Seabridge Gold (TSX: SEA, NYSE:SA): 45 M Oz of Proven or Probable Gold Reserves, Exceptional Leverage to Rising Gold Price; Interview with Rudi Fronk, Co-Founder, Chairman, & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/11/2019

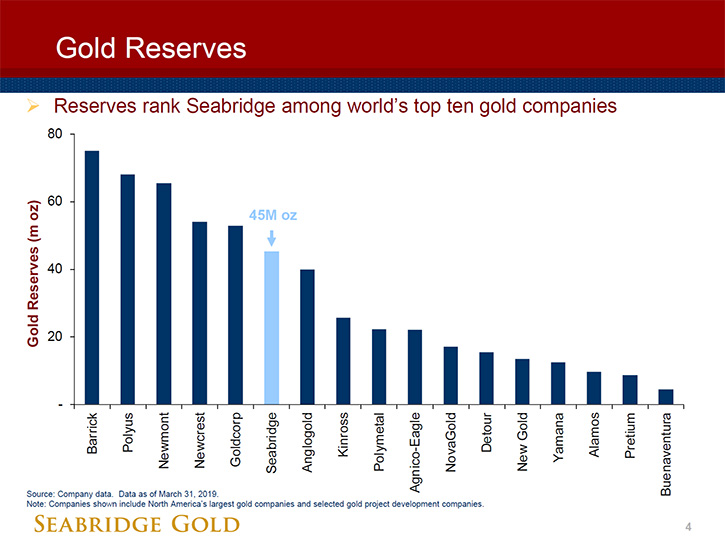

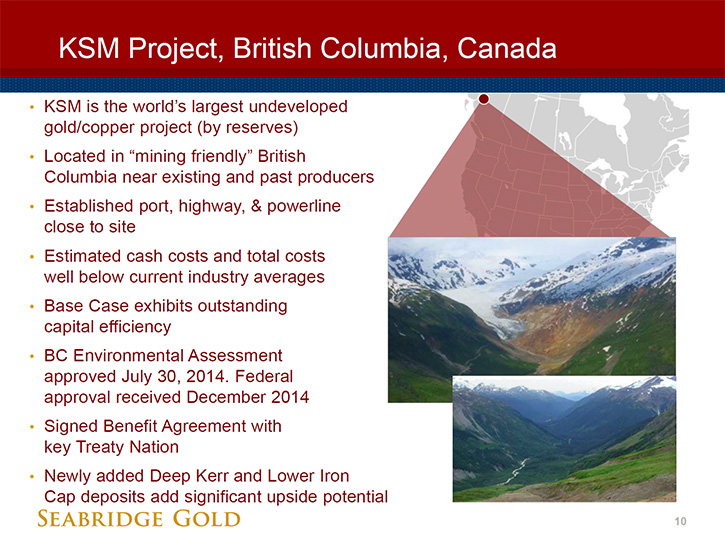

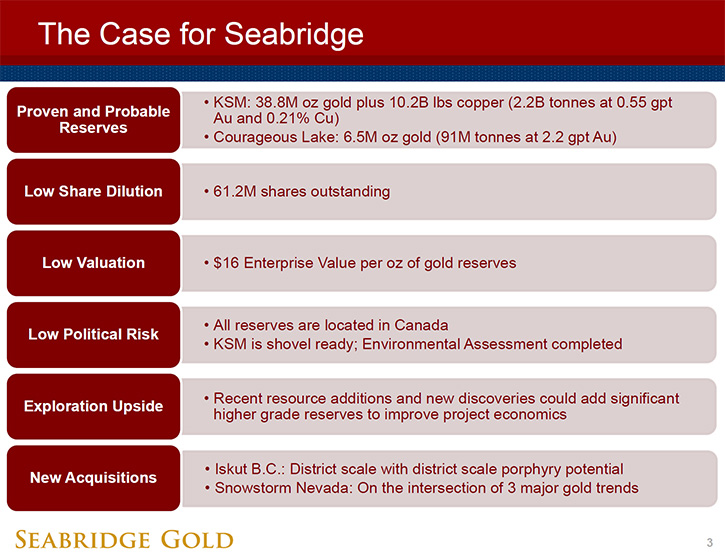

Seabridge Gold (TSX: SEA, NYSE:SA) is a gold exploration company, designed to provide its shareholders with exceptional leverage to a rising gold price. The Company holds one of the world's largest resource bases of gold, copper and silver, in keeping with its prime objective of growing resource and reserve ownership per share. We learned from Rudi Fronk, who is Co-Founder, Chairman, and CEO of Seabridge Gold, that they are sitting with 45 million ounces of proven or probable gold reserves, most of which are situated under their KSM asset, located in northern British Columbia. KSM is one of the largest undeveloped gold-copper projects on the planet. With copper and silver credits, the all-in sustaining costs at KSM will be about $350, which would be one of the industry’s lowest all-in cost.

Seabridge Gold KSM Project

Dr. Al Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rudi Fronk, who is Co-Founder, Chairman, and CEO of Seabridge Gold.

I wonder if you could give us at Metals News and our readers/investors an overview of your Company, and also tell us what differentiates Seabridge from other gold companies.

Rudi Fronk: Happy to do that, Al. We formed Seabridge in October of 1999, when the price of gold was trading at about $260 per ounce. We believed that the price of gold would go substantially higher over time, which obviously it has. Our goal back then, which remains the same today, is to build the best leveraged play to a rising gold price.

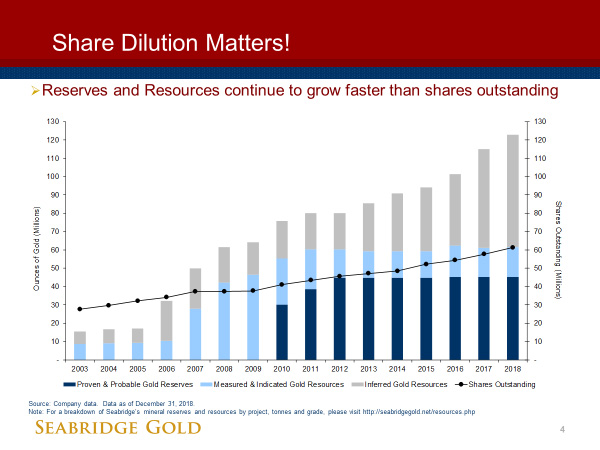

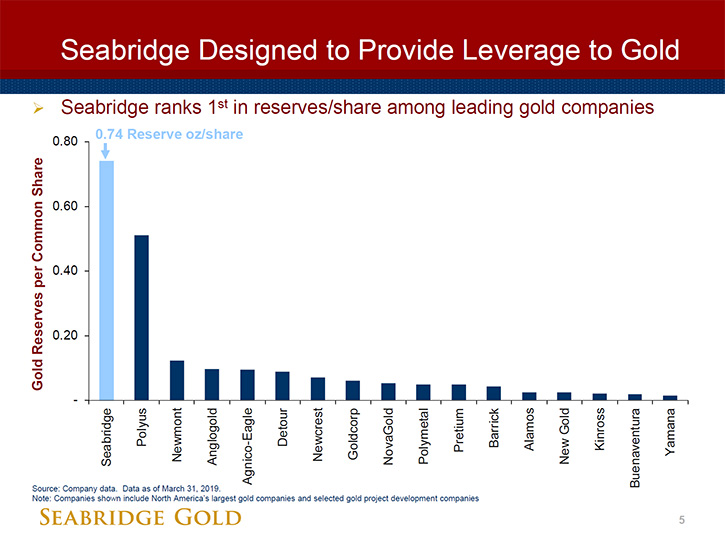

We do that through the disciplined approach of trying to offset equity dilution with accretion in gold ounces. Everything we do, from exploration through acquisitions, is focused on growing ounces per share. I think that really is a key differentiating factor between ourselves and other companies.

Our industry is hell-bent on converting gold into cash and losing money at it. They're not very good allocators of capital. If you look at the junior sector in particular, a lot of dilution happens over time without any real value being added.

If you look at our track record over the past 20 years now, we've done a good job of growing ounces in the ground while minimizing share dilution. In essence our shares represent an un-expiring call option on the gold price.

Dr. Al Alper: That sounds excellent. Could you update our readers/investors on your current reserves?

Rudi Fronk: We are sitting with over 45 million ounces of proven or probable gold reserves, 39 million of which are located at our 100% owned KSM project located in northern British Columbia. KSM is an asset that we've worked diligently for the past 10 plus years. At KSM we have over 50 million ounces of measured and indicated gold resources, and over 50 million ounces of inferred gold resources. In addition, KSM also hosts significant copper reserves and resources.

It is one of the largest undeveloped gold-copper projects on the planet. Not only is it large, it's also very capital efficient, based on the engineering studies we've completed.

In our most recent mine plan, we're able to show a project that would have an all-in cost of production of about $350 an ounce including the upfront capital, the sustaining capital, the closure costs, and operating costs, less copper and silver credits. Compare this to the industry average of the major gold mining companies of about $800 per ounce.

We've taken our project through the environmental assessment process. This project is now shovel-ready, with permits in hand to start construction.

Dr. Al Alper: That's excellent. Could you give our readers/investors an overview of what's happening in the industry, with other gold companies and what's happening to the need for more gold, and how gold reserves are being depleted by most mining companies?

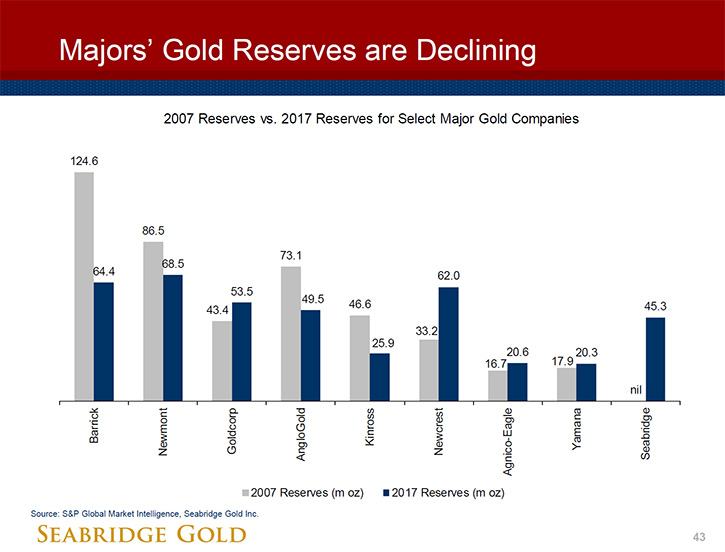

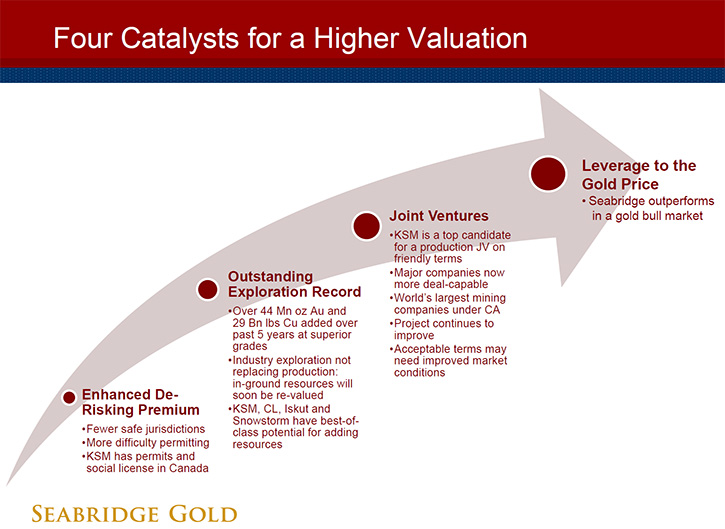

Rudi Fronk: The elephant in the room, on which not many people are focusing right now, is that gold reserves are dropping at the major mining companies. If you look at the gold industry, the reserve life left in terms of what they report as reserves, relative to their production, is only about 10 years. This is the shortest reported reserve life that I can remember in my 38 years in the business.

Also, the fact is that the major gold companies are not replacing reserves as they mine them. If you look at the decade of the 1990s, the gold companies did a good job basically finding 1.4 ounces of gold for every ounce that they mined.

The next decade, that was cut in half. Only finding about 7/10ths of an ounce for every ounce that they mined. The most recent decade is even worse, down to about 0.3 ounces for every ounce they have mined. They're not replacing reserves through their own exploration activities, which forces them to go out and buy new projects. Owning 100% of a project like KSM bodes well for our shareholders as there are very few opportunities available of scale for the majors to buy into. Having permits in hand as well as being in Canada only strengthens our position in talking with the majors on a KSM deal.

Right now, in the senior space, you're seeing consolidation going on between the biggest companies in the business, combining entities to create even larger companies. What they will need to do next is to find new projects as they now have an ever-growing void to fill without any significant opportunities within their own portfolios.

That's what Seabridge was designed to do…to provide big new projects for when the majors are hungry for them and willing to strike a deal that is acceptable to our shareholders.

Dr. Al Alper: That sounds like you're in an excellent position, with all those great reserves and the majors depleting their reserves. Sounds like the time will come when they make you a really good offer.

Rudi Fronk: We believe so.

Dr. Al Alper: Could you also tell us a bit about your potential for growth; what you're doing there?

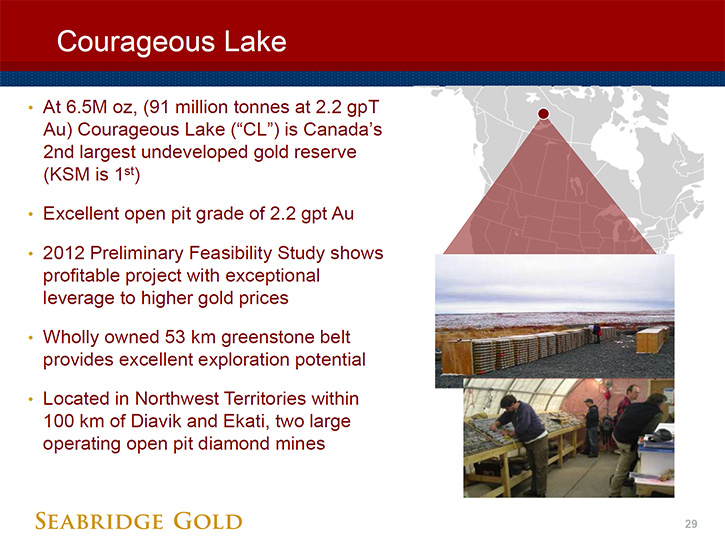

Rudi Fronk: People tend to forget that we are not a single asset Company. We have three other 100% owned projects that we believe can drive future value for our shareholders. At Courageous Lake, which is located in Canada’s Northwest Territories, we have 6.5 million ounces of proven and probable gold reserves with considerable room for expansion. Before we put one drill hole into KSM, Courageous Lake generated a market cap for our shareholders of nearly $500 million. Today I would be surprised if there was any value in our share price for Courageous Lake.

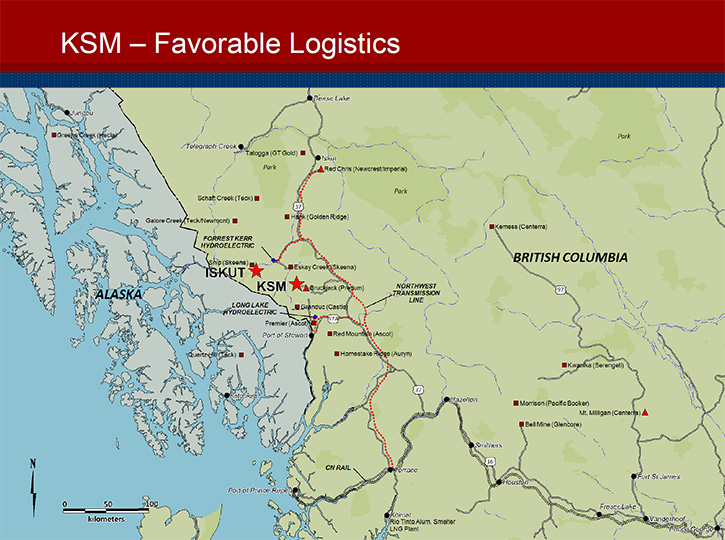

We also took advantage of the downturn we saw in the gold space over the past five plus years and went out and did two new acquisitions. One is a project called Iskut, located only about 30 kilometers from KSM. We believe it presents another KSM opportunity, a big porphyry system that is yet to be properly explored. We'll be back doing programs at Iskut later this year.

Our most recent acquisition is a large land package in northern Nevada. It sits on the intersection of the Getchell Trend, the Carlin Trend, and the Nevada Rift Trend, which host many of the best mines in Nevada.

This year we'll be doing our first drill program at Snowstorm, where we believe we have the potential to find a Turquoise Ridge or Twin Creeks style deposit.

Dr. Al Alper: That sounds excellent. Could you briefly talk about how your locations compare to any other locations? What is the advantage being in Canada and the U.S., compared to some of these other locations?

Rudi Fronk: Well, from a jurisdictional perspective, I've operated globally during my 38 years in the business. I've had mines expropriated. I've learned the hard way how real political risk can be.

I tend to believe that Canada right now is probably one of the best jurisdictions to be in, in terms of rule of law, the ability to permit projects, and also a government that is essentially pro-resource development because of the large impact the mining sector has on the GDP of Canada.

Specific to KSM, when we bought the project in June of 2000, it was pretty logistically challenged. No real major roads, no power, and no ports. If you fast forward to today, we now have three big logistical advantages at KSM. Number one, we have a major north-south highway that is situated just east of KSM.

Second, along that highway, the governments of Canada and British Columbia have now spent over $700 million extending the power grid in anticipation of mine development in the future. We'll be able to tap into that grid, and buy power off the grid for about five cents per kilowatt hour, which is some of the cheapest power in the world.

Then finally, just to the south of us, in the town of Stewart, two new port facilities that have been recently built will allow us to bring supplies in by ship and concentrates out on a year-round basis. Most other large undeveloped projects around the world are lacking these logistical advantages. Access to roads, access to cheap power, and access to ports really makes a big difference for a project like KSM.

Dr. Al Alper: That's excellent! Could you tell our readers/investors a little bit more about your leverage to the gold price and what you think might happen with gold in the future?

Rudi Fronk: We built the Company on the basis of growing ounces per share. If you look at the end of 2018, we had just over 61 million shares outstanding. In terms of total resources, we have approximately 60 million ounces of measured and indicated gold resources plus an additional 60 million ounces in the inferred category. That's about two ounces of gold per share, which is probably 10 to 20 times more gold ownership per share than any other company on the planet.

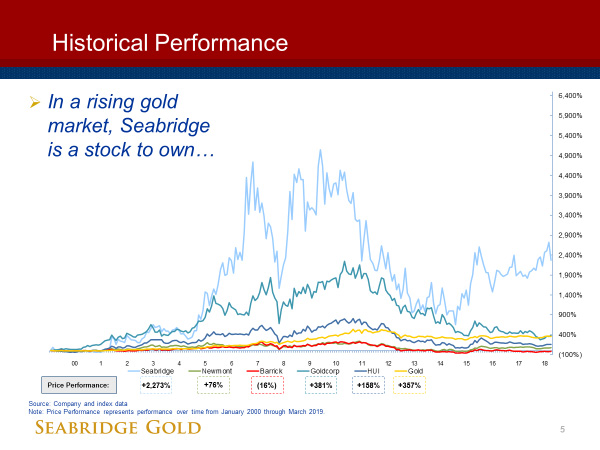

Let’s look at our track record in the marketplace over the past 20 years. The price of gold is up by about 360%. Our share price is up by over 2200%. Meaning that on average, over the past 20 years, we've outperformed the gold price by about 6 to 1. This means that, on average, every 10% increase in the gold price has resulted in a 60% increase in our share price.

That's pretty significant outperformance relative to gold as well as outperformance to just about every other gold equity. If you believe that the price of gold could go higher from here ... which we believe it will ... and you look at our track record over the past 20 years, and what we've delivered in terms of growing gold resources over the past few years, I would argue that Seabridge is definitely a stock to own in a rising gold market environment.

Dr. Al Alper: That sounds excellent. Could you tell us a little more about your share structure, where your shares are listed? Then also, a little bit about your balance sheet?

Rudi Fronk: We are dual listed, with a listing on the New York Stock Exchange, as well as the Toronto Stock Exchange. Liquidity is decent; on average, we trade about 400,000 shares a day or better.

Many of our shareholders have been with us a long time, and it's very concentrated. If you look at our insiders, including Albert Friedberg and his related entities, insiders, employees and co-founders collectively own over 30% of the Company. You would be hard pressed to find another company in our space with that level of insider ownership.

Dr. Al Alper: That sounds excellent. Could you tell us a little bit about your balance sheet?

Rudi Fronk: Yeah, we started the year actually with one of the strongest balance sheets we've ever had: over $20 million in the treasury and no debt. That cash gets us through to the end of the year and beyond. We tend to do a financing about once a year, depending on what our needs are for the upcoming year. We always try to have enough cash on the balance sheet by year end to get us through the next year.

As we advance through this year's programs, at KSM, Iskut, and Snowstorm, we will determine what our needs would be for the following year, and then look to have that balance sheet re-strengthened by year end.

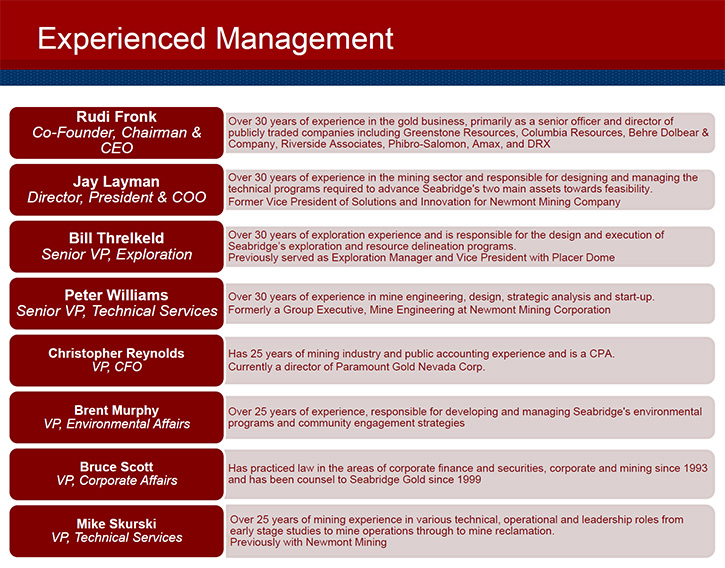

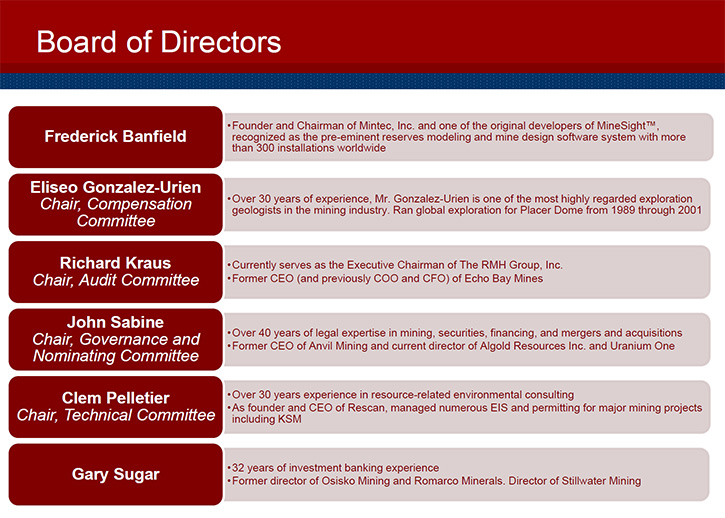

Dr. Al Alper: That sounds excellent. Could you tell our many, many new readers/investors, and refresh the memories of our others, about your background and Management team and your Board?

Rudi Fronk: I was educated as a mining engineer at Columbia University, and also did graduate degrees at Columbia in mineral economics and finance. I've been involved with mine exploration and development my entire career with project’s around the world. I recognized early in my career that there are a lot of better engineers out there than I am. My management style is to bring in the best talent possible, those that have successfully found and developed mines in their past, and just stay out of their way.

If you look at our team, most have come from the major mining companies. It's a strong team, with a lot of big project experience, involved with successful mine discoveries as well as taking projects through exploration, development, and into production.

Dr. Al Alper: That sounds excellent! Very strong team, and you and your team have excellent backgrounds and excellent experience and know what you're doing. You also have skin in the game. That's very important.

Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Rudi Fronk: Well, first, if you're a gold bug, which I will readily admit that I am, this is the stock to own. You look at our ounces per share, our relative performance to gold and other gold equities, it definitely is a stock that gold bugs should own. At our current share price, you are buying ounces in the ground at less than $10 per ounce.

Secondly, if you're not a gold bug, but you want to have gold as part of a balanced portfolio, you want an investment that gives you the best bang for your buck in case you need it as insurance. If you look at our track record, again, relative to gold and other gold equities, and the market itself, Seabridge has delivered when you need to call on that insurance.

Then last but not least, we own 100% of the largest undeveloped gold-copper project in the world today. There's no question that the major gold companies need new projects; they're running out of reserves. The big base metal companies also need big copper projects because there's not a lot of new opportunities out there for them to develop in safe jurisdictions.

We've made it very clear that KSM is a project that we do not intend to build on our own. We would like to joint venture that with a major mining company. We have turned down proposals over the past few years. We only get to do this once; terms are far more important than timing to us. But when we do get a deal done on KSM, I believe a lot of value will be unlocked very quickly in terms of share price performance.

We now have a large short position against us in the marketplace. Over 20% of our float is now short. My understanding of the argument for those shorts is we won't get a deal done with a major mining company. I believe we will.

When we do, I would expect to see a significant move in the share price, just as a result of short covering, let alone new investors coming in because of what we've been able to achieve.

Dr. Al Alper: That sounds like you're in an excellent position, and our readers/investors should look very closely at what you're doing, and what the opportunity is for them. Is there anything else you would like to add, Rudi?

Rudi Fronk: Something our largest shareholders appreciate is that we have kept to the same strategies since we started Seabridge. You won’t suddenly see us abandon our principles to pursue inconsistent objectives.

I want to thank you for interviewing Seabridge Gold for Metals News.

Dr. Al Alper: I'm impressed with what you and your team are doing. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://seabridgegold.net/

Rudi P. Fronk, Chairman and CEO

Tel: (416) 367-9292 · Fax: (416) 367-2711

Email: info@seabridgegold.net

|

|