Golden Rim Resources Limited (ASX: GMR): Building on 1 Million Ounces in Burkina Faso; Interview with Craig Mackay, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/31/2019

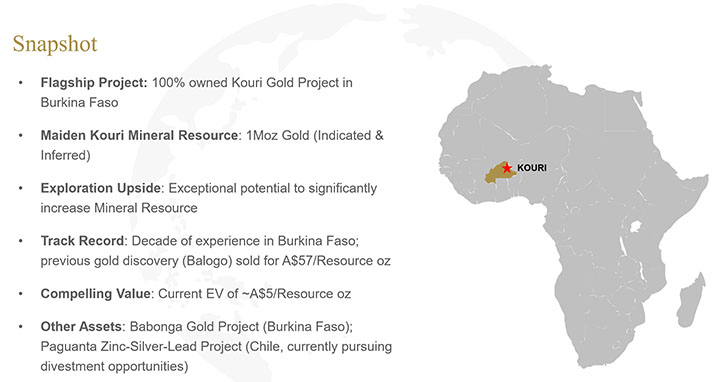

Golden Rim Resources Limited (ASX: GMR), is an emerging West African gold developer, focused on its near term Kouri Gold Project, located in north-east Burkina Faso. The Kouri Gold Project contains 1.4Moz in defined Mineral Resources, with significant upside potential to grow. We learned from Craig Mackay, Managing Director of Golden Rim Resources, that they are in the process of acquiring more land next to their property and are looking forward to doing a lot more drilling there, over the next 12 months, to expand the resource base. According to Mr. Mackay, Burkina Faso is a mining friendly country with the fastest growing gold industry in Africa.

Golden Rim Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Craig Mackay, Managing Director of Golden Rim Resources. Craig, could you give our readers/investors an overview of your company?

Craig Mackay: Sure, Al. We're ASX listed. We have an office in Melbourne on the east coast of Australia, but all of our activity is in Burkina Faso, in West Africa. We have a project there called Kouri, which sits over in the eastern part of the country. A couple weeks ago, we announced a resource upgrade for Kouri to 1.4 million ounces of gold from surface to 115 meters below surface. That mineralization is completely augmented in every direction so that's a long strike and at depth.

We've also made a new discovery about four and a half kilometers to the southwest of the initial resource. Recent gold intersections include 10m at 4.1g/t and 11m at 3.4g/t gold, so it looks like there is excellent potential to expand our resource base in this area. We're certainly looking forward to doing a lot more drilling there, over the next 12 months.

Dr. Allen Alper: That sounds excellent. I understand you have also made a bonanza gold hit recently. That sounds very exciting as well.

Craig Mackay: Yes. In addition we have made a bonanza gold hit of 4m at 44.7g/t gold from 34m, including 2m at 89.5g/t gold only 500m west of the 1.4Moz resource on a newly identified structure, the Footwall Shear.

Approximately 300m along the shear to the east we hit 3m at 8.4g/t gold from 10m, including 1m at 18.8g/t gold.

We are very excited that this high grade mineralisation is open in all directions and the Footwall Shear seems to extend for at least 5km in our existing licence and then extends further into the ground we are acquiring to the east.

Dr. Allen Alper: That is all amazingly great. Really excellent!

Could you tell our readers/investors a bit about Burkina Faso, what's going on in the country and why it's so interesting for gold exploration and mining now?

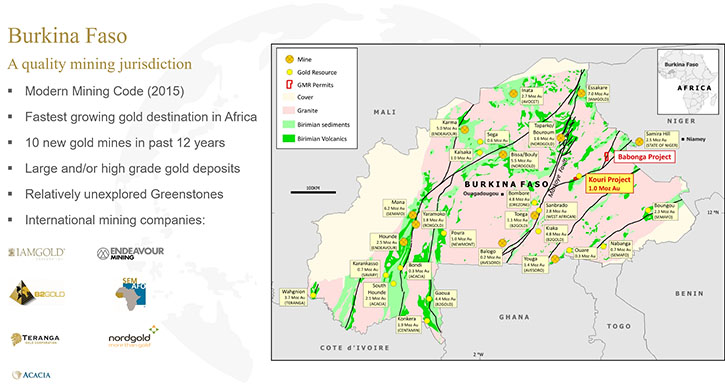

Craig Mackay: Burkina Faso, is a landlocked country in West Africa. It's actually one of the poorest nations on earth. Their major income stream is from cotton and from gold, so gold mining is an important priority for the government there and they have been incredibly supportive of us. We've been there for a decade now. The main advantage of Burkina Faso is its incredible prospectivity. It has vast gold mineralized greenstone belts, very similar to the greenstone belts we have in Australia in the west. These are greenstone belts that have largely never seen a history of mining and gold exploration.

When we arrived a decade ago, the vast bulk of the country had never been explored. You pick up ground that's never had a drill hole and so finding gold is relatively easy to do. For example, most of the holes we have drilled in our gold project have hit gold. The government has a modern mining code. It's supportive of mining. We've seen ten new gold mines built in Burkina Faso is the last 12 years. We have a number of others under construction. At the moment, it looks like Burkina Faso has the fastest growing gold action in Africa.

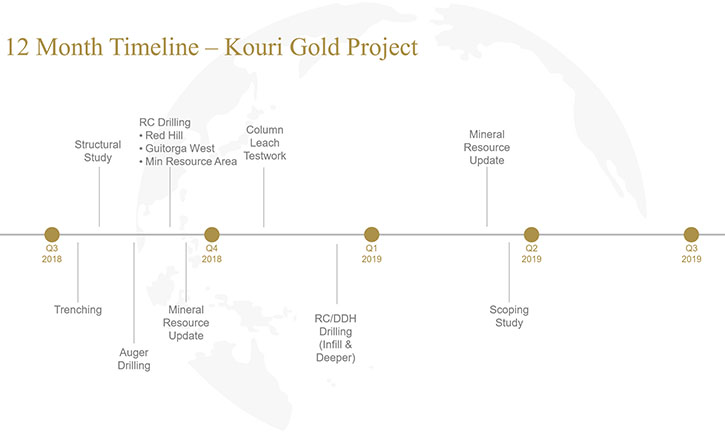

Dr. Allen Alper: That sound excellent. Could you tell us what your plans are, going forward this coming year?

Craig Mackay: Last week we announced a transaction where we're buying the ground next door to our resource project. It's for about a million dollars U.S. Now our resource at 1.4 million ounces of gold actually goes up to our eastern boundary and we believe it extends directly across into the ground next door. Our initial assessment is that the ground next door is just as prospective as what we have. Once that acquisition is finalized we will increase our ground holding by four times and we will have increased the strike extent from 16 kilometers to 40 kilometers. Certainly, as we move into the next year, it's going to be about drilling. It's going to be about expanding the resource base. We think that 1.4 million ounces is just a start.

Dr. Allen Alper: Oh, that sounds fantastic. That's excellent. Could you tell us, our readers and investors, a bit about your background, your management team and your Board?

Craig Mackay: I'm a geologist, with roughly 30 years’ experience. The first half of my career was with major companies, Shell Metals, Acacia Resources and Anglo Gold. Then the last half of my career has been in the junior end of the industry. My background is also basically all in gold so gold is what I love. In terms of the rest of the Board we have a mining engineer and an accountant as Directors, so just three Directors, all based in Melbourne here with me.

In West Africa, where really all the action is, we have an office in Ouagadougou, it's the capital of Burkina Faso, in the center of the country. In that office, we have four geologists and about another dozen support staff. That team is led by a country manager called Richard Zongo, who's a 30-year veteran geologist, with five gold discoveries in Burkina Faso under his belt.

Dr. Allen Alper: That sounds like you have a very strong experienced and excellent team and you have a great background. Could you tell our readers/investors a little bit about your capital structure?

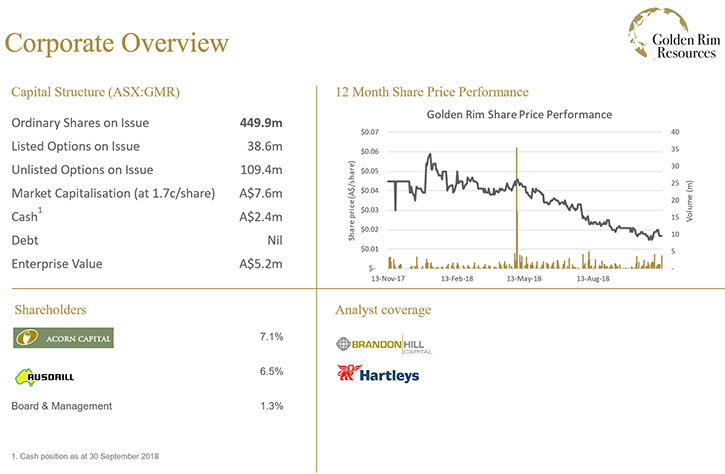

Craig Mackay: We're listed on ASX Australian Securities Exchange. Our code is GMR. Currently we have roughly 440 million shares on issue, which gives us presently a market capitalization of about seven to eight million Australian dollars. I think that's very interesting when you look at the resource base we have. Presently our enterprise value per ounce is only $5.00 Australian, so roughly $3.50 U.S., so I think we're an incredibly cheap stock at the moment.

Dr. Allen Alper: Are you planning to keep on developing and exploring and do your plans include going into production?

Craig Mackay: Yes, ultimately we do plan on going into production. Certainly our focus right now is drilling. Before proceeding to development, we need to determine the size and grade of our gold resource. The next 12 months is about doing that and expanding the resource space.

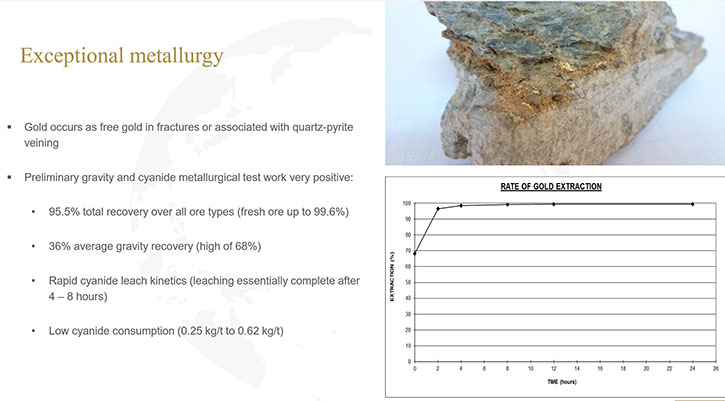

We are doing other things simultaneously. We are doing metallurgical test work for example. We did some initial work about six months ago, gravity and cyanidation test work and those results were extremely positive. So we're getting about 95.5% recovery over all types at Kouri. We're doing some additional metallurgical test work in Perth right now, so we expect those results soon. We will do other work to position the project for development, but really the key aspect right now is that drilling for resource expansion.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your property in Chile, your zinc?

Craig Mackay: We have an asset called Paguanta in northern Chile. It's a zinc-silver-lead and copper project. It's quite an advanced project. It's had about $35,000,000 U.S. spent on it in its history. We've spent probably about $8,000,000 U.S. on it. It has a resource of 2.4 million tonnes at 8% zinc equivalent. It has a lot of upside, particularly at depth. We think there are parallel structures to the south of the resource that haven't been drilled as yet.

The issue we've had in the market, is that we're getting very little traction for that project in Australia. It's possibly more suited to a listing in North America. The other issue is we have our Kouri gold project in Burkina Faso that is really using a lot of our financial and people resources. So we decided to sell the zinc project and to use the proceeds from any sale to help advance the gold project in Africa. It's on the market at the moment.

Dr. Allen Alper: Oh, that sounds like a very good approach. Could you tell our readers/investors the primary reasons they should consider investing in Golden Rim Resources Limited?

Craig Mackay: I think certainly that exposure to gold. If you believe in gold and you think it's going to be a commodity to invest in moving forward, well then certainly we should be looked at. At the exploration phase our enterprise value per ounces is really only about $3.50 U.S. and there's a lot more gold to come. We certainly are very confident we're going to be able to expand that resource space very quickly and ultimately we will get traction in the market and value in the market because of that.

Dr. Allen Alper: Sounds like excellent reasons to consider investing in gold and in these resources. Is there anything else you'd like to add, Craig?

Craig Mackay: We're a very active company. We're always drilling. Our view is to really get out there and give it a go and drill and progress things as quickly as we can. Our company is always generating plenty of news and that will continue into next year.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Latest News:Amendment to Terms to Acquire Permits Adjacent to Kouri

Quarterly Activities Report (For the period ended 31 December 2018)

http://www.goldenrim.com.au/

Craig Mackay

Managing Director

61 3 9836 4146

craig@goldenrim.com.au

|

|