Premier Gold Mines Limited (TSX:PG): New Mines Coming on Line in the Next Couple of Years will Produce Over 100,000 OZs; Interview with Ewan Downie, President CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/25/2019

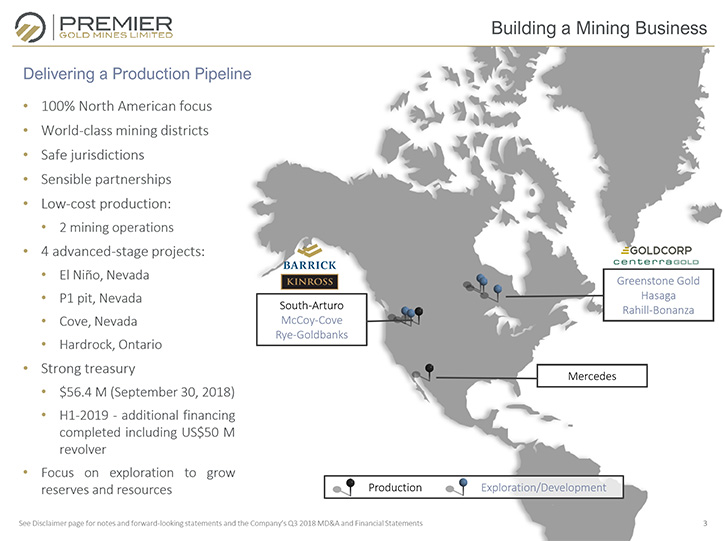

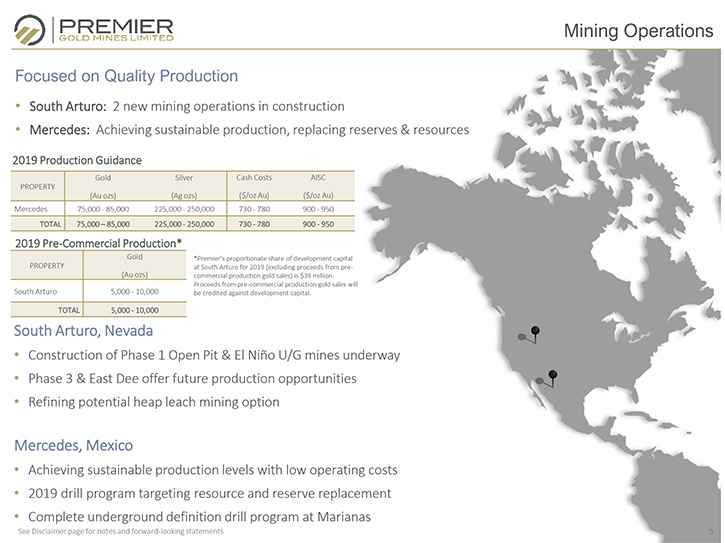

Premier Gold Mines Limited (TSX:PG) is a low-cost, mid-tier gold producer, with two producing gold mines - South Arturo and Mercedes - as well as mine development opportunities at McCoy-Cove in Nevada and Hardrock in Ontario. We learned from Ewan Downie, President CEO of Premier Gold, that the Company is currently undergoing an important transformation. The near-term goal is to increase its future production significantly, through the development of its existing asset portfolio, including the joint venture with Barrick in Nevada as well as the 100% owned high-grade Cove property. Plans for 2019 also include construction and production at the El Nino Mine, and a very significant exploration at the Cove Deposit. According to Mr. Downie, with the new mines coming on line over the next couple of years the Company will produce well over 100,000 ounces a year. Once they bring the Cove Deposit to production, Premier Gold Mines will be a Company producing two to three hundred thousand ounces a year.

Premier Gold Mines Limited Premier Gold Mines Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing, Ewan Downie, President and CEO of Premier Gold. He has a great story to tell us. We're here at PDAC, and also the Metals Investor Forum. Ewan, could you update our readers/investors on what's happening. It's been a great year for Premier Gold.

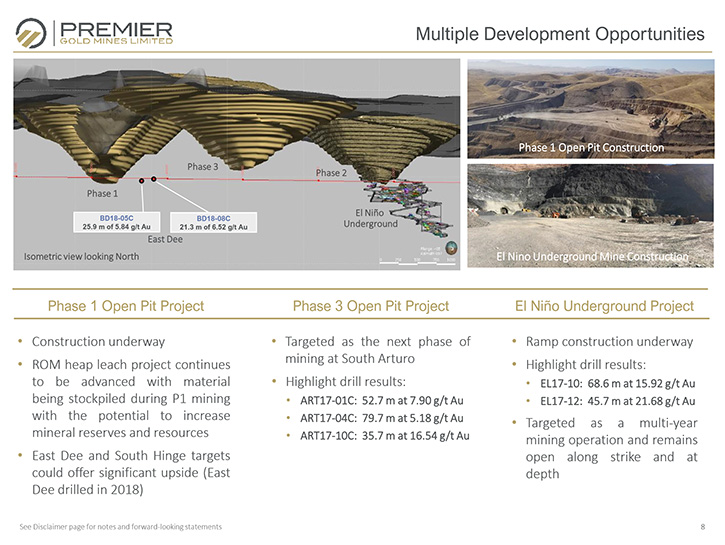

Ewan Downie: Our Company is undergoing a fairly significant transformation currently. We are looking to increase our future production significantly, through the development of our existing asset portfolio. In fact, we have two mines currently under construction, an underground and an open pit at our joint venture with Barrick in the Carlin Trend of Nevada. We're also completing the permitting of our Cove property, with the expectation of starting the underground decline either later this year or early next year. It's truly a Company that we should see grow our future production significantly from where we stand today.

Dr. Allen Alper: Well, that's excellent. Could you tell our readers/investors a bit more about what you're doing in Nevada with the resources and turning them into reserves?

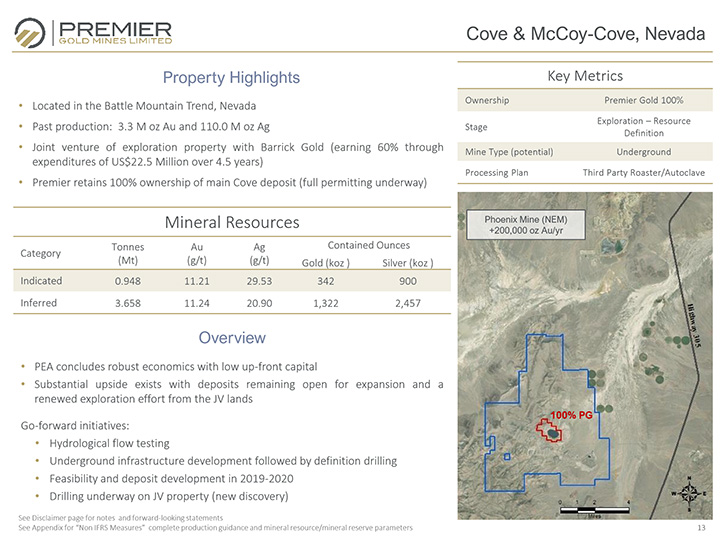

Ewan Downie: There are several projects we're working on in Nevada right now. In fact, we have three active properties. Two of them have some association with Barrick. Obviously the Barrick Newmont thing has become a big part of the news with Nevada. However, we have been very successful at growing out our reserve and resource space, particularly at Cove and at South Arturo in Nevada. We've more than tripled our resources and reserves at South Arturo, joint venture with Barrick. We are developing new operations on that property. Then, the Cove property is the next one that we view in our portfolio for development. At over 11 grams per ton, it's one of the highest-grade undeveloped gold deposits right now in North America.

Dr. Allen Alper: It sounds great. Could you tell our readers/investors your key objectives for 2019?

Ewan Downie: The primary objective, right now, is bringing the El Nino Mine into, not only construction, but to start to see first mining of ore at El Nino. That's one of the two mines were constructing with Barrick in the Carlin Trend. That's one of the key catalysts for us in the second half, seeing that mine start to ramp up into production.

Also, we have a very significant exploration program around the Cove Deposit. That's the 100% owned deposit. We're moving forward in Nevada. We're working with Barrick there. We have a very major exploration program going on that property that we hope yields some pretty significant discoveries. We aren't just giving up on exploration. We do view our ability to acquire the right property, do the right work that has resulted in several significant deposits being delineated, and now we've become a developer and a producer of those assets.

Dr. Allen Alper: That's excellent! That all has been done in a very, very short period of time.

Ewan Downie: Yeah, we started in 2006 as a Company, a pure explorer. We spent years just exploring. In 2014, we decided that if we were going to survive long-term as a Company we needed to get some sort of cash flow. We brought in a new Chairman to implement a new strategy for the Company. We replaced Board members and changed a lot of the management team to facilitate going from explorer to producer. As you know, very few companies make that transition. We successfully made that transition, with the first production in Company history only in 2016. I'd like to say that I'm quite proud of the fact that we've been able to make the transition from explorer to producer. With a growing production profile, I'd expect our stock to be a very strong performer in the future.

Dr. Allen Alper: That's excellent! Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also, for the benefit of the thousands of new readers/investors who have joined us since our last interview, could you give us an overview of your Company?

Ewan Downie: We made some major changes to the team. I personally founded the Company, my first Company Wolfden Resources, from which Premier was spun off. Premier back in 2006 was a free stock for our Wolfden investors. However, Wolfden was sold in 2007. Since then, we've set out to build up Premier to be a significant future Company.

In addition to that, on our Board four of our seven Board members are mining engineers. Whereas seven, eight years ago, I believe we had one, so we made some transitions there. If you look at our Management Team, Steve McGibbon, Brent Kristof, John Begeman, all have very strong track records of success in the industry, both in exploration, mine development, and running mines. I think we've assembled one of the top Management and Director Teams you'll find amongst the small producers.

Dr. Allen Alper: Well, you have an amazing team, amazing Board, and you yourself have an outstanding track record. You have a lot to be proud of, your accomplishments and what you've done with Premier Gold.

Ewan Downie: Thank you. I think there's a good opportunity here in our Company, given that 2018 and 2019 are what we call development years at South Arturo from the bigger production we saw in 2016, 2017. Our stock has actually been under some significant pressure. I think that just offers a tremendous opportunity. If you look at Insider Trading, you'll see last year I'm already listed as one of the largest shareholders in the Company. I increased my position by 10% in 2018 through purchases on the open market.

Dr. Allen Alper: Well, that shows you have confidence in what the Company is doing. You're willing to put your skin in the game. That's excellent! Could you talk a little bit more about the capital and share structure?

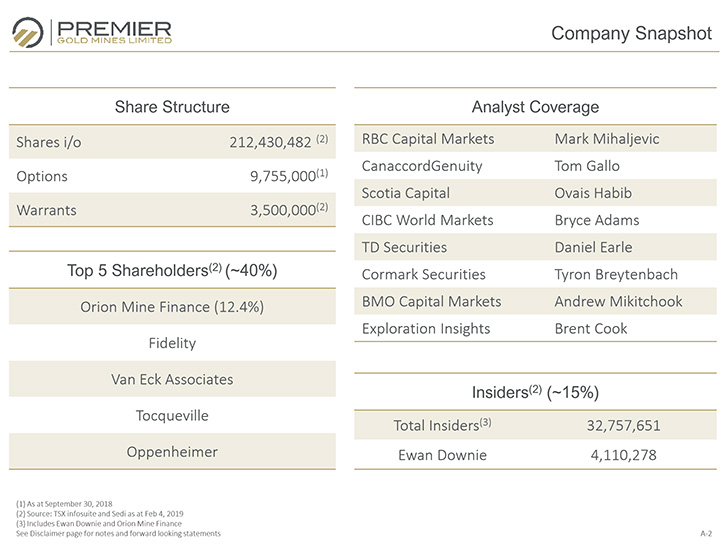

Ewan Downie: Our Company’s very well financed in terms of Canadian dollars. We have a market cap of less than 400 million Canadian dollars today. We have about 85 million Canadian in cash. We have access to a revolver facility up to 50 million U.S., so another 65 or so Canadian. We're in great financial shape. We have just over 200 million shares outstanding. The largest five shareholders own approximately 40%. In some regards, we're tightly held. Our largest shareholder has 12.5% ownership and has been a big supporter of ours, helping us make this transition from explorer to producer. In addition to them, we're held by a lot of institutions. But one of our goals is to increase our recognition among retail investors. Thank you for having an interview with us here today for Metals News.

Dr. Allen Alper: Well, that's great. I'm very impressed with what your group has done. Could you summarize the primary reasons for our readers/investors, to consider investing in your Company?

Ewan Downie: I think the primary reason to look at a Premier is our growing production profile. This year, we expect to do less than 100,000 ounces of production. However, with the new mines coming on line, over the next couple of years, at South Arturo, we expect that to jump to well over 100,000 ounces a year. Assuming we develop the Cove Deposit as well and it achieves production, we'll be a Company producing two to three hundred thousand ounces a year. I think in this environment, there aren't too many companies who have assembled a portfolio of projects where they can organically grow the way we intend to grow our Company. I think it's a great time to become a shareholder of Premier. We are looking for shareholders, who are looking for a Company who has a solid long term business plan and is looking to achieve that business plan.

Dr. Allen Alper: Well, I think those are outstanding reasons to consider investing in Premier Gold. Is there anything else you'd like to add, Ewan?

Ewan Downie: I think we covered all the top points. Thank you.

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.premiergoldmines.com/

Ewan Downie, President & CEO

Phone: 807-346-1390

Fax: 807-345-0284

e-mail: info@premiergoldmines.com

|

|