Chatham Rock Phosphate Limited (TSXV: NZP, NZAX: CRP): New Zealand’s Only Ultralow Cadmium, Environmentally Friendly Phosphate Fertilizer; Interview with Chris Castle, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/13/2019

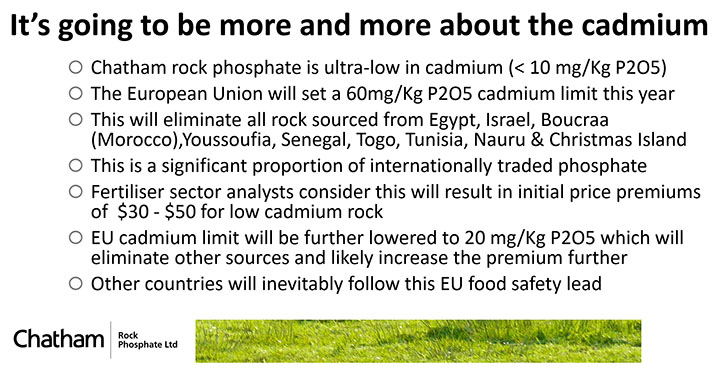

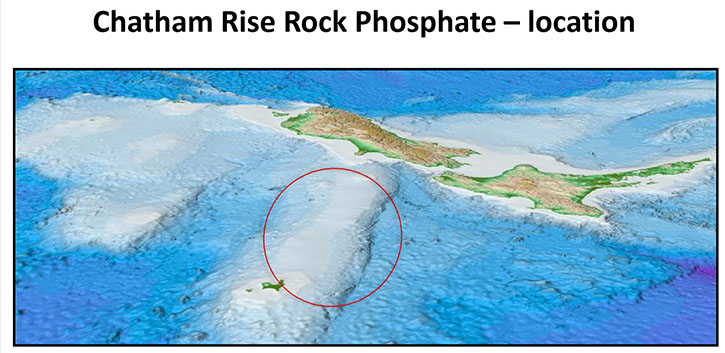

Chatham Rock Phosphate Limited (TSXV: NZP, NZAX: CRP) is the custodian of New Zealand’s only material resource of ultralow cadmium, environmentally friendly pastoral phosphate fertilizer, and aims to be the premier supplier of direct application phosphate to the New Zealand and global agricultural sector. The low-cost resource located 400 meters under the water offshore New Zealand, represents one of New Zealand’s most valuable mineral assets and is of huge strategic significance because phosphate is essential to maintain New Zealand’s high agricultural productivity. We learned from Mr. Chris Castle, who's President and CEO of Chatham Rock Phosphate, that once they are fully permitted they will be able to operate in three or four years' time with no capital cost, and with established markets for their product in several countries of Asia-Pacific and Australasia, particularly India, Pakistan, Indonesia, Malaysia, Sri Lanka, Australia, and New Zealand. The recent decision of the European Union and European Council to put restrictions on the level of cancer-causing cadmium in phosphate excludes rock from most of the major phosphate exporters around the world and gives Chatham Rock Phosphate a huge advantage in the industry.

Chatham Rock Phosphate Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Chris Castle, who's President and CEO of Chatham Rock Phosphate. Chris, could you give our readers/investors an overview of Chatham Rock Phosphate and your objectives? Then share the significance of the latest news release, where the European Union and European Council has put restrictions on the level of cadmium in phosphate and why that will give Chatham Rock Phosphate an advantage in the industry because of the low levels of cadmium in your product.

Mr. Chris Castle: Good afternoon, Allen, very good to talk with you. As you know, I'm CEO of Chatham Rock Phosphate. I've been involved with the project for twelve years. We have a mining permit, so we can extract rock phosphate from the seabed off-shore New Zealand. We have been operating for twelve years. I have a team of experienced marine scientists and we have made a lot of progress on the project. We have determined markets for our product in a number of countries. Once we are fully permitted we will be able to operate in three or four years' time with no capital cost. The exciting thing about our project is that it has some no development cost glitch for us.

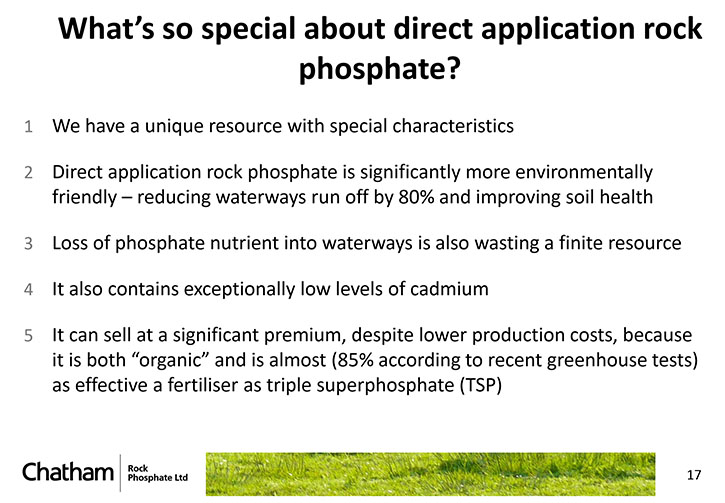

Our form of phosphate, rock phosphate, is particularly exciting because it's an organic rock phosphate, which means that it has much more beneficial properties for soil, plants, and runoff into waterways. It's very environmentally friendly. Probably the most important feature is the fact that it's an ultra-low cadmium rock phosphate; and cadmium is okay in batteries but it's not very good in people, it causes cancer.

The significance of the most recent announcement that the European Union has finally resolved to legislate against high cadmium phosphate rock. That means that anybody exporting rock phosphate, into European Union countries, has to stay under a limit of twenty parts per million. That excludes rock from most of the major phosphate exporters around the world, many of those suppliers have rock phosphate levels, which are higher than that. So that gives us a tremendous competitive advantage because it's not just the European Union, other countries are certain to follow their safety standard, it's going to become universal. That means that our rock will have an increasing competitive advantage, which can result in higher pricing for the rock, but will certainly increase demand for it.

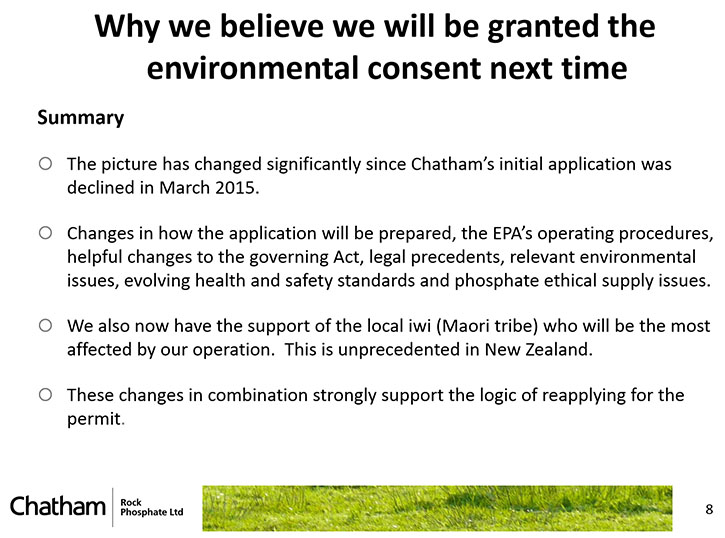

So that's the significance of the most recent announcement. Another really significant announcement since we last talked, Allen, is the fact that the indigenous people who live in the Chatham Rise (on the Chatham Islands) on NZ known as the local Iwi, or Maori tribe, have recently come out and said that (subject to gaining a full understanding of the environmental impact profile) they're supportive of our project. On that understanding, the iwi will work with us to achieve an environmental permit. And that's almost unique in New Zealand. All locals are traditionally against any development like this, whether or not they are the indigenous people. This is really exciting that they are actually supportive of us and it will make a tremendous difference in our chances of being re-permitted.

Those are the two most recent announcements in a nutshell, Allen.

Dr. Allen Alper: That sounds excellent. That's great news for investors in Chatham Rock Phosphate and potential investors, so that shows that you have an advantage for phosphate fertilizer in the industry. Could you tell our readers/investors, refresh their memories on this resource, your mining permit, and a finite resource area, et cetera?

Mr. Chris Castle: The resource itself occurs in an area of about 450 square kilometers off shore New Zealand, it is 400 meters under the water and sitting on the surface of the sea bed, so it's very easy to extract, using a dredge. The deposit is 23.4 million tons of 22% P205 strength rock, with about another 12 million tons nearby, with which we can upgrade the resource once we get going. So that's 35 million tons there. We plan to mine that at the rate of one and a half million tons per annum, so that's going to last us about 22 years.

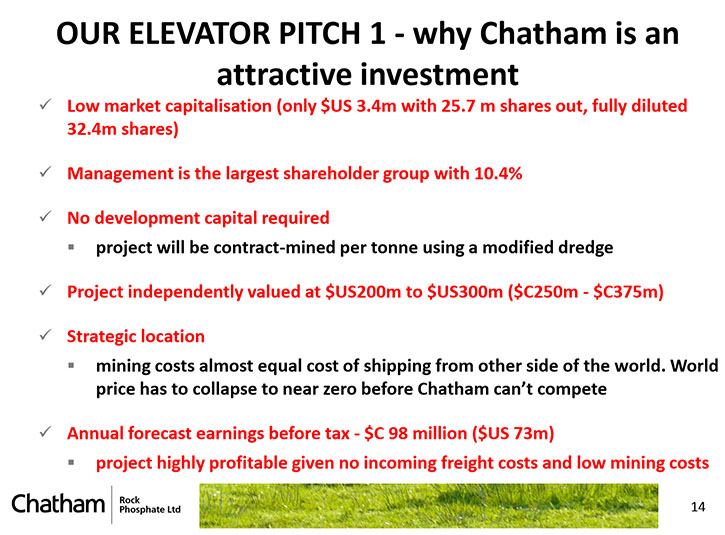

The bottom line is a very attractive number, I'm not really allowed to be too specific about that, but our operating costs will be significantly lower than the market value of the rock. It will result in cash flows of many tens of millions per year, which is pretty exciting when looking at our current market value, which, on the Canadian market is about three million dollars.

Dr. Allen Alper: Could you refresh the memories of our readers/investors on where you're listed and a little bit more about your share structure?

Mr. Chris Castle: Okay, thanks Allen. There are twenty-five million shares out, thirty-two million shares fully diluted. We have roughly 2000 shareholders and we're listed on New Zealand, on the Toronto Venture Exchange, and on the Frankfurt Exchange. Liquidity is quite low in all three markets, which is an indication of the fact that our shareholders believe in the long-term future of the Company and not traders in the stock. We have raised, over the last 12 years, about 41 million New Zealand dollars, that's about thirty-seven million Canadian, or about 30 million U.S. for this project. We have gained the mining permit. We have a technical partner, a Dutch company called Royal Boskalis, who will contract mine for us. We have developed the markets and all we really need is the environmental permit that we are re-applying for soon.

Dr. Allen Alper: That's the permit that the indigenous people are supporting you in getting, is that correct?

Mr. Chris Castle: Yes, obviously subject to them being comfortable with the environmental impacts. Their support makes a big difference, because in New Zealand, like most places, people would oppose new developments, just on principle. But in this particular case, the leadership of this Iwi has looked at the project, looked at the logic of what we're trying to do, and are prepared to work through the permitting process with us.

Dr. Allen Alper: Could you tell our readers/investors, what markets you're looking at? It's New Zealand and others?

Mr. Chris Castle: Yes, the markets, where we are seeking to sell our rock phosphate, are basically Asia-Pacific and Australasia, so the countries are India, Pakistan, Indonesia, Malaysia, Sri Lanka, Australia, and New Zealand, and perhaps a little bit into South America. We're unlikely to be exporting to the European Union due to freight costs.

Dr. Allen Alper: That sounds like a good approach, you have a big market right where you're located and then the surrounding Australia, Asia, so you have a rather huge market right close by.

Mr. Chris Castle: Yes, I guess I should emphasize, Allen, that the Indian market is probably the fastest growing economy in the world, and it has a huge middle class growing and as people have bigger incomes they tend to eat more meat protein, believe it or not, and that uses ten times more fertilizer to generate, and India is really short on fertilizer now. So probably a more significant future market would be India and Pakistan.

Dr. Allen Alper: Ah, that sounds great. Could you tell our readers/investors a little bit more about the process of dredging and then grinding to make your product?

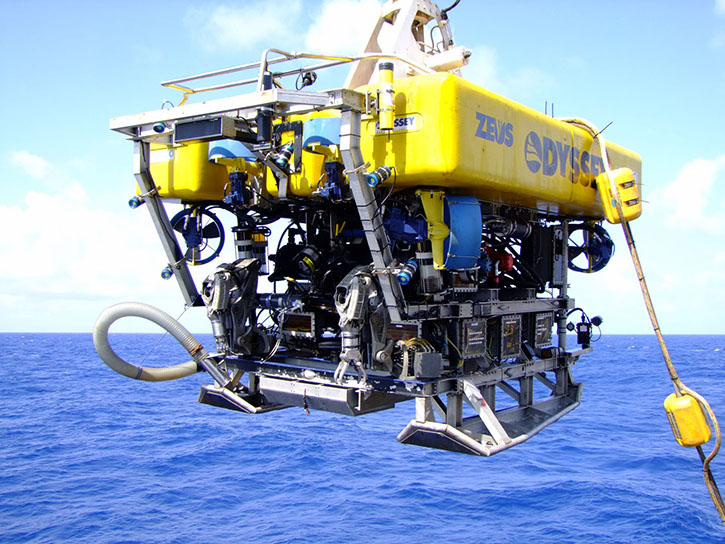

Mr. Chris Castle: Yeah, sure. The process is that we use a dredge to pick up the entire surface layer of the sea floor which is about two feet thick. That comprises the phosphate nodules, and sandy silt, all of that is brought up onto a vessel. On the vessel the nodules are separated and the sandy silt returns back down a pipe to the bottom, very close to where it was mined from. The nodules, which are mostly 2mm to 8mm in size, are taken to shore, where they are unloaded. They are sold in that form to our buyers around the world. We don't do any processing at all, that's one of the magic properties of this particular project. We effectively buy the product when it’s brought on shore by the dredging company and we sell it for a much bigger number without touching it.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors, many of whom are recent, a little more about your background?

Mr. Chris Castle: Certainly. My background is originally as a chartered accountant but I've worked quite a bit over the last forty years, with companies in mineral prospecting or mineral operating. So I’ve been very involved and interested in the mineral scene from the mid to late seventies, and I've been involved with a number of projects, including one I'm very proud of, a development in Vietnam, which was just being promoted by a geologist who really didn't have any chance of raising any money. When my company became involved with the project, we found other investors, and we developed it. It's a nickel mine in Vietnam that at the time was the largest tax payer in North Vietnam and that employed five hundred people for several years. And I've been involved in a number of other prospecting projects.

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Chatham Rock Phosphate?

Mr. Chris Castle: I think there are probably three main reasons. One is the fact that it's likely to be a very profitable investment for them. You've probably heard the phrase "ten bagger." This one, when we go to production, I think could be capitalized about a hundred times its present market value. So that's one.

I think the second one is the fact that it's very environmentally sound, and actually the rock itself is more beneficial to the planet in the sense that when it is used it results is in less runoff into waterways, it's better for the soil profile, and the carbon emissions resulting from mining it and transporting it are much lower.

I guess the next reason is the fact that it's very strong food safety-wise. This product is better for human beings than the other rock phosphate being exported around the world due to its ultra-low cadmium levels. And I guess there's actually a fourth reason; in New Zealand, most of the rock phosphate has come from a country, where there's disputed ownership being taken from a country which is a neighbor to Morocco. As it's being effectively taken from the local people, who are not being paid for it. It’s been exported to nine different countries around the world however eight of those countries have stopped this import of rock phosphate from Morocco and the Western Sahara. In New Zealand we are the only one left, in New Zealand, t still importing that rock and it’s like to cease sooner rather than later. In those circumstances Chatham will be able to offer an ethical alternative source of rock phosphate.

We are profitable, environmentally sound, offer food safety, and are ethical. I think those are four pretty good reasons to choose us.

Dr. Allen Alper: Sounds excellent!

Mr. Chris Castle: Yeah, thanks Allen.

Dr. Allen Alper: Sounds like a great opportunity and it's a product that's needed in the world. The need is growing, and as you pointed out, India, Pakistan, and that part of the world is growing very rapidly. Is there anything else you'd like to add, Chris?

Mr. Chris Castle: I'd just like to thank you for the opportunity to talk again, Allen and for Chatham Rock Phosphate to be interviewed again for Metals News, thank you.

Dr. Allen Alper: Thank you. It’s been very interesting learning so much more about what’s happening in your industry and about the amazing advantage you have and the benefit it offers consumers. I’m very impressed with what you are doing! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.rockphosphate.co.nz/

Chris Castle

021 558 185

chris@widespread.co.nz

|

|