Mako Gold Limited (ASX: MKG): Three High-Grade Gold Projects in West African in the >60Moz.Gold-Rich Birimian Greenstone Belts; Interview with Peter Ledwidge, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/15/2019

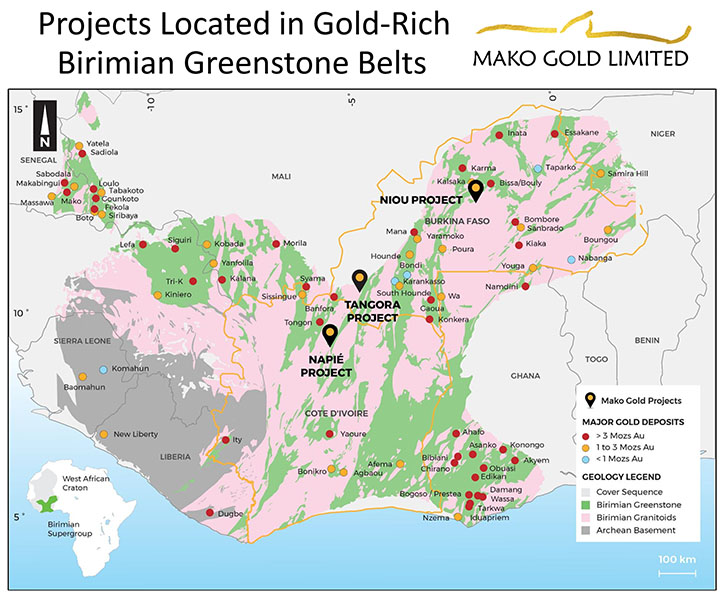

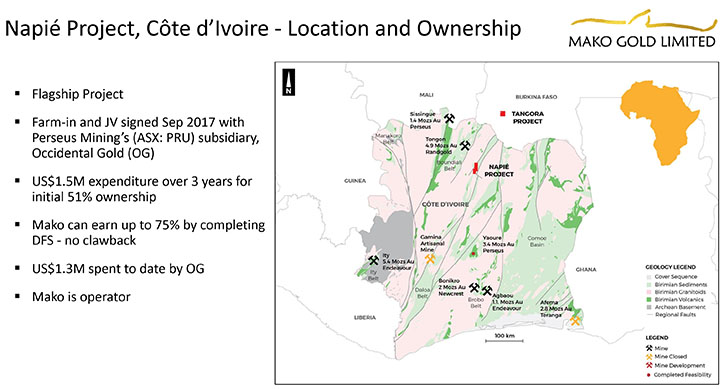

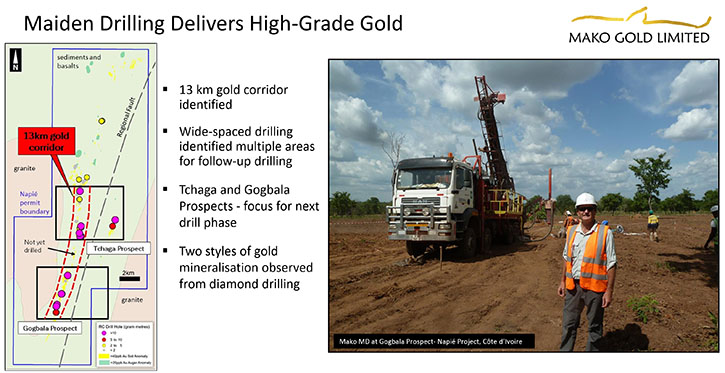

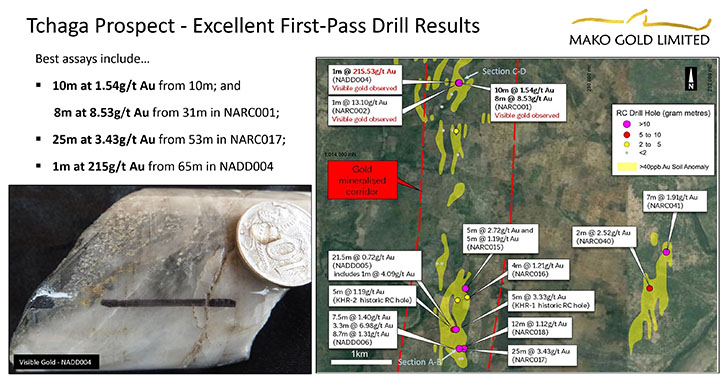

Mako Gold Limited (ASX: MKG) is an Australian based exploration company founded by a husband and wife team of geologists Ann and Peter Ledwidge, who between the two of them have 60 years of field experience on three continents. Mako Gold is focused on making a significant high-grade gold discovery by exploring its portfolio of highly prospective gold projects in Côte d’Ivoire and Burkina Faso in the gold-bearing West African Birimian Greenstone Belts which hosts more than 60 +1Moz gold deposits. Mako has three highly prospective projects in West Africa – the Napié, Niou and Tangora Projects. We spoke with Peter Ledwidge, Managing Director of Mako Gold. Their flagship Napié Project, located in the north central part of Côte d’Ivoire, is a farm-in joint venture with Occidental Gold, a subsidiary of Perseus Mining and Mako Gold and is earning up to 75% interest. To that end, the Company identified and drilled two areas called Tchaga Prospect and the Gogbala Prospect, with highest grade results of 215 grams per ton. The company's second project is the Niou gold project in Burkina Faso, where they have drilled in December 2018 and are currently awaiting assays.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter Ledwidge, who is Managing Director of Mako Gold Limited.

Could you give our readers/investors an overview of your company, Peter?

Peter Ledwidge: Mako is a company that I founded in 2015 along with my wife, Ann. We've been working together for about 25 years, as long as we've known each other. Our original co-founder is Ibrahim Bondo, our Country Manager in Burkina Faso.

Mako Gold Artisanal Mining Site- Tangora Project, Burkina Faso

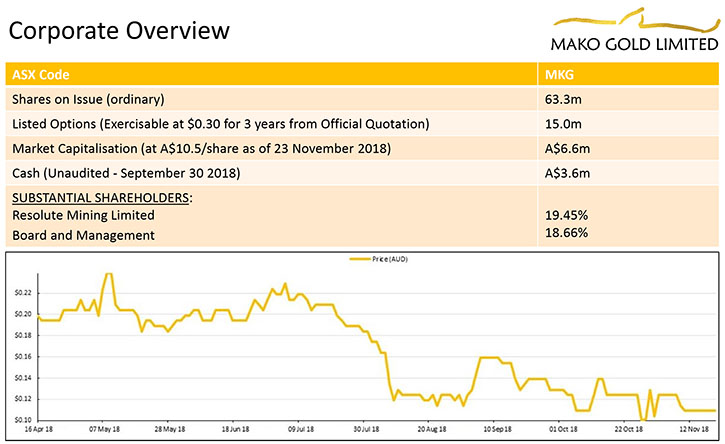

So, we waited until the time was right before we did our seed capital raise. Then in April of 2018, we did our ASX IPO and raised $6 million of which, Resolute Mining came in as cornerstone investor with $2 million.

Dr. Allen Alper: That's very good.

Could you tell our readers and investors a little bit about your properties in Africa and why their interesting? And, a little bit about the geology of the area?

Peter Ledwidge: We have two principle projects. We actually have three projects. We drilled one, our number three project very early on. It came up with disappointing results and is now in renewal phase, but we don't have to do any more spending on it.

We're focusing on the other two projects. Our philosophy is if a project doesn't meet expectations, we move along and replace it with another one.

Our flagship project is the Napié Project in Cote d'Ivoire. That's a project that, we're earning into through a farm-in joint venture with a subsidiary of Perseus Mining ASX listed, successful miner in West Africa. We earn 51% ownership by spending $1.5 million US over three years. We can earn up to 75% by completing a feasibility on it. Perseus has spent $1.3 million on it. It's all been very good work.

Peter Ledwidge: We're fortunate to be associated with two reputable Australian miners, Perseus and Resolute. Previously, most of the management, including myself and Ann, and our crew on the ground, were with Orbis Gold that was taken over in 2015 by TSC-listed SEMAFO, Inc. The reason Resolute came on board is that, when we were with Orbis Gold, we made three discoveries, two of which went through to the resource stage. I led the team for the discovery of the Nabanga Deposit in Southeastern Burkina that was 600,000 ounces at 10 grams per ton, with lots of blue sky. SEMAFO is spending some money on it this year.

My wife, Ann, always likes to outdo me, she led the team to discover the Boungou Deposit, 2 million ounces at 3.4 grams per ton, which just went into production about three months ago.

So that's what we're looking for, high grade gold deposits. We're not interested in the low-grade ones. They were the flavor of the month about six or seven years ago, but I never believed in them.

So, if you watch page 8 of our presentation, on the left hand side you'll see a map of the Napié project, the JV with Perseus. Just to give you an idea of scale north to south is about 30 kilometers. The yellow dots, I'm sorry the yellow kind of hook lines are the soil anomalies. The green ones are auger anomalies. So, when I say that Perseus spent $1.3 million, this included soil, auger drilling, 1000 RAB holes and airborne geophysics, basically everything I would have done as a geologist with over 30 years’ experience.

We had an enviable problem of taking a 23-kilometer soil auger anomaly that's parallel to that regional fault and figuring out where the best parts are. On the map, the red dots are 5 to 10 gram meters in the sectors from our drilling and the plus 10 gram meters is portrayed in pink. We did a roughly 4600 meter drill program of 52 RC drill holes and 6 diamond drill holes. The diamond drill holes were for us so that we could understand things.

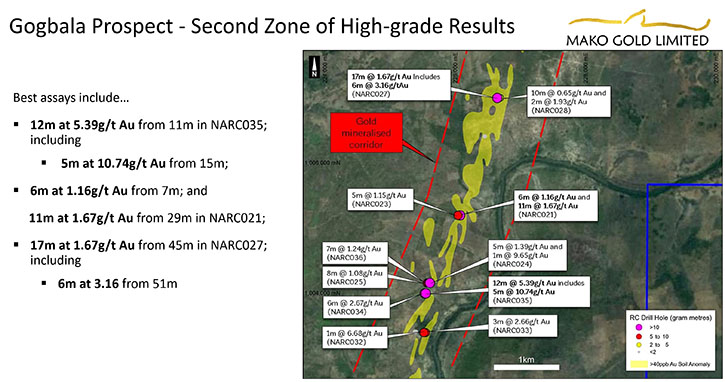

So, we identified two areas. That was the object of that drill program, to take a 23 kilometer soil auger anomaly and distill it down to something on which we want to focus. On the map you can see the black rectangles. So there's the Tchaga Prospect and the Gogbala Prospect.

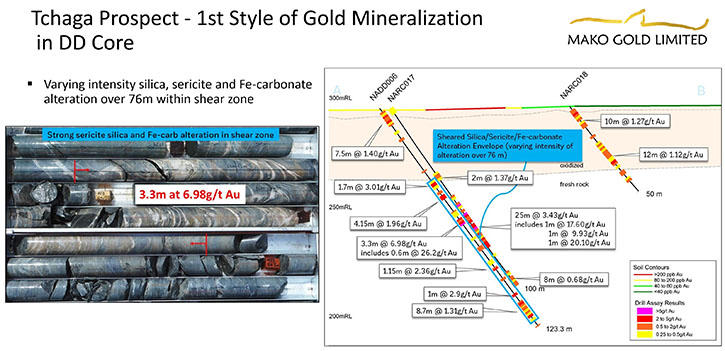

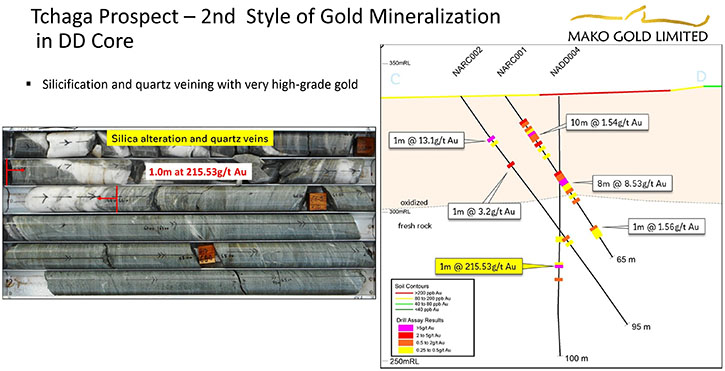

On the next slide is the Tchaga Prospect. We got some very good intersections. Our highest intersection was 215 grams per ton gold. That was in a one-meter interval. Although that sounds very good, that's not what we're chasing. What's really exciting though is the 8 meters at 8 1/2 grams per ton gold, 25 meters at 3 1/2 grams per ton gold.

On the satellite imagery, at the south end of the map, the 25 meters is at 3 1/2 grams per ton. On our next phase of drilling, which we plan to start in late January, we plan to try to extend that so, at the end of the drilling program, we can announce to market that we have half a kilometer, or a kilometer long strike. That's when, on the back of good results, we would go back to the market and try to raise money to outline a resource.

Peter Ledwidge: We learned two things from that drilling program. We got some good results. We have an association between sulfides and gold grades, so if we get low grade gold, we get 1% sulfides and if we get high grade, we get up to 5%. The sulfides are mostly pyrite, with some arsenopyrite and chalcopyrite. Because of that, we initiated an IP program, just on the Tchaga Prospect. Keep in mind that map is 5 kilometers north to south. We did four blocks, we didn't do the middle part. That program should finish in about a week.

We hired a very well-known structural geologist. He's a structural geologist that did the work for Papillon and is doing the work for OKLO Gold. I'm sure you're familiar with both those companies.

Ann spent some time on the ground with him. We were in West Africa a few weeks ago. She chatted with him about his findings. Then, I was in Abidjan doing business and I had a chance to talk to him as well. Between the structural interpretation and the IP, we think we're well poised to have a very, very good drill program in the new year. We have those new tools, out of our drill box to focus on getting new targets.

We're planning to start that drill program in late January, about 4000 meters, which will be done in two phases. We can get assay results and then start the second phase.

The core samples below show 3 meters at 7 grams gold. That's from the 25 meters at 3 1/2 meters per ton gold. We're very fortunate because we can visually identify what is carrying the gold. You can see the beige-ish gray, that is either iron carbonate or dolomite plus sericite and you can see all the little quartz stringers. As we're drilling along strike, we can visually inspect the chips, as we're drilling, to see if we're getting into the sweet zone or not.

On the right-hand side there is a section with the original RC hole on, in the RC-17, which gave us the 25 meters at 3 1/2 grams. Beside it, we twinned with the diamond drill hole and you can see the blue rectangle; that's a 76 meter envelope that consists of alternating on and off alteration.

We have a very broad target to follow and we feel pretty confident. Typically Mother Nature doesn't go straight, as we often want her to. We've seen at least two if not three events of deformation in the core and several orientations of quartz veins. You can see in that picture that the area that's carrying the gold, seems to have that preferred orientation. That orientation from the structural geologist, so far, appears to be 0 1 0, so North Northeast.

The next slide just shows the interval where we intercepted the 200 gram-er and that's really not what we're chasing up. But, one of the things that we've found, through our airborne geophysics, is that there's a North Northeast regional shear also. There are also cross cutting faults. Once we've outlined a resource, we can start exploring for this high-grade interval, instead of drilling west east. We can be drilling perpendicular to that. Looking for some of those high-grade ore shoots.

Both Ann and I've worked in camps like Red Lake, Pickle Lake, in Northwestern Ontario, and that's where you get those really high-grade mines. This is just gravy for down the road. That's not going to be the focus of our next stage of exploration.

The next slide shows the Gogbala Prospect. That's a southern prospect that we identified. It also had some very good intersections, such as 12 meters at 5.4g/t Au. What's really noteworthy is that within that interval, there are 5 meters at 10, almost 11 grams per ton. Other intersections, 17 meters at 1.7g/t Au. There again, we're getting these wide intercepts and we're targeting things that are over 2 grams per ton. It looks like we're in the right neighborhood. Even though this looks very good, we haven't done any IP and we haven't done any diamond drilling on it. So, this is something that down the road, on the back of good results, when we raise money to do a resource drill out, 90% of the money will be used for the resource drill out and 10% of the money will be used to move this forward, do some exploration so that we can outline and add more blue sky to the project.

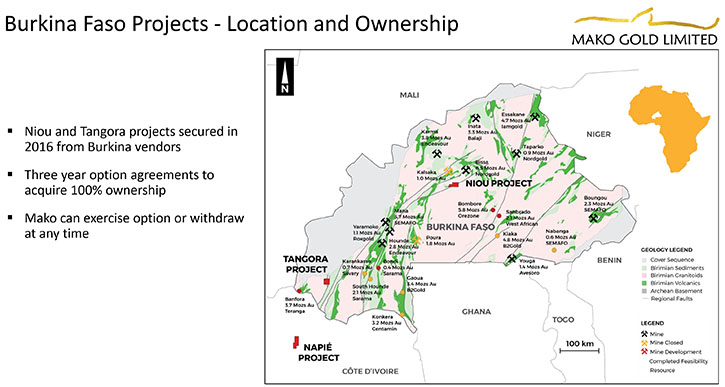

Now I'll talk about our Burkina Project. When I was in West Africa, one of my purposes for being there was to look at other projects. Business development is always ongoing and I didn't rush into anything to get these three projects, I looked at about 150 projects.

It has to be the right one, if you're going to make a discovery.

The projects that I acquired in Burkina are through three year option agreements with increasing payments over the three years. The total payment is under $100,000 US, with a 1% net profit. Very competitive deals and in the end Mako gets 100% ownership!

We can exercise our option any time we like. We can reject the project and give it back to the vendor any time we like.

I'll talk about that new project, which is located 50 kilometers north of the Capitol City, Ouagadougou. It's on a paved road. Speaking of infrastructure, the Napié Project in Cote d'Ivoire has excellent infrastructure as well. It's just off a paved road. It has a hydro line running alongside it. It has a river running alongside it. It has everything you need, if we find a mine.

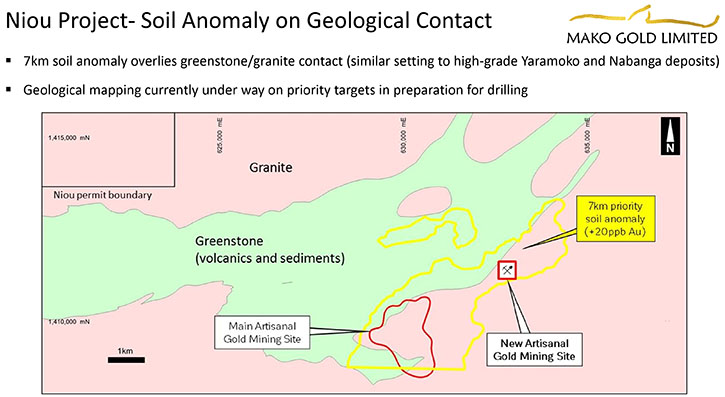

The slide below shows part of the new project. We're really excited about this one, because the Cote d'Ivoire Project was drill-ready when we started the joint venture. This one had absolutely nothing done on it except a soil sample program that the permit vendor did, but we didn't have the data and we weren't confident of his findings. It has had no previous drilling. We did our 200 meter by 200 meter regional soil sampling program and that outlined a 7 kilometers plus 20 ppb gold anomaly.

Our chief geologist is a very good Canadian geologist. He's the only expatriate we have on the team, full-time and in-country. He did all the detailed mapping over that 7-kilometer anomaly. As he did that, he discovered a new artisanal gold mining site. There's also that main artisanal gold mining site, in the southwest area.

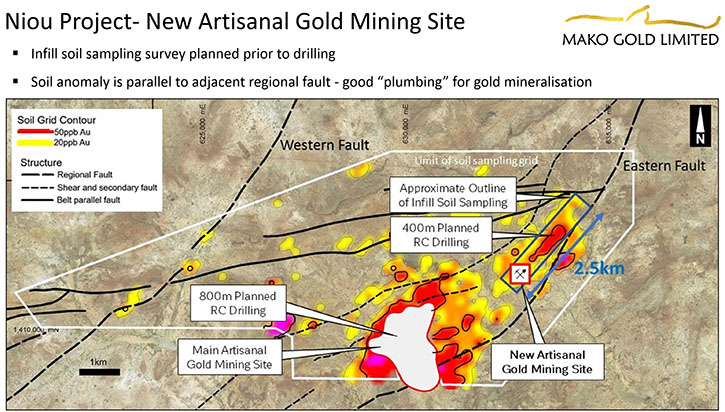

I'll go to the next slide and explain that in a little bit more detail. Before I do that, what's really exciting about that is that the soil anomaly is on the contact between Greenstone and granite. So that's a very similar geological setting to the Nabanga Deposit that we discovered at Orbis, which was 10 grams per ton. It's very similar to Roxgold's Yaramoko Deposit, which is actually a mine, which is 14 grams per ton. Below, on the satellite imagery, it shows the details of the soil sampling. So the yellow is 20 ppb and the red is anything greater than 50ppb. You can see the two kilometer by 1 kilometer artisanal site in the southwest corner. We recently put out an announcement that we're doing a drill program on that. That drill program is finished and we're waiting assays, so 800 meters of RC was drilled on that in 7 holes. We did the in-fill, soil-sampling on the 2.5 kilometer long anomaly that you see. The white outline is the 52 square kilometer, 200 meter by 200 meter regional soil sampling that we did. The blue rectangle is where we just finished a 50 meter by 50 meter in-fill. We did a heel to toe mine across the best part of the anomaly and there again we're waiting for assays.

As our chief geologist was mapping, he discovered a new artisanal gold mining site. The locals have just started excavating. That kind of corroborates our theory that there is gold in the area.

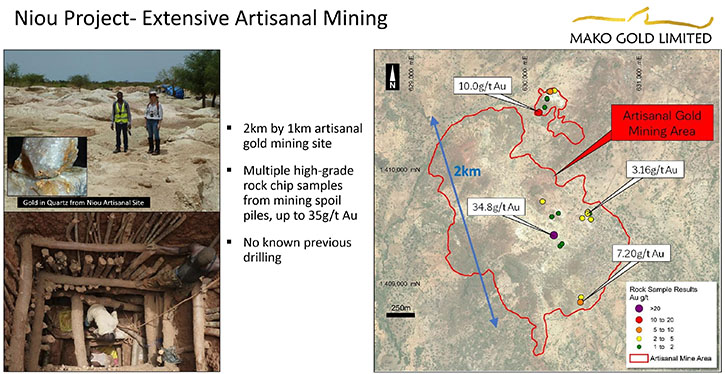

Now I'll move you to page 15 and you'll see the enlargement of the main artisanal site on the satellite imagery. You can see it's two kilometers long by about 1 kilometer wide. When Ann and I first went there, to inspect the property in 2016, it was about half that size. Obviously, the miners are getting pretty good results there. We did a lot of rock chip sampling on there. Some of the better results you see are 35 grams per ton, 10 grams, 7 grams from spoil piles and from what the artisanal miners brought up for us.

On the right-hand side, you can see the outline of the artisanal mining site on the satellite image. You can see, from the photo, the gold that comes out of there. When you see the shafts that are cribbed like that, you know those guys are not doing that just because they like digging shafts. They go down about forty maybe fifty meters maximum. Then the water table keeps them out. They use little Honda pumps and little fans to try to ventilate, but Honda pumps don't keep up with the water tables. This is where we did 800 meters of drilling and the other soil anomaly, to northeast, is where we did 400 meters of drilling.

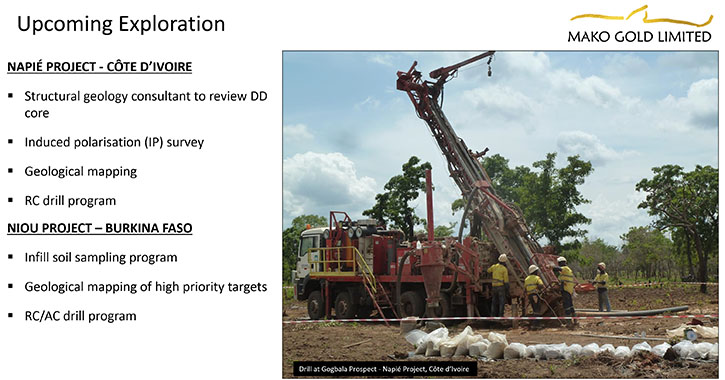

To sum up on page 17, from our presentation "From Mines and Money" in December 2018. The structure, the Napié Project, in Cote d'Ivoire, we're awaiting the final report from the structural geologist. The IP program is finished. But, geological mapping is always ongoing. The RC drill program will start in late January. About 4,000 meters separated into Phase A and Phase B, which will be roughly 2,000 meters each phase.

The new project in Burkina Faso, the in-fill soil sampling, is finished. The geological mapping at priority targets is finished. The RC Program is finished and we are awaiting assays.

That's the summary of the projects and our goals. We're good at finding mines. Out of my 30 plus year career, I spent 3 years as a mine geologist, but that wouldn't qualify me to run a mining company. Our clear goal is, within 3 to 4 years, to be taken over. That's one of the other synergies with Resolute Mining, if you're familiar with them, they fund a lot of drillers. I think they're funding five or six right now. They said that normally they don't do greenfields or grassroots projects, but based on our track record, they were willing to do us. We've been meeting them quite often and they're very happy with the work that we're doing. The other synergy, since we don't want to become a mining company, is it's an extension of their exploration arm and they're 20% shareholders, it seems reasonable that they'd be the first ones with whom we’d be talking.

Dr. Allen Alper: That sounds like an excellent approach. Could you tell our readers/investors a little more about your background and some of the key members of your team?

Peter Ledwidge: Certainly, I'm a geologist with over 30 years’ experience in North America, Australia and Africa. I dabbled a little bit in Brazil.

Ann, The General Manager of Exploration, has over 25 years’ experience as a geologist in North America, Australia and Africa. Most of our experience is in Gold, with some base metals. We really love gold. We're very passionate about it.

Ibrahim Bondo was with Orbis Gold as well. When we saw that the company was being taken over, I told him, “Hey I'm going to start a company.” He said, “Count me in.” Ibrahim, Ann and I have lots of what we like to call “sweat equity”, where we worked for two years, without a wage, to make this happen.

Jaimie Light, our Chief Geologist, was also with Orbis Gold.

The other ex-Orbis Gold person is Michelle Muscillo. So that was a vote of confidence, when he jumped on our Board. He's also on the Board of Cardinal Resources. I'm sure you've heard of them.

We brought on the Chairman because he had good Corporate Governance and is a big supporter. He is also a geologist with over 40 years of experience, which helps us as well.

Paul Marshall, is an excellent Company Secretary and CFO, with extensive experience. He started off his career with Ernst & Young in London for 10 years. He's my go-to guy. He's a chartered Accountant, with a Law Degree. He keeps me on the straight and narrow and keeps me out of trouble.

Michelle Muscillo, is a Corporate Lawyer, who specializes in IPOs and M&As, etc. in the mining world, so any question Paul can’t answer, Michel can.

We think we have an excellent team. Most of our team on the ground are ex Orbis Gold. I guess that's a testament to the fact that they liked working with us before and even if they had jobs, they left their jobs and came and worked with us again. One of our Senior Geos recently told Ann that he really likes working for us because he knows we get good projects and that's a lot more exciting than working on mediocre projects.

Dr. Allen Alper: Well, that sounds excellent! It looks like you and Ann and your group have excellent backgrounds, experience and successful track records. That's really great!

Peter Ledwidge: Thank you.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Peter Ledwidge: I just love talking about Mako Gold, if you haven't noticed my enthusiasm.

Because we work for money, but that's not the only reason we work. We work because we're really excited about what we're doing. It's really hard to make a discovery if you don't start with good projects. For example, it took me quite a while to sift through all those projects to get three projects that looked good.

We really think that we're on to two very good projects at this point. We've done it before. We know how to select a project and then how to move forward exploring it in a very methodical fashion, because we have that experience. Between Ann and myself, we have close to 60 years’ experience. Until we came to Australia, 10 years ago, we were field geologists. We lived in Yukon. We didn't have to look for work because of our reputation. Anytime anyone came to Yukon, the geological survey there just said go see Ann and Peter. During all that field experience, working on three continents, we've looked at a lot of rocks and we've worked for a lot of companies. We've seen what we liked and what we didn't like from those companies. We've tried to create Mako as a company where we've taken the best from the other companies.

I may as well explain the name of the company as well. I'm a shark nut. I've been cage-diving in Australia and South Africa. I've been scuba diving, without cages, with certain species. Because of that, when we created the company, it had to have a shark name. So we picked the Mako shark because the Mako is the fastest shark in the ocean. It's very successful, a careful hunter. That reflects how we are. We move fast, but carefully. What we're hunting for is high grade gold deposits.

Dr. Allen Alper: That sounds excellent. It sounds like you and your team know what you're doing. You and your upper management team have a lot of skin in the game and believe in what you are doing. That's excellent!

Peter Ledwidge: Exactly! Board and Management have 19%. Some investors, with whom I talk, worry about the liquidity factor. Because between Resolute and us, we have almost 40%, but you have to keep in mind that we only have 63 million shares on issue. As we do more raises in the future, the percentage of Board and management ownership will change. One thing we're very conscious of, as well, is we don't want to be one of those companies that keeps doing raises and dilutes the shareholders. We had $3.6 million in the bank at the end of September, so we are fully funded for the next phase of exploration. We don't want to do a raise when we run out of money. We want to do a raise on the back of good results. Right now, our share price is sitting at about 11 cents. That's not where we want to be, considering we listed at 20. But, if you look at all the other companies they're all trading at their 52 week low as well. That's just the way markets are treating junior explorers right now.

Dr. Allen Alper: It's a tough time for young explorers, but hopefully things will start picking up in the new year. Also, what you are doing sounds as though it will be very successful.

Peter Ledwidge: I think if we come up with good drill results, the market will still respond to that.

Dr. Allen Alper: That's very true. It’s very exciting. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.makogold.com.au/

Mr Peter Ledwidge

Managing Director

Ph: +61 417 197 842

Email: pledwidge@makogold.com.au

|

|