Blackstone Minerals (ASX: BSX): Exploring one of the world’s highest grade Cobalt Gold projects in British Columbia, Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/19/2019

Scott Williamson, Managing Director of Blackstone Minerals (ASX:BSX), outlines the Company’s world class Little Gem Cobalt Gold property in British Columbia, Canada, and provides an overview of Blackstone’s Australian Gold properties. Blackstone has a proven management team that is ready and equipped to move this very high-grade project forward. It operates in safe, mining-friendly jurisdictions.

Scott Williamson. Managing Director, Blackstone Minerals at VRIC

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News. We're here at the Vancouver Resource Investment Conference 2019 in Vancouver, Canada, the VRIC 2019. I’m interviewing Scott Williamson, who is Managing Director of Blackstone Minerals. Scott, could you give us and our readers/investors an overview of your Company?

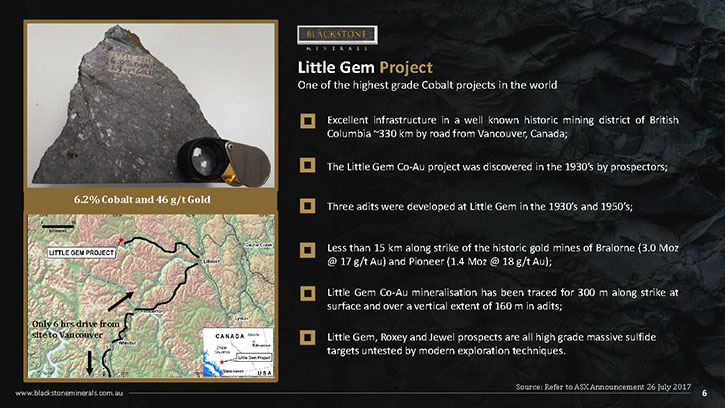

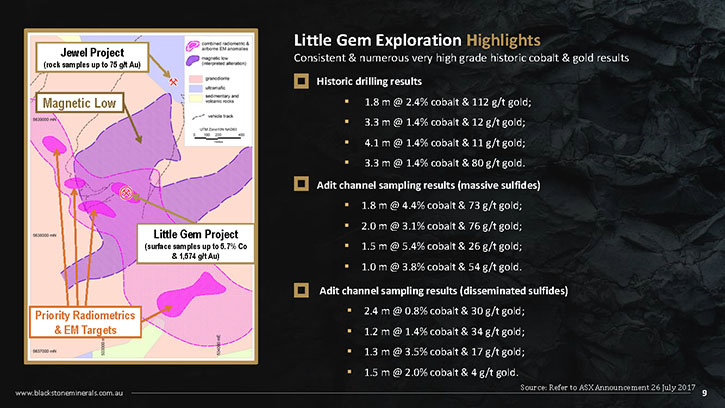

Scott Williamson: Yes. Thanks Allen. We have an asset in British Columbia, called the Little Gem Cobalt Project, near the Bralorne gold mining district. So Bralorne is actually the most prolific gold belt in British Columbia's history and they've mined 4.4 million ounces at 17 grams per ton gold. This is an area that's never been explored for cobalt and we've now been in this area for just over 12 months and we've hit some very high-grade cobalt. We're exploring this district for cobalt and we believe there could be a belt scale opportunity here.

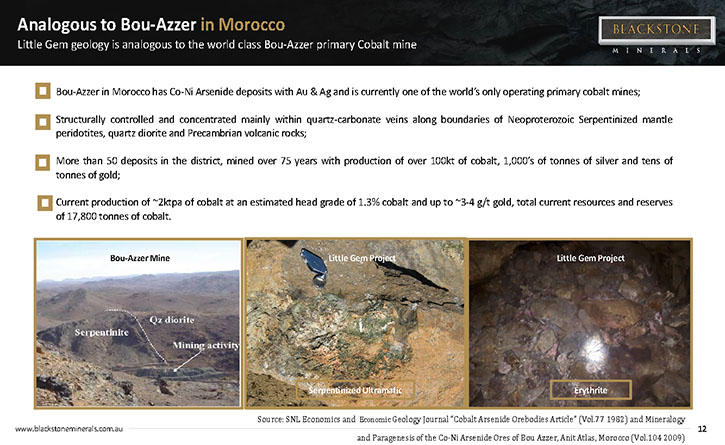

We have 48 kilometers of cobalt geology and it's the same geology as the Bou-Azzer mine in Morocco, where they've been mining cobalt for 75 years and they also have about a 50 kilometer belt with 50 different deposits and some very high-grade cobalt.

We believe we have a similar geology around Bralorne, which is about six hours away from Vancouver where we are today.

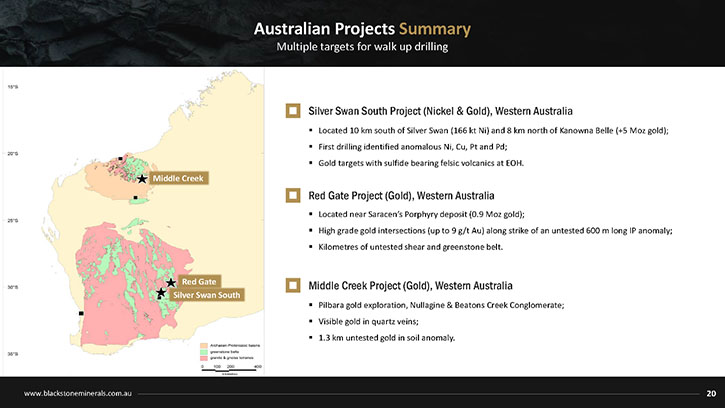

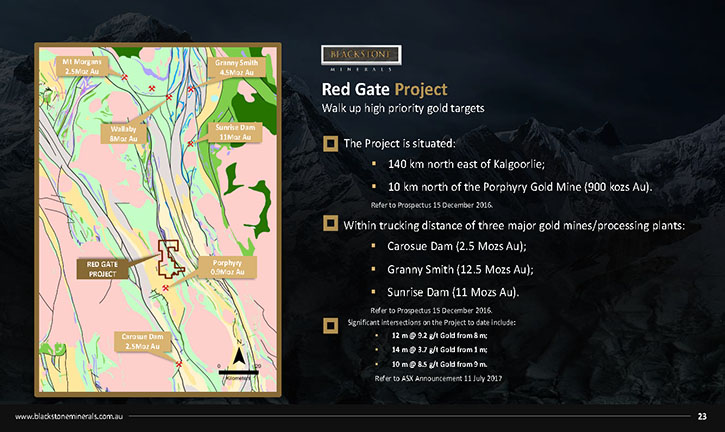

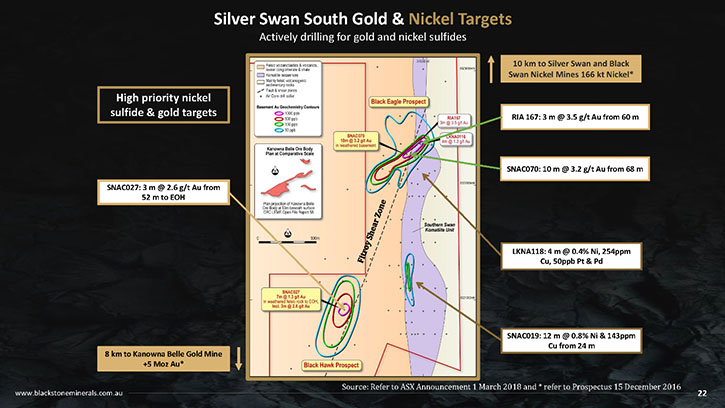

We also have some good Australian assets, where we're looking for gold and nickel sulfides near Kalgoorlie, about 30 kilometers north of Kalgoorlie. We have a good portfolio of different precious and base metals, with a particular focus on cobalt and nickel for battery metals.

It's a great conference. We come here every year because our main asset is this BC cobalt project. We'll start drilling again in April/ May of this year. We have some very large IP anomalies, which are suggesting that we have found the source of the mineralization and that's copper, gold and cobalt. So we have a very large IP survey, which is suggesting a sulfide-bearing body, which is the source of all the mineralization we are seeing.

So the mineralization at the Little Gem is very high-grade cobalt, plus one percent cobalt, very high-grade gold up to an ounce per ton gold. So very high grades around the area, but also a large sulfide-bearing body nearby, which needs to be tested as soon as possible. We're also looking at partners and larger groups to come in and help us explore. We think this is a large system that requires a significant amount of money. We've been looking in Korea and we've spoken to a lot of the battery manufacturers in Korea and we think there's a good chance we might be able to bring in a big partner to help us explore for cobalt, but also nickel.

They are also interested in nickel sulfides, and we have some very good nickel sulfide targets near Kalgoorlie that we're also testing in the next few months. Yes, a lot going on in Australia and Canada and yes we're looking forward to getting back on the ground. We just raised 1.2 million dollars. That's enough to kick things off, but we’re also looking for that big partner to come in with a significant amount of capital to really keep things going and keep the excitement, over the next few months.

Dr. Allen Alper: That sounds exciting! Very good for you and your team. Excellent! Could you tell our readers/investors a bit about your background, your Management Team and your Board?

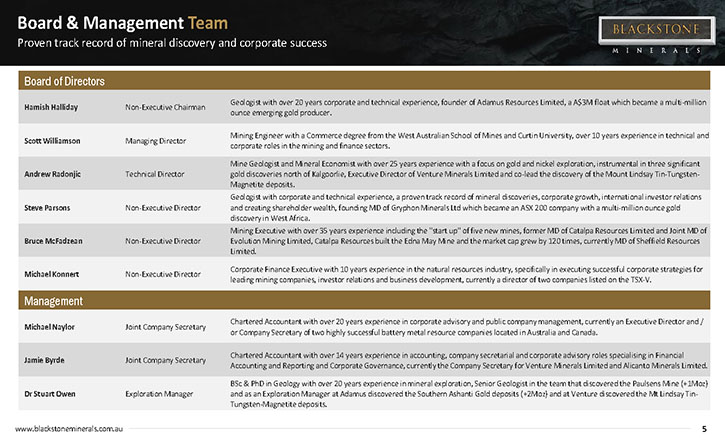

Scott Williamson: My background is as an underground mining engineer. It’s a little different for an exploration company to be run by an engineer, but I think that actually adds value because I've done a lot of mining. We can assess whether these targets are going to be a mine, very quickly, and move on if they're not. My background's underground mining and also corporate finance or stockbroking as well. So I've done a bit in the capital markets but most of my time is in underground mining as an engineer. I have a team of geologists around me so they are the experts on the rocks. Dr. Stuart Owen is one of the better geologists I have ever worked with. He's been great! The key people to note are Hamish (Halliday), and Steve Parsons. They are an entrepreneur partnership that have been working together for nearly 20 years. Over the years, they have taken a number of small companies and made them much larger companies. Adamus Resources in West Africa was Hamish's success story and Steve is also having some success recently with Bellevue Gold Limited (ASX: BGL). So we have a history of major discoveries across four or five different continents, but most importantly, generating shareholder wealth through corporate success as well.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

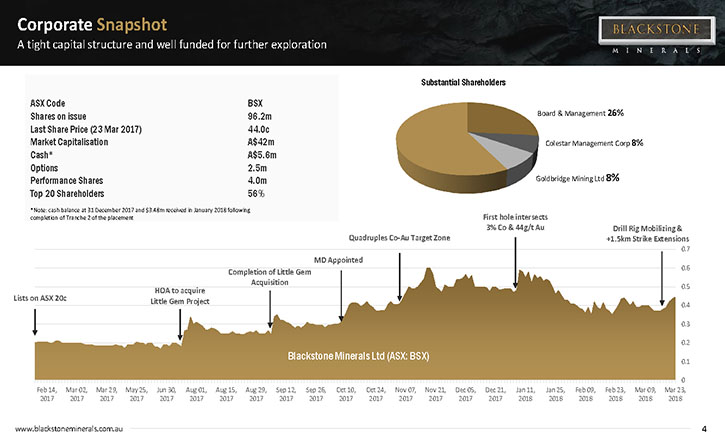

Scott Williamson: Yes. We just raised some money. We have 1.2 million dollars in the bank. We have just over 100 million shares on issue. Our market cap is hovering around 10 million dollars Australian. So a very tight capital structure since the IPO nearly two years ago now. Some major shareholders in the vendors of the asset from BC, but also we have a very important German shareholder that is very long term and is consistently buying in the market. We have some very supportive shareholders and a very tight capital structure.

Dr. Allen Alper: Sounds great. And your listings?

Scott Williamson: We're listed on the ASX and the code is BSX and that's our only listing at this stage. We're always open to other markets, but at this stage we're just listed on the ASX.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in Blackstone Minerals?

Scott Williamson: One of the primary reasons to invest in Blackstone is that we believe a large demand is coming for the battery metals, nickel and cobalt. We have exposure to both of those battery metals. We also have exposure to the precious metals of gold and copper as well as a base metal. We have a good portfolio spread across Australia and North America, but also great exposure to the battery metal space. Very quickly we'll be drilling in Australia in the next few months or so. As soon as we can hit the ground in British Columbia, that's when things will really start to move again.

Dr. Allen Alper: That sounds excellent. Is there anything else you would like to add?

Scott Williamson: Thank you for interviewing Blackstone Minerals for Metals News. It's a great time to be looking at the space. I think we've definitely found a level of support and we think that it's only time before we can start to deliver some exciting results.

Dr. Allen Alper: That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://blackstoneminerals.com.au/

Telephone: +61 8 9425 5217

Fax: +61 8 6500 9982

admin@blackstoneminerals.com.au

|

|