Newmont Mining Corporation (NYSE: NEM): Interviewed 2/28/19 Interview with Omar Jabara, Communications Group Executive

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/13/2019

Newmont Mining Corporation (NYSE: NEM) is a leading gold and copper producer, founded in 1921, with operations currently in the United States, Australia, Ghana, Peru and Suriname. We learned from Omar Jabara, Group Executive for communications, about the combination with Goldcorp Inc. that was announced in January and is expected to close in the 2nd quarter of 2019, to create world’s leading gold company. The combined Company will have the world's largest gold reserves and will be able to deliver production of between 6 to 7 million ounces of gold a year over year for at least two decades. Mr. Jabara also discussed an inferior, unsolicited proposal from Barrick to acquire Newmont.

Newmont Mining Corporation

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Omar Jabara, who is Communications Group Executive for Newmont. Omar, could you tell our readers/investors about some of the advantages of Newmont going with Goldcorp and also your thoughts about Barrick’s offer.

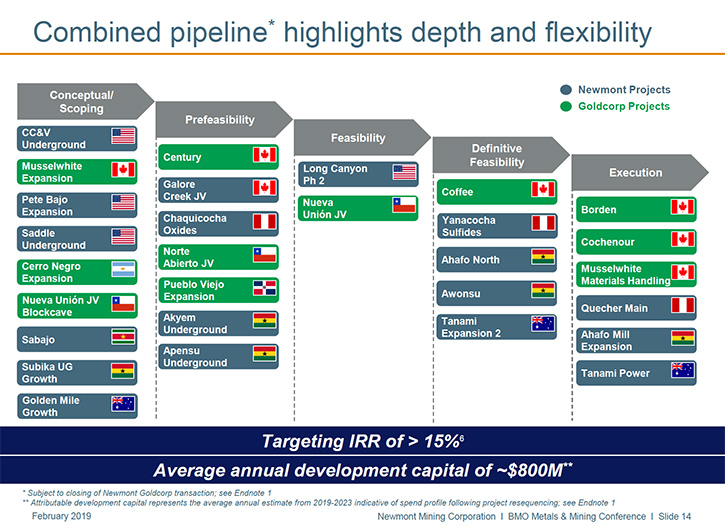

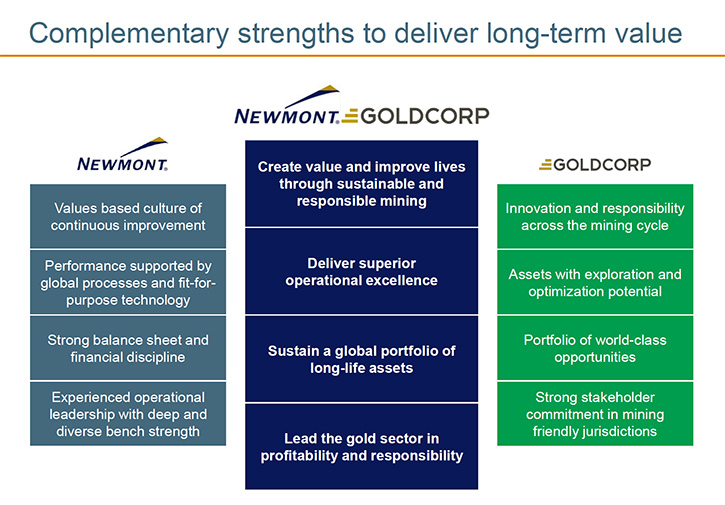

Omar Jabara: Yeah, sure thing. I'll start with the Goldcorp proposed transaction, which we announced in January. As we outlined in our announcement, once the two companies are combined, which we still expect in the second quarter of 2019, it will create the world’s leading gold company, and leading on a number of fronts. We will be able to deliver steady-state production of 6 to 7 million ounces of gold over a decades-long time horizon. When I say decades, we're talking about 2 decades, at least. There's really no other company at the moment in the gold space that can project that kind of production and deliver steady free cash flow generation for that duration into the future. The combination of the 2 companies on day 1 will immediately begin to create value to Newmont's net asset value and cash flow per share. The combined company will have the world's largest gold reserves, including, not just on a volume basis, but also on a per share basis.

The combined company will have its operations, projects and exploration prospects located in the world's most favorable mining jurisdictions and most prolific gold districts on 4 continents. That's important for a number of reasons, because it lowers jurisdictional risk and also Goldcorp's assets provide a nice compliment to Newmont's assets. Since they don't necessarily sit next to each other, it will be a combination that adds value, not just the sum of the total parts, but it will be greater than the sum of the parts. The combined company will be in a position to deliver the highest dividends among senior gold producers and we will have, once the deal closes, the financial flexibility and an investment grade balance sheet to advance the most promising and higher returning projects that generate a targeted internal rate of return of at least 15%. Additionally, the new company will have some of the most accomplished leaders in gold mining as well as high performing technical teams, along with other talent with extensive and deep mining industry experience. Also, we will maintain industry leadership in environmental, social and governance performance.

Dr. Allen Alper: Well that sounds excellent. Could you tell our readers/investors a little bit about Barrick’s proposal and Newmont’s feelings about that?

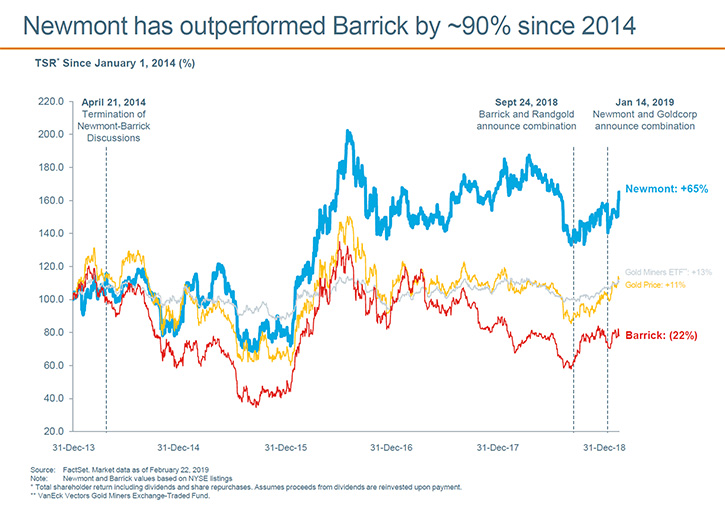

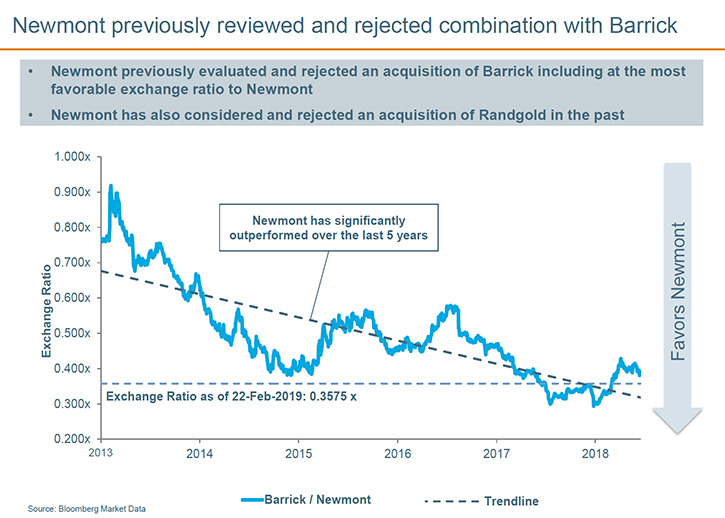

Omar Jabara: Yes certainly. As you will have read, Barrick, on Monday, initiated an unsolicited negative premium proposal. While our board will consider Barracks inferior proposal, we believe that if accepted by the shareholders, it would expose our shareholders and other stakeholders to unnecessary jurisdictional execution and sustainability risks. In years past, we have evaluated potential combinations with Barrick and Randgold separately and concluded that combining with either of those companies would be misaligned with our proven strategy, which has delivered results quite effectively since 2013. Since 2014 when Barrick and Newmont last considered combining our 2 companies, Newmont has increased shareholder returns by 65% while Barrick shareholder returns have declined by 22% in that same time frame.

So that demonstrates a few things. Our operating model is superior and our strategy has delivered better results. Newmont, through operating model, strategy and a highly qualified management team, has delivered superior shareholder returns, without exposing our shareholders and other stakeholders to unnecessary jurisdictional, execution and sustainability risks. And, of course, we believe that our proposed combination with Goldcorp represents the best opportunity to create optimal value for Newmont's shareholders.

Dr. Allen Alper: Could you sum up why the Newmont Goldcorp combination should encourage our readers/investors to invest.

Omar Jabara: Yes, certainly. Once we close the combination with Goldcorp which is expected in the 2nd quarter, Newmont Goldcorp will be the world's leading gold company and it will be the go-to gold equity for investors. It'll have an unmatched portfolio of world class operations, projects, exploration properties and opportunities, reserves, and talent. In addition, once we close the transaction, our combined company will be able to apply Newmont’s proven full potential, continuous improvement methodology to the Goldcorp operations, projects and exploration assets. Through that process, combined with the annual pre-tax synergies and supply chain savings, we expect to generate an additional $365 million per year in annual pre-tax value. We will also have the largest gold reserves and resources, including on a per share basis, the highest dividend among senior gold producers. We will be located in the most favorable mining jurisdictions, with 90% of our assets located in favorable mining jurisdictions, so North America, South America and Australia.

Dr. Allen Alper: That sounds excellent. Those are overwhelming reasons to consider investing in Newmont. Is there anything you'd like to add Omar?

Omar Jabara: I would certainly like to thank you, Dr. Alper, for interviewing Newmont for Metals News. I would also like to add that over the last 6 years Newmont has worked hard to demonstrate that we can create value for our shareholders and other stakeholders by focusing on safety, efficiency and responsibility, and creating value and improving lives for all of our stakeholders through sustainable and responsible mining.

Dr. Allen Alper: That's excellent, an excellent accomplishment and an excellent record. Thank you for sharing that with Metals News. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.newmont.com/

Media Contact

Omar Jabara

303.837.5114

omar.jabara@newmont.com

or

Investor Contact

Jessica Largent

303.837.5484

jessica.largent@newmont.com

|

|