Condor Gold (AIM: CNR; TSX: COG): Developing 2.4 million Oz. of Gold at Four Grams in Nicaragua: Interview with Mark Child, CEO and Dave Crawford, Chief Technical Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/3/2019

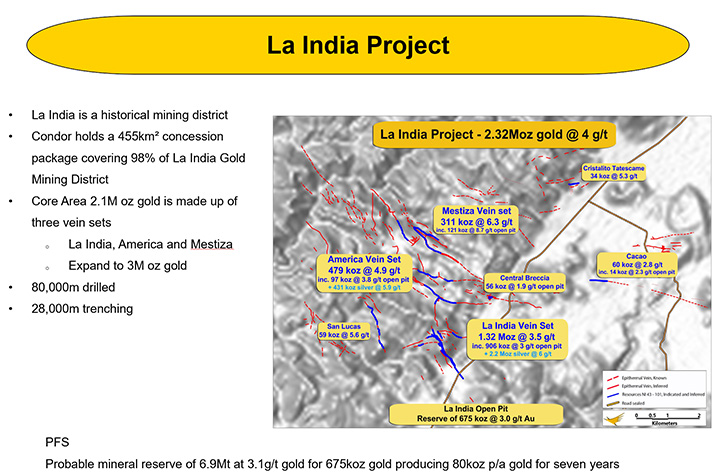

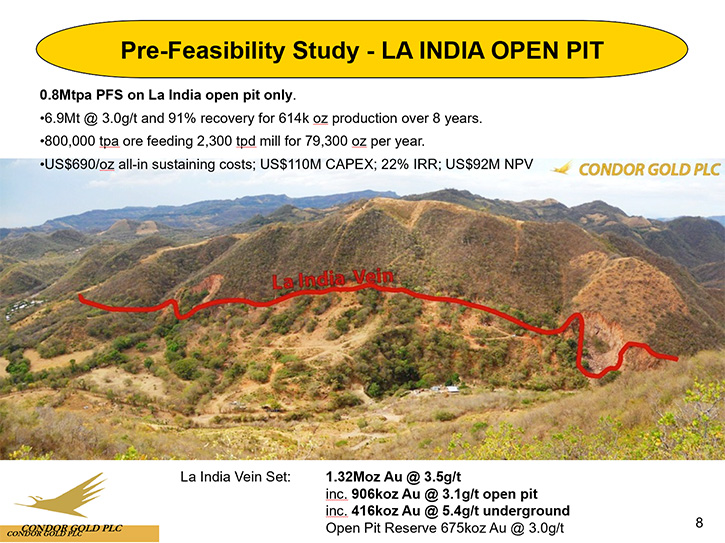

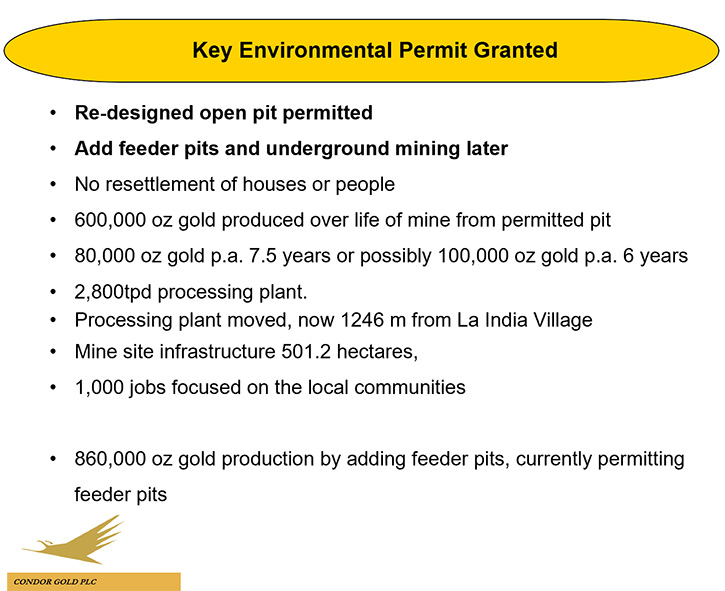

Condor Gold (AIM: CNR; TSX: COG) is focused on developing and further proving a large commercial reserve on its 100% owned, La India Gold Project in Nicaragua. In August 2018, Condor received an Environmental Permit for the development, construction and operation of a processing plant, with a capacity of up to 2,800 tonnes per day and associated mine site infrastructure at La India. At PDAC2019, we learned from Mark Child, who is the CEO, and Dave Crawford, who's the Chief Technical Director of Condor Gold, that they have 2.4 million ounce of gold at four grams, and they are looking for initial production of about 120 thousand ounce of gold, from open pit for seven years.

Mark Child, CEO and Dave Crawford, Chief Technical Director of Condor Gold at PDAC 2019

Condor Gold Plc

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, here at PDAC 2019, talking with two executives from Condor Gold; Mark Child, who is the CEO and Dave Crawford, who's the Chief Technical Director. Mark, could you give us, Metals News and our readers/investors, an overview of your company?

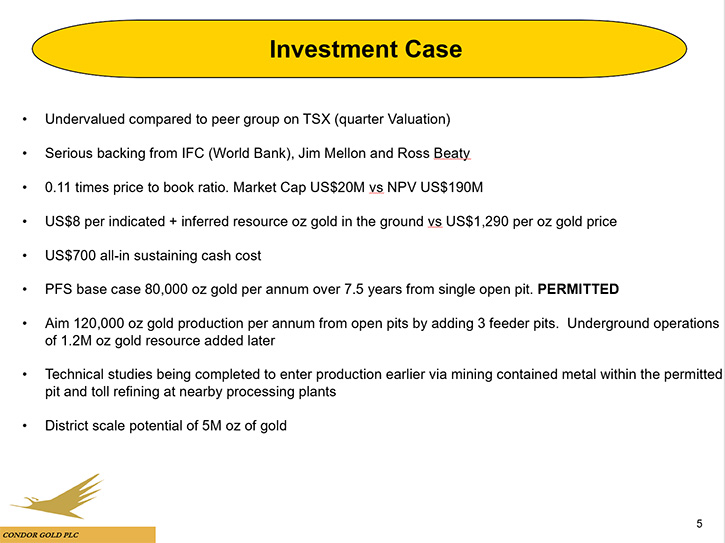

Mark Child: Certainly. Thank you for interviewing us for Metals News. Condor Gold is a jewel listed on the A market in London and on the TSX. The resources and reserves are in Nicaragua. We have 2.4 million ounces of gold, at four grams per ton. The reserve portion is 675 thousand ounces of 3 grams, open and visible. The all in sustaining cash costs are 690 US dollars an ounce. We believe we're in a major gold district. Strategy-wise, we're planning to construct and operate a mine there. We received the permits to construct and operate the mine in August last year, so we're fully permitted to construct. We can add feeder pits and satellite pits into the production, and we're looking to have initial production of about 120 thousand ounces of gold, from pittable material, for seven years.

Mark Child: In addition to that, we have high-grade underground of about 1.2 million ounces of gold, just around five and a half grams.

Dr. Allen Alper: Maybe, Dave, you could tell us a bit about the geology of the area and more detail on the deposits.

Dave Crawford: The geology itself, it's essentially a classical vein-hosted, low sulfidation, epithermal system. It's narrow vein, relatively speaking, but for our areas, they're pretty good. Economic areas are upwards of two to more in some cases, five, ten liters. What we've been finding, as a rule, is that the geology is driven by structure, as most of these are, and our best intersects are usually found along dilation openings that resulted from the tectonic activity in Nicaragua. Looking at the maps, you'll notice most of the structures are parallel, typically around a kilometer, a little over a kilometer apart. Other than that, it's relatively straight forward. You have to drill it accessibly to be able to find what you want. We have surface trenching. We have 80 thousand meters of drilling and another 20 thousand meters of trenching in the surface. So it takes some work to get it, but the grades are very rewarding.

Dr. Allen Alper: That sounds very good, Dave. Mark could you tell us a bit about your team and yourself?

Mark Child: Yes, certainly. We have four Directors on the Board. I am Chairman and CEO, we have Andrew Cheatle who's former CEO, PDAC with Goldcorp. For eight years he was the chief geologist of the Musselwhite Mine. We have Jim Mellon, who's an entrepreneur, who has 10% of the company. We have Kate Harcourt, who is in charge of environmental. So that's the Board of Directors. The local Chief Technical officer is Dave, with whom you've spoken here. He's been with us for five years. I have been with the company for 12 years, but I had a finance background for 20 years before this. So I run the ship. I've raised about 55 million US dollars, which has all gone in to Nicaragua’s developing this 2.4 million ounce gold deposit.

The team on the ground is all Nicaraguan. We have former VG Gold mine superintendents. VG Gold has two producing mines in the country. So we have mining engineers from both general managers and running the show. We have an environmental team down there, social team, geologists, accountants. We have all the officers up at the field camp. That's the team, about 45 people on the payroll in country.

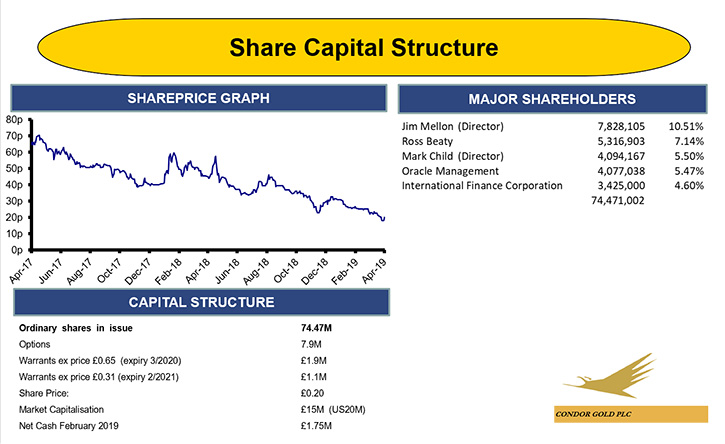

Dr. Allen Alper: Sounds like you and your team have a great background, well positioned to carry through, with your work and development production. Could you tell us a bit about your capital and share structure and your balance sheet?

Mark Child: Yes certainly. Management owns about 60% of the Company. I have 6%. Jim has just over 10%. The other shareholders are Ross Beaty, who has 7%. The IFC, the world bank investment arm, has about 5%. We have a number of institutions. So about 40% of the shares are held by 6 shareholders. They're all institutional, long term. We have 74 million shares outstanding in the Company, and letter warrants and things which are out of the money. Cash-wise, we have just over two million US dollars in cash, in the bank at the moment. We raised money last month, so we're funded through for this year.

Dr. Allen Alper: That sounds great. Mark, could you tell our readers/investors the primary reasons they should consider investing in your company?

Mark Child: Well there are two main ways to evaluate gold exploration companies. One is ounces in the ground and the other is based on a price to book ratio. If you look at the ounces in the ground, we are trading at ten dollars an ounce in the ground, so that's pretty low. It's about a quarter of the average, compared to the average Canadian listed company. You saw Dow Radian Resources in Northern Ireland, which is un-permitted, was acquired for 50 dollars an ounce in the ground. That discount is partly due to Nicaragua and partly because we haven't been marketed in Canada or the United States. So there is a discount.

Mark Child: For price to book, we're about .18 times price to book value, so we have a market capitalization of 25 million US. We have an NPV of 190 million US dollars, just on pure value basis. That gives nothing for the outside potential of the project. We have a huge land package, and we're fully permitted. A lot of countries aren't permitting mines. We're fully permitted to construct and operate a mine. We own 100%, unlike most of Africa, where you have to give 20% away to the government for a free carried interest, we own 100% of earnings. Our project numbers are good. The all in sustaining cash costs have a matrix lower quartile at 690 US an ounce and the IRR's at mid-30's percent. So everything's stacking up for us. We think the project size can double.

Dr. Allen Alper: That sounds excellent. Could you say a few words about how it is operating in Nicaragua?

Mark Child: Yes. Nicaragua is run by President Ortega, and has been for 12 years, and the Sandinista National Liberation Front. I've been operating down there for 12 years. Until the crisis last year, it was the safest place in Central America, had the lowest murder rate per capita. The message from the government was more, "Come and invest, come and make money, but don't get involved in politics." It went through a crisis last year where about 320 people were killed according to the United Nations. That's a tragedy, and we as a company encourage peaceful dialogue and a peaceful solution. After six months of no talks, talks started again last week on Wednesday, brokered by the EU. The talks were held in Panama. They're behind closed doors, and the different parties have come together for a dialogue to find a political solution.

Mark Child: So I hope there will be a solution in Nicaragua. The economy needs it, and the country needs it. I don't believe that the President would've agree to those talks unless they'd agreed to the basis for the talks and professional mediators.

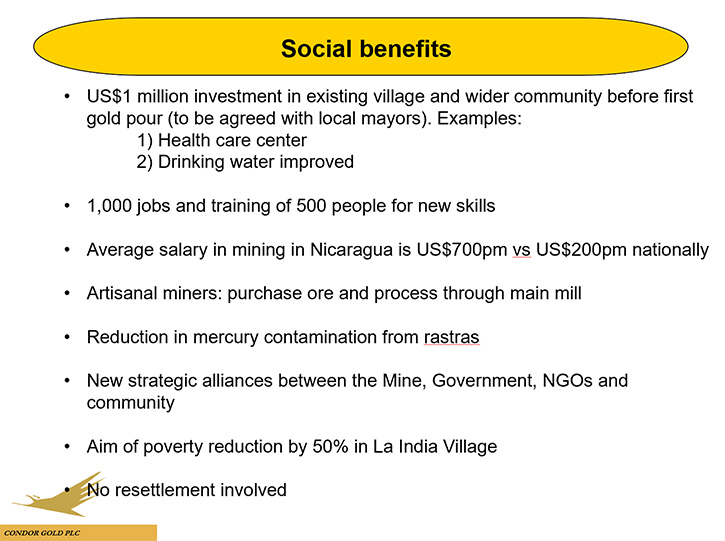

Mark Child: In terms of working, we were permitted last year. We found the government very receptive. The government, clearly with the crisis they had, doesn't see tourist arrivals as boosting the economy, so mining is a priority. Gold's Nicaragua’s biggest export, after coffee and beef. They want to see bond investment. We have a permitted mine. We were granted a new concession in December last year. In fact, we're going to announce in the next couple of days, that we're permitting these additional feeder pits to make the project 50% bigger. So it's in permitting mode as a Country, and you can operate down there. We've worked very well with the ministries. You have to, of course, get the community on your side. But every mining project around the world has to look at that. This is a former mining town that closed in 1956 by Miranda, who mined it. We do a lot in the community. We have a big social team, and we're very conscious, with the World Bank supporting us, to get a social license to operate. That's very high on our agenda to reduce poverty in an old mining town that has about 40% poverty levels.

Mark Child: We've found it quite a good place to operate. Not without its challenges, but you can do business there. If you have a problem, you can talk to the government about it, and they can help mediate and find solutions.

Dr. Allen Alper: That sounds very good. Sounds like things are improving and getting stabilized. It's good that you have all your permits in place, and it sounds like you have a great opportunity to grow the resource. What is your view on the opportunity for discovering more gold?

Dave Crawford: We have a huge land package. We've had a couple of areas that are largely unexplored, the Andrea corridor, for example. We went up there and we had some rock chip samples that were 150 gram per ton and then 30 meters away was another 50 grams per ton. We put some holes into it. We actually hit some decent grades up there, which for epithermal mold systems, is very impressive. You don't normally hit something that's economic on your first real drilling effort in an area. Then of course we have the Kakoa area, which we extended this year. We also have the Santa Barbara area. We knew something was out there and we started sampling it. There's expansion potential there. Our biggest problem is we have too many targets. It's really a very, very open area. This has the earmarks of what I would say could be another large gold district.

Dave Crawford: They started off with a relatively small operation, and they just keep finding more and more gold. You have to drill for it, but it's still out there, and they keep finding more. I suspect we're sitting on exactly that kind of a deposit here.

Dr. Allen Alper: That sounds excellent. It's nice to have a problem where you have to focus on which place to drill and explore first. You have all that potential for growth. Is there anything else you'd like to add, Mark?

Mark Child: Just to conclude, we're a quarter of the value of the average exploration company. We have the critical mass of 2.4 million ounces and we're at ten dollars an ounce to gram, less than .2 price to book. We own 100% of it. We have lower quartile sustaining cash costs. It is permitted good to go, it's largely de-risked. There are very few companies with these qualities.

Dr. Allen Alper: Well that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.condorgold.com/

Condor Gold plc

Mark Child, Chairman and CEO

+44 (0) 20 7493 2784

|

|