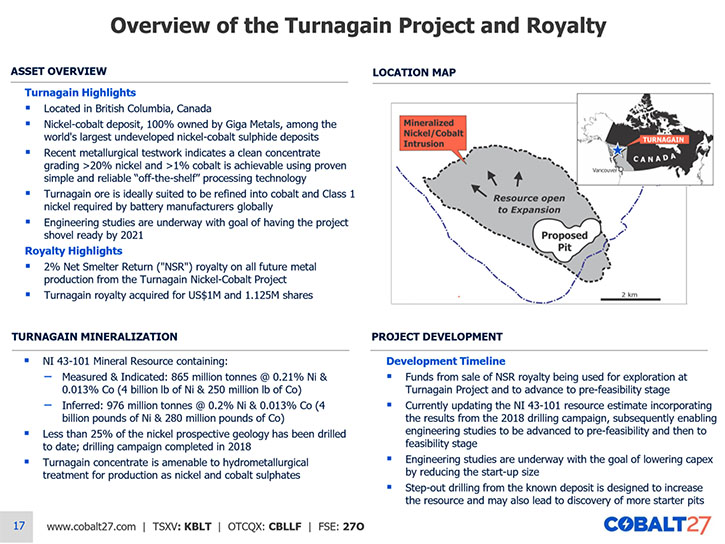

Dumont is a shovel-ready nickel-cobalt project in Quebec, Canada, one of the best mining jurisdictions in the World to build a project. Turnagain is among the largest undeveloped nickel-sulphide deposits in the world in terms of total contained nickel, and is in the process of completing a pre-feasibility study, then moving towards feasibility. Giga Metals has 100% ownership of the project and we hold an equity interest in Giga.

We're highly excited with the portfolio. As we see battery chemistry shifting towards a nickel rich chemistry, but still with a cobalt aspect. All these mines have both nickel and cobalt production. It is going to be a really exciting endeavor for our shareholders.

Dr. Allen Alper: Well that sounds exciting. It sounds like 2019 is an exciting time for Cobalt 27 and Nickel 28.

Anthony Milewski: Absolutely! It is going to be a big year. Justin Cochrane is the Chief Operating Officer of Cobalt 27, and also the President. Justin spent his career in the streaming and royalty business At Sandstorm, he was responsible for the structuring, negotiation and execution of over $500 million of royalty and stream financing contracts around the world, across dozens of projects.

Prior to Sandstorm, he spent nine years in investment banking and equity markets with National Bank Financial where he covered the resource, clean-tech and energy technology sectors.

Justin has done numerous transactions. He will tell your readers/investors about Nickel 28 and why we're so excited about it.

Dr. Allen Alper: Okay, great. Justin, could you give our readers/investors an overview of Nickel 28’s mission and strategy?

Justin Cochrane: Yes, absolutely. Thanks for the intro, Anthony, you set it up well. Nickel 28 will maintain nickel and cobalt exposure and exposure to battery metals, which were a foundation of Cobalt 27. And will continue to be a foundation of Nickel 28.

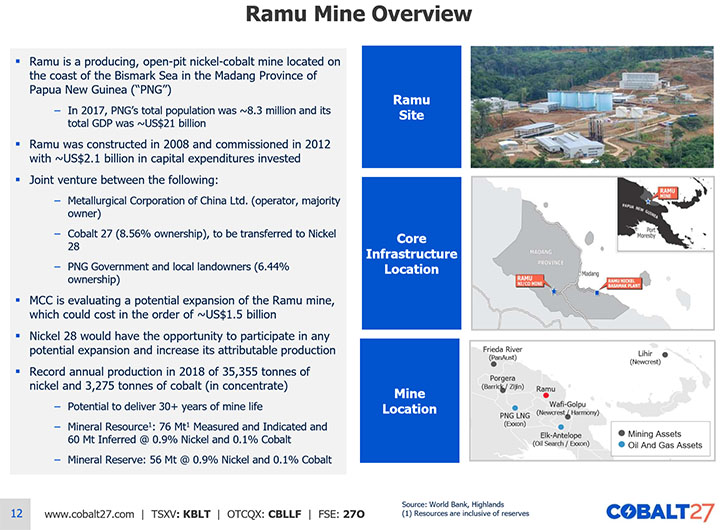

Our asset portfolio is comprised of four main assets: Ramu Joint Venture is an 8.56% interest in the Ramu nickel cobalt mine. Ramu, which is located in Papua, New Guinea, was financed, constructed and commissioned in 2012, by majority-owner and operator Metallurgical Corporation of China Limited (“MCC”), for US$2.1 billion which, at the time, was China’s largest overseas mining investment.

The Ramu mine is widely considered as the only successful High-Pressure Acid Leach (HPAL) trains (autoclaves) nickel operation that's been built in the last 20 or 30 years. And, in 2018, the Ramu mine achieved record annual production of 35,355 tonnes of nickel and 3,275 tonnes of cobalt.

It is absolutely a world-class mine. It has a 30-year resource life, based on exploring less than 15% of Ramu’s exploration license, pointing to significant mine life upside and it is in the first quartile of the nickel cost curve. In addition, the owner and operator, MCC is looking into potentially doubling capacity at the project, which is a very nice upside scenario for us as minority joint venture holders.

The second significant asset is Dumont where we acquired a 1.75% net smelter return royalty on all future production over all metals from the Dumont Nickel-Cobalt Project, which contains the world's largest undeveloped, permitted, and construction-ready reserves of nickel and cobalt. The Dumont project is located in the geopolitically secure and mining-friendly Abitibi region of the Canadian province of Québec. That's an asset that Cobalt 27 purchased about a year and a half ago. A world class project that just had an updated feasibility study, released by Royal Nickel a couple of weeks ago. That's a royalty on its own, that we expect could generate US$10 to US$12 million of cashflow per year, once the project is up and running.

As Anthony indicated, it's fully permitted and construction ready. Waterton and Royal Nickel are the two joint venture owners of that project and will be looking to advance and finance that project in the near term. That's a project that is expected to have a long mine life and generate significant cashflow for the Company. We're quite excited about the potential of that project.

Turnagain, the third asset is a Nickel Sulphide Project in British Columbia, 100% owned by Giga Metals, in which we have an equity interest, as well as the 2% net smelter return royalty that we have on that project. We're quite close to that project. I've been very excited about the progress they've shown. Extensive metallurgical test work has shown that froth flotation can reliably create a clean concentrate grading greater than >20% nickel and >1% cobalt, a very desirable product that can be upgraded to high purity Class 1 nickel for use in lithium-ion batteries. We have roughly 7.4% equity stake in Giga Metals which would become another key asset of the proposed spin-out company, Nickel 28 Capital Corp.

The fourth asset is the cash position and potential return of contingent consideration that we have inside Nickel 28. We have US$5 million cash out of the gate, and US$6 million that is held in an escrow account that was related to the acquisition of Highlands Pacific whereby $6 million will be paid to Highland's shareholders if before December 31, 2019, the London Metal Exchange official closing cash settlement price for nickel is US$13,220 per tonne or higher for a period of 5 consecutive trading days, If nickel doesn't exceed US$13,220 per tonne for five consecutive days before the end of the year, roughly US$6 million of cash will come back to Nickel 28, and be another asset to be held by the company.

We have at least US$5 and potentially up to US$11 million of initial working capital to commence operations of Nickel 28, with the operating Ramu project and other royalty assets as part of the portfolio and no debt. We ascribe a value of C$2.18 per share to Nickel 28 Capital Corp, in our press release relating to Pala’s proposed acquisition of Cobalt 27. I think we've been extremely conservative with that valuation.

For the most part it's the purchase price that we paid for each of those assets. I could definitely argue significantly higher values than what our purchase price was. And the only one that's not at our purchase price is the Dumont royalty, which just had an updated feasibility study. We have included the valuations in our updated investor presentation that's on our website.

I'd encourage your readers/investors to go take a look at that investor presentation, which details some of those assets in more detail. But Nickel 28 is a company, about which Anthony and I are quite excited. It has great leverage to battery metals nickel and cobalt and the electric vehicle theme. Nickel 28 has some inherent growth opportunities built into it, with the ability to increase our JV interest in Ramu from 8.56% to 11.3% upon repayment of JV partner loans, and the expansion opportunity in which we have the potential to participate in, without contributing any capital. Some real upside scenarios for Nickel 28!

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about the timing? When Nickel 28 will become independent, and where it will be listed, et cetera.

Justin Cochrane: We're expecting the Information Circular to go out towards the middle to end of July, which would put the shareholder vote around the end of August or early September. The transaction is subject to the approval of Cobalt 27 shareholders by both a 66 2/3% vote by all shareholders and excluding votes of Pala and certain other interested persons, at the special meeting of shareholders. Following receipt of all shareholder, court, regulatory and TSX-V approvals, the transaction is expected to close in late August or early September 2019. Nickel 28 will be trading on the TSX Venture Exchange shortly after closing.

Dr. Allen Alper: That sounds great. Maybe either Anthony or you could talk about the market for cobalt and nickel.

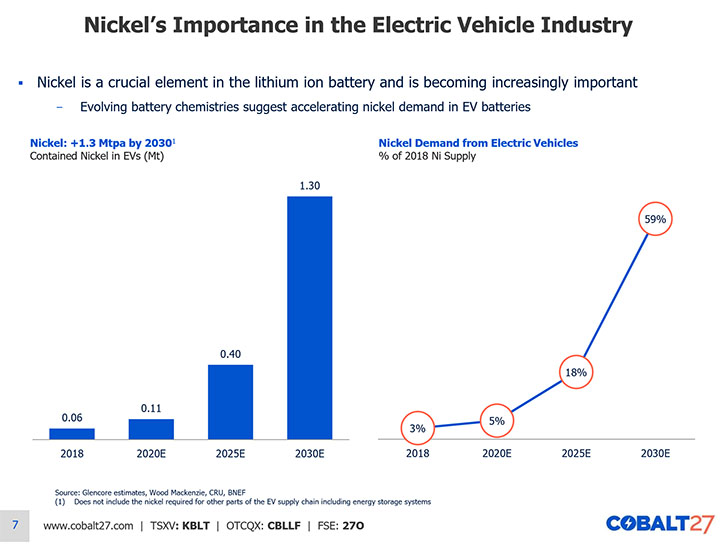

Anthony Milewski: I'm happy to do that. There are two different markets, but they both have the same end use, the battery chemistry, a nickel, manganese, cobalt chemistry that powers the electric vehicle.

Current and proposed battery chemistry involves an interplay between nickel, manganese and cobalt, and today that is a five, three, two ratio. Moving over time to a six, two, two, and then on to an eight, one, one. Those numbers delineate the proportion of each metal. So that becomes eight parts nickel, one part manganese, one part cobalt, over time.

The cobalt market is a much smaller market, with mined production of approximately 110,000 metric tonnes per year. 40% of that is metal, but the balance of it is intermediates going into a variety of chemical applications. It's a market that is three to five years out when there's 15% electric vehicle penetration. That market could double in demand. You could have several hundred thousand metric tons of cobalt demand, and a market, which may or may not be able to expand to meet that demand.

Nickel is an interesting market. It's a couple million metric tonne market, with two very different uses. One is a nickel pig iron. The other million tonnes is nickel sulphide, a Class 1 nickel. Nickel’s story is very similar to cobalt’s, as demand ramps up for these batteries, there will be tremendous pressure on Class 1 nickel.

It is our view that the EV demand surge will result in a class 1 nickel demand surge. And, with EV adoption still in the early stages, our research suggests that EV-driven nickel consumption could account for up to 10% of global nickel demand by 2025, supporting a long-term deficit. We expect significant demand growth for Class 1 nickel through 2025, with nickel demand critical to this trend as a continued key element in advanced battery chemistries. According to our research, Class 1 nickel - used in EV batteries, is forecast to go into deficit after 2022. The capital intensity to develop new nickel projects is high and development times are long. It is estimated that by 2030, the nickel industry will need to invest up to US$70 billion to meet expected demand. With current nickel prices well below the incentive price required to support new capacity, we view the potential for Nickel 28’s JV interest in the Ramu mine as a world-class opportunity to gain exposure to nickel through a producing, long-life, low-cost mine, with significant expansion capacity.

Dr. Allen Alper: Well that's an exciting, huge potential for cobalt and nickel.

Anthony Milewski: You've been a supporter of us since the very beginning, since the IPO. It's amazing, when Justin and I were reflecting on the IPO, the numbers we used in terms of electric vehicle penetration and sales were much too low. Electric vehicle sales as a percentage of new car sales today, is materially higher than we projected even a couple of short years ago. Auto manufacturers are selling far more electric cars than expected.

Analysts three to five years out have moved their projections even higher. I think we're going to be surprised again as to the upside. The adoption of the electric vehicle is now inevitable. It's happening. That's exceptionally important, not just for nickel and cobalt but also for a handful of other commodities, lithium and manganese and ultimately copper.

I think the next big story, which is also very relevant to nickel and cobalt, is grid storage and battery storage. That's going to be a more complex story, with multiple segments, and different types of batteries. But definitively the nickel, manganese, cobalt battery chemistry is going to play a big role there. And that demand is not factored into anyone's models yet.

Whatever you read is based on demand from electric vehicles. There's a whole new source of demand, which is not even built into the model yet. This is as exciting a story as natural resources has seen, since the China story over a decade ago. This is big news, and it's going to impact a lot of commodities.

Dr. Allen Alper: Oh, it sounds excellent. It sounds like an excellent opportunity for long-term growth of assets, for careers and shareholders. Is there anything else that either of you would like to add?

Justin Cochrane: We're, excited about the prospects for Nickel 28. We're excited about the fact that we were able to include a share of Nickel 28 in the consideration that Pala is providing to our shareholders. We see significant upside potential in that vehicle. We’re hoping your readers will join us in participating in that alongside Anthony and myself.

Dr. Allen Alper: Well that sounds excellent.

Anthony Milewski: Thank you very much for your time and support as always. We appreciate you interviewing us for Cobalt 27/Nickel 28 for Metals News.

Dr. Allen Alper: I enjoyed talking with both of you. It's an exciting period for all your stakeholders and shareholders and for anyone who's interested in the battery market and the growth of opportunities and materials for batteries. Thank you both of you.

Anthony Milewski: I really appreciate your coverage and hope that you'll continue to cover us in our next iteration.

Dr. Allen Alper: We definitely will. Our readers/investors will be interested in following you closely and reading many of your articles as the year progresses. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.cobalt27.com/

Justin Cochrane

President & COO

info@cobalt27.com

|

|