Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF): Producing Over 200,000 Ozs of Gold a Year; Interview with Mike Davies, CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/15/2019

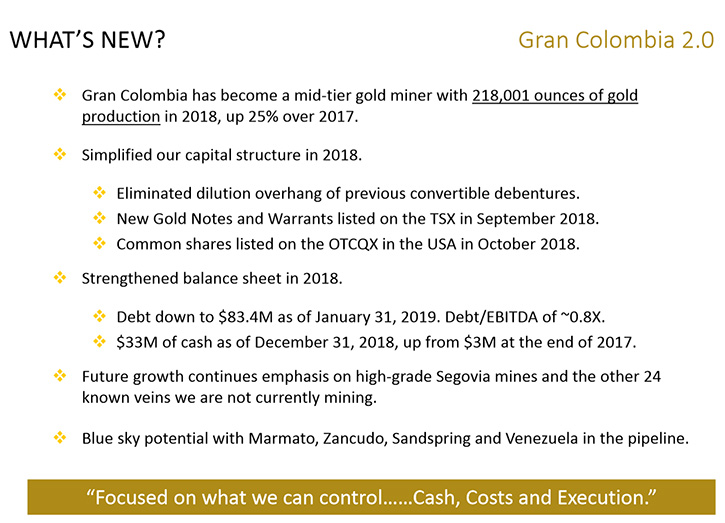

Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF) is currently the largest underground gold and silver producer in Colombia, with several mines in operation at its Segovia and Marmato Operations. At PDAC2019, we learned from Mike Davies, Chief Financial Officer of Gran Colombia Gold, that they have been producing over 200,000 ounces of gold a year and expect 210,000 to 225,000 ounces of gold this year, most of which is largely coming from their high-grade Segovia operations. According to Mr. Davies, Segovia operations have large upside potential. In 2019, the Company plans to raise money to increase its high-grade resource via step-out and brownfield drilling. We learned from Mr. Davies that with the current political changes in Venezuela, Gran Colombia hopes to be able to return to the country and reclaim some of the gold projects that were nationalized in 2011 by the government.

Gran Colombia Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, who's Chief Financial Officer of Gran Colombia Gold. We're here at PDAC 2019 in Toronto. Mike, could you give our readers/investors an overview of your Company?

Mike Davies: Sure. We're a mid-tier gold producer. Our primary focus is in Colombia. We did over 200,000 ounces of gold last year in 2018 and 100 million of EBITDA. We've been growing quite quickly from the production front. We expect this year to do another 200,000 ounces from our projects.

Dr. Allen Alper: Well, that sounds great. What are your key objectives for 2019?

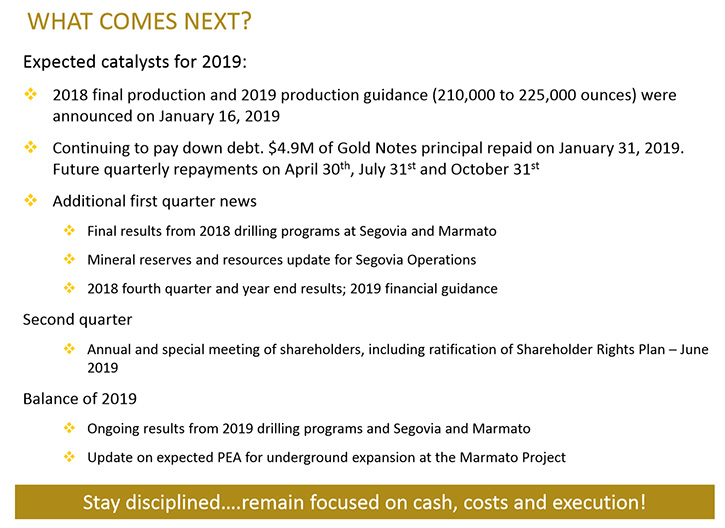

Mike Davies: From the production side, we've already announced our guidance of 210,000 to 225,000 ounces of gold this year. Most of that coming from our high-grade Segovia operations. We'll report our financial guidance, that'll be at the end of March. We're looking at this being another year of similar type results, continuing to control costs, generate cash, and invest in our Segovia projects. In particular, starting to do step-out and brownfield drilling at the Segovia project to test the high-grade veins that we've not been able to test in the past.

Dr. Allen Alper: How do your geologists feel about the opportunity to expand the resource?

Mike Davies: I think at Segovia we have some pretty good prospects. There are 27 known veins from the past 150 years of mining. Over those 150 years, the grades at Segovia have averaged over 10 grams per tonne. We're pretty confident about the high-grade nature of the title. We've been mining the last two years at about 17 grams per tonne, given the three main veins that we're mining. The other 24 offer us a great opportunity now to step-out and do some brownfield drilling. We're also doing some step-out extension testing at our three core mines that are in production.

Dr. Allen Alper: That sounds excellent. Now am I correct, did you recently announce acquiring a company or not?

Mike Davies: No. I think what you might be referring to is a couple of weeks ago we announced that with the evolving changes coming in the political scene in Venezuela, that we see an opportunity to get back into Venezuela. Recover some lost mining titles that were nationalized in 2011 by the government. Look to use a separate public company vehicle, in which we'll have a majority stake, to use the capital markets to fund the development of these gold projects in Venezuela should we be able to get them back.

Dr. Allen Alper: Great. Well, that sounds like an opportunity.

Mike Davies: I think it's a potential breakout strategy for us to get back to these projects. The projects, in particular, the Increible gold deposit, which is in an historic gold district in Venezuela and already had a 43-101 resource on it of almost a million ounces of gold. We know that there's gold there. It's a prolific area. We just want the opportunity now to go back in with the new government and start to be able to invest in the country as it starts to recover from what's gone on the last few years.

Dr. Allen Alper: That's excellent. Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company?

Mike Davies: The team is our Executive Chairman, Serafino Iacono, who's the founder of the Company, and the one that's steering us forward, in terms of the strategy. Lombardo Paredes, our CEO, is based in Medellin, and deserves credit for the turnaround in operations the last couple years that's given us this platform to move forward on. I'm the CFO, based here in Toronto. I worked with the group right from the beginning in 2010. Alessandro Cecchi is our VP of Exploration and the key person responsible for the drilling programs and exploration success we're getting at both Segovia and Marmato.

Dr. Allen Alper: That sounds excellent, strong team, experienced, accomplished. That's really great. Could you tell us a bit about your capital structure and your balance sheet?

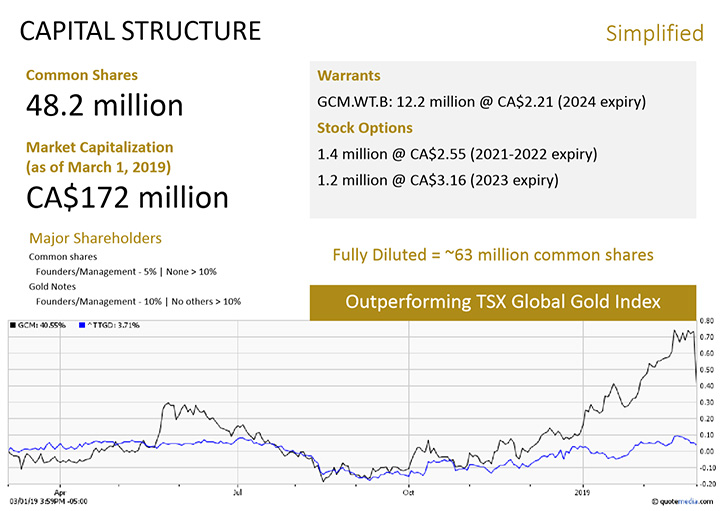

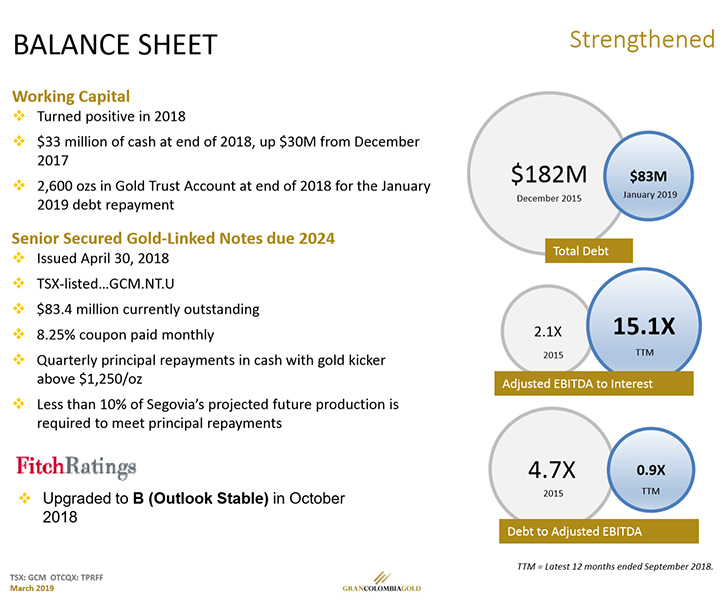

Mike Davies: We spent a lot of time in 2018 bringing together our activities to strengthen the balance sheet and improve our capital structure. We have 48 million shares outstanding right now. On a fully diluted basis with warrants and options being exercisable, we would have 63 million shares. We have $83 million US of debt right now. That'll amortize down to about $5 million a quarter going forward. At the end of December, we had $33 million cash, so a nice strong balance sheet now to back this up.

Yesterday we announced that we're also going to raise another C$20 million Canadian through a bought deal led by GMP and Scotia to raise C$20 million. We will use the proceeds to continue the exploration program in Segovia. We want to accelerate the drilling. Where our normal program, funded by cash flow this year, is going to do 20,000 meters, this money will allow us to accelerate and do another 60,000 meters over about the next two-year time period.

We really want to go hard at improving the resources and reserves we have in Segovia, get them onto paper so people know the quality of this project. That will allow us to do some mine planning as we start to look towards the future for some mine life extension.

Dr. Allen Alper: That sounds like an excellent approach and a great thing to do. That's really very good. Could you tell our readers/investors what are the primary reasons they should consider investing in Gran Colombia?

Mike Davies: Yes, I think the main thing would be we're a company that has good, quality assets. We've demonstrated our ability to operate the assets. I think the most compelling reason is probably looking at our share price performance over the last year. We've been outperforming the TSX Global Gold Index. We still have lots of valuation room left, as we continue to the turnaround.

Our shares right now are trading in the C$3.75 to C$4.00 range. We have a couple of targets out there from analysts at GMP at $6.00 and from Fundamental Research at $5.62. We have some external people looking and believing that this stock should, if compared to peers, be much higher. That's, I think, why people would want to have a look at us. There's still some re-rating potential.

Dr. Allen Alper: Those are outstanding reasons to consider investing in Gran Colombia. Money is important?

Mike Davies: It's certainly what drives us. Management is a big believer in it. Serafino and his partners do put their money behind it, as well. Management owns about 5% of the common shares, 10% of the debt, and 10% of the warrants. Management continues to put its own stake money at play in this company, not just expecting the investors to do it.

Dr. Allen Alper: That's great to see management having skin in the game and confidence in the project, what they're doing, and the company. Is there anything you'd like to add?

Mike Davies: I think we've covered all the main points for today. I appreciate the opportunity to be interviewed by you for Metals News.

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|