Aethon Minerals Corp. (TSX-V: AET): Well-Funded Mineral Exploration Company, Focused in South America; Interview with John Miniotis, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/28/2019

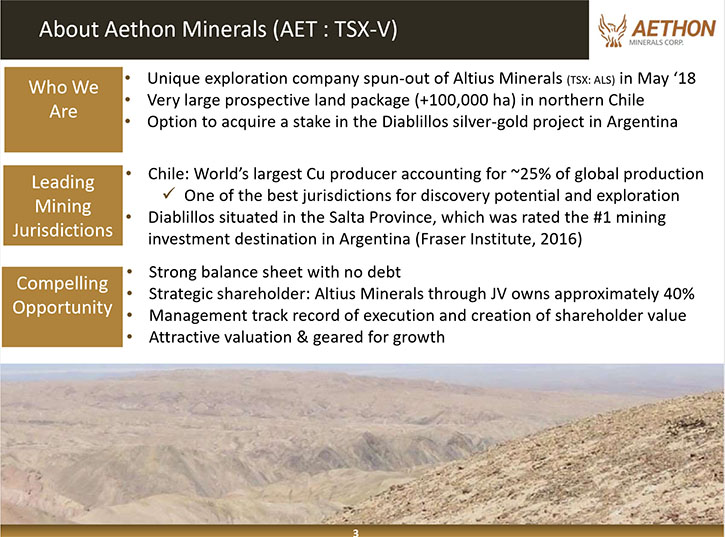

Aethon Minerals Corp. (TSX-V: AET) is a well-funded mineral exploration company, focused in South America. They were spun out of Altius Minerals, in May of 2018, with over 100,000 hectares of prospective land package, in northern Chile and a goal to advance it and to find potential partners to explore the properties. We learned from John Miniotis, Interim CEO of Aethon Minerals, that the Company recently entered into an option agreement to acquire an interest in the advanced-stage Diablillos silver-gold exploration project, owned by AbraPlata Resources in Argentina. The project has over 80 million ounces of silver and 750,000 ounces of gold, in measured and indicated resources. Near term plans include doing detailed due diligence on the Diablillos property and working out an option agreement with favorable terms.

Aethon Minerals Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Miniotis, who is Interim CEO of Aethon Minerals Corp. I wonder if you could give our readers/investors an overview of your Company. Then I'd like you to tell us what has taken place since our last interview, highlights of what has been accomplished in 2018, and your plans for 2019.

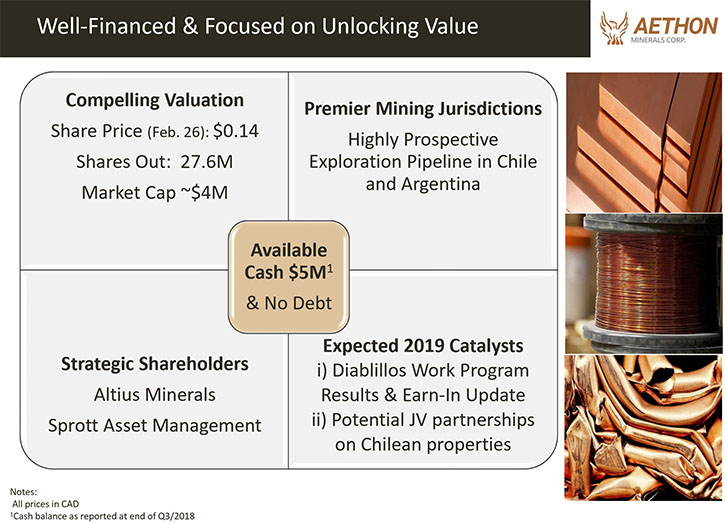

John Miniotis: Absolutely, Aethon Minerals is a well-financed, exploration company. We're focused in South America. In May of 2018, we were spun out of Altius Minerals, a large base metal royalty company.

We have a very large prospective land package in northern Chile, consisting of over 100,000 hectares of prospective Greenfields exploration ground. Our primary focus for those assets has been to advance those properties by identifying potential partners that would be interested in earning into the projects.

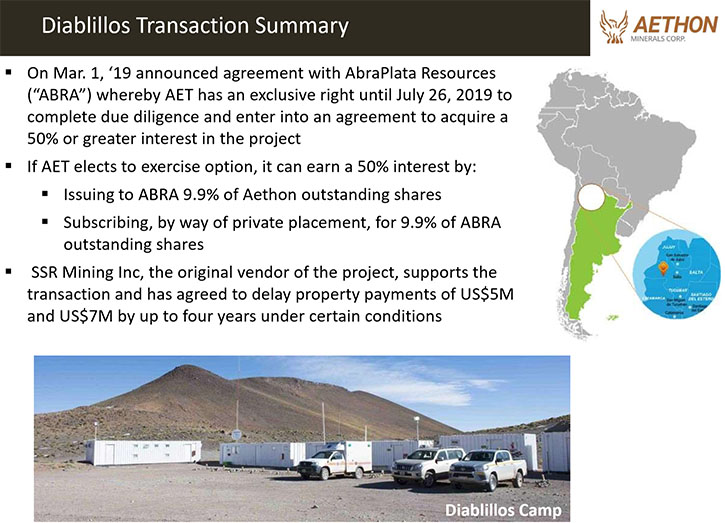

In addition, since we last spoke with you about a year ago, we recently announced an agreement on a project in Argentina, with a company called AbraPlata Resources. The project is called the Diablillos Silver-Gold Project. It has over 80 million ounces of silver and 750,000 ounces of gold in measured and indicated resources. It's quite an advanced stage exploration property and we think there is still a lot of room to expand the high grade resource.

We now have exclusivity until the end of July of this year. We have about four months to do some final detailed due diligence, at which stage we can earn into the project on favorable terms. So that's really the focus of Aethon in the near future.

We're very well financed. At the moment we have over $4 million in cash. Our market capitalization at this time is also about $4 million. We're trading very cheap, similar to most exploration stage companies, but we think this is quite a unique risk-reward profile for our shareholders. We have lots of upside here, based on our asset base in Chile and Argentina, and the fact that we're basically trading at cash value, offers a significant unique opportunity for shareholders.

Dr. Allen Alper: It sounds that way. It sounds great. John, could you tell us a little bit more about your Management Team and your Board of Directors?

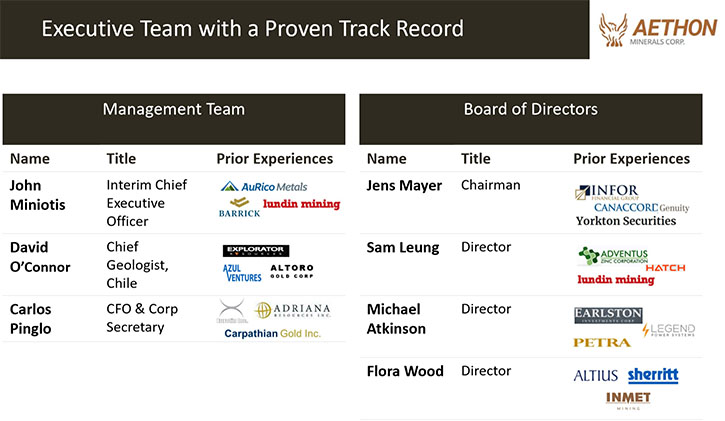

John Miniotis: Yes, absolutely. I'm the interim CEO. I have a finance background, with 15 years of experience, primarily focused on corporate development and M&A. Prior to Aethon, I worked on the corporate development side for Barrick, for Lundin Mining, and most recently AuRico Metals. We also have our Chief Geologist, David O'Connor, based down in Chile. He has over forty years of experience and is responsible for reviewing opportunities on the ground.

The unique thing about Aethon is that because we're a spin-off of Altius and Altius is our largest shareholder, we rely quite heavily on them for their technical expertise. That's a unique advantage. That's why we're able to keep our head count so low. We run quite a tight ship here. We rely heavily on Altius for technical due diligence. They provide their services to us at no cost, so we benefit greatly from our unique relationship with Altius.

Altius also has one seat on our Board. Regarding our Board, Jens Mayer is our Chairman. Jens is well known to most people in the capital markets. He's a Principal at INFOR Financial. He's a geologist by background and has spent most of his career in investment banking. I feel that we have a very strong, lean, capable team in place. With the support of Altius as our largest shareholder, I think we're in a great situation.

Dr. Allen Alper: All right. Sounds like a good position to be in to have the support of Altius. That gives you both technical and financial support, so that sounds excellent. Could you tell our readers/investors a little bit about your capital structure?

John Miniotis: Yes, of course. We’re very tightly held with only 27.6 million shares outstanding. Of that, Altius owns about 40% through a JV partnership that they have. Then Sprott Asset Management is also a strong strategic shareholder of ours. They own about 10% of our shares outstanding, so a very tight ownership structure. We're currently trading at about $.14 a share, so only a $4 million market cap valuation.

Dr. Allen Alper: That sounds very good. It sounds like a big opportunity with the properties that you're exploring in Argentina and in Chile. Could you tell us a little bit more about your Chilean properties and also your silver-gold properties in Argentina?

John Miniotis: Sure. I'll start off with Diablillos, which is the Argentinean property. On March 1st of this year we announced an agreement with AbraPlata Resources, where we have the exclusive rights until the end of July of this year to complete detailed due diligence and enter into an agreement to acquire at least a 50% interest in the project.

As I mentioned, that project has a large existing resource, with over 80 million ounces of silver and about 750,000 ounces of gold. That project came to AbraPlata through SSR Mining. In total there's been over $35 million that has been spent historically on the property. We feel there's still excellent exploration up-side, particularly at depth, where some of the gold intercepts that have been intersected remain open and are very high-grade.

We like the exploration up-side of the project. We're currently conducting our review of the existing PEA and we should have some additional information to announce to the market by this summer.

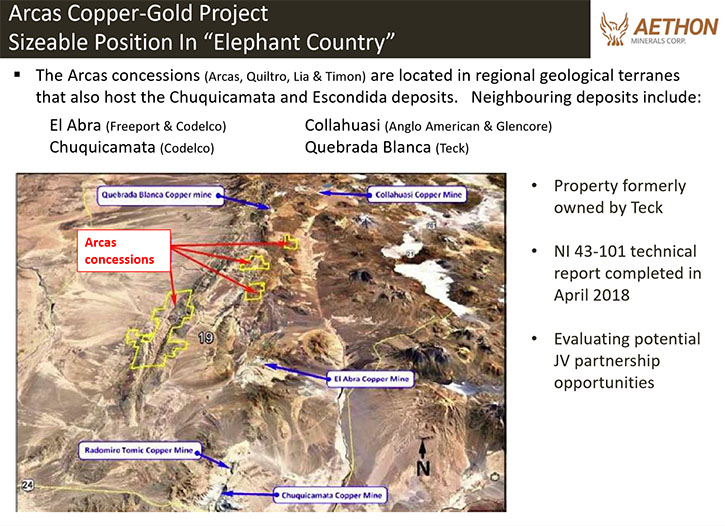

Then in Chile, we have a very large strategic land package, consisting of over 100,000 hectares. Certainly a unique opportunity there, as well, very well-positioned in northern Chile. Of course, Chile is the largest copper producer in the world. Our properties are situated in some of the most prospective belts. Arcas is the key project there and sits in between Freeport's El Abra mine and Teck's Quebrada Blanca mine in the Antofagasta Belt.

The Chilean portfolio consists of earlier-stage Greenfields properties. Our goal for those projects, over the next few months, is to be able to announce partnership opportunities, whereby a major would be looking to earn into the projects by conducting exploration work.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Aethon, John?

John Miniotis: For sure. First and foremost, it's a very compelling and unique risk-reward opportunity. By investing in Aethon at this time, you're essentially buying a company that's trading at cash value. As such, I think the downside risk is quite protected here over the near-term.

Whereas in terms of upside, we have several catalysts that we're looking to announce, including partnership agreements, hopefully on the Chilean properties, and the potential of earning into the Diablillos project, which we think could be a very transformational opportunity for us. Also, the fact that we're very well-financed. We have over $4 million in cash in the bank and a very lean and capable team, supported by Altius. We feel this presents quite a unique compelling opportunity.

Dr. Allen Alper: That sounds excellent. John, is there anything else you'd like to add?

John Miniotis: I definitely appreciate the opportunity for Aethon Minerals to be interviewed for Metals News. Thank you.

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.aethonminerals.com/

Tel: 1-416-306-8334

Email: jminiotis@aethonminerals.com

|

|