White Rock Minerals Ltd (ASX: WRM); Zinc, Silver, Gold and Lead –3.7M Ozs of Gold Equivalent in Australia and USA; Interview with Matthew Gill, Managing Director & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/21/2019

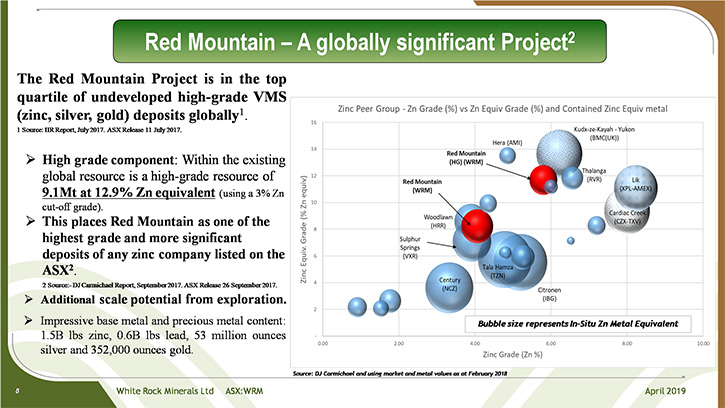

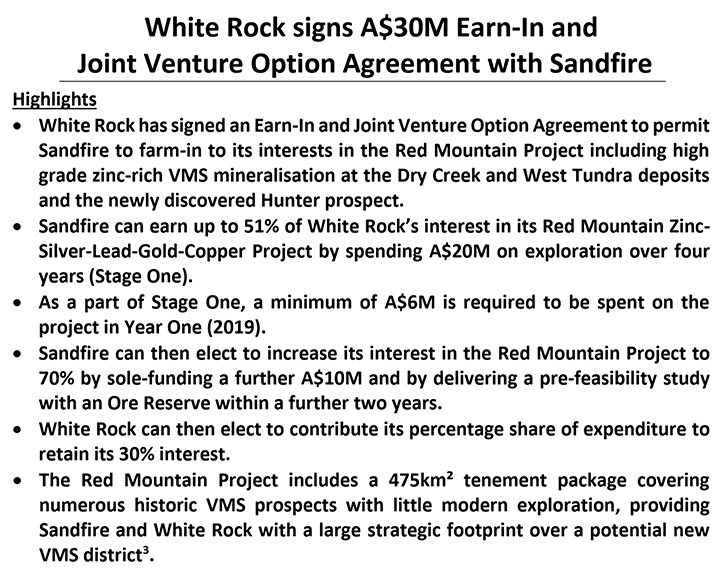

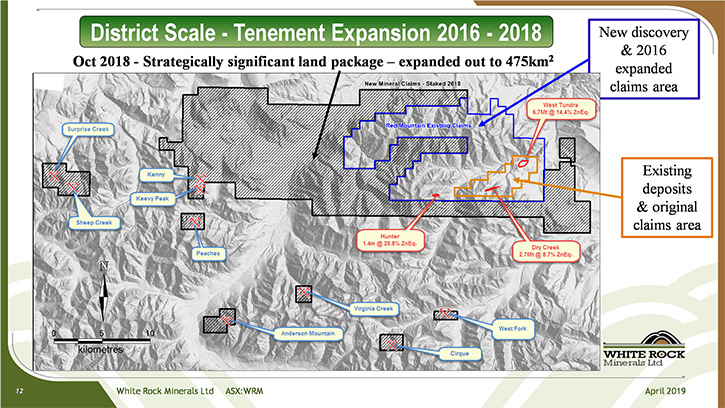

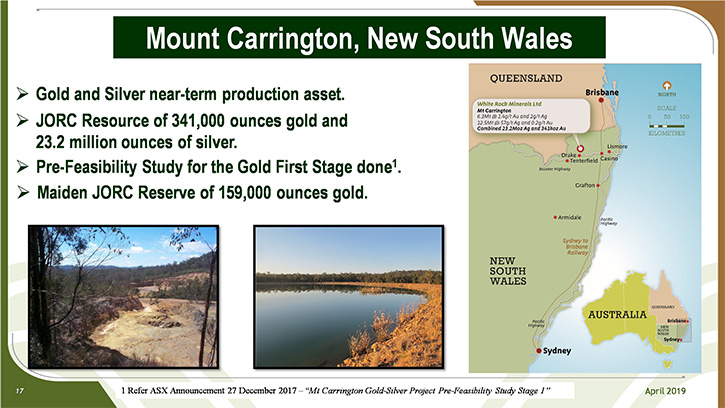

White Rock Minerals Ltd (ASX: WRM) owns 100% of, the globally significant, Red Mountain polymetallic volcanogenic massive sulphide (VMS) exploration project, in an established VMS district of central Alaska, where there is significant potential to discover several new large zinc-silver-lead-gold-copper deposits. This project has a recent maiden JORC 2012 Resource of 9Mt grading 13% ZnEq. We learned from Matthew Gill, who is Managing Director and CEO of White Rock, that in the beginning of the year they entered into a joint venture with Sandfire Resources, a billion dollar ASX-listed Company, to progress exploration at the Red Mountain. Sandfire has to spend $20 million Australian, over 4 years, before they can earn 51%, with an option to acquire 70%, by spending another $10 million. As part of that, in 2019, they have to spend a minimum of A$6 million. White Rock also owns 100% of the Mt Carrington gold-silver project in New South Wales, Australia, with a JORC Resource estimate, containing over 340,000 ounces of gold and 23 million ounces of silver.

White Rock Minerals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Matthew Gill, who is the Managing Director and also CEO of White Rock Minerals Ltd.

Matt, could you give our readers/investors an overview of what has been happening in 2019 with White Rock Minerals?

Matthew Gill: Very happy to Al.

White Rock Minerals is an ASX listed company, headquartered here in Australia. We have two projects. We have an advanced gold and silver project in New South Wales, here in Australia. Our current main focus is our other project, which is a high-grade zinc and precious-metals VMS project in central Alaska.

So, the first few months of this year saw us sign a transformative joint venture agreement, with another ASX-listed company, called Sandfire Resources. We went into a joint venture to help us progress exploration on our Alaska asset.

Dr. Allen Alper: That sounds excellent! And that is on your high grade zinc and precious metals, VMS Red Mountain Project in central Alaska, is that correct?

Matthew Gill: That's correct. Our Red Mountain project.

We delivered to the market a maiden JORC resource on that asset in 2016. It put that project in the top quartile of undeveloped zinc projects in the world, with 9 million tonnes, and an outstanding grade of 13% zinc equivalent.

We did our first exploration program there last year, in our own name, White Rock, and we're doing it all over again this year in a joint venture partnership with Sandfire Resources, a billion dollar listed company on the ASX. They're providing the funding. We have the first $2 million of that funding in our bank account already.

Dr. Allen Alper: That's excellent! That's really great. It's an outstanding project in a great area with great grades. It's nice to have a partner like Sandfire Resources on a project.

Matthew Gill: Yes. We obviously believed in the project when we acquired it, and we believed in it when we raised funds last year to conduct our exploration.

Sandfire is experienced in discovering, developing and operating VMS projects. They have a very high grade copper mine here, in Western Australia. They liked and could see what we were doing at Red Mountain. So much so, that they invested $2.5 million of their own money at the equity, at the head-co level. Now, they're our major shareholder, with 12.7%. That's a great vote of confidence and endorsement on the quality and potential of this asset.

But further, they're prepared to put up to A$20 million, before they even earn any percentage of this project, in helping us explore. We think that's a great vote of confidence and validation of what we see. It's nice to have another party endorse that. And I think that should give your readers/investors confidence that it's not just White Rock saying what we think, it's endorsed by a very successful independent party that's prepared to put millions of dollars into this project. The White Rock shareholders will be the beneficiary of the exploration news flow that will come from spending Sandfire’s money.

Dr. Allen Alper: Excellent! You've approved a $6 million Australian budget for 2019 exploration, is that correct?

Matthew Gill: That's right. So the joint venture agreement is in stages. The commitments are that Sandfire has to spend $20 million, Australian, over 4 years, before they can earn 51%. As part of that, in year one, they have to spend a minimum of 6 million, which is this year. So, that's that number. We already have just under half of that in our bank account, which has allowed us to start with our exploration program. I can come back to that.

The second stage then is the joint venture agreement. After they've spent $20 million to get 51%, if they elect to, they can move to 70% of the project by spending another $10 million, Australian, and delivering a feasibility study with a JORC reserve.

So you could see a scenario where they're the major joint venture partner. White Rock would still have great exposure, with 30%. But we are free-carried to feasibility study and JORC reserve. Sandfire will have to have spent a minimum of $30 million to get there.

When you consider that White Rock only paid $1 million for this project in paper, I would like to think that, that's a great outcome for White Rock and, obviously, its shareholders.

Dr. Allen Alper: That's outstanding. That's really showed that you and your team had great vision and power getting that project and exploring it, and getting it to where Sandfire was willing to invest a significant amount of money to develop it.

Matthew Gill: Yes, we're very happy. They're a great partner to work with. Not just because they're Australian listed, but they're the same DNA as ourselves. They're a mining company, they do exploring. And they've had the good fortune of making a great discovery in Western Australia and taking that through development and into operation.

We're looking forward to a great working relationship with Sandfire.

Dr. Allen Alper: Sounds excellent!

Could you tell our readers/investors a little bit about what's happening with the Mt Carrington Gold and Silver Project?

Matthew Gill: Sure. Mt Carrington was the asset that White Rock listed in 2010. So we've had this project for a while. At the end of 2017, we completed a feasibility study on the gold half of the project. It's an unusual project. Half of the value is in gold, and the other half of the value is in silver. So we're one of the few projects with genuine exposures to gold and silver.

We have a JORC resource for the gold and silver there, and a JORC reserve for the gold. It's on mining lease. Our next step is to seek a partner, funding, strategic or joint venture, to take it through the approvals process. That's our next major step.

Australian gold prices are very strong at the minute. US gold price has been up and down a little bit, but the benefit in Australia is we're exposed to the exchange rate, so we get an added kick if there's a favorable exchange rate movement, which there is.

There's currently strong Australian gold pricing. That has created some interest in this project, and we're having discussions with various parties on how we might take Mt Carrington forward, which we would do to add value for White Rock shareholders.

Dr. Allen Alper: Oh, that sounds excellent.

Could you tell our readers/investors a little bit more about yourself and your team?

Matthew Gill: There's a Board of four of us. Two of us are mining engineers. I'm one of them. Our Chairman is a mining engineer. Our Chairman is more experienced as a broker/ analyst and in business development, and in M&A with some of the bigger companies in this space, Oxiana and Newcrest, to name a few. He also sits on a few other boards. I'm more an operational type, from study through development, and operations. Then we have two business development people on our Board, finance, business development, M&A.

It's a good Board with broad technical, operational, and corporate capital markets experiences. And I'm ably assisted by an Exploration Manager, a geologist, who's worked in Australia and the Americas, with big companies and little ones. Big ones like Newmont and Normandy. He and I are really the two key executives. Then we have back office support, with the CFO and Accounting.

We're a very small team, with a little humble office, here in Ballarat, located about 100 kilometers outside of Melbourne.

But as a small company, we need to keep those G&A costs down, but all the while trying to grow the business, which is always a bit of a challenge. But, we think we're skilled.

In our experience, with the support of our shareholder base, we will continue to advance our projects.

Dr. Allen Alper: Oh, that sounds excellent.

Could you tell our readers/investors a little bit about your share and capital structure?

Matthew Gill: Yes, Al, sure.

We are not unusual in Australia, but I am aware that it is unusual, certainly on the TSX. We have a lot of shares on issue, about 1.6 billion shares on issue, which I know is hard to understand for quite a few people in North America. I have come across that. It's not unusual here.

We've never done one consolidation or rollback, as you would say. We have funded ourselves through equity raisings. So, that's how we've come to be where we are. But a rollback at some stage may well be in the cards.

We're a small junior. Our market cap in Australian dollars is around 11 million. So, it is a small market cap for a company that has two great projects, both that have JORC resources.

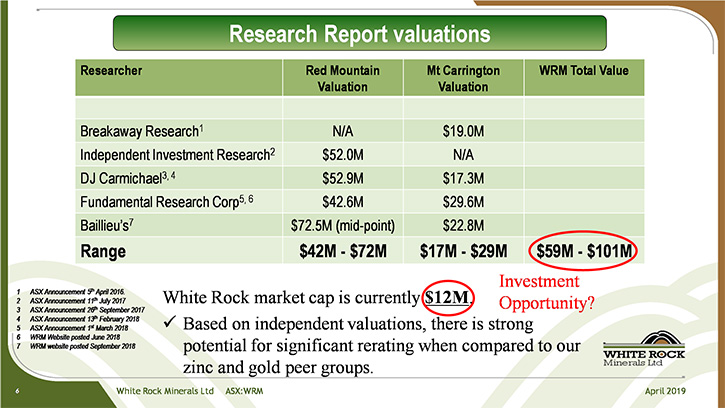

I guess my challenge, and I think the value uplift opportunity for an investor, is that there is a big disconnect, a big gap between the underlying value of our projects and the current market capitalization. And if your readers/investors want to have a look on our website, at our Company presentation, there's a particular slide in there that shows valuations for both Mt Carrington and Red Mountain, done by others, up to five different groups, that shows this gap. These are independent people, who have opined on the underlying value of White Rock and their current market capitalization.

I think, therein lies an opportunity for an investor, if and when we have a success and a re-rating. But obviously, I can't give financial advice, I would encourage your readers/investors to have a look at our website, the Investor Relations presentation and obviously seek their own financial advice. But I think there's a great opportunity there.

Dr. Allen Alper: It sounds like it's an excellent opportunity for our readers/investors to investigate White Rock Minerals and see if they would like to invest. It seems like the timing would be excellent. With all your programs going on in 2019, I'm sure a lot of information and data will be coming forward, which will increase the value of your project.

Matthew Gill: Yeah, that's right, Allen.

In its simplest terms we have $6 million of someone else's money, so non-dilutive at the shareholder level, coming into our project, generating $6 million worth of news flow, minimum, using modern exploration techniques that haven't been applied to this field before.

If and when we have exploration success, I'd like to think that the market will see that, and respond. Our news flow will be something to look out for.

Dr. Allen Alper: That sounds excellent, Matt, is there anything else you would like to add?

Matthew Gill: It's always great to have a chat with you, Al. Hopefully we'll continue to do this. Thank you for interviewing White Rock Minerals for Metals News.

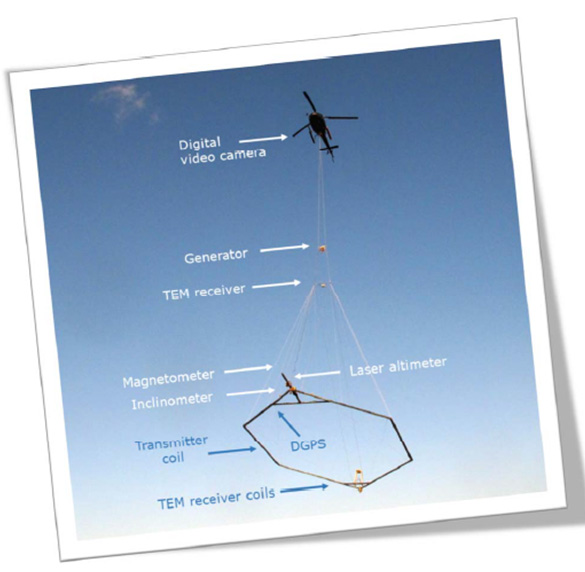

We have started our exploration program already, as we speak. We have just completed flying an airborne electromagnetic survey, which involves a helicopter slinging a large loop underneath it, and flying on a grid pattern over our 475 square kilometers of strategic tenements.

Airborne EM equipment being flown from underneath a helicopter

This area hasn't had this type of modern exploration tool applied to it. So, a very exciting time. That will help identify zones of response that then, the on-ground geologists can follow up to investigate. We have the camp already, and a drill already on site. We'll have that camp full with geologists and drillers around the third week of May.

So we've already started, and we're all ready to mobilize. We already have $2 million US to kick us off. I think the next four, five, six months, field season will be a very exciting time for White Rock.

Dr. Allen Alper: Sounds excellent! Very exciting! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.whiterockminerals.com.au/

Matt Gill (MD & CEO)

Phone: +61 (0)3 5331 4644

Email: info@whiterockminerals.com.au

|

|