Argo Gold Inc. (CSE: ARQ): Gold Exploration Projects in Central and Northwestern Ontario in a Multi-Million Ounce District, Interview with Judy Baker, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/8/2018

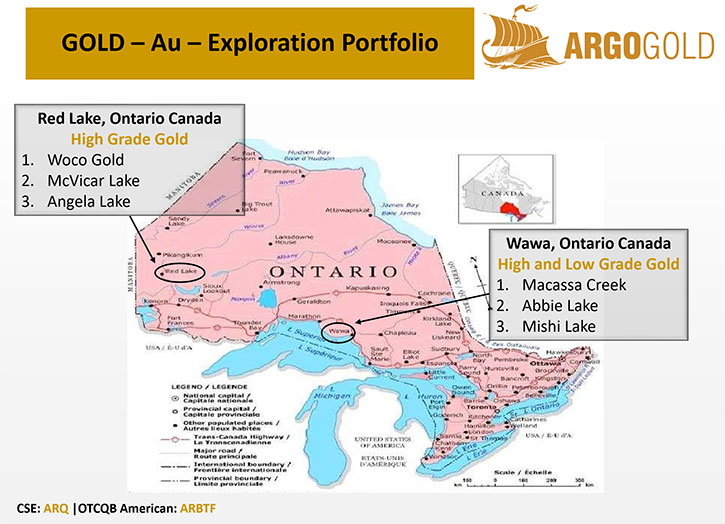

Argo Gold Inc. (CSE: ARQ) is a Canadian company focused on gold exploration projects in central and Northwestern Ontario that have indications of economic viability. All of Argo Gold’s projects are 100% owned. We learned from Judy Baker, President and CEO of Argo Gold, that they are very excited about their flagship Woco Gold project, after Great Bear Resources closed a $10 000 000 financing, with Rob McEwen and the McEwen Mining. Great Bear's Dixie Project and Argo Gold's Woco Gold project have major similarities, including the fact that both projects are in the Confederation volcanics, proximal to the major structure, on the south boundary of the Uchi Geological Province. Argo Gold’s flagship Woco Gold Project also has historical drills results that are comparable to Great Bear’s Dixie in terms of grades and depth. We learned from Ms. Baker that they were in meetings all last week and there is a lot of interest in Argo Gold now.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Judy Baker, who is the Founder and CEO of Argo Gold. Judy, could you give our readers/investors an overview of Argo Gold?

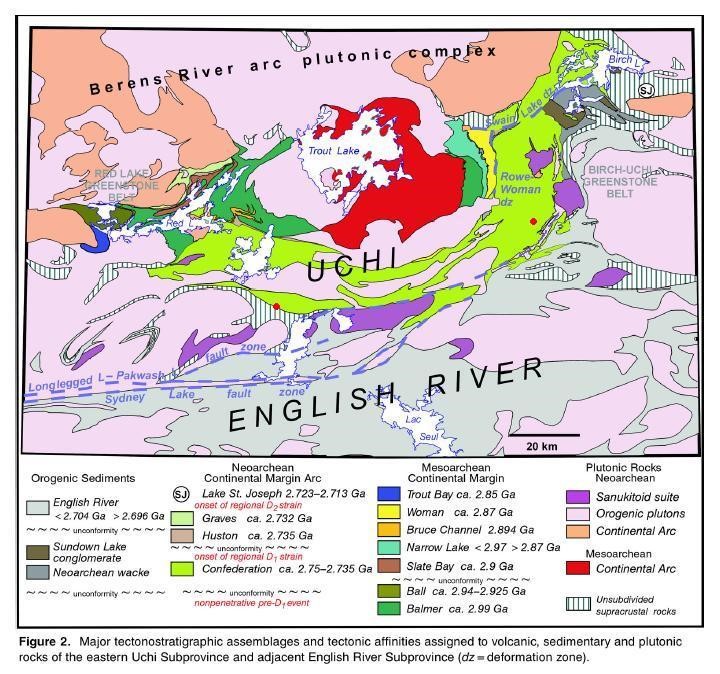

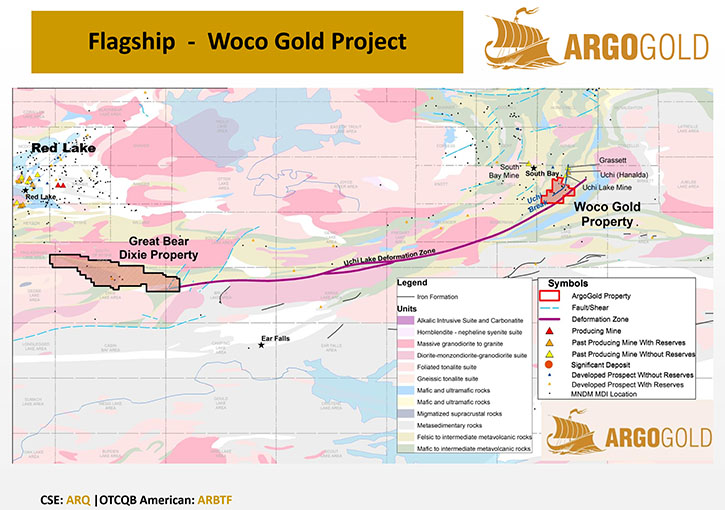

Judy Baker: Okay in late August of 2018 Great Bear Resources press-released some spectacular results from their Dixie Project, 25 kilometers southeast of Red Lake and 75 kilometers west of Argo Gold's flagship Woco Project. Subsequent to that, by mid-September they had closed a $10,000,000 financing at a valuation of $70,000,000 with the lead order from Rob McEwen and the McEwen Mining, which is fantastic. Basically, Great Bear's Dixie Project and Argo Gold's Woco project have similarities. Both projects are in the Confederation's volcanics. The Confederation volcanics are about 2.75 billion years old. They overlie the underlying Balmer volcanics which are about 2.9 billion years old and host the famous Red Lake Gold Mines.

Both Great Bear's Dixie Project and Argo Gold's Woco project are proximal to a major structure. It's called the Uchi Deformation Zone, where Argo Gold's Woco project is. It is basically the major structure that separates the Uchi Geological Subprovince, which hosts significant Greenstone Belts, from the English River to the south. The most prolific gold belts in the world are associated with major structures.

Two red Dots on the map, shows Dixie on the left and Woco on the right

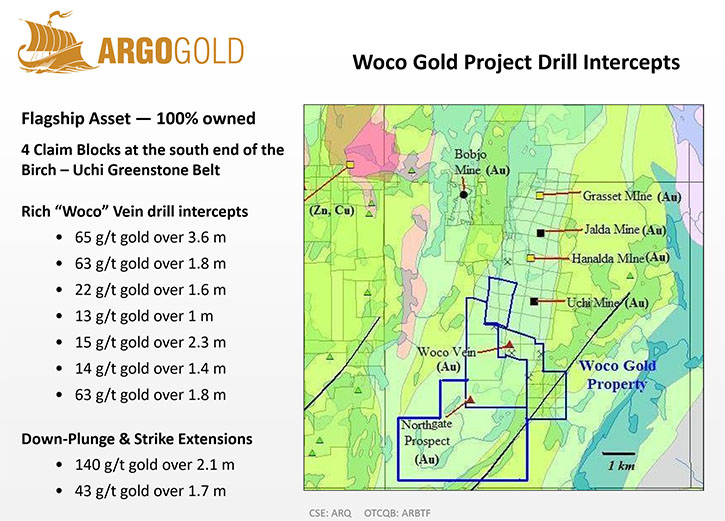

The third thing that's similar between Great Bear and Argo Gold is both Great Bear's Dixie and Argo Gold's Woco project have similar historic drill results in terms of grade and depth. Argo Gold’s Woco Gold Project has only been drilled to approximately 100 metres and Great Bear’s Dixie Gold Project only to a depth of approximately 200 metres. Having high-grade gold at relatively shallow depths is quite intriguing, as the gold mineralization in the Greenstone Belts of the Uchi Geological Subprovince are known for their depth potential.

Another element of similarity is that there is not a lot of outcrop at either project area. This would have inhibited some of the historical exploration efforts at both projects.

Great Bear Resources has created a stir, as not only have they completed a $10 million-dollar financing with mining legend Rob McEwen, the share price has doubled since the September financing.

Given the similarities between Great Bear’s Dixie Project and Argo Gold’s Woco Gold Project, there is a lot of interest in Argo Gold now.

The recent drill results, at Great Bear’s Dixie Project, highlight the discovery potential in the Greenstone Belts of the Uchi Geological Subprovince, a region already known for high-grade and long-term producing assets. This has brought renewed investor interest to the area - which is great!

Dr. Allen Alper: Well that sounds excellent! Do you have any drill data?

Judy Baker: Yes. Argo Gold's Woco Gold project was a 1993 discovery by St. Jude Resources. This was the first drilling at Woco although the area was initially mapped in the 1930’s and visible gold in outcrop was noted at both the Woco outcrop and the nearby Northgate outcrop, which are both part of Argo Gold's Woco Gold project now.

Northgate was initially drilled in the 1930’s and Argo Gold press released those drill results when the Northgate Block was acquired in August 2017.

The Woco Gold Project was acquired by Argo Gold in November 2016 and press released the drill results of St. Jude’s discovery and drilling completed in 1993 and 1994. St. Jude Resources intercepted multi-ounce intercepts of a vein system and follow-up drilling in 1994 continued to get high-grade intercepts.

Unfortunately, risk capital fled Canada in 1993 after the expropriation of the Windy Craggy Copper Gold Mine in British Columbia. By the end of 1993 exploration spending in Canada was 20% of what the 1992 numbers were. The expropriation of that asset didn't just negatively impact companies in British Columbia; it impacted companies in Ontario and all across Canada. And so, St. Jude Resources, even with this great discovery, couldn't generate much interest. Narrow vein, high grade deposits weren't seen to be in favor and people were looking internationally. The world was opening up internationally and people were more interested in low-grade open pit mineralization. However now, Canada has become the fifth largest gold producer in the world, up from number eight five years ago. Mining companies want to be here. These narrow, high-grade gold systems have continued to grow and to produce for companies because they have great depth extension.

Dr. Allen Alper: That sounds excellent. Sounds like you really did your homework and tracked down good deposits. Could you tell me a little bit more? I know you have other projects too. Could you tell us a bit about them?

Judy Baker: In 2016 Argo Gold was targeting high-grade gold project in Northwestern Ontario. We staked McVicar Lake in May 2016 before acquiring Woco the flagship project in November 2016

Argo Gold also acquired five projects in a Wawa camp near Wesdome and Richmont Mines. Wesdome and Richmont Mines are two good examples of companies having small high-grade gold deposits that have continued to produce. In fact, Richmont Mines’ Island Deep discovery was such high-grade material that they were able to increase their production from 50,000 ounces a year to 80,000 ounces a year without increasing the size of their mill. Richmont Mines was bought by Alamos for a billion dollars in shares. Wesdome’s Eagle Mine – also a small high-grade underground gold mine – has produced for over 20 years now.

Argo Gold carried out exploration activity at all of its projects in the 2017 field season and determined that its five projects in the Wawa Greenstone Belts were satellite assets as the economically viability of the project was related to the fact they could ship to nearby mills. So, we declared those assets as non-core and we have focused on consolidating ground around the core Woco Gold Project, which we see as a company maker asset.

Dr. Allen Alper: Well that sounds like a good approach to move forward with your Company. Could you tell our readers/investors a bit more about your background, your Board and your Team?

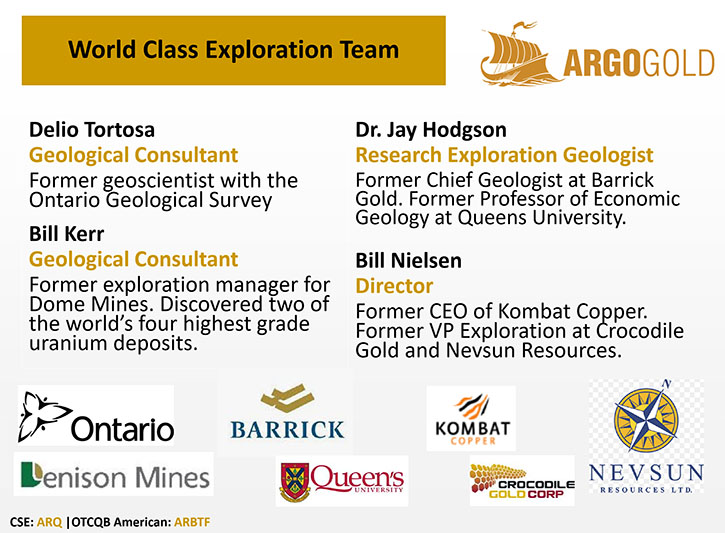

Judy Baker: The Argo Gold business plan was the business plan of Delio Tortosa, Bill Kerr and myself. We saw Northwestern Ontario as an area with a lack of mineral exploration yet some very good high-grade, long-term producing assets. With Canada becoming the fifth largest gold producer in the world – up from number eight – five years ago; we saw Northwestern Ontario as an area that has the potential to contribute to the trend of increasing gold production in Canada.

Bill Kerr was with Dome Mines in exploration and has a lot of experience in Northwestern Ontario and had a theory that there was a lot of high-grade gold discoveries to be made in Northwestern Ontario as it was completely under-explored. The third person on the team is, Delio Tortosa who did a lot of the detail work looking at projects in the Ontario Government Assessment Files. Delio identified the Woco Project as a target project for Argo Gold to acquire.

On our technical team, we have John Walmsley, who is an experienced geologist as well as an excellent GIS specialist, incorporating and reviewing all the historic data into a 3D digital medium. We also have Jay Hodgson, who was Chief Geologist at Barrick's for ten years. So we have a great technical team.

We also have Bill Nielsen on the Board of Directors. Bill discovered the Bisha Project in Eritrea for Nevsun Resources and has a lot of exploration experience. We also have Paul Olmstead, on the board of directors that is the CFO of Superior Gold and who was VP of Corporate Development with IAMGOLD. A lot of experience there! Chris Irwin is a very experienced lawyer and then George Langdon, who has mainly worked in the oil and gas exploration field. So that rounds out Argo Gold’s technical team and Board of Directors.

I have a geology and engineering degree from Queens University and an MBA from Western’s Ivey Business School. My first job in the mining industry was very impactful seeing mineral exploration create economic wealth and higher commodity prices generate significant free cash flow. It was the Matagami Camp in the summer of 1989. The Matagami camp is very interesting because there's no outcrop but mineral exploration was still able to discover many satellite deposits, which became continuous mill feed for the main Matagami mine mill. The second thing that happened was zinc prices doubled that summer which resulted in very high prices being paid for zinc-copper concentrate from an already profitable mining operation. Another shot of economic wealth for the company, its employees, the community and the country.

Dr. Allen Alper: Well, that's excellent. I know you've had many other experiences with other mining companies. You have a great background.

Judy Baker: I was a founder of Canada Lithium and a founder of Superior Copper and on the Board of Nemaska Lithium for nine years.

Dr. Allen Alper: That's great. I know Nemaska Lithium is doing quite well.

Judy Baker: Yeah, Nemaska Lithium will be the first large miner and producer of battery grade lithium products in North America.

Dr. Allen Alper: Very, very good! You have an excellent background and an excellent team so you're well equipped to move Argo Gold forward.

Judy Baker: Thank you.

Dr. Allen Alper: You're welcome. Could you tell us a bit about your share and capital structure?

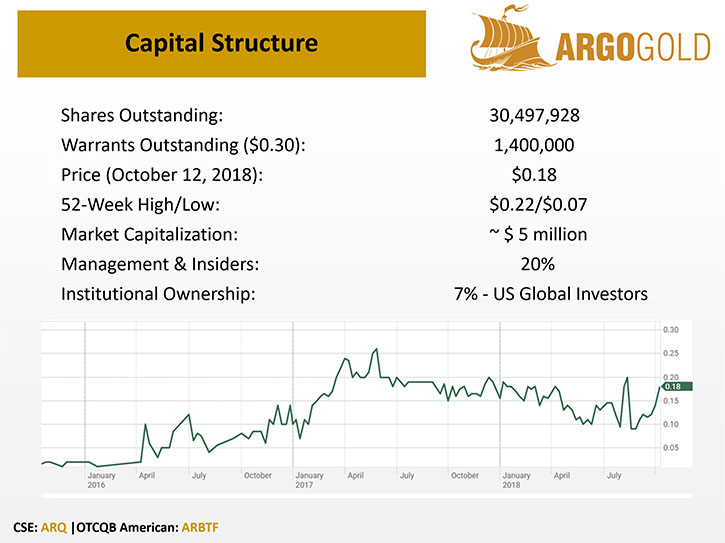

Judy Baker: Argo Gold has 30,000,000 shares outstanding and a market capitalization of about $5 million.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Judy Baker: Argo Gold only has a market capitalization of 5,000,000 Canadian and all projects are 100% owned, including the flagship Woco Gold Project which has interesting similarities to Great Bear’s Dixie Gold Project.

Dr. Allen Alper: That sounds very good. Is there anything else you'd like to add, Judy?

Judy Baker: Argo Gold also has an all-star technical team.

Dr. Allen Alper: Oh that's great. That's very important and your team has very impressive experience.

Judy Baker: Also of note it that there is a lot of interest in financing Argo Gold right now.

Dr. Allen Alper: Excellent! I enjoy working with you and I'm looking forward to hearing more about your successes. I think you and your team are doing a great job. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Judy Baker: Thank you very much, Dr. Alper. I really appreciate your comments.

http://www.argogold.ca

Judy Baker

jbaker@argogold.ca

365 Bay Street, Suite 400

Toronto, Ontario M5H 2V1

T: 416 786-7860

F: 416.361.2519

|

|