Nevada Copper (TSX: NCU): Commence Production of Copper in USA Q4, 2019; Interview with Matthew Gili, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/15/2019

Nevada Copper (TSX: NCU) owns Pumpkin Hollow, a copper project that aims to commence production by the end of 2019. Located in Yerington, Nevada (USA), Pumpkin Hollow is host to an underground development and an open pit development.

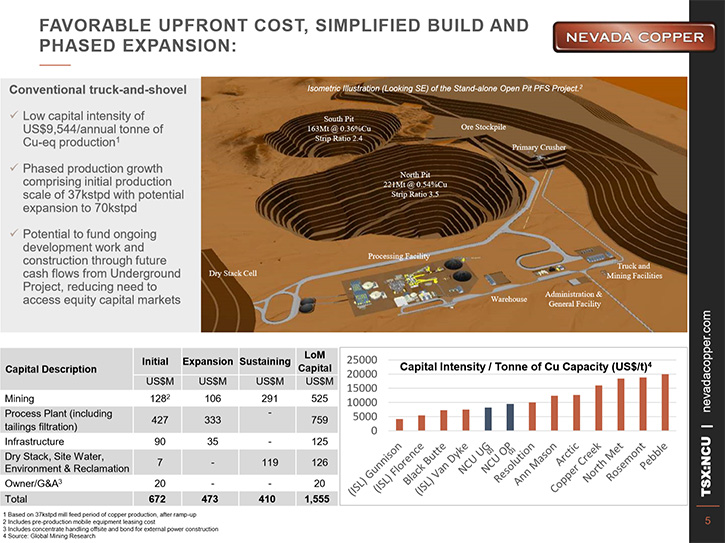

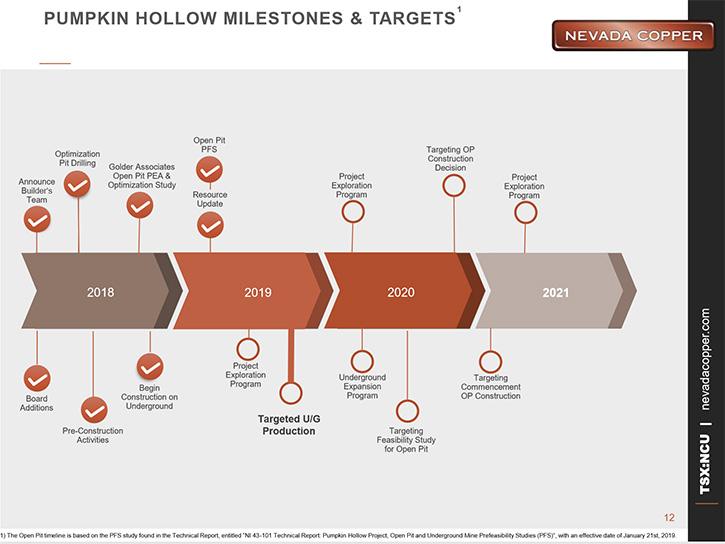

We learned from Matthew Gili, who is President and CEO of Nevada Copper, that the underground mine construction remains on track to enter production in Q4, 2019 and that the new open pit pre-feasibility study that was posted on April 17th, shows the ability to start operating the North pit at a low capital intensity, relative to peers, and use the cash flow generated to expand to the South pit. Together, the underground and open pit could achieve a peak annual Cu-eq production of 150,000 tons of copper.

As well as completing underground mine construction, the plans for 2019 include an exploration program that incorporates both some greenfield exploration on a new land claim they added to the Pumpkin Hollow project, as well as expanding the ore body knowledge in and around the open pit. According to Mr. Gili, copper is a commodity that is on the upswing and is seeing a very steady and robust demand.

Nevada Copper

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Matthew Gili, who is President and CEO of Nevada Copper Corporation. Matt, could you give our readers/investors, an overview of the new Open Pit Pre-Feasibility Study that was posted on April 17th?

Matthew Gili: Absolutely Al. What makes this PFS new, is both the ore body knowledge that we were able to use, combined with a different approach to maximize value from the open pit.

So really there are two things here. The first thing is the drilling campaign we did in 2018. We took the results of that drilling campaign and brought that into the resource model. We spent a lot of time fine tuning that resource model, making sure we had a very solid, a very robust model, with which to do mine planning.

The second thing is the way we've approached value. From our standpoint, value is all about your IRR, your ability to have a very low capital intensity, to be efficient with the use of capital, and to maximize returns to your shareholders.

We've approached this in a very similar way to how a gold mine approaches an open pit. This keeps it very efficient and allows us to conserve capital and target high returns by concentrating initial development on that higher grade North pit and bring those returns to the shareholders more quickly.

It also allows for the use of part of those cash flows, generated from the North pit, to fund the expansion into the South pit, and then the expansion of the entire facility, so that you're up to a 70,000 ton a day processing facility for the Open Pit, with a peak annual copper production of 111,000 tons of copper.

Dr. Allen Alper: Oh, that sounds excellent! Could you give our readers/investors a little more detail on the highlights of the Pre-Feasibility Study?

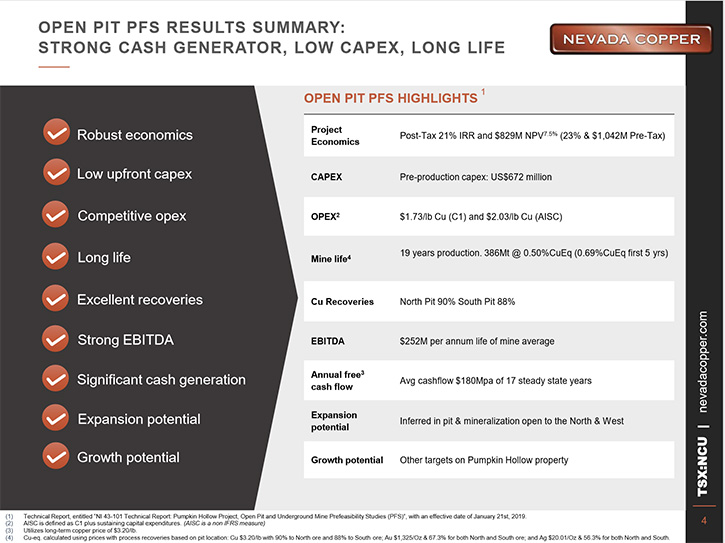

Matthew Gili: Absolutely. When you look at the study, you're going to see a project that has a post-tax IRR of 21%, a post-tax NPV of $829 million at the 7.5% discount rate. All of our figures are in US dollars, so just assume everything is US dollars. This is a mine that will have an annual copper production that peaks out at 111,000 tons per annum, with robust copper grades of 0.69 copper equivalent for the first 5 years with a C1 cash cost of $1.73 per pound. It's a robust open pit, it's somewhat modest in its size, but very robust in its return.

We talked about keeping it nice and efficient from a capital standpoint. The initial CAPEX for this is $672 million and gives you a very low capital intensity of $9,544 per annual ton copper equivalent. So, I'm really, really pleased with those results.

Its conventional truck and shovel. Also, a few things we have done with risk mitigation sets us apart, particularly with regards to tailings. We are a dry stack tailings facility. Our underground is being built as a dry stack facility right now, and the open pit will also be built as a dry stack facility. That takes away a lot of the risk of a tailing storage facility, and we really value that derisking.

We are fully permitted, we're in a mining town, in a mining state, surrounded by people who value mining and appreciate the benefits that a good, responsible mining partner can bring to the community.

Dr. Allen Alper: Well that sounds very promising! What are the next objectives going forward?

Matthew Gili: As we take the project to feasibility, there are a few spots we're really going to concentrate on. The first one is Ore Body knowledge. If we look at our 2018 campaign, those results were extremely positive. All the holes hit mineralization, some holes even hit mineralization that was outside of the existing pit boundary, so this is all potential expansion. At the same time, we also recognized there were several areas inside the open pit where we had inferred mineralization inside the open pit. So, we will also be drilling that out to be able to bring that into the reserve calculation.

A couple weeks ago, we announced our exploration program for 2019, which will pursue Ore Body knowledge in and around the open pit. This will include infill drilling within the deposit, with the goal of converting Inferred resource to Indicated resource. It will also include some confirmation drilling around the edge of the deposit to make sure we know the limits of the boundaries. However, the program also incorporates some greenfield exploration on a new land claim that we picked up, a new land parcel that we picked up earlier this year. I'll touch on that later.

So, there are two things we're going to focus on as we go to feasibility. The first thing is the Ore body knowledge. The second real work program that we're going to focus on is fine tuning and bringing together that estimate for the processing facility, a very well-engineered facility.

We did that with the underground, and that allowed us to do an EPC contract. We really like the low risk profile of the EPC contract. We're very pleased with how our EPC contract is going for the underground. What you need in order to go into an EPC contract is to have a high level of engineering because once you go into the contract you can't make changes to the design. So, we did that with the underground. We're very pleased with that. We're going to use that same process when we go into the feasibility study for the processing plant for the open pit.

Dr. Allen Alper: That sounds like an excellent approach. While you're doing this, you'll also have plans going forward to get into production underground in 2019. Is that correct?

Matthew Gili: That is absolutely right, Al. The underground development is going well. It's a fascinating project. I live here, I moved myself, and my family, and my team, and my corporate headquarters to Reno, and that's where we're based, so we can be onsite. We can influence how construction is going, and it is going really well. We're on schedule, and we're within a standard variance of 3% of budget and I am extremely proud of that target.

Dr. Allen Alper: That sounds excellent. I know you put together a mine building and capital markets expert group. Could you tell our readers/investors about yourself and some of the team members on that group?

Matthew Gili: Okay, absolutely. I am a Mining Engineer. I've been in the business since 1990. I graduated from the University of Idaho, and had the opportunity to travel around the world. I started off with Hecla Mining and Silver in North America, traveled around North America and Mexico, and then ended up in Alaska. I then had the opportunity to be the Mine Manager at Greens Creek in Alaska and that was a fantastic opportunity.

From there I moved to Africa and took over, first as the General Manager, and then as the President and Managing Director, of Palabora Mining Company, which is a large copper operation in South Africa. I was just thrilled with the job and the lifestyle. I just loved South Africa. That job was with Rio Tinto.

From South Africa, I moved to Mongolia, where I was the Chief Operating Officer for Oyu Tolgoi, and took that massive copper deposit, in the Gobi Desert, through construction into operational readiness, and brought that into production. I’m very proud of the accomplishments there with Oyu Tolgoi.

Then I moved off to Barrick and took over the Cortez operations. I ran those for several years before I moved to Toronto as the Chief Technical Officer for Barrick, before coming to Nevada Copper.

For me personally, I just couldn't be happier here at Nevada Copper. It is the best balance I've ever had; personal happiness and career happiness. It's a great team of people to work with. It's a great community to live in. It's challenging and its rewarding. I'm really thrilled to be able to see Pumpkin Hollow develop, and to grow this mine and to grow this Company. So, that's me.

We really pulled together a great team of people, who understand mining. We brought in people with that same skill set. We brought in a Chief Commercial Officer, Mark Wall. He was my colleague at Barrick, and he has an extensive background in all of the really hard places to work such as Tanzania and Argentina. He's seen it all and he's able to adjust and adapt to any environment and to any situation. That's a skill that I really appreciate. He's a great asset to the Company.

We have David Swisher, as our highly accomplished Senior Vice President of Operations. He comes from an underground background, most recently Stillwater.

We have Braam Jonker, who is a very seasoned CFO, with multiple companies including Western Coal, and also Rich Matthews, who guides the Company through its investor relations and helps get the message out that we are doing something really special at Nevada Copper.

Dr. Allen Alper: You and your team have a very strong background, and a great track record of success. I can see how you all are equipped to go forward, bringing Nevada Copper to production on the two levels, underground and eventually open pit. Could you give our readers/investors the primary reasons they should consider investing in your company?

Matthew Gili: That is a brilliant question. It really comes down to two things. The first thing is that we have a very robust, a very minable, a very value-adding copper deposit. Copper is a commodity that is considered to be on the upswing. We've been seeing a very steady and robust demand. As the world turns to technology and innovation you're seeing this copper demand. Copper is a commodity for the future, and we're very proud to be part of being involved with that commodity. The second thing is, when you are now going to invest in copper, you have to look around the world and see where there's copper available in terms of favourable jurisdictions. And, there isn't a better place for copper to be available than in Nevada.

We’re basically in a mining city, in a mining state, that's amenable to mining. We have no endangered species, we have extremely low environmental impact. And logistics; we don't have to build a camp, we don't have to barge materials to the mine site. We're 30 miles from highway I-80, we're near the Tesla Gigafactory, we're just over an hour away from the Reno International Airport. All this translates into an operation that is very low risk. It's very low risk from the standpoint of community and environmental safety. It’s very low risk from the standpoint of logistics, and attracting the right people, and being able to operate in a very mining friendly environment.

That’s the story for Nevada Copper. You have this very robust deposit in a very low risk environment. Now, when you talk about the future of Nevada Copper, you talk about that entire land package. The current Pumpkin Hollow deposit is one tiny part of a much larger picture. We had 15,000 acres that we controlled, and we've added another 5,000 acres to that. We’re excited about this new land because this is all extremely prospective ground. To use mining analogies, we're hunting for elephants and we're in elephant country. The Yerington district is an historic copper mining district. We're really fortunate. We have multiple occurrences of ore-grade copper mineralization on surface. We just need to understand our deposit and develop it and explore this enhanced land package that we now control.

Dr. Allen Alper: That sounds excellent. Those are extremely strong reasons for our readers/ investors to consider investing in Nevada Copper Corp. It's great to have such a great mine being developed this year, with another one fully permitted and a pre-feasibility study done. Also to have robust economics, the potential for growth and for exploration and development. It is excellent to be in Nevada, where mining is held in high regard. They have extremely pure copper, if my memory is correct.

Matthew Gili: That is right, the Fraser Institute just came out with that, Al. Nevada was 3rd, and now they're number 1 and yes, we have very clean concentrate.

Dr. Allen Alper: That's excellent! So, you have the right location, the right product, the demand for copper is growing and it looks like for electric vehicles that demand is continually growing. It looks like you're in the right place at the right time, and with the right product. Looks like Nevada Copper has everything going for it.

Matthew Gili: My team and I certainly think so, Al.

Dr. Allen Alper: That's excellent! That's an enviable position to be in.

Matthew Gili: Absolutely.

Dr. Allen Alper: Matt, is there anything else you would like to add?

Matthew Gili: No, I think you've been very thorough, Al, in all that we've talked about. We've talked about the underground that is in construction right now. We'll be having our first production from the underground in the fourth quarter of this year. We just put out the PFS for the open pit, which is extremely robust. As we finish up and come to the next stage of the open pit study, we'll take that to the Board for a construction decision at the end of 2020. Then we’ll talk about the exploration program that we've just announced for the year. As we get more results, we'll keep you informed.

Dr. Allen Alper: That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.nevadacopper.com/

Rich Matthews,

VP Marketing and Investor Relations

Phone: 604-355-7179

Toll free: 1-877-648-8266

Email: rmatthews@nevadacopper.com

|

|