Interview with Rob McEwen, Chief Mining Owner and Chairman of McEwen Mining Inc. (NYSE: MUX, TSX: MUX)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/11/2019

McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a gold and silver producer, with principal assets in the Americas: the San José mine in Santa Cruz, Argentina (49% interest); the Black Fox mine in Timmins, Canada; the Fenix Project in Mexico; the Gold Bar mine in Nevada; and the large Los Azules copper project in Argentina, advancing towards development. We learned from Mr. Rob McEwen, who is Chief Owner and Chairman of McEwen Mining, that while they went through some deferral of revenue in the first quarter of 2019 and had to do a financing, the Company is still looking at 16% increase of production over the last year and a very good exploration upside. Mr. McEwen believes that gold is under-owned and has a substantial growth potential.

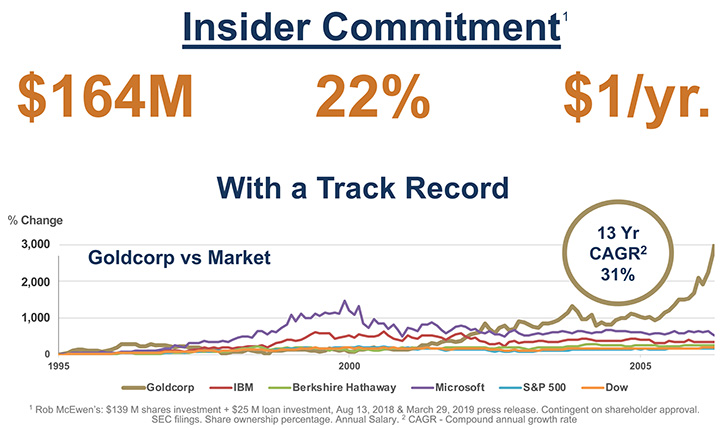

Rob McEwen is the founder and former Chairman and CEO of Goldcorp Inc., which was one of the largest gold producers in the world and recently merged with Newmont. Newmont Goldcorp is now

the world’s leading gold company and a producer of copper, silver, zinc and lead. In 1990, Rob transitioned from investment industry into the mining industry. By 1993, he had begun a consolidation of five companies that would take eight years to complete. The resultant company was Goldcorp Inc., which became a gold mining powerhouse. During the last thirteen years of Rob being Goldcorp's CEO, the company’s market capitalization grew from $50 million to over $8 billion and its share price grew at a compound annual rate of 31%.

Rob was awarded the Order of Canada in 2007 and the Queen Elizabeth's Diamond Jubilee Award in 2013. He holds an Honorary Doctor of Laws and an MBA from York University and a BA from the University of Western Ontario. Also, he received the 2001 PDAC Developer of the Year Award, was inducted into The Canadian Mining Hall of Fame in 2017 and received the 2018 Bryden Alumni Award for Outstanding Contribution.

McEwen Mining Inc. image of Gold Bar mine under construction

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Rob McEwen, who is Chief Owner and Chairman of McEwen Mining.

Rob, I wonder if you could give our readers/investors your insights into what's happening with gold, silver and copper, and the marketplace, and what you see happening in the future.

Mr. Rob McEwen: Happy to Al. Looking at gold and silver, I call them cheap, unloved, and a very good store of value. Right now seems to be an opportune time for your readers/investors to be thinking about adding precious metal to their portfolio!

To illustrate how under-owned gold is, one just needs to compare the value of the gold stocks in the S&P to the value of aggregate market capitalization of all the companies in the S&P. There is only 1 gold company in the S&P, which has been recently renamed, Newmont Goldcorp. Its market cap is less than 0.1% of the S&P’s aggregate market capitalization. The S&P index represents approximately 80% of the value of all the public companies in America.

Investors have been ignoring gold, because its price performance has been weak relative to the performance of the S & P and the Dow. So, if gold is performing poorly, why should investors think about buying gold equities? Well, if they looked a little closer at the sector, they probably would be quite surprised by how well gold equities have performed.

Since the beginning of 2016 to May 7, 2019, while gold is only up about 21%, and the S&P is up 41% and the Dow is up 49%, and the GDX (the ETF for the intermediate and senior gold stocks) is up 51% and amazingly outperforming the Dow! While this performance has pretty much gone unnoticed, I believe we are in the early stage of a gold bull market and it is time for investors to be establishing a position in gold and gold equities.

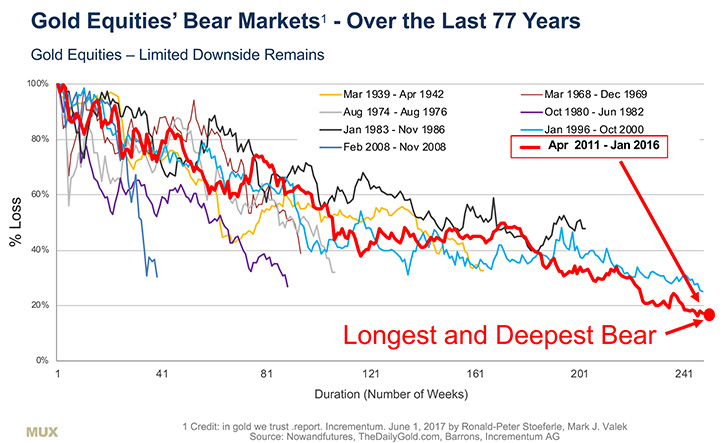

I'll throw in another observation. In the last 77 years, there have been eight bear markets for gold equities. But the last bear market we were in, started in 2011 and finished at the end of 2015. It was one of the longest of the eight bear markets (shown as the red line in the chart below) and it was the deepest. It lost the most value, losing greater than 80% of its value. That suggests to me, that the downside risk is low!

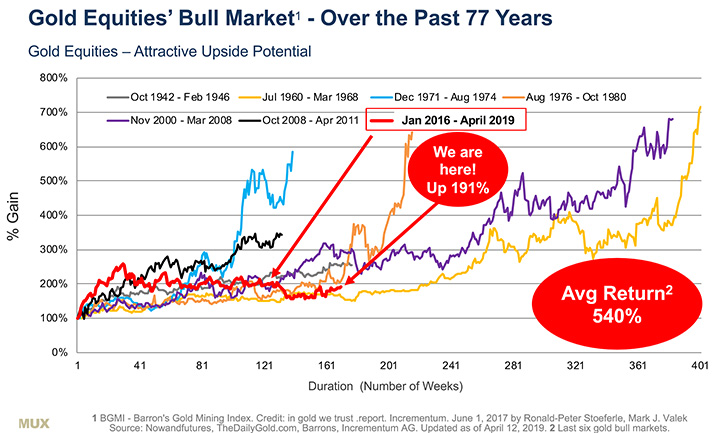

During that same 77 year period, there have been six gold equities’ bull markets, where the average return has been 540%. Today, we are in the seventh bull market, which started in January 2016 (shown as the red line in the chart below). As you can see the 7th bull market is currently up 171%. So, the upside potential to reach the average gold equities bull market return of 540% is more than 2 1/2 times from where we are today.

One of the largest hedge fund operators in the world, Ray Dalio of Bridgewater Associates LP, has been advocating since last fall, that one should have 5-10% of their investment portfolio in gold as a form of diversification.

Another factor to consider is a large number of central banks are buying gold. The largest buyers have been Russia, China, Turkey and India. They have been using dollars to buy gold. Recently, the Bank of International Settlement, which is based in Switzerland and is the lender to central banks around the world, has permitted central banks, for the first time, to value their gold holding at market rather than their cost. Thus central banks now acknowledging that gold is money.

Now let’s talk about McEwen Mining. During the first two month of 2019 we experienced some difficult operational issues at 2 of our 4 mines that effectively interrupted our revenue for 2 months. So, at the end of February, it was looking like our gold production and revenue for the quarter was going to be very low. As a result, we completed an equity issue of $25 million in March in order to satisfy a working capital covenant associated with our $50 million debt, I am delighted to say that: one, we are fully funded to cover all our activities planned for the year; and two, we made a big recovery in March as gold production and our revenue increased significantly. The operating issues have been resolved and we are looking forward to a strong Q2 performance.

We expect to declare that our new Gold Bar mine in Nevada has achieved commercial production later this quarter.

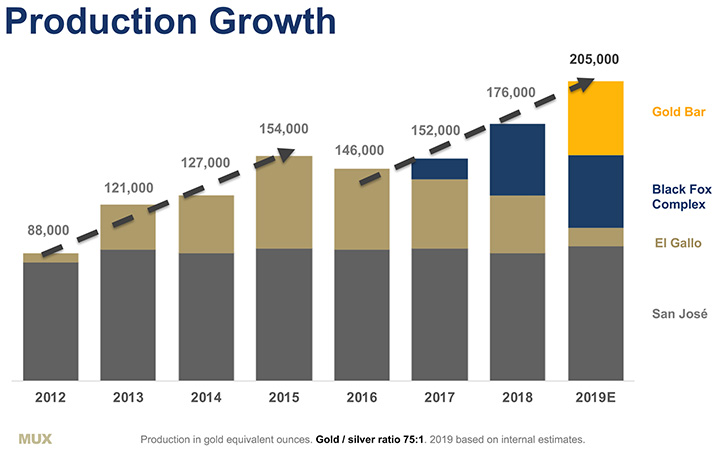

In 2019, we expect to produce a total of 205,000 gold equivalent ounces, with the mines contributing the following production: San Jose 92,000; Black Fox 50,000; Gold Bar 50,000 and El Gallo in Mexico 13,000. Production grew 16% from 2017 to 2018 and we expect to generate the same rate of growth this year.

We have a large exploration program of $27 million this year. Some $17 million will be spent at Black Fox in Canada, $5 million at Gold Bar in Nevada, and $5 million at San Jose in Argentina. We have a number of exciting targets that we will be testing. As a result, there will be a steady stream of exploration news generated throughout the year.

In Argentina, we also have a large copper project, Los Azules. While we do not yet have any reserves defined there, we do have a mineral inventory of indicated and inferred resources totaling close to 30 billion pounds of copper. A preliminary economic assessment has been completed in 2017 that showed a very robust economic return at a copper price of $3/lb. This project provides MUX with great optionality to the copper price in addition to its gold and silver production.

Dr. Allen Alper: That sounds very good. Sounds like 2019 will be an excellent year for McEwen Mining both in operations and exploration.

Mr. Rob McEwen: Yes, we are looking forward to lowering our production cost per oz. of gold and silver and through exploration build our reserve and resource base.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in McEwen Mining?

Mr. Rob McEwen: There are a number of good reasons why your readers/investors should consider buying shares of MUX. First, as you said earlier, McEwen Mining is rather unique in the industry, due to the financial alignment or commitment of insiders, principally myself. Where the cost base of my investment in MUX is $164 million; Second, I believe the operational difficulties of Q1 are resolved and behind us, but our share price has not recovered, so now is a good time to buy; Three, our treasury is full and not under any pressure; Four, We have four sources of production. We produce gold and silver and we also have a large copper deposit. These assets are located in Canada, the United States, Mexico, and Argentina. We have production growth this year. We have a large exploration program that will be generating news throughout the year; and Five, we have a growing and diversified production base.

Furthermore, if your readers/investors believe that the price of gold is going higher and they want an investment with good leverage to gold then they should seriously consider McEwen Mining (MUX). Because, according to Bloomberg News, MUX has one of the highest betas to gold in the gold mining industry, a beta of 3.1.

In addition, MUX trades on the NYSE and TSX exchanges. It has good market liquidity and 90% of its daily trading occurs on the NYSE. MUX is a Colorado corporation. Therefore, McEwen Mining is one of the very few gold-producers in the world that could qualify for inclusion in the S & P because to qualify a company must be incorporated in America.

Dr. Allen Alper: Well those sounds like very strong reasons to consider investing in McEwen Mining. I'd like to point out that my family I are invested in McEwen Mining.

Is there anything else you'd like to add, Rob?

Mr. Rob McEwen: Al. I would like to emphasis again that our portfolio of properties provides exposure to three important minerals: gold, silver and copper. I find our copper exposure particularly intriguing, given its size and the potential to have a significant positive impact on the value of MUX, due to the growing demand for copper in the manufacture of electric vehicles.

Dr. Allen Alper: Excellent! Thank you very much Rob. I appreciate talking with you and getting more insight on what's happening in the gold and precious metals and copper markets, and also in getting an update on what's happening with McEwen Mining.

Mr. Rob McEwen: You're most welcome, Al. Thank you for your continued interest and being a share owner of McEwen Mining!

Dr. Allen Alper: You're very welcome. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Disclosure: The Alper family owns McEwen Mining stock.

https://mcewenmining.com/

Mihaela Iancu

Investor Relations

(647) 258-0395 ext. 320

info@mcewenmining.com

|

|