Aeris Resources Limited (ASX: AIS): Australia’s Fifth Largest, Independent Copper Producer; Interview with Andre Labuschagne, Executive Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/16/2019

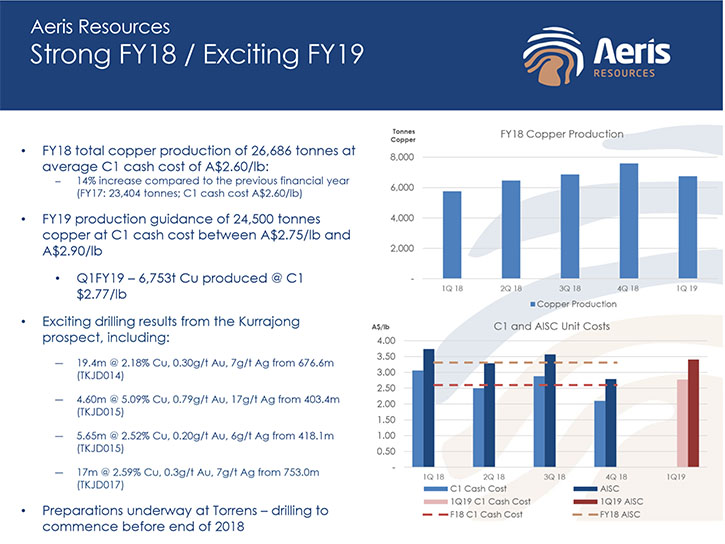

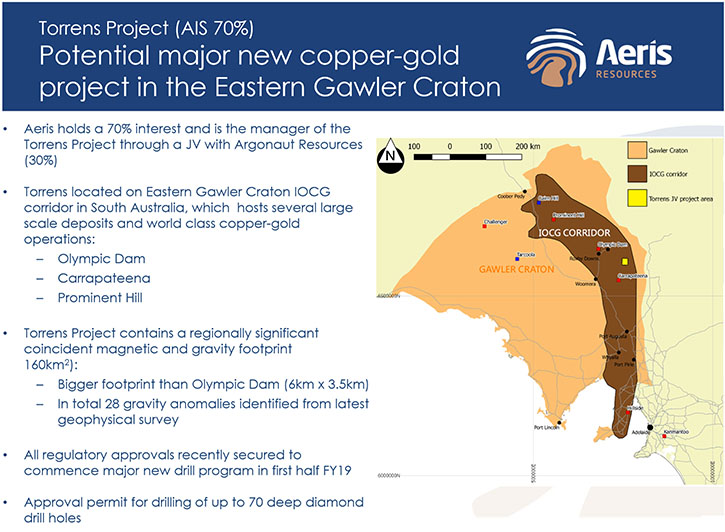

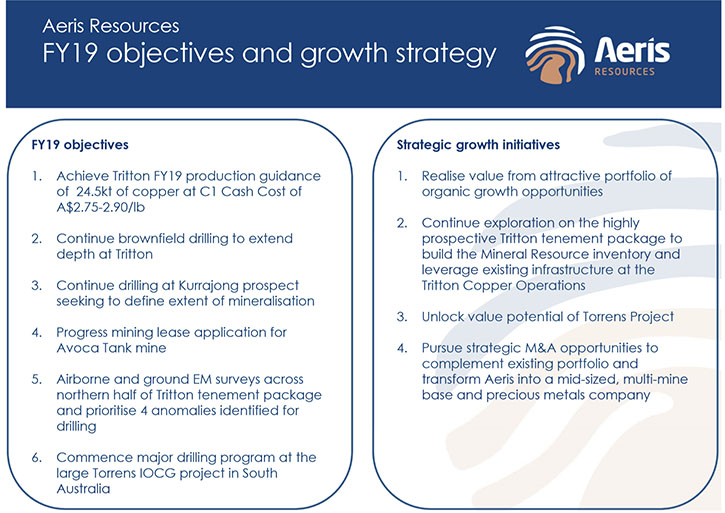

Aeris Resources Limited (ASX: AIS) is currently Australia’s fifth largest, independent copper producer by volume produced. Its flagship asset, the Tritton Copper Operations in New South Wales, has delivered record production in recent years and is targeting production of 24,500 tonnes of copper in FY2019. The Tritton Copper Operations include multiple mines and a 1.8 million tonne per annum processing plant. We learned from Andre Labuschagne, the Executive Chairman of Aeris Resources, that the company is focused on extending the mine's life, re-starting greenfields exploration activities and accretive mergers and acquisitions. The company is also about to start drilling at their 70% owned Torrens project, which is a very large IOCG anomaly in South Australia, not far from the BHP's large Olympic Dam mine and also in close proximity to BHP’s recently announced Oak Dam discovery. According to Mr. Labuschagne, Aeris Resources is now positioned for growth and ready to spend money on exploration, with significant upside potential both at Tritton and at Torrens.

Tritton Copper Operations

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing André Labuschagne, Executive Chairman of Aeris Resources. André, could you give our readers/investors an overview of your company?

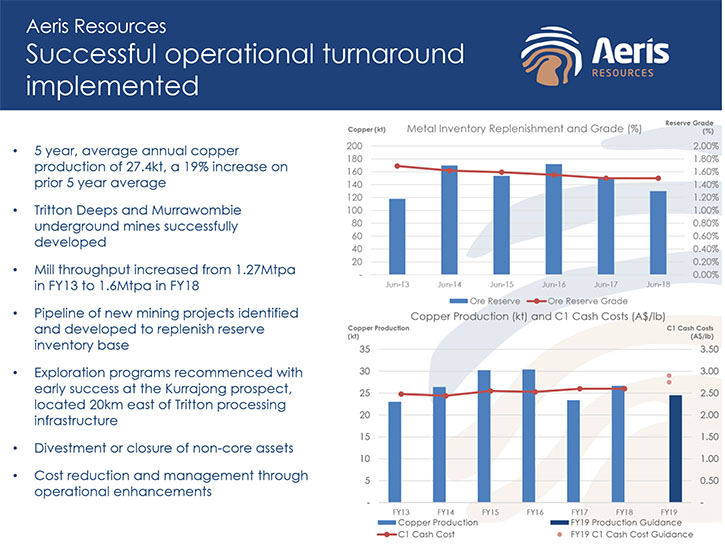

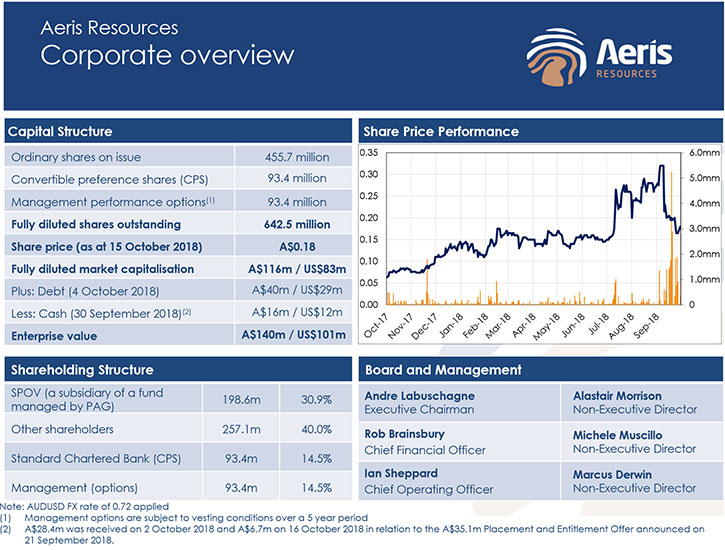

André Labuschagne: Sure. Aeris Resources is a copper mining company, producing on average about 25,000 tons of copper annually. It has a copper mine, called Tritton, in western New South Wales near the town of Nyngan. The company has gone through an extensive restructure over the last six years, specifically on its debt. When we started with the Company in early 2013 we had $136 million US dollars in debt. As of October 2018, that debt has been reduced to US$29 million, through various restructuring negotiations, with Standard Chartered Bank and Credit Suisse.

It is the first time in over six years where the company's balance sheet is not impacted by excessive debt. The operational performance over the past five years has been exceptional. Tritton has produced up to 30,000 tons of copper in some years.

Dr. Allen Alper: That's excellent! What you've done in the last few years!

André Labuschagne: Thank you. The Tritton copper mine currently has a five year reserve life, with significant expansion opportunities at both the Tritton underground mine and Murrawombie underground mine. There are also numerous other advanced mining projects which provide further options to expand. So we see a great opportunity to extend that mine life or reserve life beyond the five years.

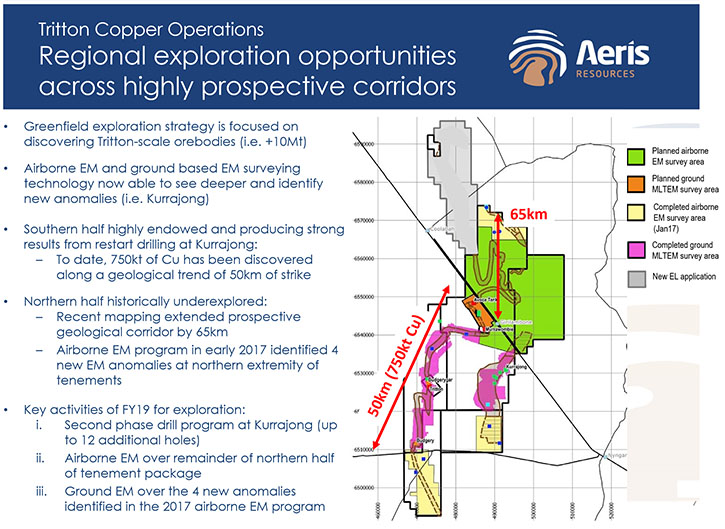

We've also, over the last 12 months, started to re-look at exploration on our tenement package. We have over five hundred thousand acres surrounding the mines that we really haven't spent much money on, over the last five or six years, purely because of the focus on the balance sheet and operations.

We're currently doing an aerial electromagnetic survey over the northern part of the tenement package, which hasn't been explored at all. This is quite exciting for us because we do think this type of deposit we have comes in clusters and this is a great opportunity to find another in that northern extension of the tenement package. Following previous exploration, we've started drilling the Kurrajong prospect, with some very good and interesting results, getting intersections of 17 meters plus at 2.5% copper. We're in the process of drilling the first stage. Then we will reassess the project and do further drilling to get it into a resource position.

Quite exciting! It will further expand the current mine plan.

Dr. Allen Alper: That sounds excellent.

André Labuschagne: On top of the Tritton project, we also have the 70% owned Torrens project. It's a very large IOCG anomaly between BHP's Olympic Dam and Carrapateena. It’s a very large anomaly, bigger than the Olympic Dam footprint for example. It's not far from the site of BHP’s recent Oak Dam discovery that was announced last December. It just shows that it's in the right area. It's a good opportunity and we have announced that we're ready to start the drilling in mid-January. The contracts have been awarded. The driller is mobilizing the drill at the site over this period and then the project will kick off in January. That will be quite exciting.

Dr. Allen Alper: That's excellent. Sounds like it's a very exciting time for Aeris Resources, a lot of recovery and lowering your debt and increasing your resources.

André Labuschagne: Yes. Now that we have a balance sheet that has responded to the work we've done, we’ve always said we wanted to become a material copper player. We will continue to look for opportunities to grow the business beyond just the 24,000 tons of copper, through our own exploration, but also looking for opportunities to expand through M&A activities.

Dr. Allen Alper: That sounds excellent. Could you give our readers/investors your background and that of your Management Team and your Board?

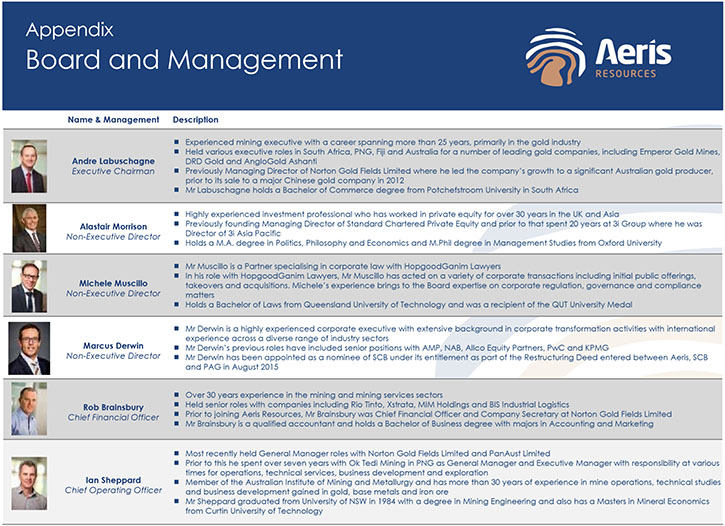

André Labuschagne: Certainly. For close to 30 years now, I've been in South Africa and Australia and also involved with mines in Papua New Guinea, Fiji, Africa and Australia. Rob Brainsbury is the CFO. Ian Sheppard, the COO, is one of the best mining engineers I've ever worked with. We have been working together now for probably eight years. We used to run a company called Norton Gold Fields as a Management Team. When that was bought out, in 2012 we decided to stay together and so when this opportunity came up, to become involved with restructuring the old Aeris Resources, we stuck together. So the Management Team has been together for a long time and has done these kinds of restructures with both balance sheets and operations a few times now.

From a Board perspective we have a very small Board. I'm the Executive Chairman. Michele Muscillo, who's a lawyer, has been involved with the Company and the Management Team for more than ten years. We know him really well. We brought him on the board when we were going through the restructure. Then we have Alastair Morrison. He was in private equity banking. He's an investor specifically working in investment portfolios. He's a very good asset to the board, specifically while we try to grow the business. Marcus Derwin, is the other Board Member. He's a representative of Standard Chartered Bank. He's mainly in restructuring business and has been really valuable for us, great through all these restructure exercises. That's the Management Team.

Dr. Allen Alper: It sounds like you have a very strong Management Team and very compatible, having that experience working with each other. Excellent! Could you tell our readers/investors a bit about your capital structure?

André Labuschagne: In terms of a capital structure. Currently the biggest shareholder is PAG, a private equity fund, who has been involved with the company and assisted us with the restructuring of the debt, over the past three years. PAG is currently shareholding on a fully converted basis is around 35%. PAG is very supportive and always aligned with us in growing the business. Of the other shareholders we have, probably the biggest shareholder on the register is Bain Capital. We also have Glencore on the register and they're also our offtake partner so they have the offtake for our copper concentrates. Then we have the Keet Family, a father and son family out of Singapore, who have been associated with the company since it was first formed.

Dr. Allen Alper: Sounds like you have very strong companies supporting your Company. That's excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Aeris Resources?

André Labuschagne: From my perspective, we have a very strong Management Team and Board. We've shown over the years that we can run these businesses and make them work. We have a very strong alignment with our major shareholder for growing the company. The Company is now, for the first time in many years, positioned to look at growth and spend money on exploration. The upside of exploration is significant at both Tritton and obviously at Torrens. So there are exciting times ahead for the company. If we're going to achieve what we want to, in terms of growth, it will be a very exciting prospect to become one of the material players in the copper industry in Australia. If you look at the Australian copper market, Oz minerals and Sandfire are the two largest listed copper companies and they're worth around $4 billion and around $1.2 billion respectively but then after that, there's no one. We aspire to become the next material copper player, close to Sandfire and Oz minerals in size. That's the opportunity I see for investors out there looking for opportunities to invest in an emerging company.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add André?

André Labuschagne: I think 2019 is going to be very exciting. We still think copper is going to go up and everyone out there seems to have the same view. Investing in an emerging copper player would be an exciting venture.

Dr. Allen Alper: That sounds great, like an excellent opportunity for our high-net-worth readers/investors to consider investing in your company. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.aerisresources.com.au/

Mr. Andre Labuschagne

Executive Chairman

Tel: +61 7 3034 6200

|

|