Bluestone Resources Inc. (TSXV: BSR, OTCQB: BBSRF): Feasibility Study, Quick Pay Back, Production to be 146,000 Ounces per Year; Interview with Darren Klinck, President & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/21/2019

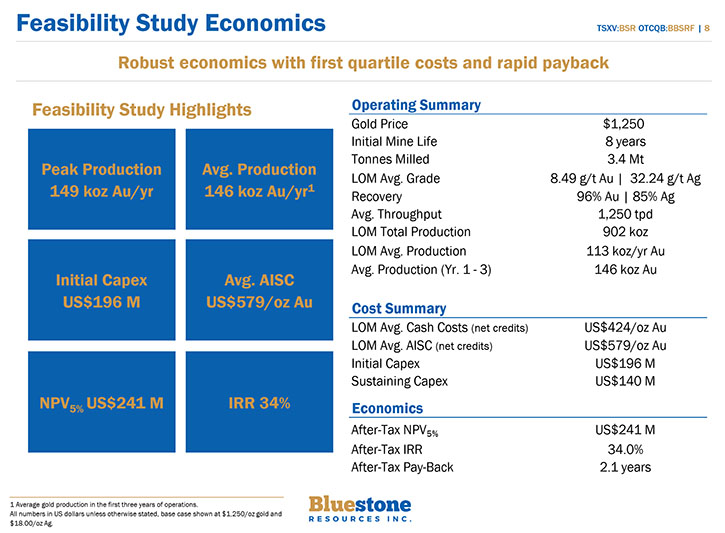

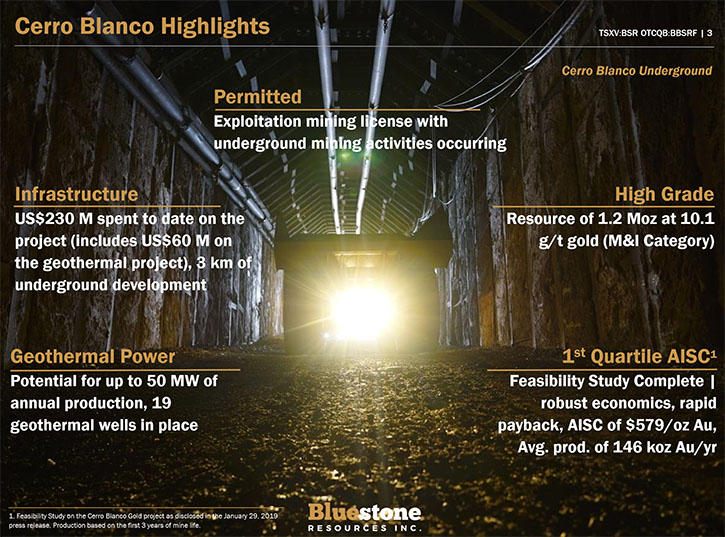

Bluestone Resources Inc. (TSXV:BSR, OTCQB:BBSRF) is a mineral exploration and development company that is focused on advancing its 100%-owned Cerro Blanco Gold and Mita Geothermal projects, located in Guatemala. A Feasibility Study on Cerro Blanco returned robust economics, with a quick pay back and an average annual production projected to be 146,000 ounces per year, over the first three years of production, with all-in sustaining costs of $579/oz gold. The Mita Geothermal project is an advanced-stage, renewable energy project, licensed to produce up to 50 megawatts of power. We learned from Darren Klinck, President, CEO, and Director of Bluestone Resources, that Cerro Blanco is one of the highest-grade undeveloped gold projects today. In its first full year of annual production it is expected to generate more free cash flow than the current market cap of the Company. The capital expenditure estimated to build the project is $200 million and Bluestone plans to finalize the project's financing in 2019. Near-term plans also include drilling to upgrade the inferred resource into measured and indicated, which will add significant NPV and value to the overall project.

Bluestone Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Darren Klinck, who is President, CEO, and Director of Bluestone Resources Inc.

Could you give our readers/investors an overview of your Company and an update on the most significant things that have been going on with Bluestone in 2018, and some of the highlights of your plans going into 2019?

Darren Klinck: Very good, Thanks, Allen, for interviewing us for Metals News. It's great to be back with you here today.

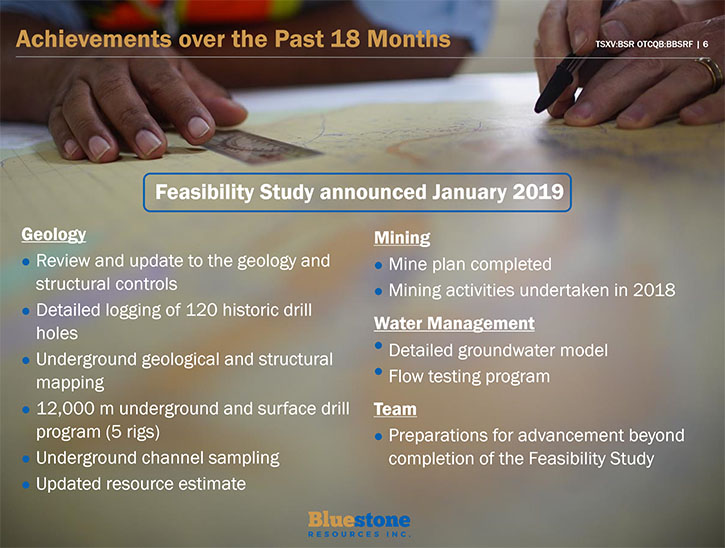

I think it's fair to say that since Bluestone came into its current formation, just over 18 months ago, we have been largely focused on a core of technical work that largely has culminated in the announcement of the Feasibility Study on the Cerro Blanco Gold project.

We acquired this asset from Goldcorp in 2017. Successfully raised C$80 million, so about US$60 million. This asset, which has had more than US$200 million already invested in it by Goldcorp and Glamis Gold, an advanced project, with its exploration license already in place. We acquired it for US$18 million.

Over the last 15 to 16 months, we’ve been working on the feasibility study, starting with the geology, a lot of structural geology work. Mapping, sampling, re-logging. Then, the infill drill program, which ultimately led to the updated resource in the fall of 2018.

We provided updates on the metallurgical test work, which demonstrated a 5% increase in our overall recoveries.

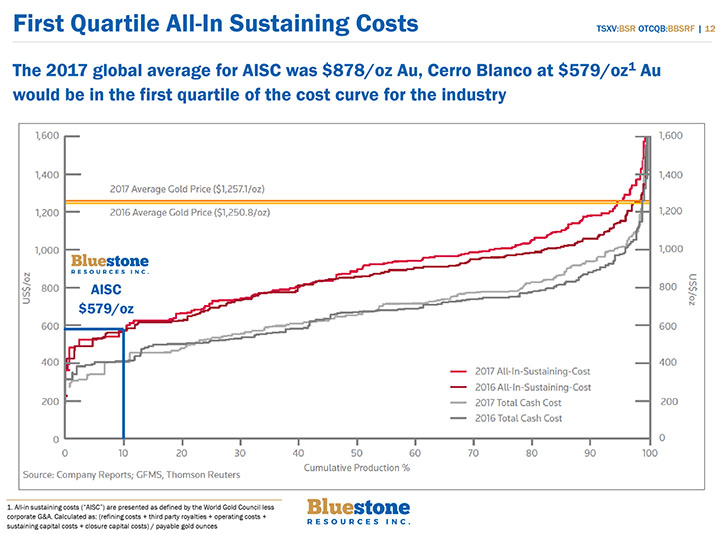

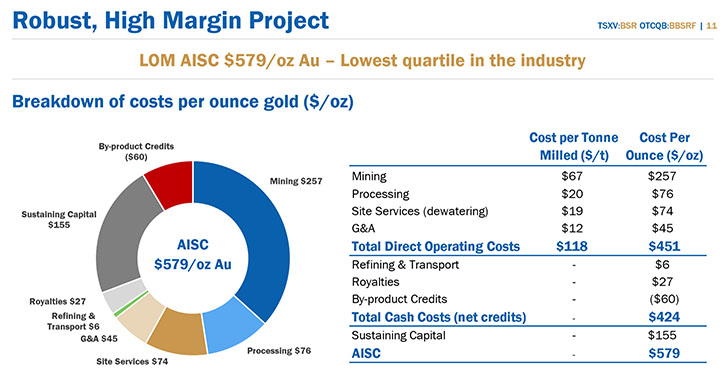

We recently announced a feasibility study that outlines that Cerro Blanco is one of the highest grade, undeveloped gold projects out there today. It is expected to produce over the first three years, 113,000 ounces of gold per annum, at an all in sustaining cost of $579 per ounce, which firmly puts it into the first quartile of a cost structure, across the global cost curve.

Importantly, this asset has an IRR of 34%. In its first full year of annual production, this asset should produce more free cash flow in its first year than the market cap of the company today. It's truly a remarkable opportunity, I think, for Bluestone, for our local stakeholders, and government partners. Over the next six to eight months, as we continue through an optimization process, reviewing trade off studies, while we are looking to put the project financing in place.

The capital expenditure estimated to build the project is US$200 million. In today's world that is relatively modest for resource projects. It demonstrates quick pay back, modest capital, and very good returns.

Dr. Allen Alper: That's an outstanding feasibility study, with outstanding results. You and your team should be congratulated on the great work you did, and also the great deposit you have, and how you've moved so rapidly forward in exploring and developing the project.

Darren Klinck: Thank you. For us, we've only just started. There's still an enormous amount of work to do here over the next couple of years, but I think we have a very good base and a robust business, regardless of what we're producing.

Of course, they often talk about the fact that you need a margin. If you're making Swiss chocolates, or tennis shoes, or gold bars, you need to have a margin. This project will have some of the best margins in the business today.

At the end of the day, we are a price taker. We do not control what the gold price is. The best thing we can do is to maintain our cost structure. If you can focus on quality assets, which are harder and harder to find today, that's one less variable you need to worry about.

Dr. Allen Alper: That's great to have a high-grade deposit and a projection of getting cash back so rapidly and being one of the lowest cost potential producers. That's all excellent.

Darren Klinck: Thank you. We're very pleased with the outcome.

Dr. Allen Alper: Well done! Could you update our readers/investors on your capital structure and on who is supporting you? I know you have very impressive investors.

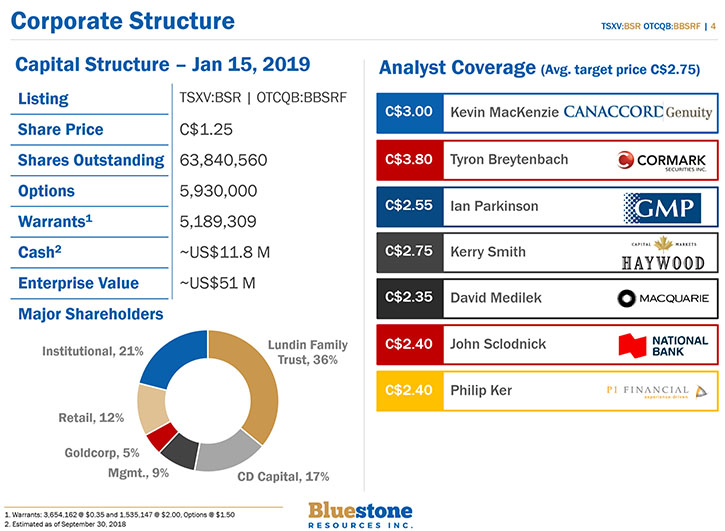

Darren Klinck: Sure. The company trades on the Toronto Stock Exchange under the symbol BSR, as well as on the OTCQB under the symbol BBFRF. We currently have about 63 million shares out, so a relatively modest number of shares. There's about five million options, which are held by insiders and five million warrants that are outstanding. So, a share structure that's relatively tight.

Our largest shareholder that we have remains to be the Lundin family, who are well known for being successful in the resource space. Both in mining and the oil and gas space.

They have a 36% interest in the company. On top of that, CD Capital out of London, a well-known resource private equity group, holds 17%. Gold Corp retained 4.9% and management has 9%. When you add that up, about 65% of the shares are held within four hands, all very supportive for us to continue to advance as we are.

Dr. Allen Alper: That's excellent.

Could you give our readers/investors an update on what's happening in Guatemala?

Darren Klinck: Sure.

Many people, probably aren't aware of how fiscally conservative Guatemala is. It has a very good track record over the last number of years, in terms of its fiscal policy.

Guatemala has been growing at two to four percent per annum for a number of years. It's a very right of center government, very close ties with the United States, of course. About 40% of the exports from Guatemala end up in the America.

I believe, Guatemala has one of, if not the most stable currency in Latin America over the last 10 years. It has ranged between seven and eight Quetzales against the US dollar. You compare that to the Brazilian reals, which have moved around more than 100% in that period of time. The Mexican peso, I think, closer to 80%. The Chilean peso, closer to 80%. Even when we compare the Canadian dollar against the US dollar, we've definitely had a much higher movement than 15% over that 10 year period.

Very strong marks from the IMF, in terms of their fiscal management. Guatemala has a sovereign debt rating that is on par with many of the larger economies in Latin America and other parts of the world. It's on par with Brazil, for example at a BB rating. Further ahead than in places like West Africa, where there's a lot of mineral investment. Even in countries like Ecuador. Guatemala has a stronger credit rating, and only slightly lower than Mexico or Columbia.

From that perspective, Guatemala is a very solid place for investment and we'll continue to see that as we go forward.

Tahoe Resources, which was a mine operator, operating gold and silver mines throughout the Americas, in Canada and Peru, and, of course, the flagship asset in Guatemala, the Escobal project, was recently acquired by Pan American Silver for $1.1 billion. Despite some of the challenges that Escobal has had, I think that sent a very strong message when that deal was announced in November. It's a very significant acquisition for Pan American Silver, and I think, bodes very well with regards to a path forward not only in Guatemala, but also of course, for Escobal.

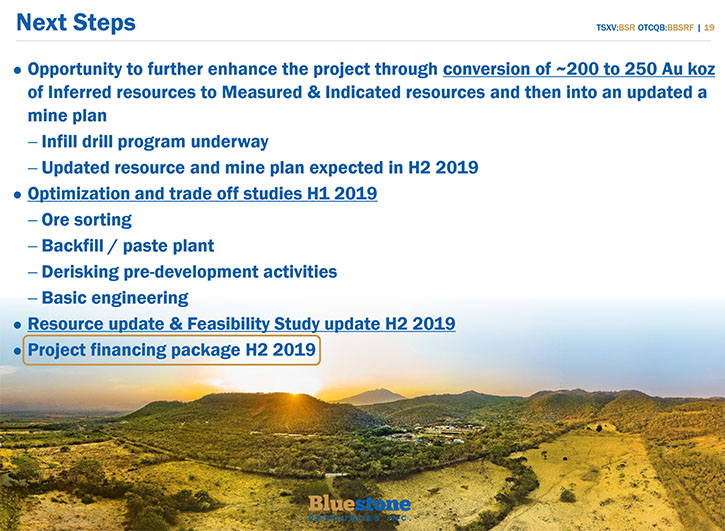

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the next steps for Bluestone Resources going forward?

Darren Klinck: Sure. I think, much like the last 18 months, it has been pretty hectic. I think the next 18 months will be even more so. But, very exciting.

In the near term, over the next six plus months, we have a key focus right now on continuing to drill, to upgrade our inferred resource into measured and indicated. We've already had a couple of news releases out on that over the last three to four weeks. This is a very targeted program, focused on the inferred resources that sit within the deposit at Cerro Blanco, with an objective of upgrading that into the indicated and measured category.

What that will allow us to do as we get towards the middle part of the year, is to update the resource, then ultimately update the mine plan. Our objective is to try and upgrade an additional 200,000 ounces of high grade gold into the indicated and measured categories. By doing that, we see the opportunity, as we update the feasibility study to add significant value to the overall project.

It's very rare that you can drill holes with this level of surgical precision and a high level of confidence that virtually every hole is going to have a positive commercial impact on the project. We're really excited about that. David, our VP of Exploration, is very focused on that right now.

With the feasibility study out, we will be turning our attention to putting in place project financing. We have a number of parties that are already engaged and are in a data room. Our hope is that as we move forward over the next six months, we'll be able to progress and put in place a project financing package that will allow us to then move into a development stage.

As we get into the back half of the year, I think you can expect to see the updated resource and ultimately we'll update the feasibility study. All things being equal, if those things come into place, then we would be kicking off development activities later in the year. Well, Al, I think it's really quite simple. Regardless of what business you're in, we, as investors, will always look for business opportunities that have good margins and good returns.

In the mining space, it tends to be a very capital intensive business. The beauty of Bluestone, and a big reason why I joined, is that Cerro Blanco represents a very high grade, low impact, small footprint, low capex project. Something that's financeable, something that brings with it some of the highest grade out there, which means you have some of the best margins.

On top of that, it's been de-risked from the perspective of having more than US$200 million of sunk capital being put in over a number of years and most of the key permitting requirements already in place.

It's a great business opportunity regardless of what the gold price does. Also, in a timeline that we think is very achievable here over the next couple of years.

Dr. Allen Alper: That sounds excellent. I can't get over the magnificent progress that you and your team have made. What a compelling story you have, and proposition for investors.

I wonder if you could summarize why our high-net-worth readers/investors should consider investing in Bluestone Resources.

Darren Klinck: Right.

Well, Al, I think it's really quite simple. Regardless of what business you're in, we, as investors, will always look for business opportunities that have good margins and good returns.

I think the opportunity for investors is that you simply look at the Company and the metrics in the feasibility study and say, if I were investing in a business that I knew was going to generate more free cash flow in the first year than the current market capitalization of the company, would I be interested? I think virtually every one of your high-net-worth readers/investors will look to that and say, “Without a doubt that is a place where I'd like to be invested.”

We're all invested here as management. I can reassure you that 130% of our time is very much focused on managing the opportunity as we move forward.

Dr. Allen Alper: Well, that's excellent. Those are compelling investment reasons to consider investing in Bluestone Resources. That's an excellent opportunity for our high-net-worth readers/investors to consider.

Is there anything else you would like to add, Darren?

Darren Klinck: I think, Al, we've covered the main points.

I’m happy to take any questions or queries from any of your readers down the road. It is important to go through this information that was out this morning. There's quite a bit of information that's available now, with the feasibility study. Your readers/investors can review the presentation online. There's also a video there that walks through the feasibility study, which we've put up on the website.

Lots of information. We look forward to catching up with you again in the next few months.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.bluestoneresources.ca/

Bluestone Resources Inc.

Darren Klinck | President, Chief Executive Officer & Director

Stephen Williams | VP Corporate Development & Investor Relations

Phone: +1 604 646 4534

info@bluestoneresources.ca

|

|