Abitibi Royalties Inc. (TSX-V: RZZ, Nasdaq OTC: ATBYF): Owns Royalty Interests at the Canadian Malartic Mine near Val-d'Or Québec, Interview with Ian Ball, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/1/2018

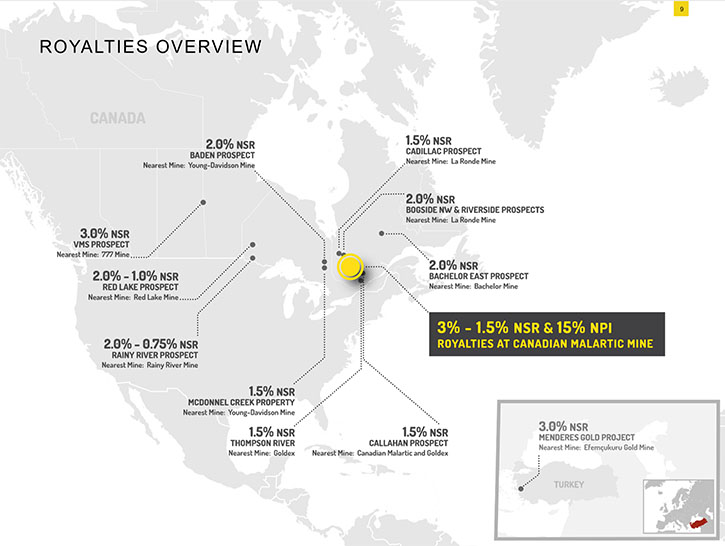

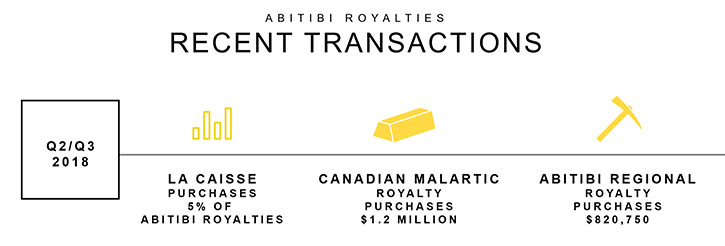

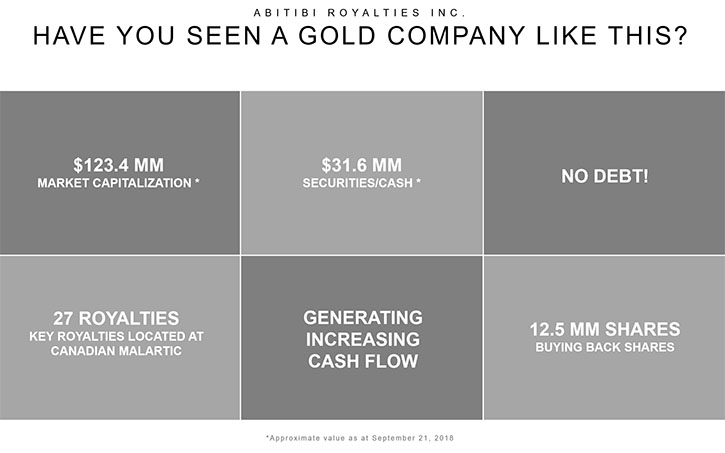

Abitibi Royalties Inc. (TSX-V: RZZ, OTC: ATBYF, Nasdaq: ATBYF) owns various royalty interests at the Canadian Malartic Mine near Val-d'Or Québec, including a 3% NSR on portions of Odyssey, East Malartic, Jeffrey, Barnat Extension, 2% NSR on portions of the Gouldie/Charlie zones, 1.5% NSR on the Midway Project and a 15% NPI on the Radium Property. In addition, the Company is building a portfolio of royalties on early stage properties, near producing mines and currently has 27 royalties in total. The Company has approximately CDN$35 million in cash and securities and is debt free. We learned from Ian Ball, who is President and CEO of Abitibi Royalties, that underground ramp construction will begin during the fourth quarter on the upper portions of Odyssey and East Malartic. Royalty income is also scheduled to begin this quarter from the open pit portion. The most important part, according to Mr. Ball, is the large exploration program, which should continue to increase the size of the discovery. In addition, during the summer the company made several new royalty acquisitions predominantly on ground owned by either the Canadian Malartic Mine, or by Agnico Eagle Mines in the Abitibi region.

Abitibi Royalties Inc

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Ian Ball, who is President and CEO of Abitibi Royalties. Could you give our readers/investors an overview of your company?

Mr. Ian Ball: Certainly. Abitibi Royalties is a royalty company focused within the Abitibi region of Quebec, Canada. We have 27 royalties in total. The most important is our royalty at the Canadian Malartic mine. We've been building our royalty portfolio throughout the Abitibi region, using cash flow, not shares, to acquire additional royalties that we believe to be attractive.

Dr. Allen Alper: Could you tell our readers/investors a bit more about your primary royalty and why it’s so important, so valuable?

Mr. Ian Ball: Sure. We have a 3% NSR which stands for Net Smelter Royalty. It's 3% of any revenue that comes from that portion of the mine, 3% of the gold price, and every ounce of gold that is sold, we get a portion off the top. The two discoveries, Odyssey and East Malartic, total approximately 4 million ounces of gold.

The portion that falls within our royalty area is about 2.6 million ounces. There's a very large exploration program ongoing at the property, approximately $17 million US. They anticipate that by the end of this quarter, the fourth quarter, ramp construction will begin on Odyssey and East Malartic. Also royalty income is scheduled to begin this quarter, from the open pit portion that falls within our royalty. Cash flow is beginning on the open pit, underground developments beginning on the deeper portions, and the most important part is the large exploration program, which we think, based on the historical data, is going to continue to increase the size of the discoveries.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit more about some of the other royalties, and why they're important?

Mr. Ian Ball: In the summer, we made a series of acquisitions. When we look at acquiring additional royalties, we want to make sure that the underlying operator is strong. So the royalties that we acquired were predominantly on ground owned by either the Canadian Malartic Mine, or by Agnico Eagle Mines. They were all within Quebec. There are two key acquisitions of the package. One, the Midway Property, in 2010 had approximately half a million ounces of gold on the property and had produced 1.7 million ounces of gold historically. Canadian Malartic bought the property in 2016 with the idea that they could integrate this into the Canadian Malartic Mine. So we acquired a royalty over that area. There's been drilling for approximately 2 years. No data has yet been released from those results, but just based on what was known on the property, and the discoveries that were being made by the previous owner, it seems like there's very good potential for that to increase, as well as to go into production, since there's a lot of underground infrastructure already in place in that property.

The second royalty is called Callaghan. It's owned by Agnico Eagle Mines, and the property is very close to Wesdome’s Kiena Deep discovery, and that discovery trending right towards Callaghan. The last reported drill results appear to be about 500 meters away. It also adjoins the Marban discovery, which is owned by Osisko Mining. It's a property that has had an exploration shaft built on it by Falcon Bridge in the '80s. It has seen exploration work, but it sat dormant for the past 35 years, and Agnico Eagle acquired it in 2016.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors why royalty companies are valuable and something that should be considered for them in their portfolio?

Mr. Ian Ball: If you look at the track record of the industry, whether it's Franco Nevada, or others, there's been a very good history delivering share appreciation for the owners. The advantage of a royalty company is that you get a percentage of the income off the top, and you're never required to put in any additional capital. So whether the mining's expanded, whether there's an exploration program, you don't incur any of those costs, but you get the benefit of every additional ounce of gold that's produced. It’s a very good business model, and you're able to use that cash flow to buy additional royalties, to buy back your shares, so you don't have the need to issue any new equity, which I believe is one of the fundamental reasons why most gold companies underperform the price of gold.

Dr. Allen Alper: Sounds very good! Could you tell our readers/investors a little bit about your background, your board, and your management team?

Mr. Ian Ball: I originally started at Goldcorp in 2004, I then proceeded to join what became McEwen Mining, working my way up to the position of President. There I was in charge of exploration, the construction, and then the production for that company. I was directly involved with several discoveries, within that company. I then proceeded to move to Abitibi Royalties in 2014.

I thought Abitibi Royalties had an exceptional business plan and I really liked the property. It was adjoining the largest gold mine in Canada, which is Canadian Malartic. I just really felt where the company was going was very attractive, and the share price bears that out, going from 35 cents a share to approximately $10 a share in the past four and a half years. We've been one of the best performing gold companies.

If you look at our shareholder base, it's a very strong share ownership. Golden Valley Mines, from whom we were spun out, owns 44%, Rob McEwen, who was the founder of Goldcorp and now CEO of McEwen Mining owns 11%, and then this summer, we had one of the largest investors in the world, Caisse de dépôt et placement du Québec (CDPQ) buy 5% of the company by putting in 5 million dollars. They have approximately about 310 billion dollars under management. So we have a very good business model with a good pedigree of shareholders.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors what are the primary reasons that they should consider investing in Abitibi Royalties?

Mr. Ian Ball: Well, there're a couple. One is we don't issue stock options. The second is that you've seen a material growth in the discovery, where we have a royalty, cash flow is expected to start increasing now quarter over quarter. So that in the 4th quarter of this year, we should see our best quarter of cash flow to date and that's because the Jeffrey Zone at Canadian Malartic is entering production and then you have myself as CEO after 4 and 1/2 years. I continue to reinvest all of my after-tax salary and bonuses into the company, so that's been ongoing now for quite some time and will continue in the future. So there's direct alignment there. For the past 2.5 years have not issued any equity compensation nor do we have any equity compensation plans in place. We've refrained from doing that to better align ourselves with shareholders. And we have a good royalty model, focused in Canada. So I think it has a lot of attractive attributes for somebody who might be a long term investor.

Dr. Allen Alper: Sounds excellent. Is there anything else you'd like to add, Ian.

Mr. Ian Ball: The biggest thing for us is we feel we know we have an area of expertise, which is in the Abitibi. We really think we have a competitive advantage there in terms of understanding the properties and the geology. We're not going to compete with all the other royalty companies in auctions or issuing shares or debt. We have a narrow focus in terms of how we see the growth of this company, which is surrounding Canadian Malartic and it is arguably one of the 15 best gold mines in the world. To get a royalty on a mine of this size is quite a unique opportunity. When you combine that with the fundamentals we outlined, we think it's a good investment proposition for somebody who has long term time horizons.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://abitibiroyalties.com/

Shanda Kilborn – Director, Corporate Development

2864 chemin Sullivan

Val-d'Or, Québec J9P 0B9

Tel.: 1-888-392-3857

Email: info@abitibiroyalties.com

|

|