Osino Resources Corp. (TSXV: OSI) (FSE: RSR1); Successful Team with Strong Financial Backers Exploring Namibia’s Rich Damara Gold Belt; Interview with Heye Daun, CEO & Co-Founder

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/26/2019

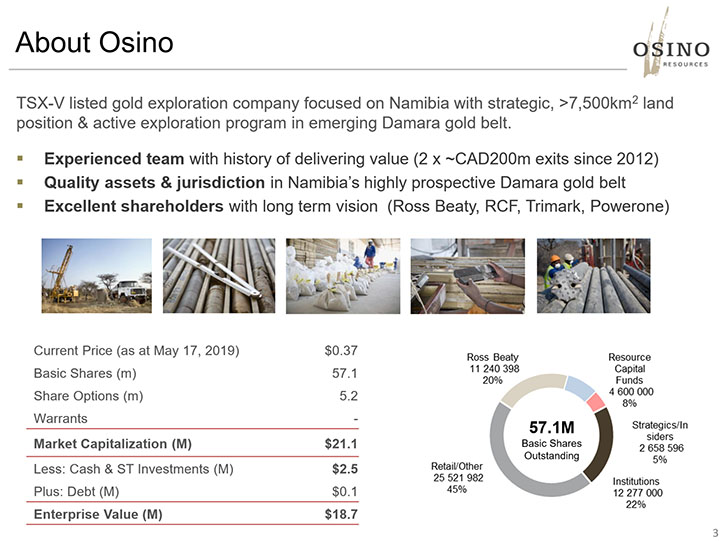

Osino Resources Corp. (TSXV: OSI) (FSE: RSR1) is actively advancing a range of gold discoveries, prospects and targets across its 7,400km 2 ground position, located within Namibia’s prospective Damara mineral belt, mostly in proximity to and along strike of the producing Navachab and Otjikoto Gold Mines. We learned from Heye Daun, who is CEO, Co-founder and Executive Director of Osino Resources, and a Namibian himself, that Namibia is a great jurisdiction, similar to Texas or Western Australia in looks and infrastructure, as well as in regulatory framework. It is secure and safe, and easy and cheap to operate in Namibia. With the team that has delivered value before, and an impressive group of shareholders that includes Ross Beaty and Trimark, Osino Resources is well positioned to reach its objective, which is to make a significant economic gold discovery.

Osino Resources

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Heye Daun, who is CEO, Co-founder and Executive Director of Osino Resources. Could you give our readers/investors an overview of your Company? Also, tell us what differentiates your Company from other junior mining companies?

Heye Daun: Certainly, Al. Thank you very much. I appreciate being interviewed by you again for an article in Metals News. Osino Resources is a gold exploration company, active in Namibia in Southern Africa. Just to remind you, I'm a Namibian myself; I have a long history and deep connections and an excellent track record in Namibia, so we know our way around there.

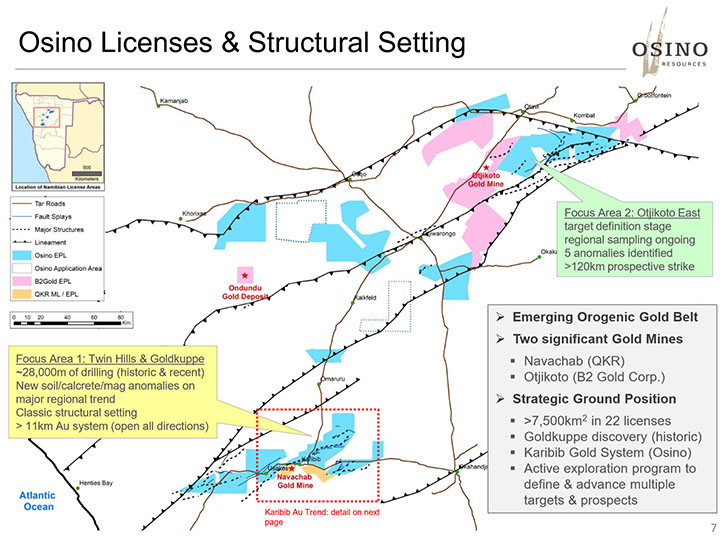

Osino has a very large portfolio of exclusive prospecting licenses in Namibia. In the Damara Gold Belt, which is an emerging gold belt, which currently has two successful gold mines, multi-million ounce gold mines. We've consolidated a large area, bookended by these two mines. We are actively exploring this ground and our aim, our vision is to make a significant economic gold discovery.

You asked me what differentiates us from other juniors? A couple of things. Firstly, we are in Namibia, which is a Tier 1 jurisdiction in Africa. I like calling it the Switzerland of Africa. It's very much like Texas or Western Australia in looks, in infrastructure, and also in regulatory framework. It's very secure and very safe and very easy and cheap to operate in. That's one factor. We're in a great jurisdiction.

Another factor that differentiates us is our group of shareholders. Ross Beaty owns 20%; a lot of your investors and readers probably know him. With Ross Beaty came a whole club of people that support him and his other deals. There's also Trimark, which owns around 8%, which is a Dubai-based investment group.

We also have “Resource Capital Funds” out of Denver, a very respected, sophisticated mining investor. They own just under 10%. We also have PowerOne out of Toronto that owns around 8%. In addition to that we have a range of sophisticated European and Canadian specialist mining investors

Also, the founders, myself and my partner, Alan Friedman, have invested a significant amount of money and we are therefore completely aligned with our shareholders. So that is the second differentiation factor; we have a great shareholder group that stands behind us.

And lastly, of course, we believe we're a good team. We have a good track record, we've delivered value before; we've raised money, developed projects and sold projects before, so we know what we are doing and we understand the mining venture capital game very well. I would say that sums it up.

Dr. Allen Alper: Yes, I know you and your team have been successful and have a great track record. Could you mention some of your past successes?

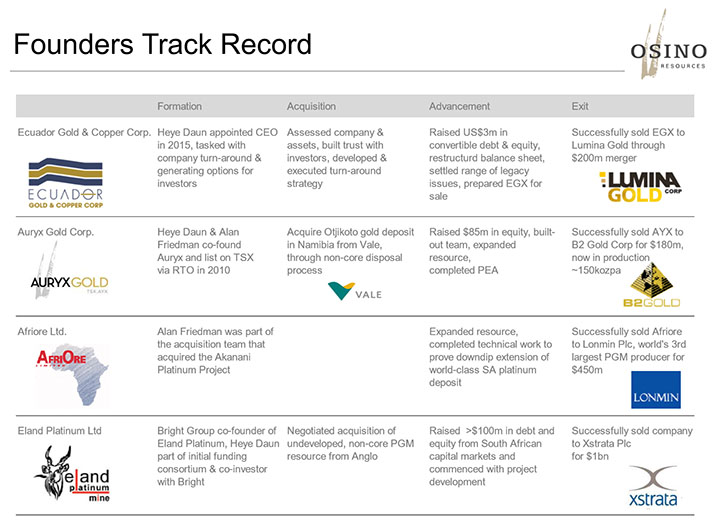

Heye Daun: I think there are two in particular. One of them was a company called Auryx Gold, of which I was a co-founder. Auryx owned a gold project in Namibia, which we acquired in 2010. We then raised a significant amount of money, took it public and significantly increased the resource. We ended up selling that company to B2Gold in 2012, who did a really good job and built a gold mine, which is now very profitable and operating very happily. B2 really built the model mine in Namibia.

That helped our track record and demonstrated that the kind of projects that we were developing at the time were feasible, and were real, and became real mines; unlike many other projects that were bandied about in the last bull market around 2012. Ours was a significant deal that actually came through and turned from a dream into a real, profitable, operating gold mine called Otjikoto.

I subsequently had another successful exit with a company called Lumina Gold. Lumina Gold was formed out of the merger of a Ross Beaty company, Odin Mining, and an Ecuadorian explorer, which I was running, called Ecuador Gold & Copper Corp. Through that process, I got to know Ross quite well and he took a liking to my Namibian gold idea. Also, Ross spent time in Namibia when he was young. There was a wavelength that developed, and as a result of that, Ross became the largest shareholder in Osino.

Dr. Allen Alper: That's very impressive. Could you highlight and refresh the memory of our readers/investors about your Directors and Management team?

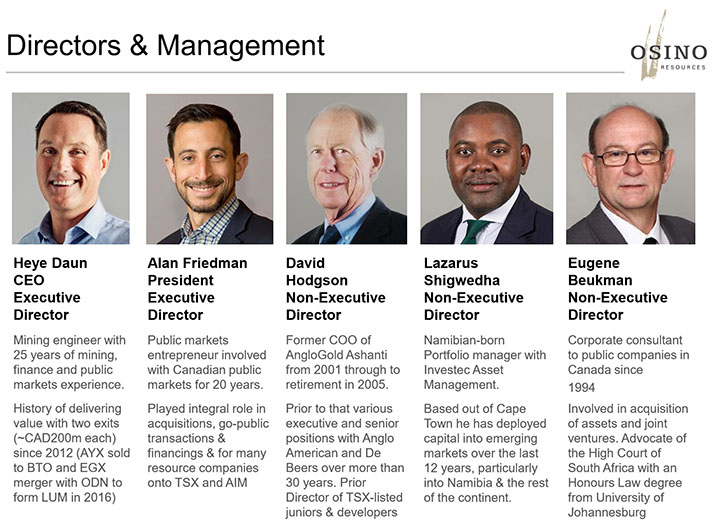

Heye Daun: Sure. The two key executives are Alan Friedman, my partner, who's the President of Osino Resources, and I. Alan and I have done everything in mining together in the past. Alan was also a co-founder of Auryx Gold, so he's walked this path with me.

He's based in Toronto, he's a lawyer of South African descent, but he's a Canadian capital market specialist, so he's very helpful in terms of managing our investor base and attracting new investors.

I'm the CEO, I'm a mining engineer by background; many years in the industry, building and operating mines, and I spent quite a bit of time in finance, and then became a mining entrepreneur.

In addition to that, we have Dave Hodgson, who's my ex-boss from AngloGold. He's a non-exec. He was on the board of AngloGold until very recently. And he's a real sort of elder statesman of gold mining globally.

We also have Lazarus Shigwedha, who's a Namibian fund manager with Investec. Investec is a large South African fund management group. Lazarus manages a significant portfolio on behalf of Investec; he's a Namibian citizen too, like I am.

Then thirdly, we have Eugene Beukman, who's a corporate administrator, based out of Vancouver. He has started and manages a range of public companies and handles most of our corporate administration out of Vancouver.

So that's our Board currently. As the Company evolves, we plan to add further skills and competency to that Board. But at the moment, it's very functional and credible and it works well.

Dr. Allen Alper: That sounds great. Great team! Successful past! It's nice to work with people you know and with whom you’ve had success before. That's excellent.

Could you tell our readers/investors a little bit about the Namibia Tectonic Setting?

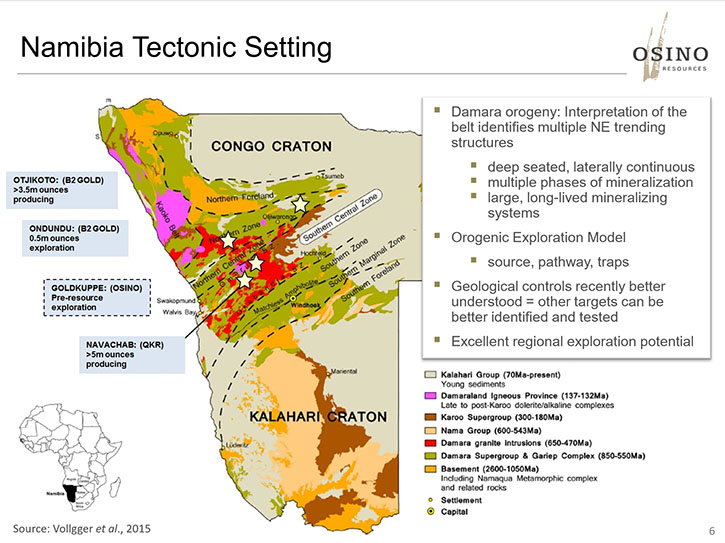

Heye Daun: Absolutely! That's important. Namibia has a mineralizing belt running through it called the Damara Belt. And the Damara Belt, very simply speaking, is a tectonic belt, related to tectonic movement. It sits in between the Congo Craton to the north and the Kalahari Craton to the south. Now, in exploration in geological terms, these cratons broadly represent tectonic plates as part of the earth’s crust.

As these plates moved apart sediments were deposited through erosion and later, as these plates came back together, generating heat and pressure, partial melting and formation of mineralizing fluids occurred. Those sediments are thus the source rock for a lot of the mineral deposits that were formed in this belt subsequently.

Now, some of your readers may or may not be aware that Namibia is host to some very significant ore deposits. Particularity in uranium, in copper, and lately, also in gold.

Now, one of the issues that Namibia has, and one of the reasons it is a relatively recent and emerging belt is the fact that it is largely under cover. Meaning, there's overburden, which is an erosion product, on top of the bedrock.

That makes exploration somewhat more difficult, but it's also an opportunity because it means that a lot of the future discoveries are still hidden. As we all know, significant discoveries in today's world are mostly found undercover. Osino has adapted some innovative techniques to be able to explore through this cover.

Dr. Allen Alper: Well, that's excellent. Great to be in such a huge region with high potential of a very large gold district. Could you elaborate a bit on your gold prospect, what you see possibly for the future, and what your plans are?

Heye Daun: Yes, certainly. Osino, in summary, is following a portfolio approach geared to discovery. What I mean by that is we have a large portfolio of land holdings, and we have a multitude of targets on that portfolio. We are advancing most of these targets. We have grouped them into three baskets, broadly speaking.

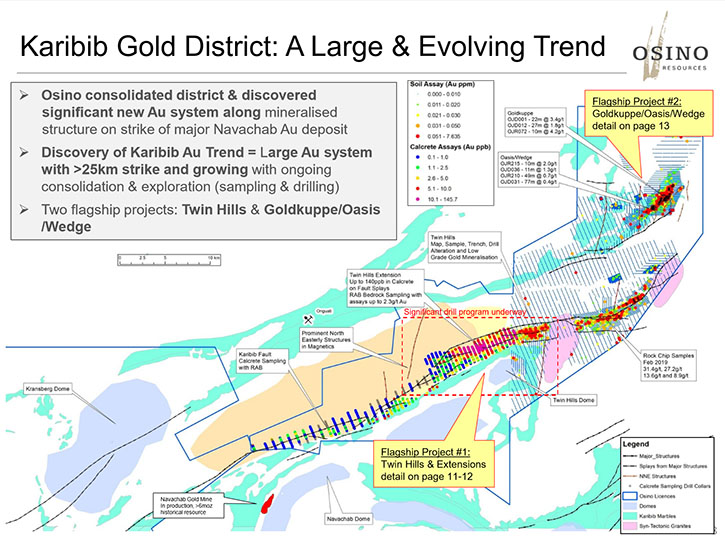

The primary basket is in the south. It's called the Karibib Gold Project, which is most advanced; we're spending most of our effort and money on that project. It's basically a large regional structure that we identified, which has a very significant large-scale gold anomaly on it, which we are drilling right now. That's what we are most excited about.

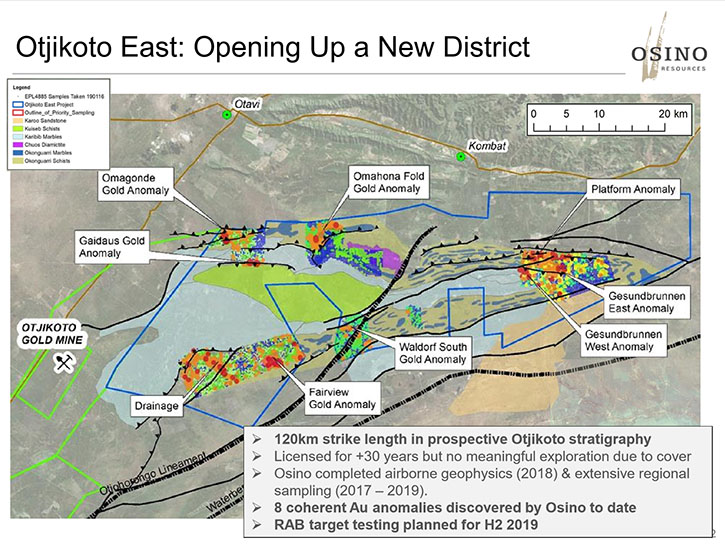

Our second basket is what we call Otjikoto East, which is the strike extent of the B2Gold Gold Mine in Namibia, further to the east. We have explored it actively for the last two or three years, and we've identified a number of gold anomalies on surface. Later this year, we are going to drill a number of these anomalies in order to turn them into bedrock anomalies. That's the secondary basket.

Then the third basket is the Pipeline, as we refer to it, which is much more early stage. We are basically generating new targets on what we've identified to be prospective ground. The advantage of such a portfolio approach is that it gives us multiple kicks at the can. We are not reliant on just a single project. Of course, it does cost quite a lot to explore this ground, and to do justice to it.

Dr. Allen Alper: Well, it sounds like an excellent approach and excellent opportunity for exploration and development. Could you tell our readers/investors why they should consider investing in your company?

Heye Daun: Certainly, I'm of course not a macroeconomist. I'm not going to be speaking about the pros and cons of investing in gold in general. As we all know, the markets are depressed at the moment. But it might be a very good buying opportunity, as Warren Buffett once said, "The best time to buy is when there's blood on the streets."

In terms of the gold market, I would say it's safe to say that there's blood on the streets currently. I think there are very good macro reasons why one should invest in gold stocks at this point in time.

If we look at the micro reasons, the fundamental reasons within the Company itself, there are a couple of things that set us apart as a junior. Most importantly, the fact that we have a very strong group of shareholders standing behind us that will support us even in difficult markets, as we are in right now. That's life insurance, because I would say that the biggest risk when investing in juniors is for these juniors to run out of money. I think that's highly unlikely to happen to us.

Secondly, we are in a solid, safe jurisdiction and we have a large-scale geological opportunity. Lastly, we know what we're doing. We've done this before; we've raised money before; we've built companies before. And we've sold companies before. I think those are the key takeaways on why Osino is an excellent opportunity, and they set us apart from many others.

Dr. Allen Alper: Very strong reasons for our readers/investors to consider investing in Osino! It's great to have the financial backing, be in an area that has a lot of gold and is not too well explored, and to be in a good jurisdiction. Excellent reasons!

Is there anything else you'd like to add, Heye?

Heye Daun: Maybe I should just mention that we are doing a financing right now. It was announced about two weeks ago. We're raising a small amount of money, just $2,000,000, which is largely spoken for by existing investors, who are participating pro rata. It is strongly supported but is still open for another week or so. But we invite interested investors to contact me to participate. I'm sure that you will add our contact details to your piece when you publish this. (See contact info below.)

We are going to use those funds to progress our very active work program, In fact, we started diamond drilling on our key project, literally yesterday. Right now are exciting times for us, with a lot of news flow expected over the next few weeks and months. We're very bullish about the future.

Dr. Allen Alper: Sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://osinoresources.com/

Osino Resources Corp.

Heye Daun, CEO

Tel: +27 21 418 2525

hdaun@osinoresources.com

|

|