Lithium Chile (TSX-V: LITH): Owns Fifteen Projects, 159,950 Hectares on Li-Rich Salars in Chile; Interview with Steven Cochrane, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/22/2019

Lithium Chile (TSX-V: LITH) owns fifteen projects, encompassing 159,950 hectares on Li-rich Scalars in Chile – which has the largest, high-grade lithium reserves and lowest-cost lithium production in the world. At the 2019 Vancouver Resource Investment Conference, we learned from Steven Cochrane, who is President and CEO of Lithium Chile, that 2018 was a successful year. The Company drilled its first property, called the Ollague prospect and hit lithium bearing brines across the entire five holes. We learned from Mr. Cochrane that the company augmented its already outstanding team, with Mr. Jose De Castro Alem, who is the South American lithium expert and a recognized pioneer in lithium brine exploration, development and production. He was on the team responsible for Orocobre’s growth from a sub-$10 million market cap to over $1 billion market cap. Plans for 2019 include beginning of exploration at the company's second prospect called Turi, which offers two sources of potential lithium on the property — hypothermal and the leeching action. Lithium Chile also hopes to have final approval from the Community at Coipasa to begin their drill program on Coipasa and Turi exploration concurrently.

Salar de Talar

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Cochrane, who is the President and CEO of Lithium Chile. Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since October, could you give us an overview of your Company?

Steve Cochrane: Absolutely, Allen. Again, let me thank you for the opportunity to update both yourself and your readers/investors. I think it was October we had our last interview. We completed drilling our Ollague prospect. It was a bit of a good news, bad news story. Good news is we had lithium. We had lithium bearing brines across the entire five holes we drilled. More importantly, we validated our geophysics, where we saw the conductive horizons geophysically on the structure, is exactly where we hit it. So, we were very pleased that we encountered lithium bearing brines because the probability of hitting lithium on your first hole is remote, but we were fortunate, and having our geophysical data validated was excellent for the company. This gives us a high degree of confidence geologically when we look at the data from our other prospects

Drilling lithium brines is not for the faint-hearted. It's challenging, difficult, these are sands, these are gravels, they're brutal on drilling equipment. We learnt a lot, we understand the process and the challenges of dealing with these brines a lot more, but I also realized at the time that we needed to build out our team and our expertise on the lithium side.

Lithium Chile Enhances Technical Team and Board of Directors; Appoints Leading Lithium Expert, and Grants Stock Options

I'm pleased to announce to you and to your readers that Lithium Chile has been fortunate enough to attract the services of Mr. Jose De Castro, who just joined the company the first of January, as Manager of Lithium Operations. Jose brings to our team experience and skills that in my opinion are second to none in South America today. Argentinian by birth, he was born in Salta, the heart of the Argentinian lithium-producing area. He's a chemical engineer, who started his career with FMC. More importantly he was one of the original employees of Orocobre. He joined the company when there were eight employees and a market cap less than 10 million dollars. He left it in 2016 at a billion-dollar market cap and 300 employees. He oversaw everything — exploration, design, development, feasibility, build out, and the commissioning of the lithium carbonate processing plant.

To have as well-rounded, as experienced, an individual join the team as Jose, I feel very grateful. I'm privileged to have a man of his talent.

Dr. Allen Alper: That's great experience. I interviewed Orocobre twice.

Steve Cochrane: Well, Orocobre has been one of the great success stories as you know, I think one of the only five producing lithium brine companies globally, and Jose was there at the beginning.

Dr. Allen Alper: That's fantastic, that's a real coup to get him.

Steve Cochrane: It is, that's exactly how I describe it as a real coup for Lithium Chile.

So last year was a successful year, both acquiring land and running geophysics successfully. We drilled our first property, learned a lot, but more importantly we saw the need to augment our already outstanding team with somebody with a strong lithium background. I think we have just that man in Jose.

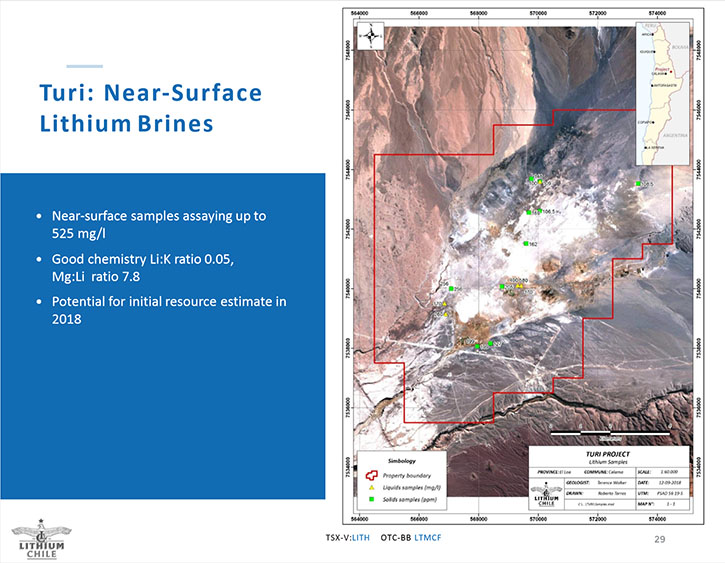

We just press released on Wednesday January 16th that we've been approved for our second prospect, Turi. It's one we like because we own 100 percent of the basin, 76 square kilometers, it's very large. In Chile, the source of your lithium is two-fold. One is the natural leeching action from the snow melt, year in and year out. It leeches the salts and deposits them in these alpine lakes or aquifers. The second source, in South America and particularly Chile, is hydrothermal. The geological activity in Chile is ongoing, as evidenced by the earthquake just last night. So globally it's a very geologically active area. We have two hot springs on the property and as you know these geothermal springs are the second major conduit of lithium into these basins.

We're very encouraged both by the permission from the community and indeed the support of the community to explore and the fact we see two sources of potential lithium on the property — hypothermal and of course the leeching action.

Our plan now is to begin next week, weather permitting, with an expanded geophysics program, shooting additional TEM — transient electro-magnetics — and with a target for an active drill program towards the end of February.

Dr. Allen Alper: Sounds great. Sounds like 2019 will be exciting.

Steve Cochrane: Well one of the things Jose has identified — and again we certainly value his experience — he'd like to see us have two drill exploration programs going on two separate properties, Plan A and Plan B. We're working closely with the two communities, both of which have approved us from the executive level. Turi of course has been approved by the community at large and is plan A. Plan B would be the Salar de Coipasa. The community executive has given us the go-ahead. We are just waiting for the community at large to support the deal.

We're hoping between now and the next time we talk with you, we'll not only have advanced the program to a drilling stage, we'll be able to announce a second program concurrently.

Dr. Allen Alper: Sounds excellent! A great year coming up, really exciting!

Steve Cochrane: We're very excited to be able to marry the talents of our geological team to the experience and expertise of our lithium manager, Jose and come up with a winning result for all our shareholders.

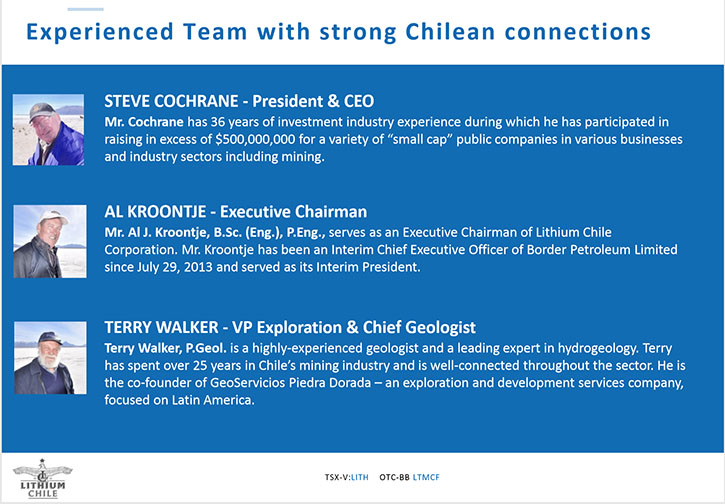

Dr. Allen Alper: That sounds great. Could you refresh the memory of our readers/investors on your background and the other members of your Management Team and Board?

Steve Cochrane: Well I was on the investment side, that might be a dirty word.

Dr. Allen Alper: It's important! I don't think any mining group works without money.

Steve Cochrane: Well I have deals I'm very proud of and deals that I'm maybe not so proud of. In my 36 years on the investment side, the banking side, I took many many companies public. I participated in raising over half a billion dollars in my career. I did the initial IPO on Lithium Chile, a copper gold property at the time, now they have grown into a pure lithium play. Obviously, Chile is the world's leader in lithium brine production, lowest cost producer, and unbeknownst to maybe a lot of your readers, 53 percent of the known reserves globally in lithium reside in Chile. So it's a great jurisdiction, in which to have our property and be working.

Initially I was retained to raise some money, but it's like the gentleman from Gillette. I liked the company so much, I joined as the President and CEO, and that was August of 2017. I've grown as the company's grown, learned a lot, I'm only a small piece of the puzzle. I think the key is our team, right now we have eight, nine employees in Chile, support, geologists, engineers, land guys. They’re the backbone of the company. Adding Jose’s lithium expertise has been a real coup for us. Here in Canada there's myself and I have a great business development gentleman by the name of Jeremy Ross, who has really been instrumental in introducing our story to people like yourself. So couldn't do without them.

Dr. Allen Alper: Well that sounds great. Could you tell our readers/investors a bit more about your capital structure?

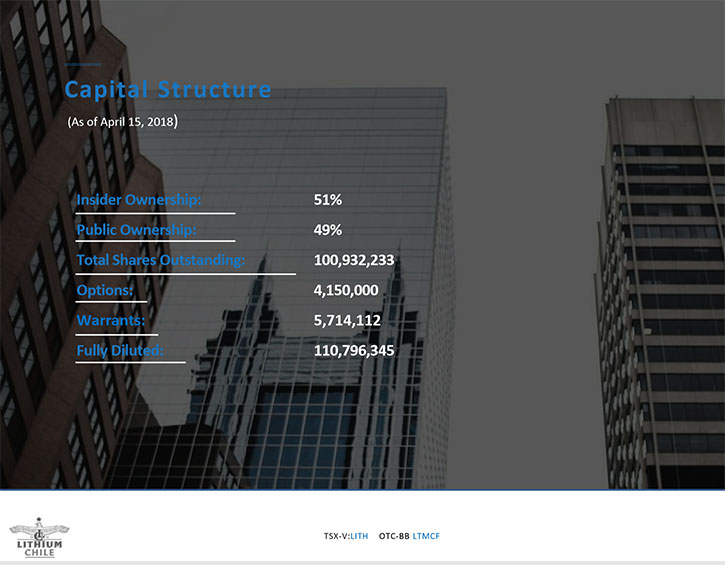

Steve Cochrane: Currently we have approximately 104 million shares outstanding, which gives us a market valuation of about 52 million Canadian. We have, right now, close to a 2.3-2.4 million in cash. We also have another $3,000,000 in receivables from our spin of our copper gold subsidiary Kairos Metals. We lent them $1.4 million in cash and they owe us another $1.6 million for the properties themselves. Concurrent with that, the shares in Kairos Metals were dividend to the Lithium Chile shareholders. They have drilled their first property, seven holes were drilled. We're waiting results. The idea there is they'd like to go public early this year, at which time they'll repay us a million and a half dollars.

So between our working capital and our receivables, we have $5.5 million dollars Canadian.

Dr. Allen Alper: That sounds great! What would you say are the primary reasons our high-net-worth readers/investors should consider investing in Lithium Chile?

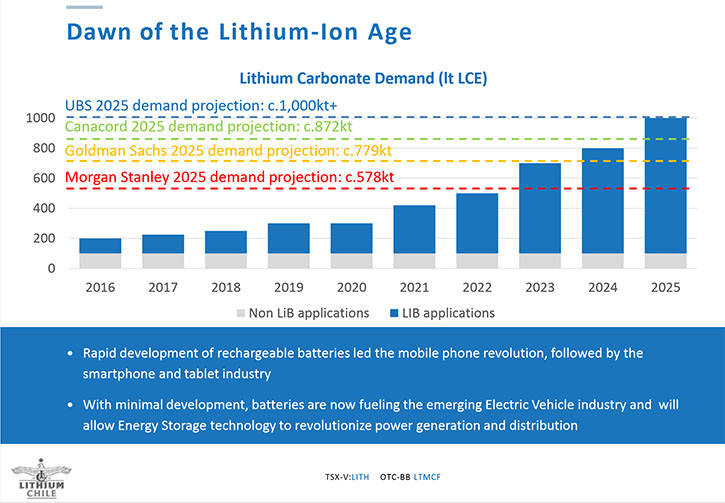

Steve Cochrane: A great article came out early in January. The gist of it was 2018 will be the peak for oil and gas use. They see in 2019 going forward, the switch from internal combustion engines to electric and a continual decline in demand for oil, certainly from the transportation industry. The fact that people see electric mobility, electric transportation, taking over, going forward. That's evidenced by the fact that in 2016 there were three or four models of electric vehicles, there were three or four options for people that wanted to buy an electric vehicle. This year there'll be 40+ different models, and 80 different models are forecasted by 2020.

The whole industry has taken off, batteries are driving that industry and what's driving the battery industry is lithium.

While we've seen a downturn in the lithium equities and we've seen a bit of pullback in lithium prices, the fact is that the electric mobility industry is showing no signs of slowing. It's growing exponentially, double digits, year after year. It's fundamentally sound. When you can see demand growing on the transportation side, it will translate to additional demand for batteries, which is going to be good for lithium.

So, we're in the right space, I think we have a temporary disconnect between the ongoing double-digit growth in the EV sector and the recent downturn for Lithium mining companies. For most of 2018 the public Lithium exploration companies saw a decline in their market value in the 40 to 60% range. At the same time battery demand and EV growth were in the double digits. This has resulted in some very good valuations in these junior exploration companies. We have already seen some M&A activity in the sector most recently, with the buyout of LSC Lithium (LSC-V) by Pluspetrol Resources Corporation. I firmly believe we will see more deals like this as 2019 progresses.

It was interesting, Harley Davidson just opened up their first motorcycle showroom in China, devoted exclusively to their electric models of motorcycles. You read these headlines every day. It just reinforces in my mind that we're in the right industry.

Dr. Allen Alper: That sounds great. Those seem like very strong reasons to consider investing in Lithium Chile.

Steve Cochrane: Exactly.

Dr. Allen Alper: Is there anything else you'd like to add, Steve?

Steve Cochrane: During the time last year and eight months that I've spent within the lithium community, the battery community, I really believe we're in the right space at the right time.

We may be at the front of the parade right now because we're new and North Americans are still married to the internal combustion engine, and I don't think we have fully embraced, or fully appreciate the growth in the industry. Europeans have, certainly the Asians have. There was an article recently that Shenzhen has been the second city in China to go fully electric in both their bus fleet and their taxi fleet. There are 27 000 taxis in the city of Shenzhen now, 100 percent electric.

There is a revolution taking place under our noses, and unfortunately I think that North Americans are slow to get on the bandwagon. But it's coming. So just let your readers/investors know to get to the front of the parade, and take a hard look at Lithium Chile. I can honestly say that we've seen progress all along the way.

Dr. Allen Alper: Sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Steve Cochrane: Thanks, Allen.

https://www.lithiumchile.ca/

Steven Cochrane, President and CEO

steve@lithiumchile.ca

Jeremy Ross, VP Business Development

(604) 537-7556

jeremy@lithiumchile.ca

|

|