Lithium Chile (TSX-V: LITH): Seventeen Projects, 159,700 Hectares of Potential Lithium Bearing Salars in Chile, World’s Largest, High-Grade Lithium Reserves and Lowest-Cost Lithium Production; Interview with Steve Cochrane, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/11/2018

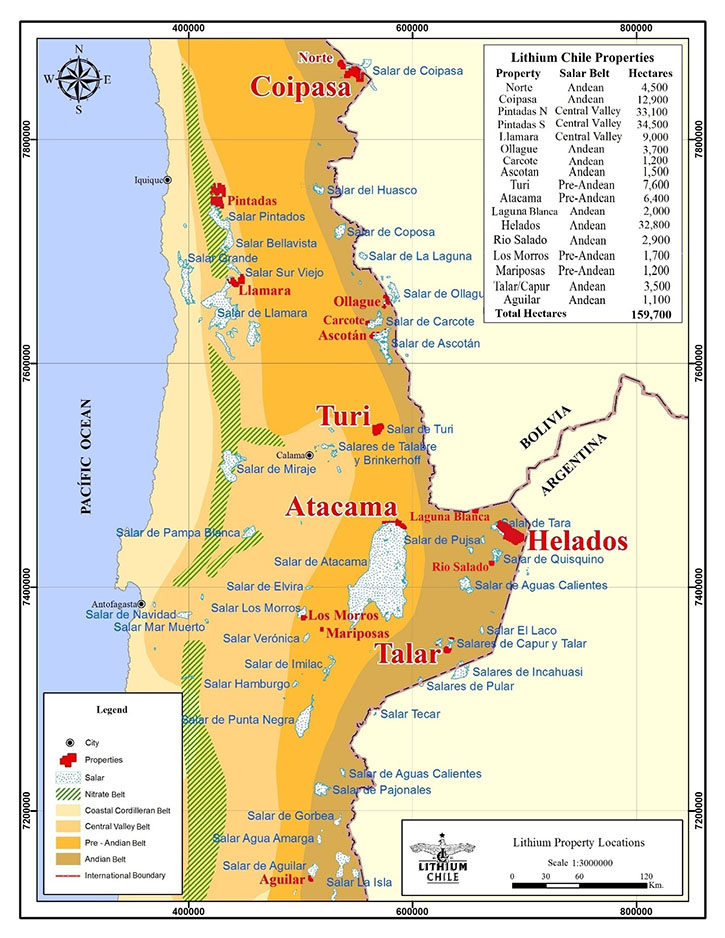

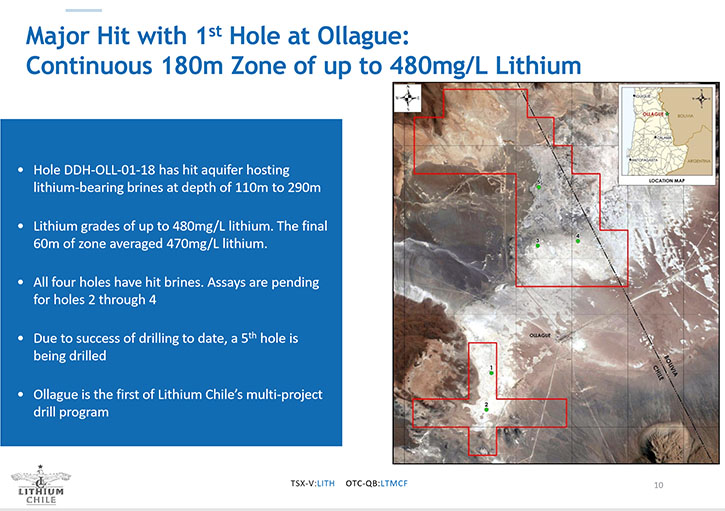

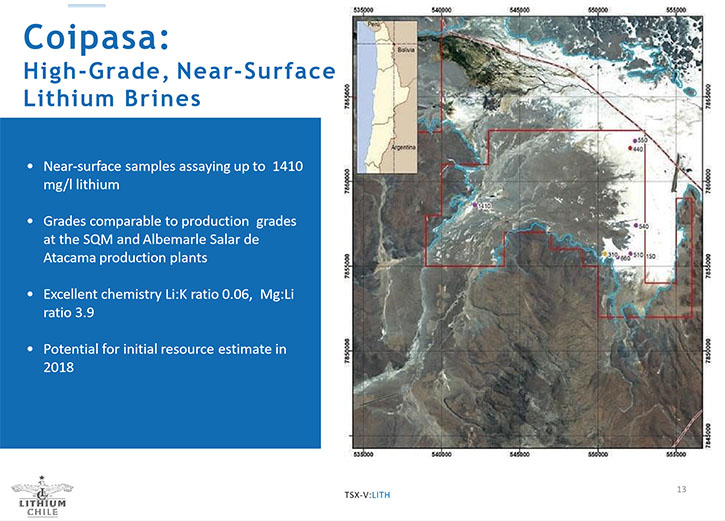

Lithium Chile (TSX-V: LITH) owns seventeen projects, encompassing 159,700 hectares of potential Li-bearing Salars in Chile – home to world’s largest, high-grade lithium reserves and lowest-cost lithium production. The portfolio includes projects with potential for high-grade lithium brines and excellent chemistry. We learned from Steve Cochrane, President and CEO of Lithium Chile, that they had put together one of the best, and certainly one of the biggest, exploration packages of perspective Lithium properties in all of Chile. The company completed a sampling program and prioritized 6 of its 17 prospects, based on grade, size, infrastructure and access, and conducted an extensive follow up geophysical program on 5 out of the six prospects, with great data on all 5 of them. Based on this, the company prepared a reconnaissance drilling program on four prospects and submitted the program and received approvals from the Ministry of Mines in Chile. Lithium Chile then entered into negotiations with the local communities associated with all 4 of these prospects to secure surface access for their exploration programs. Following the approval of the local community for access to their Salar de Ollague, Lithium Chile completed a successful 5 well program. The company encountered lithium bearing brines on all 5 holes with grades ranging from 190 mg/l up to 480 mg/l in the target horizon. Lithium Chile is now conducting negotiations, with the community, on their Salar de Coipasa to secure surface access. The company plans to run the second drilling program on the Coipasa prospect because they consider this property to be one of their most prospective properties. According to Mr. Cochrane, Lithium Chile has de-risked its story over the last nine months by drilling and encountering lithium bearing brines on Ollague. With the recent retrenchment in the lithium share prices for most of the publicly traded lithium companies, at current share price the company presents an attractive investment opportunity.

Lithium Chile Continues to Intercept Lithium Brines on Its Ollague Drill Program

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Cochrane, President and CEO of Lithium Chile. Steve, could you give our readers/investors an overview of your Company, your focus and current activities and why Lithium is so important?

Steve Cochrane: Well, thanks, Allen. Thanks for taking the opportunity to interview me again for Metals News. It's been an extremely busy eight or nine months since the last time we talked. If you recall, we had put together one of the best, and certainly one of the biggest, exploration packages of perspective Lithium properties in all of Chile. And I would argue, from an exploration standpoint that we have the best collection, of properties in all of South America.

We completed a property-wide, near-surface brine and salt geochemical sampling program from which we prioritized 6 of our 17 prospects, based upon grade, based upon size, and based upon infrastructure and access. Those six properties are Atacama, Coipasa, Helados, Ollague, Turi, and Talar. On five of those six, we completed gravity surveys to define the depth and dimensions of the salar basins, and trans-electromagnetic surveys on four of them, which identified extensive thick low resistivity horizons suggestive of subsurface brine filled aquifers. That was Coipasa, Helados, Atacama, and Ollague. I'm pleased to say that we had great geophysical data come back on all of those four properties.

We planned a drill program and submitted it to Ministerio de Minería, the Ministry of Mines in Chile. They approved the drill program for those four properties, Ollague, Coipasa, Helados, and Atacama, contingent upon us getting surface access approval from the communities. We began discussions with all four communities at the same time. That was late spring, early summer. The community of Ollague was the first to give us approval, and we began in late July, our initial exploration drilling program on the Salar de Ollague.

I'm pleased to announce it was a successful program. It was successful on three basis. The first basis, we encountered lithium bearing brines on all five holes we drilled on the property. It was successful on the second basis in that it validated our interpretation of the TEM geophysical data, the conductive horizons were exactly where we expected them and were filled with lithium brine. So, the drilling program really went a long way to validating and indeed, giving us confidence in our TEM geophysical data. The third success was it proved that our team in Chile is capable of identifying prospective lithium properties that actually turn out to hold lithium. Overall, we were pleased with the program.

Ollague, while the first community to give us approval, was not our first target in terms of priority, but we drilled it anyway. We have a lot of data to analyze. We had lithium, as I said, in all the holes, ranging in from a low of 190mg/l to a high of 480mg/l. We did see magnesium, lithium ratios start fairly high in the upper area of the drill holes, but in the lower depths, in the most recent holes we drilled, the magnesium to lithium ratio went down to 6.8, 6.9 on par with the Salar de Atacama production brines. Great chemistry from that standpoint! We still have to get an understanding of why some of the grades in some of the holes were up to 480mg/l, and some were 260 to 270mg/l. Nevertheless, to hit lithium brines on your first hole and your first program is very encouraging for us.

Brings us to where we're going from here. We have continued to negotiate on all of the three additional properties, where we submitted drill programs. Right now, the discussions with the community for Coipasa have been going very well. They've asked for a couple of things and we are willing to accommodate these requests. We're hoping the community is going to meet sometime in the next week to 10 days for final approval. That would be a great development for us.

Coipasa happens to be, in my mind, one our most prospective properties. It's a great looking property, again, for three reasons. Very large. It's our second largest property at 174 square kilometers in total between the two blocks we control Coipasa and Norte on this salar. We control 80 or 85% of the Chilean side of the Salar de Coipasa, so we're the majority shareholder on the Salar. The Salar de Coipasa also happens to be the second largest Salar in Bolivia. So while we control 80 or 85% on the Chilean side, the Bolivian border goes through this particular Salar. It's much more extensive on the Bolivian side, so it could be a tremendously large basin, almost 2500 sq.km. We also got our highest Li brine auger sample of any of our properties. We did a three-feet auger sample that returned 1,410 milligrams of lithium per liter. The geophysical data we collected shows a very large conductive horizon, covering about 65% of our property, so about 110 square kilometers. This beautiful TEM target has really excited us. If the community comes through in the next 10 days, we hope to have a rig on that property before the end of the year.

Dr. Allen Alper: That sounds excellent. Sounds like you and your team are making progress. That's excellent!

Steve Cochrane: Trust me, we'd always like it to be quicker. No matter how fast you go, you could always go faster. Both our shareholders and the market would like to see us move more quickly, but we think, when we look back, that the team in Chile has accomplished a great deal.

Dr. Allen Alper: That sounds excellent. Could you refresh our readers/investors memories on why lithium is so important, and what's going on in the marketplace?

Steve Cochrane: Typically, we talk about why lithium, why Chile, and why Lithium Chile. We started with the Lithium Chile story. Why Chile? It's very simple. Chile holds over 50% of the known lithium reserves in the world today. They alternate between Australia and Chile as the world's largest lithium producer. Last year, Chile was larger than Australia with about 39% of the global production of lithium carbonate. Most importantly, Chile is the lowest cost producer, anywhere on the globe, of a ton of lithium carbonate equivalent. They can produce a metric ton of LCE for around 1,500 to 1,800 U.S. That, by far and away, is lower than their nearest competitor by about 50%. As it's been referred to, Chile is the Saudi Arabia for lithium, lowest cost, greatest reserves.

Chile's a great country. It's a great jurisdiction to be in. They're pro-business. pro-mining. The new government that came in, I think, since we talked last, the Pinera government, was installed in March. They have made it clear They're that they are supporting the mining sector, and that's been evidenced by the amount of direct foreign investment in Chile. In the first four months of this year, it was around $8.5 billion. That was 26, 27% higher than the total foreign investment in Chile for all of last year. So in the first four months of this year, they've surpassed by over 25% the entire investment in the country last year. I think that sends a good message.

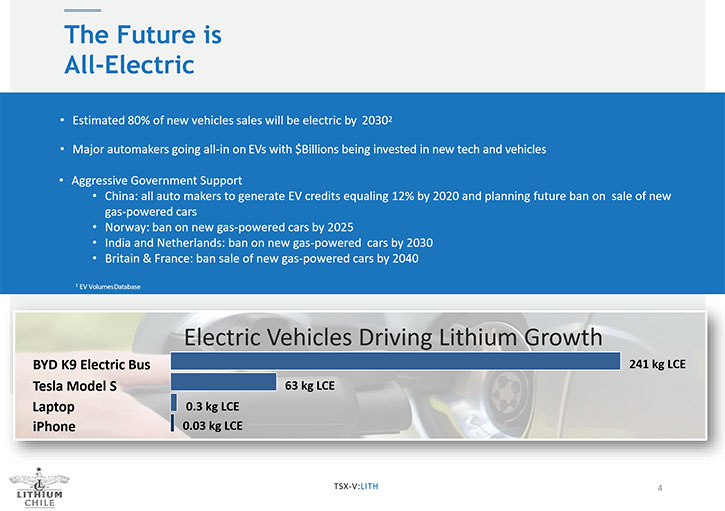

The other thing your readers might be interested in knowing is China is the global leader right now in electric vehicles. The Chinese Government is showing leadership by mandating that Chines drivers will have to think differently on how they get around. They have a policy in place that 8% of all new cars sold in China must be electric. This year, that could equate to more than 2 million EV’s based upon forecasted sales. They're the biggest player in the lithium space. They've made some pretty significant investments in lithium, including an announcement a while back that the largest lithium producer, Tianqi had bought the 24% stake in SQM from Nutrien for $4.1 billion U.S. Well, just last week, the Chilean Bureau of Competition, the Chilean government, approved that acquisition. That sent a very strong message, certainly to the Chinese, that Chile is open for business and it welcomes an investment. There are some conditions attached to it, but the fact they approved a large Chinese investment in the largest lithium producer in the world sent the right message.

That takes us to why lithium. There's just no question. The demand for lithium was driven, initially, by the revolution in the telephone, the Apple iPhone, and indeed the iPad and the Mac Pros, and really all the personal computing and now personal mobile devices, had really created the initial demand in lithium. Lithium's the lightest material. Right now, it's the best electrolyte for accepting and releasing the electrons. Anode cathode technology has changed, but as far as the electrolyte that provides the current, the electricity, lithium has been the preferential material, certainly in all the conferences that we have attended. While there are some developments in the battery space, nobody sees anything on the horizon for the next 10 to 15 years that will replace lithium as the medium. The rise of the personal computer and the new generation of cell phones, which are really pocket computers, drove the initial demand for lithium.

But what's overtaken it now, is this move towards electric mobility. It's not just the electric car anymore, it's electric buses. I was in China and Beijing, last weekend and these buses are running along a major avenue. Every 15 minutes you see these purely electric buses. They're the longer accordion style bus. They're beautiful and that side of public transportation is growing. Electric motorcycles are now becoming the in thing. You see a number of the manufacturers introducing electric motorcycles. The same advantage in terms of power and acceleration, which you've seen in Teslas, is applicable to the motorcycle industry.

Of course, virtually everything you buy these days is cordless, right? From vacuum cleaners, to snow blowers, to power tools. They're all driven, now, by lithium batteries. We've seen a huge spike in, first of all, the demand for batteries, and of course, the components, particularly lithium, that power that new generation of batteries. That's doesn't seem to be ending any time soon. The growth in electrical vehicles, for the last five years, has gone from 300,000 units to this year, 2018, where it's forecast that it'll be close to five million electric vehicles sold. We're seeing over 50% year-over-year growth in the sale of electric vehicles globally.

That's only going to accelerate, because there's been a number of governments globally, London, for example, Paris, Norway, and of course China, that have mandated that by 2025 through 2040 a lot of these jurisdictions will have to convert entirely to electric. That's unique, because governments taking such a stand and influencing how we're going to get around and what transportation will look like in the future has never happened in an industry before. This mandated move towards electric vehicles is going to keep the demand for batteries, and of course the demand for lithium, strong for the next 10 years, for sure.

Dr. Allen Alper: Well, that's an exciting time for lithium, and electrical vehicles, and the use of lithium, and the rapid growth throughout the world. It's an exciting time, and you're in the area of one of the largest and lowest cost lithium countries in the world. Sounds like Lithium Chile has everything going for it.

Steve Cochrane: Well, we've certainly taken a major step in that direction by proving that our team has the capability of identifying and, indeed, drilling a lithium deposit. We learned a lot in our first drill program. There are some things, in hindsight, we would have done differently, but a lot of that information, a lot of that experience that we got from our Ollague program we are going to put to work at Coipasa, should we get the access we're hoping for here in the next little while. The lessons learned from drilling on Ollague, I think, are going to allow us to do a better, quicker, more accurate drill program on Coipasa. I'm very excited. I think the best is yet to come. Since we talked last, we've certainly de-risked, I think, our story somewhat, because we've shown that, A, we have lithium on our properties, but more importantly, we can identify and exploit it. I think that should encourage your readers/investors to take another look at us.

That coupled by the fact that there has been a recent retrenchment in lithium share prices across the board. Valuations have come down. At the same time the price for Lithium Carbonate has stabilized. I think this Friday, the average prices for a metric ton of lithium was around $14,500 U.S. Off from its high in the low 20s, here this time last year. But some of the lithium exploration companies and some of the producers are off 60 or 70% from their high of this time last year. I think valuations, now, are very attractive from an investment standpoint. Demand hasn't gone away. For a lot of companies, like Lithium Chile, we have advanced our projects, so we feel we've de-risked our story over the last nine months, and yet our valuations have come down. I think we're at the bottom, or we're certainly near the bottom, and right now would be a good time to establish your position.

Dr. Allen Alper: That sounds like our readers/investors have opportunity, now, in the lithium sector, with some kind of correction, and now there's an opportunity for future gains.

Steve Cochrane: We've expanded our property holdings significantly, since we've talked last. We've increased our total land holdings, now, to over 155,000 hectares. I'm going to send you an updated presentation and an updated map showing the expanded property. Your readers may find that interesting.

Dr. Allen Alper: That sounds excellent. Could you briefly refresh the memory of our readers/investors about your background and your team?

Steve Cochrane: Sure. I was an investment banker for 30-plus years. I was the one that initially took Lithium Chile public in 2011.

At that time, the Chairman made a great decision in hiring Terry Walker, who's our Vice-President of Exploration and is based in Chile, and acquiring the assets they did. Terry's been the key to the success of the company to date. He has a great geological team with him down there. We have three other geologists now working with us. But he has a key land guy, through his relationship and his knowledge of Chile. He went down originally in 1991 with Noranda and fell in love with Chile. He's been there ever since. Terry's knowledge of Chile combined with the team Terry's assembled and his initiative has allowed the team to go out and identify these prospective lithium projects, but more importantly, acquire this large land base purely through staking.

We've been able to amass 155,000-plus hectares at an average cost of $3 per hectare. Those, essentially, represent our staking costs. We own 100% of our properties. We have no further capital costs associated with them, other than the annual, I think it's a buck-and-a-half per hectare tax that the government collects, but we have no work commitments. We have no royalties, or further cash payments required. We own our properties 100% outright. That $3 a hectare acquisition cost, that compares favorably to what some of these lithium properties are trading for in Chile now. They're going for anywhere from 500 U.S. to 800 U.S. a hectare. So that $3 cost gives us a significant cushion, right? I think that's important. It also reflects well on the team we have on the ground in Chile.

Dr. Allen Alper: That's excellent. That's a great position to be in and to have that kind of knowledge and background. Could you tell our readers/investors a little bit about your capital structure?

Steve Cochrane: We currently have around 100 million shares in our float. Fully diluted, we're around, I think, currently 110 million shares. Both are, obviously, because of longstanding warrants that we have, and if those are exercised, we will get the cash in the door. Our cash position, now, is around the $3 million range, but we also have receivables from our spin-out of our copper gold properties into Kairos Metals. We advanced them$ 1.5 million Canadian in cash so they could initiate an exploration program on their properties and Kairos Metals owes Lithium Chile $1.5 million US on the purchase of those properties. Between cash on hand and our receivables, we have about $5.5 million dollars. The company also has no debt.

Dr. Allen Alper: That's excellent. My understanding is the Management Team and the Board has quite a bit of their skin in the game. Is that correct?

Steve Cochrane: Yes. Between management, family, friends, associates, and a couple of key brokers, who have supported us from day one, we have the majority of the shares. So over 60% of the issued and outstanding are in friendly hands, either with the management group or close associates.

Dr. Allen Alper: That's great. It shows the investment community that you all have confidence in what you're doing and are willing to put your own money into the projects.

Steve Cochrane: I'm pleased to say that all the insiders are holding their shares. They're all big believers. Big believers not only in Lithium Chile, but in the whole revolution that's taking place right now in the personal transportation space. We just see demand for lithium and the growth in the lithium sector continuing for many years to come.

Dr. Allen Alper: That's excellent. Could you, Steve, highlight why our readers and high-net-worth investors should consider investing in Lithium Chile?

Steve Cochrane: Well, first and foremost, best property portfolio in the best lithium jurisdiction in the world is reason one that you have to look at Lithium Chile. Two, the fact, now, we've converted a pure exploration play to an exploration play with a lithium discovery. I think that de-risks the play. We've shown we can take these raw exploration properties and, on the first one, turn it into a lithium discovery. That should build confidence in our team and our ability.

Of course, the third reason is the valuations. This time last year, we were trading at about a $120 million market cap. With the recent weakness in the sector and the recent weakness in the overall market. We're in that $60 million market cap range right now. Arguably, the current valuations have overshot on the downside. So best property package, and best jurisdiction, and having now identified a lithium deposit on one of our prospects, and a valuation that's 50% discount to where it was, I think are all compelling reasons to look at us again.

Dr. Allen Alper: That sounds like very, very compelling reasons to consider investing in Lithium Chile. That's sounds excellent. Is there anything else you'd like to add, Steve?

Steve Cochrane: No. I think I'm pleased with our performance over the last year. The Company has come a long way. We have shown we can identify, not only geophysically a property, but prove that there's lithium on it. I think that has gone a long way to de-risk the story. Again, I'm a big believer that this whole revolution we're seeing in electric mobility is going to continue. That's going to bode well for demand for batteries and demand for lithium, and we're in the right place.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.lithiumchile.ca/

#900, 903 – 8th Ave.

S.W. Calgary, AB,

T2P 0P7

Jeremy Ross, VP

toll-free (844)-243-8989

local (604)-900-7135

|

|