White Rock Minerals Ltd (ASX: WRM): Exploring and Developing a Zinc and Precious Metals Massive Sulphide (VMS) Project in Alaska and a Large Gold and Silver Resource in Australia; Interview with Matthew Gill, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/30/2019

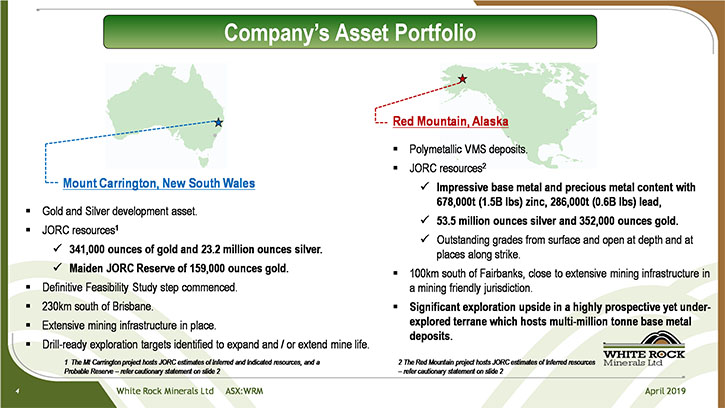

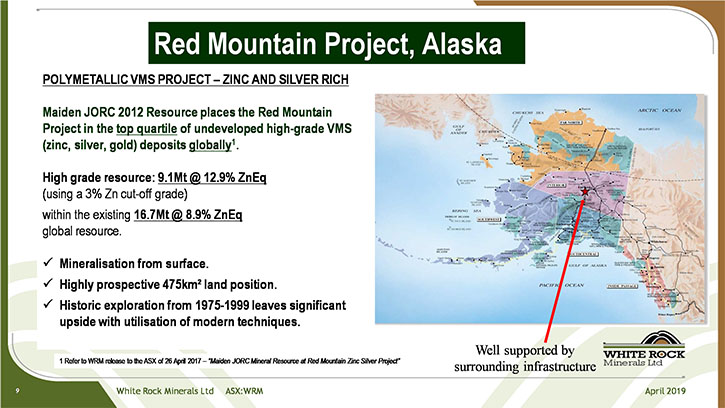

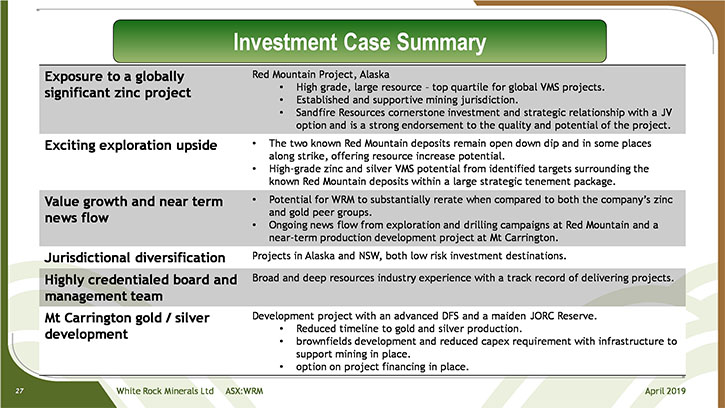

White Rock Minerals Ltd (ASX: WRM) owns 100% of, the globally significant, Red Mountain polymetallic, volcanogenic, massive sulphide (VMS) exploration project, in an established VMS district of central Alaska, where there is significant potential to discover several new large zinc-silver-lead-gold-copper deposits. This project has a recent maiden JORC 2012 Resource of 9Mt grading 13% ZnEq. We learned from Matthew Gill, who is Managing Director and CEO of White Rock, that Sandfire Resources is spending a minimum of 6 million dollars on this year's four-month exploration program at the Red Mountain as part of their joint venture agreement with White Rock. In Australia, White Rock has an advanced gold and silver project called Mount Carrington, with an existing JORC gold and silver resource, with a gold Reserve and near term production possibility. According to Mr. Gill, with over six hundred thousand ounces of gold and over seventy-five million ounces of silver between these two projects, along with base metals (1.5B lbs. of zinc and 0.6B lbs. of lead), White Rock Minerals has enough commodity diversification to attract potential investors.

White Rock Minerals – Red Mountain, central Alaska

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Matt Gill, who is Managing Director and CEO of White Rock Minerals Ltd. Could you tell our more recent readers/investors your objectives and give them an overview of your Company, what your plans are and your latest programs in Australia and Alaska.

Matt Gill: Happy to, Al. White Rock Minerals is a small junior exploration and development company listed on the ASX. We have two projects. We have an advanced gold and silver project in northern New South Wales here, in Australia. We also have a very-exciting, large and strategic land holding, highly prospective, zinc and precious metals VMS project in central Alaska.

Dr Allen Alper: That sounds great. Could you elaborate on the latest announcements about your exploration program you are currently conducting on your zinc VMS project in Alaska?

Matt Gill: We recently announced the commencement of White Rock's second funded exploration season at our high-grade VMS project in central Alaska. The project is called Red Mountain. It's being funded by our joint venture partner, ASX-listed Sandfire Resources, who has a market cap of A$1B. We signed this joint venture earlier this year, in which Sandfire is having to spend a minimum of six million dollars this year, and a total of twenty million dollars over four years, before they can earn 51%. So White Rock, as manager of the JV for this year, has commenced this first year's program. With Sandfire's funding, we've now commenced efforts on the ground. That includes four geologists doing reconnaissance, soil mapping, and sampling. This will be followed by an on-ground geophysics team in early June. We've already started diamond drilling in the last week or so. We have about twenty people now on site. The next few months will be very exciting, with this comprehensive exploration program funded by Sandfire into White Rock's fully owned asset.

Dr Allen Alper: That sounds like fun. Could you tell our readers/investors a bit more about the Red Mountain project?

Matt Gill: Sure, Al. We acquired it about three years ago. It was only fifteen square kilometers, it came with two known deposits. We released a maiden JORC resource the following year, in 2016. That JORC resource has a high-grade component of nine million tons at 12.9% ZnEq. That grade put it in the top quartile of undeveloped zinc projects in the world. Last year we raised five million dollars and conducted our first program ourselves. We made a greenfield discovery. We were also getting drill holes intersecting over 40% zinc equivalent. We attracted Sandfire, our current joint venture partner, and subsequently, over time, we've taken that original fifteen square kilometers up to a strategic land holding of four hundred and seventy five square kilometers (117,000 acres for some of your readers).

We have a great project, high grade zinc and precious metals, underpinned by a JORC resource with eight to nine geochemical anomalies to follow up. Earlier this year, we flew the first modern day airborne electro-magnetic survey over that full tenement package. So, it's all systems go with boots on the ground and drilling occurring, and looking forward to that news flow over the next few months.

Dr Allen Alper: Sounds excellent! Could you update our readers/investors on what's happening in Australia?

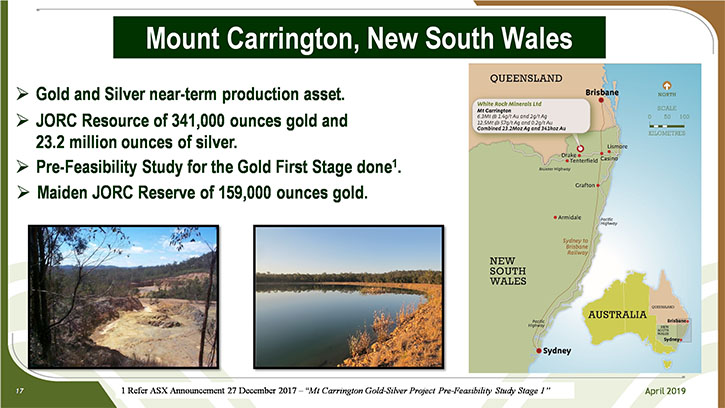

Matt Gill: The other project that White Rock has is its Mount Carrington gold and silver project. It, too, has a JORC resource, but it is further advanced. It also has a JORC reserve for the gold part, there's still silver in resource. It's on mining lease, it's had past mining. You walk onto ore, the previous plant site is already cleared, but all the equipment's been removed. There is also an existing tailings dam and there is state power grid onto the site. The next step is the approvals process, which we anticipate will take twelve to eighteen months. It would then take twelve to eighteen months to build it. Once we push that button, and it is dependent on funding, we could see White Rock producing gold within three years. Given that the current Australian gold price is at record highs – greater than A$1,900 per ounce, this makes our Mt Carrington project a very attractive cash-generating project. At these current prices, the Gold First stage of the Feasibility Study (before any of the silver is mined) delivers over A$65M in free cashflow in its initial 4 to 5 years, with an IRR of 56% and a payback in under 18 months.

The reason we like this project is because it does have a JORC resource and reserve, there's been over one hundred thousand meters of drilling, lots of metallurgical test work, and existing infrastructure (valued at over A$20M), so we know it quite well. Currently the Australian gold price is very healthy. Gold is denominated in US dollars, and it's up and down. It is up at the moment, with risks of trade wars, and Brexit, and Iran, and who knows whatever drives the gold price.

Australia gets an advantage by the exchange rate, and so currently Australian gold prices are close to historical highs, over nineteen hundred dollars an ounce, and that, materially, improves the financial metrics of that Mount Carrington project, so we're keen to take advantage of this very positive gold price environment. There aren't many projects in Australia this advanced, and we would like to see that in a cash flow positive scenario, which I think would also add significant value for White Rock shareholders.

Dr Allen Alper: That sounds excellent. Could you refresh the memory of our readers/investors on your background and your team?

Matt Gill: I'd be happy to, Al. We're a Board of four. My Chairman is a mining engineer, but the bulk of his career has been more in M&A and business development. He's also been Chairman of other ASX listed companies, so good depth and breadth of both technical and corporate. I'm a mining engineer, my skillset is probably more studies, leading and developing teams, building and operating mines, but obviously, as an MD, I've become knowledgeable in capital markets and corporate governance obligations. And I have two other Board Members experienced in M&A, finance, business development with one living in London, so we have good boots on the ground about the London capital market and what's going on there. I'm ably supported by Rohan Worland. Rohan is our Exploration Manager. He's currently overseas. His experience has been with big companies, Normandy, Newmont, as well as at the smaller end of town. He has worked around Australia, South America, like I did, and he's also worked in Nevada.

So, we're a small team. I have a Company secretary and CFO, dual hat in Shane. And, we contract our accounts, so there's really only a handful of us. A small junior needs to keep its G&A down, but also stay nimble and also be quick to move, without the inertia that maybe sometimes comes with bigger companies. So, small but nimble, Al, would be the way I'd like to describe our teams.

Dr Allen Alper: That sounds like a very strong background, and a very excellent team. Could you highlight your capital and share structure?

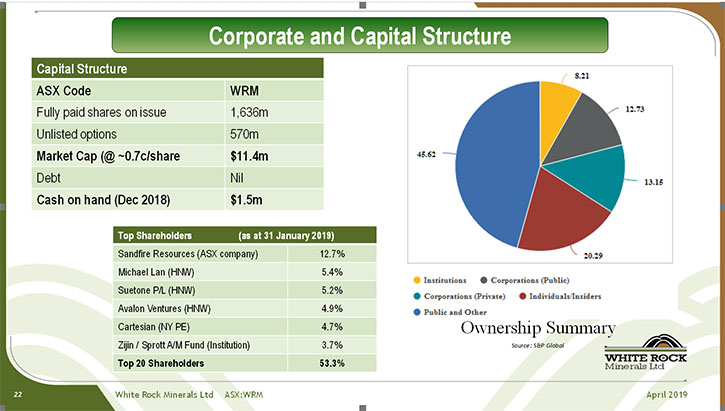

Matt Gill: I'd be happy to Al. It's not uncommon in Australia to have a very large number of shares on issue. I am aware that it is very uncommon in North America, and people are a bit surprised, but we have about 1.6 billion shares on issue. Our share price is under a cent, and our market cap, as a result, is around ten million Australian. The large number of shares is the product of White Rock having been listed for nine years, with equity funding being raised through share issues, we've never done one rollback, and obviously there are conversations from time to time whether there's merit in doing that at some point, but that's our capital structure. We are obviously freely traded on the ASX.

Dr Allen Alper: Wow, that's excellent! Could you tell our readers/investors the primary reasons they should consider investing in White Rock Minerals?

Matt Gill: That's a good question Al. I believe investors will have a range of investments in their portfolios, not just in mining but it could be real estate, banks, IT, maybe even cryptocurrency. But, within their mining investment portfolio, which I think an investor should have, precious metals is good, gold in particular, and silver. So, commodity diversification is usually a good selling point for an investor. We have over six hundred thousand ounces of gold and over seventy five million ounces of silver between our two projects, so nice exposure to that, but also base metals, and you need base metals in construction and building, so commodity diversification, I think investors should look at White Rock for commodity diversification.

Another component that I think is important, is the skillset of the board, given that we're the people that will manage investors' money, the investor wants to make sure those managing their money are competent and capable to add value.

I would also suggest an investor should look hard at jurisdiction risk, sovereign risk. We're in two first world jurisdictions, Australia and the USA. In fact, Alaska is in the top five in the world, according to the Fraser Institute, and our experiences in Alaska have been very refreshing and very positive.

In summary Al, I think White Rock is undervalued given the quality of our assets, so I think there's an opportunity there. We're on the ground in Alaska generating exploration news flow, which should interest an investor. We have commodity diversification, so not all our eggs in one basket. We also have jurisdictional diversification in two great areas. There are at least four key points for an investor to consider in looking at White Rock.

Dr Allen Alper: Well those are very strong reasons for investors to consider investing in White Rock Minerals. Matt, is there anything else you'd like to add?

Matt Gill: I'm looking forward to the next few months as our team of twenty on the ground get to work in central Alaska. I think that's going to be a very exciting time. As always Al, thank you, it's been a pleasure talking with you. Hopefully your readers/investors will enjoy reading the article as well.

Dr Allen Alper: Excellent! I know they will. I’ve enjoyed the update and your insights. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.whiterockminerals.com.au/

Matt Gill (MD & CEO)

Phone: +61 (0)3 5331 4644

Email: info@whiterockminerals.com.au

|

|