Interview with Randy Smallwood, President and CEO of Wheaton Precious Metals (TSX: WPM, NYSE: WPM)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/22/2019

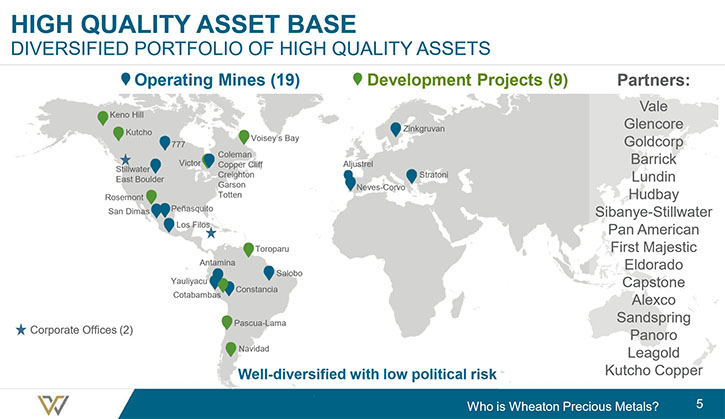

Wheaton Precious Metals™ Corp. (TSX: WPM, NYSE: WPM) is one of the largest precious metals streaming companies in the world. Wheaton currently has streaming agreements for 19 operating mines and 9 development stage projects. We learned from Randy Smallwood, President and CEO of Wheaton Precious Metals, that in 2018 the Company made their first venture into cobalt, by acquiring a cobalt stream from Vale's Voisey's Bay mine in June. They have also closed a new precious metals purchase agreement, with First Majestic, on the San Dimas Mine, whereby Wheaton will now get 25% of gold production as well as 25% of the silver production paid in gold. At the end of 2018, Wheaton reached a settlement with the Canada Revenue Agency ("CRA"), which has taken much of the tax risk out of the Company. According to Mr. Smallwood, 2018 was a foundation year, from which the company can grow.

Randy Smallwood, President and CEO

The Peñasquito Mine, Goldcorp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Randy Smallwood, who is President & CEO of Wheaton Precious Metals Corp. Randy, could you update us and our readers/investors on some of the most significant things that have happened since we had our last interview in 2016 and highlights of 2018. Then later we'll talk about what you see happening in 2019.

Randy Smallwood: Certainly, Allen. And thanks for the opportunity to be interviewed for Metals News. 2018 was an incredible year for Wheaton Precious Metals. I call it a foundation year. We've built ourselves a very firm foundation to build ourselves up and continue to grow and expand the range of the company. We started off 2018 by completing a refreshed streaming contract on the San Dimas Mine. It was the very first streaming contract that we had when we created the company back in 2004 and it had to be renegotiated with a new owner. First Majestic came in and we sat down with them and worked over a period of, a better part of a year and came up with a much stronger contract that does well both for us and for First Majestic.

So First Majestic took over ownership early in 2018 of the San Dimas Mine, the stream is now gone from a pure silver stream to a silver and gold stream. We now get 25% of the gold produced and 25% of the silver produced. All of the silver is delivered to us in gold equivalent ounces. That allows First Majestic free access to the entire property in terms of pursuing what's best for that project going forward. It's a much healthier arrangement. It is truly a win-win arrangement. So that was the first accomplishment.

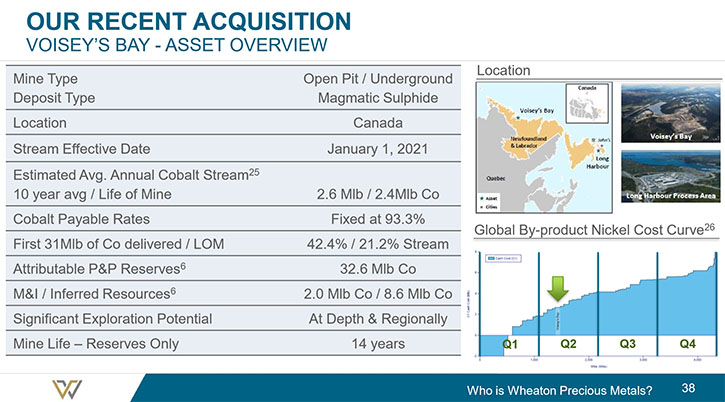

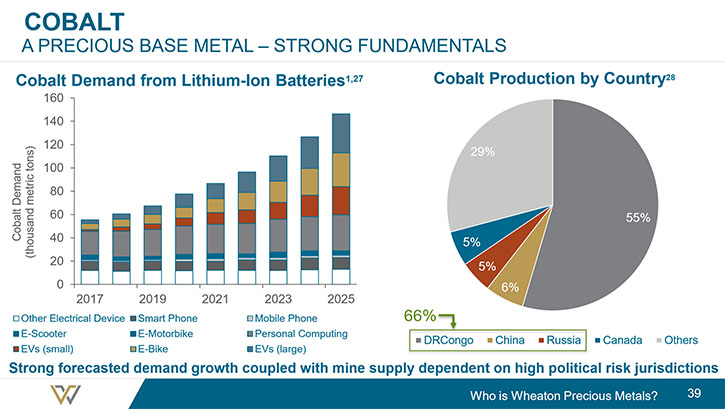

We then struck a deal with Vale, at the Voisey's Bay Mine, for cobalt. That’s our first venture into cobalt, not something that we are typically pursuing as we are 100% focused on precious metals. But, this asset came along and when we study cobalt, we feel it is a unique specialty metal. We are very bullish on being able to take advantage of what we see as a huge growth in demand, on a worldwide basis, for energy storage, mobile energy storage, which really is batteries, the demand for batteries and battery technology. It is most obviously used in electric vehicles, but also in mobile electronics. And mobility is one of the key objectives in terms of where the human race is going. As we become more mobile, we require energy storage and batteries.

Cobalt's going to play a role in that. I have no doubt there will be a measure of thrifting in cobalt as we move forward, but the increase in demand is substantially going to outweigh any negative effects from thrifting. We don't receive any of that cobalt from Voisey’s Bay until 2021. We're eager to know where electric vehicle demand and battery demand is going to be by 2021. I believe it will be definitely higher than where we are right now. As that manifests itself, we see increases in demand, we're very comfortable with that. Another unique thing about Voisey’s Bay cobalt is that it is Voisey’s cobalt. It's not from the DRC, it is not potentially a conflict metal. It is processed by a dedicated smelting facility at Long Harbour. So we can guarantee pure providence all the way through to the consumer. And we know that we should be able to differentiate the Voisey’s Bay cobalt from any other cobalt in the world.

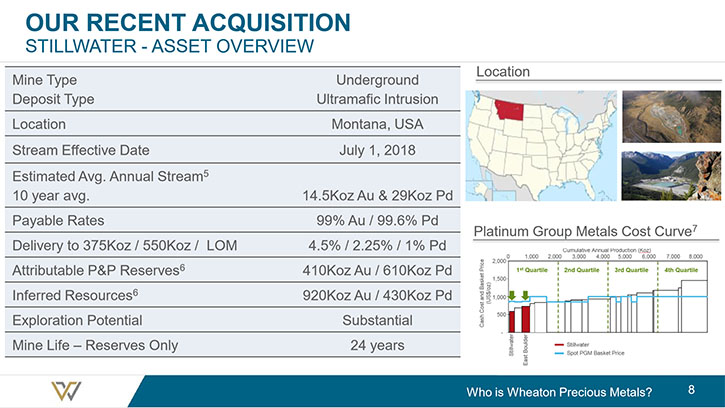

It's among the cleanest, greenest, most socially and environmentally responsible cobalt in the world. And so we really do see us being able to differentiate that and even deliver a bit more value to our shareholders just because of the tender and the quality of this product, which is something we always focus on in Wheaton Precious Metals—quality of product. Shortly after that, we then completed a stream with Sibanye-Stillwater on the Stillwater mines in Montana.

The Stillwater deposit is one of the most incredible, precious metals deposits I've ever seen. It has a 45 kilometers strike length. It has two different operations, the East Boulder Mine and the Stillwater Mine. And Sibanye of course, acquired it a couple of years ago, has been continuing to improve and optimize operations. The Blitz Project should be coming on in a little while. So through that stream, we made our first ever investment in palladium. We now get 100% of the gold from the Stillwater Mine and we get 4.5% of whatever palladium it produces. Palladium has turned into the most precious of the precious metals now, it's up well over $1,300 an ounce, and we see increases in demand. Palladium is generally used as a catalyst for gasoline engines and we see a shift away from diesel into gasoline. Ultimately long-term, we see a shift from gasoline into hybrid and ultimately long-term into electric vehicles.

But I think there'll always be a demand for clean fossil engines, therefore, a requirement for palladium. And so, an incredible deposit that I'm confident will be producing metal for us for many decades, it's a deposit that just has no known boundaries. Strike length has been sort of defined at 45 kilometers, but nothing in depth has been confirmed and so much potential in terms of that asset continuing to grow and expand. With Sibanye operating it, we do feel that there are going to be some increases in efficiency.

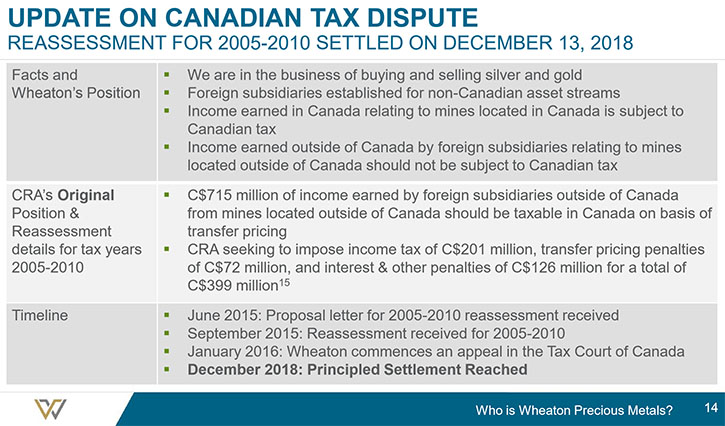

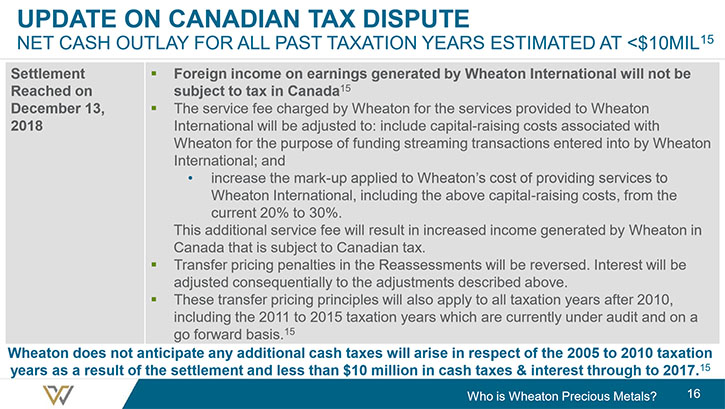

Of course, our last accomplishment in 2018 was finally settling our dispute with the CRA, which we announced December 13th.

This was a longstanding dispute. We were reassessed under transfer pricing rules of the 2005 to 2010 taxation years related to income generated by the Company's wholly-owned foreign subsidiaries outside of Canada. We finally came to an agreement and basically what was potentially over a $1 billion liability up until the end of 2017 and another billion plus on a go forward basis, turned into a less than $10 million cash payment. So we now have a principled settlement that applies on a go forward basis. We have tax confidence, so we've gone from one end of the tax risk spectrum to the other end, and we have confidence that on a go forward basis, as long as we don't change our business model, we will be treated that way by the Canada Revenue Agency. It's been an incredible burden for our shareholders to bear for many years now and I look forward to us gradually clawing that value back and delivering it back to our shareholders.

And so all in all, 2018 was an incredible year. Probably one of our most productive, it's a foundation year. We have growth optionality in front of us over the next few years. Peñasquito is ramping up in grades, we have the Constancia Mine in Peru that'll be ramping up over the next while, we have the Stillwater Mine, the Blitz project coming on and over the next two, three years that production climbing. We have additional growth from the Salobo expansion, which has been committed to by Vale. It's about a 50% increase throughput capacity down at the Salobo Mine and even, optionality in the form of say Rosemont to being able to come on.

I see 2018 as a foundation year and we are now a very high quality growth company that has organic growth structured into its portfolio in the next five years. Really good position to be in right now.

Dr. Allen Alper: Oh it sounds excellent. That was an outstanding year of accomplishments for Wheaton Precious Metals, so that's excellent. Could you tell our readers/investors a little bit about what's going to happen or what you're going to focus on in 2019?

Randy Smallwood: With the CRA behind us, it allows us to focus totally on delivering value to our shareholders. We have put in extra effort, in terms of running our business, while we were fighting the CRA. But having that behind us, allows us to put our entire focus on continuing to build and grow our Company and focus on accretive acquisitions. I will say the marketplace right now is a little bit skinny in terms of opportunities, there's not a lot of investment going into the space and we do supply capital to the industry to help with growth, but if there's not investment into the space, it definitely reduces our own opportunities. That's not sustainable in the long run, mines do get exhausted and there's always a requirement for additional capital. And so we're pretty comfortable that we will see a pickup in that.

I will say that the opportunity set that we're looking at right now generally focuses on growth. It's either funding, co-funding acquisitions or funding project growth, either expansions or new mine builds. There's not a lot of what I call balance repair opportunities—I don't see any in our opportunity set right now. It's a year where we think we can continue to add a few more opportunities. We already have organic growth within our current portfolio. The bulk of the growth in the next few years is going to come from higher grades Goldcorp’s Peñasquito Mine. And of course we get 25% of the silver production. With the pyrite leach plant, they're shifting into the higher grade zones within the Peñasquito body. So we should be in very good shape there.

We expect free cash flows in excess of $500 million, probably even in an excess of $600 million. And if we don't spend it in the ground, we'll just put it up against the debt, after of course paying our dividend. We do deliver 30% of our cash flow back to our shareholders on a quarterly basis, averaged over the previous four quarters. So we have a very healthy dividend that currently is around a 2% yield.

Dr. Allen Alper: Well that sounds excellent. Is there anything else you'd like to add Randy?

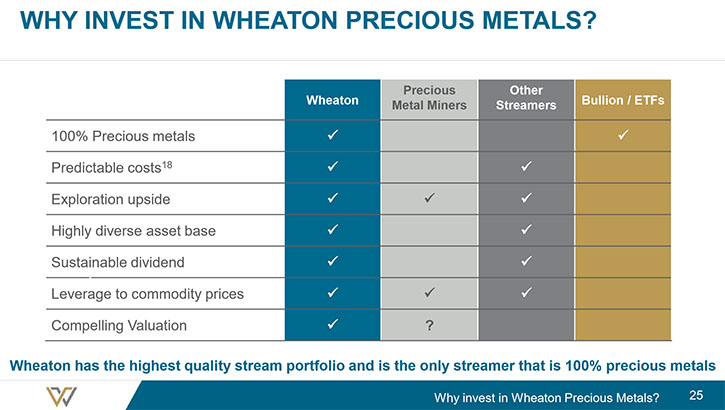

Randy Smallwood: Our Company, since the announcement of the CRA settlement, has recovered about 15% of its value. We still have a lot more to gain back to trade like our peers. And so we are still by far the most attractively priced of the streaming companies on a relative basis. The multiples that we are trading at are still substantially below our peers and I think all together that adds up to us currently being the best way to invest in precious metals. The streaming model is a much lower risk investment vehicle in terms of precious metals and yet it still delivers all the benefits. The cost risk has been taken out in the streaming model. You know what our operating costs are, you know what our capital costs are, and yet we still deliver your organic growth, we still deliver leverage, we still deliver yield, we still deliver so much more than traditional other low risk forms of precious metals investments. The streaming model is the best way to invest in precious metals, and Wheaton is the most attractive of the streaming model opportunities.

Dr. Allen Alper: It sounds like Wheaton Precious Metals is an excellent opportunity for our readers/investors to consider. I'm very impressed with what you have accomplished this past year and your outlook for 2019.

Randy Smallwood: Thank you Allen. It has been a good year. We're going to continue to build on it.

Dr. Allen Alper: Well done. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.wheatonpm.com/

Wheaton Precious Metals Corp.

Suite 3500 - 1021 West Hastings St.

Vancouver, BC Canada V6E 0C3

Tel: 604-684-9648

Toll Free: 1-800-380-8687

Fax: 604-684-3123

info@wheatonpm.com

|

|