Cobalt 27 Capital Corp. (TSXV: KBLT, OTCQX: CBLLF, FRA: 27O): Leading Battery Metals Streaming Company Exposure to Cobalt and Nickel; Interview with Anthony Milewski, Chairman, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/22/2019

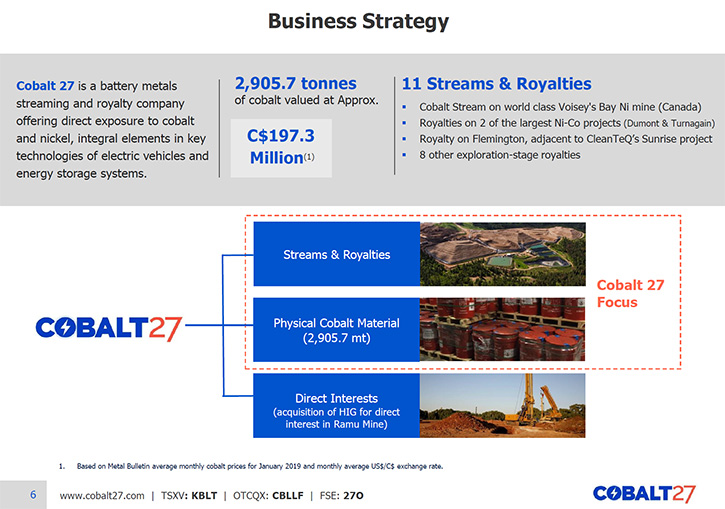

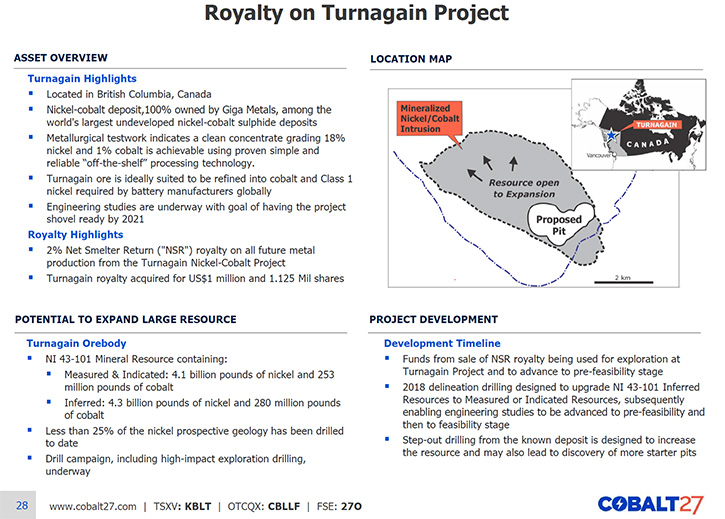

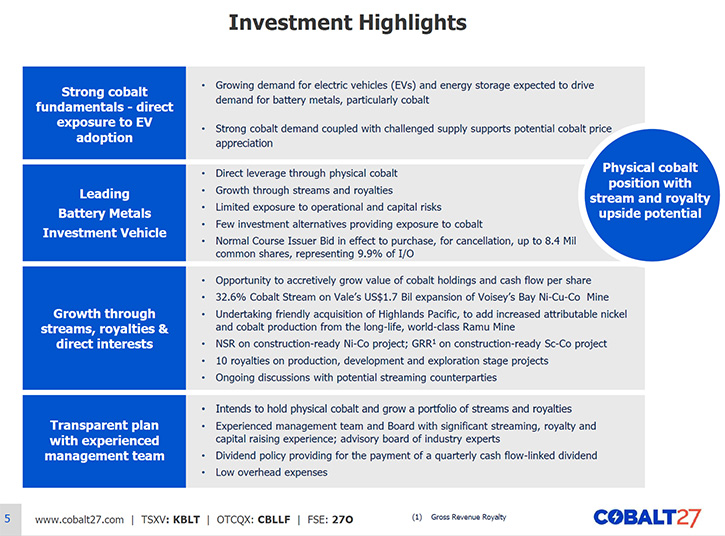

Cobalt 27 Capital Corp. (TSXV: KBLT, OTCQX: CBLLF, FRA: 27O) is a leading battery metals streaming company offering exposure to cobalt and nickel, metals integral to key technologies of the electric vehicle and energy storage markets. The Company owns 2,905.7 Mt of physical cobalt and a 32.6% Cobalt Stream on Vale's world-class Voisey's Bay mine, beginning in 2021. We learned from Anthony Milewski, Chairman, CEO, and Director of Cobalt 27, that they have royalties across some of the major battery metals development assets globally, including Giga Metals’ Turnagain and Dumont, in Canada, and they are currently closing a deal on a new joint venture interest in the producing Ramu nickel-cobalt mine, a large, long-life, low-cost, high-growth nickel-cobalt operation in Papua New Guinea, which is one of the best nickel-cobalt projects in the world.

Cobalt 27 Capital Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Anthony Milewski, who is Chairman, CEO, and Director of Cobalt 27. Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company, what has been happening in 2018 and what your plans are for 2019?

Anthony Milewski: Sure. Thank you very much for interviewing me again for Metals News. I appreciate it. Cobalt 27 is really a proxy for the adoption of the electric vehicle, and more broadly, for the electrification of things. We see that in battery storage systems, as well as electric vehicles.

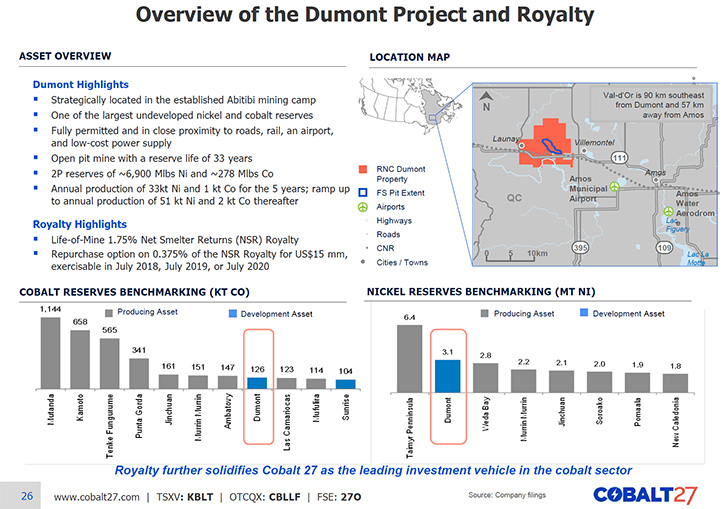

In the same way that Franco-Nevada Corporation and Wheaton Precious Metals have streams and royalties, Cobalt 27 has streams and royalties on nickel and cobalt assets globally. In particular, we have royalties across some of the major development assets globally, including Giga Metals’ Turnagain and Dumont in Canada.

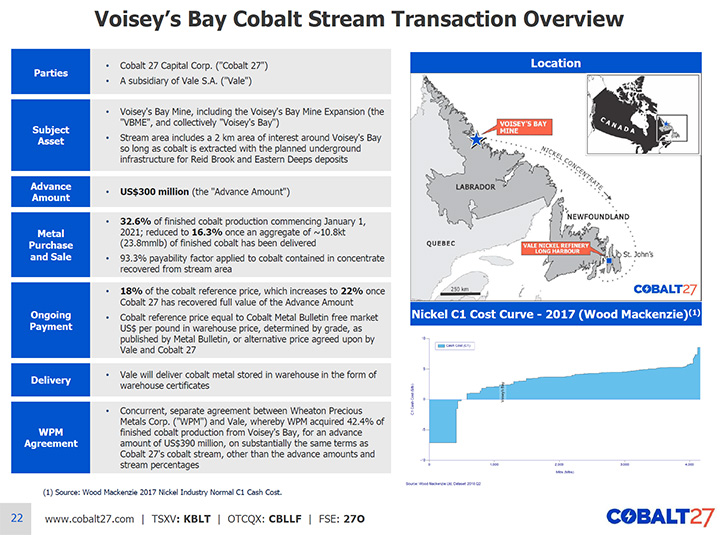

We have a 32.6% cobalt stream on the Voisey's Bay mine, in Newfoundland and Labrador, Canada, which is operated by Vale, and then, finally, we are in the process of acquiring a joint venture interest in Ramu Nickel, which is a nickel-cobalt producer in Papua New Guinea, and one of the best running and operating HPAL projects in the world.

One of Cobalt 27’s core principles is to invest in geopolitically stable jurisdictions outside of the DRC. We believe the primary issue facing cobalt supply is the major concentration of cobalt reserves and production in the DRC, and the underlying human rights and environmental issues, as well as political uncertainty associated with the region.

Dr. Allen Alper: That sounds excellent.

Anthony Milewski: In 2018, we were able to close the Voisey's Bay stream. We were able to buy the Dumont royalty and the Turnagain royalty, Turnagain is among the largest undeveloped sulphide nickel deposit in the world in terms of total contained nickel.

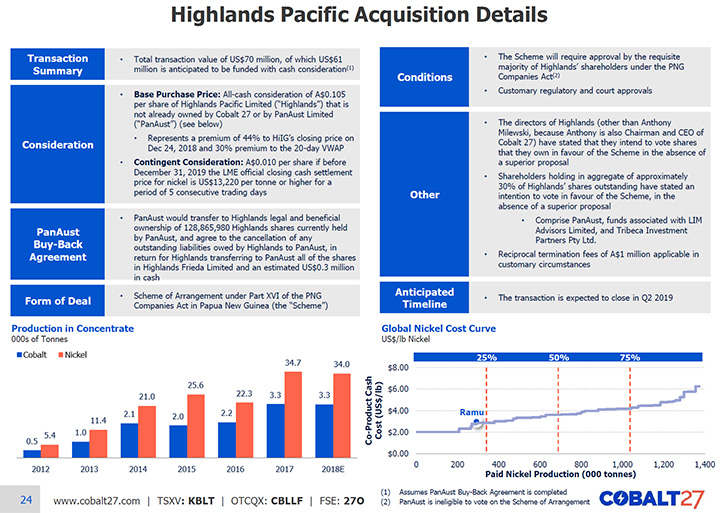

In January of this year, we announced the proposed acquisition of Highlands Pacific, a mining and exploration company listed on the Australian Stock Exchange and the Port Moresby Stock Exchange in PNG. Highlands' primary assets include an 8.56% interest in the producing Ramu mine.

Ramu is majority owned and operated by a first in class operator, Metallurgical Corporation of China Ltd. (“MCC”), which has market capitalization of approximately US$12 billion. The Ramu Mine is one of very few major success stories in building a nickel-cobalt mine in the past 20 years. The mine was delivered on budget - US$2.1 billion which, at the time, was China’s largest overseas mining investment, and is operating above name plate capacity.

Ramu exceeded annual production projections in 2017, reporting net cash flow of US$170 million (unaudited), on production of 34,666 tonnes of contained nickel and 3,308 tonnes of contained cobalt, both in excess of nameplate capacity. Ramu is among the most efficient nickel-cobalt operations in the world, ranking in the first quartile of the 2017 global nickel asset cost curve.

Cobalt 27 is now Highlands' single largest shareholder, having increased our equity interest from 13% to approximately 19.99% during the first quarter of 2019. We anticipate closing the transaction, with Highlands, later this year, ultimately resulting in cash flow into the business.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your thoughts on cobalt, nickel, copper and the electric vehicle market and electrification of the world?

Anthony Milewski: Sure. As your readers would know, cobalt and nickel are critical components in the battery chemistries. Almost every single automaker in the world is using a nickel, manganese, cobalt formulation or a nickel, cobalt, aluminum formulation in their electric vehicles, all of which require cobalt and nickel.

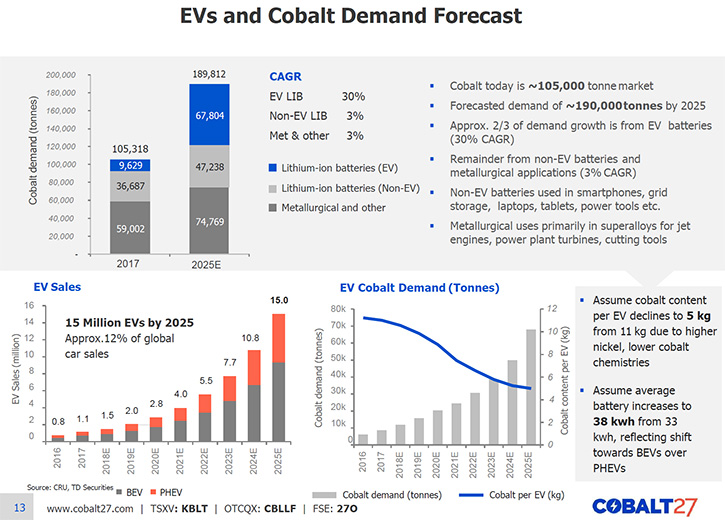

When we look at the future, the demand for these metals is incredibly strong. To put in perspective the demand, if we have 15% electrical vehicle penetration, we may need to double current cobalt production to meet the demand just from electric vehicles alone, not even talking, more broadly, about electrification.

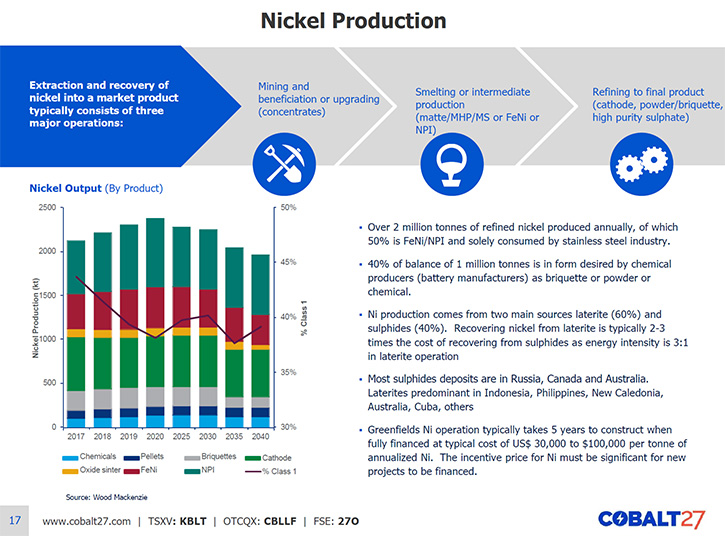

It's similar for nickel as well, especially as battery chemistries continue to evolve, they become more nickel-rich, once again, putting tremendous pressure on class one nickel in the coming years. Copper is slightly different. Copper is probably more related to electrification and changes in the grid, however, tremendous amounts of copper are used in the electric vehicle itself.

When we think about what's interesting in the coming years, we think of copper, nickel and cobalt. Each are basic materials that are going to benefit immensely from structural changes in two of the most important markets, namely energy and the automobile industry.

Dr. Allen Alper: That sounds great. What are your key objectives for 2019?

Anthony Milewski: Our key objective is closing the Highland Pacific acquisition and ensuring the cash flow of the business. That's something we've been focused on since the beginning, and this year we're really focused on bringing that cash flow into the business.

Dr. Allen Alper: That sound very good. Could you tell our readers/investors a little bit about your background and your Team and your Board?

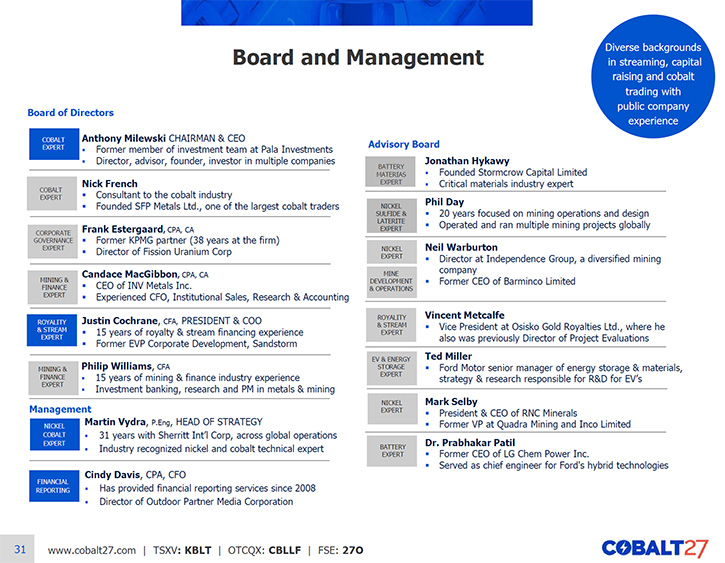

Anthony Milewski: Yes. We have a really strong Board, Advisory Board, and Management Team. In particular, we have Justin Cochrane, who is the Chief Operating Officer and President, who spent his career, first as a banker, and then, ultimately, at Sandstorm, working on streaming and royalty transactions.

On the technical side, we have Martin Vydra, who spent over 30 years at Sherritt, working in different aspects of the nickel-cobalt operations.

Myself, I've been in finance my entire career. On the Advisory Board side, we have a member of the LG Chem team, a member of the Ford Motor Company team, as well as an individual, like Phil Day, who is highly experienced on the technical side.

Combine that with the actual Board of Directors. Nick French, who's traded cobalt his entire career, Frank Estergaard, a former partner at KPMG. What we've sought to do is really build a deep Board and Advisory Board for execution of the business strategy.

Dr. Allen Alper: That sounds like an extremely strong Team and Board. It's nice to have experienced, knowledgeable, and accomplished Team and Board, and, of course, you have an excellent background and series of accomplishments, so that's all great. Could you tell our readers/ investors a little bit about your capital structure?

Anthony Milewski: Sure. We only have common shares, no warrants, and then we have some options out to Management. It's a very simple capital structure. At this time, we don't have any debt outstanding. We have a fully undrawn US$200 million credit facility that we can draw into if we need to, but we've intentionally kept the structure very straight forward.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors the primary reasons they should consider investing in Cobalt 27?

Anthony Milewski: Cobalt 27 is a proxy for the adoption of electrical vehicle and electrification, more broadly. I don't know who the winner's going to be, if it's going to an automobile maker, a chip maker, maybe even an industrial player building machinery. I don't know who's going to ultimately win the electric vehicle race, but what I do know is so long as there is a winner, the basic materials are going to be winners, and Cobalt 27 provides investors with a proxy for the adoption of electric vehicles vis-a-vis cobalt and nickel.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add?

Anthony Milewski: Yes, the main thing I would highlight for readers/investors is it's a good time to begin thinking about the impact of the accelerated global adoption of electric vehicles across all your investments. We need to think about your copper and nickel investments, not just cobalt. Also, I think we should think more broadly if we are invested in automobile companies. What are their plans for electrification and electric vehicles. This is going to have a tremendous impact on a number of industries and it's important that, not just your basic material investments, but across all your portfolio, that we're aware of these changes and taking them into account as we make investment decisions today and going forward.

Dr. Allen Alper: Well, that sounds like excellent advice to our readers/investors.

Anthony Milewski: Thank you, I appreciate you interviewing me for Metals News.

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.cobalt27.com/

Cobalt 27 Capital Corp.

4 King Street West, Suite 401

Toronto, Ontario

Canada

M5H 1B6

Tel: 647.846.7765

Email: info@cobalt27.com

|

|