Largo Resources Ltd. (TSX: LGO, OTCQX: LGORF): Developing the World's Best Vanadium Resource; Interview with Mark Smith, CEO and Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/27/2019

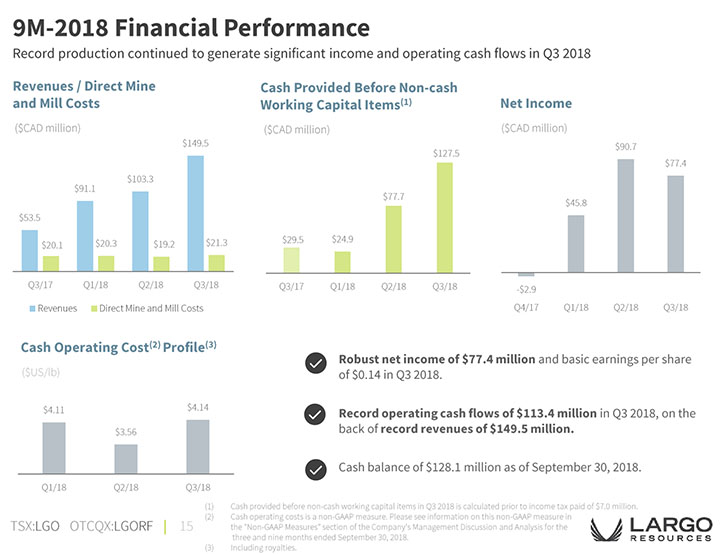

Largo Resources Ltd. (TSX: LGO, OTCQX: LGORF) is a Toronto-based strategic mineral company, focused on the production of vanadium flake, high purity vanadium flake and high purity vanadium powder at the Maracás Menchen Mine located in Bahia State, Brazil. At PDAC2019, we learned from Mark Smith, CEO and Director of Largo Resources, that Largo's team is one of the best in the industry, they are committed and competent, and they are developing the world's best vanadium resource, processing it with the lowest unit cost, highest recovery, and ending up with the highest purity level of V205 in the world. According to Mr. Smith, today's fundamental supply deficit in the vanadium markets is very favorable to the company, which recorded cash flow of about $129 million dollars in the third quarter of 2018.

2018 was a record year of production for the Maracás Menchen Mine, with 9,830 tonnes of vanadium, a critical element produced.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mark Smith, who is CEO and Director of Largo Resources that was acknowledged to be the best performing stock on the OTCQX in 2018. In 2018, Largo produced 9,830 tonnes of vanadium, a critical element. Why it is so sought after, and why is Largo so well positioned to serve that market during a short supply.

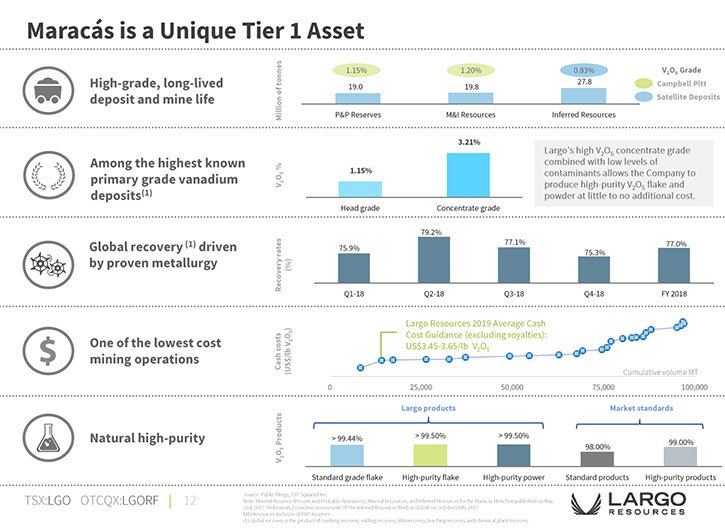

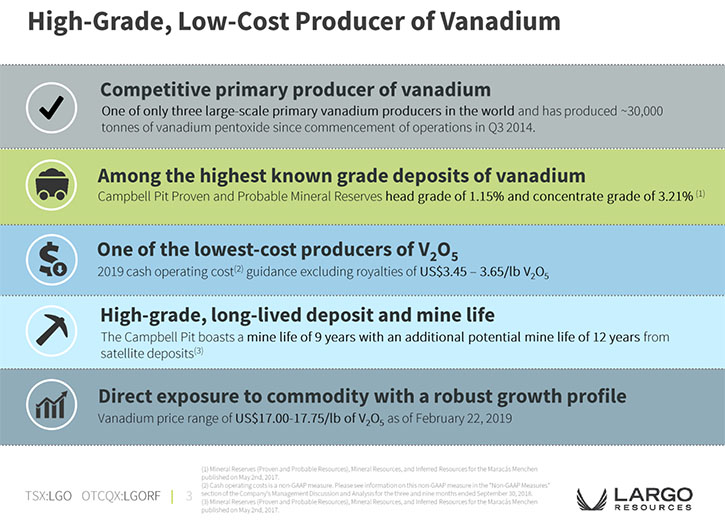

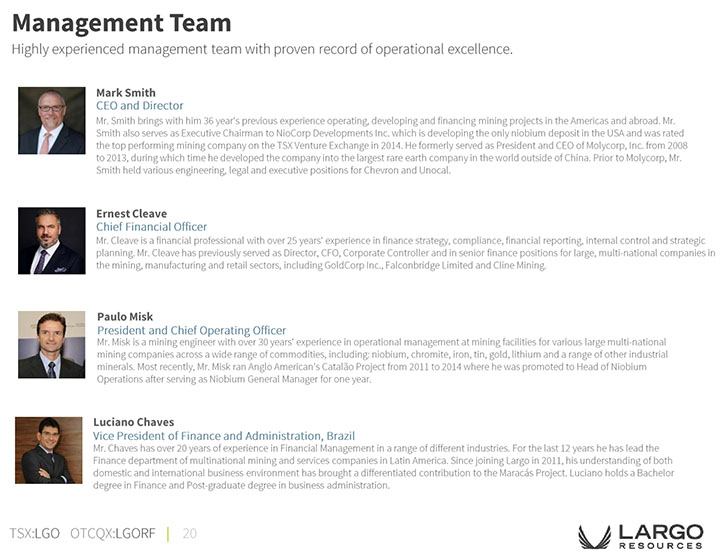

Mark Smith: We welcome that opportunity and thank you for interviewing us for Metals News, Al. You've already hit the nail on the head. It's all about a team. The Largo team is one of the best teams I've ever had the good fortune to work with. Everybody is extremely committed, they're technically competent, and they're very passionate about success, and that to a large extent has been the big driver for us. It's just blocking and tackling, and making sure that we're managing one of the best vanadium resources in the world, processing it with very low unit costs, high recoveries, and ending up with the highest purity level of V205 in the world.

Those are the things that we stay focused on because those are the things that are within our control. Then when we couple that really great performance by our operations team with a very disrupted market right now, where there's a fundamental supply deficit in the vanadium markets, that equates to a very robust business in terms of our economics right now. Our margins are very favorable to the company. As an example, if you take a look at our third quarter, 2018 numbers, we recorded revenues of about 149 million, and we recorded cash flows of about $129 million dollars.

So, that gives you a very good sense that the margins at this facility are phenomenal. Even though they are phenomenal and even though prices are very robust right now, we stay absolutely laser focused on continuing to improve our operations, increasing the pounds produced, as every little bit counts. In addition, we continue to set quarterly records for production at the mine. Then making sure that our unit costs are, if not the lowest in the world, certainly in the top two in terms of being the lowest in the world.

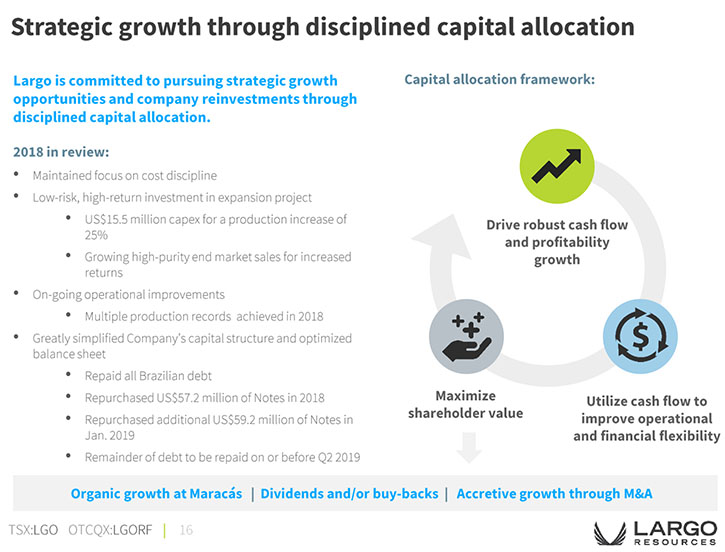

So that's what we stay focused on and with that good fortune of having a lot of cash, the company has been disciplined. What I mean by that is we've taken that cash, we've paid down our debt in the Company. We currently have 29.1 million dollars of debt remaining on our balance sheet and about a year ago that debt figure looked more like 250 million dollars of debt. So we're staying very focused and making sure that everything we do is for the betterment of our shareholders, and we think good operations and zero debt is a very good start.

Dr. Allen Alper: That's amazing. I'm really impressed with what you've done with your balance sheet, that's a very impressive job. I understand you have no Brazilian debt right now, and you're paying off some notes that you expect to have paid off fairly soon.

Mark Smith: Yes and in early June of 2019 our company will have zero debt.

Dr. Allen Alper: That's fantastic. That's an amazing job! Congratulations to you and the team!

Mark Smith: Thank you.

Dr. Allen Alper: From what I see you're taking funds and expanding your production and lowering your costs, could you say a few words about that?

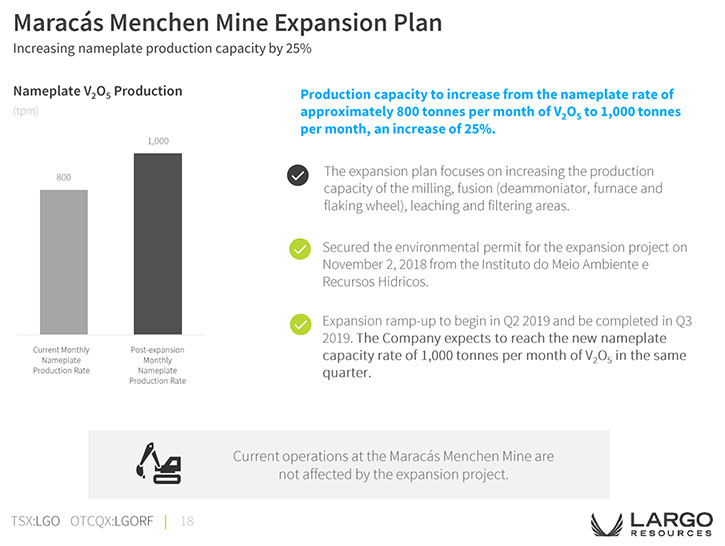

Mark Smith: Absolutely, and it's a great introduction to where the company is going because we will take excess cash that we're generating, and we will put it into organic economically robust capital projects. We have undertaken one that the Board approved last April. It's an expansion project that allows us to take our current 800 tonne per month design rate and increase it to 1000 tonnes per month, so about a 25% increase in production.

We're going to do that 25% increase in production, for a total capital expenditure of less than 20 million dollars U.S. What that means, with today's price of V2O5, is that there's a very short pay back on this project. If we can find excellent organic capital expenditures that create that kind of shareholder value, we won't even hesitate to undertake them. The good news is we can fund them on our own as well. So it's a good position to be in.

Dr. Allen Alper: Well that's excellent. Could you tell our readers/investors a little bit about your corporate structure?

Mark Smith: Well our corporate structure is fairly typical of a publicly traded company. We are traded on the TSX under LGO and we're also traded on the OTCQX under LGORF. We were the number one rated performing stock in OTCQX for 2018 and we're very proud of that. The OTCQX has been a wonderful mechanism for Largo to get increased liquidity, increased exposure to the markets. So it's been a very good decision on behalf of the company to become listed on that exchange.

We have over 500 million shares outstanding. About 149 million warrants outstanding, all in the money. Average price on those warrants is about 50 cents Canadian per share, so about 75 million dollars’ worth of extra capital coming into the company at some point. Then we have diversified our shareholder base significantly in the last year. The company undertook a secondary offering in July of 2018, and we brought what I would call the A-list of institutional investors into the company. We have some very big-name investors in our Company at this point in time, and I think that we have very happy shareholders at this point in time.

Arias Resource Capital continues to be a significant shareholder of Largo, holding approximately 46% of the company. They've been an outstanding supporter and contributor to the company, and we can't thank them enough.

Dr. Allen Alper: That sounds excellent. Can you tell our readers/investors what is vanadium and Largo's approach to the high purity end markets.

Mark Smith: Yes I would love to Al, that's such a great story because a lot of people don't understand what vanadium is or what it's used for. Over 90% of the vanadium produced and sold in the world today is actually used in the steel industry. Vanadium increases the yield strength of steel. The very simple formula that we like to use because it's so understandable is approximately one kilogram or a little over two pounds of vanadium added to one ton or 2000 pounds of steel will increase the yield strength by a factor of two.

So it's a very small quantity of vanadium, very little additional cost for the steel producer to put vanadium into their steel, and yet they can double the yield strength of the steel that they're selling and get a much better margin on their material. It does a lot of other good things as well for the steel industry in that with that increased yield strength you don't have to put as much steel into structures, or bridges, or roads, and you end up having lower transportation costs for your construction materials to these job sites because you don't need as many pounds of steel to do the same thing.

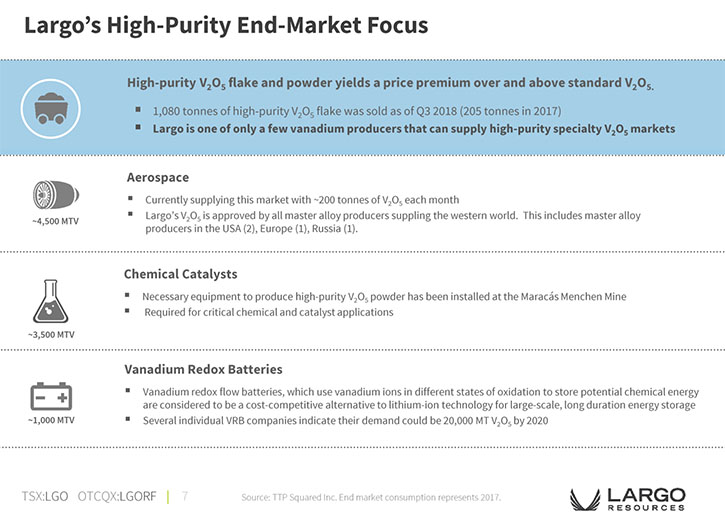

But outside of the steel industry is an area that Largo is particularly focused on, and we have the ability to be focused on because we have such a high purity V2O5. Every pound of V2O5 that we produce far exceeds the high purity specification that certain industries are looking for. Those industries boil down to three areas, the first area is aerospace alloy and that's a process where they take aluminum, titanium, and vanadium and they alloy it together, and they make an alloy that is used in the construction of certain jet engine components and now actually some of the components of some of the larger planes.

This is an alloy that there is no substitute for, it's a wonderful growing business, it's growing at about a 6.8% compounded annual growth rate. It's one Largo’s vanadium has qualified for at all four of the major alloy producers in the world, and we're selling as much material through Glencore as we can into that structural aerospace alloy application. The beauty of that is that the high purity commands a premium for the product, so we actually receive more dollars per pound than what is listed as the spot price for the vanadium in most of the subscription news services.

So aerospace alloy is about 50% of the high purity applications and then roughly 40% is use of high purity vanadium in the chemical business. To a large degree that chemical business is the catalyst business. Vanadium has an unbelievable ability to change valance states from plus three, plus four, to plus five and back and forth, so it is used as the active ingredient in multiple catalysts that are used throughout the world in industrial processes. Again, because of the high purity level of the vanadium that's required for those catalyst purposes, there is a premium associated with that high purity.

So again, we get more dollars per pound, more revenue for the same unit production cost that we would otherwise experience. Then the third category is one that's up and coming, it's the vanadium redox flow battery, and that is one that, as the renewable energy power generation continues to grow worldwide, those renewable energy sources are going to have to be coupled up with battery storage devices so that those renewable energy resources can be considered part of the base load for the public utility companies.

The vanadium redox flow battery is absolutely the most superior technology available for long duration grid level storage, and we're seeing this business grow quite rapidly since 2016, and we anticipate that it's going to continue to grow. Once again, the batteries need the high purity material, so it really puts Largo in an outstanding position to participate in that industry as well. We're very excited about our high purity material, and the premium that we can get from it.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about the global vanadium supply and demand?

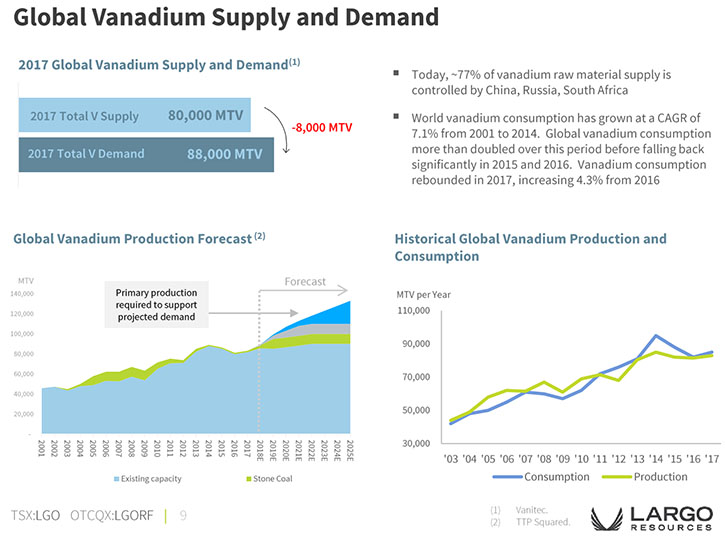

Mark Smith: Yes. In 2017 the supply situation was roughly 80,000 metric tons on a vanadium basis, and the demand was upwards of 88,000 metric tonnes on a vanadium basis. If you take a look at that supply and demand situation, which is about 10% greater demand than it was supply, and you couple that with about seven years of the industry having to dig into its inventory to cover the supply and demand short fall, what that means today is that there's very little if any inventory available.

Then in late 2018, on the demand side of the equation, China passed some new regulations that will require more vanadium to be used in the steel that they produce and use in the Country, and that should significantly increase demand, the supply side isn't going to go up very much. We anticipate in 2019 the demand side is likely going to be upwards of 98-103,000 tons. So the deficit is worsening, and we really do have a fundamental supply deficit now that's going to be with us for some period of time because you cannot bring new vanadium production on line very fast at all.

We anticipate for three or four years this is going to continue to be a problem, but I also want to say with all of that in mind, Largo takes this fundamental supply deficit problem very seriously, and we are doing everything we can to get new production into the world market as soon as possible. Hence, we take this supply deficit problem very seriously, and we plan to take a leadership role in filling that deficit.

Dr. Allen Alper: Well that's excellent. Mark could you summarize the primary reasons our readers/investors should consider investing in Largo resources?

Mark Smith: Absolutely. It's really quite simple, we have one of the best vanadium resources in the world, we have the best processing in the world, and we produce the best product in the world. Increased vanadium prices as a result of the supply and demand shortage right now is allowing the company to generate very large amounts of cash. There are very few ways that we can spend the cash, and the Company will be looking for ways to distribute that cash back in the form of either a dividend or a share buyback program. When the decision is made the company make an announcement to the market.

I think that will be a very exciting time for shareholders in Largo, especially the ones that have been there for seven or eight years, but we certainly welcome new ones as well. You'll see the company sending capital back to the shareholders, and that's how this whole system is supposed to work. So we're anxious for that day to come.

Dr. Allen Alper: Well that's great because my family and I are shareholders of Largo and we appreciate it.

Mark Smith: Fantastic Al.

Dr. Allen Alper: Your team ideal is really great.

Mark Smith: Perfect.

Dr. Allen Alper: Is there anything you'd like to add Mark?

Mark Smith: Just to emphasize the whole team effort again, at Largo. This has been a very long road that we've taken. We've stayed committed to it, we kept our passion and our commitment to the Company strong, and it is really wonderful to be in the position that we are today. We don't take it lightly. We remember where we came from, so we're going to continue to work hard every day to make this Company successful.

Dr. Allen Alper: Oh that's fantastic. I enjoy talking with you and getting updated again, I'm very impressed with what you and your team have done.

Mark Smith: Thank you, Al, for the interview for Metals News. We're very proud.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.largoresources.com/

Alex Guthrie

Manager, Investor Relations and Communications

Tel: +1 416 861 9797

Fax: +1 416 861 9747

aguthrie@largoresources.com

|

|