Ascot Resources Ltd (TSX.V: AOT; OTCQX: AOTVF): Near-Term High-Grade, Advanced Exploration, Large Upside Potential in Golden Triangle of BC; Interview with Derek White, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/3/2018

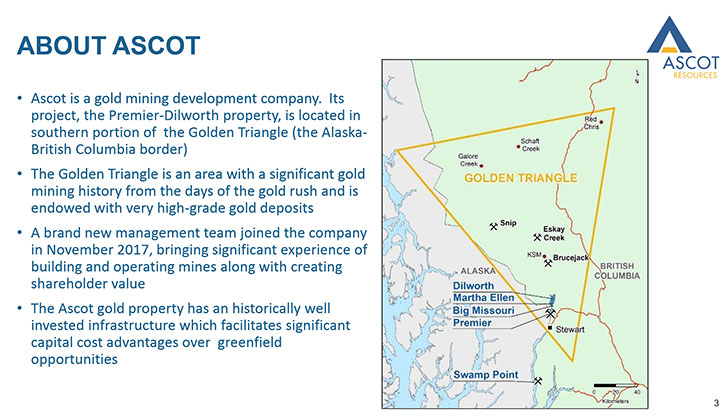

Ascot Resources Ltd (TSX.V: AOT; OTCQX: AOTVF) is a gold and silver focused exploration company, with a portfolio of advanced and grassroots projects in the Golden Triangle region of British Columbia. The company's flagship Premier Project is a near-term, high-grade, advanced exploration project, with large upside potential. We learned from Derek White, President and CEO of Ascot Resources, that since November 2017, the company has a new management team that is focused on developing its high-grade resources, from three areas, in order to provide potential feed for the existing mill. We learned from Mr. White that in early May of 2018, Ascot issued their maiden underground 43-101 resource from the Premier Northern Lights mining area, which established about three million tons of material mineralized, with high-grade gold equivalent. The second resource, expected to be completed by the end of November, is in the Big Missouri Ridge, where they did 45,000 meters of infill and exploration drilling this summer. The third resource, which will be the new addition to the company's portfolio, will be the adjacent, high-grade, past producing Silver Coin project. With its experienced and successful exploration, development and operating team, Ascot is poised to be the next Golden Triangle producer.

Ascot Resources Ltd

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Derek White, President and CEO of Ascot Resources and Kristina Howe, VP, Investor Relations. Could you give our readers/investors an overview of your progress, since we spoke last, and the magnificent project that you're developing and taking to mining at some point.

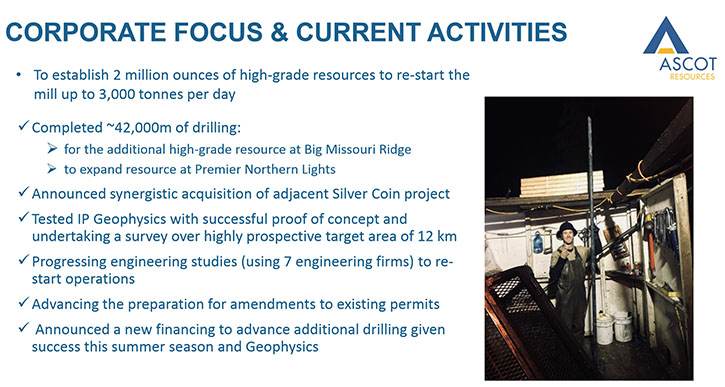

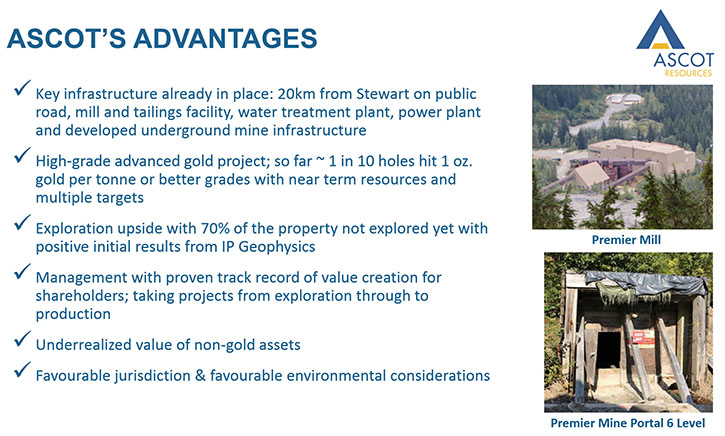

Derek White: Certainly. Ascot had a new management team come in last November, November 2017. And the focus of the team and the company has been working towards the restart of high-grade materials to feed the existing mill and infrastructure. Ascot has been blessed with having a lot of historical investment, which can establish an approximately 3,000 ton a day mill, a tailing facility, a power plant, a water treatment plant, and an underground mine area. Since we last spoke in April, the company's really been working towards developing three high-grade resources and the engineering studies related to the restart plan.

On the first resource, within the old Premier/Northern Lights mining area, the company issued an updated 43-101 resource statement for the high-grade underground material on May 10, 2018, which established about three million tons of 281,059 AuEq oz in the indicated category and 319,675 AuEq oz in the inferred category.

The second area that the company was working on over the summertime, did approximately 45,000 meters of drilling focused on in-fill and exploration drilling in the Big Missouri Ridge. The Big Missouri ridge was the next area to try to establish another resource. And that resource is expected to be completed by the end of November.

The third area is the adjacent Silver Coin project, which the company announced in August of 2018, that it will acquire from Jayden resources and Mountain Boy. The Silver Coin project was a mining added property that had established an underground resource, but had fed the premier mill at around nine grams a ton in 91 and 92. Ascot has done some drilling on that, and is updating that resource as well by the end of November.

On top of that, the Company has been working on developing its engineering studies to restart mining as well as, involving gathering sufficient data to apply for permit amendments applications. The engineering studies are expected to be announced by the end of the year.

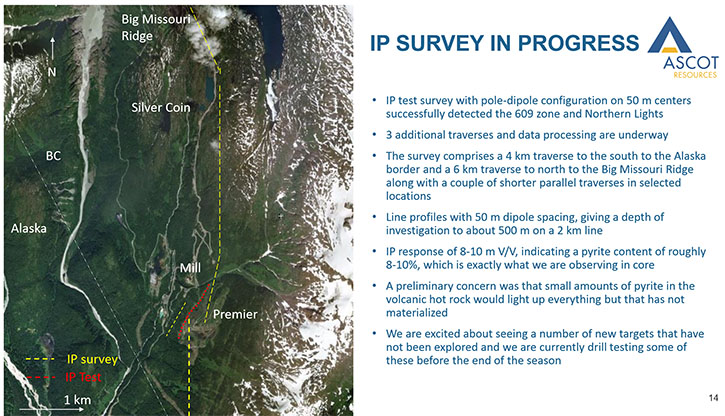

This summer Ascot conducted an induced polarization survey, a method of geophysics, which uses chargeability, which works quite well in this part of the world. The company did a test line over known resources over the Premier/Northern Lights area in the 602 and 609 zones. It found that it showed up the mineralization and associated pyrite quite well. The company then undertook an additional survey covering 13,500 meters and 20,00o data point a vast distance from the border of Alaska at the southernmost end of the property all the way up to the Big Missouri Ridge in the northern part of the property. This established a number of very interesting targets on which the company has been following up. So certainly, a number of very good exploration opportunities that the company hopes to drill in 2019.

Generally, there's been quite a lot of activity in the area as we've developed the maiden underground resource. We're very close to releasing the second two resources as well as the engineering studies. It's been a very busy first year together as a team.

Dr. Allen Alper: All right, sounds fantastic! Could you tell our readers/investors some of your key plans for this coming year?

Derek White: Sure. Obviously, the company sees an opportunity to potentially restart the mine for very little capital. Once the engineering studies are developed, the key issues for 2019 are really as follows:

The first thing the company is hoping to do is submit what's called a Mines Act Amendment to put the mining permit back into active status. Sometime in the first quarter of 2019, the company would be hoping to do that and work with the regulators and the first nations, especially the Nisga’a Nation, in terms of working through putting the mining permit back into active status.

The second thing is to continue to drill to upgrade the resources, from any of the inferred resources to an indicated or better status, also to work on underground drilling to get some of the resources to a potential reserve or higher category of confidence. Once the engineering studies are done, the company will be looking at getting the financing in place to put in the ball mill and the sag mill in order to restart operations, depending on how the development of the plans with the permitting goes.

On the exploration side in 2019, the company hopes to follow up in three areas.

First of all, to follow up with three-dimensional IP geophysics and drilling on the number of the IP targets that have been identified, especially in the areas that haven't been looked at in the past. Because they have been mining in this area over the last 100 years, there are some areas that look very promising that geophysics can show us. So certainly, following up on that.

On the extension of the resources, on the Big Missouri Ridge, now that Ascot has a consolidated ownership, certainly looking at drilling to the south of the Big Missouri target area towards the Silver Coin and a number of the targets at Silver Coin.

Also, we 2019 we would like to work on expanding the resources that we found in 2018, especially to the northwest of the Premier/Northern Lights and also around the Big Missouri area. There's an opportunity to expand resources there.

Dr. Allen Alper: Sounds exciting! It sounds like 2019 will be a great year; so a great year for news from Ascot and a lot of wonderful things will be done. Investors should be very interested in following your progress and your announcements all through the year.

Could you tell our readers/investors a little bit about your background, Derek, and also your Management team and your Board?

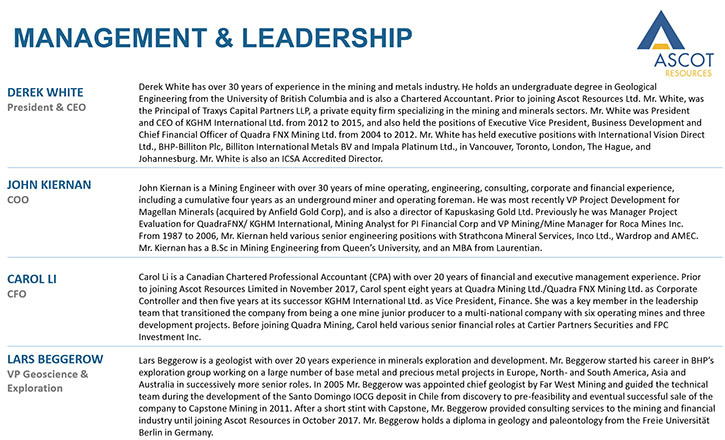

Derek White: Sure. We’ve just been in the company about a year. I'm a geological engineer. I've been working in mining and metals for the last 30 years in various companies. I spent a fair bit of time working for BHP Billiton. Then was also involved with the restart of the Robinson mine and forming a company named Quadra FNX Mining Ltd. I have been involved in building operations, financing them, running them and exploring for new projects, so certainly a gamut of things.

The management team is divided into three or four key components. Our COO, John Kiernan, is a mining engineer, with a lot of underground mining experience, especially in the Sudbury area. He worked with me in the previous Quadra FNX, and has extensive experience in underground mining and especially with mining conditions, like we would see at Ascot’s Premier/Northern Lights.

Our head geologist is Lars Beggerow, a geologist from Germany. He had a career working with BHP and also worked with a company named Far West. For some of the German investors, it's been helpful to have him explain things in German. He is an exploration and mining geologist, who is well-versed in looking for gold deposits like the ones we've seen in Premier/Northern Lights. He also has some people working with him, Lawrence Tsang, who's a geologist who's been working on this project for the last nine years. And then on the environmental and permitting side, we have Diane Stoopnikoff, who's an environmental scientist. She's actually worked at this operation in the 1990s. So, she's very familiar with the area and has been helping the company with the first nations and regulatory requirements from water treatment to baseline studies. Carol Li is our CFO. She has a lot of experience in operations and financing of mining activities from her days at Quadra FNX. On the investor relations side, we have Kristina Howe, whom you've met before at the PDAC and who also worked with John, Carol and I at Quadra FNX, in both Business Development and Investor Relations

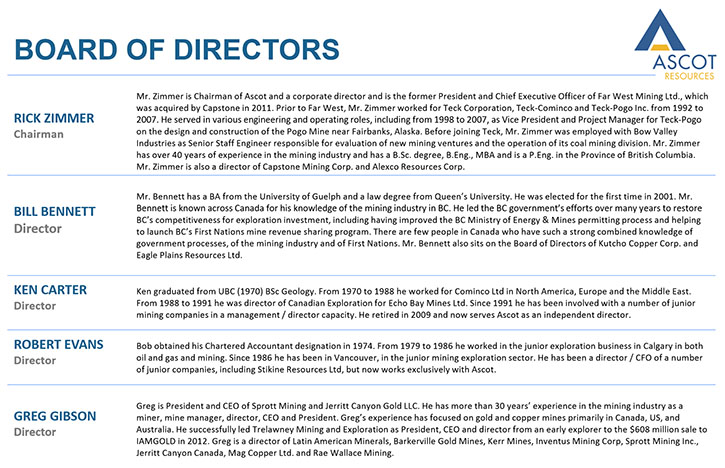

We did make some changes to Ascot's board, we wanted to get a bit more mining experience. Our newly-appointed Chairman last year was Rick Zimmer who is a mining engineer who worked for Teck-Cominco and has been involved in projects in mining operations. Also, Don Njegovan from Osisko Mining, a mining engineer, who has certainly helped with the technical aspects of what we're doing. The other Board members we have are; Greg Gibson, who's familiar with the project and works with Eric Sprott mining group and is involved with a number of different companies, both public and private, especially in the gold mining space. Ken Carter, who is a mine geologist, who was involved with Cominco and was involved with the former Ascot. He certainly brings a wealth of geological experience. We also have the Honorable Bill Bennett, who is the former three-time minister of mines in British Columbia. He certainly knows a lot from the regulatory stand point in this part of the world, being in BC and relations with Alaska.

Dr. Allen Alper: You, your Team and your Board have very strong backgrounds and proven track records, in which we as investors could be very confident. So that's one thing.

Derek White: Yes, thank you for that. I think we were very successful in 2004 in restarting the Robinson Mine in Nevada and that did very well for investors. We're hoping again that we can restart the Premier Mine. We have a good all-around skill set from exploration and development to actually mining construction and putting the infrastructure back into operation. I think investors can ride the value uplift the management team can bring over the next year or so, with a plan to re-start the mine and expand resources to maximize the cash flow value in the near term.

Dr. Allen Alper: That sounds excellent!

Kristina Howe: On his background, it may interest you to know that Derek currently sits on boards of Mag Silver and Orca Gold.

Dr. Allen Alper: That's excellent. Could you tell us a bit about your share and capital structure?

Derek White: The Company has just recently completed the acquisition of the Silver Coin project, where we bought the Jayden resources for shares. That gives us the market cap of 148 million dollars Canadian at today's prices. The share count is about 175 million shares outstanding. There are about 14.7 million options that are with the previous management and the current management. On a fully diluted basis, we're in the neighborhood of about 189 to 190 million shares that are trading approximately around 90 cents Canadian at the moment.

As of October 31, 2018:

| Common shares outstanding: | 174,256,515 | | Stock options: | 14,690,000 | | Warrants: | 190,125 | | Fully diluted shares: | 189,136,640 | | Market cap: | $148,118,038 |

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Ascot resources?

Derek White: Sure. For investors who want clear mile stone events that change the value of the company and can provide pretty good returns Ascot is an attractive opportunity. This generally occurs at two points in time in the mining cycle.

It happens when explorationists make a discovery, and it also happens generally when things are put back into production. The reason, which distinguishes Ascot from everybody else, is the fact that we have a historic infrastructure, which was well-invested by some large companies in the past. We can take advantage of that, in a very short time frame, relative to other mining companies, we're able to put something, which is high grade, back into production for very little capital. When that happens, the return dynamics are very strong and value is clear because it's always hard to argue with cash flow.

I know it's a difficult market. There are always questions about what things will happen, but when you're actually making the cash flow it's hard to argue with that value. The attraction of this opportunity is that it requires very little capital.

We will be able to mine something that has already been built. This kind of potential can offer, even for the number of shares we have outstanding, can be an extremely impressive return for investors than they may have with other mining opportunities that are longer term greenfield sites.

Dr. Allen Alper: That sounds excellent. Those are compelling reasons for our high-net-worth readers/investors to consider investing in Ascot. Derek or Kristina, is there anything else that you'd like to add?

Kristina Howe: I think, the investors and the newsletter writers should watch for the next resources we hope to have coming out in the next month or so, and then the announcement on the engineering studies, which we hope to have by the end of the year. Those things should start to give everyone a better picture of the value that the company can create.

Dr. Allen Alper: That sounds excellent! Exciting times! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Derek White: Thank you for interviewing us for Metals News.

https://www.ascotgold.com/

Kristina Howe

VP, Investor Relations

778-725-1060 / khowe@ascotgold.com

|

|