Anaconda Mining Inc. (TSX: ANX, OTCQX: ANXGF): A Growing Gold Producer in Atlantic Canada; Interview Dustin Angelo, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/18/2019

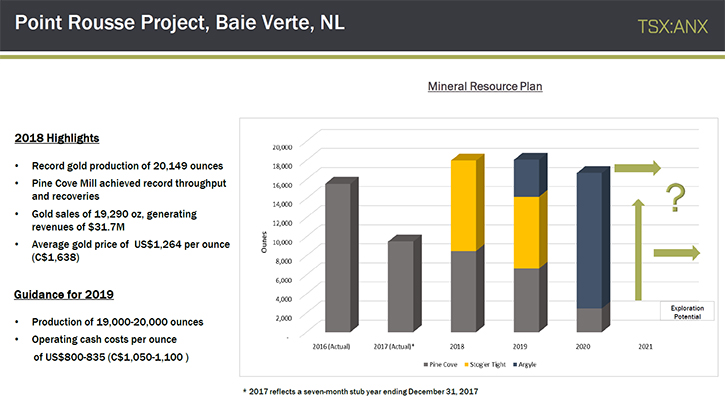

Anaconda Mining Inc. (TSX: ANX, OTCQX: ANXGF) is a growing gold producer in Atlantic Canada. Anaconda Mining operates the Point Rousse Project, located in the Baie Verte Mining District in Newfoundland, and is also developing the Goldboro Gold Project in Nova Scotia, a high-grade Mineral Resource, subject to a 2018 preliminary economic assessment, which demonstrates strong project economics. We learned from Dustin Angelo, President and CEO of Anaconda Mining, that they are currently producing around 20,000 ounces at the Point Rousse Project, with plans to bring the Goldboro Gold Project to production by 2021. According to Mr. Angelo, this will allow Anaconda to get up in the 50 to 60,000 ounce range, ultimately looking at about 100,000 ounces a year, in production, through organic growth.

Dustin Angelo, President and CEO of Anaconda Mining at VRIC

Anaconda Mining Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dustin Angelo, who's President and CEO of Anaconda Mining. Could you give our readers an overview and also an update on what's been happening with Anaconda, Dustin?

Mr. Dustin Angelo: Certainly. Anaconda is a growing gold producer in Atlantic Canada, a top tier jurisdiction. We have two principal project areas, in which we work; the Baie Verte Peninsula in Newfoundland, where we have our flagship asset, our producing mine, the Point Rousse Project, and then we also have a property called Tilt Cove. Tilt Cove is about 30 kilometers east of the Point Rousse Project and is a high-grade area, an exploration property that we'd like to tie into the Point Rousse Project when we find a deposit there.

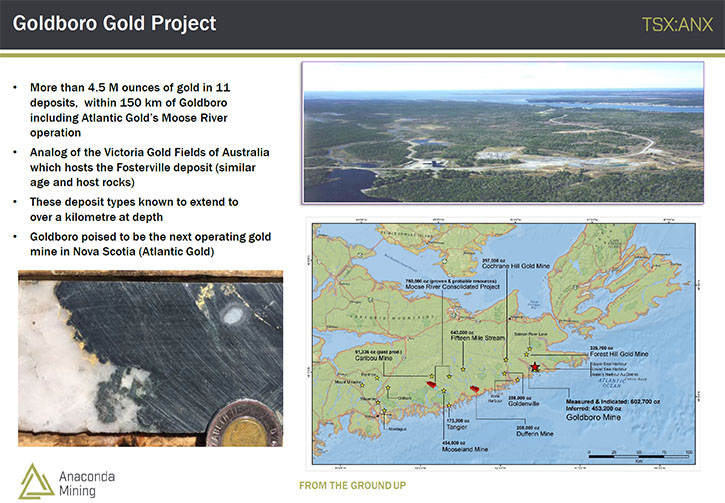

Also, in Nova Scotia, we have the Goldboro Gold Project, which is near Cape Breton, in the Eastern part of Nova Scotia. It's a high-grade gold deposit that we're currently developing, and planning to put into production by 2021. We're currently producing around 20,000 ounces of gold from our Point Rousse Project. When we bring on Goldboro in 2021, we're looking to get up to the 50 to 60,000 ounce range. Ultimately we're looking to reach about 100,000 ounces a year in production through organic growth.

Dr. Allen Alper: That sounds great. Could you tell us and our readers/investors a bit about some of the highlights of what you've found and the production?

Mr. Dustin Angelo: We just came off a very good year at Point Rousse. It was a record year. We had record production, over 20,000 ounces and record throughput in our mill. So we had a significant amount of cash flow generation out of Point Rousse. Then on the Goldboro side, we've been growing Goldboro. We had a big mineral resource increase, when we put out our updated estimate back in October. When we originally bought the project it had 870,000 ounces of total measured, indicated and inferred resources. And now it has approximately 1,056,000 ounces.

We've had pretty good drill results of late as well, and we're demonstrating that we can expand the deposit. There are three main systems, within the deposit, and they're all growing, they're all extending at depth along strike and down plunge. Based on our exploration results to date, we have a goal to get to about two million ounces at Goldboro, and we're just over halfway there.

Dr. Allen Alper: Oh that sounds excellent. Could you tell our readers/investors a bit more about your cash flow, your capital structure and some of your finances?

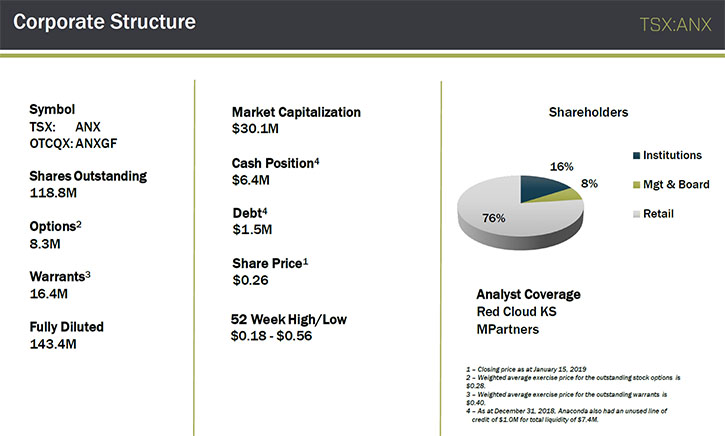

Mr. Dustin Angelo: We have about 118 million shares outstanding. We're trading in the mid 20 cent range. In Canadian dollars, we have about a 30 million dollar market cap. At the end of December, we had 6.4 million dollars in cash in the bank, and only about a million and a half dollars in debt, and that debt is a combination of capital leases and government loans, so very manageable. We don't have our full year financials out just yet, but through the first nine months of 2018, we generated about 6.7 million dollars in free cash flow generation at Point Rousse after operating expenses, cap ex, and exploration. We’re continuing to generate a lot of free cash flow, and we'll carry that in 2019, having similar guidance for 2019, in terms of production at Point Rousse. With the support of our cash flow generation, we're looking to finalize our permitting by the end of 2019 at Goldboro, and also complete a feasibility study. By the end of the year, we plan to be shovel ready to start construction in 2020.

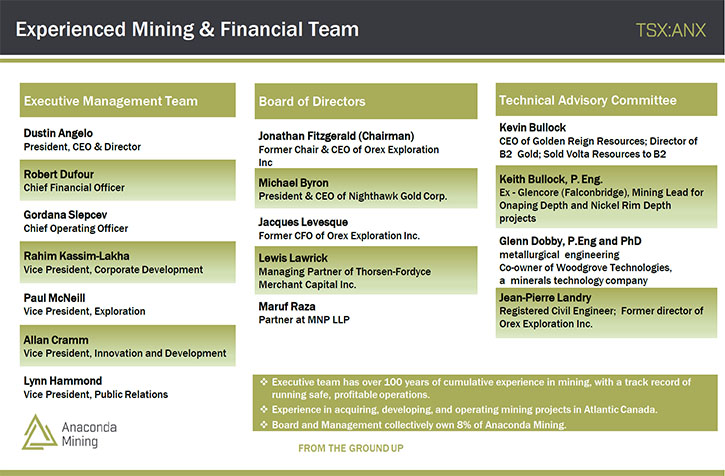

Dr. Allen Alper: Oh, sounds excellent! We have many new readers, so could you go over your background, your Management team’s and your Board’s?

Mr. Dustin Angelo: Sure, I'm an accountant, a CPA from the United States. I have about 13 years of mining experience early on in coal mining, and now for about the last 9 years in gold mining. I have an investment banking background and a public accounting background as well. I've been a part of a few different startups in the mining industry.

Our team in general has lot of experience in Atlantic Canada. We've worked on several projects, not only just our current projects, but other projects prior to coming to Anaconda. So the team has a lot of experience in the area. We know the geology, we have really good government relations. We know how to attract top talent to the area, we know the vendors. We really know how to do business in Atlantic Canada, as a team.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our high-net-worth readers/investors the primary reasons they should consider investing in your company?

Mr. Dustin Angelo: Well I think from an valuation standpoint, we're at a low point right now, when you look at relative comps out there, we're probably trading somewhere in the low teens on a per ounce basis. On average, the comps that we look at are probably around 40 dollars an ounce. And there are some comps much higher than that. We have a lot of infrastructure, we have an experienced management team, and we generate cash flow at our producing project, the Point Rousse Project. We have a significant growth project with Goldboro. So all that together, gives us a lot of good catalysts to move us up the valuation curve. Going from, where we are right now, to about the average, would be a four times increase in valuation, which I think is pretty reasonable, considering what we have in place.

So it's a good entry point if an investor wants to invest in Anaconda, in terms of the stock price. There's a lot more upside at this point, versus downside.

Dr. Allen Alper: Sounds like excellent reasons to consider investing in Anaconda. Is there anything else you'd like to add Dustin?

Mr. Dustin Angelo: Our two key projects are Point Rousse on the Baie Verte Peninsula, and Goldboro in Nova Scotia, and they're going to be pretty key catalysts for growth over the next several years.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.anacondamining.com/

150 York Street

Suite 410

Toronto, Ontario, Canada

M5H 3S5

Phone: (416) 304-6622

Fax: (416) 363-4567

info@anacondamining.com

|

|