Nova Minerals Ltd (ASX: NVA): Advancing Globally Significant Intrusive Related Gold Project in Alaska Similar to Fort Knox and Dublin Gulch also the Thompson Brothers Lithium Project in Manitoba, 6.3 Million Tons at 1.3%; Interview with Louie Simens, Dire

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/2/2019

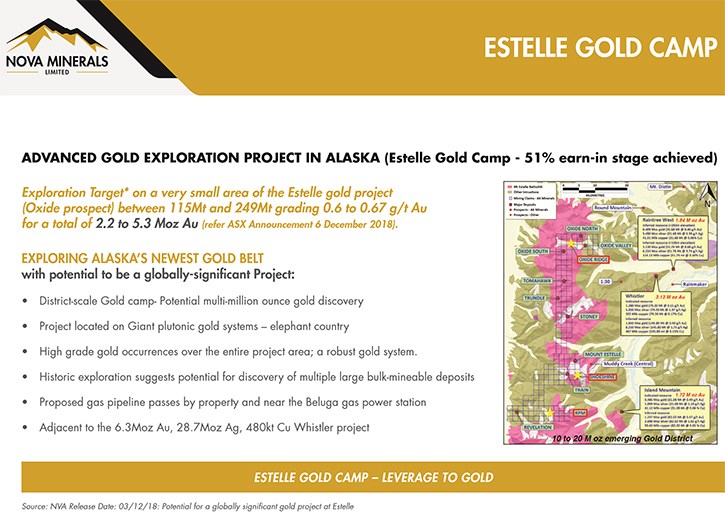

We learned from Louie Simens, Director of Nova Minerals Limited (ASX: NVA), that they are focused on their advanced, potentially globally significant, Estelle project, a Intrusive related gold system (IRGS) exploration project in Alaska's newest gold belt. This is a district-scale gold camp with a potential for a multi‐million-ounce gold discovery with Geologically sharing similarities to Kinross’ Fort Knox Mine and Victoria Gold’s Eagle Gold Mine (Dublin Gulch). Nova's second project, the Thompson Brothers lithium project in Manitoba, has a resource of 6.3 million tons at 1.3% and is in the process of being listed on the Canadian Stock Exchange as a spin-off. We learned from Mr. Simens that the Estelle gold project has full support of the Government departments, and the Oxide prospect has the potential to be a near- surface, open-pittable, early payback opportunity being one of 15 known targets of similar size. Plans for the rest of 2019 include finalizing the lithium spin-off and putting together a maiden resource for the gold project.

District Scale Estelle Gold Project

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Louie Simens, who is Director of Nova Minerals Limited. Could you give our readers/investors an overview of your Company and strategic plans for Nova Minerals?

Louie Simens: Sure. We have two core projects within our Company. One is the District Scale Estelle Gold Project that is being developed and is owned by Nova Minerals.

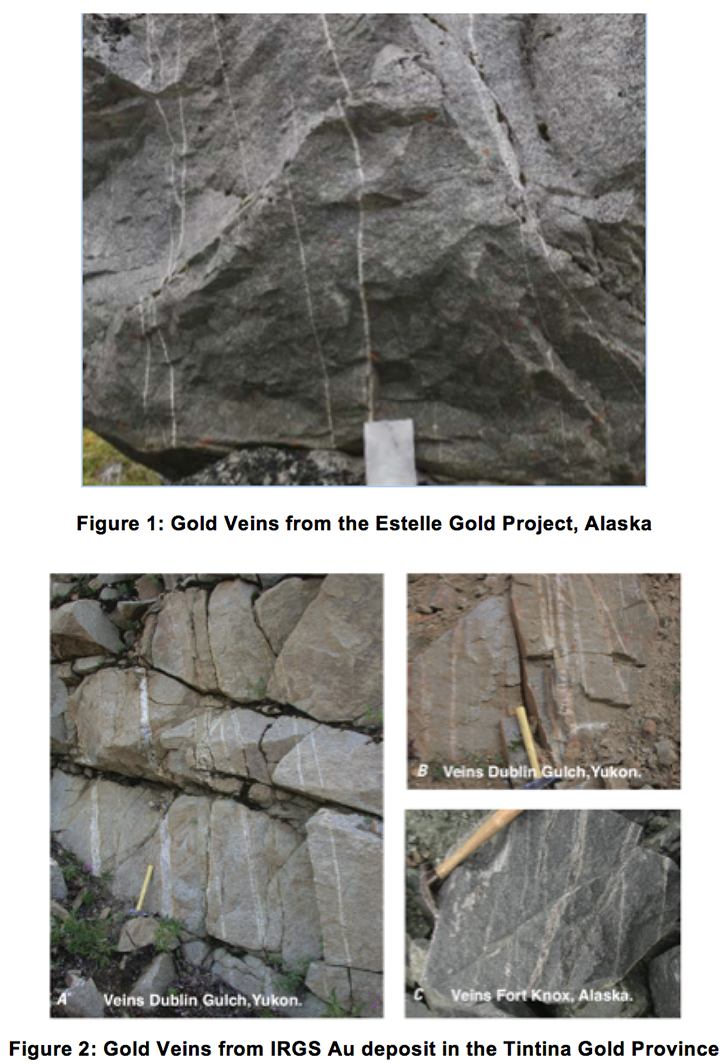

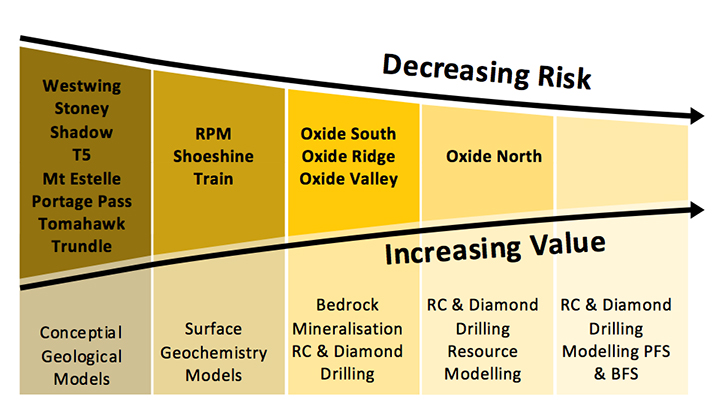

We have had the IP crew cover the Oxide prospect that we are focused on and have the drill turning now at the project; this part of the property only represents a small portion of the total property package. Geologically speaking, the Oxide Prospect at Estelle Gold has gold mineralization that fits the Intrusive-Related Gold Systems (IRGS) genetic model. Similar IRGS deposits in the region is the 9.2 million oz Au Fort Knox mine owned by Kinross or the 6.0 million oz Au Dublin Gulch project owned by Victoria Gold, both located within the Tintina Gold Province.

Historically the project has had some fantastic intercepts, for example 41.45 at 1.14 grams per ton, 387 meters at 0.4 grams per ton, and it's all at or pretty close to the surface. We’re currently exploring three or four square kilometers of the 113 square kilometers tenement package.

We have an exploration target for the project of 2.2 million to 5.3 million ounces on under 1% of the project area, although we have found that these IP surveys are showing much broader mineralization outside of that exploration target envelope and mapped alteration zones. Oxide South is looking just as prospective as Oxide North. We believe we certainly have a good shot at discovering a very large gold system and multiple large gold deposits. Together with targeting a large gold system, we are looking for the close to surface, early production type orebodies and by all accounts, that is what we're finding. We are excited by the IP that has come back to date over historic drilling and the drill is now turning on these targets. We have a lot of targets, which is definitely a good problem to have and we will have more to say on this.

With the IP survey completing soon on the Oxide Prospect, Drill crew and rig mobilized, and surface sampling and geologic mapping program at RPM and Shoeshine prospects to commence in early July, we are eager to expand the project’s exploration footprint for years to come.

We're in a fortunate position with the size and the scope of the Estelle Gold project; we have support from the locals and local government departments as well. Alaska is very pro-mining, pro-development and a great place to operate.

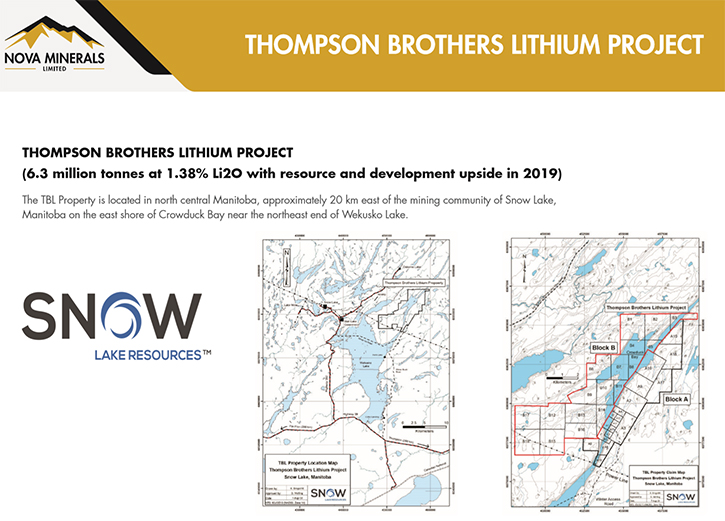

The second project is the Thompson Brothers lithium in Manitoba. We're currently spinning it off on the Canadian stock exchange as Snow Lake Resources Ltd. It has 6.3 million tons @ 1.3% lithium resource, open in all directions and there's a lot of work happening in the background. Basically, it underpins Nova's valuation at 2.3c in Australian dollar terms. Credit to Dale Schultz- we've built a great technical team at Snow Lake Resources Ltd -one of the guys that is assisting us is probably the only fellow in Canada that has built and operated a flotation plant in Canada. It should be listed on the Canadian Stock Exchange in July or early August.

Dr Allen Alper: Well, that sounds like you have two excellent projects, with great potential and diversity, one in gold and one in lithium. As a long term investor you want to be a buyer of quality companies when their sector is out of favor and Nova would be a perfect example of this sort of a setup.

Louie Simens: It certainly is a transformational period for the company. The lithium project, once the spin-off is complete, will be its own independent company with a company making project, in its own right, on the Canadian Stock Exchange. Nova will be holding a large position that could deliver a large upside and the Estelle Gold project has the size and scope to be of global significance, so I wouldn’t discount it from delivering many surprises if it’s the deposit that we think it is. We’ll be a different company in 6-12 months to what we are now. We are certainly trying to build long term value and ultimately become a household name in the resource sector.

People often forget that mining is a cyclical business, and when you have a time like this where mining companies are out of favor and liquidity is low, everyone thinks it’s going to last forever but it doesn’t. It’s cyclical. The biggest money is always made from buying near the low-point of the cycle and selling near the high part of the cycle. Nobody can time it perfectly but we know for certain that we’re definitely not at the high right now, and there’s a very good chance that we’re very close to the low. Quite frankly, I believe that we’re in a long term secular bull market for gold. I believe the long term gold price will exceed the previous high made in 2011 and that was US$1800/ounce, and when that happens any investor buying Nova Minerals or any other quality gold Junior is going to do very very well.

The same can be said for Lithium, fundamentals haven’t changed with demand for Electric Vehicles and the expansion of energy storage will drive demand for lithium far into the future, and equities will follow this trend.

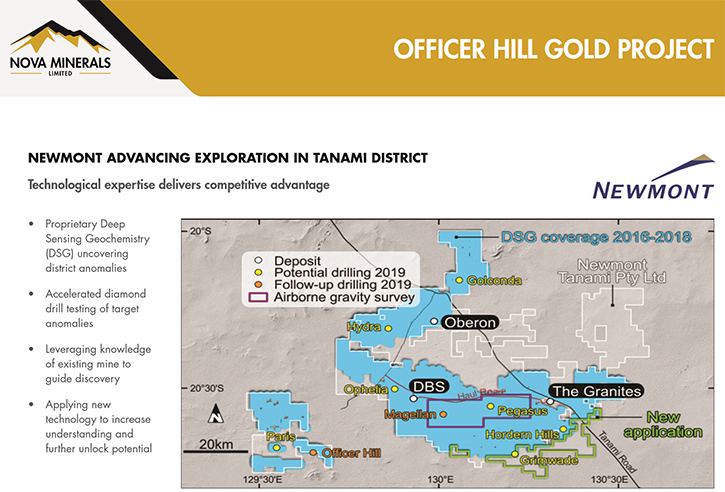

We have 2 other pretty significant projects. We have a joint venture with Newmont, in the Tanami Northern Territory of Australia. That's an early stage exploration project. Planning more exploration work out there shortly and that should be ongoing over the next 12 months.

Also, we have the Windy Fork Rare Earth Elements Project, we'll look to extract further value from that project at some point in line with our focus on long term wealth creation for shareholders.

Dr Allen Alper: Sounds excellent. Sounds like two further excellent projects. Could you tell our readers/investors about your background and the team’s background?

Louie Simens: This is my first public Directorship. I've had other opportunities to take on positions, but I’m solely focused on Nova and hitting our objectives. This is a long-term play for me. My two fellow directors and I have put about two and a half million dollars of our own money into the Company. For some background on me, I've been involved in building and construction for over 20 years privately. I entered the markets about a decade ago.

I've been involved in Project Generation for about eight to nine years. I've been involved in companies going from a million to $450 million on market, from green field to production, and pretty much everything in between; involved with technology companies as an investor, from start ups in Australia and globally, alongside large VC firms.

Avi Kimelman has a broad range of business dealings and experience ranging from capital raisings, to mergers and acquisitions, initial public offerings and reverse takeovers. He's been involved in a number of directorships, both private and public. He been involved in manufacturing, property development and technology, although predominately resource exploration and production.

Avi Geller, Non–Executive Director, is New York based, he's the Chief Investment Officer of Leonite Capital, a family office. They're investors, but predominately in debt, and primarily Hybrid type funding facilities.

Our technical team on the ground now is basically second to none; we have about 200 years of technical experience onsite as we speak. Dale Schultz, for example, head of geology, was involved in the Kori Kollo deposit in Bolivia, which is very similar to the Estelle Project. He has worked on a host of large gold systems in the Americas.

Brian Youngs is the head of exploration and logistics. Again, Brian has many years of field experience and the guy just makes the hardest task a breeze. He gets it done and for a fraction of the cost and we have multiple consultants that assist us which include Mr. Tom Bundtzen, a pre-eminent Alaskan geologist.

Management from Nova Minerals WebsiteAvi Kimelman - Executive Chairman & CEO

Avi Kimelman experience spans over a decade in the financial markets. He is the managing director and founder of Carraway Corporate, a corporate advisory business with significant experience in capital raising, mergers and acquisitions, initial public offerings and reverse takeovers for various listed companies. He has been a director of a number of publicly listed and unlisted companies in a range of fields in manufacturing, property development, technology, and education, but his prime focus has been in mining exploration and production.

Louie Simens – Director

Louie Simens a decade of experience in micro-cap equities and startup investing, including experience in corporate restructuring, due diligence, and mergers and acquisitions. Prior to entering the junior resources sector, he owned and operated a successful civil and building construction business, where he gained extensive knowledge of corporate governance and project management. Mr Simens understands the fundamental parameters, strategic drivers and market requirements for growth within the junior resources sector.

Avi Geller - Non–Executive Director

Avi Geller has extensive investment experience and a deep knowledge of corporate finance, including capital markets, venture capital, hybrid, debt and private equity. He served as Chief Investment Officer of Leonite Capital, a family office he co-founded focusing on real estate and capital markets. Mr. Geller also serves as a director of the real estate company Parkit Enterprise Inc. (TSX-V: PKT | OTCQX: PKTEF) and the events and technology company Dealflow Financial Products. He previously served as Chairman of Axios Mobile Assets.

Dale Schultz - Group geologist

Dale Schultz has over 20 years of experience in the mining and exploration industry in North and South America. He has a M.Sc. from the University of Saskatchewan and is a registered Professional Geoscientist in Manitoba and Saskatchewan. Over the years, Mr. Schultz has been the Qualified Person (QP) for a number of projects including Solex Resources’ Pilunani and Macusani projects in Peru, Channel Resources’ El Mozo project in Central Ecuador, and Avalanche Networks’ “E” project in Northern Ecuador and has also extensive experience in a number of other mining operations. Mr Schultz brings with him invaluable experience ranging from initial exploration stages through to underground and open pit mine production of large gold systems.

Brian Youngs - Head of Exploration and Logistics

Brian Youngs heads exploration and logistics at Nova. He is a Certified Technician, with the Ontario Association of Certified Engineering Technicians and Technologists and a member of the Canadian Institute of Mining, Metallurgy and Petroleum. Mr Youngs completed with Honors a diploma in Mining Engineering Technician and post-diploma in Geographic Information Systems (Applications Specialist Program). He has a robust understanding of geology, mineralogy and mineral processing and was awarded for excellence in the subject of Geology.

Dr Allen Alper: Sounds like you have a great team, a very strong team and a diversified team, so that's excellent.

Louie Simens: Yes, absolutely! I think we've found the right team that are all invested in making Nova a success. Everyone is passionate about our projects, future prospects and what we are trying to achieve- that’s for sure! Over the long term we expect Nova to outperform due to our extremely strong management team and strong asset base. We intend to keep our heads down and develop our assets and we should to ensure we do very well regardless of the gold and lithium price. Obviously, if the gold and lithium prices rise Nova shares will do even better but we don’t need to see a rising prices to still do very well for our shareholders.

Dr Allen Alper: That's excellent. Could you tell our readers/investors a bit about your share structure?

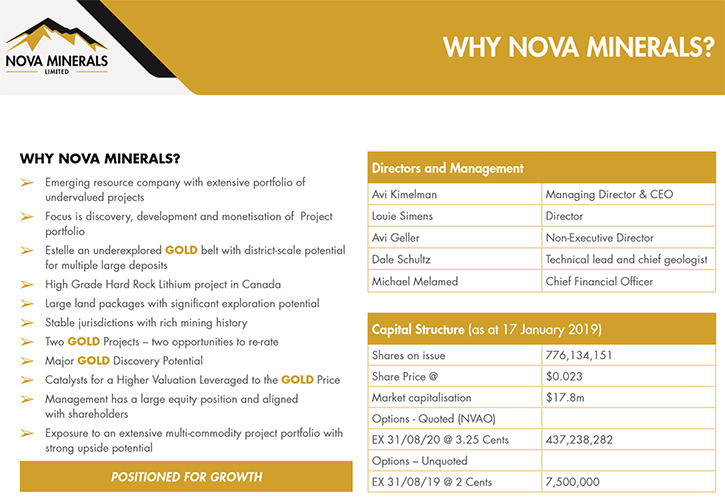

Louie Simens: We have about 774 million shares on this year, 437 million options. We have about a 17 million market cap.

Dr Allen Alper: Could you tell our readers/investors why they should consider investing in Nova Minerals?

Louie Simens: We're a great value proposition and growth story. We have underpinned value with the lithium spinoff at 2.3 cents; it’s a fantastic project with significant upside. We have an enormous amount of exploration upside across the Estelle Gold Project particularly, with gold in a long term secular bull market. Also, we have a great Rare Earth Project, and the Newmont JV, you get it for free.

Our long-term business model is quite simple. Work hard, develop assets to a point of liquidity event for the company and shareholders (as is the case with Snow Lake Resources (lithium) Spin off) or develop assets to cash flow and Repeat.

Dr Allen Alper: Sounds like excellent reasons to consider investing in Nova Minerals.

Louie Simens: I just want to reiterate that the Estelle Project is a district scale project within the Tintina belt. Projects like this in the Carlin trend, or in the Yukon, or many other mining district would be valued at many times our current value, and I believe it is only a matter of time that the market to catch on to the size and scope. The geology is one of 3 deposits, there's us, there's Kinross’ Fort Knox, and there's Victoria Gold’s Eagle Gold Mine. It’s a great comparison to look at in terms of geology on the Estelle gold project and where we can take it.

Dr Allen Alper: Well, that sounds excellent, sounds like an excellent opportunity. Is there anything else you'd like to add Louie?

Louie Simens: I want to thank you for interviewing Nova Minerals for Metals News. It's a transformative time for us. We'll have the lithium spin-off with the project to progress rapidly. We're aiming to have Maiden gold Resource at Estelle. We'll have some news on the Rare Earths Project. And we'll have our ongoing work on our Newmont JV. So we'll have a lot of news over the next 6 months and the Company will look very different in 12 months from now.

Dr Allen Alper: Well, it sounds like 2019 will be a very exciting time for Nova Minerals and we look forward to monitoring your progress.

Louie Simens: Thanks Allan, looking forward to keeping you updated on our progress.

Dr Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://novaminerals.com.au/

Nova Minerals Limited ACN: 006 690 348

Level 17 500 Collins Street, Melbourne, VIC 3000 Australia

+61 3 9614 0600

info@novaminerals.com.au

|

|