Troilus Gold Corp. (TSX-V: TLG): Re-Start of the Former Gold and Copper Troilus Mine Northeast of the Val-d’Or District, Interview with Justin Reid, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/23/2018

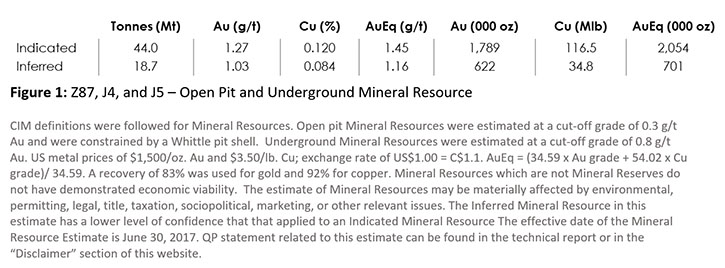

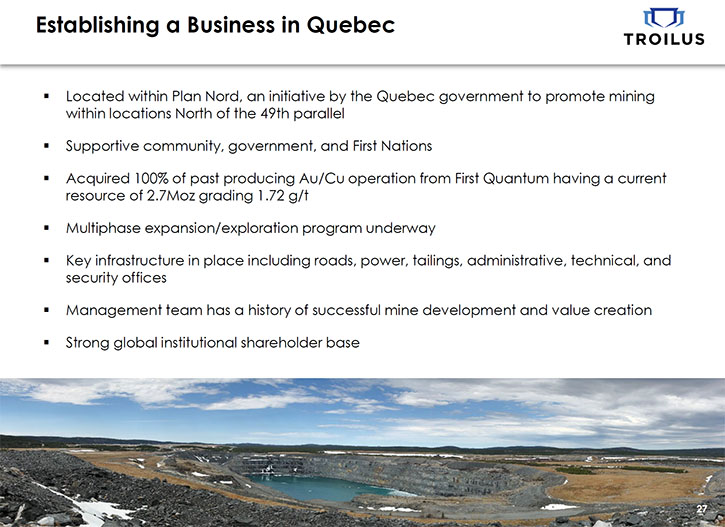

Troilus Gold Corp. (TSX-V: TLG) is an advanced-stage exploration and early-development company, focused on the mineral expansion and potential mine re-start of the former gold and copper Troilus mine. The 4,700-hectare Troilus property is located Northeast of the Val-d’Or district, within the Frotêt-Evans Greenstone Belt in Quebec, Canada. We learned from Justin Reid, CEO of Troilus Gold Corporation, that Troilus is a past producer of 2 million ounces of gold and 70,000 tons of copper, and with over 2 million ounces of indicated and 700,000 of inferred mineral resource still in the ground with complete infrastructure in place (Figure 1). The company has just finished a 36,000 metre drill program that is already showing the upside potential of the deposit. According to Mr. Reid, they expect to release an updated mineral resource estimate in late Q4 2018.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Justin Reid, who is CEO of Troilus Gold Corporation. Could you give our readers/investors an overview of your Company?

Justin Reid: Certainly and thank you for this opportunity. Troilus was formed as an asset spin out of Sulliden Mining Capital in January of 2018. The Troilus Mine’s background is as a past producer in Northern Quebec, originally operated by Inmet Mining. During its 14-year mine life, it produced approximately 2 million ounces of gold and 70,000 tons of copper via an open pit.

Inmet was taken over by First Quantum for the primary focus of developing Cobre Panama and the operation of Las Cruces in Spain, as well as the operations in Turkey, and as such Troilus was put into reclamation. There are over 2 million ounces of gold equivalent left in the deposit that have yet to be mined, and for the past five years, our team has been trying to acquire this asset from First Quantum (Figure 1). We succeeded in 2016 by signing an option agreement through Sulliden Mining Capital, a private equity fund.

Through a successful RTO, we launched Troilus in November of 2017. We raised $23.5 million, and subsequently, have raised another $16 million, so in total we have raised approximately $40 million to date.

Dr. Allen Alper: That's very good in that time.

Justin Reid: We have almost 100% institutional ownership, including some of the largest mining funds in the world. When we signed the option agreement with First Quantum, Troilus was not on anybody’s radar in the mining world. The market did not care about gold, and in particular, Quebec gold. We were able to complete our internal work on the asset at the time. Once we were confident in the potential of the asset we had, we took the company into the public markets at a very favourable valuation to our investors.

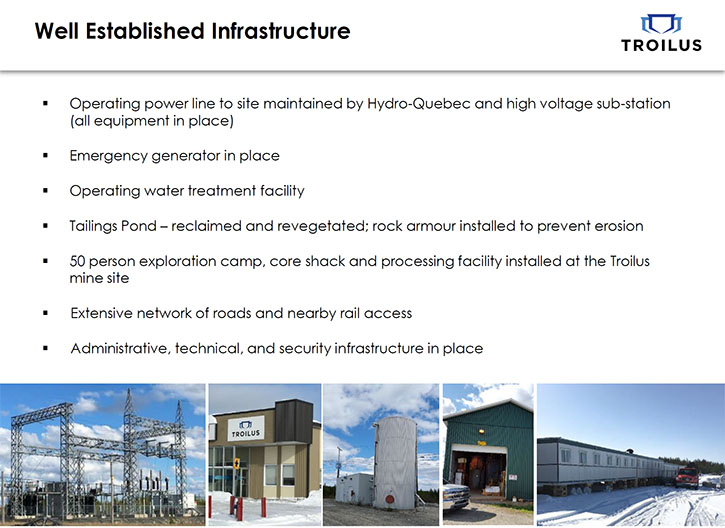

We did not just inherit over 2 million ounces of gold equivalent, we also inherited a mine site, with a 50mW power sub-station, capable of supplying all the power required for the future plant and associated facilities (Figure 1). We have a tailings impoundment that has been permitted that can be raised for future operations. We also have all roads and structures, spillways, and a water treatment plant that would require to be constructed for a greenfield project. We have just put in a 50-person all-season camp, and our plan is to simply take the existing resource, redefine it, expand it, and then put an economic framework around it.

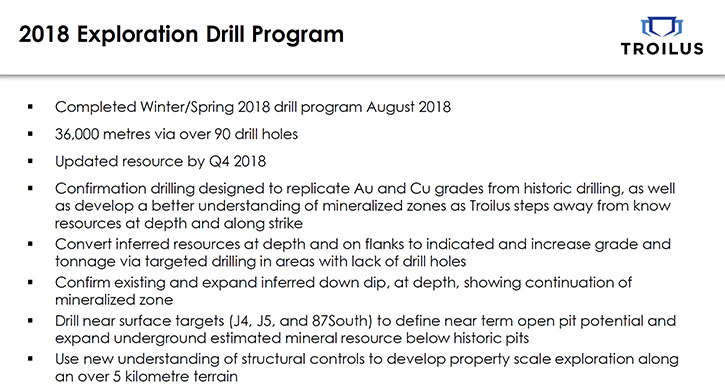

We've just completed a 90 hole, 36,000 metre, drill program with results coming to the market now. The purpose of the drill program was multi-faceted; first, it was to confirm the existing resource that we had in our main pit, which is Z87. We have 2 million ounces of indicated at 1.7 grams per ton equivalent, so it's a lower grade bulk ton deposit (Figure 1). We have put out numerous results to the market already that are showing material thicknesses in excess of 40 metres at the historic mine grade below the historic mine horizon. In Z87, we are seeing a great build out of our resource model.

We have also completed drilling at the J4 and J5 pits, where minimal production occurred historically, and we are seeing significant verification and expansion. In Q4 2018, our goal is to release an updated mineral resource estimate that shows an expanded resource.

Justin Reid: We completed a significant amount of engineering before acquiring the deposit. We are working towards a PEA in H1 of 2019, and we are funded to do that. We have about 65 drill holes to come to the market, over the next month, and I think the market is going to be impressed with what we will be releasing.

When the mine began producing in 1996, Inmet’s focus shifted away from expanding the resource and exploring the property, thus leading to all the historic production being done in a sub-$300 gold environment. Now we are seeing a $1200 gold environment, and we have more than $100 million dollars’ worth of installed infrastructure that we inherited. By remodeling the historic resources and materially adding to the resources that we have, the economics of this deposit, which in those days was considered marginal, looks promising, and we look forward to showing that to the market.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about operating in Quebec?

Justin Reid: The Frasier Institute ranked Quebec one of the top three mining jurisdictions in the world, so we have security of tenure. Troilus has some of the lowest cost power, especially where we are in Northern Quebec and we fall within Plan Nord which has a provincial government directive to facilitate, expedite, and encourage development in Northern Quebec. We have seen significant infrastructure and capital put into Northern Quebec over the past 15 to 20 years. Not only with the development of Malartic Mine, which was originally with Osisko, now with Agnico Eagle after a JV with Yamana. We have just seen that Gold Corp has put Éléonore into production at approximately $2 billion.

These are huge capital infrastructure projects that are being built in Northern Quebec, and the majority of it has been focused in the Abitibi, so call it in the Val-d'Or region. Chibougamau is just North of the Abitibi, where historically over $10 billion has been spent, and 103 million ounces of gold have been developed. Where we are in Plan Nord has similar geology, but because of time and location, we have had less than $2.5 billion spent on the development of 16 million ounces.

When the capital starts moving North, and infrastructure is built, like power and roads, we are going to see a significant increase in development. Similar to Goldcorp’s Éléonore and Stornoway’s Renard mines, there are several other companies producing or developing there, so we are going to see a significant amount of capital going into that area of Quebec. We started the project at a good time I think, and we are well-funded, which sets us apart from a lot of the junior market right now. We have $20 million in the bank today, and, if necessary, that can get us through the next two years.

Dr. Allen Alper: Well, that is an excellent position to be in, and a great location. Tell us about your background, the board’s and the management teams.

Justin Reid: I am a 45 years old geologist by training, with a BSC (bachelor’s degree) from Saskatchewan, and a master's from the University of Toronto. I spent six years with Cominco, which is now Teck, in their project development group, and then I completed my MBA at Northwestern in Evanston, near Chicago. Upon graduation, I became a mining analyst at Sprott Securities, and a partner and senior mining analyst at Sprott/Cormark Securities in Toronto. After 2009, I went to Australia for a year and a half to work on some M&A deals, and then I took over global mining at the National Bank of Canada. Most recently, I acted as President and Director of Sulliden Gold Corporation, until its acquisition by Rio Alto Mining in 2014. I have been a managing Director at Aguia Resources Ltd. since 2015.

Dr. Allen Alper: You have a very impressive background.

Justin Reid: I have a lot of experience on the technical and financial side. I know how to structure deals, both at the boutique broker level and at the bank level, and that certainly makes my Rolodex a little bigger than most, so it allows me to penetrate further when I need to.

When I moved from National Bank I began investing in a company called Sulliden Gold. I knew the team incredibly well because I had worked on their various financings during my career. I loved their asset and I joined as President of Sulliden in 2013, when they had a $50 million market cap. Eighteen months later, we sold the company to Rio Alto, which was then taken over by Tahoe for $450 million, so our shareholders made a great return on that transaction. It was a win-win for the acquirer, for us, for everybody, and our team did a great job de-risking the asset through the BFS and permitting process.

When we sold Sulliden Gold, we spun the balance sheet out. We had about $23 million to $24 million in cash, and we spun it into a new company called Sulliden Mining Capital. We left it on the Toronto Stock Exchange, and we dividended it back to all our shareholders. The purpose of that vehicle was to make numerous structured and focused investments. We kept our team together, while looking for opportunities in the mining market, when there was no available risk capital; we were able to get Troilus at that time. We brought it into Sulliden. We spent about a million and a half dollars on engineering, de-risking, environmental, technical studies, and that got us to a point where we felt confident we could roll it out for the valuation that we did. You know today we have $20 million in the bank, 48 million shares outstanding, 19 global mining institutions on our registry, and we have a market capitalization of about $60 million.

From a valuation stand point, we are one of the cheapest on an enterprise value to ounce basis, but I am not worried about that simply because we have been so busy drilling and de-risking this project over the last six to seven months, leaving us with not a lot of time to disseminate information to the market, certainly during the summer months. Anyway, we are in a position now where, over the next month, we are going to be releasing a significant amount of information to the market, as the drill holes come in and we can expand on the existing resources that we have.

Dr. Allen Alper: That sounds great. Sounds like you are in a great position. Looks like the coming months are going to be very important for readers/investors so could you tell us a little bit more about your team and your Board.

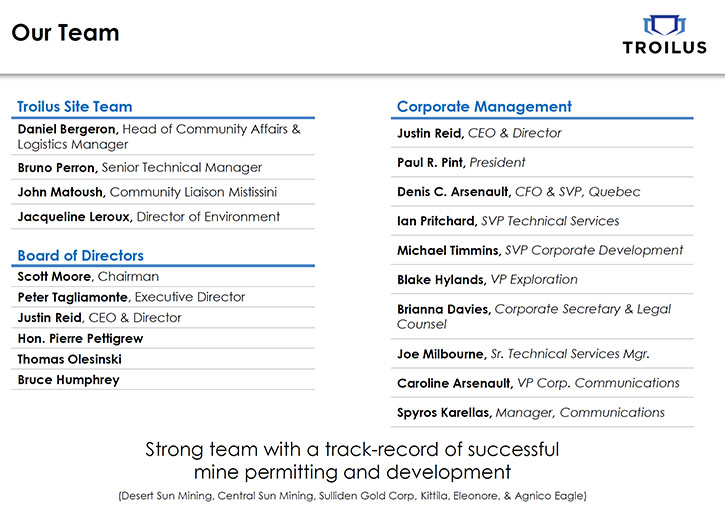

Justin Reid: I will start with our team. We always like to focus on our Quebec operational team before we get into our management team because the guys on the ground are doing a great job. We have four key people on our team, Daniel Bergeron is the Head of Community Affairs and Logistics in Northern Quebec. He is the one that runs everything on a day-to-day basis and has basically developed a seamless infrastructure. From a management perspective, it makes our job incredibly easy. He has had logistics experience at all the major mines, and certainly knows all the suppliers, routes, timing, and how to get everything done.

Bruno Perron is our Senior Technical Manager, and a key player on site. He was originally an exploration and production geologist at the Troilus Mine on the day it opened. He knows all the hidden gems that were never followed-up. Already, he has been able to show significant expansion on the existing resource, and I think we are going to be able to show it as a direct result of his knowledge and applying that to our project.

John Matoush is our Head of Community Affairs in Mistissini. Mistissini is the Cree Nation, whose historical lands overlay our deposit. We signed a pre-development agreement with them earlier this year and we have a working committee set up with the grand council of the Cree. The Troilus Mine was one of the first impact benefit agreements signed by the Cree in Northern Quebec and was considered a huge success. Our plan is to continue moving forward with this strong partnership.

Jacqueline Leroux is our Director of Environment. It was a huge coup being able to secure her. She has been responsible for the environmental permitting of many Northern Quebec mines lately, and so we have been able to take her skill set and her expertise. She is applying it directly for us.

I have Paul Pint, who is our President. Paul has been an institutional broker for much of his career. Paul's focused on the market, fundraising, and communication with the market, which sets us apart from most. Historically, Paul was with CIBC for years and Desjardin as their Global Head of Sales, which is a French bank, very important when you are a French mining company. We began working together at National Bank, when he was my partner.

Denis Arsenault is our CFO. Denis has had an incredibly successful career with junior, mid-tier, and major mining companies on boards as CFO. He was our CFO at Sulliden Gold when we sold it to Rio Alto, so again, keeping the team together.

Ian Pritchard is our Vice President Technical Services. He has had a long career with major mining companies, focused on engineering and development of mines.

Mike Timmins is our Senior Vice President, Corporate Development. He came to us from Agnico after ten to twelve years of experience there. Agnico obviously being an incredibly conservative, partially Quebec based producer. Mike brings that deep Quebec corporate experience to us, and we are focusing on that.

Blake Hylands is our VP Exploration, and he is our key man in the company right now. He runs all our programs. All the success that we are having is a direct result of his input, his focus, and his guidance, and he is probably one of the hardest working people we have.

Possibly more important, Peter Tagliamonte is the Executive Director on our board. He oversees all our technical work. Peter was my partner at Sulliden and has worked with several mining companies. He has had a successful career with Eldorado and was the CEO and the COO of Desert Sun, when it sold to Yamana for $700 million. He is currently the CEO of Belo Sun and is a great member of our board and our technical team.

The Honorable Pierre Pettigrew, the former Minister of Foreign Affairs in the Canadian government is on our Board. Pierre certainly helps us navigate, not only our personal politics, but all our federal politics, and is one of the most respected bipartisan politicians in Canadian history, an affluent, great addition to our board. He was part of our Sulliden board originally as well.

Bruce Humphrey came onto our board recently. He was a former COO of Gold Corp. We have a lot of, not only political experience, financial experience, technical experience, but we have a lot of operational experience as well.

As a junior company, we are ticking all the boxes, a resource in the right area, imminently expandable to scale, and significant infrastructure in place. We are going to have a lot of permitting modifications and permitting to complete, but with what we have inherited, which is 15 to 16 years of known data, we are not starting from scratch.

We have a team that punches way above our weight. I would say that our team can accomplish anything on the level of any major company right now, with the experience that we have. We have incredibly supportive, long term shareholders who will be there again and again as we develop this operation. We are in a capital-intensive business, at a capital-intensive time, in project development, and we are sitting in a pretty good spot. We have a lot of fun, which is important. Everybody likes coming to work. If you do not have fun, it is not worth doing it.

Dr. Allen Alper: That sounds excellent. Fantastic team and board! That is great. Great experience and group that knows how to work well together, so that is great. And you have the technical and the financial backing, so that is excellent. Could you tell us a little bit about your capital and share structure?

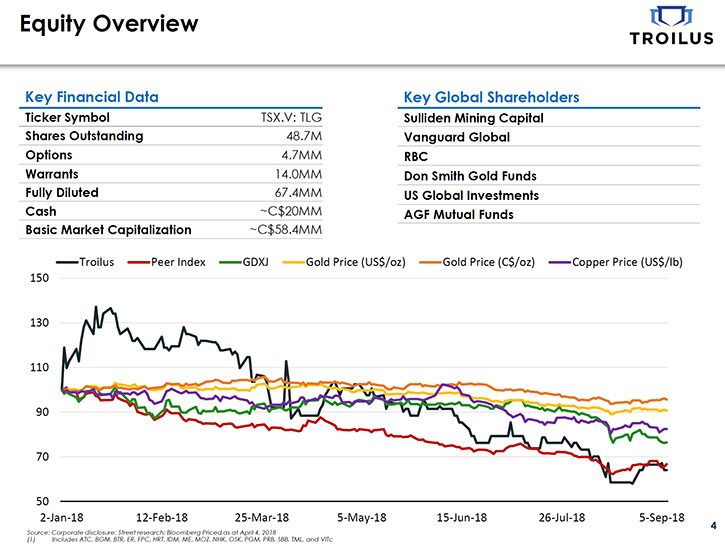

Justin Reid: We currently have 48.7 million shares outstanding, 4.7 million options, 14 million warrants, so fully diluted we are 67.4 million that gives us a basic market cap of just about $60 million. We have about $20 million in the bank. Our largest shareholder; Sulliden Mining Capital, Vanguard Global, Royal Bank of Canada, Don Smith Gold Funds, US Global, AGF, and several others. The majority of the large global gold funds have a stake in us, as of right now.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Troilus Gold?

Justin Reid: We are a known entity with a large proven resource of more than 2 million ounces of indicated and 700,000 ounces of inferred (Figure 1). We are well funded, and we are immediately showing the market that this is expanding. We have significant infrastructure, including roads, power, water treatment, spillways, and a 50-person camp that puts us well ahead of the junior explorer. We have 15 years of production data, so we know what the recoveries are, the mining widths, the grades, and we are showing in our drilling that we can replicate this, and in some cases improve on it.

Nothing we are doing is innovative. It is merely precise and structural, and that is the way we want it. Our team is incredibly seasoned we have been together for a long time, and we have done this before. Even when the markets are volatile gold investors understand that better than anybody else, but if you take a long-term view of what we can do, you are going to see in the near term lots of positive results coming out proving our thesis and expanding upon it.

Our plan is to release an updated mineral resource estimate in Q4 2018, that we expect is going to show a validation of the historic resource and perhaps an increase. Engineering is well underway, and we plan on having a PEA to the market in the first half of next H1 year. This is all within a company that has full stakeholder engagement with our partners, the Cree Nation of Mistissini, the towns of Chibougamau and Chapais, our shareholders, and our employees. We run this company like a major company, and I think you are going to see the result.

Dr. Allen Alper: That sounds fantastic. Excellent reasons for our high-net-worth investors to consider investing in Troilus Gold. Is there anything else you would like to add, Justin?

Justin Reid: No, we are on our way to the Beaver Creek Conference tomorrow and then to the Denver Gold Show after that. We have a team that is focusing on retail marketing in North America, so we have numerous initiatives to get this story out. I think for the first time since the company was formed, we are now able to really hit the road, telling people what we are all about. I thank you for the opportunity, because this is one of our first.

Dr. Allen Alper: That sounds excellent. Our readers can follow your press releases that we will publish on Metals News as you put them out.

https://www.troilusgold.com/

Spyros Karellas

Communications Manager

+1 (416) 433-5696

skarellas@troilusgold.com

|

|