Chatham Rock Phosphate Ltd (TSXV: NZP, NZAX: CRP): Aims to be the Premier Supplier of Phosphate for Agricultural; Interview with Chris Castle, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/27/2019

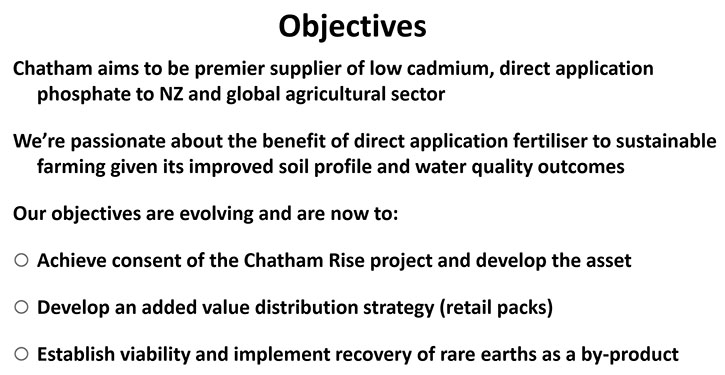

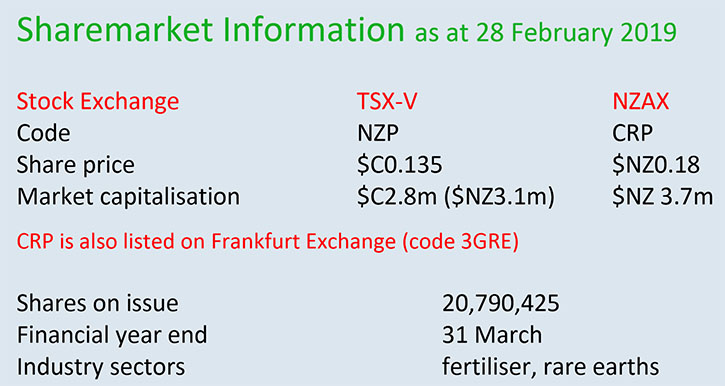

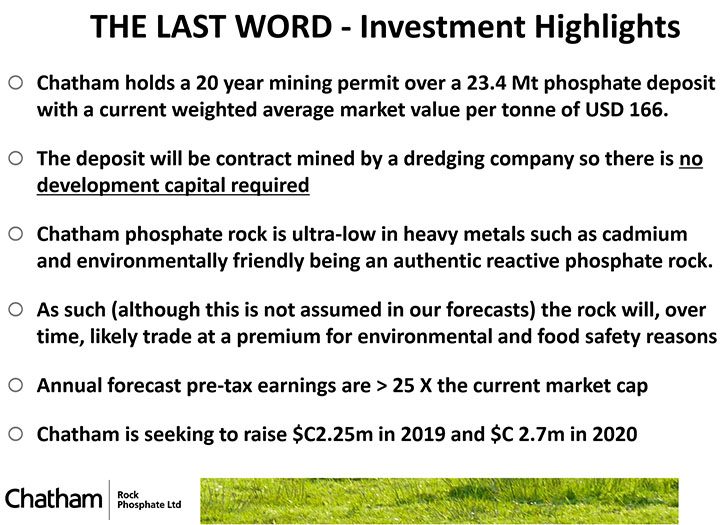

Chatham Rock Phosphate Limited (TSXV: NZP, NZAX: CRP) aims to be the premier supplier of direct application phosphate to the New Zealand and global agricultural sector. At PDAC2019, we learned from Chris Castle, President and CEO of Chatham Rock Phosphate, that their main project, called Chatham Rise project, is located off-shore of New Zealand. It has a resource of 23.4 million tons of medium -grade rock phosphate, a mining permit, and a business partner for mining. The Company is currently working on raising funds to reapply for an environmental permit, which it expects will be granted in 2021. Mr. Castle expects Chatham to be in production in 2023.

Chris Castle, President and CEO of Chatham Rock Phosphate at PDAC 2019

Chatham Rock Phosphate Limited

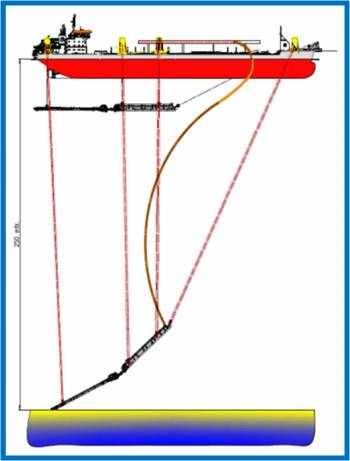

Deep Water extraction method

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, here at PDAC 2019, in Toronto, Canada, interviewing Chris Castle, who is President and CEO of Chatham Rock Phosphate Limited. Good morning, Chris, could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company? We've done quite a few articles on your Company and we're impressed with the progress you've been making. Could you also tell us what has been accomplished in 2018, the key things. And what your plans are for 2019?

Chris Castle: Absolutely! Good morning Allen. It's very nice to meet you in person. As you said I'm Chris Castle, I'm CEO of Chatham Rock Phosphate and the founder of the Company. I've been involved with it since 2007, about 12 years now. The Company's major project is a rock phosphate project off-shore New Zealand, where we have a mining permit, granted in 2013. And we're working towards the grant of an environmental permit. We have a well-defined resource of 23.4 million tons of medium grade rock phosphate. We have a business plan and a business partner, who is contracted to mine it for us. So the numbers look very good. When we go into production we will make something similar to our current market capitalization every week. But we have yet to get into production, so the milestones over the last 8 months or so have been mainly, fundraising in order to reapply for the environmental permit. That's a $6 million exercise. We need to raise all of that money before we reapply.

That process will take 15 months, once we are funded, and then another 9 months for the permit to be granted. So hopefully we'll be fully permitted in 2021, then in production in 2023. One of the most exciting developments in 2018 is the fact that we've discovered rare earths, incorporated in both the phosphate nodules and in the sea floor materials surrounding them. And the value of those rare earths, if they can be recovered, is perhaps 100 times the value of the rock phosphate. But we don't know how to separate them yet so part of what we're doing at the moment is working, with outside companies, to determine separation technology. I had a very fortuitous meeting with one of the world experts in that here at PDAC. I'm quite excited about that development. It shows the real benefit of coming to a show like this. Much of the relevant expertise in the world is assembled in one place. So those are the two current focuses at the moment. The reapplying for the environmental permit and working on the rare earths project.

Dr. Allen Alper: Oh that sounds excellent. Could you tell our readers/investors how you'll process the phosphate and what markets it'll go to?

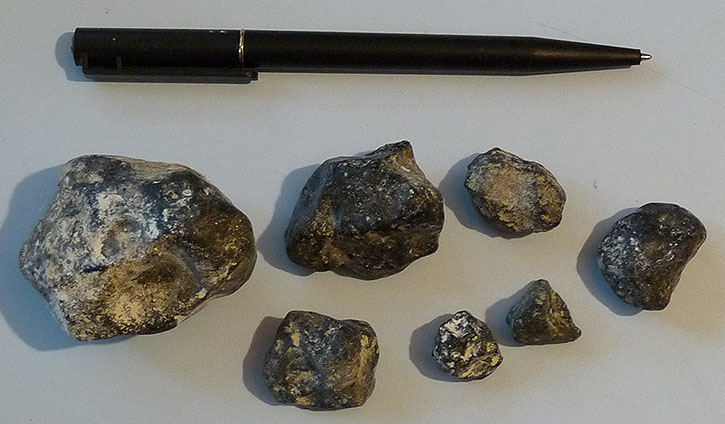

Chris Castle: Okay, the rock phosphate is in the form of nodules mostly about fingernail size. And they're sitting on the surface of the sea floor. So they'll be mined by a suction dredge, brought to the surface and separated from the sand, which surrounds them. We will then take them to shore and sell them in that form. There will be no processing as far as we're concerned. We’ll sell them in that form to a variety of markets. We've identified buyers in eight different countries. Mostly Asia-Pacific, but also in Australasia and South America.

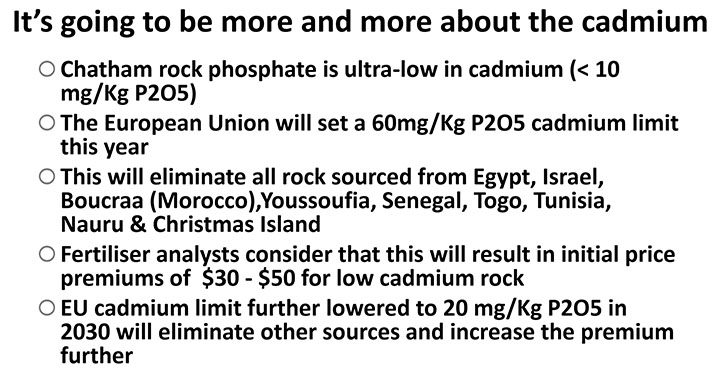

The reason we can sell the rock in such a variety of markets is because it has special characteristics. It's what known as a reactive phosphate rock, which means it can be applied directly to the soil, doesn't need processing and it's actually a very powerful fertilizer. Because of its characteristics it has much less run off into waterways. So it has water quality benefits and also soil quality benefits because of the nature of the rock. Highly processed fertilizers provide a quick fix to plants but don't do a lot for the soil profile. Over time they actually damage it. And the other real benefit of the Chatham rock phosphate, the fact that it's incredibly low in cadmium values. It has cadmium running at about two parts per million. Some of the phosphate rock from Morocco, for example, is around 400 or 500 parts per million. And there are limits being put in place in various regions including the EU, at 60 parts per million. And that will happen in other countries as well.

So having a low cadmium rock phosphate is increasingly going to be an asset and I think we will probably finish up being part of a larger fertilizer group eventually, who want to access our low cadmium rock. Cadmium's good in batteries but not very good for humans. So that's really our marketing plan. I believe that the nature of our rock is such that we'll be allocating the product, rather than selling it when we go into production in 2023.

Dr. Allen Alper: Oh that sounds excellent. Could you tell our readers/investors about your background and your team?

Chris Castle: I've been involved in the mineral sector since 1975. I spent a period in the 70s and 80s raising money for mining companies based mostly in New Zealand. Subsequently, since about 1999, I was involved in a nickel project in Vietnam, a company called Asian Mineral Resources that successfully raised money and mined its project out. AMR has an option over a small project in BC, but is effectively a shell that's looking for new projects. Although I trained in accounting and am a chartered accountant I became involved in mining from almost the first time I started in business.

My Chatham team consists of marine-geo physicists, whose skill base and experience is directly relevant to our marine project, a senior geologist with marine experience, and environmental experts. Our environmental permitting star is Renee Grogan, who is also a director of the World Ocean Council. She works for a range of clients in the marine space, including NGO's and mining companies. She will lead our reapplication process for the Chatham rock phosphate environmental permit, and she'll be playing a major role in our development over the next few years.

Dr. Allen Alper: That sounds like you have a strong team to get the job done, so that's great. Could you tell us a little bit about your capital structure?

Chris Castle: There're just over 20 million shares out, and fully diluted about 25 million. The market capitalization is currently about $3 million, it's been as high as $50 million and we've invested about $40 million in the project so far. So at the moment we're doing a financing to raise another million in Q1 this year, with plans to raise another $2 million in Q4, or$3 million in total by the end of this year. Those funds are primarily required to finance the reapplication process. That's a very tight capital structure, which is really appropriate for this market. We made a rollback of 65 to one to arrive at that capital structure, when we listed in this market two years ago.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors the primary reasons to consider investing in your company?

Chris Castle: I think the first reason is probably the top reason for any investor that the return on capital will be pretty exciting. We also have very strong environmental benefits. We have a low cadmium rock that's also a reactive phosphate rock, with resulting outcomes being much lower water runoff and a healthier soil profile. Using our rock will also result in a much lower carbon footprint than that created by rock imported from overseas into New Zealand. So we have strong environmental benefits in addition to expected high profitability. It's looking like a very exciting future, when we get into business.

Dr. Allen Alper: That sounds excellent. Chris is there anything else you'd like to add?

Chris Castle: Well I'd just like to thank you for the opportunity to meet with you and talk again. Thank you for interviewing us at Chatham Rock for Metals News.

Dr. Allen Alper: Nice talking with you again and meeting you in person. It sounds like you have a very, very excellent project, something that farmers and growers will need.

Chris Castle: Yeah, I agree. And that's the reason I've been involved with this project for nearly 12 years, I think it's such a worthwhile thing to happen. Of course I'm a shareholder in it, but it's more than that. I think it's a worthwhile thing to be doing.

Dr. Allen Alper: I agree with you. That is the way our family feels as well. It is very important to do good. I’m very impressed with both you and your Company.

Chris Castle: Thanks. Thank you.

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.rockphosphate.co.nz/

Chris Castle

President and Chief Executive Officer

Chatham Rock Phosphate Limited

64 21 55 81 85 or chris@crpl.co.nz

|

|