Image Resources NL (ASX: IMA): Australia's Newest Mineral Sands Miner, High Grade and High Value Zircon, First Production in 2018; Interview with Patrick Mutz, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/5/2018

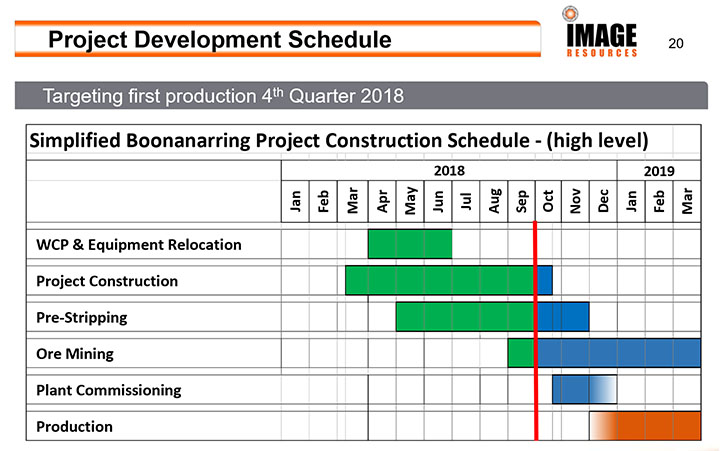

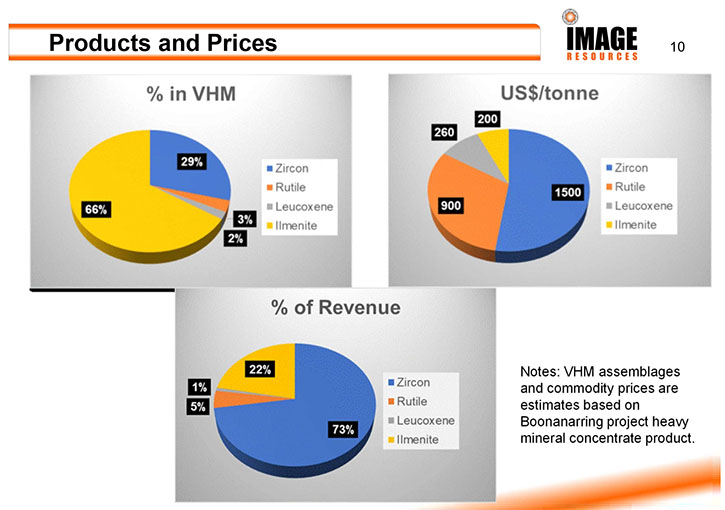

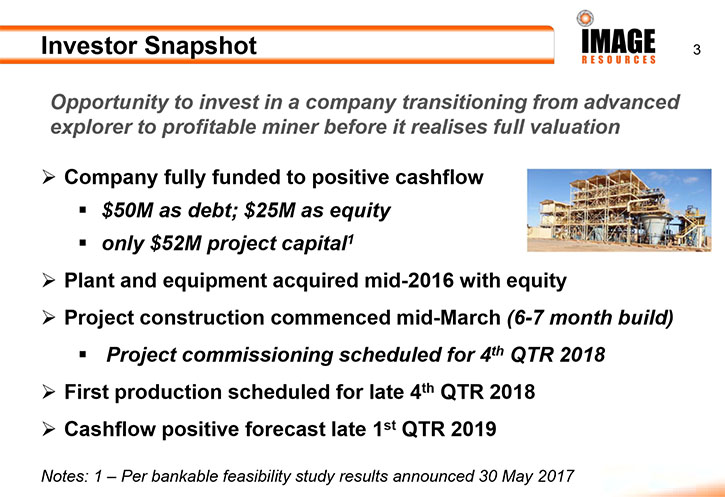

Image Resources NL (ASX: IMA) is Australia’s newest Mineral Sands producer, following the recent development of its high-grade, zircon-rich Boonanarring Project in the North Perth Basin in Western Australia. We learned from Patrick Mutz, Managing Director of Image Resources, that they have been in the process of constructing a mine and a processing facility, since the first of April 2018, and, in October and November, they announced the start of wet commissioning of the process, first production of Heavy Mineral Concentrate (HMC) and transport of HMC to storage at the port, ready for export and receipt of first project revenue before Christmas. The company is on track to achieve positive cash flow by the end of the first quarter of 2019. We learned from Mr. Mutz that in addition to being very high-grade, the Boonanarring Project is also rich in zircon, the most valued mineral within the heavy mineral matrix of the deposit. Premium grade zircon currently sells for as much as US$1,640 per tonne, and its price has been climbing very quickly and steadily since mid-2016. According to Mr. Mutz, over 73% of the revenue from the Boonanarring Project is coming from zircon, the rest is coming from the titanium dioxide products, principally ilmenite, with rutile and leucoxene as minor contributors. Image Resources will ship the HMC to its off-takers in China, where it will be separated into the various final products.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Patrick Mutz, Managing Director of Image Resources. Patrick, could you give our readers/investors an overview of your company? I know this is an extremely exciting time for you, your team and your company. Launching a new mining project into production is really exciting. The price of zircon is increasing, so it sounds like the end of this year and next year are going to be a booming time for Image Resources.

Patrick Mutz: Allen, I'm happy to give a bit of a summary. Image Resources firstly is a mineral sands mining company. We are Australia's newest mineral sands miner. We have been in the process of constructing a mine and a processing facility since the first of April 2018. Across the last six weeks we announced that we have commenced wet commissioning of the process, generated first production of heavy mineral concentrate or HMC and have started transporting the HMC to storage near the Bunbury port in Western Australia in anticipation of making our first shipment of product to our off-takers in China and receiving our first project revenue before Christmas. And, I should add, we achieved these milestones on schedule and on budget. Indeed, we are looking forward to achieving positive cash flow by the end of the first quarter of 2019.

Dr. Allen Alper: That's fantastic. That's amazing. Your return on investment is so rapid, I'm really surprised. What a great IRR you have projected. That all sounds excellent. Could you elaborate on your Boonanarring mineral sands project?

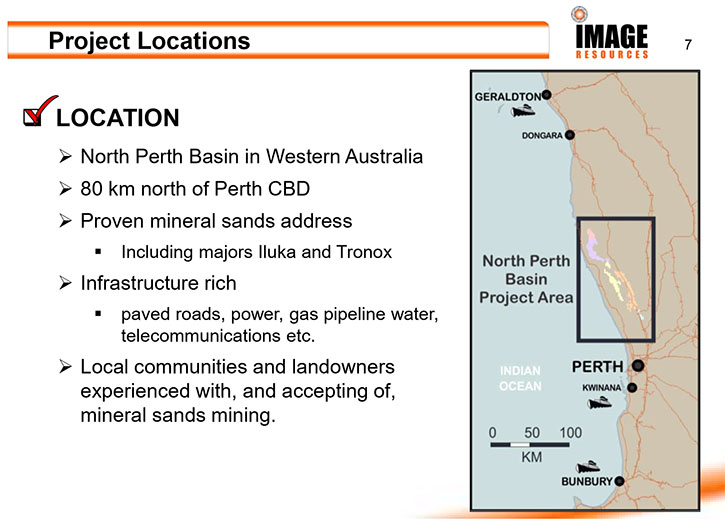

Patrick Mutz: Some of the things that sets us a apart from our competition includes the fact that our flagship Boonanarring project is located just a little over an hour drive north of Perth in Western Australia. So we are in an area of major infrastructure and a large population base to draw our workforce, and workers will drive to work in the morning and return to their families at the end of each day. Great work/life balance.

The second thing that sets us apart from the competition is that the ore grade and zircon grades are very high. Boonanarring is one of the highest grade, zircon-rich unmined mineral sand deposits in Australia. From the standpoint of heavy minerals, the grade is nearly 8%, whereas a typical mineral sands deposit might be around 3% heavy mineral. So it's very high-grade!

But in addition, it's very rich in zircon. Zircon happens to be one of the four products that come out of a mine like Boonanarring and it's the one that has the most value carrying capacity, in that it currently sells for as much as US$1640 per tonne. Whereas the other three products are considerably lower in value. The fact is, the richness of the zircon grade in our deposit means that over 73% of the revenue is coming from zircon. And, as importantly, for the last year and a half, the zircon price has been climbing very rapidly. Our feasibility study, published in the middle of 2017, originally valued the project with a net present value of A$135 million, but that was when zircon was approximately $1100 per ton. Today it's trading at over $1600 and therefore the net present value of that project has increased to over A$235 million.

Dr. Allen Alper: That's excellent. I noticed that you have a 13 month payback projected, is that correct?

Patrick Mutz: Yes, that is correct. And the reason is that the project has a very low capital cost and very healthy cash flows from the sale of HMC product. Total capital cost on the ground at Boonanarring was A$52 million. On the other hand, EBITA for the first two full years of production combined is A$150 million. In summary, because of the high grade ore which is rich in zircon, and the fact that the zircon price is doing so well in the market, coupled with very low capital costs, the amount of cash generated allows a payback period of about 13 months. That’s a fantastic position! Launching a company into production at a time when the price for the primary commodity is growing as quickly as it is, is a very good proposition for the company and its shareholders.

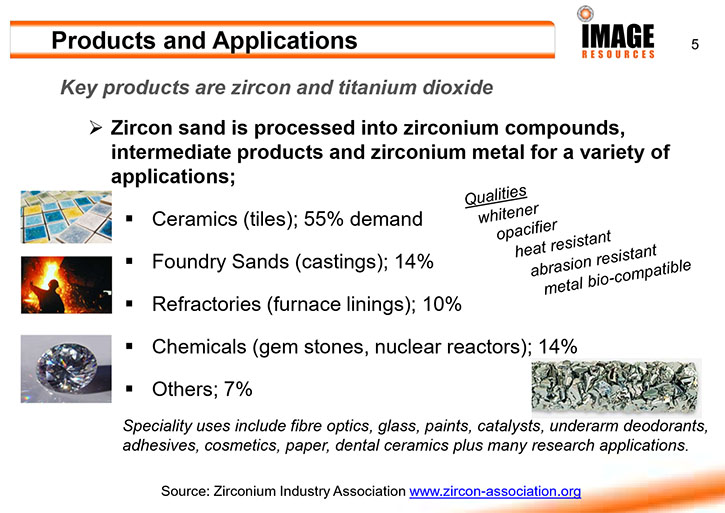

Dr. Allen Alper: That sounds excellent. I wonder if you could take a moment and tell our readers/investors what zircon is used for and why the price of zircon is increasing and what's causing this.

Patrick Mutz: Zircon is used in many different products around the world. About half of it is used for ceramic tiles. That's at the low-value end of the scale. On the higher end it's used for a variety of different chemicals, zirconium compounds, which are used for a variety of different components, from high temperature ceramic bearings to the linings that go into high temperature furnaces as it is a very refractory material. It is also used to make titanium metal, which is used in medical products that go into the human body, as well as in aircraft engines and aviation in general and even spacecraft. On the very high-value end, it is actually used in nuclear reactors because zirconium metal does not absorb neutrons. So zircon is a very important and valuable mineral commodity.

The reason the price for zircon has been climbing is that a significant supply deficit has been building since the middle of 2016. This has been influenced by the fact that heavy mineral ore grades and zircon grades and indeed ore reserves of the bigger suppliers are coming down. The largest global supplier of zircon, Iluka Resources from Australia, have shut down one of their major zircon producing mines at the end of 2017 and they've had lower-grades coming out of their higher-grade zircon mine in South Australia. Overall, moderate increases in demand across the past two year, coupled with decreasing supply from miners has created a significant supply deficit that will likely continue for the next four years. Importantly, Image has been very fortunate to be positioned to enter the market at a time of such a supply deficit and the Company is planning to provide 60,000 to70,000 tonnes per annum of zircon into a market with more than 100,000 tonnes per annum of deficient supply. This suggests zircon prices are likely to continue to rise.

Dr. Allen Alper: That sounds excellent. That's really a very enviable position that Image Resources is in, with high-grade, very excellent location and such great economics. Could you also tell us a bit about the titanium dioxide products?

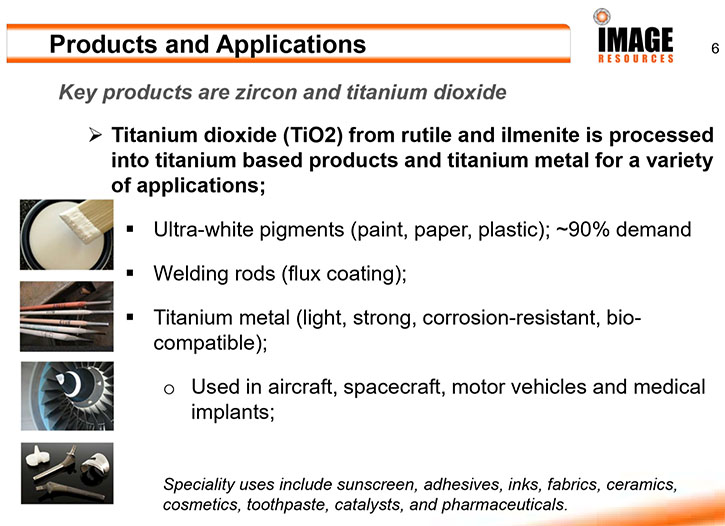

Patrick Mutz: Certainly. While zircon will represent 70-75% of total revenue, the balance will come from the titanium dioxide (TiO2) products, principally ilmenite, but including rutile and a bit of leucoxene. Fact is, we are actually selling a concentrate, which means that all three TiO2 products plus the zircon are still mixed into the concentrate or HMC. The HMC will be sold and delivered to China. The off-takers in China will separate it into the various products. So about 25-30% of our total revenue will come from the TiO2 products.

Almost 95% of Ilmenite is used for making an ultra-white pigment that is used in paint, for example, but also in paper and plastics. It is also used in many other products including welding rods, sunscreen and even toothpaste. A small amount TiO2 is used to make titanium metal, which is also biocompatible and is used in things like hip replacement joints and other parts that go into the body as well as in aircraft and motor vehicles.

Dr. Allen Alper: Well that sounds excellent. It sounds like they're all strategic minerals, zircon, ilmenite and rutile that you'll be mining. That sounds excellent. Could you tell our readers/investors a bit about where your deposit is located and where your primary customers are located?

Patrick Mutz: One of the key advantages to investors in Image Resources is the location of the mine. It is located in an area that is infrastructure-rich and is reasonably close to a major city center, the city of Perth. It's about an hour and fifteen minutes north of Perth. Consequently, as we were hiring mining staff, we heard over and over from candidates wanting to come to work for us instead of our competition because they could drive to work in the morning and drive back home at the end of each day and be with their families. In mining, that's not so common, especially in Australia. Normally you have to stay in a mining camp and/or fly-in and fly-out every other week or so. The location is very good, but this is not a new area. Mineral sands have been mined in this area for more than 25 years, so the community is very well aware and accepting of this kind of mining

Dr. Allen Alper: That's very impressive.

Patrick Mutz: To answer your question about our customers, the fact is most of the customer base for mineral sands products is overseas, between Europe, India, China especially, and even America. In our particular case, our customers are our off-takers. We have two off-takers that are taking 100% of the production for the life of the mine. They are both located in China. China happens to be one of the bigger demand centers for mineral sands products. Pricing for our HMC product is market-based. So, as the zircon market prices have been increasing since we've signed the off-take agreements, of course that means that Image's forecast revenue continues to increase. And, as mentioned earlier, we are seeing a supply deficit that suggests zircon prices might continue to rise, or remain very buoyant, for the next few years. So this could be very, very beneficial the way we have structured our off-take agreements on market-based pricing.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors approximately the annual production at Boonanarring?

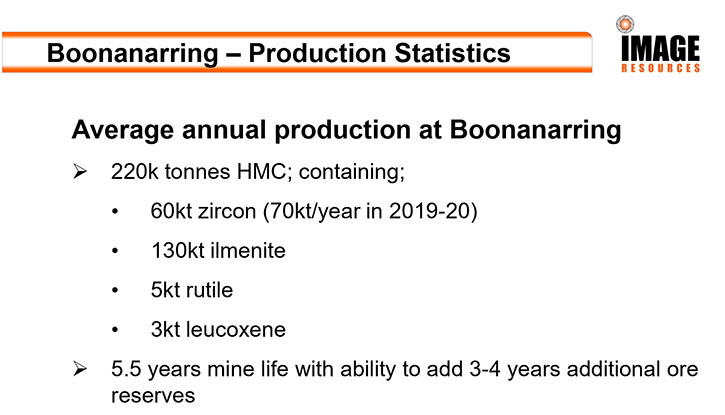

Patrick Mutz: The size of the mining operation is relatively small. The number I use to describe it is the number of tonnes of ore that we process per hour. And that number is 500. That's about as small a mineral sands operation as you can get. Having said that, because the heavy mineral ore grade is so high, up to two to three times higher than a typical mineral sands project, and because the zircon grade in the heavy mineral is so high, from a revenue standpoint the small amount of production from Boonanarring punches four times above its weight on a revenue basis. From a revenue standpoint, it is as if we will be operating at 2,000 tonnes per hour, which is a reasonably large mineral sands mining operation.

Dr. Allen Alper: That's excellent. From what I understand, you'll be producing 60,000 tons of zircon, is that correct?

Patrick Mutz: That's right. We are producing and selling a heavy mineral concentrate. We plan to produce on average about 220,000 tonnes of concentrate per annum for the first five years. This amount of concentrate will contain 60-70,000 tonnes per annum of zircon with the balance principally as ilmenite. There is a small amount of rutile and leucoxene, but it's only 2-3%. So it's really ilmenite and zircon. From a revenue standpoint, we have a very high cash flow in general. Revenue is going to average approximately A$120 million per year. The operating margins at Boonanarring, with the current commodity prices will averaging 75%, which means the revenue to cost ratio averages 1.75:1. In the first two full years, 2019 and 2020, the revenue to cost ratio is closer to 1.9:1 and this only gets better as the zircon prices continues to rise.

Dr. Allen Alper: That's amazing. Really great numbers! Excellent!

Patrick Mutz: If I might add one more point about that the economics of the project, to help put some perspective for your readers/investors. We have had to take on a small amount of debt, a total of A$50 million. It is on a three year term, which is already running from the time we completed drawdown of the loan. Therefore there is about two and a half years left for the debt to be repaid. Based on forecast cash flows, repayment of the loan, we should have upwards of A$80-90 million in the bank. If this turns out to be the case, it means in another two and a half years, the company could very well be in a strong position to not only be debt free, but to have a significant amount of cash with which to consider offering a dividend to shareholders and to invest in a second mining project to grow the company to the next level of market capitalization. And the good news, the Company already owns a number of projects, within its current portfolio, from which to choose to develop.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit about your background, your team and your board?

Patrick Mutz: Certainly. The board and I and most of my senior team come from mineral sands backgrounds. Three of the board members and myself, in fact, worked together at a previous project in south Australia. We ran a mineral sands mining company, where we were also focused on a zircon-rich deposit. So we already understood the value proposition of zircon. The other parts of my team generally come from mineral sands in Western Australia. I'm very happy to say that one of the reasons we have constructed the project on time and on budget was due to the very experienced team that know how to develop a mineral sands project. I am very confident, now that we have started production and are seeing positive results that we will be successful in ramping up production to steady-state, name-plate capacity as scheduled, in six months or less.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your share and capital structure?

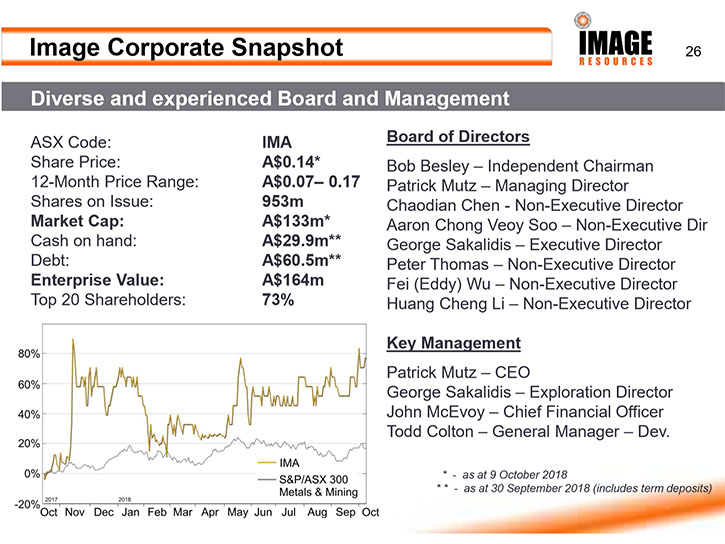

Patrick Mutz: We have 953 million shares on issue. Share price has been climbing across this last full year, from as low as five cents a year ago to where it is today at about 12-13 cents per share. That means the market cap currently is around A$125 million. With a project net present value of A$235 million and an enterprise value that will be pushing A$180 million at the end of November, it is pretty clear that our share price is still lagging a bit in the market. We think there are a few reasons.

One is, that mineral sands mining is not as well understood as say gold. However, the economics on the Boonanarring project looks so good that I think it will get the market’s attention as we continue to make announcements about first shipment of HMC product, receipt of first revenue, and finally our first quarterly report on revenue, costs, cashflow and profit. I believe the share price will almost certainly respond positively to continued positive information as we move to become a profitable mining company. Two research groups have followed our story now for the past year and both have been suggesting a short to mid-term share price of A$0.20-0.21, suggesting there is still a strong investment proposition at this time.

Dr. Allen Alper: That sounds excellent. Are there any other things you'd like to add on why our high-net-worth readers/investors should consider investing in Image Resources?

Patrick Mutz: There is one more thing. Of course all of the financial metrics that I've been talking about, the internal rate of return of 125%, 13 month payback, and a very healthy net present value. And the Company will be debt free in another two and a half years. By the way, all of those financial metrics are just on our first project; Boonanarring.

Within our portfolio, we have five other projects that could be mined using dry mining technique. We already own them and each has mineral resources that can be expanded with additional drilling. They are in the same area as Boonanarring. Any one of them could become a second operating center. We also have three projects with mineral resources that are mineable using lower cost, higher economy-of-scale dredge mining techniques. I have my eye on one particular project in the dredge mining category, which we own 100%, called Bidaminna. This is likely to be the next project we start focusing on from the standpoint of the pre-feasibility study. So Image is a company with a current market capitalization of A$125 million today, with one project just moving into production. It is forecast to be a strong cash and profit generator. And, we already have our eye out for a second operating center. So I think the upside potential provides a very reasonable prospect for the company to grow substantially across the next few years.

Dr. Allen Alper: Well that sounds excellent. Sounds like very compelling reasons our high-net-worth readers/investors should consider investing in Image Resources. Is there anything else you'd like to add?

Patrick Mutz: Just thank you, Al, for the opportunity to be interviewed by you for Metals News.

Dr. Allen Alper: Image Resources sounds like a very promising opportunity. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.imageres.com.au/

Patrick Mutz

Managing Director

+61 8 9485 2410

info@imageres.com.au

|

|