Breaker Resources NL (ASX: BRB): Discovering and Developing Large New High-Grade Gold Deposits, in Australia’s Super-Terrane; Interview with Tom Sanders, Executive Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/26/2019

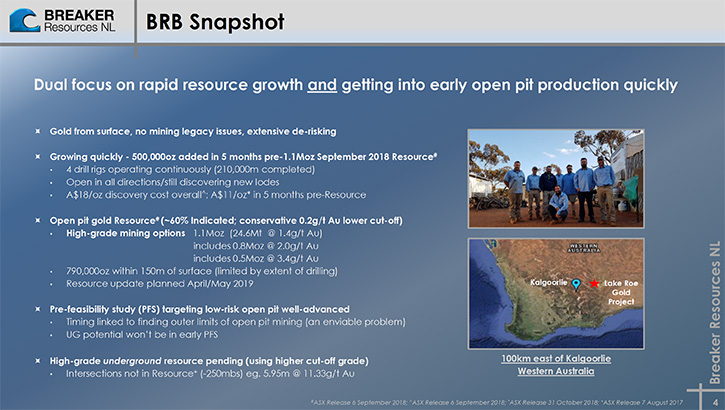

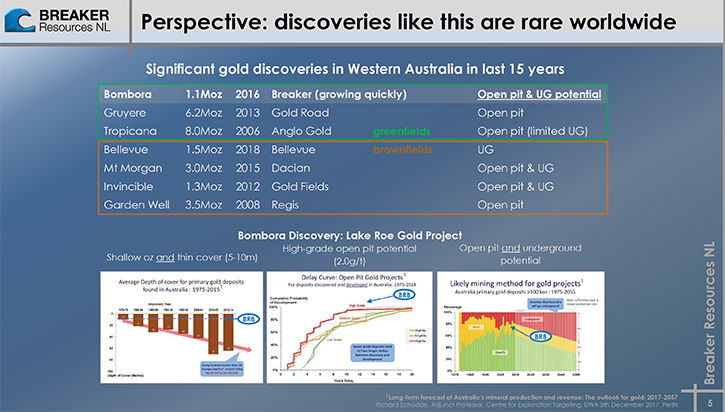

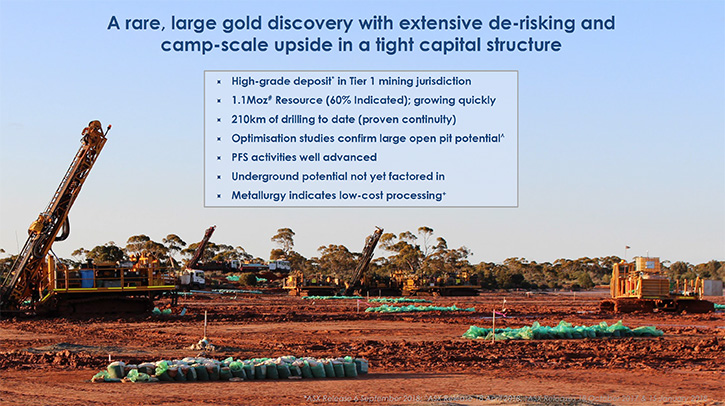

Breaker Resources NL (ASX: BRB) is focused on discovering and developing large new gold deposits, hidden by transported cover, in Western Australia’s Eastern Goldfields’ Super-terrane, where the Company made three separate high-grade gold discoveries in 2016. We learned from Tom Sanders, Executive Chairman of Breaker Resources, that they have been drilling non-stop for the past two years, and have the current resource of 1.1 million ounces that is currently being updated. The Company's strategy is to continue growing the discovery, and at the same time progressing a pre-feasibility study aimed at early open-pit production, while drilling continues to expand the resource, with the possibility of going underground.

Breaker Resources

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Tom Sanders, who's Executive Chairman of Breaker Resources.

Could you give our readers/investors an overview of your Company, and what differentiates it from other companies?

Tom Sanders: The Company was listed in 2012, specifically to look for large new gold systems, concealed by transported cover, in Australia's highest gold-endowed area, which is around Kalgoorlie. In 2016, we discovered primary mineralization concealed by five meters of transported cover, an absolute greenfields discovery with no outcrop and no historical workings of any sort. We've been resource drilling continuously for the last two years, with three to four drill rigs. We have a resource of one point one million ounces, and we're due for a resource update in July 2019.

It is a high-grade deposit that comes to the surface. Our strategy is to continue growing the discovery, and at the same time progressing a pre-feasibility study aimed at early open-pit production, while drilling continues to expand the resource. We see potential for a single, large open pit to kick things off, but in the long term, we can see this going underground.

I guess the key differentiating aspect is that it's a greenfield discovery, and it's quite high-grade, and we think it's the tip of an iceberg. We think it's the early phase of a brand new gold camp, only 100 kilometers east of Kalgoorlie.

Dr. Allen Alper: Excellent! Sounds like you are really drilling aggressively and you'll have great discoveries. You've drilled quite a large amount of meters, and I think you are planning to do much more in-depth drilling.

Tom Sanders: Correct. We've drilled about 220,000 meters so far. Our discovery costs are, for all the drilling that we've done, about $18 Australian per ounce. But that drilling will continue both along strike and at depth to grow the deposit, while we progress our pre-feasibility studies, which we expect to transition into feasibility studies. Our pre-feasibility study is quite advanced at this point. The drilling we've been doing is still trying to find the edge of the initial open pit, so it's quite exciting.

Dr. Allen Alper: That sounds great! From what I understand, your project is open in all directions, is that correct?

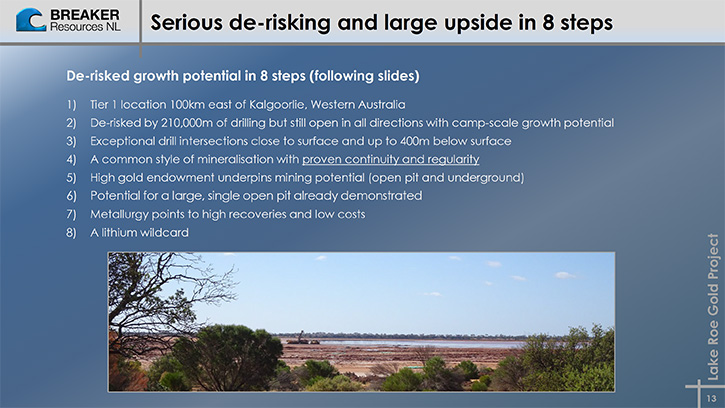

Tom Sanders: That is correct. Not only are we drilling to find the edge of the first open pit, but after that amount of drilling, it is open in all dimensions. Yeah! Even in the initial drill-out area, we are still discovering new lodes as we step out to drill deeper. One of the aspects of the geology is that it's a well-known mineralization style. We're talking sulfide lodes and stockwork in quartz dolerite that has many similarities to St. Ives or Paddington, and even the Golden Mile.

I'm not comparing the metal endowment, of course, but we see three mineralization orientations similar to the Golden Mile. For that reason, we've had to use a 40 by 20 meter drill pattern, which is quite tight, in order to remove the ambiguity. We are seeing good continuity, and we expect that to translate into good mine-ability.

Dr. Allen Alper: That's excellent! You really have a very exciting project. It's really fun to have a greenfield project, and be a discoverer. Excellent!

Tom Sanders: Yeah, thank you very much. Given the amount of drilling that we've done and the positive metallurgy results, we see it as an investment opportunity, something that's been extensively de-risked and backed by the resource, which minimizes the downside. I believe it is still quite early in the growth of the discovery, and early in the feasibility process. So our ounces in the market are still valued quite cheaply, but I expect that feasibility work to result in a higher value per ounce as we demonstrate mine-ability. I think at the same time, the ongoing drilling will continue to make a bigger pie. And the capital structure is still quite tight, so we believe it's an unusual combination and a very positive one.

Dr. Allen Alper: That sounds excellent. Could you tell our readers /investors a bit about your background, and your Board of Directors?

Tom Sanders: The Board consists of four seasoned, long-term mining industry professionals. I'm a geologist with equal exposure to mining and exploration. Mike Kitney, a metallurgist, and although he's non-executive, he is overseeing the metallurgical side of the pre-feasibility studies. Linton Putland, a mining engineer, who's operated many mines in his past, is overseeing the engineering aspects of the feasibility work. The fourth member is Mark Edwards, a lawyer who has been involved extensively in the resource industry, pretty much all of his career.

The Board Members are also shareholders. The Board controls about 14% of the stock, so we think like shareholders and we try to manage things like investors, and I believe that's reflected in the relatively tight capital structure.

Dr. Allen Alper: Excellent. It's good to see the Board and top Management having skin in the game. So, that's excellent. It shows you're with your investors, looking for and discovering gold. So, that's great.

Could you tell us a little bit more about your share structure, capital structure?

Tom Sanders: There are about 203M issued shares following the recent capital raise and the market cap is in the order of $60M (Australian). That pretty much sums it up.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Breaker Resources?

Tom Sanders: I think primarily it has the upside of a brand new greenfields discovery, whereby one point one million ounces has been generated, and we believe that's going to continue to grow. Given the amount of drilling and the positive metallurgy, I think it's fair to say there's been extensive de-risking that limits the downside. And, we can see extensive upside, given the high-grade nature of the deposit, given that it's growing, and given that early indications are that it is eminently mineable. It has the prospect of scale in the long term, and it has a relatively tight capital structure with good management.

Dr. Allen Alper: Sounds like excellent reasons to consider investing in your Company. Is there anything else you'd like to add, Tom?

Tom Sanders: Allen, I think we've pretty much summed things up, unless you have any other questions?

Dr. Allen Alper: Very good. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.breakerresources.com.au/

Investors/Shareholders

Tom Sanders

Tel: +61 8 9226 3666

Email: breaker@breakerresources.com.au

|

|