Pelangio Exploration Inc. (PX: TSX-V; OTC PINK: PGXPF): Amazing Successful Team Exploring in Top-Ranked Mining Jurisdictions in the world, Ontario, Canada and Ghana; Interview with Ingrid Hibbard, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/23/2019

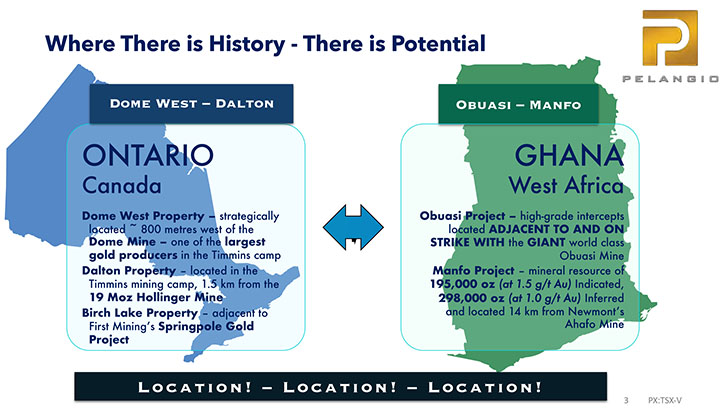

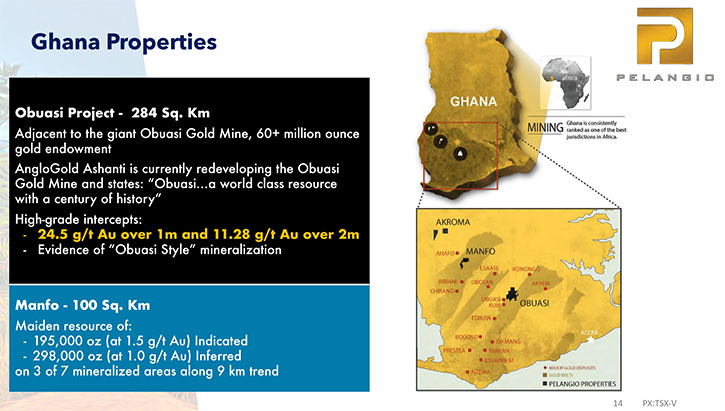

Pelangio Exploration Inc. (PX:TSX-V; OTC PINK:PGXPF) is focused on exploring large land packages in world-class gold belts in Canada and Ghana, West Africa. In Canada, Pelangio controls a number of early-stage properties in Ontario, in areas with active and historic mining activities. In Ghana, the Company is focusing on two 100%-owned camp-sized properties: the 100 square kilometers Manfo Property, the site of seven recent near-surface gold discoveries, and the 284 square kilometers Obuasi Property, located 4 kilometers on strike and adjacent to AngloGold Ashanti’s prolific high-grade Obuasi Mine. We learned from Ingrid Hibbard, President and CEO of Pelangio Exploration, that last year the Company made some strategic acquisitions in Canada. Pelangio is currently focused on the Dome West property, located 800 meters west of Goldcorp’s Dome Mine, where they've just completed a very successful drill program. With five core properties and a proven project generator strategy, Pelangio is well positioned for success.

The photo of the Dome Mine in Timmins, taken from the grounds of Pelangio's recently acquired Dome West property.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ingrid Hibbard, who is President and CEO of Pelangio Exploration. I wonder, Ingrid, if you could give our readers/investors an overview of your Company and your strategy.

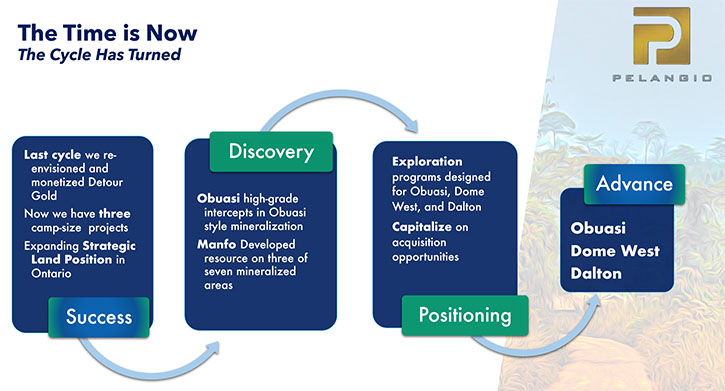

Ingrid Hibbard: As an overview, Pelangio is a gold exploration company. We're focused in Ghana, West Africa and Ontario, Canada, primarily around the Timmins camp. Our predecessor company was Pelangio Mines Inc., which spun out the Detour Lake Project into what is now Detour Gold and the Detour mine.

Our strategy from that continues to be to look for significant gold deposits in areas where there has been significant historical production on major prolific gold belts.

More recently, we have added a project generator focus to our strategy, as a mechanism to bring in more revenue to offset some of the overheads. With that in mind, we recently did a corporate acquisition of 5SD Capital, a private project generator company. With that we acquired eight projects, about $500,000 in cash and a share portfolio. One of the more interesting things that comes out of that is that Kevin Filo was running that private company. He was the VP of exploration back when we originally acquired the Detour Lake mine project from Placer Dome and then when we spun it out to Detour. It is really good to be working with Kevin again, in addition to our existing team. We have been on a bit of a mission to add to our team recently.

Dr. Allen Alper: That's excellent. Could you tell us more about the properties both in Ontario and in Africa?

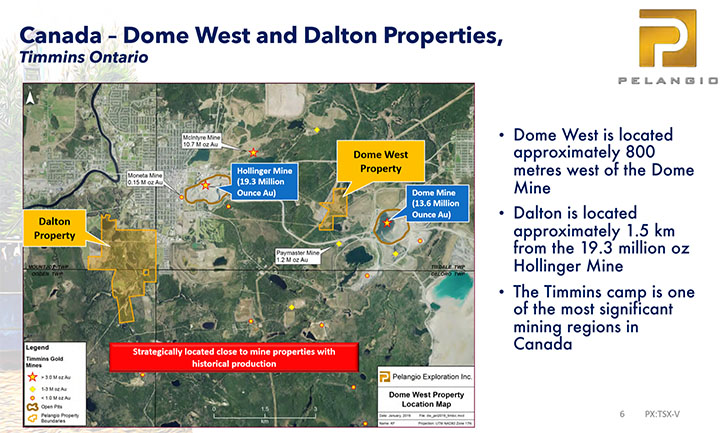

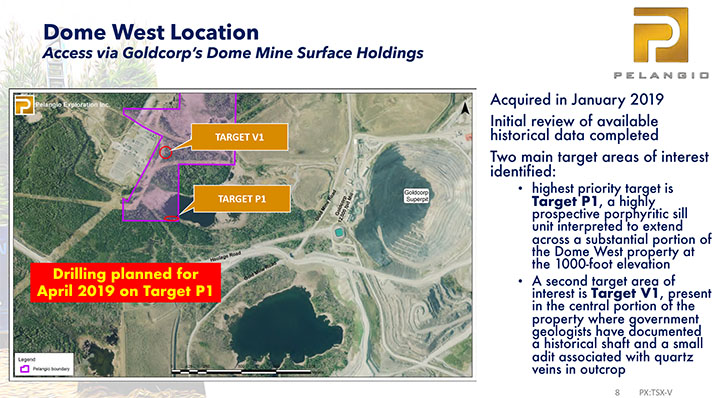

Ingrid Hibbard: We're pretty excited because, for the last 18 months, we've added to our projects dramatically in Canada. Along with the eight projects that we got from 5SD, we've also acquired two very strategically located projects, virtually in downtown Timmins. Timmins is home to the Porcupine Gold Camp, one of the world’s premier gold camps. We acquired two properties in the camp. The Porcupine Mining Camp is known to have produced over 70 million ounces, so we are talking a significant camp. The Dome West property is located 800 meters west of the Dome pit and 500 meters North West of the former Paymaster mine shaft.

The Dome mine was a significant producer in the camp and has produced for well over a hundred years and the Paymaster is a smaller high grade mine. Strategically located between those two mines, one a current mine and one a former producer, is a great place to be. Interestingly, it's been virtually unexplored since the 1940s.

At the Dome West property, we just completed a drill program 543 meters on the P1 target. We were drilling there to confirm the existence of a highly prospective porphyritic sill which was interpreted to extend off that Paymaster. We are 500 meters North West of the shaft. We were successful in doing that, so we have intersected the main altered porphyritic unit at 280 meters to 322 meters where we expected it to be. We've also intersected a number of quartz veins, both above and below that.

And there's more at Dome West. Our secondary target there is known as V1. We only acquired this project in January. By the time we got it, it was covered in snow, this is Timmins after all. The first work we're doing is just based on assessment files, or reports that we could find, because we really couldn't get underground and take a look at it. But we were so anxious to get started we drilled this one hole. It will set us up for the next drill program to get the lay of the land as to what the geology is and where that porphyritic sill is.

V1 was based on government geologists having documented an old historical shaft and a small adit, associated with quartz veins so that we don't have any record of what sampling was done there or the results. Now that the snow has gone, we're getting onto the ground and we're going to be prospecting in that area for the summer. So that's going to give us more information this summer on the secondary target at Dome West.

I don't know if you remember Al, but I actually grew up in Timmins. Timmins is my hometown, so it's pretty exciting to be back there working.

Dr. Allen Alper: I do remember. You were brought into the mining business by your dad who also did some great work.

Ingrid Hibbard: Exactly! My dad was a prospector and growing up with that it was just too exciting to leave the industry. It's too much of a fun place to work, when you can find a mine or play a part in finding a mine and significant mineralization. I don't think it's ever done by one person. It really is a wealth generating activity, so it's a really exciting industry to be in. The Detour success shows you the kind of success you can have for shareholders. Our shareholders made, depending on when they bought, 30 to 100 times their money. Those are really wealth generating opportunities.

This project being located virtually in downtown Timmins, beside the famous Dome mine and the Paymaster, is as good a place as you want to be looking anywhere in the world. It is so close to the mine that we had to get an access agreement from Goldcorp, now Newmont Goldcorp, and in order to be very careful and good neighbors we chose to do that drilling with helicopter support. Even with that type of drilling, downtown Timmins is one of the most cost effective places you can work and it's one of the most mining friendly jurisdictions in the entire world.

We acquired two projects in Timmins in the last year. We've been looking for a while, you can imagine I'd be anxious to get back to work in my hometown. It takes the right circumstances and the right part of the market. We've talked about cycles before and we think the cycle is turning, so we were really anxious to be able to acquire these projects right at this point in the cycle.

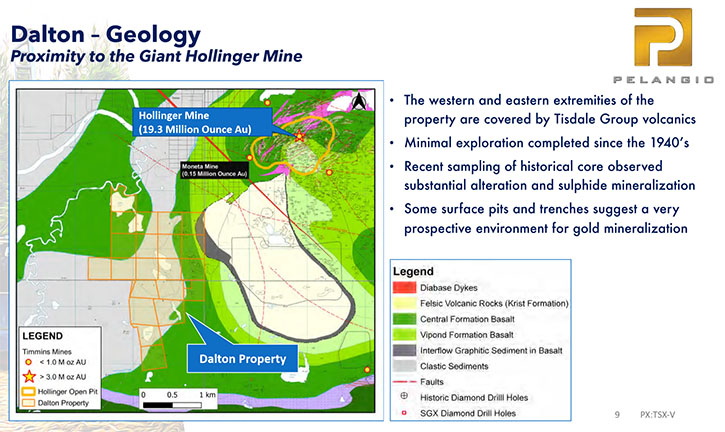

The other project that we acquired is the Dalton project, which is one and a half kilometers from the Hollinger mine, which is the largest mine in the Porcupine camp. I think it's produced 13.6 million ounces. It has only been lightly explored since the 1930s and 40s. It's been in the hands of a family for all that time and there were only six or seven holes drilled in the whole property since the 1930s and 40s and they were very shallow holes. It was completed about ten years ago and it didn't test all the targets that had been developed, even at that time. We're doing additional target development work ourselves. We just completed a detailed airborne magnetic drone survey. That's out being interpreted and this summer we're going to be doing some prospecting and geochemical sampling to outline some other targets. We plan to put in several holes in the fall.

It has been a very exciting six to eight months for Pelangio, with these two properties and the private project generator company that Kevin is running. We really see the future as bright, going ahead.

Then in Ghana we continue to have our Obuasi mine, which we acquired based on the whole Detour strategy. We looked around to see where in the world we could find a huge land package, on a very prolific gold belt, and we took that concept to Ghana, West Africa, one of the world's great gold producers as well. We were able to acquire the Obuasi project, which is 284 square kilometers directly adjacent to and on strike with AngloGold Ashanti's huge Obuasi mine.

The Obuasi mine has produced over 35 million ounces, over the last hundred years. AngloGold Ashanti, who owns the mine next door, has done a re-development. They've shut down, after producing for over a hundred years, and did a brand new re-look. With that new development, they have come up with a new resource. After having produced 35 million ounces their resource is 33 million ounces, with the reserve of six million ounces at 8.8 grams per ton. To put this into perspective, one mine has a mineral endowment the size of the entire Porcupine camp basically, the 70 million ounces of the Timmins camp. We have 284 square kilometers adjacent to and on strike with that. It is just a remarkable opportunity.

We have done some work there in the past. There was virtually no exploration at all on the project when we got it, so we had to start from square one with 284 square kilometers and do all the target generation. We've generated multiple, multiple targets. There are two structures, at least, running through the project and on the structure to the South we have intersected Obuasi style Mineralization with 24 grams of gold over a meter and 11 grams over two. We're pretty excited about that.

We know it is Obuasi style mineralization. It has that high grade signature, but because the market is turning, but hasn't yet turned, we need to be very cost effective. So, one of the things we're now utilizing at Obuasi, about which I'm really excited, is we're using artificial intelligence to assist with our exploration targeting. We've contracted a firm out of Germany, Beak Consultants. Their initial pass validated a number of our existing targets. With that validation we're pursuing on to stage two, a follow-on program where they'll help us prioritize our targets and hopefully generate some additional targets at the Obuasi project. That's really exciting and really cost effective.

Our other project is our hundred square kilometer Manfo project, which is 14 kilometers away from Newmont's Ahafo mine, also in Ghana. It's on the Sefwi belt and Newmont's mine is a 19 million ounce mine. So, you're detecting the theme that we like to be in the neighborhood of really big, really prolific mines. And we're 50 kilometers from Kinross' Chirano. We've discovered seven mineralized areas there so far, along a nine kilometer geochemical trend. We have a maiden resource on just three of those. There are additional trends, on which we have just had geochemical work done. So, there's lots to do here and lots of upside potential.

We have a great portfolio of projects, with the addition of Kevin, as well as additions to our Board of Directors. We're strengthening our team and we are of the opinion that the cycle is turning.

Our success at Detour was to be able to buy the mine at the bottom of the cycle and slowly work on getting our ideas together as the markets turned. Now, we have acquired projects as the market is turning, as we have with Dome West and Dalton, and then as things get better and we're able to raise more money at better prices then we can really move forward with our exploration.

We think we're at that early stage of where the market's turning. We have five key strategic projects, including Birch Lake, so we have a number of core projects that we will work ourselves. In addition, we have these eight project generator projects, where we'll be looking to work with partners to move them forward and make a little money for Pelangio.

Dr. Allen Alper: That sounds great. It's a great thing to have a talented successful team, with a great track record and to have great properties, in great locations, with proven results, that's excellent. Could you tell us about your directors’ and management’s background.

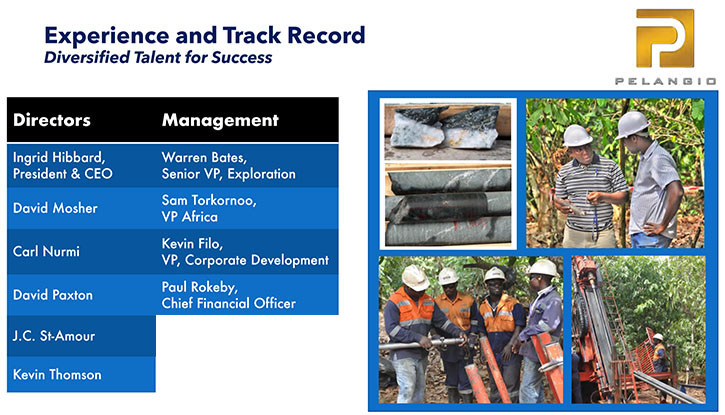

Ingrid Hibbard: I am the CEO, I've been CEO of Pelangio or its predecessor since 1996. I'm a lawyer by training. One of the things that sets us apart is we have a very strong technical exploration team, but we're also strong on the corporate side and how we structure deals. One of the big reasons for the success of Detour was how that deal was structured. We owned 50% of the new company Detour Gold’s asset where at the IPO Pelangio sold the project for 20 million shares (a 50% interest in Detour Gold Corp). This strategy allowed for Pelangio’s early shareholders to realize extraordinary returns. A purchaser of Pelangio Mines Inc. shares in January 2004 might have paid $0.10 per share. By late 2010, with Detour Gold at $30 and Pelangio Exploration at $1.00, those original shares would have been worth $8.70, a remarkable 8600% return on the initial investment. Those returns illustrate Pelangio's goal of generating wealth for its shareholders via both the drill bit and intelligent corporate structuring.

Warren Bates is our Senior VP Exploration, he has 35 years of international exploration experience, primarily gold, but not exclusively, which will help us on the project generator side. Because one of the things we're doing on the project generator side is not staying just gold focused. For example, our Montcalm project, which we've optioned to Pancon Resources, is a battery metals project. By using this idea of collaboration and working with others, you can give your shareholders additional exposure to other areas of expertise. With the team we have, there's just so much depth of experience that we might as well build on that. With Warren’s experience, he and Sam Torkornoo, who is our VP Head of Africa, were the movers behind the Manfo project and those seven discoveries that we made along nine kilometers.

Sam is our on the ground person for Ghana. He is Ghanaian, he lives in Ghana, he has a geological engineering degree from Ghana and an MBA in Resource Management from Freiburg Germany. Just a little piece of trivia, Freiburg is the oldest mining university in the world, so there's an awful lot of expertise there. He ran his own contracting business before working a lot with Canadians and Australians. There's always a little bit of a cultural difference place to place, so he's able to bridge that. He's just done a tremendous job for us and it just saves so much that we built up a local team. Basically, most of the time, there are no expats in Ghana. Our Ghana projects can run exclusively with Ghanaians and give the whole CSR corporate community license to operate. Having that expertise, is the reason why Ghana is one of the great places to work, as it has had a mining history that goes back longer than Canada. You have the expertise in-country that you can draw on. So, he's our VP Africa.

Kevin Filo has joined as our VP Corporate Development, bringing all of his experience, also international, but with a real, real focus. He lives in Timmins, he's been focused in Timmins now for about 20 years and he will be running all of our Timmins based exploration plus doing Corporate Development work in terms of looking for new opportunities or looking for collaboration.

On the Board of Directors side, there have been a few new additions. David Paxton joined us a year ago, he is a mining engineer and he's based out of London. He was a mining analyst for a number of years so he's well connected in London, so he helps with our reach through Europe.

JC St-Amour joined recently, JC's an investment banker, who was with Fraser Mackenzie. He is a geologist by training.

Just recently we added Laurie Clark to our Advisory Board. In 2017 she was named one of the hundred most powerful women in Canada. She has a background in finance and technology, so she brings us a bit of a different point of view, which I think is going to be really exciting for us. She's excited to be learning about the mining industry.

So, we are really, really well set up here for the future. I'm pretty excited about where things are going Al.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors why they should consider investing in Pelangio?

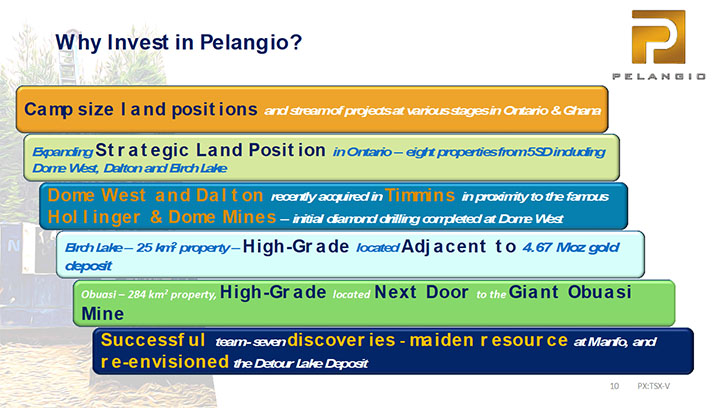

Ingrid Hibbard: Well I'm just looking for the slide that you can refer to here because I think we have one entitled just that, "Why invest in Pelangio Exploration?"

Dr. Allen Alper: Excellent!

Ingrid Hibbard: Our core properties tend to be camp size, although I have to admit Dalton and Dome West are not, but we have camp sized projects in world class gold belts. That tends to be cliché, but in this case it's absolutely the truth. The Ashanti Gold Belt is one of the most prolific gold belts in the world. The Obuasi mine produced for over a hundred years, the first 30 years, over one ounce per ton. So, we have these camp sized positions, and we have a stream of projects at various stages. Manfo has a resource, some of the others are more early stage. On Obuasi we've done a lot of work, we have two trends to look at and we are expanding our strategic land position with Dome West and Dalton and the eight project generators in Timmins.

Dome West and Dalton, which we recently acquired, are in proximity to two historic famous mines the Hollinger and the Dome. Birch Lake property, which I really haven't had a chance to talk to you about, we beefed up during this quiet time too and it's now 25 square kilometers, so it is one of those camp sized projects. It's adjacent to a four and a half million ounce development project at Springpole of First Mining Finance Corp. We've had results there of 34 and a half grams of gold over 9.85 meters and 113, almost 114 grams over three meters. In light of the recent excitement over Great Bear and high grade in the Red Lake area, this is in the Red Lake district. It's near a development project, it's a camp sized project, with high-grade results. We haven't talked much about Birch Lake yet, but it too is a very exciting project.

We really have five core projects, three in Ontario (Dalton, Dome West and Birch Lake) and two in Africa (Obuasi and Manfo) and then we have this other stable of about ten project generator projects, some of which are already optioned out, and on some of which we're looking for partners.

Dr. Allen Alper: That's fantastic. It's great to have a fantastic, successful team and outstanding properties. It's really great to be so well positioned.

Ingrid Hibbard: Well I think so. I'm looking forward to the next three to five years here as we're able to move along with the improving market. I think that the upside is tremendous.

Dr. Allen Alper: That sounds like an excellent opportunity for our readers/investors. Is there anything else you'd like to add Ingrid?

Ingrid Hibbard: You and I speak so often that I know you know the whole story from way back.

Part of this game is playing the cycles and that requires some patience. The opportunities are there when things look dark. We've been really on a push lately because I feel like the market is turning, so the window to do some of these acquisitions, at a really cost effective price, was starting to close. Getting Dome West and Dalton and buying 5SD and bringing with that cash and shares and most importantly Kevin Filo, is really setting ourselves up for the future good times that I think are right ahead.

Dr. Allen Alper: That sounds excellent. It's great to have a successful strategy, know what you're doing and move aggressively ahead and sense in the market to advance when times are tough and get ready for when they start showing signs of improvement.

Ingrid Hibbard: Exactly. So, thanks for taking the time again Al. I really appreciate it.

Dr. Allen Alper: I’m very impressed with what you are doing! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://pelangio.com/

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

|

|