Anaconda Mining Inc. (TSX: ANX, OTCQX: ANXGF): Growing Newfoundland and Nova Scotia Gold Mining, Development and Exploration Company; Interview with Dustin Angelo, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/10/2018

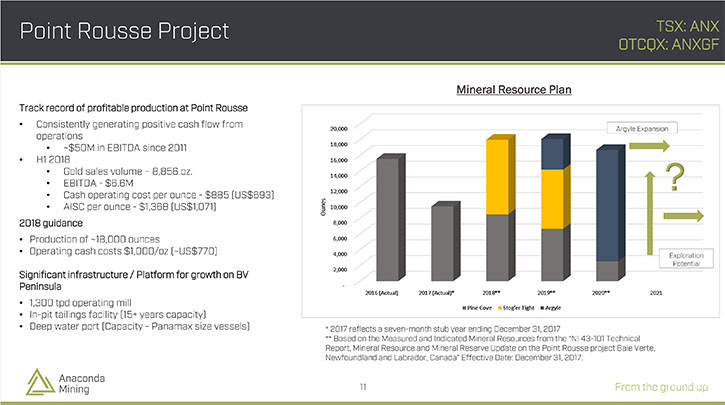

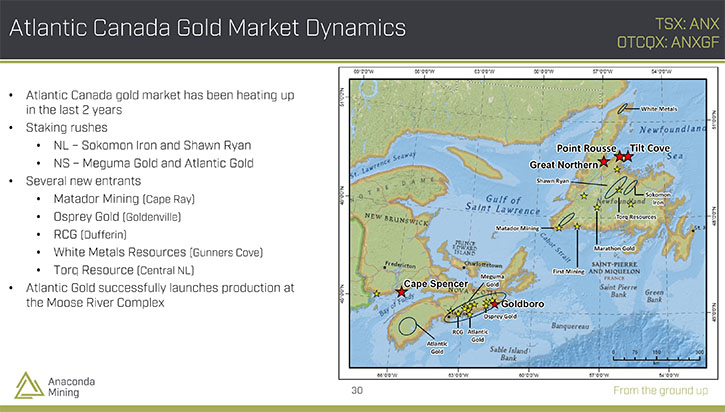

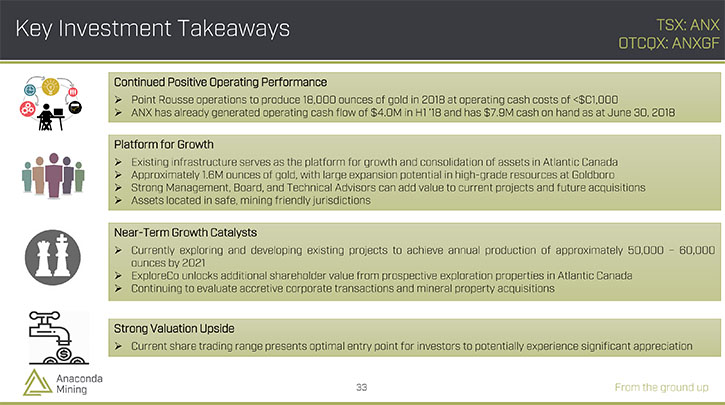

Anaconda Mining Inc. (TSX:ANX, OTCQX: ANXGF) is a gold mining, development and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse and Tilt Cove Projects, located in the Baie Verte Mining District in Newfoundland, comprised of the Stog'er Tight open pit mine, the Pine Cove open pit mine, the Argyle Mineral Resource, the fully-permitted Pine Cove Mill and 7-million tonne capacity tailings facility, and approximately 9,150 hectares of prospective gold-bearing property. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade Mineral Resource, subject of a 2018 preliminary economic assessment, which demonstrates a strong project economics. We learned from Dustin Angelo, President and CEO of Anaconda Mining, that Point Rousse has been generating a tremendous amount of cash-flow for the company, producing about 16,000 ounces a year of gold, for several years, with 2018 being a record year of about 18,000 ounces or more. This year Anaconda also expanded the resource on the Goldboro Project up to about 1,056,000 ounces of gold. According to Mr. Angelo, the Company will be in production at the Goldboro by 2021, increasing overall company production to about 50,000 to 60,000 ounces a year, with the goal to increase to about 100,000 ounces a year over time.

Anaconda Mining

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dustin Angelo, President and CEO and Director of Anaconda Mining Company. Could you give our readers/investors an overview of your company, and an update on what has been happening since we talked last in March?

Dustin Angelo: Sure, Anaconda is a growing gold producer in Atlantic Canada. We have two main projects, two centers of operation. Our first one is on the Baie Verte Peninsula in Newfoundland, where we've been operating for about 10 years, producing gold for the last eight years, at the Point Rousse Project. We also have an exploration project called Tilt Cove, about 30 km east of Point Rousse on the Baie Verte Peninsula. At Point Rousse, we've been producing about 16,000 ounces a year of gold for several years now. This year we'll have a record year of about 18,000 ounces or more. It's been a project that's generating a tremendous amount of free cash flow.

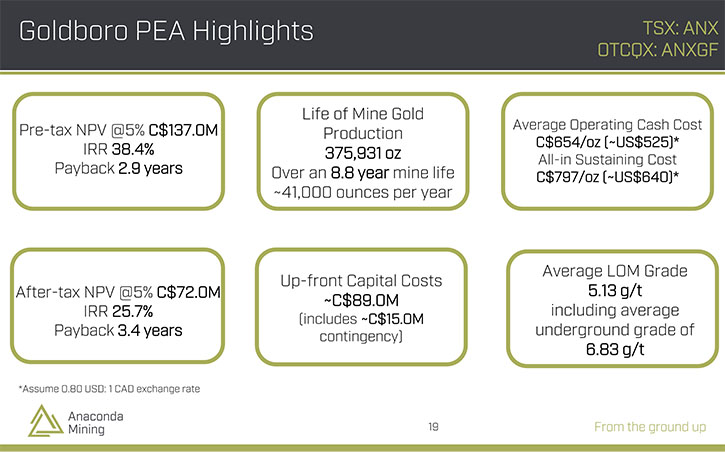

Then we also have our Goldboro Project, which is down in Nova Scotia, about 180 km northeast of Halifax. It's a high-grade mineral resource that we acquired in May, 2017 from Orex Exploration, and paid about $15 per ounce for it. It had about 870,000 ounces, and we recently put out a new, updated mineral resource where, after about 12,000 meters of drilling over a year's time frame, we expanded our mineral resources to about 1,056,000. Those are the two centers of operation. We're planning to be in production at the Goldboro by about 2021, and then, between the two areas, be producing about 50,000 to 60,000 ounces a year. We're looking, ultimately, to increase to about 100,000 ounces a year over time.

Dr. Allen Alper: That sounds great. Sounds like an exciting period of time for Anaconda, as you explore and you develop and increase your capacity. I think you are also working on increasing efficiencies and adding to and strengthening your already talented staff and team. Is that correct?

Dustin Angelo: Yeah. We're in continuous improvement mode. We're always looking to be more efficient. We've driven down our operating costs a lot. This year we've gotten our cash operating costs per ounce below $1000 in Canadian dollars, about $800 or below in US dollars. We have a well-trained workforce, a good corporate culture. We are consistently training and trying to add to our workforce's repertoire to be able to produce more efficiently, and over time, it's worked pretty well. We've done a lot of automation projects. We've instituted a lot of different innovative technological ideas, and those have worked out really well, particularly on the grade-control side. Then we've done some outside of gold, out-of-the-box type projects like shipping waste rock as a construction aggregates product. We've really looked at ways to optimize the operations, reduce cost, improve efficiency, and generate as much revenue and value out of all the natural resources at site.

Dr. Allen Alper: That sounds excellent. That's really very good. Could you tell our readers/investors what's happening in your region, the Atlantic region?

Dustin Angelo: Over the last couple years there's been a renewed interest in Atlantic Canada. I think it's been because there's been some more high-profile companies, including us. Marathon Gold has done very well to grow its mineral resources in Newfoundland. Atlantic Gold has gone into production in Nova Scotia, so there's been a lot more interest, a lot more investment coming in, new companies popping up, a lot of staking going on. We and Atlantic Gold are still the only gold producers, but a lot more mineral exploration companies have come in. There's been a renewed interest from investors, and a lot of capital going into these provinces now over the last couple of years. We've been there for a while, and recognize the opportunities, and feel like we have a first-mover advantage. We are a little bit ahead of the game.

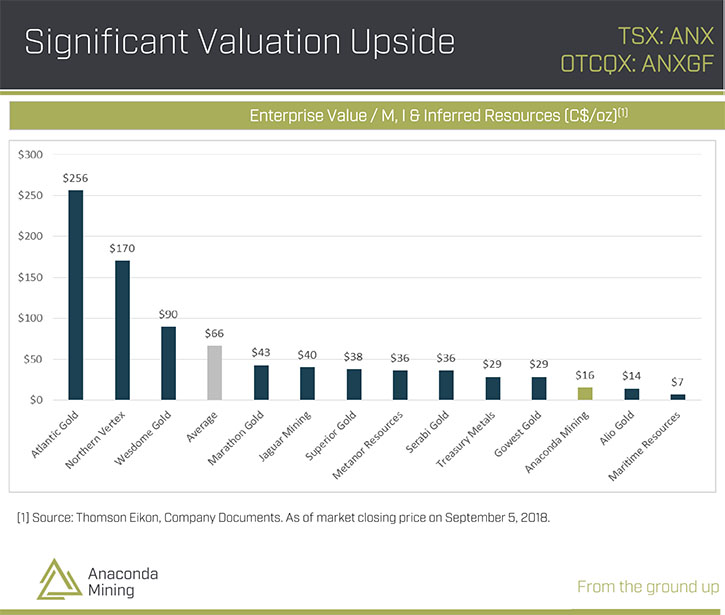

Dr. Allen Alper: Well, that sounds very good. Could you update our readers/investors on how you're being evaluated for gold in the ground compared to some of your peers?

Dustin Angelo: Sure. From a value per gold ounces in the ground, we're probably on the lighter side. Between our two main projects, Point Rousse and Goldboro, we have about 1,250,000 ounces in mineral resources. We're trading below $20 per ounce, enterprise value per ounce, so it's pretty low for a company that has current production of 18,000 ounces, this year and free cash-flow generation at our Point Rousse Project. We also have a growing development project in Goldboro that is expected to be in production by 2021, taking us to about 50,000 to 60,000 ounces a year. I think we're multiples lower than probably what we should be based on other comparable companies in the area of our size.

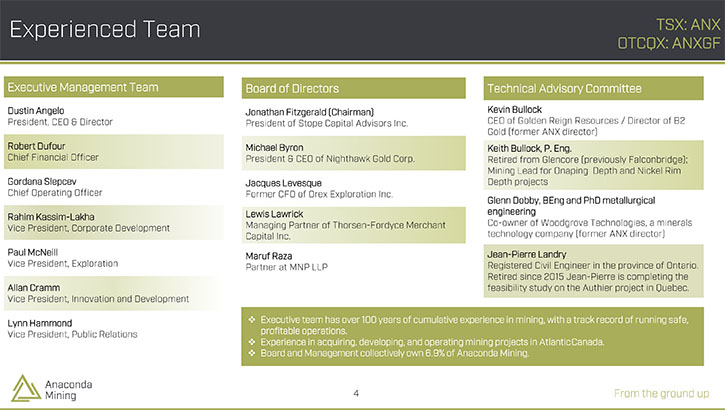

Dr. Allen Alper: Well, that seems like that would be an excellent opportunity for our high-net-worth readers/investors. Could you refresh the memories of our readers on your background, and your experienced team?

Dustin Angelo: I'm an accountant. I have a CPA license from the United States. I've been in the mining industry for about 13 years. The first five or so were in coal mining in west Kentucky as the CFO of a company that went public on a TSX back in 2008. Then I moved over to Anaconda, joined the board in 2009, and then became CEO in 2010. So, my last eight years have been in gold mining. Prior to that, I worked in public accounting and investment banking doing M&A advisory. I have more of a finance-accounting background with operations, and most of that's been in gold, and a little bit in coal, and actually aggregates as well. I was part of a founding group that created an aggregate's company in Indiana. That's my background.

Most of the folks on our executive team have significant experience in Atlantic Canada. They've not only worked on our projects, but other projects, in past roles in different companies, so we have experience from start to finish in terms of finding mineral resources, proving up discoveries, developing projects, and then, production. We have folks on our team that have put in mines before. We have folks on our team that have discovered gold deposits. We've all been in production for a long period of time. So, we run the full gamut, and we know how to do business in Atlantic Canada. We have very good relations with the government, especially in Newfoundland. We know the suppliers. We can attract talent. It's the product of being in the region now for 10+ years.

Dr. Allen Alper: Ah, that sounds excellent. Sounds like a very strong team, a knowledgeable team, and a team that knows what they're doing in the region, so that's great.

Dustin Angelo: I would agree.

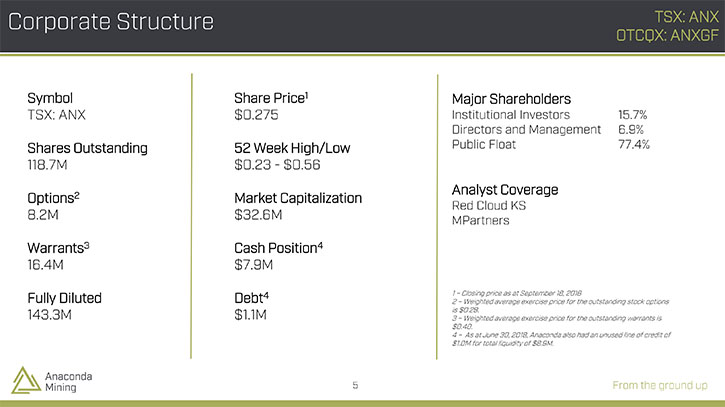

Dr. Allen Alper: Could you tell our readers/investors a little bit about your shares and capital structure?

Dustin Angelo: Sure. We have about 118 million shares outstanding, and our stock price is around about 20 cents resulting in a market cap between $20 million and $25 million. At the end of the third quarter in September, we had about 7 1/2 million dollars in cash in Canadian dollars on the balance sheet, and only about a million and a half dollars in debt, and those were capital leases and government loans, so very manageable. It's a very clean, strong balance sheet for a company of our size. We continue to generate cash flow, and it's a pretty good capital structure, very strong equity to debt ratio.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Anaconda Mining?

Dustin Angelo: Well, I think that there's a tremendous amount of upside in our Company and what we're doing. We're at 18,000 ounces of production right now, marching clearly towards 50,000 to 60,000 ounces in the next couple of years, with a goal to get to 100,000 ounces a year. We have a strong team. We're focused on a specific region, and we have a lot of experience operating in that region. We generate free cash flow out of our current operation, so any money we raise, whether it's equity or debt, as we move into the later stages of development in Goldboro, is all about growth. It's growth capital. We're not raising money to fund working capital, and certainly not to fund management salaries. I think there's a significant, solid underpinning, foundation, to the company. We've created a platform in Atlantic Canada from which to grow, and I think there's a lot more upside in our company than there is downside.

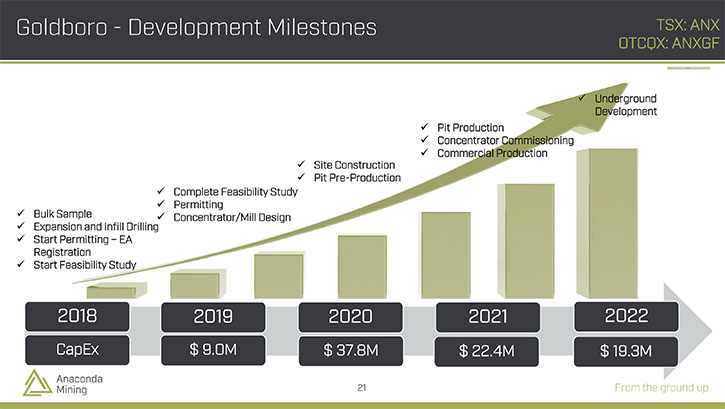

Goldboro has had a lot of activity lately. Going back to the early part of the year in January, we put out a PEA that has very good economics, and showed a mine life of nearly 9 years at an underground grade on gold of about 7 grams per ton. The operating cash costs were $640 per ounce Canadian, about US$525 and then all in sustaining cash costs of $800 per ounce Canadian, around $650 in US dollars. So, very strong economics just from the PEA.

We're in a 10,000-meter drill program right now, following up the first 12,000 meters, which was incorporated in the mineral resource that we put out in October. We registered the project. We're going through the environmental permitting right now, so that was done in August, and we're in the process of doing a 10,000-ton bulk sample. We're hitting all of our milestones for Goldboro to advance and develop the project, and most importantly, de-risk it as we move forward. As far as Point Rousse goes, we're doing drilling there. We found some other prospective areas. We're looking to expand on our latest deposit called Argyle, and have a record year for production.

Dr. Allen Alper: All that sounds like excellent reasons to consider investing in Anaconda. Is there anything else you'd like to add, Dustin?

Dustin Angelo: Just to thank you for your continued interest in Anaconda and interviewing Anaconda for an article in Metals News.

Dr. Allen Alper: I’m very impressed with what you are doing! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://anacondamining.com/

Dustin Angelo

President and CEO

(647) 260-1248

dangelo@anacondamining.com

|

|