X-Terra Resources Inc. (TSXV: XTT, FRANKFURT: XTR): Acquisition, Exploration and Definition of Gold Resources in Canada, Primarily in Quebec, Interview with Michael Ferreira, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/8/2018

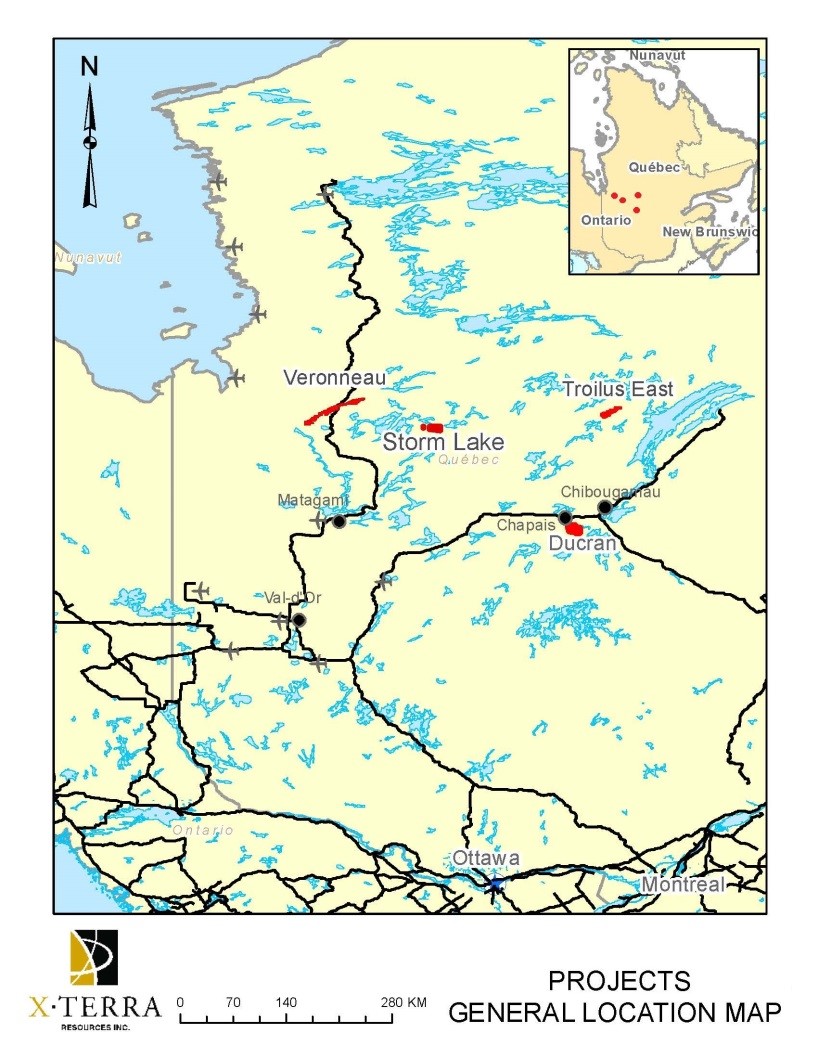

X-Terra Resources Inc. (TSXV: XTT, FRANKFURT: XTR) is a mineral exploration company, focused on the acquisition, exploration and definition of precious metal resource properties in Canada, with numerous properties primarily located in Québec. X-Terra currently holds a 60% option on the new Véronneau gold property and also holds a 100% interest on the Troilus East property, as well as a 100% ownership of the Ducran polymetallic property located in the Chapais-Chibougamau mining camp. We learned from Michael Ferreira, who is President and CEO of X-Terra Resources, that the company has spent about 1.4 million dollars on the Véronneau gold property located in James Bay, and is now focused on acquiring the 100% interest in it. X-Terra plans more geophysics and drilling on the Véronneau property next year. Other near term plans include exploration work on the company's Ducran polymetallic property as well as a $45-50,000 work program on the Troilus East property.

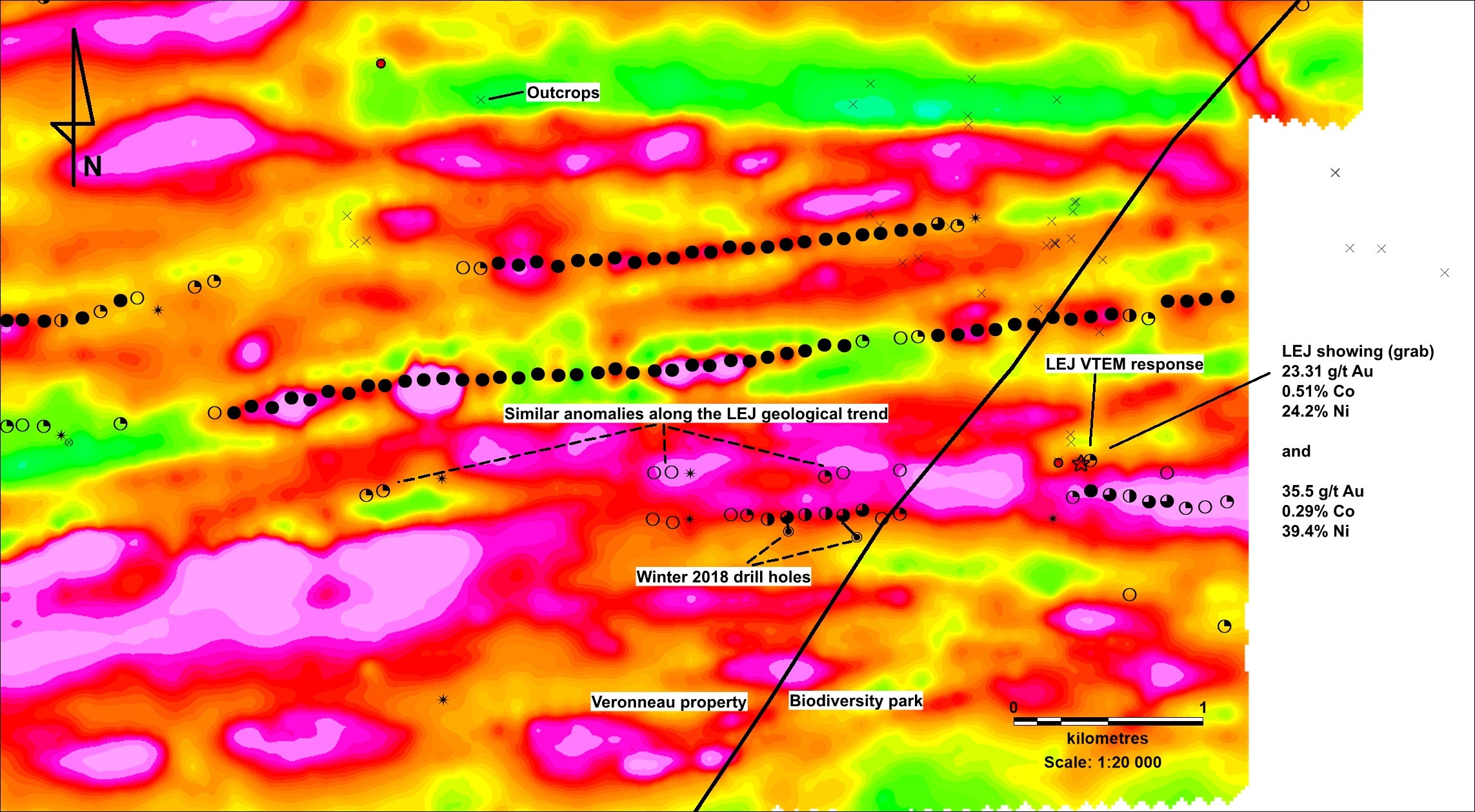

Véronneau gold property

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Michael Ferreira, who is President and CEO of X-Terra Resources.

Could you give our readers/investors an overview of your Company, your focus and current activities, what you're doing in Canada, looking for gold?

Mike Ferreira: Thank you Allen for taking the time to allow us to introduce X-Terra to your readers. X-Terra Resources is a mineral exploration company focused on the acquisition, exploration, and definition of precious metals resources in Canada. We have numerous properties primarily located in Québec. And most recently we've signed an LOI for an acquisition that's going to bring us toward the East Coast, in New Brunswick. We also hold a 100% interest in 13 oil exploration licenses in the St-Lawrence Lowlands of Québec.

Ever since I took over the company, our primary focus has been on its metal properties, primarily precious metals properties in Québec, with a focus in James Bay.

Dr. Allen Alper: Could you tell our readers/investors, a bit more about your James Bay property and what makes it so interesting?

Mike Ferreira: The main asset, on which we've been focusing and of which we're in the process of acquiring a 100% interest, is the Véronneau property. We originally signed a 60% option agreement for the Véronneau property due in part to Michel Chapdelaine's preliminary interpretation and his observations of the alterations when we completed our first site visit in 2016.

Since then, we have spent a total of 1.4 million dollars on this project. These expenditures are going to allow us to work on the property without having to rush into expenditures for the next four years, with respect to work obligations necessary to keep these claims in good standing.

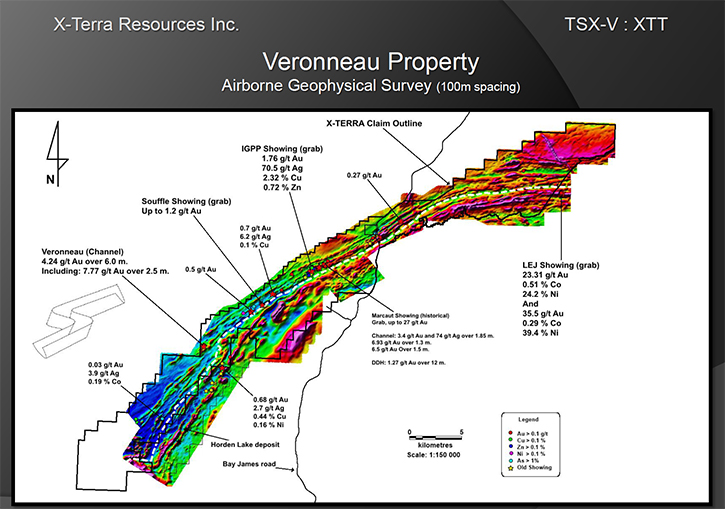

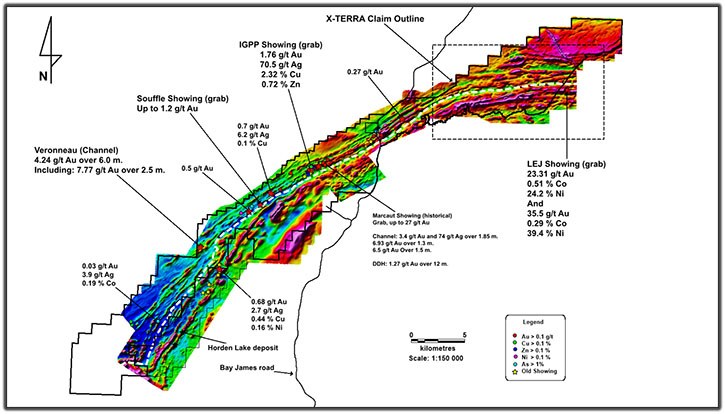

The Véronneau property itself occupies the entire Colomb-Chaboullié Greenstone belt, which is situated on the contact zone in the Subprovince of Nemiscau and Opatica. Originally the claim package was comprised of only 280 claims. Now it comprises a total of 515 mining claims, which covers a total surface area of just over 250 square kilometers.

This particular property can be divided into two informal units. There is a volcanic horizon to the Northwest, which is bounded to the southeast by a meta-sedimentary horizon. The volcanic horizon on this property is essentially composed of metabasalt, 80%, which includes mafic to intermediate volcanoclastic horizons, and massive to semi-massive sulfides. Layers associated with the old occurrences that we've observed and achieved.

Unfortunately to this day, this contact between these two informal units, the volcanic and the sediments, has never been observed in the field, due to the lack of outcrops. However, the geophysics paints a very clear picture.

The claim package is broken down into three essential territories. We have a Southwest, a Central, and a Northeast territory.

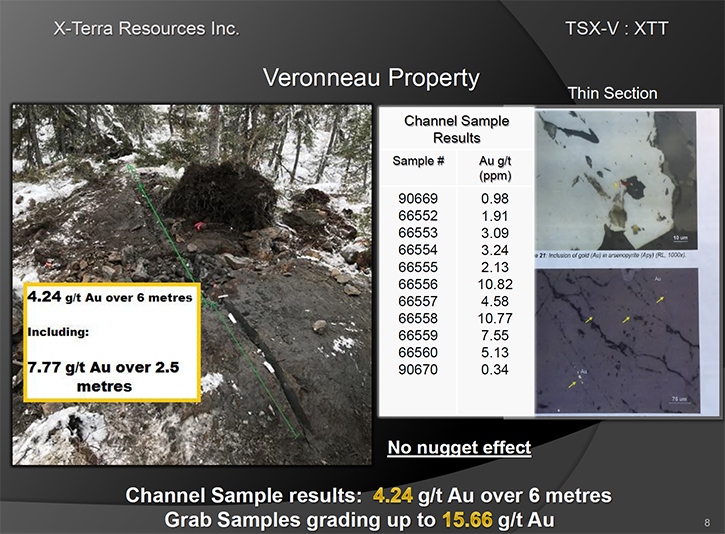

Right now we're focusing on the central territory, where the Véronneau discovery is located. The Véronneau channel sample that grades 4.24 grams over six meters, which includes 7.7 over 2.5 is our main focus area, on which we've done some additional ground geophysics. We completed a gradient IP survey this past March 2018, which highlighted numerous drill targets. Now, we'd like to follow that up with a 3D IP before commencing any drill program, to make sure that we're de-risking, as much as possible, any of the drilling dollars that we're putting into the ground.

Our other focus has been in the Northeast territory just west of what's known as the LEJ Showing, which is located 400 metres east of our property boundary in a projected biodiversity reserve. The samples taken there have obtained results up to 35.5 grams per ton of gold, up to .5 percent in cobalt, and up to 39.4 percent in nickel.

We have only tested two anomalies from our recent VTEM survey, which we completed in January of 2018. We put two drill holes in the Eastern territory. We drilled two anomalies that were based on the preliminary data from our VTEM survey. Unfortunately, by drilling anomalies stemming from the preliminary data, we weren't able to understand what was going on. When the final data set was delivered to X-Terra, we realized that the LEJ sample, (while not on the claim limits, because it's located in a projected biodiversity reserve), has a geophysical signature that we didn't see in the preliminary data set. We then noted there were four similar anomalies, with the same geophysical signature, on our property north of the anomalies that we had drilled and these anomalies have never been tested. (See diagram above)

So that wraps up the Véronneau property. While the drill targets around the LEJ anomalies have been identified, the following steps are going to be: additional ground geophysics in the Northeast to delineate additional targets, as well as Véronneau. We plan to complete a work program that's going to consist of geophysics and drilling next year in 2019.

Moving on to our Ducran property:

We also have a 100% ownership of the Ducran property, which is located in the Chapais-Chibougamau mining camp, at the eastern extremity of the Abitibi Subprovince, which hosts the Chibougamau-Chapais mining district of Archean Abitibi core greenstone belt. According to the MRN, the Ministry of Resources Naturelles et de La Faune, the MRNF, the Dore Lake and Chibougamau Lake sectors have produced 47.5 million tons at one point and then 2% copper, 2.3 grams per ton gold. This equates to 1.6 billion pounds of copper and 3.2 million ounces of gold. So the Chapais mining camp, which was the Dore Lake and Chibougamau, has produced 24.2 million tons at 2.24% copper and 1.3 grams of gold, for a total of 1.1 billion pounds of copper and .8 million ounces of gold, with 8.2 million ounces of silver.

The property started off fairly small, but we've since added claims to it. The property now consists of over 60 mining claims, totaling just over 33 square kilometers. We completed some drilling on this property (3 holes), just north of the Boma Mountain Prospect, discovered in the thirties and drilled in the sixties. The results of those three drill holes, identified that we have hit a sheer structure, which is going to require some more follow-up that we plan to do in 2019.

In 2018 X-Terra focused on identifying more projects that we could add to our property portfolio, as we are still building out X-Terra. However, there's an additional work program that's going to be taking place next year on the Ducran property.

Moving on to our next 100%-owned property, Troilus East, which happens to be located adjacent to Troilus Gold, which has just recently completed a 36,000 meter drill program for 2018. The drill program served to expand existing mineral resources from the historically producing Troilus mine, as well as explore downdip and along strike from known mineralization. X-Terra plans to undertake a short work program before the end of 2018.

The program will consist of a systematic sampling of the entire property and some airborne geophysics. The property is located, on the Frotet-Evans greenstone belt, and comprises a total of 92 claims covering over 50 square kilometers. According to the MRNF, the property contains two zones of high favorability of porphyry-copper-gold and molybdenite type mineralization. And the property is located less than two kilometers from the former Troilus mine, which has historically mined out two million ounces of gold and over 70,000 tons of copper. It is also important to keep in mind that this property is located in an area that has seen very little drilling, even though it is near significant mining infrastructure.

We like the potential of near-surface mineralization, and also exploring along the Troilus diorite boundary.

Additionally we completed a Till survey on the Troilus property last October. The results were obtained by X-Terra at the end of March. It highlighted that we have a significant amount of pristine gold grains, with almost every sample containing more than five gold grains. Following the ice flow, there seems to be two areas of high prospectivity on the property, where we get a collection of not only pristine gold grains, but Till samples that have more than five gold grains, up to 13-14 gold grains.

Dr. Allen Alper: Sounds excellent! I did an interview with Justin Reed of Troilus Gold and also with Claude on Eastmain. They're in the general area where you're working. I also did an article on Marathon on the East Coast of Canada, recently. So your article will be in good company.

Mike Ferreira: That’s great to hear.

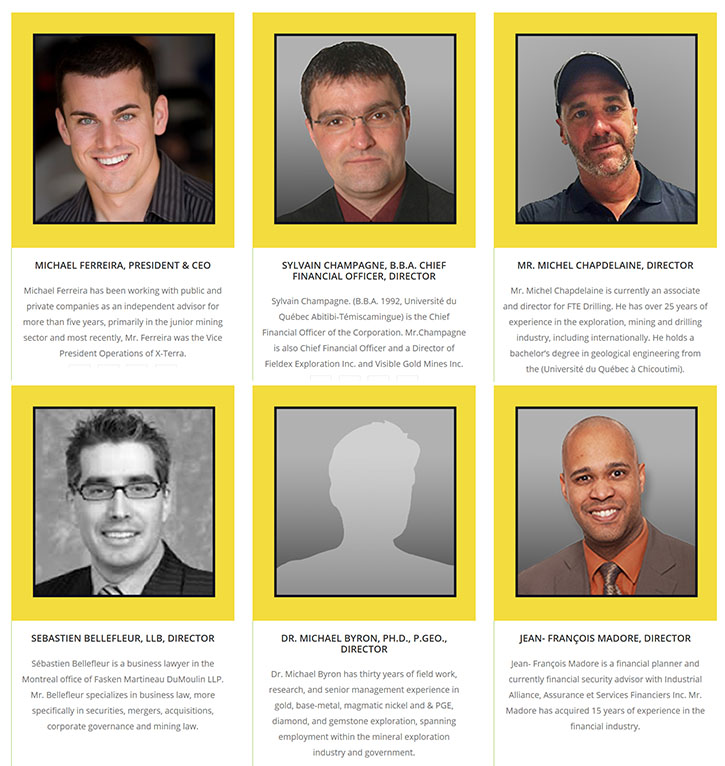

Dr. Allen Alper: Could you tell us a bit about your background and your team?

Mike Ferreira: Absolutely. I became involved in the mining exploration industry in 2012. I was previously working with public companies and private companies as an independent advisor for more than five years, primarily in the junior mining sector. Most recently, prior to taking the role of President and CEO of X-Terra, I was the Vice-President of Operations. My strengths include identifying sourcing projects and structuring investments in business development. I have a background in mathematics and business. The analytical skills that I have obtained have helped me decipher which projects I think will enable X-Terra to move forward and provide the best shareholder return over the long term.

The team itself is extremely strong. We have Dr. Mike Byron on the board, who is currently the CEO of Nighthawk Gold. Dr. Byron has 30 years of field work experience, senior management experience in gold, base metal, magnetic nickel, and PGE, which is really helping us in understand the LEJ sample near the Véronneau property. He also has a lot of experience in diamond and gemstone exploration. Dr. Byron is also attributed with the rediscovery of the Horne 5 Deposit, which is now Falco Resources' premier asset.

In June of 2017, we added Michel Chapdelaine to our board of directors and recently appointed him Vice-President of Exploration and Development. Michel Chapdelaine is a critical part of our management team. His background is in geology. He was formerly an associate and Director for FTE Drilling, an RC drilling company.

He has over 25 years of experience in the exploration, mining and drilling industry, including internationally. He holds a Bachelor's degree in geological engineering from the Université du Québec à Chicoutimi (UQAC). After Michel completed his Master's study on a gold-bearing banded iron formation in Northern Québec, with SOQUEM, he joined Virginia Goldmines as the Senior Supervising Geologist. He remained there, with Virginia, for over ten years, where he was involved, and instrumental in a number of gold and base metal discoveries in James Bay and Northern Québec, which include none other than the Gayot nickel-copper-PGE discovery, the Coulon zinc-copper-silver discovery, and outstandingly the Eleonore gold mine, where he was directly involved in the sale to Goldcorp.

Michel's experience, with the greenstone belts in James Bay, was paramount for X-Terra to add him to its management team, especially given the alterations observed at Véronneau. One of the main reasons he decided to join our company was because of the alterations that he was able to observe on the Véronneau property.

Dr. Allen Alper: That sounds good. Sounds like you have a very diversified and strong team.

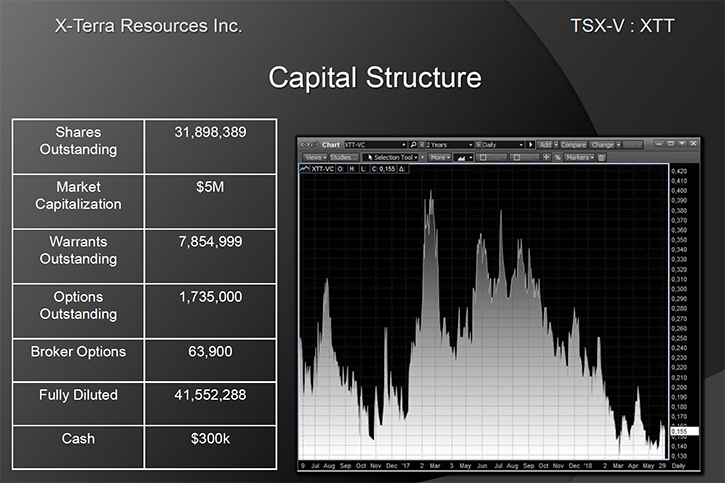

Could you tell our readers/investors a bit about your share and capital structure?

Mike Ferreira: X-Terra's a very healthy company in terms of the current share structure. We currently have just under 32 million shares outstanding. We have five Quebec institutions that participated in X-Terra's two most recent private placements. The ownership combined with friends, family, directors and the Quebec institutions, totals approximately 75% of the outstanding stock.

We believe that maintaining capital structure is important, because investors want the biggest upside possible, while limiting their downside. And we are happy that we've been able to maintain a good capital structure throughout the challenging market conditions. Now, our future plans require us to complete an equity financing, with respect to the New Brunswick acquisition.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in X-Terra Resources?

Mike Ferreira: There are two reasons I would recommend buying X-Terra Resources. The first one is our management team, due to the amount of technical background and previous success they have had. And secondly, the solidity of the projects that we've put into our portfolio, along with the acquisitions that we're currently undertaking. This is one of the main reasons we're going after camp-size land packages. While risky in terms of our market cap, it attracts major companies to associate themselves with you. And we have literally just scratched the surface of these properties.

As previously mentioned, we've spent the majority of 2018 protecting our capital structure. We could have been financing at much lower prices, much more aggressively, to work our properties, but we have a very methodical approach, especially on our technical side, to exploring our properties. We will always de-risk as much as possible all of the drilling money that we put in to the ground. And by de-risking that drilling money, we're upping our chances at drilling success.

Unfortunately that takes time. However, we're looking at building a company over the long term, five, ten, even 20 years.

Dr. Allen Alper: Sounds like very good reasons to consider investing in X-Terra. Is there anything else you'd like to add, Michael?

Mike Ferreira: If anybody would like any additional information, feel free to give me a call. I love speaking with potential investors and current investors to give them a one-on-one tour of our game plan, what we would like to do over the next six months to three years, and how we anticipate undertaking that game plan.

Dr. Allen Alper: Excellent!

Mike Ferreira: Also, your readers should take note of the LOI we recently signed and we hope to sign a definitive agreement in the coming days. It is a large mining property located in the northwestern parts of New Brunswick. The Grog property, was a new discovery that was made by Tim Lavoie and Pierre-Luc Guitar a couple years back, and was recently acquired by NB Gold. Our most recent press release, will give you a little bit more background information on the property.

The property is characterized by the geology of the Grog Brook group. So the layer is dated from the Late Ordovician and Early Silurian and divided into two formations, the Golden Brook Formation and the White Brook Formation. The property is comprised of more than 1,350 mining units, covering over 280 square kilometers. This emphasizes X-Terra's business model, going after camp-sized land packages, where there's more potential spread over a large area.

The local geology on the Grog Brook property was exposed in the trenches of the 2017 work program. It exposed heavily deformed siltstone, conglomerates and quartzites, which had been intruded by several different phases of felsic intrusives. The Grog Brook property contains four properties. There is the Grog Brook property, the Rim property, the Dome property, and the Bonanza property.

The Grog Brook is located in the north-east, and the Rim-Dome-Bonanza properties are located in the south-west, connected along the McKenzie Fault. The Rim and Bonanza sectors present quartz veins in sedimentary rocks. Quartz veining in Bonanza, appears to be related to folding. The presence of gold and traces of copper appear to be associated with the hinge zones of the faulting, while the veins at Rim are small, with high-grade gold at angles with the bedding layers.

We just recently completed a site visit over this past six days, and took numerous samples, which we'll be sending to the lab. We really look forward to getting those results back based on what was observed over the past six days, by our team, including Michel Chapdelaine and Alex McKay, a geologist from Nova Scotia.

Some of the historical results obtained to date, and this is excluding what we've just recently collected, range from .5 grams per ton gold all the way up to 3.7 grams per ton gold at the Grog Brook where the porphyry potential exists.

In the southern area of the property, where Rim-Dome and Bonanza are located, the Rim vein graded up to 1,315 grams per ton gold. The Dome veins, grading up to 57 grams per ton gold and the Bonanza vein has graded up to 493 grams per ton gold.

We look forward to moving forward with this transaction in the short term.

Dr. Allen Alper: That's really very exciting. It sounds like this coming year's going to be a great time for X-Terra.

Mike Ferreira: It's going to be a wonderful time. The challenge is going to be to get a strategic financing done, which is going to maximize our financial capabilities, undertaking all of this work, while at the same time protecting our capital structure.

The end of 2018 and 2019 is going to be a very exciting and busy time for X-Terra, undertaking a very large program in New Brunswick and also a large program on Véronneau and Ducran. One of the advantages of the Ducran property, as well as this New Brunswick property, is the accessibility to these properties as they do not require helicopters for access. There are logging roads that go in and throughout the property everywhere.

And so our exploration dollars, on these properties goes a long way, which is important for shareholders and the Company. The accessibility and how close we are to infrastructure, in the town of Saint-Quentin and Kedgwick, NB, and for the Ducran property, in Chapais-Chibougamau is a big advantage.

Dr. Allen Alper: That sounds excellent. By the way, I've been in business a long time and I have hundreds of contacts. I might be able to get you a partner, if you're interested in a strategic partner.

Mike Ferreira: Absolutely. We are always looking at potential partnerships in order to share some of the exploration risk.

Dr. Allen Alper: Oh it sounds great. I'm very impressed with what you're doing and your projects. We’ll publish your press releases as they come out so our readers/investors can follow your progress. I’m expecting to be hearing some really good things!

Mike Ferreira: Thank you.

http://www.xterraresources.com/

Mr. Michael Ferreira,

President & Chief Executive Officer

139 Québec Avenue, Suite 202

Rouyn-Noranda, Québec,

J9X 6M8

Telephone: 819-762-4101 | Fax: 819-762-0097

E-mail: info@xterraresources.com

|

|